PIMCO Enhanced Short Maturity Active ETF

Latest PIMCO Enhanced Short Maturity Active ETF News and Updates

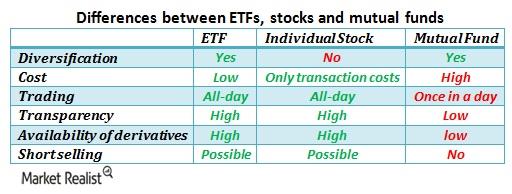

A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

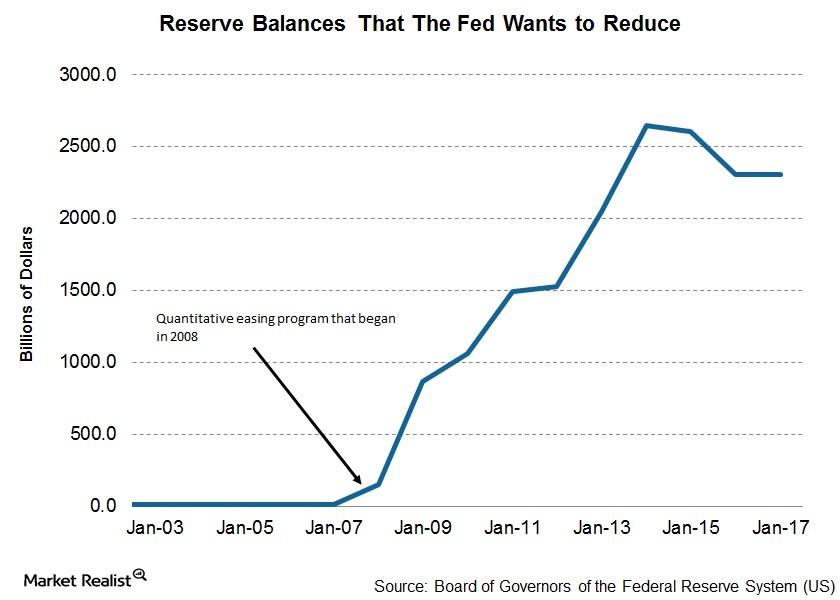

Why the Fed Has Initiated Balance Sheet Normalization

Atlanta Federal Reserve president and CEO, Raphael Bostic, recently spoke at a conference about the Fed’s balance sheet normalization program.

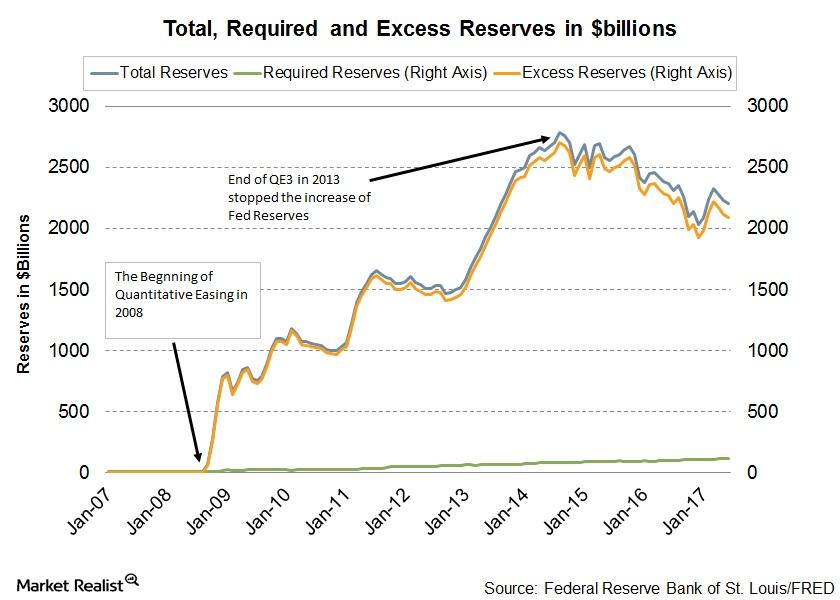

Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

Why FOMC’s John Williams Sees No Impact of Balance Sheet Unwinding on Markets

In the long run, Williams said it would be difficult to predict how markets would react to the Fed’s balance sheet unwinding program.

Why Is FOMC Starting to Unwind Its Balance Sheet without a Target?

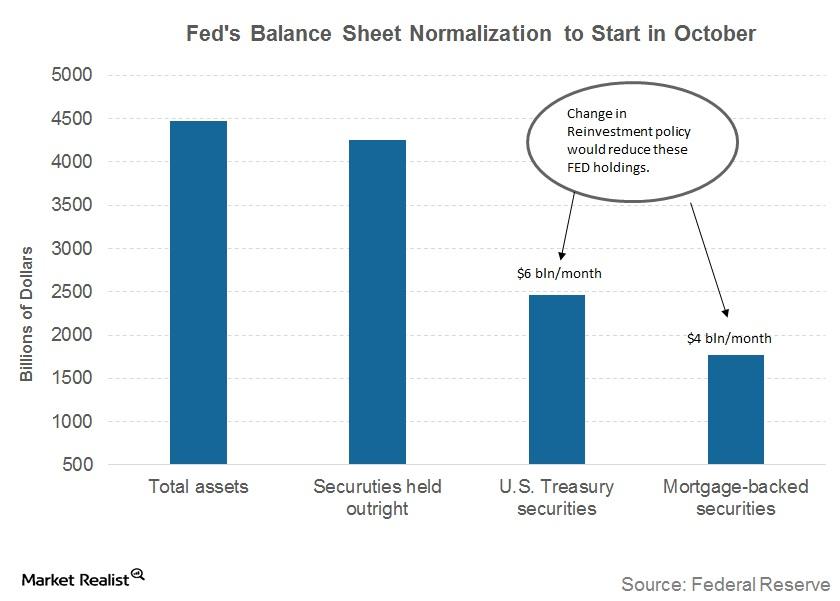

In the September 20 meeting, FOMC (US Federal Open Market Committee) finally announced the start date of its balance sheet unwinding program.

Markets Are Confident on Fed Balance Sheet Trimming Announcement

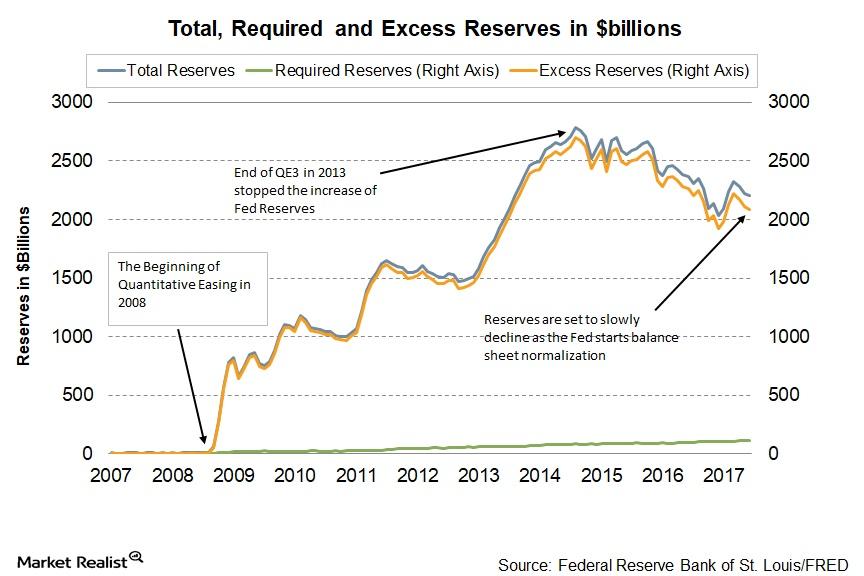

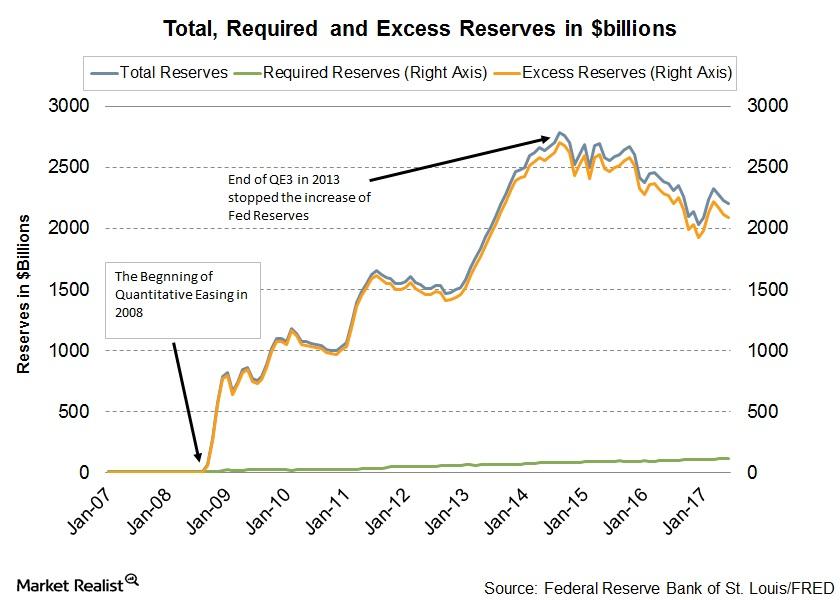

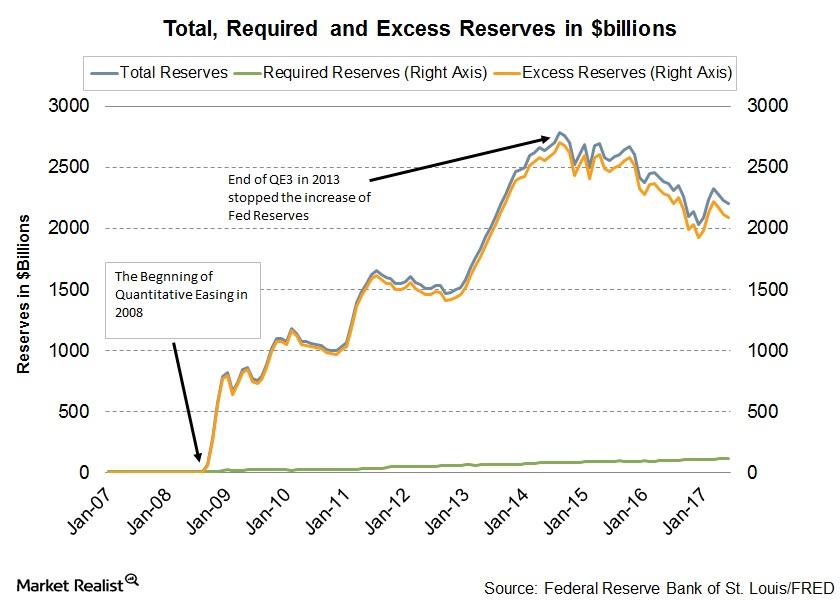

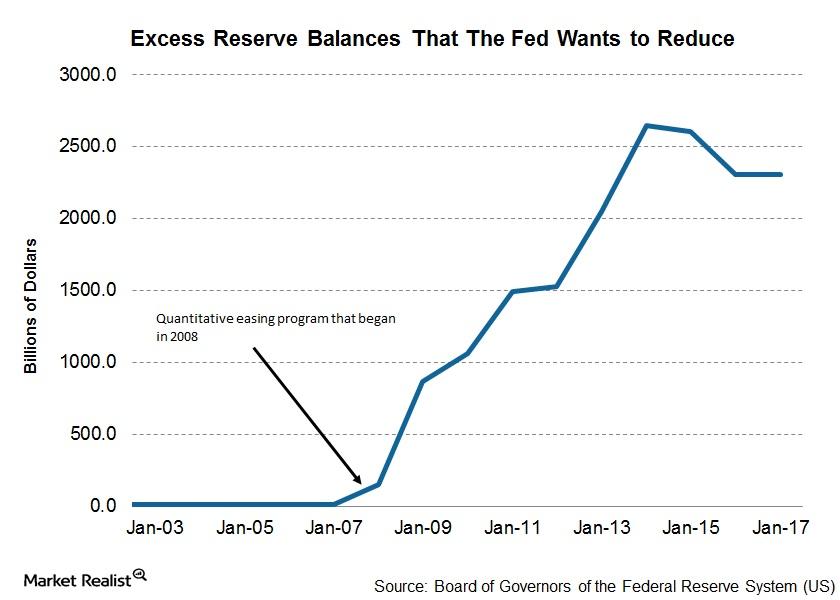

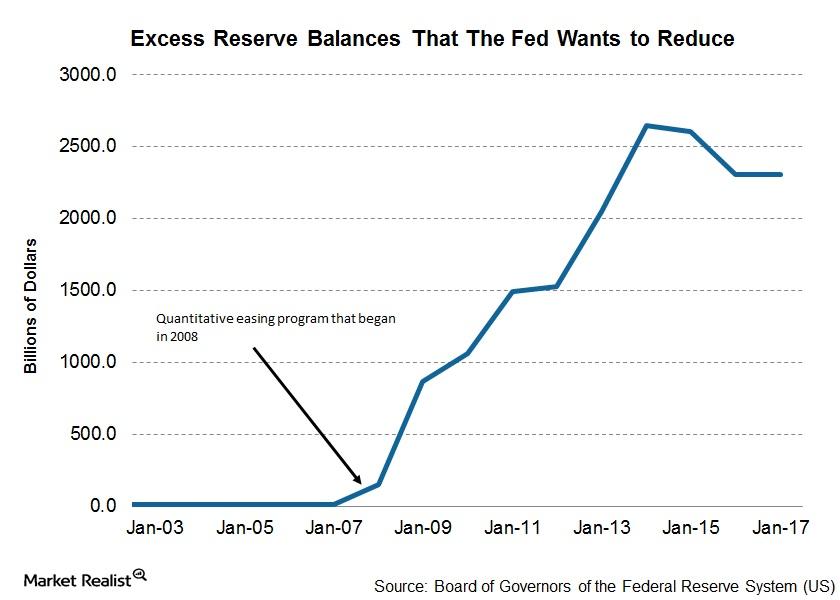

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

Could the Fed Announce Balance Sheet Shrinking in September?

The Fed, in its efforts to normalize policy, announced that it is starting the balance sheet unwinding program soon.

The Fed Could Announce Balance Sheet Reduction Plan in September

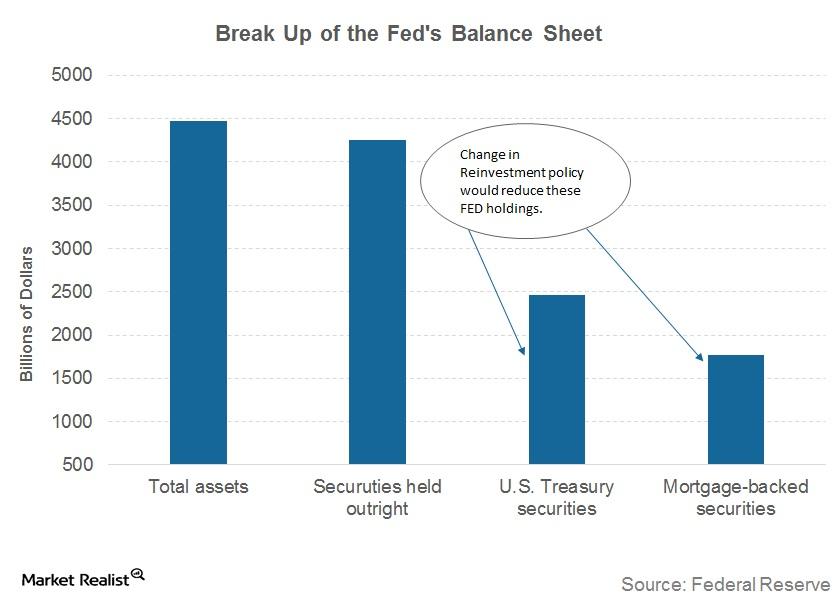

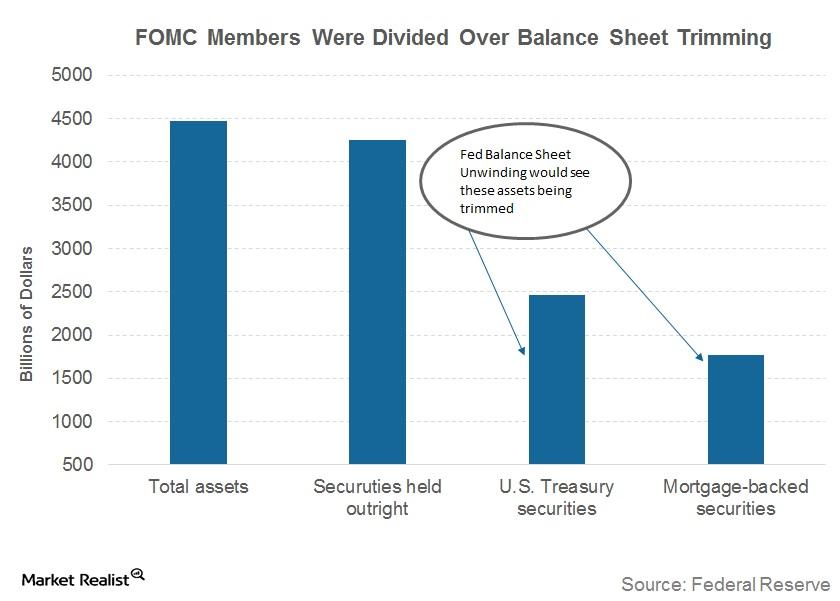

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

Will the US Balance Sheet Unwind Affect the Markets?

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

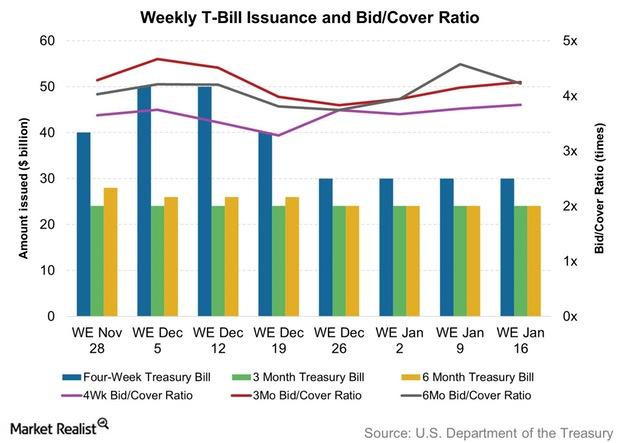

The bid-to-cover ratio rose at the 13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.