Vanguard Total Bond Market ETF

Latest Vanguard Total Bond Market ETF News and Updates

San Francisco Fed John Williams and Monetary Policy Challenges

John Williams, president and CEO of the Federal Reserve Bank of San Francisco, spoke on November 16, 2017, at the 2017 Asia Economic Policy Conference in San Francisco.

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

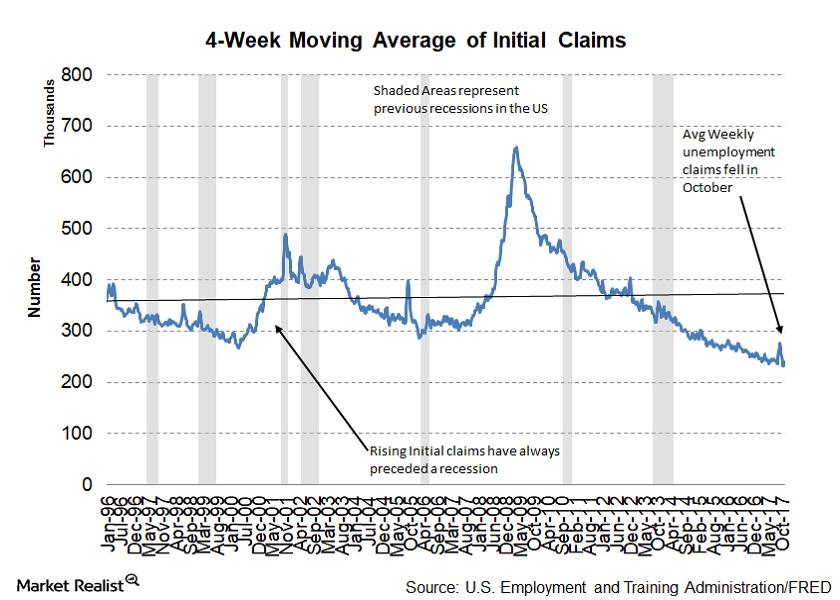

What Decreasing Weekly Unemployment Claims Say about the US Economy

In the Conference Board Leading Economic Index, the average weekly unemployment claims have 3.0% weight.

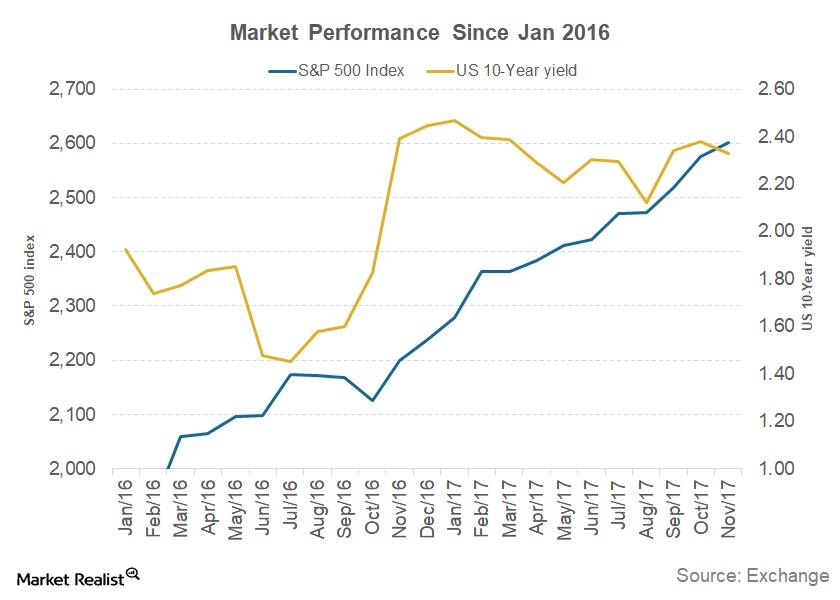

The FOMC’s View of the Equity and Bond Markets

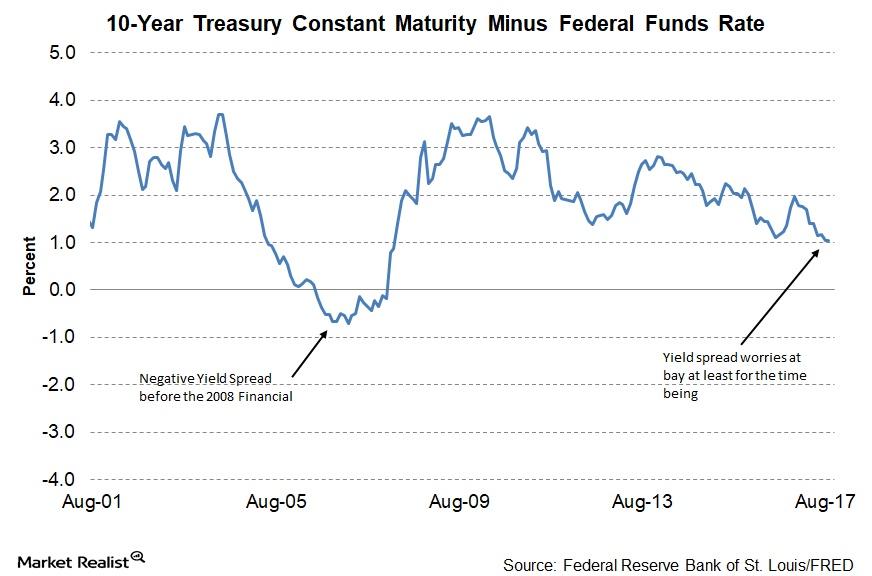

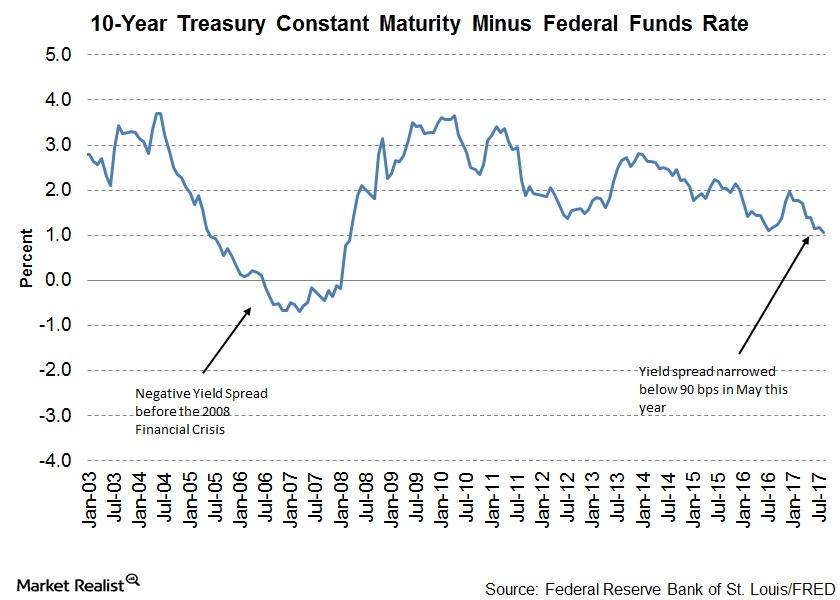

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

The FOMC’s Outlook for the US Economy

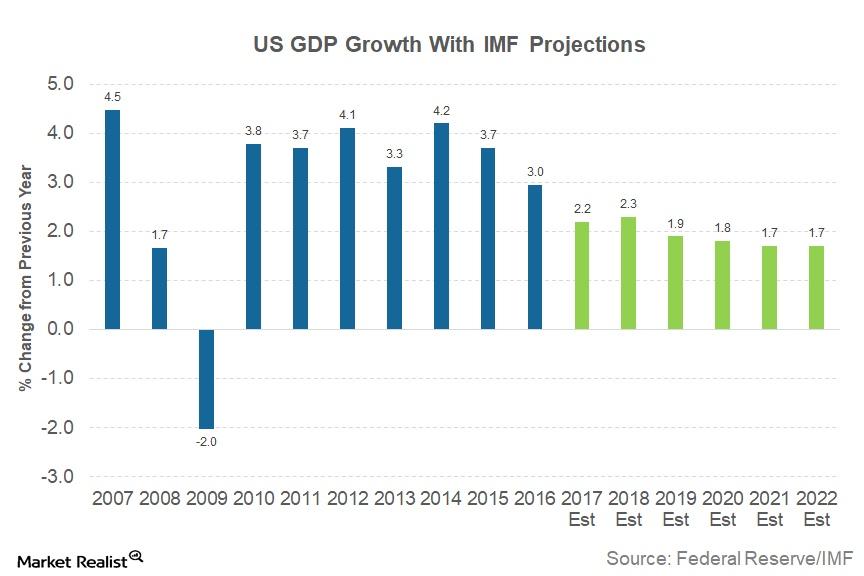

As per economic projections prepared by the FOMC, US real GDP is expected to improve in the final quarter of this year.

The November FOMC Meeting Minutes: Must-Knows

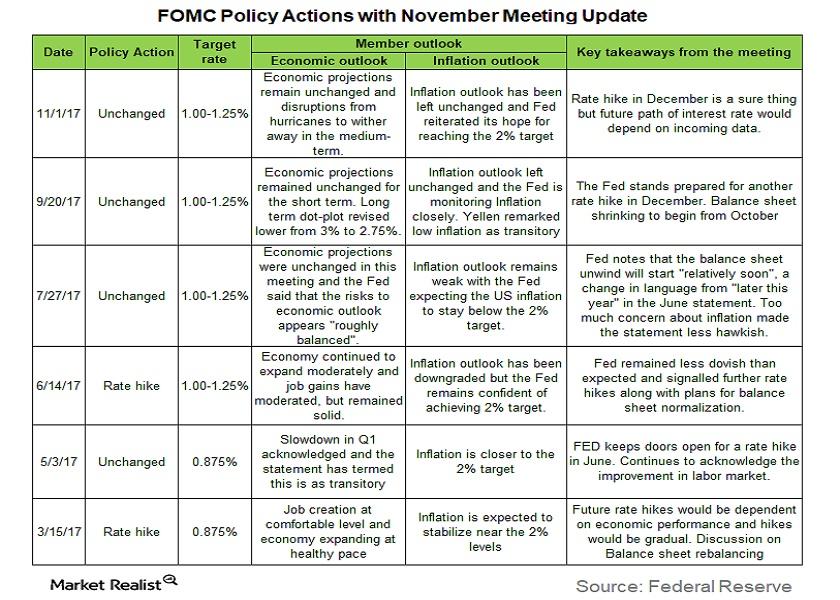

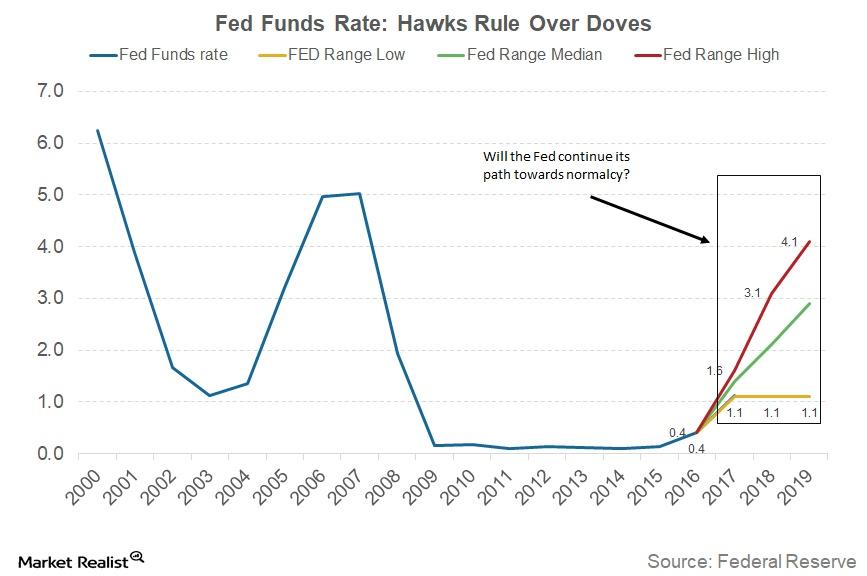

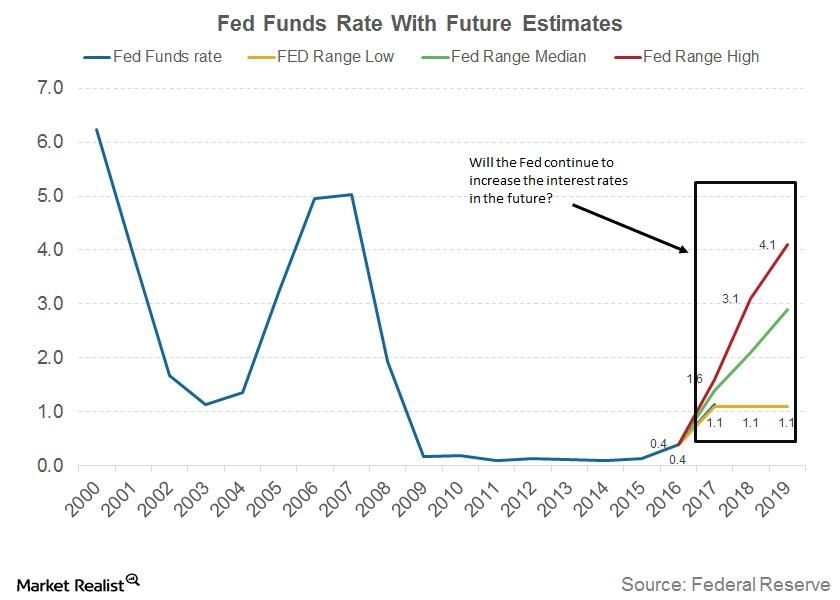

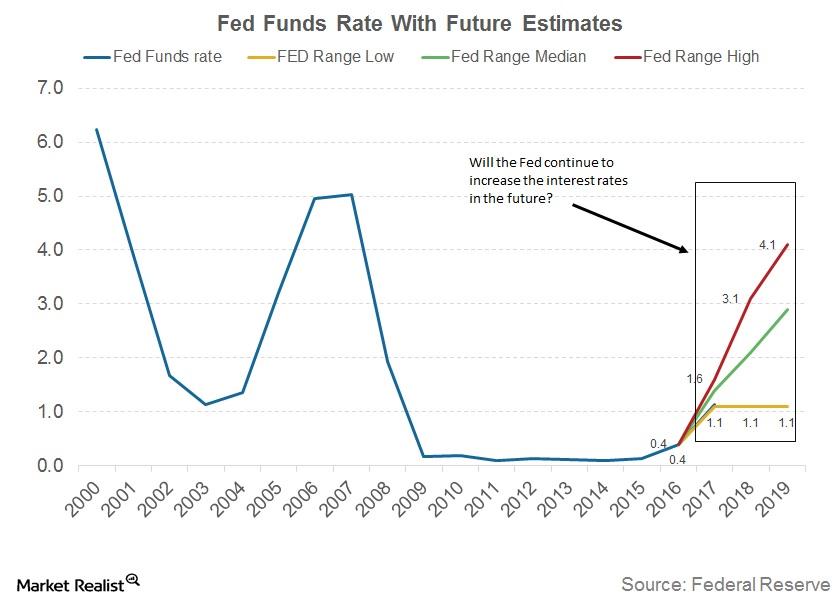

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

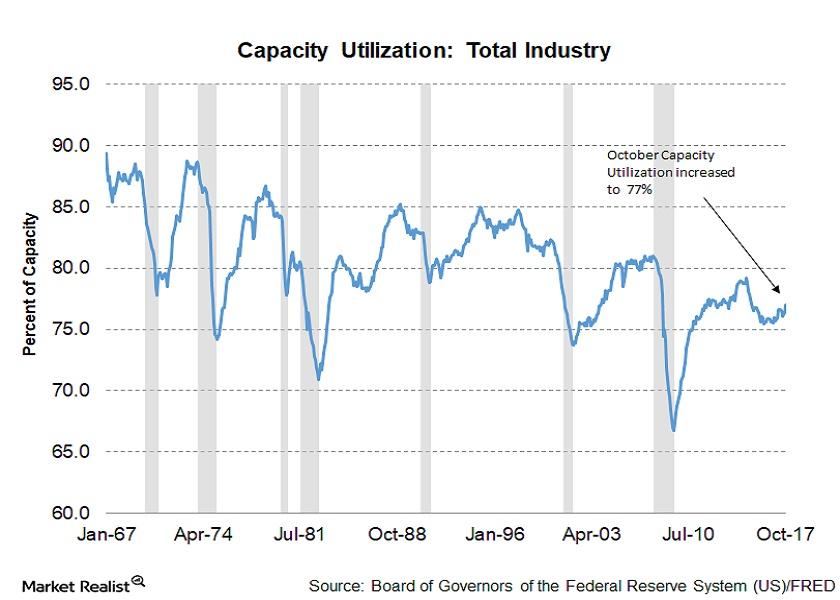

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

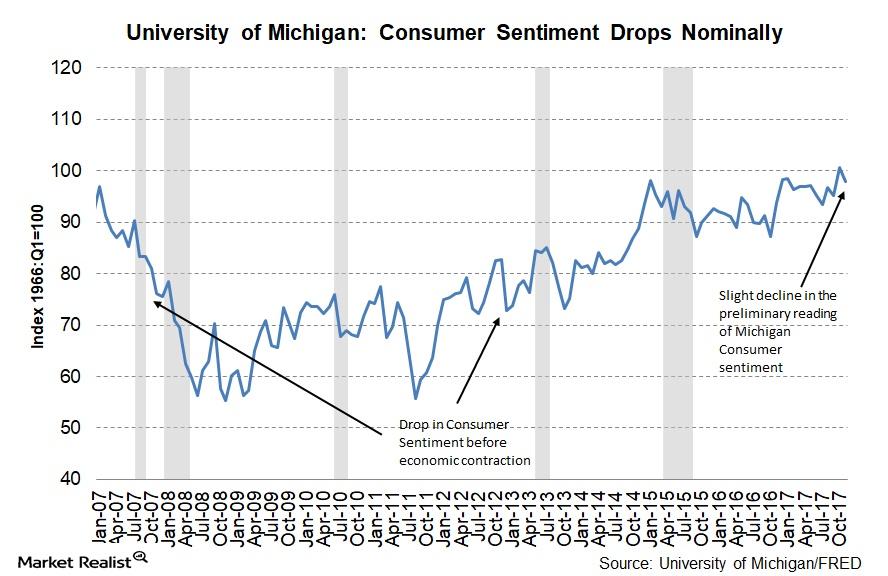

Here’s What Drove Consumer Expectations Lower in November

The University of Michigan Preliminary Consumer Sentiment for November was reported at 97.8, which was 2.9 lower than the final October reading of 100.7.

Key FOMC Insights and the New Fed Chair

The US FOMC left rates unchanged after the November 2017 meeting, as expected, setting the stage for a potential rate hike in December.

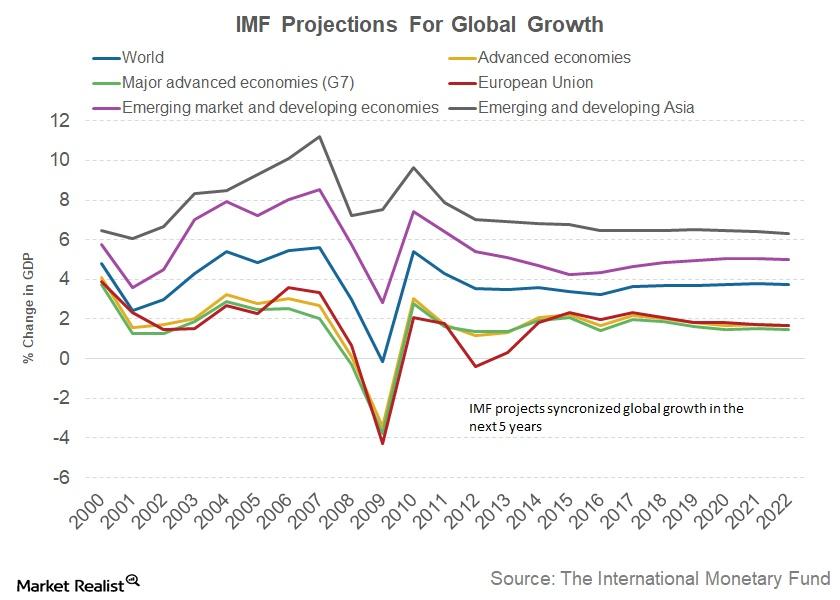

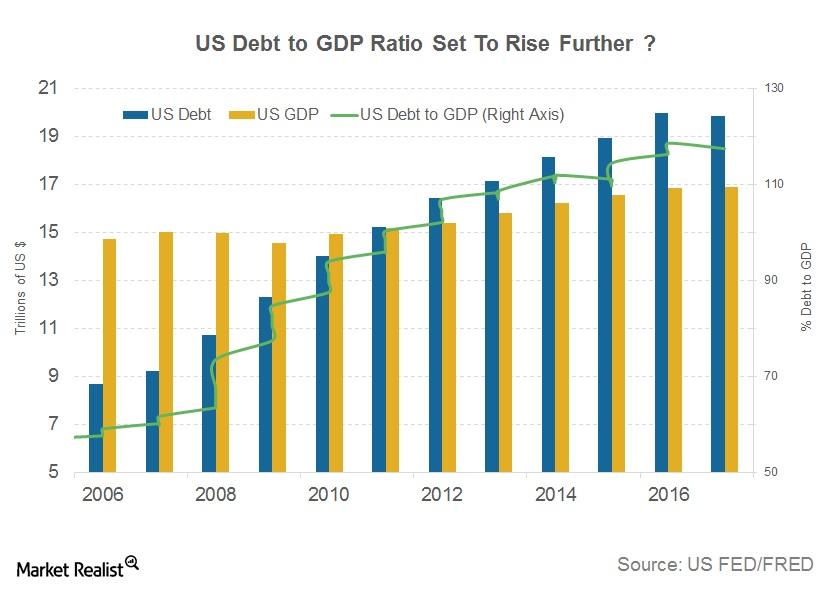

IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

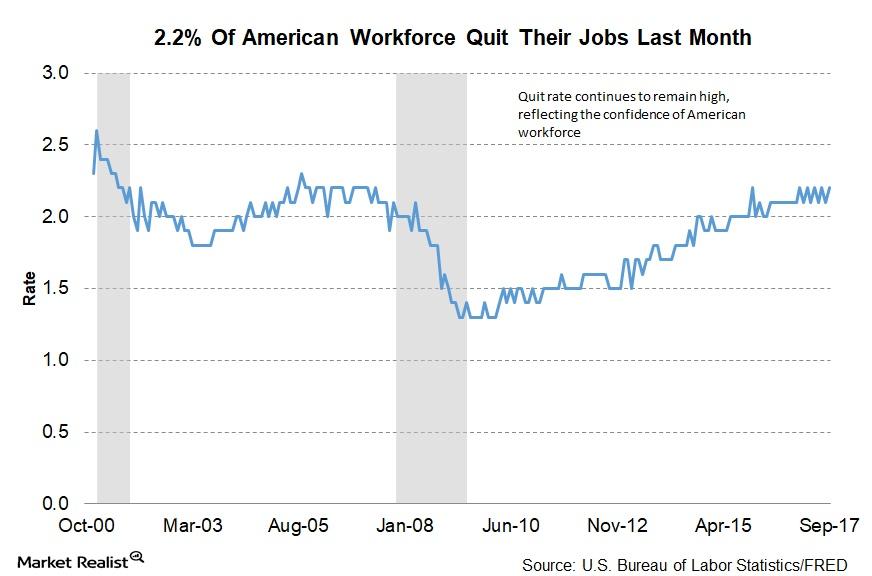

3.2 Million Americans Quit Their Jobs in September

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in September.

Did Job Openings Rise in September?

The Job Openings and Labor Turnover Survey (or JOLTS) report for September came out on November 7. Job openings remained unchanged at 6.1 million as of the last business day in September.

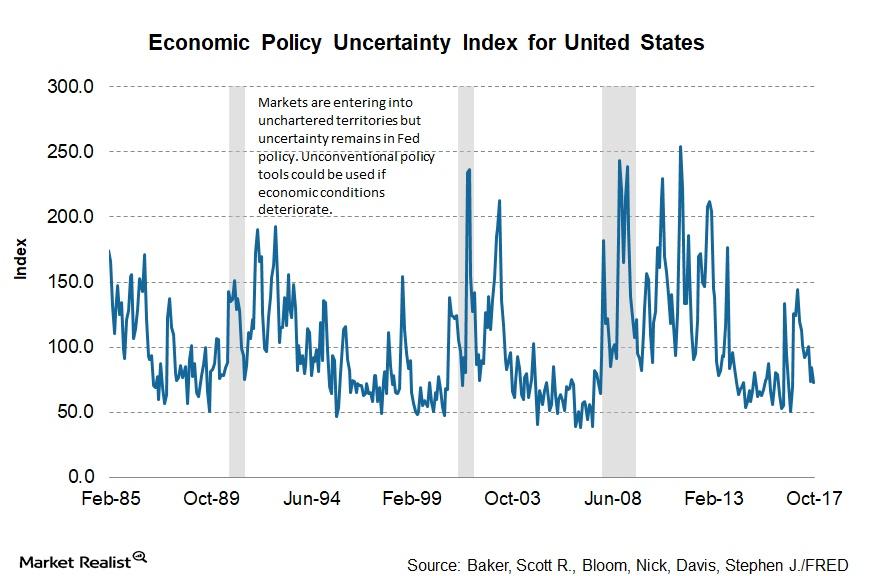

Janet Yellen: A Key Question for the Future

In a speech at the 2017 Herbert Stein Memorial Lecture, Fed Chair Janet Yellen shared her thoughts on monetary policy for the future and discussed whether there will be any role for unconventional policy again.

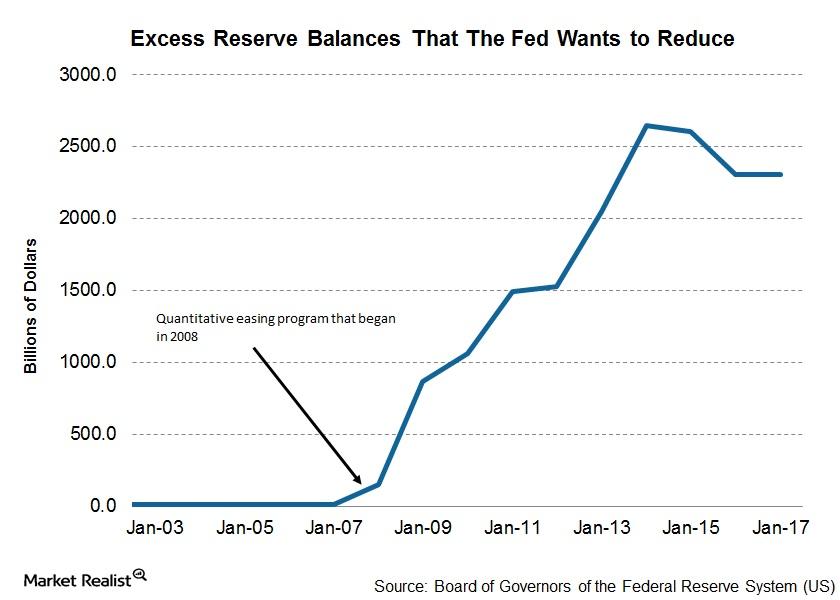

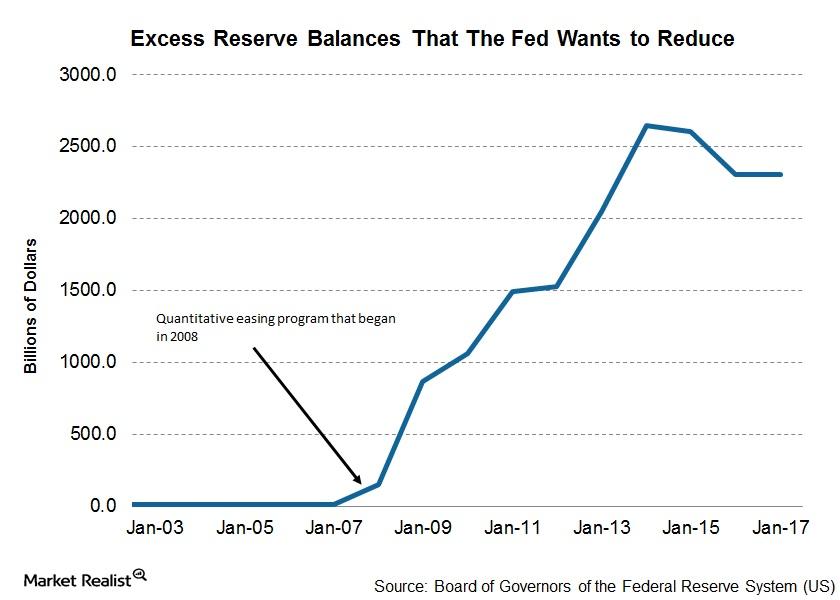

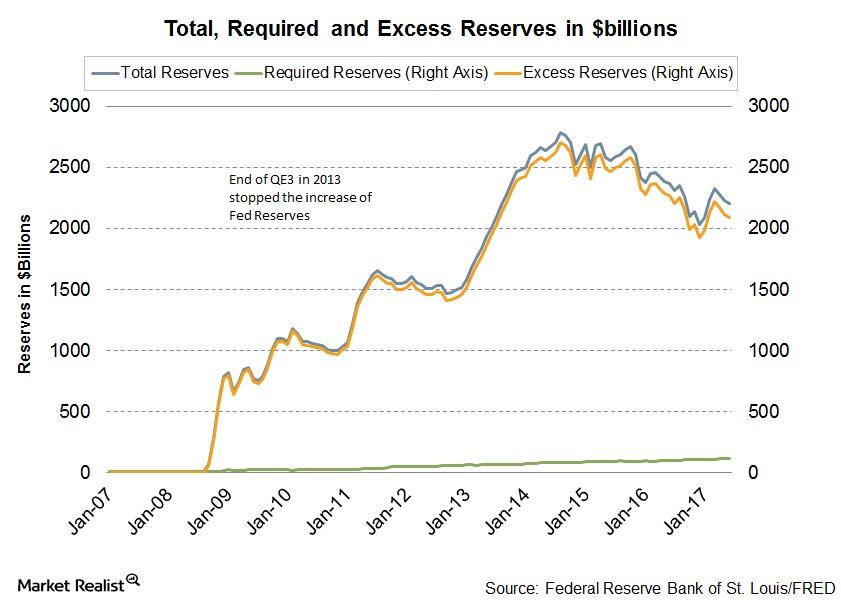

Janet Yellen Balance Sheet Strategy a Closer Look

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

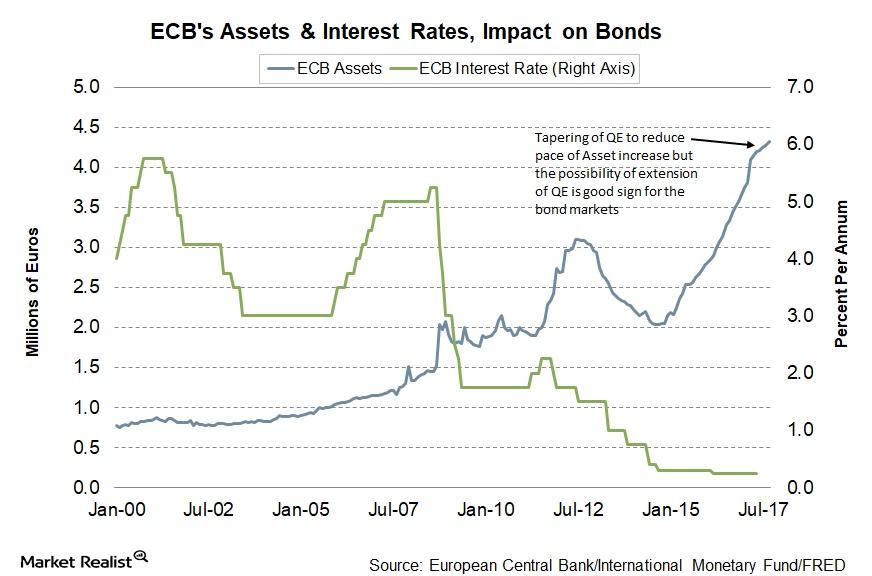

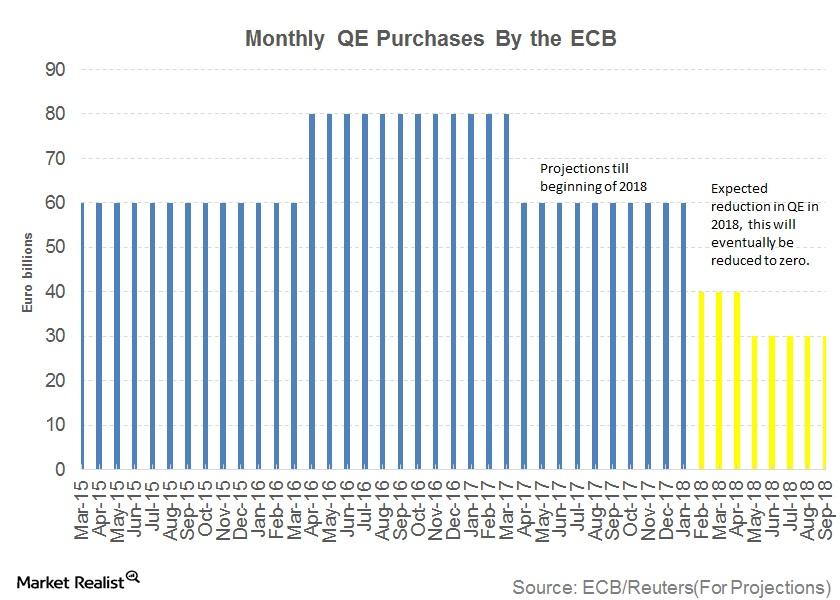

Analyzing the European Central Bank’s October Statement

The reduction to the ECB’s bond-buying program will likely have a mixed impact on the bond markets of countries in the European Union.

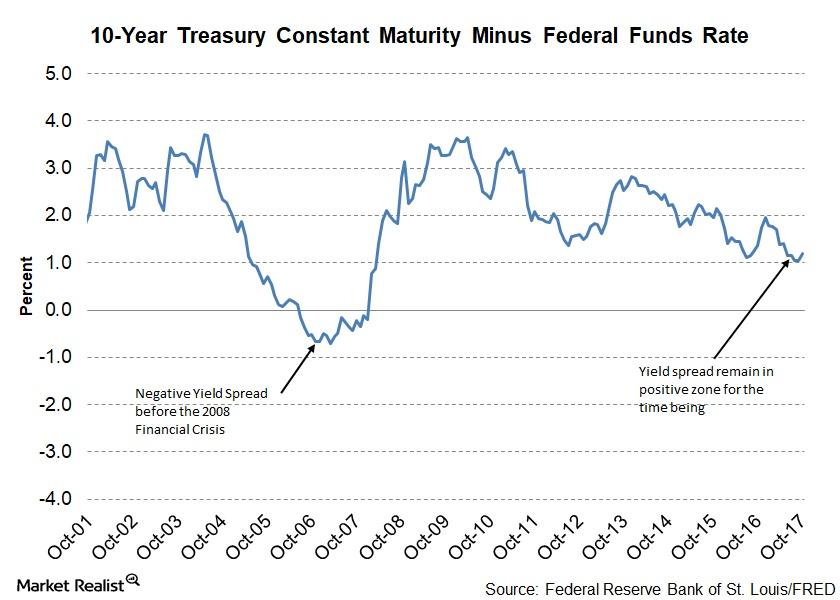

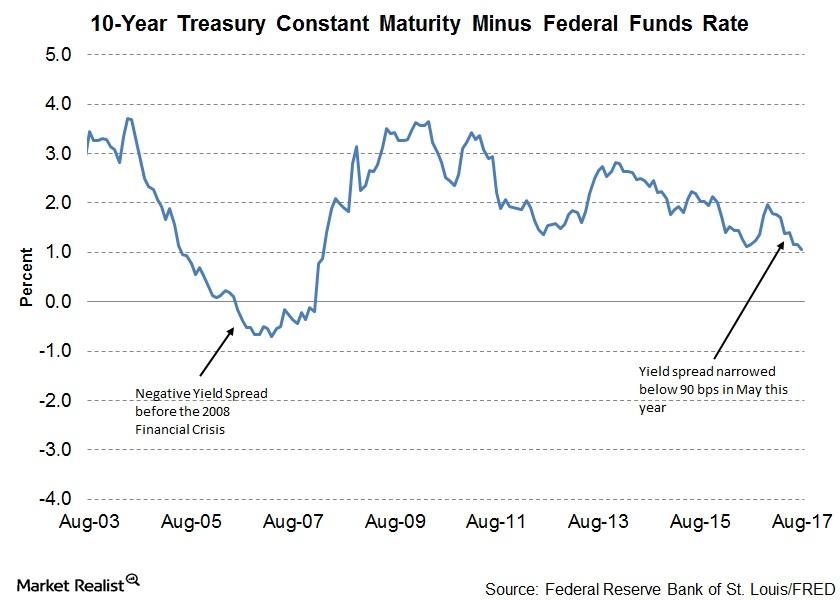

Are Declining Yield Spread Worries Done for Now?

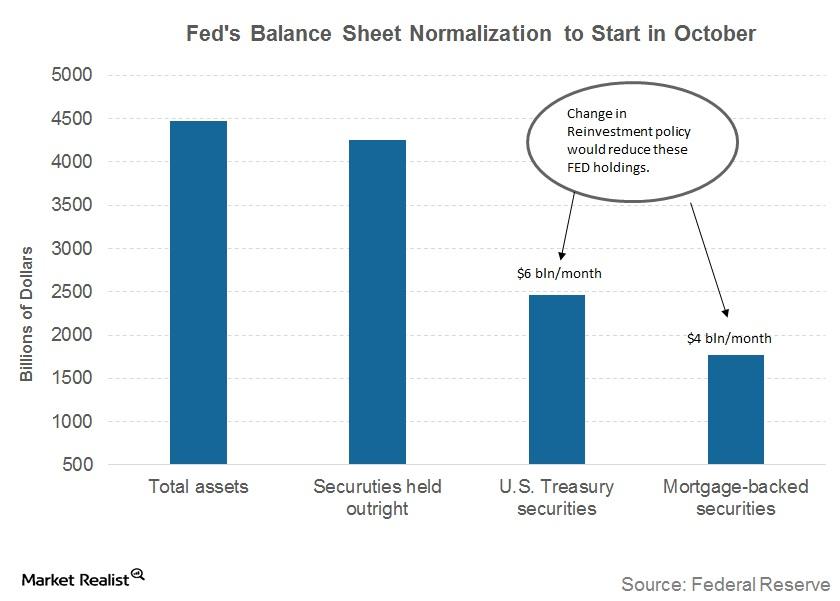

At the last FOMC (Federal Open Market Committee) meeting on September 20, 2017, Fed members decided to initiate a balance sheet normalization process starting in October.

Why a December Rate Hike Shouldn’t Be Taken for Granted

Not all members of the FOMC, according to the minutes of the meeting, were on the same page with respect to a December interest rate hike.

Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

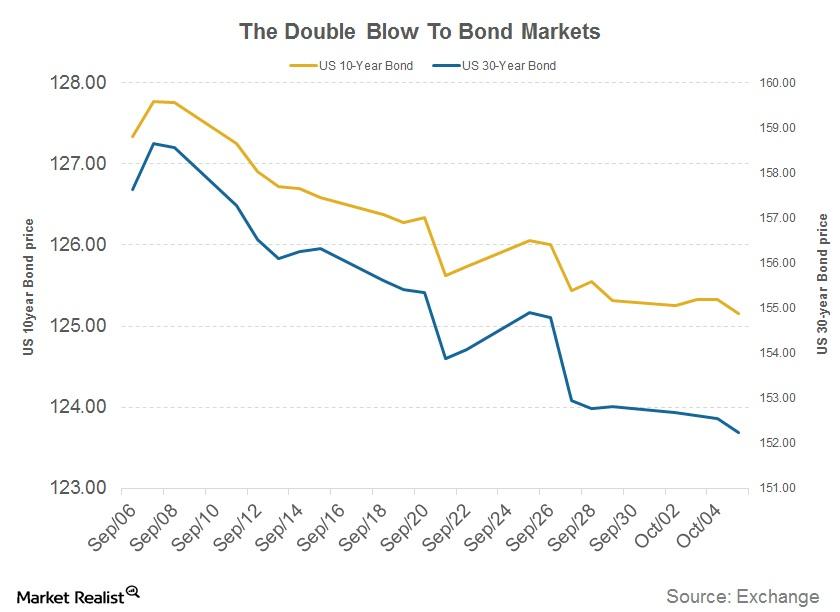

A Double Blow for Bond Markets?

The announcement of the GOP tax reform plan added to the pressure on bond markets.

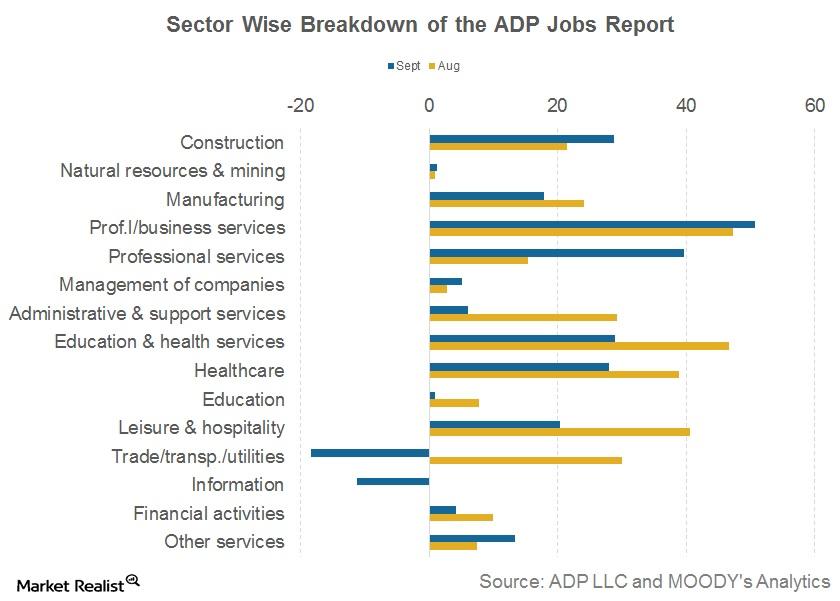

Which Job Sectors Saw the Most Impact from Hurricanes Last Month?

As per the September ADP Employment Report, there was a major drop in the number of jobs created in the trade, transport, and utility sector.

Why FOMC’s John Williams Sees No Impact of Balance Sheet Unwinding on Markets

In the long run, Williams said it would be difficult to predict how markets would react to the Fed’s balance sheet unwinding program.

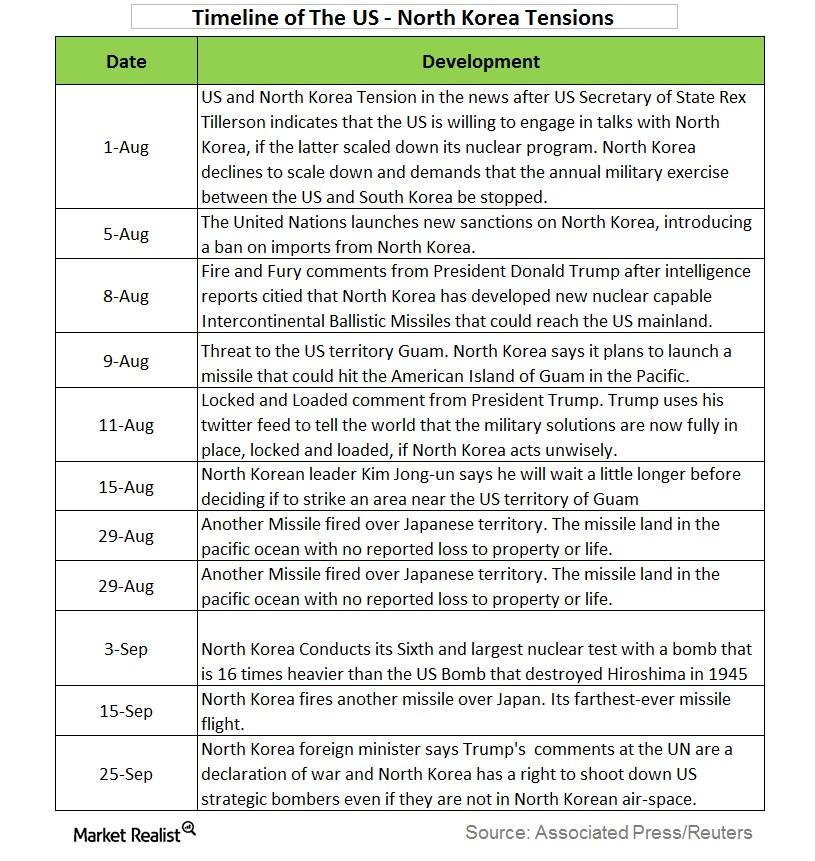

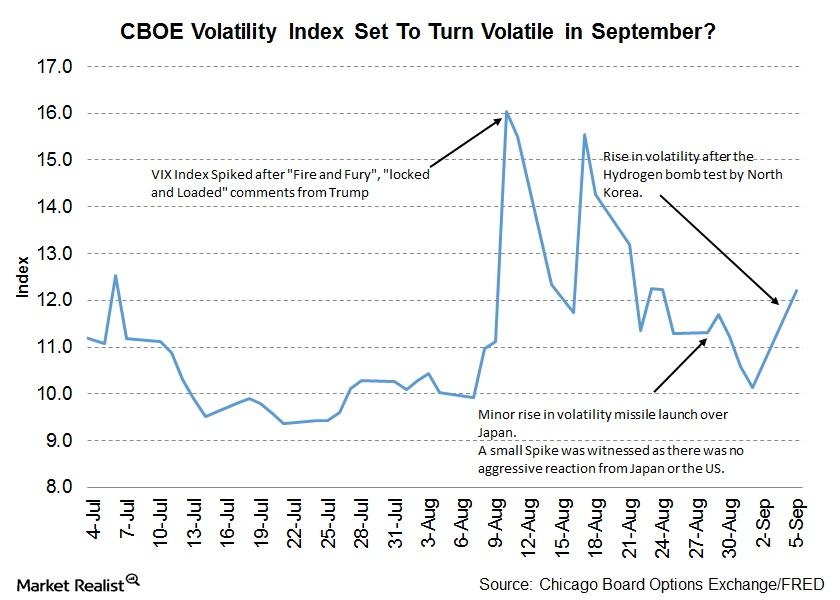

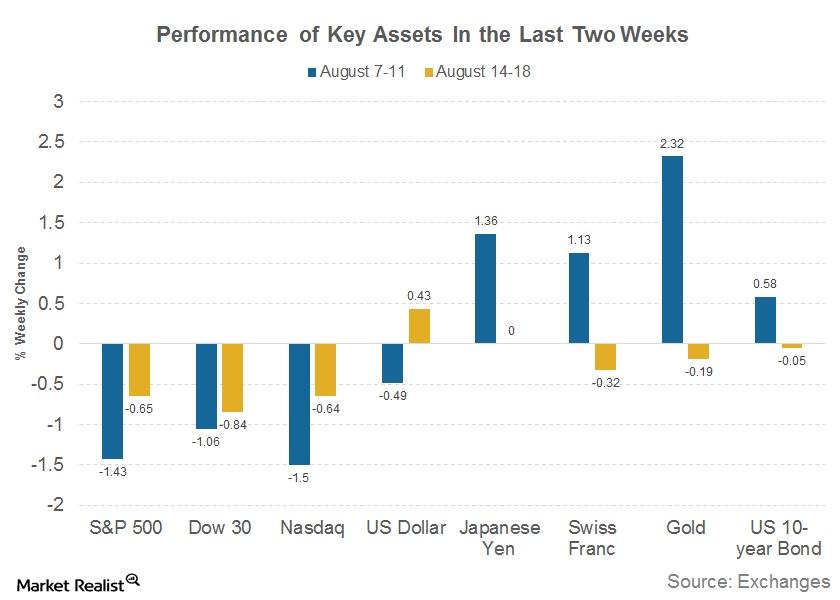

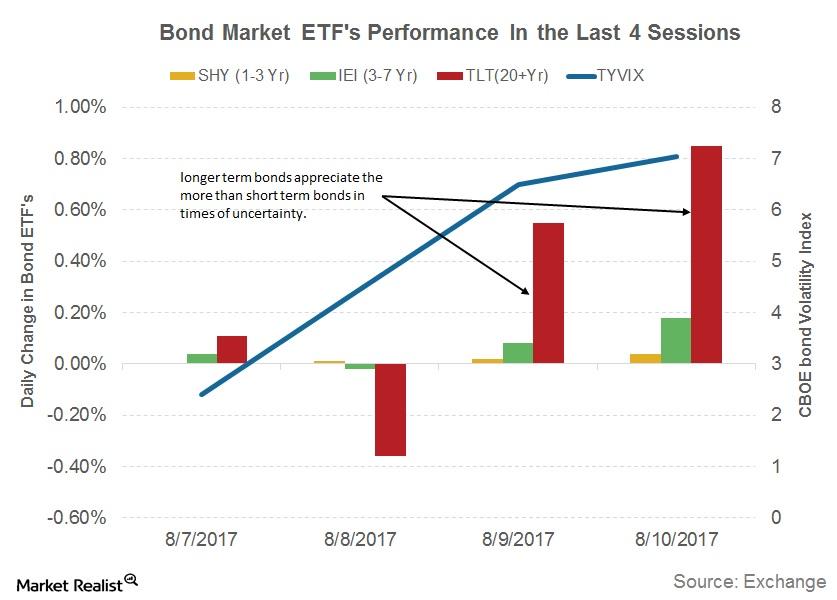

Effects of the North Korea–US Tension on Investors

Rising North Korea tensions In the last two months, tensions between the United and North Korea have continued to escalate, with both sides refusing to back down. North Korea has initiated a series of missile and nuclear tests, worsening tension in the region, and the US president has responded to these tests with strong warnings. […]

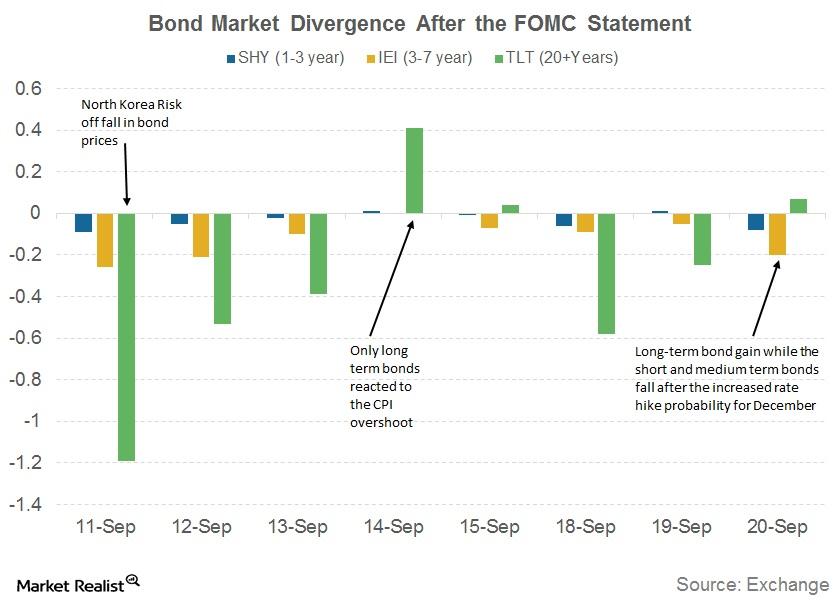

How Credit Spreads May React to the Fed’s September Statement

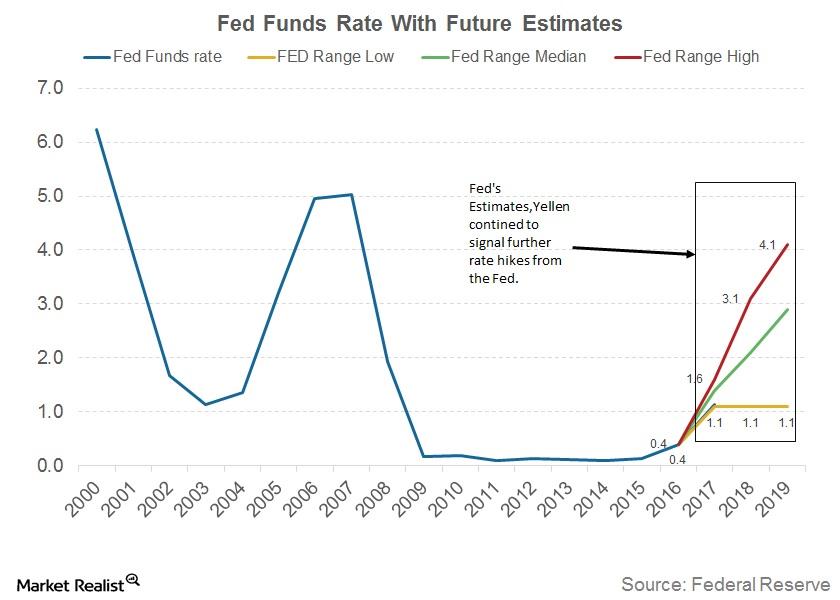

Another rate hike in 2017 The FOMC’s (Federal Open Market Committee) meeting on September 20 changed the outlook for bond markets (BND). It suggested that the Fed could be looking at another rate hike by the end of this year, along with a balance sheet unwinding program. Gains in August inflation (TIP) boosted Fed members’ […]

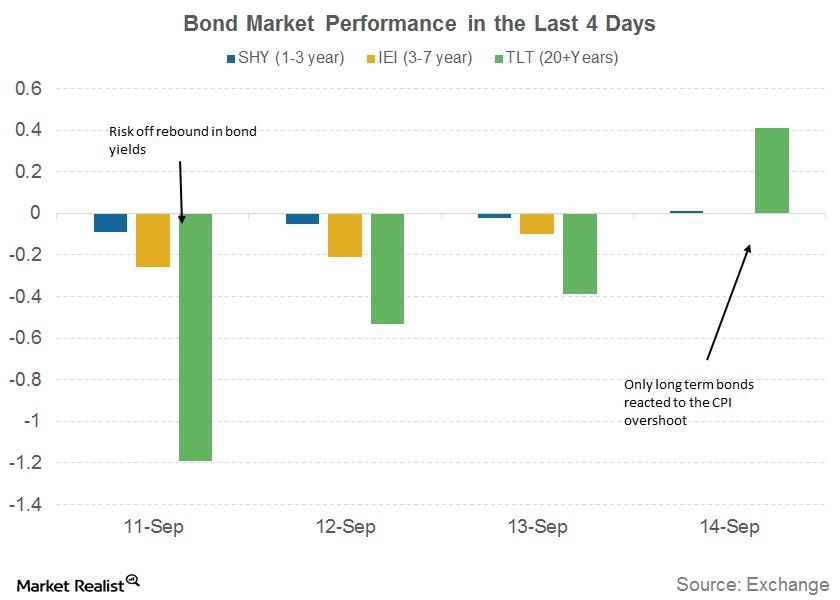

Why Maturity Bonds Reacted Differently to the Fed’s September Statement

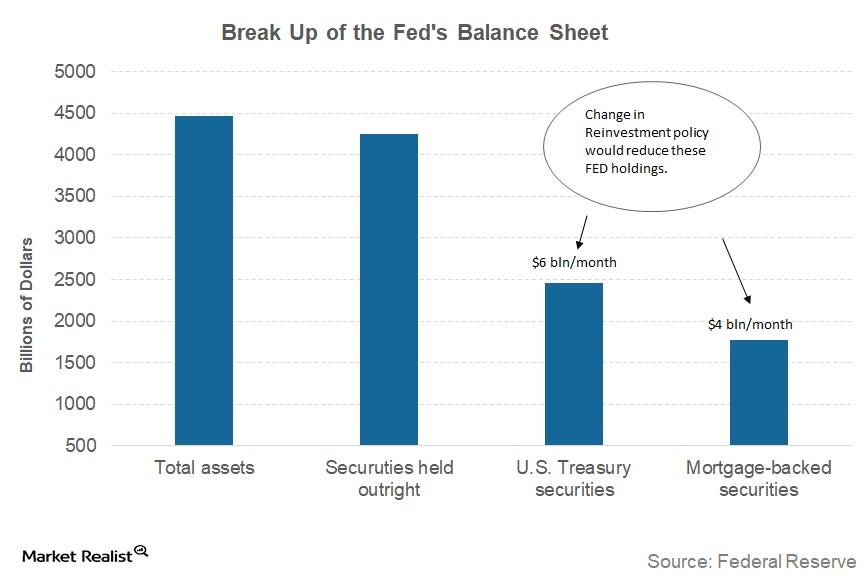

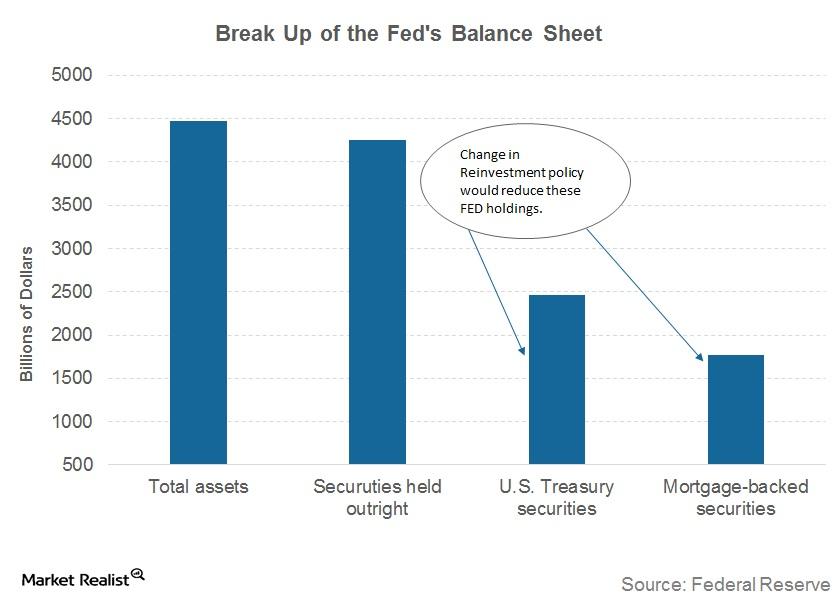

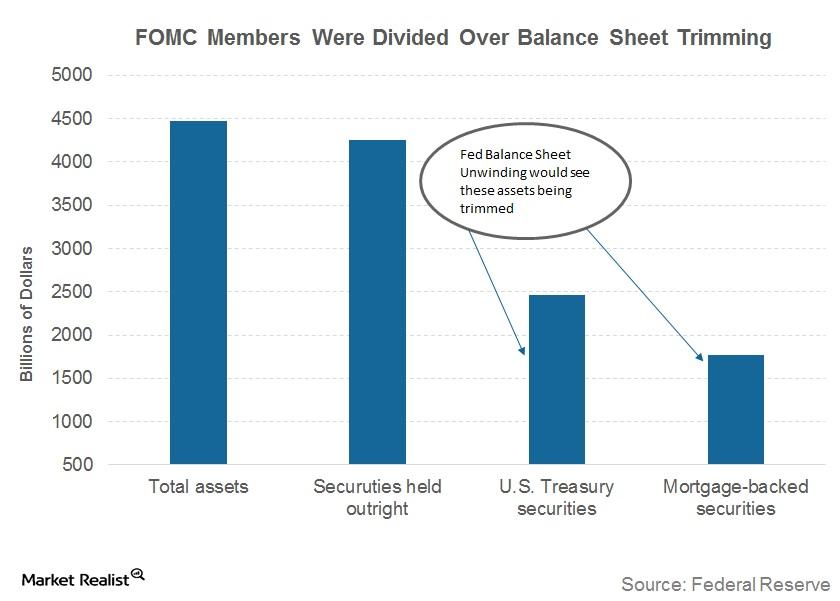

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.

Why Is FOMC Starting to Unwind Its Balance Sheet without a Target?

In the September 20 meeting, FOMC (US Federal Open Market Committee) finally announced the start date of its balance sheet unwinding program.

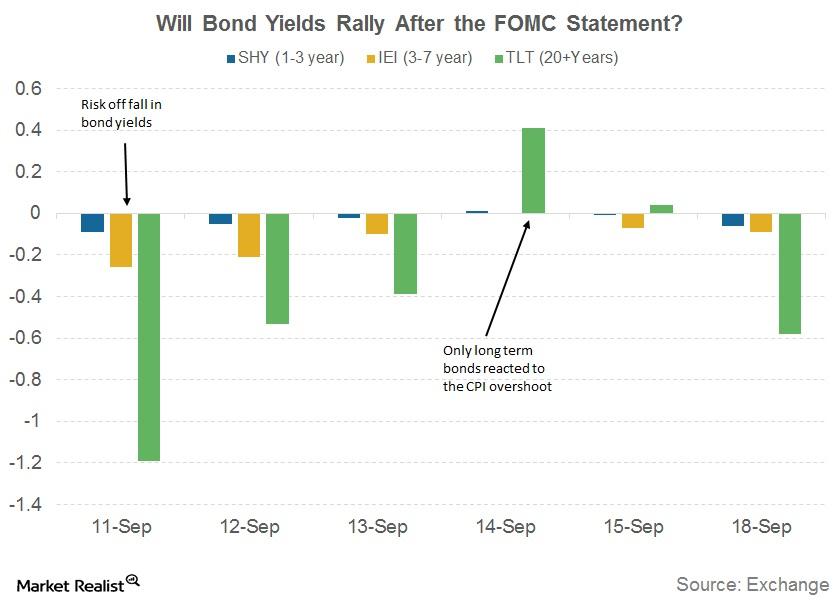

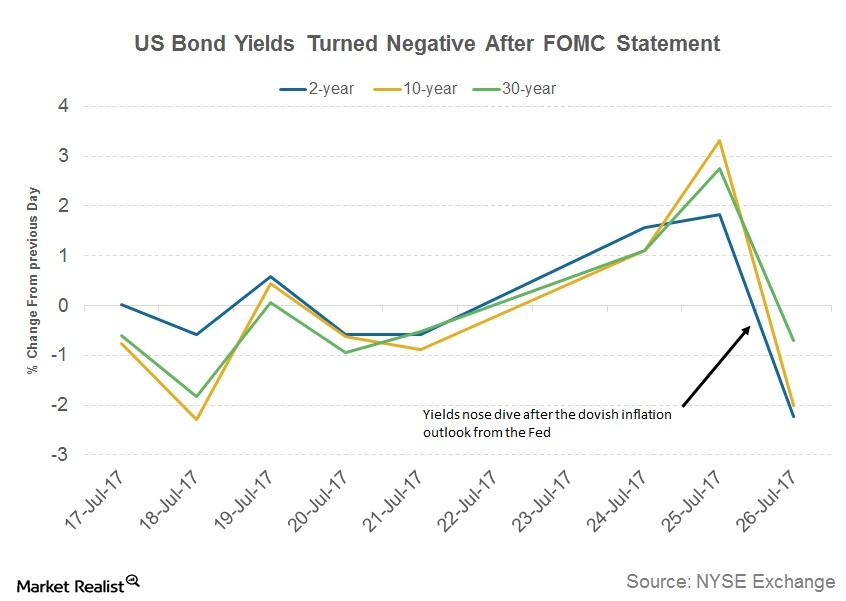

Will US Bond Yields Rally after the FOMC Statement?

The bond markets are the most impacted asset class by any changes to the Federal interest rates.

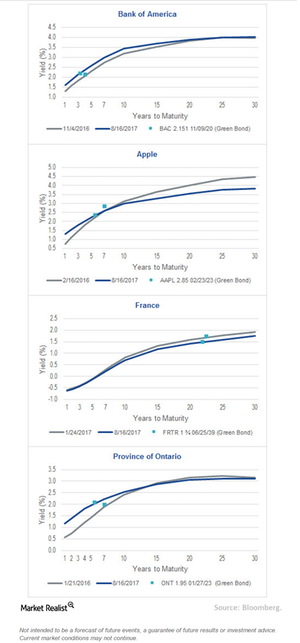

Does the Green Bond Premium Exist?

Despite the rapid rise in issuance, demand for green bonds continues to outshine supply. The excess demand for green bonds has led to higher returns.

The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

How ECB Tapering Could Impact European Bond Markets

The European bond market’s reaction to the ECB’s (European Central Bank) September 7 statement has so far been positive.

Why the US Debt Ceiling Fight Has Been Postponed

The key reason for the debt ceiling deal was to approve aid to Hurricane Harvey victims. A US government shutdown could have adversely impacted relief operations.

Why September Could Be Volatile for Financial Markets

August was a volatile month, filled with economic, political, and geopolitical uncertainty. September could turn out to be another nail-biter for the financial markets.

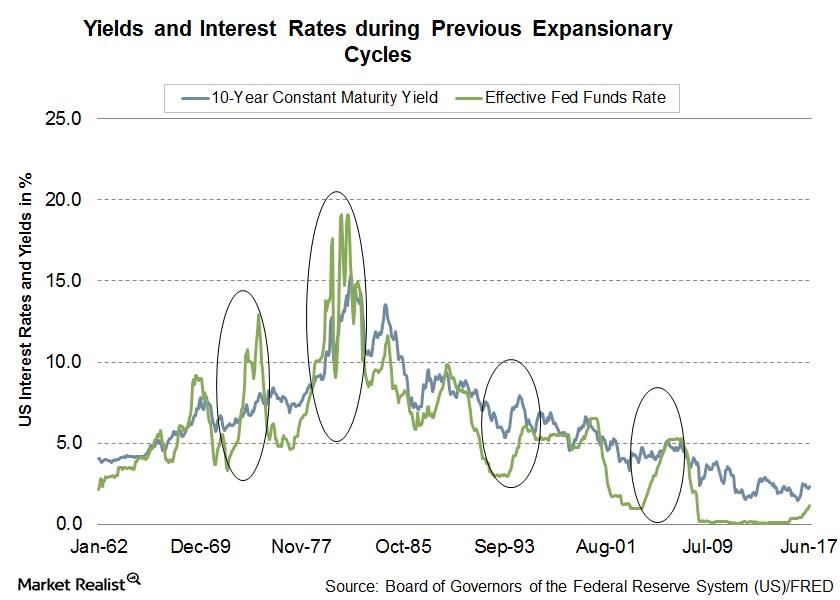

Stanley Fisher’s Solution for Low Interest Rates

Stanley Fisher, vice chair of the U.S. Federal Reserve, has shared his views on low interest rates and some solutions to get rates back to normal levels.

Why Interest Rate Spreads Are Growing

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

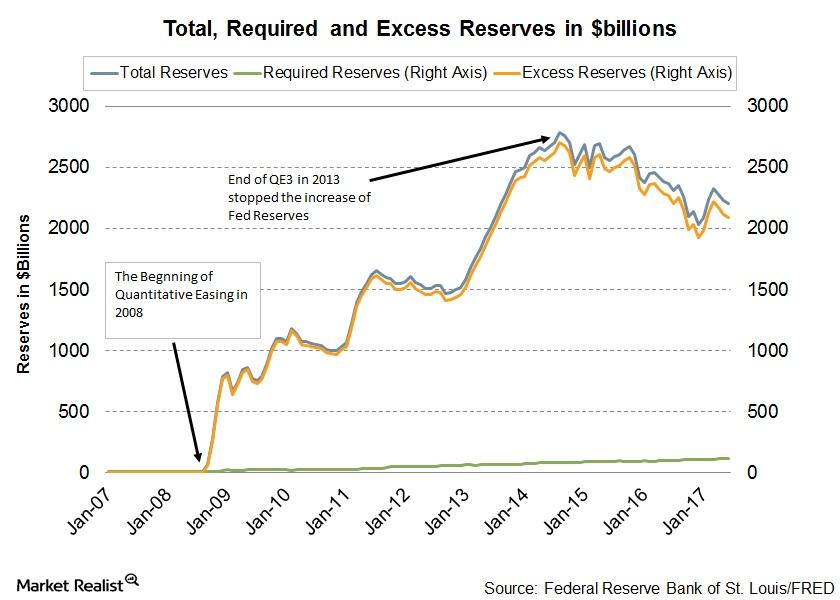

Will the Fed Repeat Its Taper Tantrum Mistakes?

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

Washington or Wyoming: What Will Drive Markets This Week?

The last two weeks have been eventful for financial markets (SPY).

The Fed Could Announce Balance Sheet Reduction Plan in September

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

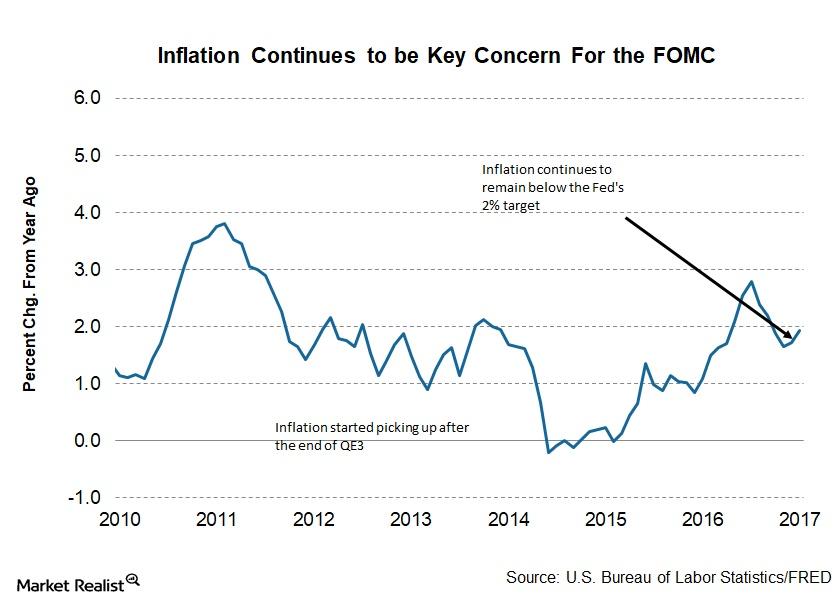

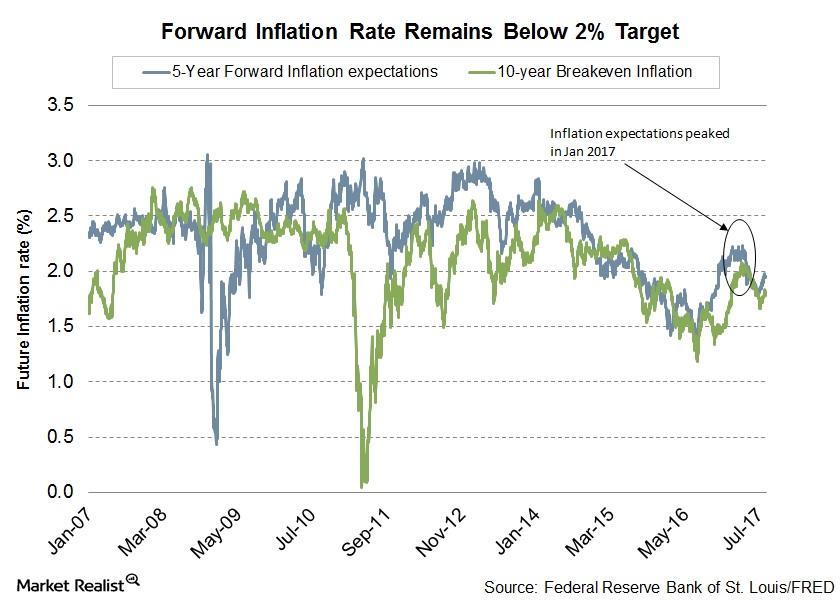

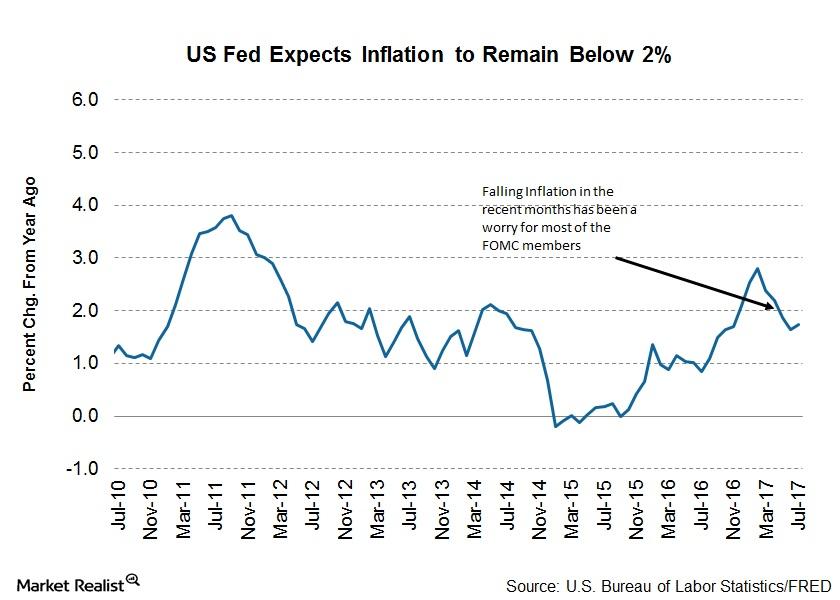

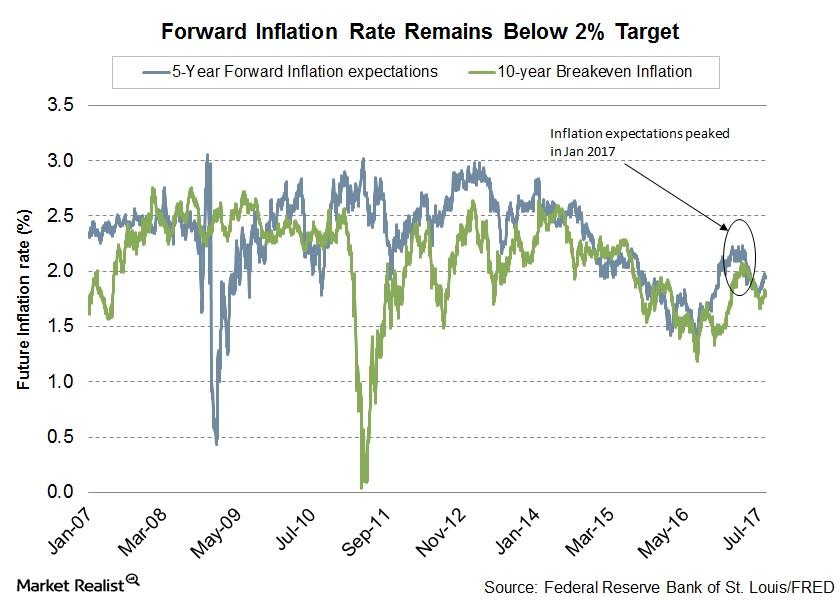

Why Inflation Remains a Huge Concern for FOMC Members

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation growth to idiosyncratic factors.

New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.

Can There Really Be a Bubble in the Bond Market?

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case.

Why Bond Prices Rose after the FOMC’s Statement

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

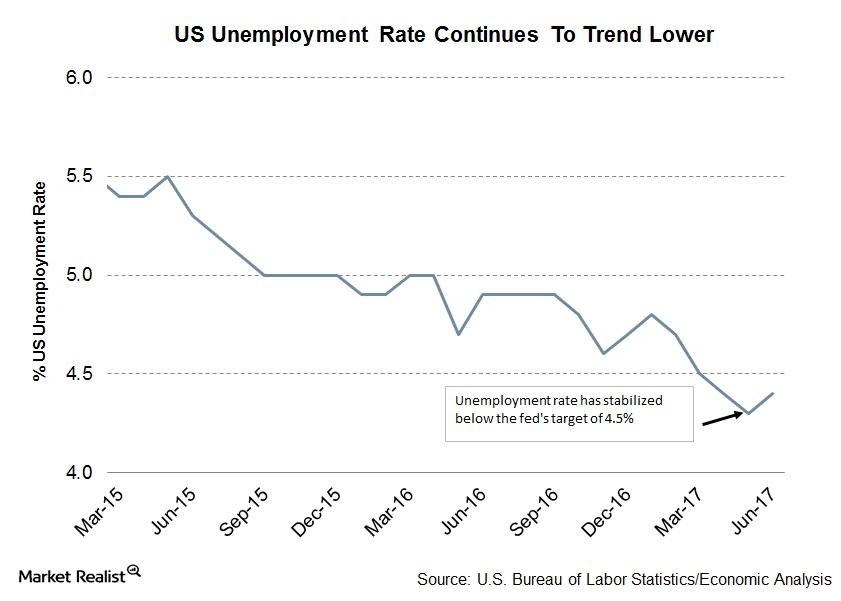

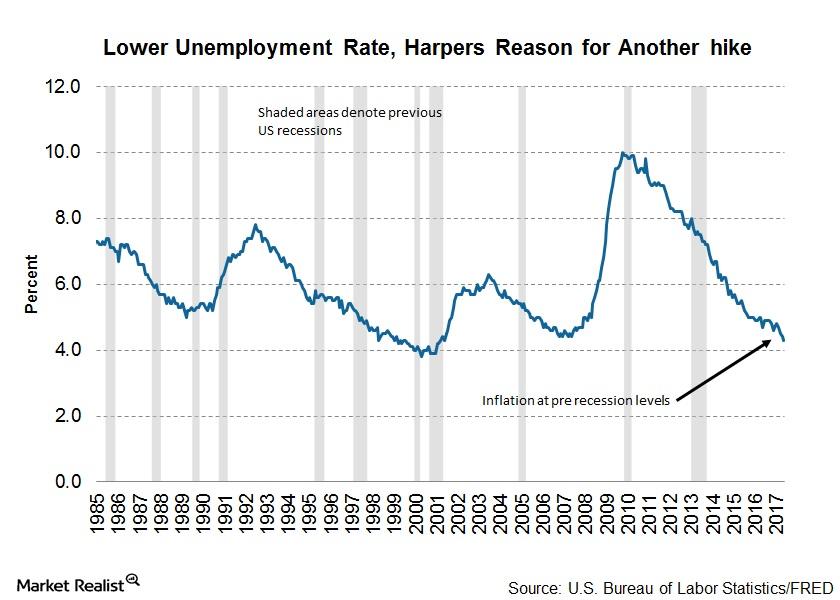

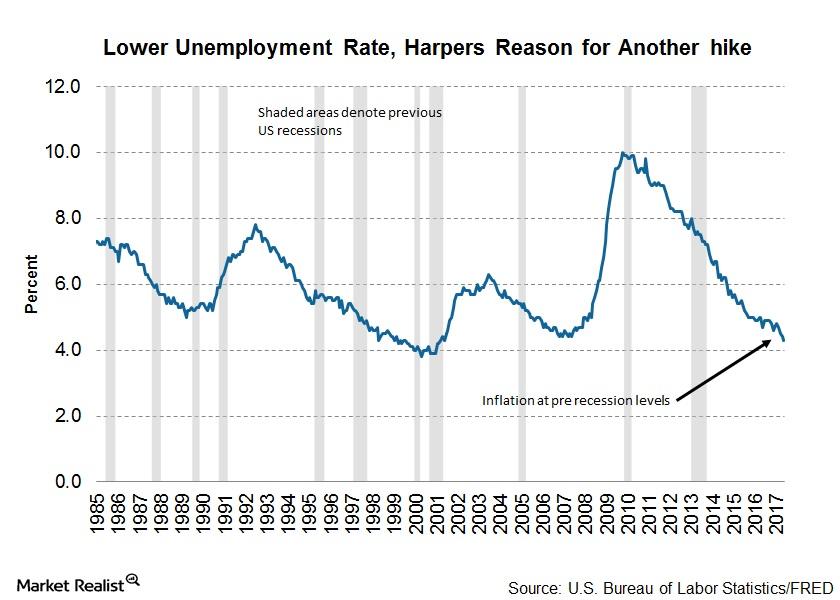

US Unemployment: The Fed’s Favorite Metric Continues to Improve

In a statement following the conclusion of its two-day monetary policy meeting, the FOMC stated that US labor market growth was solid.

Will the US Balance Sheet Unwind Affect the Markets?

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

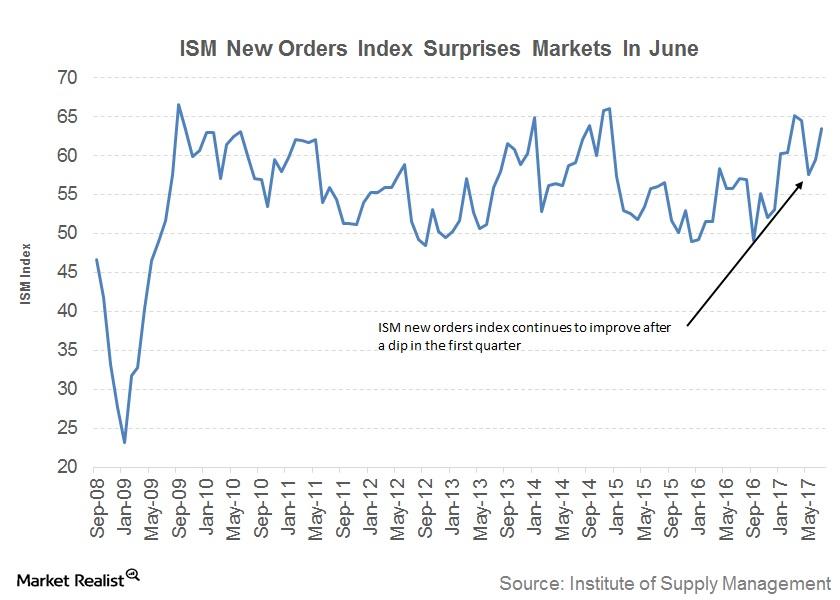

What the ISM New Orders Index Indicates for the US Economy

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers.

Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

Why Minneapolis’s Fed President Voted Against a Rate Hike

In an essay published by Minneapolis’s Federal Reserve president, Neel Kashkari, after he voted against a rate hike in the Federal Open Market Committee’s (or FOMC) June 2017 meeting, he explained why he dissented.

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

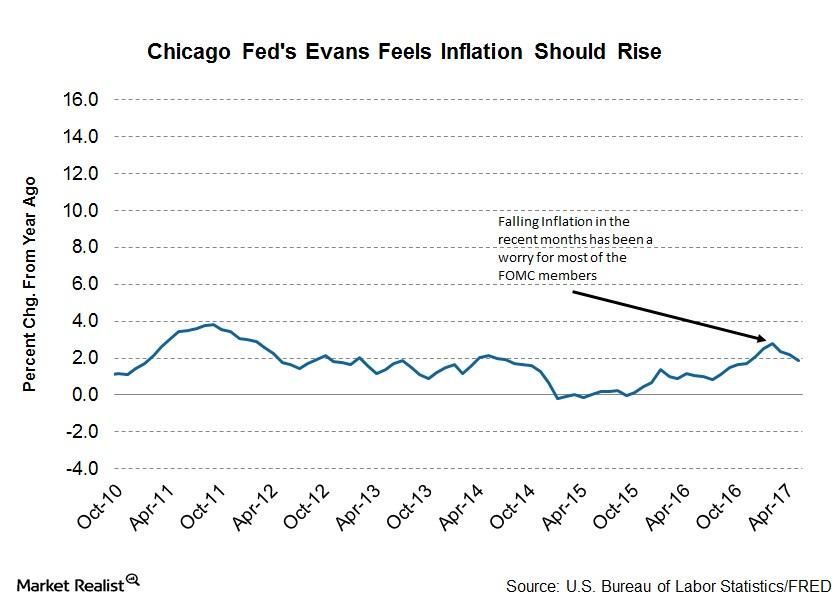

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.