Vanguard Total Bond Market ETF

Latest Vanguard Total Bond Market ETF News and Updates

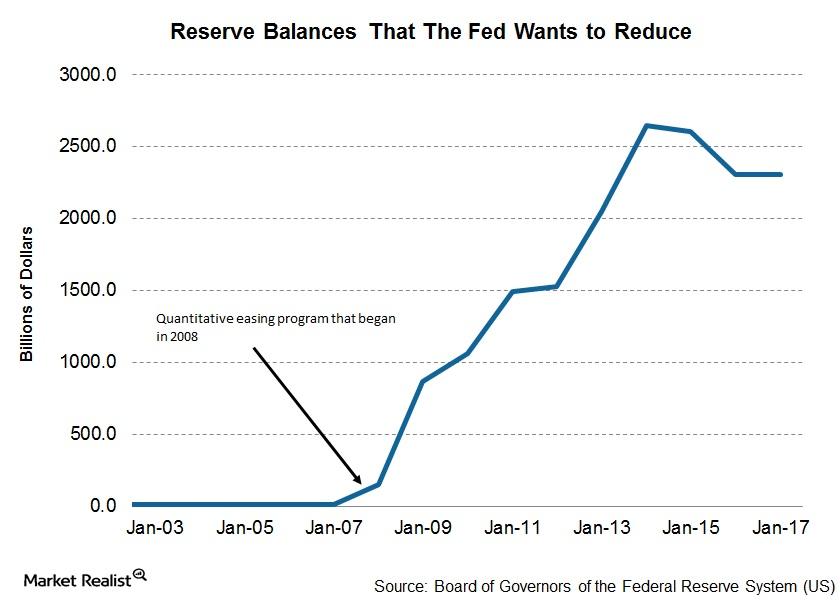

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

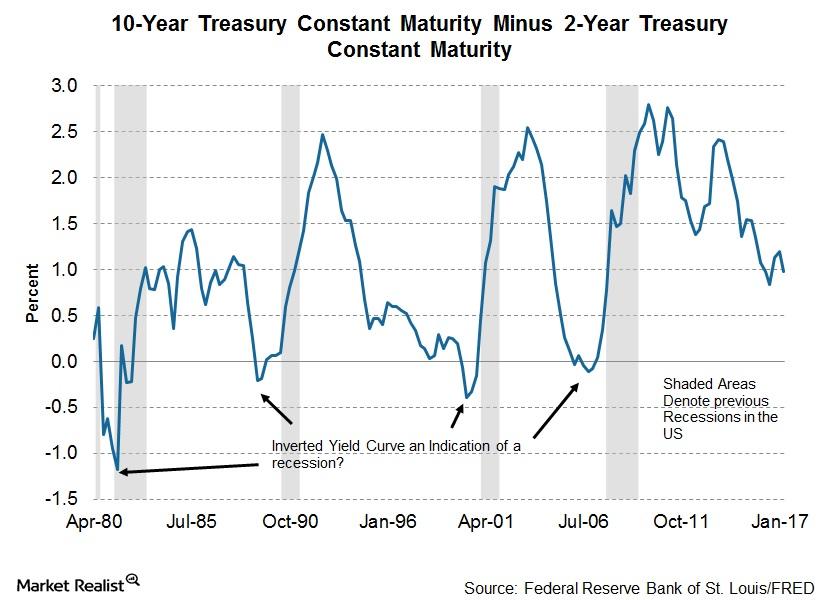

Is a Flattening Yield Curve a Sign of an Impending Recession?

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

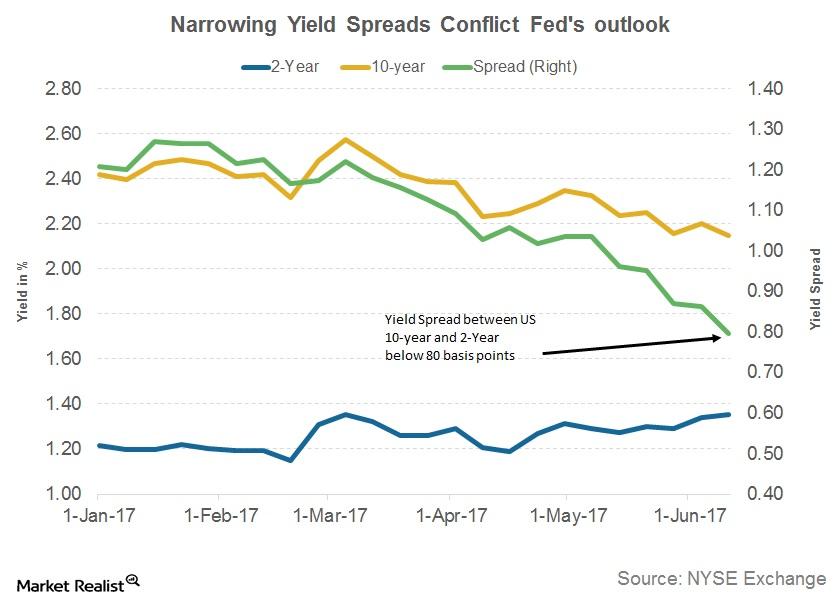

What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

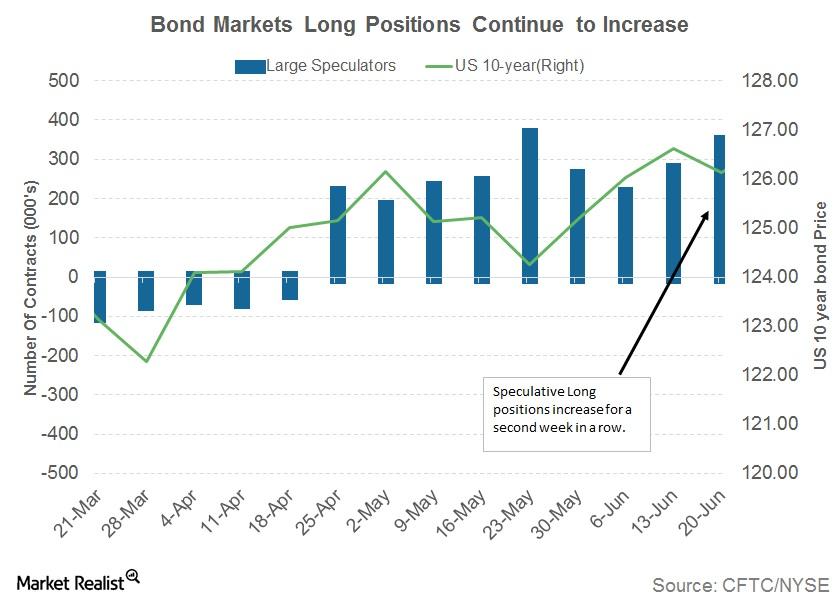

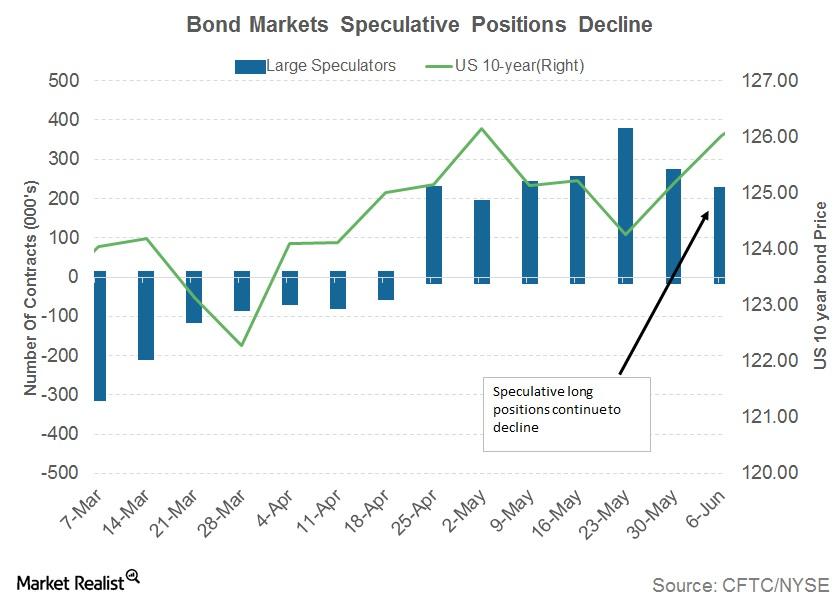

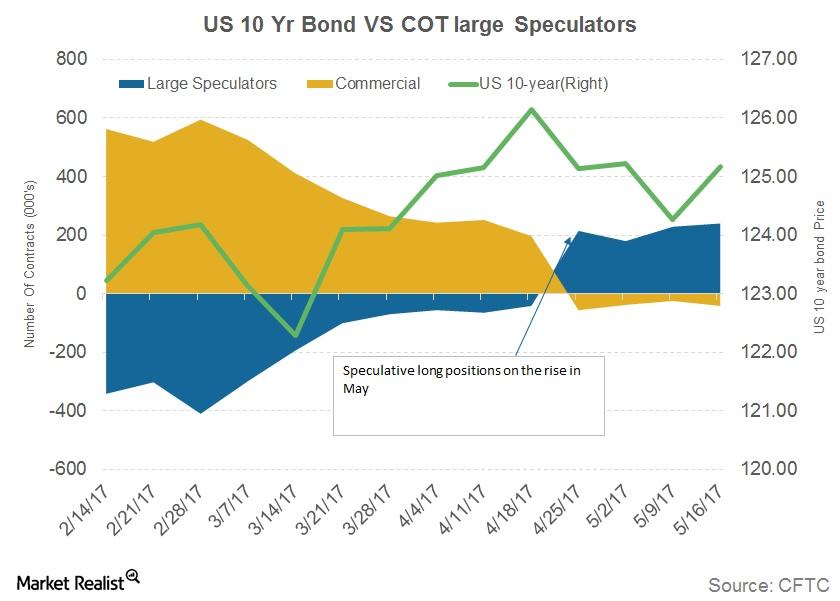

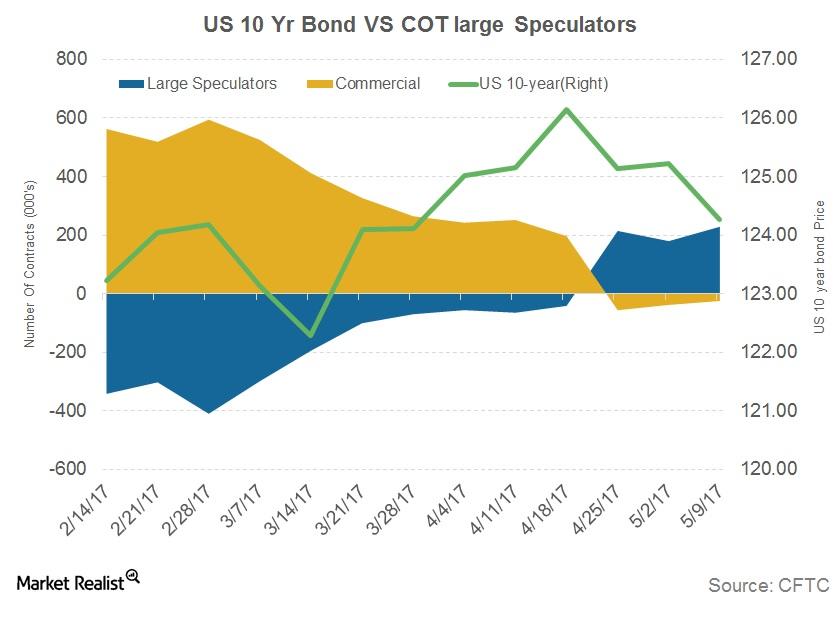

Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

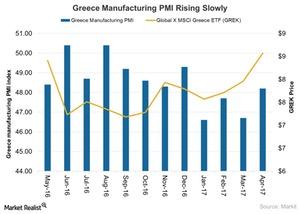

Why Greece’s Manufacturing Activity Is Struggling amid Improved Expectations

Amid its financial chaos, Greek manufacturing activity rose in April 2017, though it remains below the acceptable mark of 50.

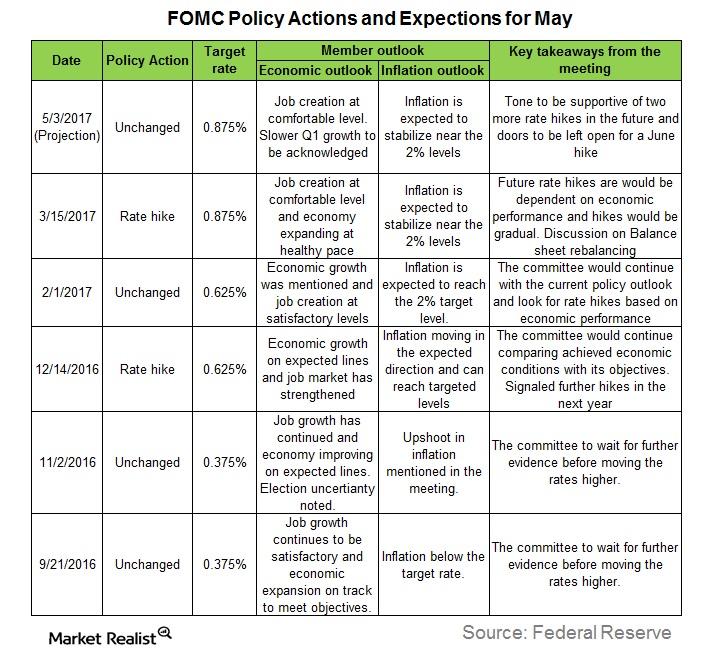

Will the FOMC Remain Hawkish?

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

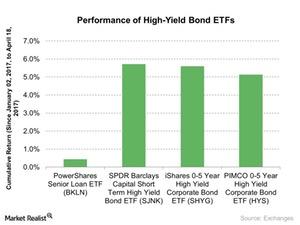

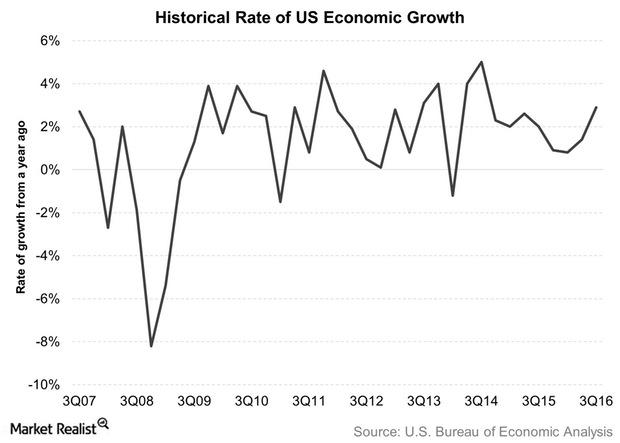

Bill Gross and High-Yield Bonds: Priced for Too Much Growth

Investors generally invest in high-yield bonds (BND) when there are expectations for higher growth in the economy.

Green Bonds and Conventional Bonds: What’s the Difference?

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles.

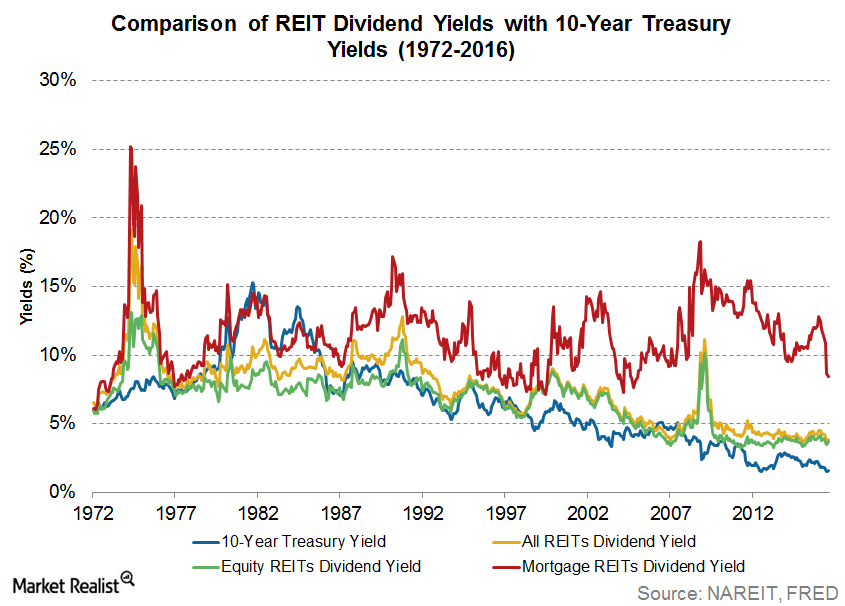

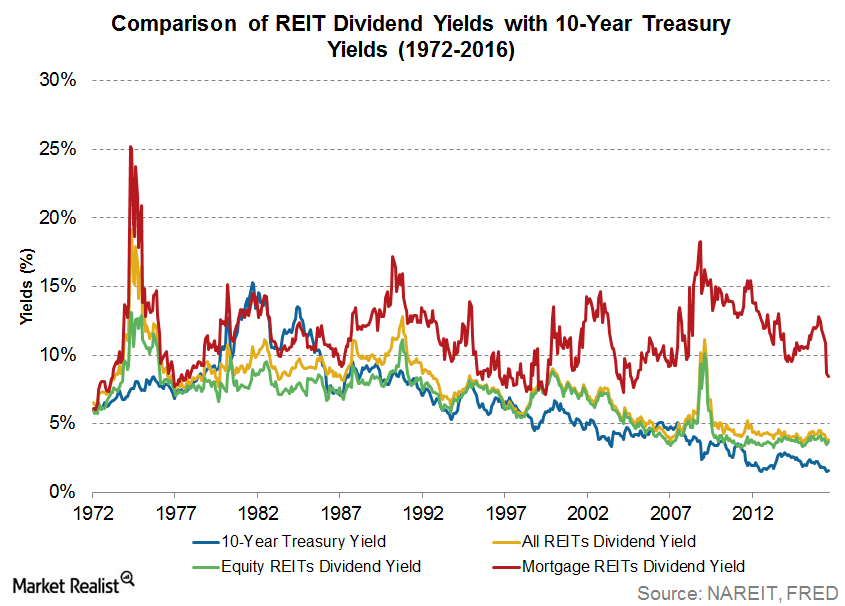

Why REITs Tend to Offer High Dividend Yield

COMPARING DIVIDEND YIELDS ACROSS ASSET CLASSES Since 1999, approximately half of the total return of the Dow Jones U.S. Select REIT Index has come from dividends. During periods of heightened volatility, this income could act as a buffer and may mitigate negative price movements. Historically, the Dow Jones U.S. Select REIT Index has produced higher […]

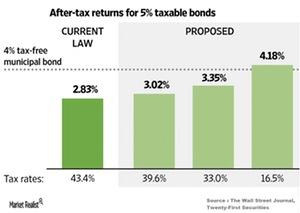

Tax Reform Is Full of Unknowns

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by muni bond investors.

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

Why REITs Tend to Offer High Dividend Yields

REITs (IYR)(VNQ) are known for their high dividend yields, outclassing almost all other broad market indices.

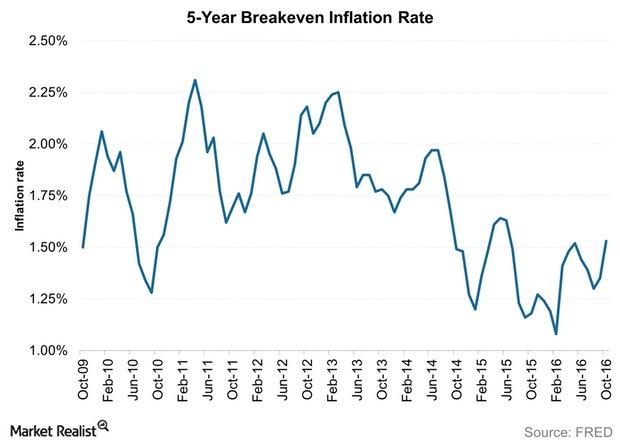

How Holding Duration Is Risky during Rising Inflation

Moving on to the fixed income space, the Janus team sees holding duration in portfolios as a risk.

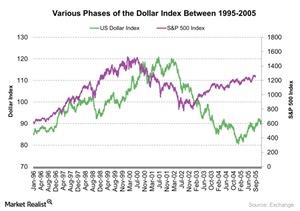

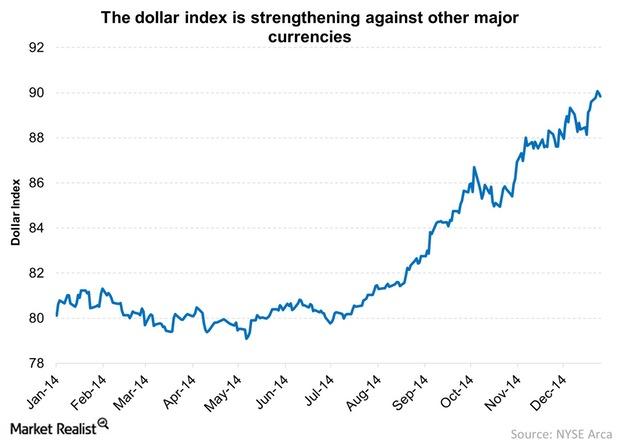

The Dollar Index and Economic Uncertainty: Is There Correlation?

The rally in the US Dollar Index can be correlated to two important events: the dot-com bubble crisis in 1999 and the Argentine debt crisis in 2001.

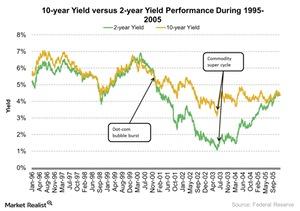

How Might Yields React to a Dot-Com Bubble Situation?

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. It made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

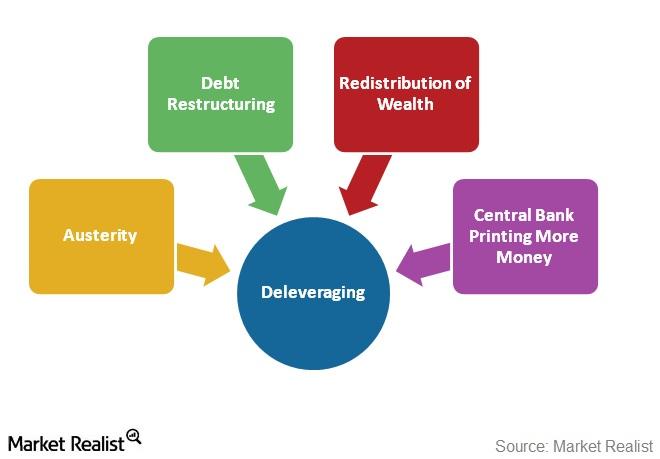

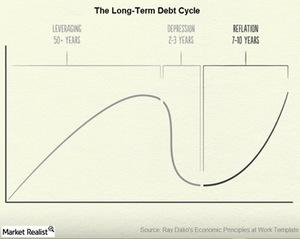

4 Ways an Economy Can Deleverage: Ray Dalio Explains

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage. Find out why this matters.

Where Are We in the Long-Term Debt Cycle? Ray Dalio Weighs In

According to Ray Dalio, the Fed needs to study the long-term debt cycle in order to understand the huge downside risks that currently face the US economy.

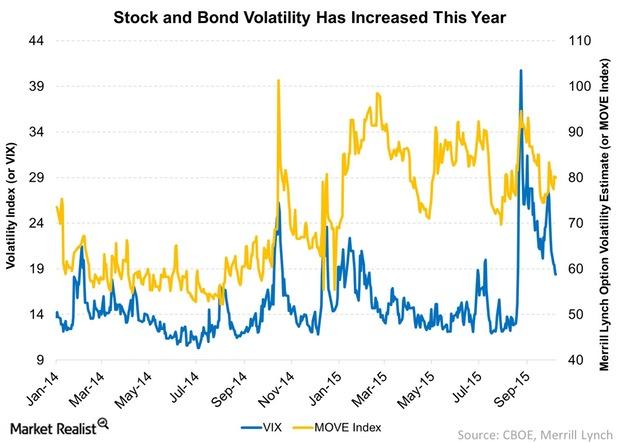

Higher Volatility: You Need to Rethink Your Portfolio Strategy

Higher volatility calls for you to rethink your strategy. After being calm for most of 2014, both bonds (AGG)(BND) and stocks have experienced volatility this year.

Key Catalysts Behind The US Dollar Rally In 2014

Can the US dollar rally continue? What does this mean for commodities? Russ answers these queries in his latest Ask Russ installment.

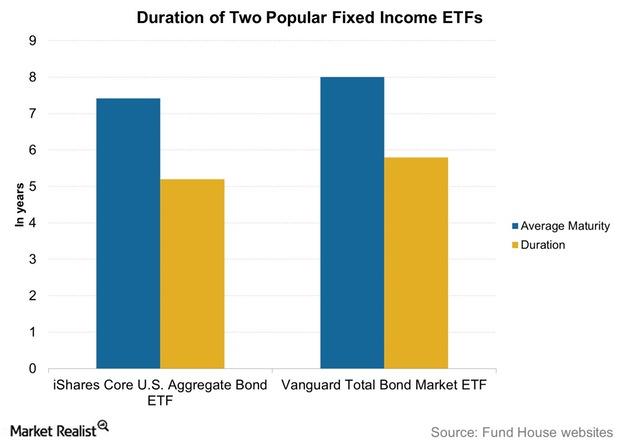

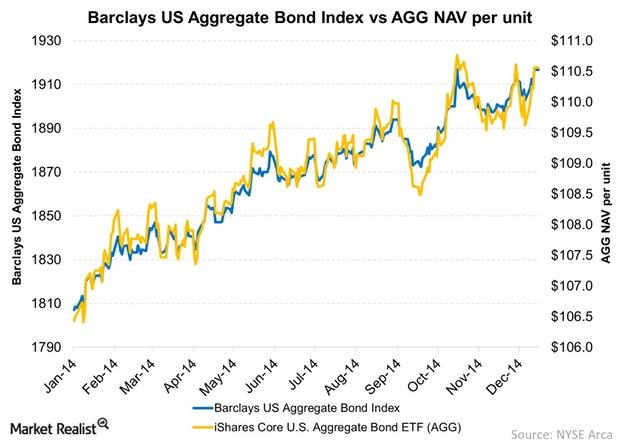

Calculating A Bond ETF’s Underlying Value

The calculation of a bond ETF’s underlying value is going to be less precise than a stock ETF’s underlying value.

What are alternative investments?

Alternative investments seek to provide a hedge against various market risks by following hedge fund-like strategies.Healthcare Key differences between investment-grade and high-yield investments

Corporate debt is divided into investment-grade and high-yield on the basis of the credit risk associated with the issuer. Credit rating agencies issue ratings to corporations and debt issuance on the basis of associated credit risk.