Tax Reform Is Full of Unknowns

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by muni bond investors.

Dec. 21 2016, Updated 10:57 a.m. ET

VanEck

Looking Forward

We see three critical issues that muni bond investors may want to pay attention to in the months ahead as we transition to a Trump administration.

Lower Tax Rates on Corporations and Individuals

Much of Trump’s economic platform is concerned with corporate and individual tax reform. He has proposed lowering taxes across the board for individuals and corporations, while also lowering taxes on repatriated earnings to encourage corporations to bring money back from overseas. Perhaps most notably for high net worth individuals, it is proposed the three highest tax brackets — currently 33%, 35%, and 40%, respectively — would be collapsed to a single 33% rate.

Corporations — in particular property and casualty insurance companies — and high net worth individuals are some of the largest purchasers of municipal bonds. One of the most important contributors to muni bonds’ attractiveness to corporations and high net worth individuals is their status as tax-exempt investments. If corporate tax rates fall, this tax-exemption could become less of an attraction for this class of investor in muni bonds.

Such tax rate decreases would likely force a repricing of the municipal bond marketplace in order to keep these investments attractively valued relative to other asset classes. In other words, municipal bond yields would have to rise in order to remain competitive with ordinary taxable bonds. This is not to say that higher yields would necessarily reflect poorer creditworthiness on municipalities’ part.

Market Realist

Tax-free may not be free anymore

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by municipal (or muni) bond investors. Interest on muni (MLN) (SHM) bonds is tax-free at federal and state levels if they’re issued by your home state.

On the other hand, interest on corporate bonds is taxed as ordinary income. So an investor losing 40.0% of his or her income in taxes will lose 40.0% of those interest payments as well. Investors looking to replicate muni bond (HYD) (SMB) (ITM) yields of 6.0% need to earn a tax equivalent yield of 8.0% on corporate bonds, if his or her federal tax bracket is 25.0%.

Appeal could be wiped out

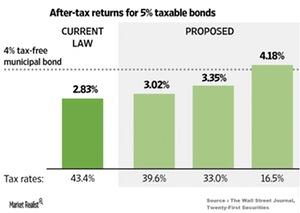

This appeal could be wiped out after the proposed lowering of tax rates on investment interest. Trump and other Republicans have proposed lowering interest on taxable bonds such as Treasuries (TLT) and corporate bonds (BND) to 16.5%, from 43.4%. The 3.8% surtax on net investment income would be repealed under the new reforms.

Lower taxes require muni bonds to increase their yield to attract investors. That would create an additional burden for states planning to issue new muni bonds, as they will need to pay higher interest than the current one.

To understand the impact, let’s take a look at the above graph. Without the surtax, individual investors who pay the highest rate of 43.4% will have their rate reduced to 39.6%. The proposed lowering of taxable interest to 16.5% will earn more returns for prevailing taxable bonds, which means the current yield for muni bonds would be heading upward in the coming days.

According to Robert Gordon of Twenty-First Securities, “The math on munis is changing, and structurally the tax exemption will be less valuable – we just don’t know to what degree.”