WisdomTree Europe Hedged Equity Fund

Latest WisdomTree Europe Hedged Equity Fund News and Updates

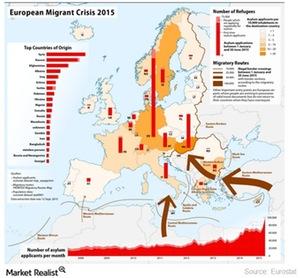

What Does the UK Really Have to Gain from Exiting the EU?

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

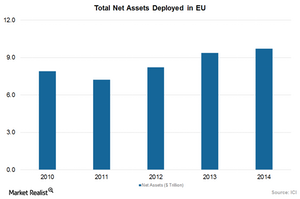

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

Credit Suisse and Barclays Are Bullish on European Equity for 2016

Credit Suisse (CS) strategists forecast 10% earnings growth in Europe versus a 6.8% growth expected from the US.

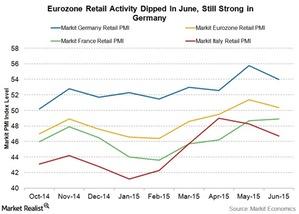

Eurozone Retail Activity Dipped In June, HEDJ Down 2.32%

The Eurozone’s Retail PMI (purchasing managers’ index) dipped to 50.4 in June from the 51.4 recorded in May.

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

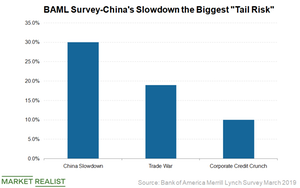

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

Strong Economy and a Rate Cut: Can Trump Have It Both Ways?

Today, President Donald Trump told reporters, “Our country’s doing unbelievably well economically.”

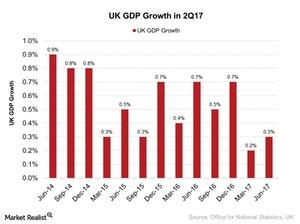

Will UK’s 2Q17 Growth Strengthen Investor Sentiment?

The UK’s 2Q17 economic growth surprised the market with a rise of 0.3% as compared to a 0.2% rise in the first quarter of 2017.

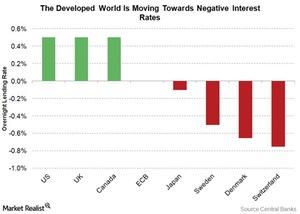

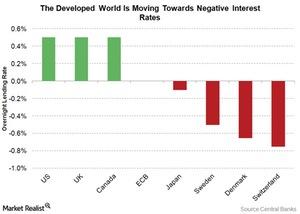

Will the Fed Have to Use More Unconventional Measures?

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

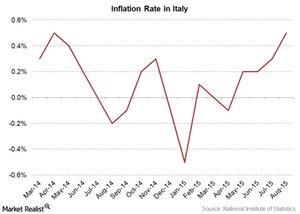

Italy’s Inflation Rate Rose in August: EWI Fell 0.40%

According to the August 31 release by the ISTAT, the EU’s harmonized inflation rate in Italy rose to an impressive 0.50% in August on a YoY (year-over-year) basis.

How the Eurozone ZEW Economic Sentiment Index Looked in October

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 26.7 so far in October compared to 31.7 in September.

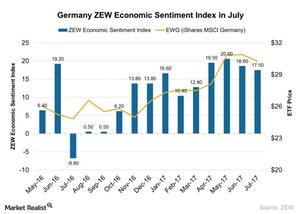

What the Germany ZEW Economic Sentiment Index Indicates

The Germany ZEW Economic Sentiment Index was 17.5 in July 2017 compared to 18.6 in June. It didn’t meet the market expectation of 18.0.

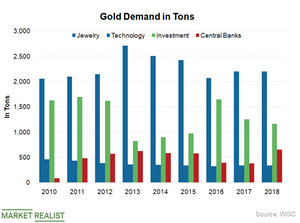

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.

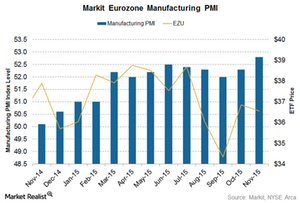

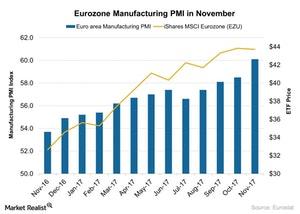

Eurozone Manufacturing Rises at a Higher Rate in November

Eurozone manufacturing data The Eurozone’s manufacturing PMI (purchasing managers’ index) stood at 60.1 in November, compared with 58.5 in October 2017, according to Markit Economics. The reading met the preliminary estimate of 60. Eurozone manufacturing activity rose due to increases in the following: production output new orders and export orders employment Production output and new order levels reached […]

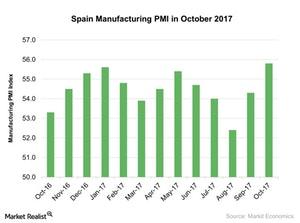

Behind Spain’s New and Improved Manufacturing PMI

Spain’s manufacturing PMI rose to 55.8 in October 2017, compared with 54.3 in September 2017. The PMI figure beat the preliminary market estimation of 54.9.

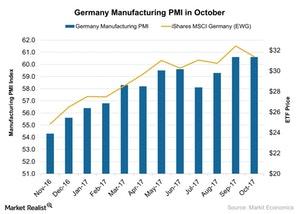

What No Change in Germany’s Manufacturing PMI Could Mean for Its Economy

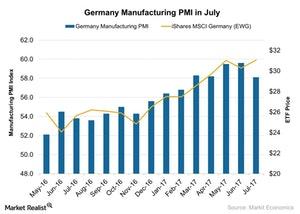

Germany’s final manufacturing PMI showed no change in October, coming in at 60.6, and meeting the preliminary market estimation of 60.5.

How France’s Unchanged Manufacturing PMI in October Could Affect Markets

The final France manufacturing PMI, remained unchanged in October 2017, standing at 56.1 and falling short of the preliminary market estimate of 56.7.

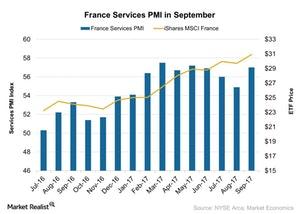

France’s Services PMI Strengthened in September after a Gradual Fall

The iShares MSCI France ETF (EWQ), which tracks France’s performance, rose 4% in September 2017.

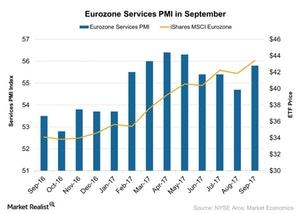

The Eurozone Services PMI Improved Strongly in September

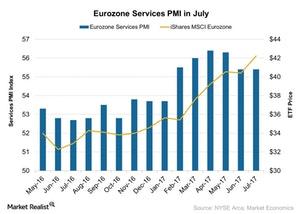

The final Eurozone services PMI (purchasing managers’ index) rose strongly in September 2017. It stood at 55.8 in September 2017, up from 54.7 in August 2017.

Does France’s Rising Manufacturing Mean a Strong Business Climate?

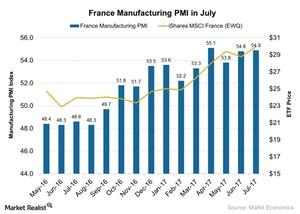

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 56.10 in September 2017, compared to 55.80 in August 2017.

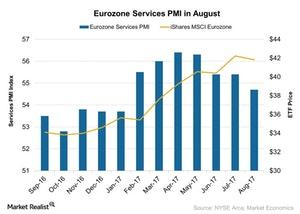

Eurozone Services PMI Weakened: Will It Affect the Business Climate?

According to a report by Markit Economics, the Eurozone services PMI (purchasing managers’ index) stood at 54.7 in August as compared to 55.4 in July 2017.

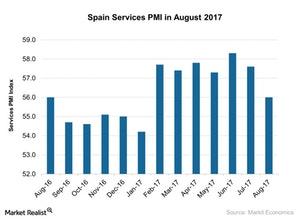

Why Spain’s Service Activity Dropped in August 2017

According to a report by Markit Economics, the Spain Services PMI (purchasing managers’ index) stood at 56 in August compared with 57.6 in July.

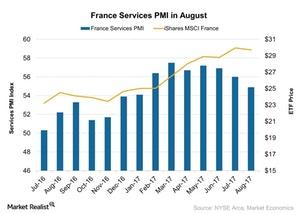

Why France’s Services PMI Fell in August

According to data provided by Markit Economics, the August France Services PMI (purchasing managers’ index) stood at 54.9 in August 2017 compared with 56 in July 2017.

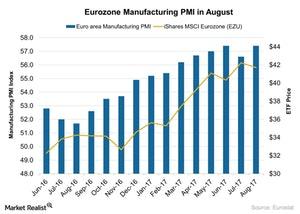

Eurozone’s Manufacturing PMI Indicates Healthier Economy

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved in August 2017.

What Does France’s Rising Manufacturing Activity Suggest?

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 55.8 in August 2017 compared to 54.9 in July 2017.

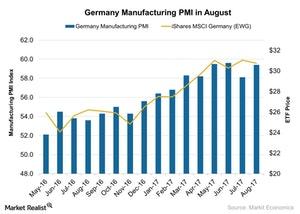

How Germany’s Manufacturing Activity Was Trending in August 2017

According to a report by Markit Economics, Germany’s flash manufacturing PMI stood at 59.4 in August 2017 as compared to 58.1 in July.

How France’s Flash Manufacturing Activity Is Trending

According to data provided by Markit Economics, the flash Markit France manufacturing PMI (purchasing managers’ index) stood at 55.8 in August 2017 compared to 54.9 in July 2017.

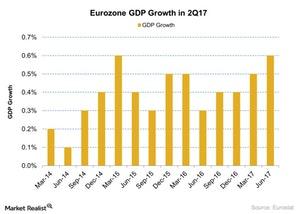

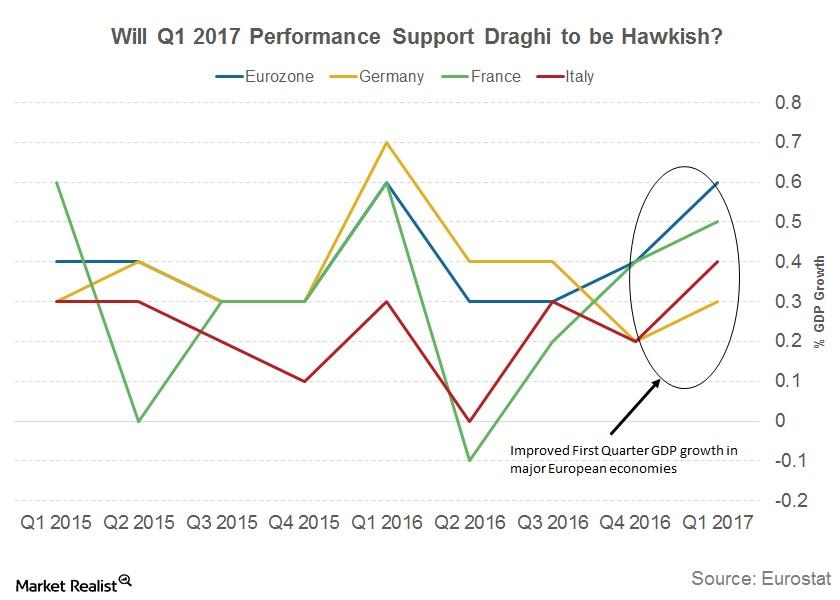

Eurozone’s Growth Rate Rose 0.6% in 2Q17

According to Eurostat, the Eurozone’s economy posted a growth rate of 0.6% in 2Q17. In 1Q17, the economy posted a growth rate of 0.5%.

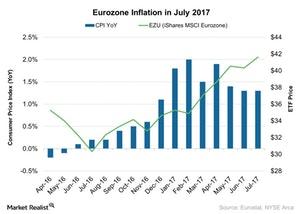

Analyzing the Eurozone’s Inflation in July 2017

On a year-over-year basis, the Eurozone Inflation Index was at 1.3% in July 2017—the same as in June, according to data provided by Eurostat.

Why Draghi Is a Person of Interest at Jackson Hole

ECB President Mario Draghi is scheduled to speak at this year’s Jackson Hole Symposium on August 25—after a hiatus of three years.

What Happened to the Eurozone Services PMI in July

The Eurozone Services PMI remained unchanged in July 2017, coming in at 55.4 but missing the preliminary market estimation.

How France’s Manufacturing Activity Trended in July

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 54.9 in July 2017 compared to 54.8 in June 2017.

How Did Germany’s Manufacturing PMI Trend in July?

The final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 58.1 in July 2017 compared to 59.6 in June 2017.Macroeconomic Analysis Germany’s Rising Manufacturing: A Change in Sentiment

According to data provided by Markit Economics, the final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 59.6 in June 2017 compared to 59.5 in May.

What Does France’s Services PMI Indicate for the Economy?

The final Markit France services PMI stood at 57.2 in May 2017—compared to 56.7 in April 2017. The PMI was below the initial estimate of 58.0.

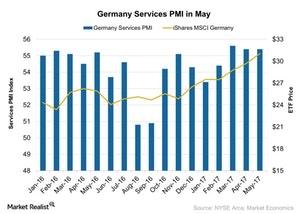

Why Germany’s Services PMI Didn’t Change in May

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index) stood at 55.4 in May 2017.

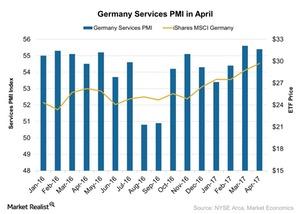

How Germany’s Services PMI Performed in April

According to Markit Economics, the Germany Services PMI stood at 55.4 in April 2017 compared to 55.6 in March 2017.

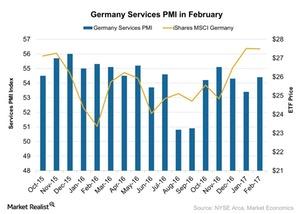

What the Strengthening of the Germany Services PMI Indicates

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index), released on March 3, 2017, stood at 54.4 in February 2017.

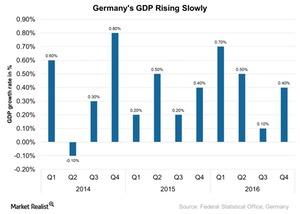

What’s Driving Germany’s Economic Growth?

The German Stock Index DAX 30 (DAX-INDEX) surged over its 12,000 historical mark in March and was trading at 11,941 on March 9, 2017.