iShares Russell 2000

Latest iShares Russell 2000 News and Updates

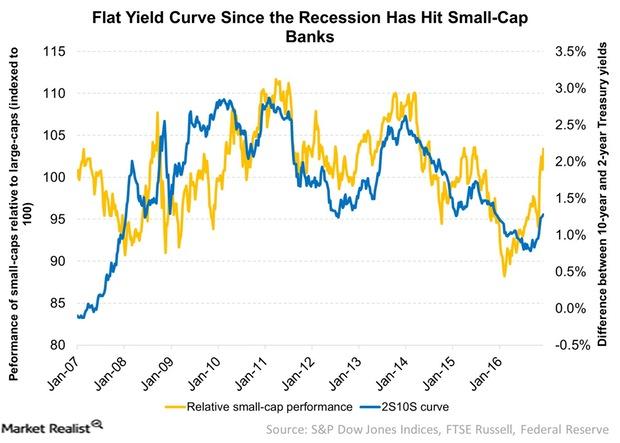

Analyzing How the Yield Curve Impacts Small Caps

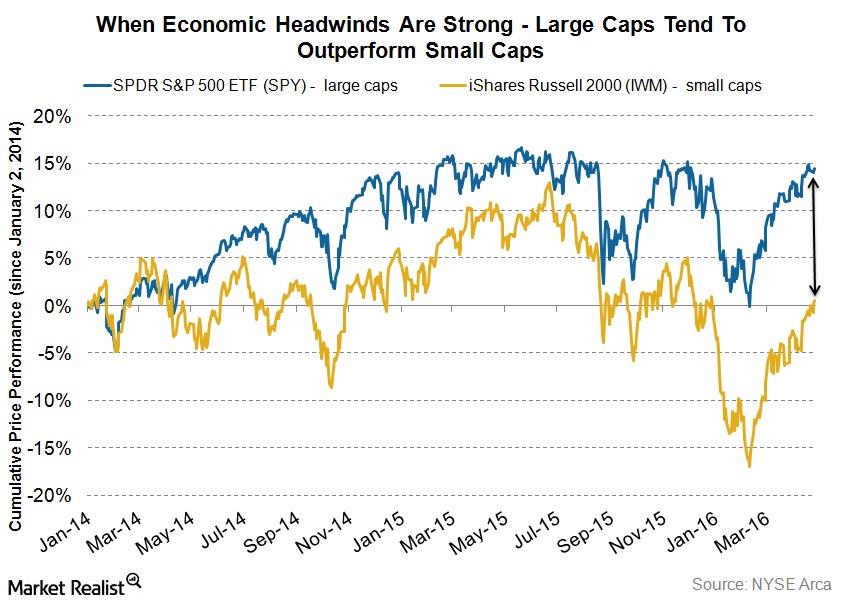

Another factor that impacts small-cap stocks’ performance is the yield curve. The yield curve has remained on the flatter side since the recession.

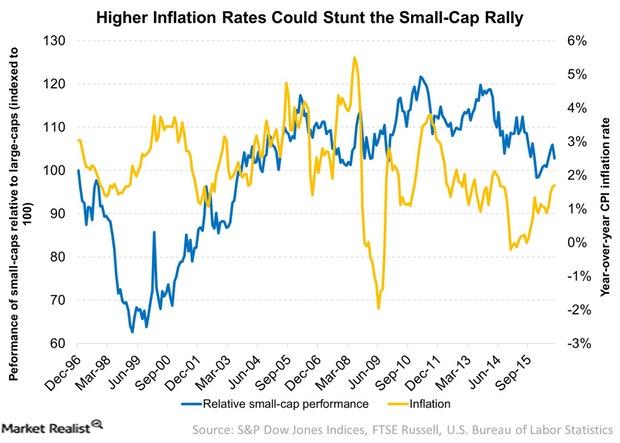

How Would Higher Inflation Impact Small Caps?

Higher inflation rates suggest that the economy might be improving. It’s good for small caps. They tend to outperform large caps during economic upturns.

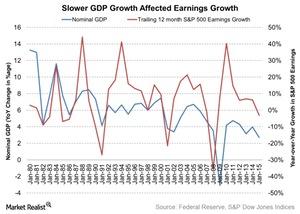

What’s the Primary Driver of Corporate Earnings?

Nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500.

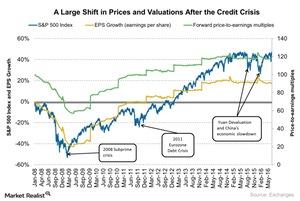

In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

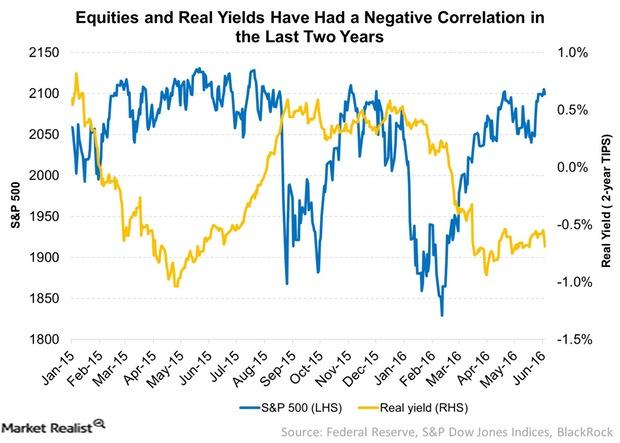

How Rising Real Yields Could Affect Equities

Since the start of 2015, the S&P 500 and real yields have had a high negative correlation. Falling real yields have encouraged investors to take more risk in search of higher returns.

Active Fund Management: Will It Make Passive Attractive?

In recent years, the performance of various mutual funds and hedge funds followed by an active fund management strategy haven’t been so impressive.

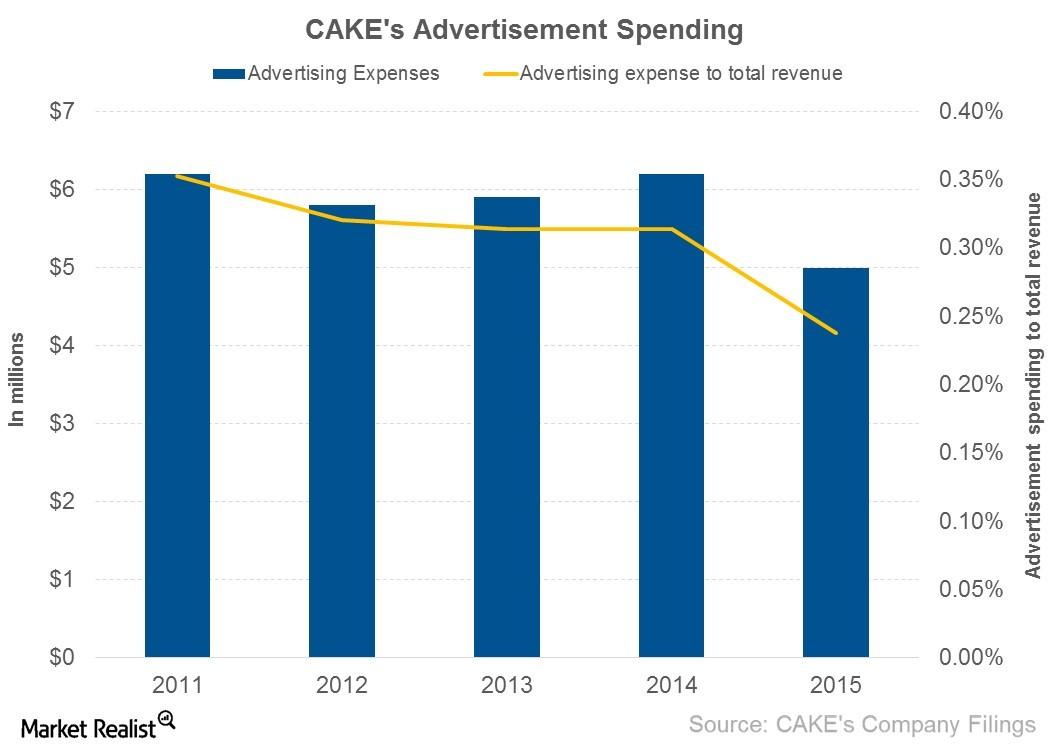

What Is The Cheesecake Factory’s Marketing Strategy?

The Cheesecake Factory (CAKE) is competing in a highly competitive restaurant business, where innovation is absolutely necessary to keep up.

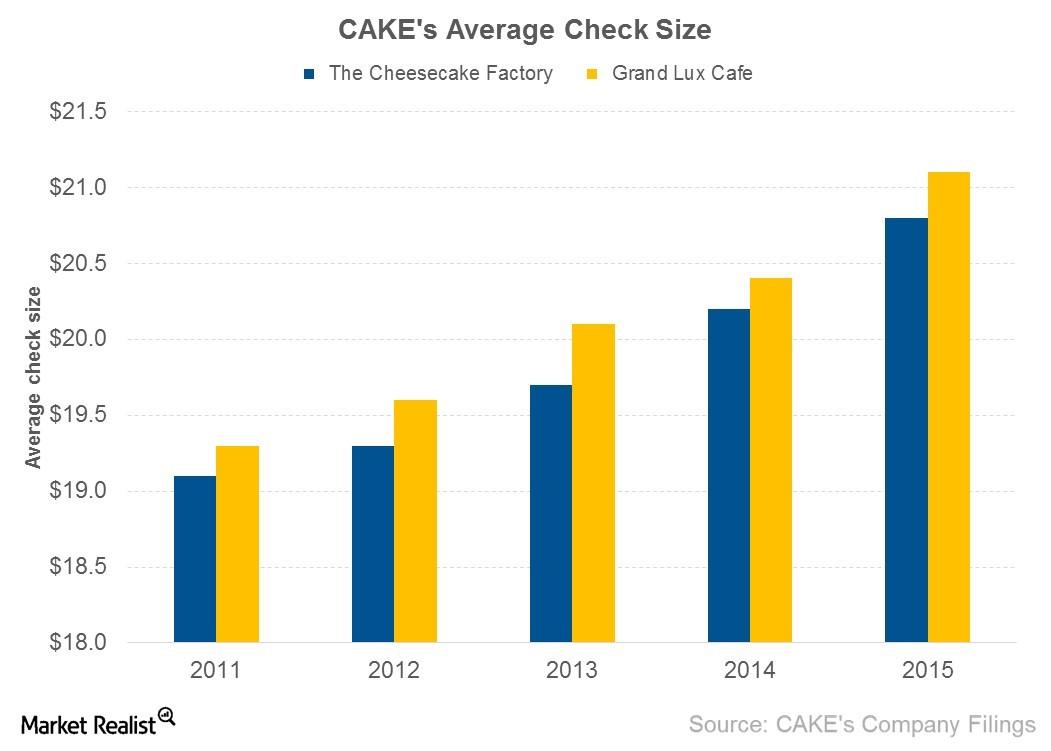

CAKE’s Average Check Has Increased Year-over-Year

In 1992, when CAKE was listed, its average check size was at $13.6. By the end of 2015, the company’s average check size had increased to $20.8.

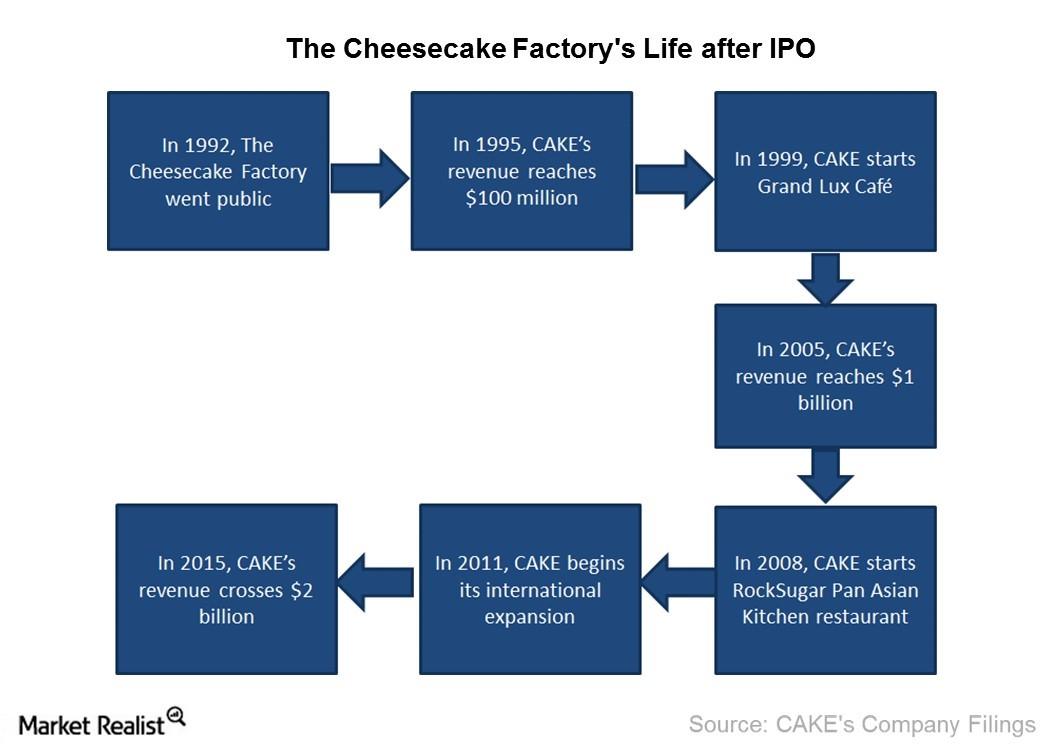

How Did The Cheesecake Factory Expand after Going Public?

In February 1992, The Cheesecake Factory (CAKE) went public by offering 2.3 million shares at $20 per share. It closed its opening day at $27.3 per share.

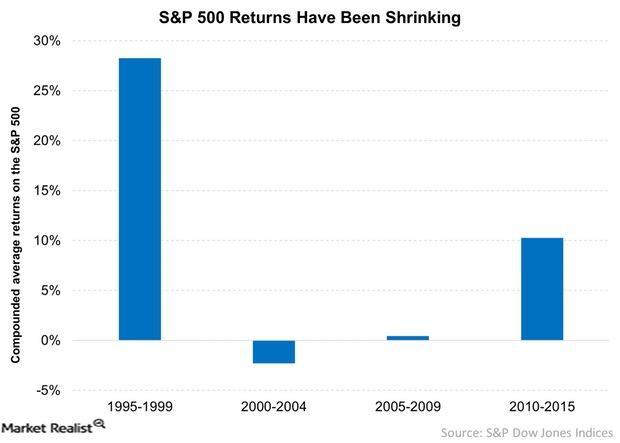

Why Your Portfolio Needs More Carry

Since 2009, equities have staged a comeback. Between 2010 and 2015, the S&P 500 index has risen 10.3% on a CAGR basis. Most of the comeback is due to multiple expansion.

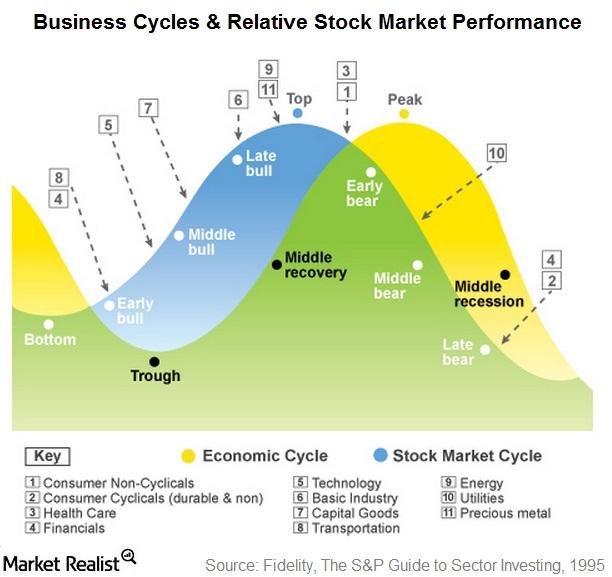

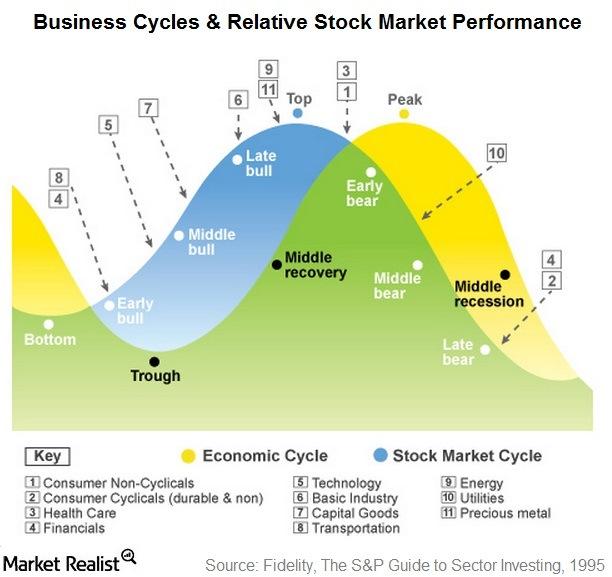

What Phase of the Business Cycle Are We In?

Studied in conjunction, stock market and economic conditions give clear indications of the business cycle phase we are in.

Positioning Your Portfolio According to the Business Cycle

Style investing involves selecting a particular asset class that should outperform during a business cycle phase and positioning your portfolio accordingly.

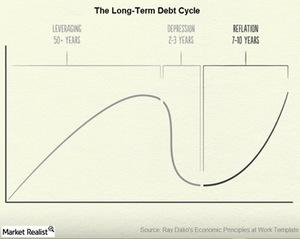

Where Are We in the Long-Term Debt Cycle? Ray Dalio Weighs In

According to Ray Dalio, the Fed needs to study the long-term debt cycle in order to understand the huge downside risks that currently face the US economy.

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

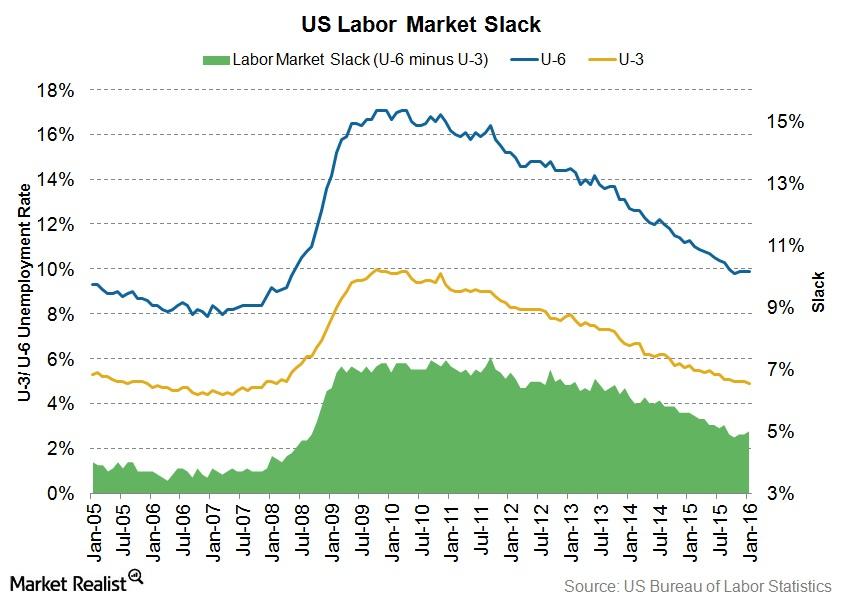

What Is Labor Market Slack?

The unemployment rate doesn’t help us gauge the extent of labor market slack. The actual employment gap that exists also consists of a slack component.

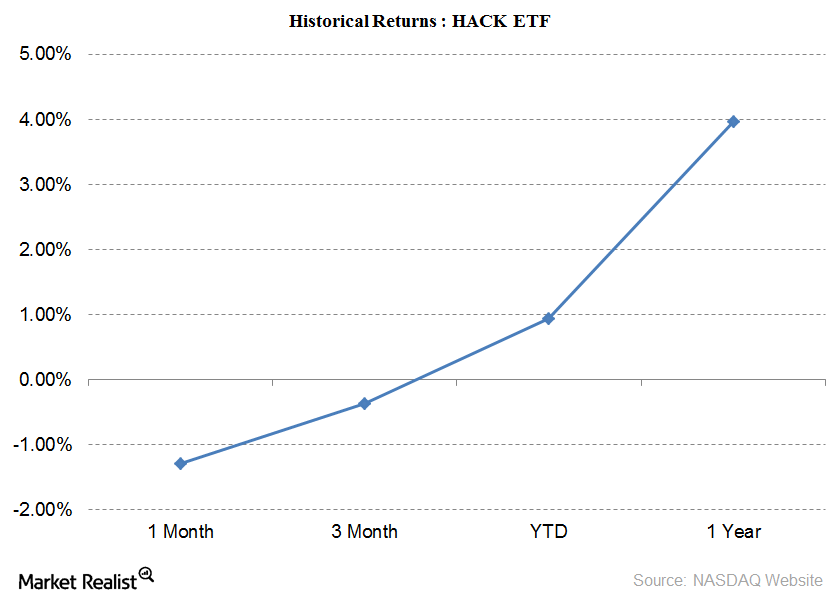

HACK Sees $1.17 Billion in Fund Inflows in Trailing Twelve Month Period

Overview of HACK The Purefunds ISE Cyber Security ETF (HACK) tracks a market-cap weighted portfolio of U.S. cyber security companies. This ETF tracks the performance of 34 publicly listed companies in the US cyber security sector. The market capitalization of the HACK is $1.08 billion with an expense ratio of 0.75% and average daily volume […]

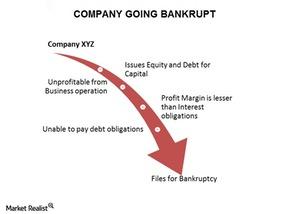

What Is Bankruptcy Investing?

Informed investors can profit from businesses that have filed for bankruptcy. A chapter 11 bankruptcy gives a company a second chance to revive its business.

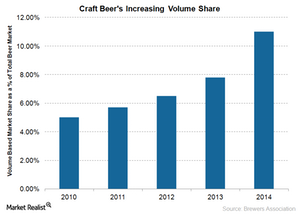

Craft Beer and Its Rising Popularity

Americans are moving toward craft beer due to better taste, innovation, and brewing techniques. Its market share increased to 11% in 2014 from 7.8% in 2013.

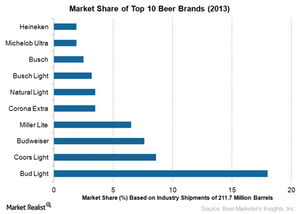

Beer Brands That Make a Difference in the US Market

Bud Light is the leader among major beer brands, with 18% share of the beer market based on the 2013 total beer industry shipments of 211.7 million barrels.

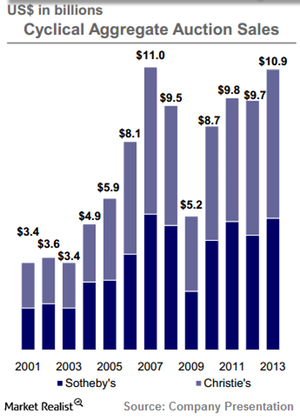

Christie’s Maintains Lead over Sotheby’s

While Sotheby’s was facing Daniel Loeb’s activist pressure, the new management team at Christie’s was implementing a global strategy.

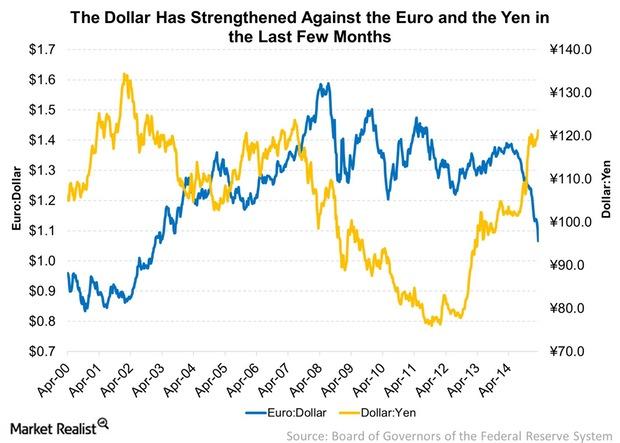

What’s Causing the US Dollar to Strengthen?

The strength in the US dollar is because of divergence in central bank policies. The US dollar is strengthening against most of the major currencies.