Positioning Your Portfolio According to the Business Cycle

Style investing involves selecting a particular asset class that should outperform during a business cycle phase and positioning your portfolio accordingly.

April 29 2016, Published 2:11 p.m. ET

Style investing

Style investing is quite popular in active portfolio management. Style investing is about selecting a particular asset class or style that should outperform during a given business cycle phase and positioning your portfolio accordingly.

An understanding of style investing and its various types helps investors to position their portfolios to reap benefits from the business cycle. Certain investment styles work better in certain economic phases. Style investing is thus about understanding these phases and making gains by timing the market right.

Let’s take a look at the most popular equity investment styles.

1. Large-cap versus small-cap investing

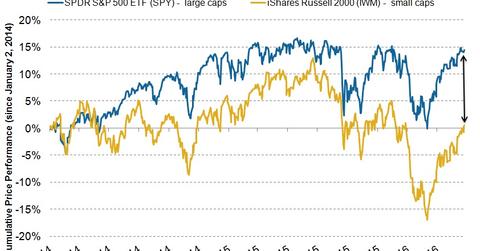

When economic headwinds are stronger, large caps (large market capitalization stocks) tend to outperform small caps. On the other hand, when economic growth is going strong, small caps tend to outperform the overall market.

The Russell 2000 Index (IWM) is a widely followed measure of small-cap US stocks, while the S&P 500 (SPY) is a good measure of large-cap US stocks.

2. Defensive versus cyclical investing

Cyclical companies are disproportionately related to economic conditions. When growth is strong, these sectors—materials, industrials (XLI), and consumer discretionary (XLY)—rise more than others, while when headwinds are strong, they suffer more than others.

The financial (XLF) and energy (XLE) sectors also show cyclical traits at times. Defensive sectors such as consumer staples (XLP), healthcare (XLV), telecommunications, and utilities (XLU), on the other hand, are less dependent on the business cycle. Cyclicals generally tend to outperform during the recovery phase of the business cycle.