Health Care Select Sector SPDR® ETF

Latest Health Care Select Sector SPDR® ETF News and Updates

How Can Changing Demographics Impact Investors?

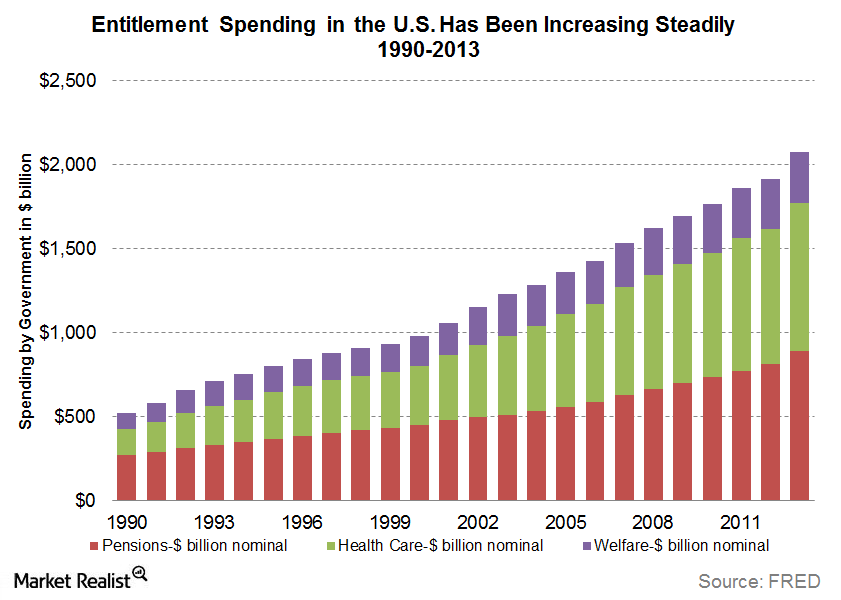

Changing demographics impact investors in many ways. The demand for bonds could increase, putting downward pressure on yields.

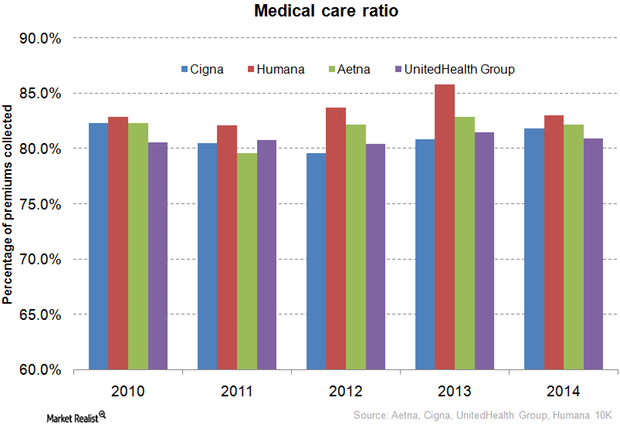

How Does Aetna Compare to Its Peers in Medical Care Ratio?

The medical care ratio of health insurance companies is calculated as the ratio of the total money spent in health care claims to premiums earned.

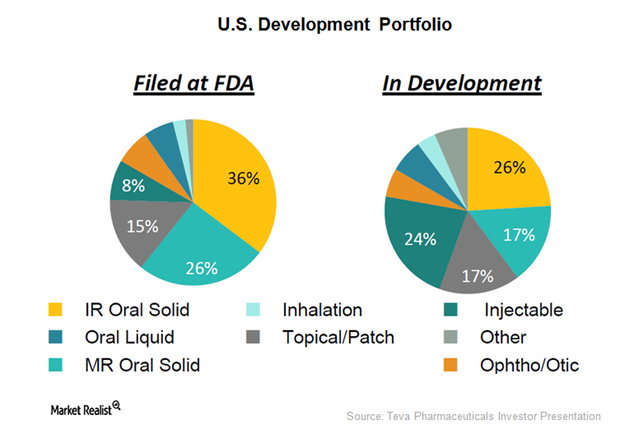

Teva Can Benefit by Acquiring Allergan Generics

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

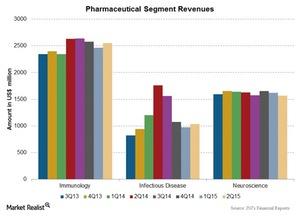

Johnson & Johnson’s Pharmaceuticals Segment Grows in 2Q15

Johnson & Johnson’s (JNJ) Pharmaceuticals segment grew by 1.0% at constant exchange rates, reporting a revenue of $7,946 million for 2Q15 over 2Q14.

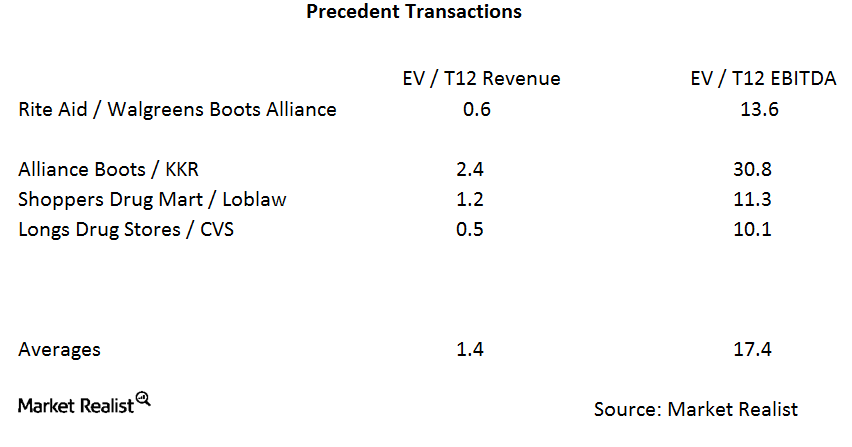

Could the Rite Aid–Walgreens Merger Get Competitive?

In the Rite Aid–Walgreens merger, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA.

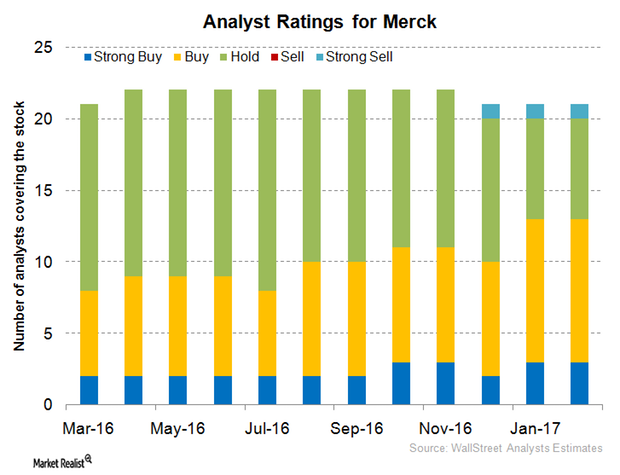

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

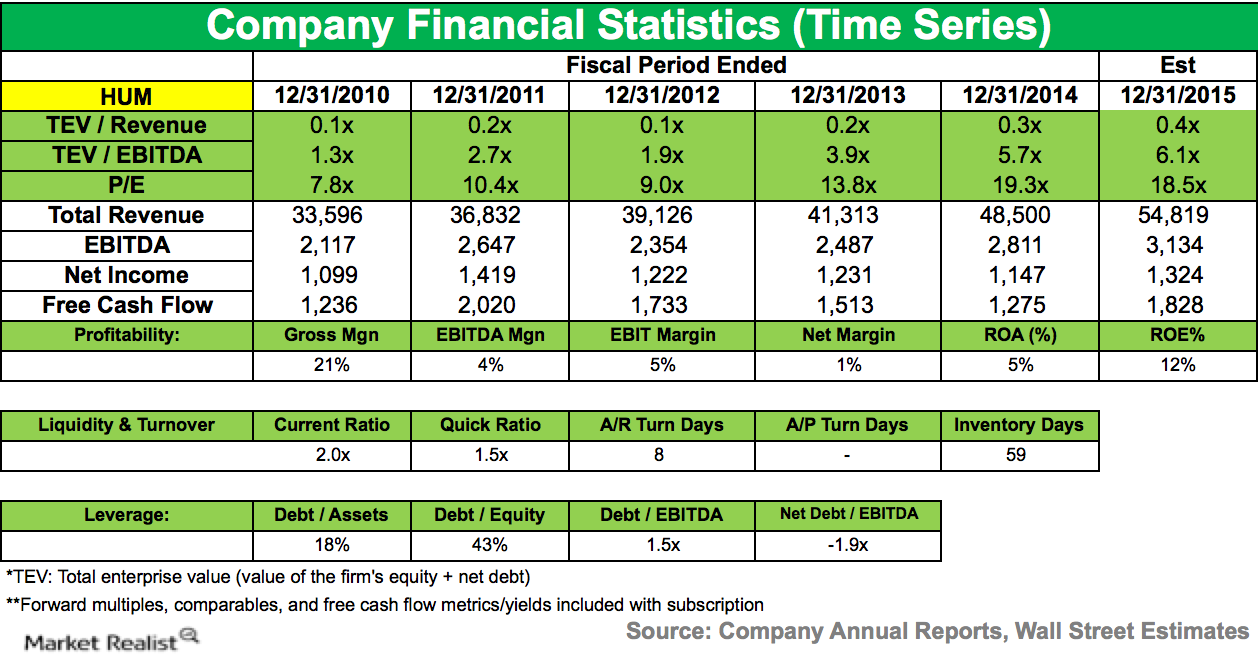

Eminence Capital Reduces Position in Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The company accounted for 1.33% of the fund’s 4Q14 portfolio.

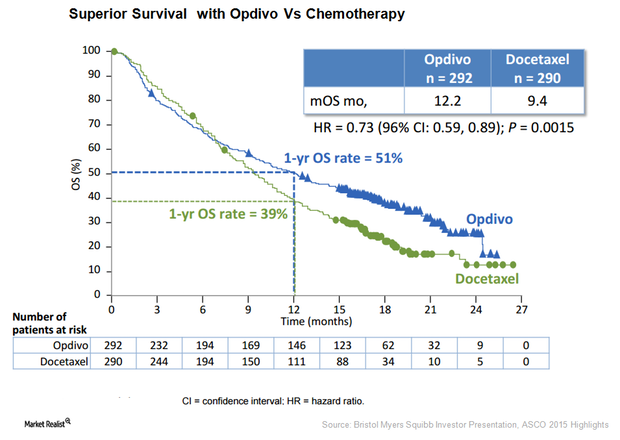

Bristol-Myer Squibb’s Opdivo Is Keytruda’s Strong Competitor

the U.S. Food and Drug Administration accepted the filing of a supplemental Biologics License Application for Bristol-Myers Squibb’s Opdivo.

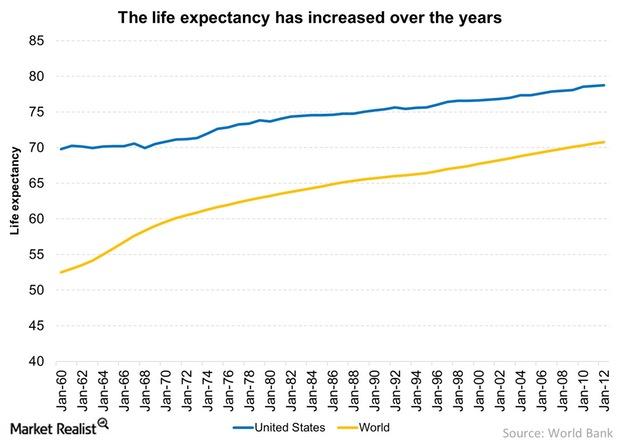

Increased Life Expectancy Means A Longer Investment Horizon

Increased life expectancy means a longer investment horizon. With life expectancy increasing, young investors should invest in equities aggressively.

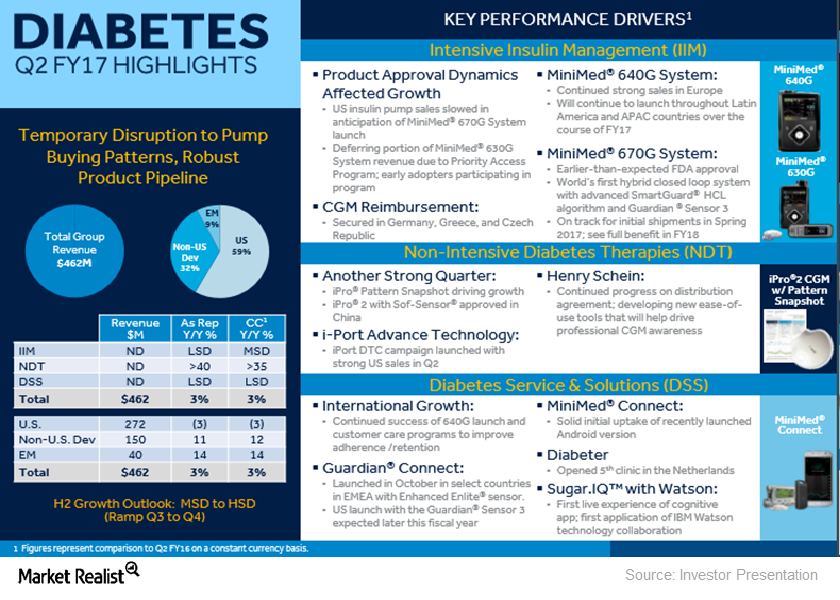

What Really Disrupted Medtronic’s Diabetes Segment Sales in Fiscal 2Q17?

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 1Q17, ~$0.46 billion came from its Diabetes segment, representing ~6% of the company total.

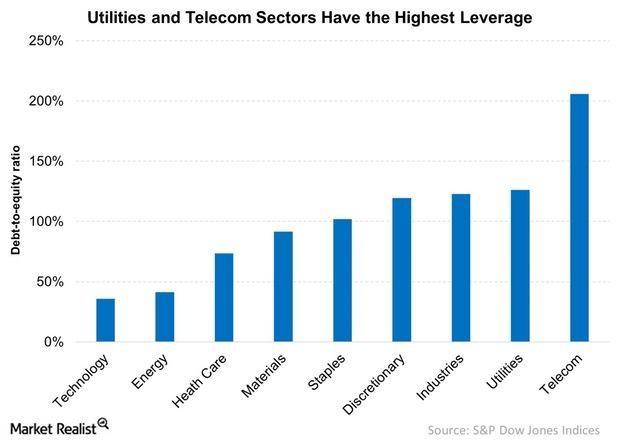

How a Rate Hike Could Affect High-Leverage Sectors

Industrials, utilities, and telecommunications have much higher leverage, as these sectors have massive capital needs.

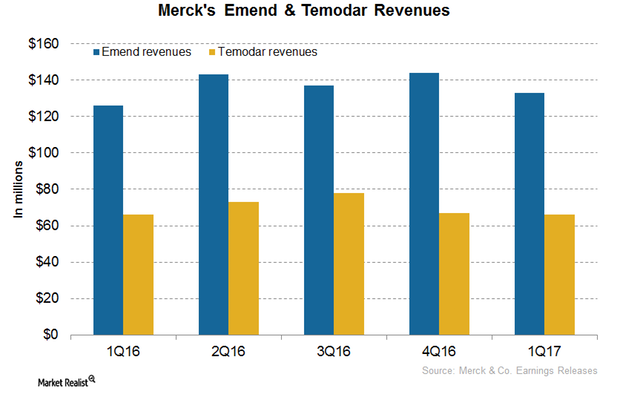

How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017

In 2016, Merck’s (MRK) Emend reported revenues of around $549 million, which reflected 3% year-over-year growth.

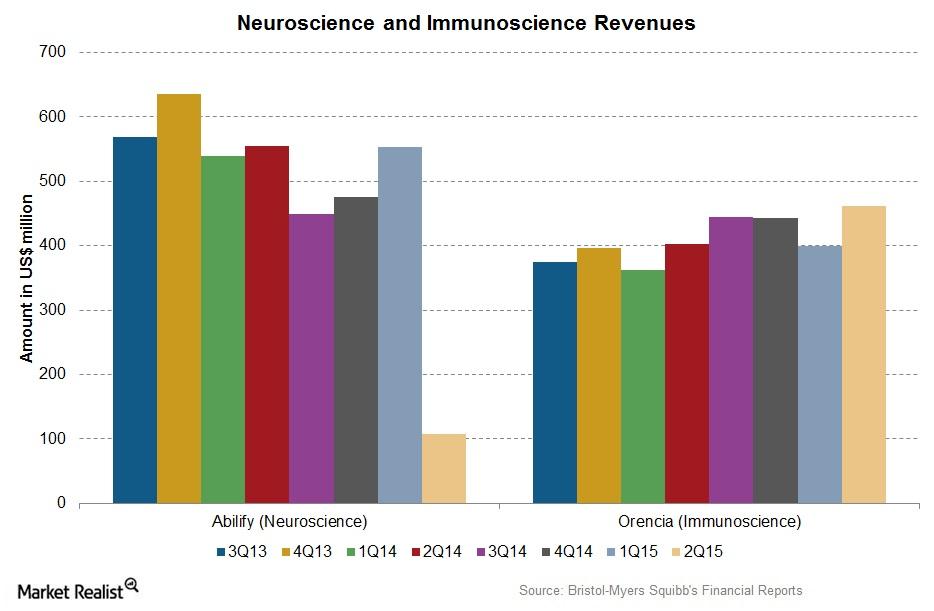

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

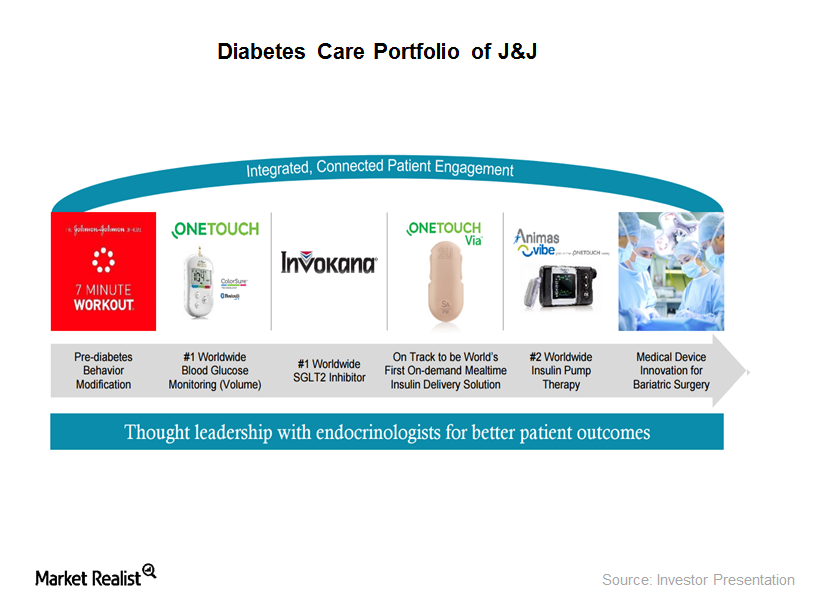

Johnson & Johnson Gets FDA Approval for Type 2 Diabetes Drug

On September 21, 2016, the FDA approved Jannsen Pharmaceuticals’ Invokamet XR for the treatment of adults suffering from Type 2 diabetes.

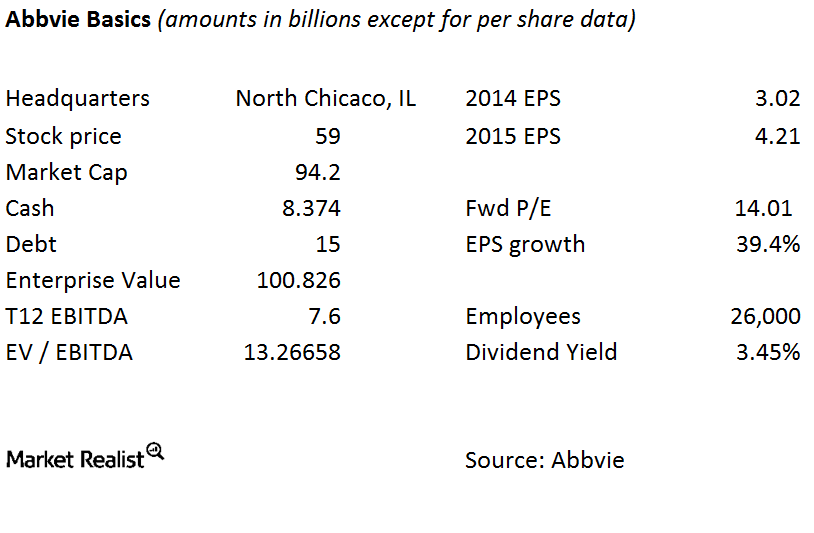

The Pharmacyclics–AbbVie Merger: The Basics of AbbVie

A major reason for the Pharmacyclics–AbbVie merger is to diversify AbbVie away from its reliance on a single product, Humira, and boost its pipeline.

Must-read: Is the US hospital industry truly non-cyclical?

The hospital sector is widely considered a non-cyclical or defensive industry, meaning demand for hospital services doesn’t change with the economic cycle.

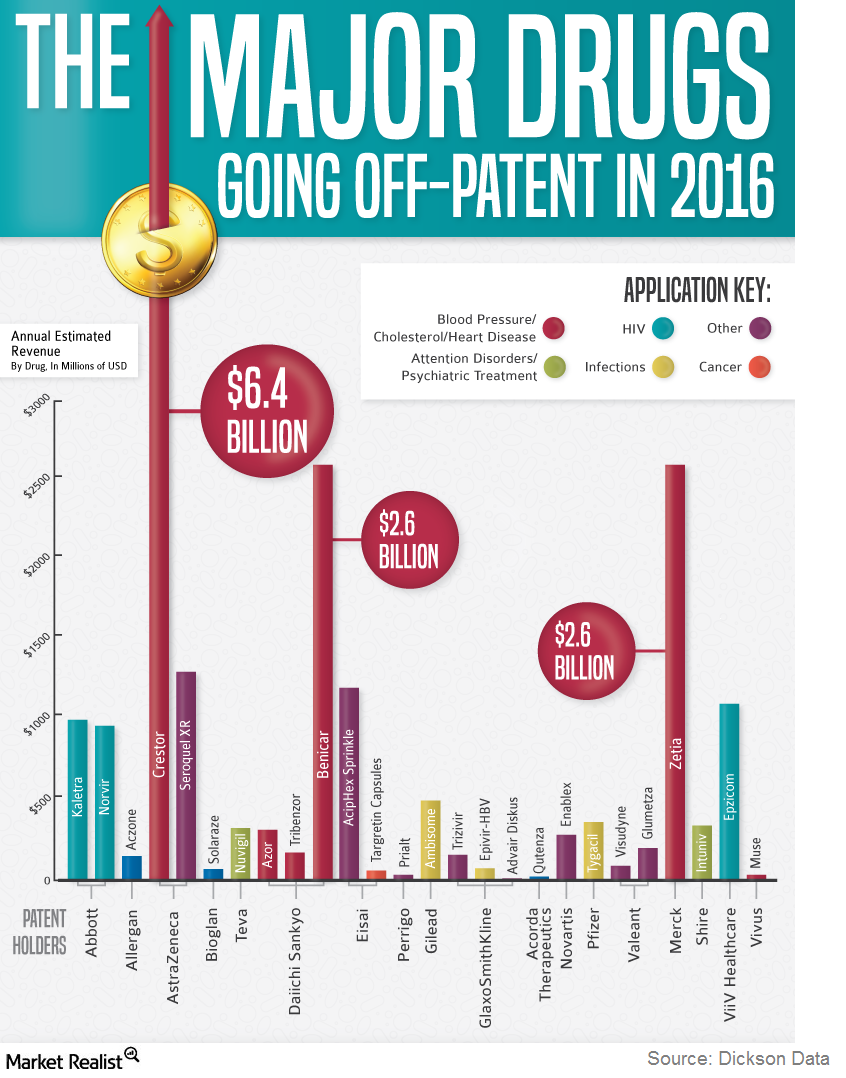

Drug Patent Expirations: $190 Billion Is Up for Grabs

According to estimates by Evaluate Pharma, a whopping $120 billion in sales was lost to patent expirations between 2009 and 2014.

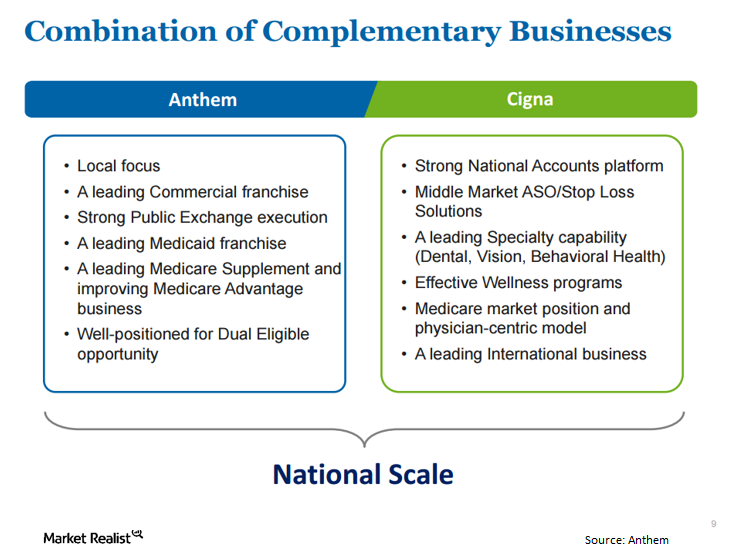

Anthem Files Bear Hug Letter for Cigna on June 21

On June 21, Anthem (ANTM) filed a bear hug letter for Cigna (CI). A bear hug letter is a formal press release in which an acquiring company discloses its interest in a target company.Financials Key differences between PCE and CPI as inflation measures

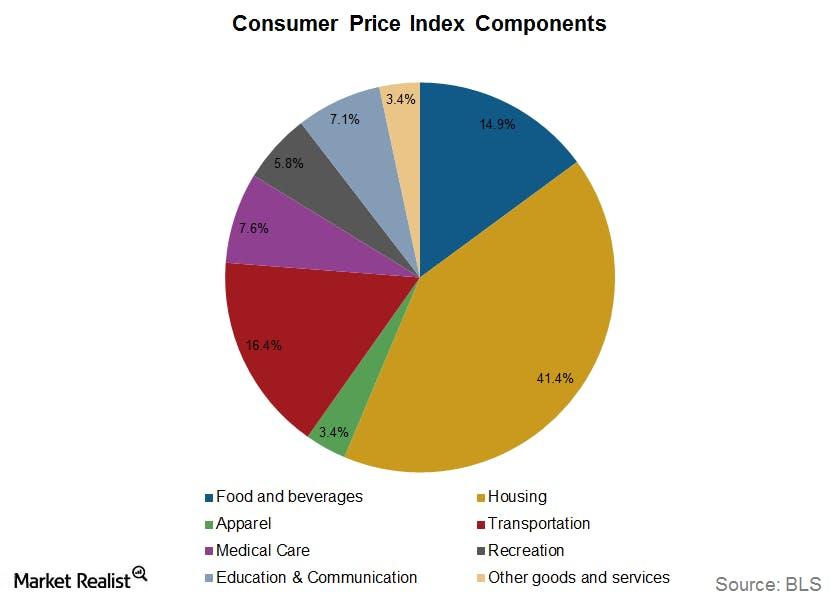

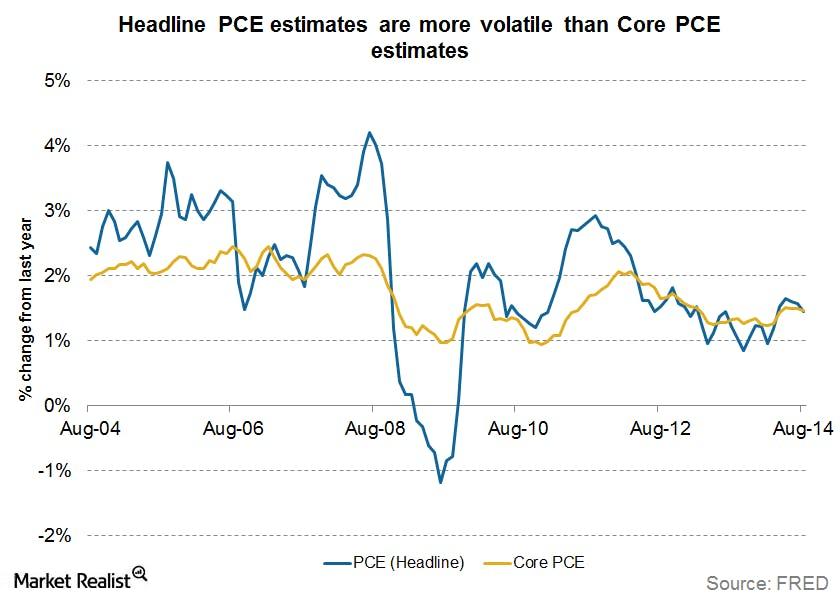

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

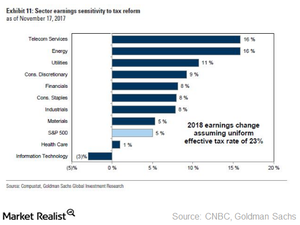

Will Tax Reform Hurt Health Care Sector?

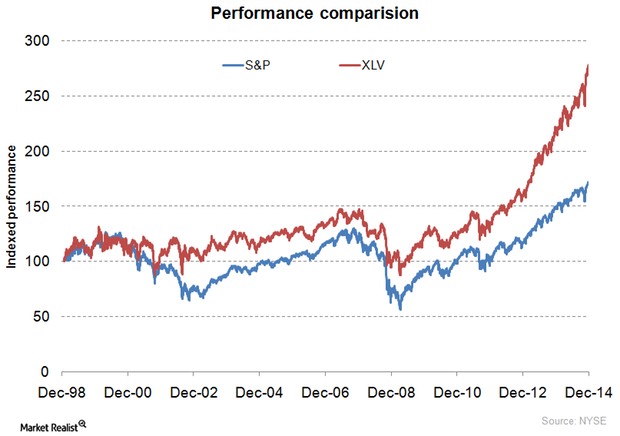

The health care sector played an important role in the recent bull market (SPX-INDEX) rally.

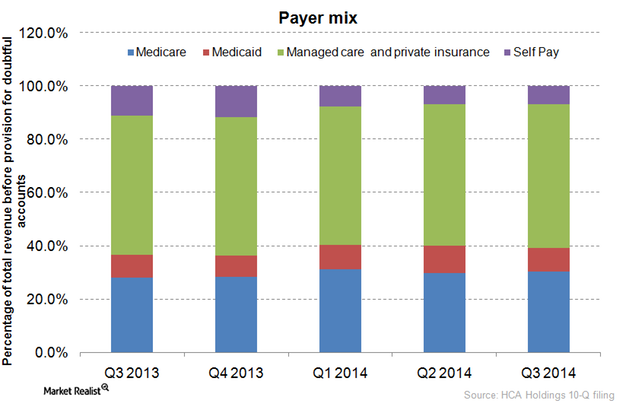

Exploring payer mix trends at HCA Holdings

In terms of payer mix, the percentage of HCA Holdings revenues contributed by Medicare rose from 28.0% in 3Q13 to 30.3% in 3Q14.

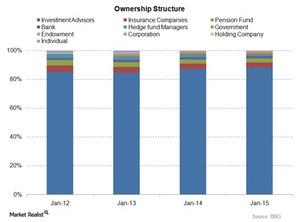

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.Must-know fundamentals about the US Consumer Price Index

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.Why personal consumption expenditure is important to investors

The U.S. Bureau of Economic Analysis issues PCE data, and the price index is a measure of the average increase in prices for all domestic personal consumption.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]

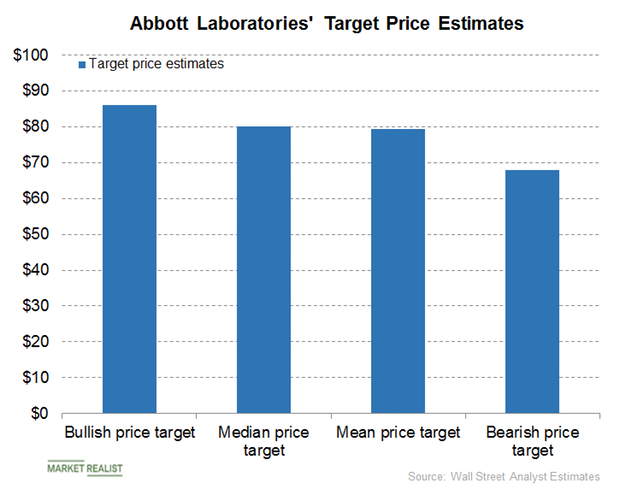

What Do Analysts Recommend for Abbott Laboratories in January?

The 12-month consensus analyst recommendation for Abbott Laboratories on January 18 is a “buy.”

Do Abiomed’s Valuations Look Attractive?

Abiomed’s (ABMD) revenues rose 36% YoY to ~$180 million in fiscal Q1 2019 compared to $133 million in Q1 2018.

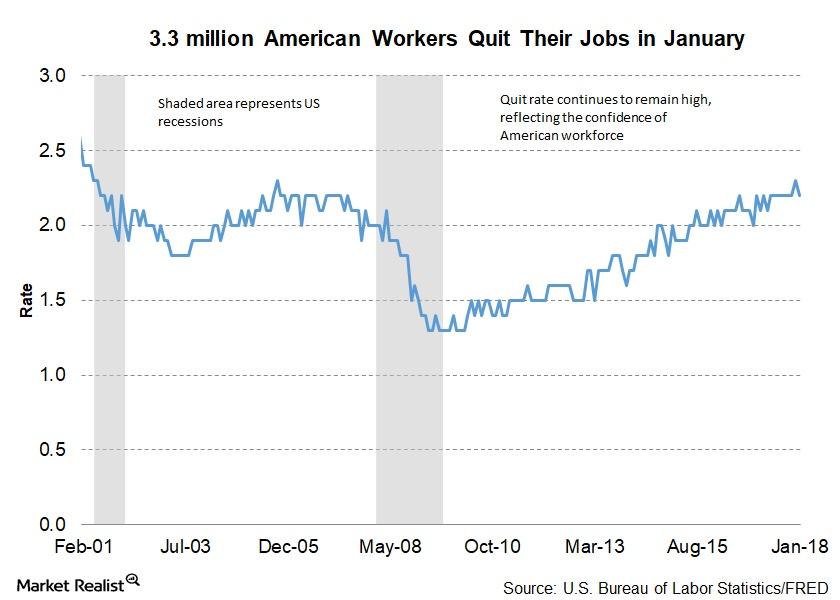

Why the US Workforce’s Quit Rate Has Remained High

January’s JOLTS (Job Openings and Labor Turnover Survey) data, which contains information about job openings and total separations, was reported on March 16.

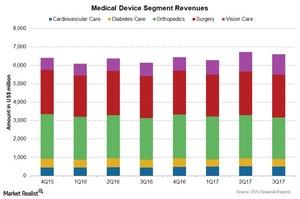

Johnson & Johnson’s Medical Devices Segment: 4Q17 Estimates

Johnson & Johnson’s (JNJ) Medical Devices segment includes products for specialty surgery, orthopedics, cardiovascular care, surgical care, diabetes care, and vision care.

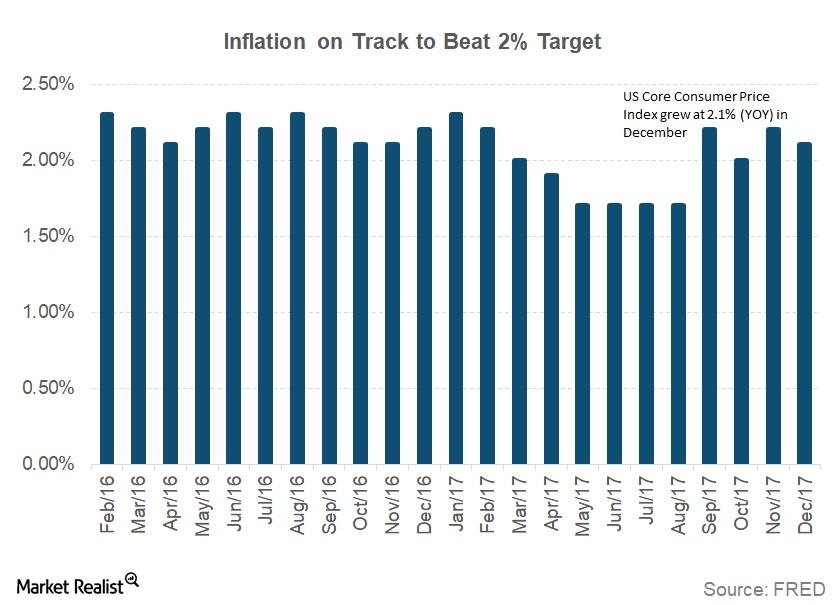

Why Did the Consumer Price Index Rise in December?

According to the December CPI report released by the U.S. Bureau of Labor Statistics on January 12, consumer prices in December increased 0.1%.

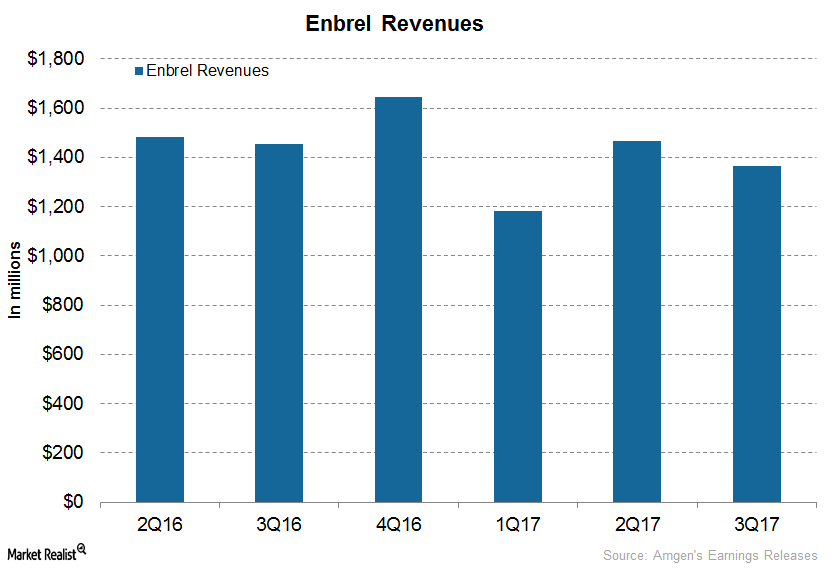

How Amgen’s Enbrel and Nplate Are Positioned for 2018

In 1Q17, 2Q17, and 3Q17, Amgen’s (AMGN) Enbrel generated revenues of ~$1.2 billion, ~$1.5 billion, and ~$1.4 billion, respectively.

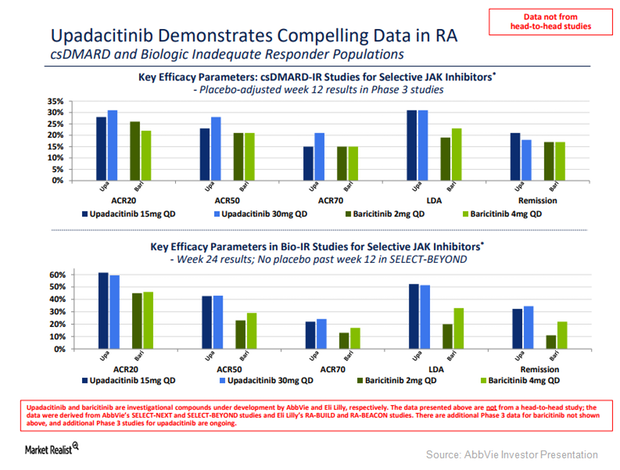

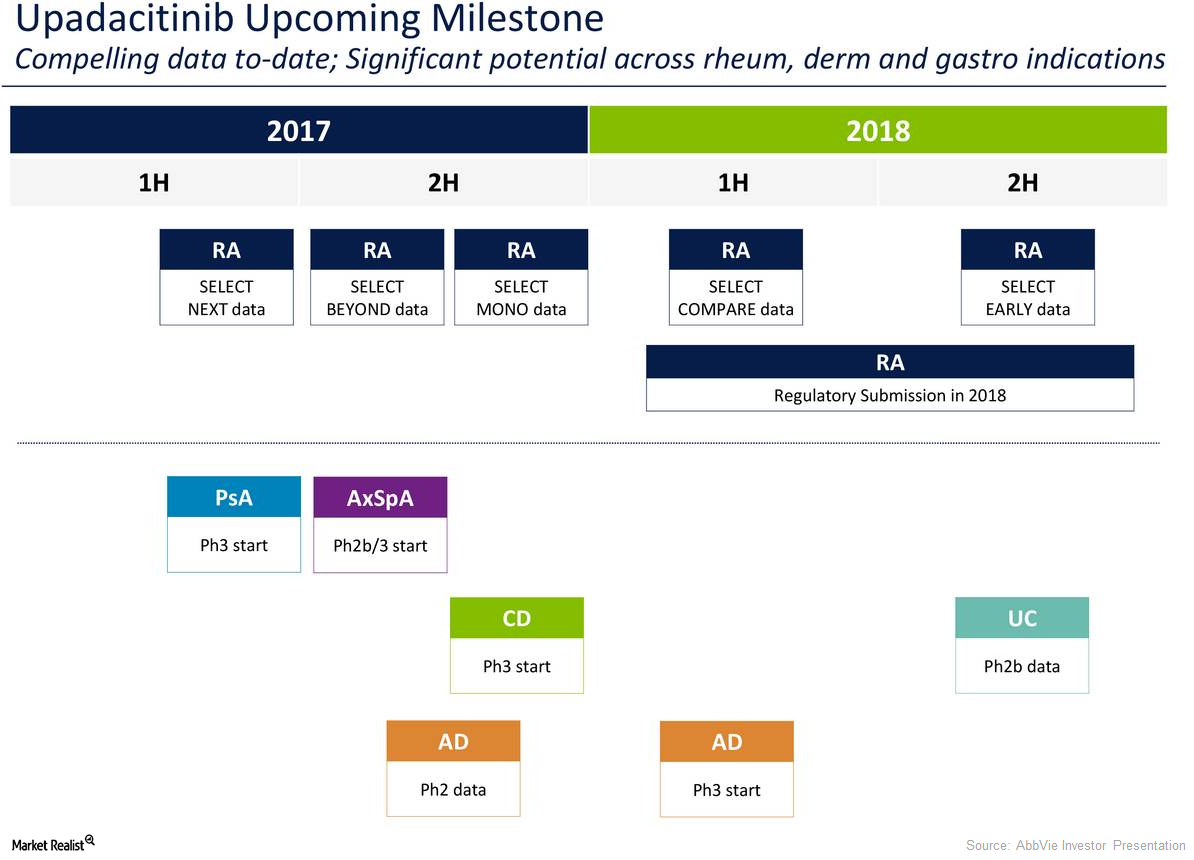

What Upadacitinib Did for AbbVie in 2017

In September 2017, AbbVie’s (ABBV) investigational immunology drug, Upadacitinib (ABT-494), managed to demonstrate its clinical potential.

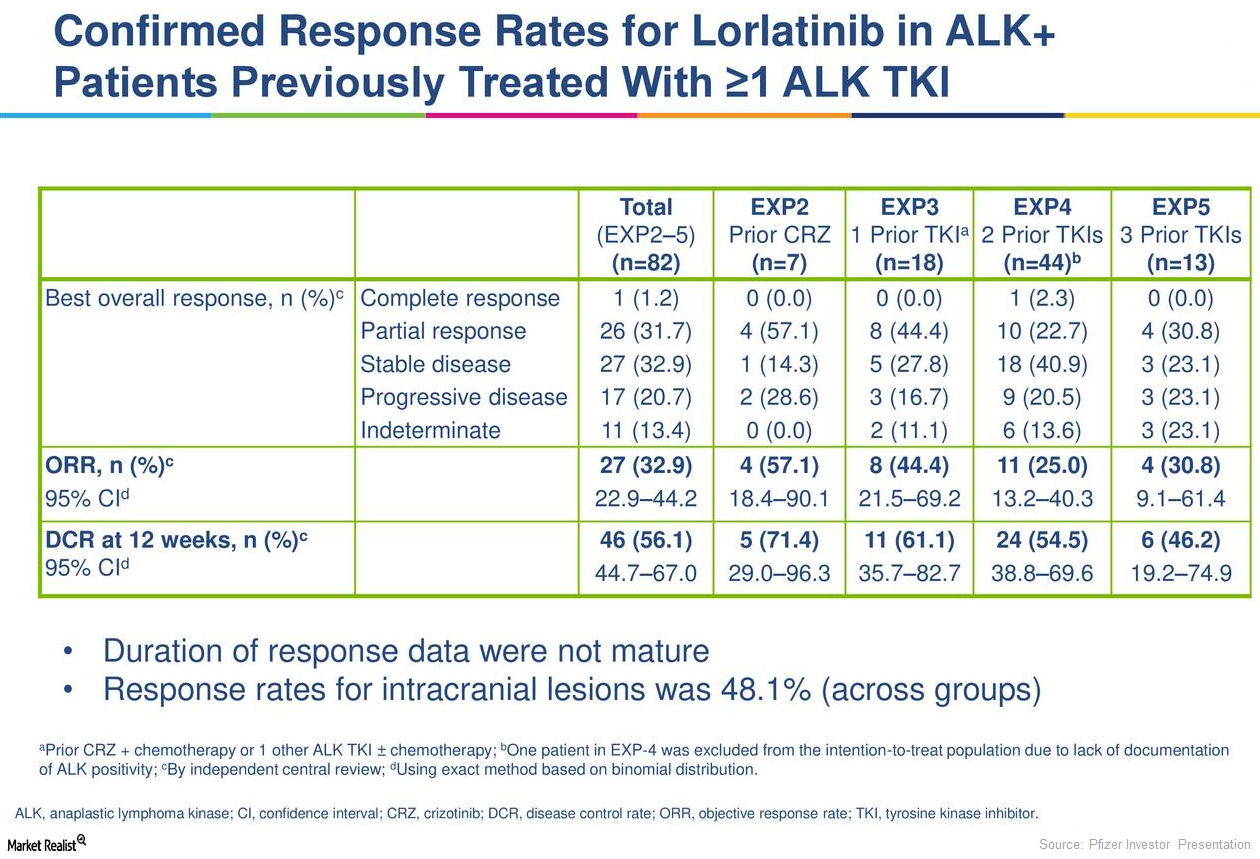

Could Lorlatinib Be a Long-Term Growth Driver for Pfizer?

Lorlatinib is Pfizer’s (PFE) investigational next-generation ALK/ROS-1 tyrosine kinase inhibitor in clinical trials to evaluate its safety and efficacy in the treatment of ALK-positive metastatic non-small cell lung cancer.

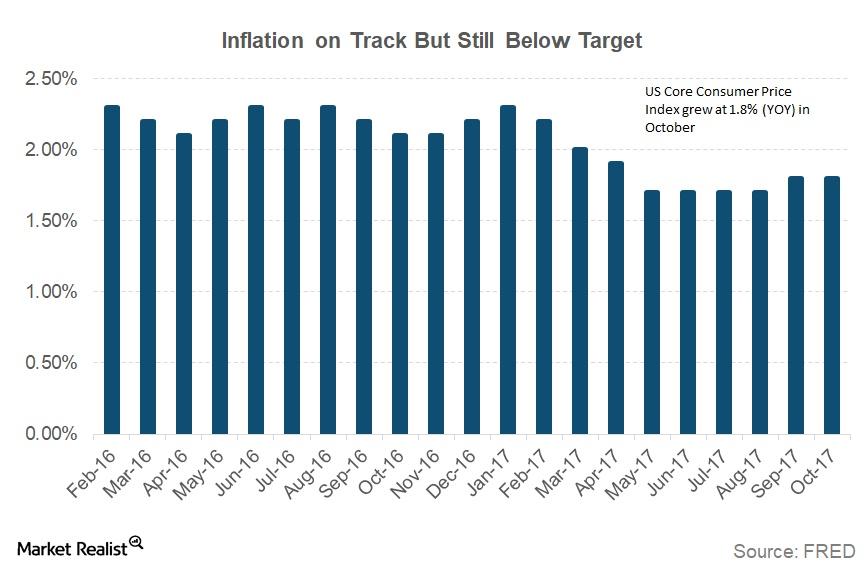

Chart in Focus: The Consumer Price Index Rose in October

The Fed is expected to increase the target funds rate by 0.25% at its December meeting.

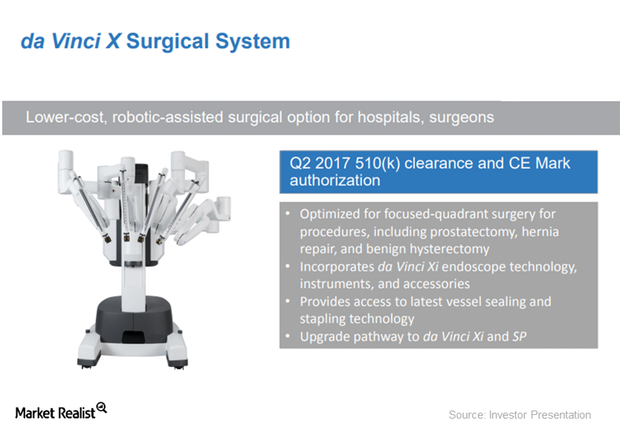

How Intuitive Surgical Is Expanding Its Da Vinci X Systems Worldwide

Intuitive Surgical’s (ISRG) Da Vinci X received early FDA approval in May 2017 and was given a CE Mark in Europe in April 2017.

Why Upadacitinib Could Drive AbbVie’s Long-term Growth

In September 2017, AbbVie (ABBV) presented the results from a phase 2B trial of upadacitinib (ABT-494) for the treatment of adult individuals with moderate to severe atopic dermatitis.

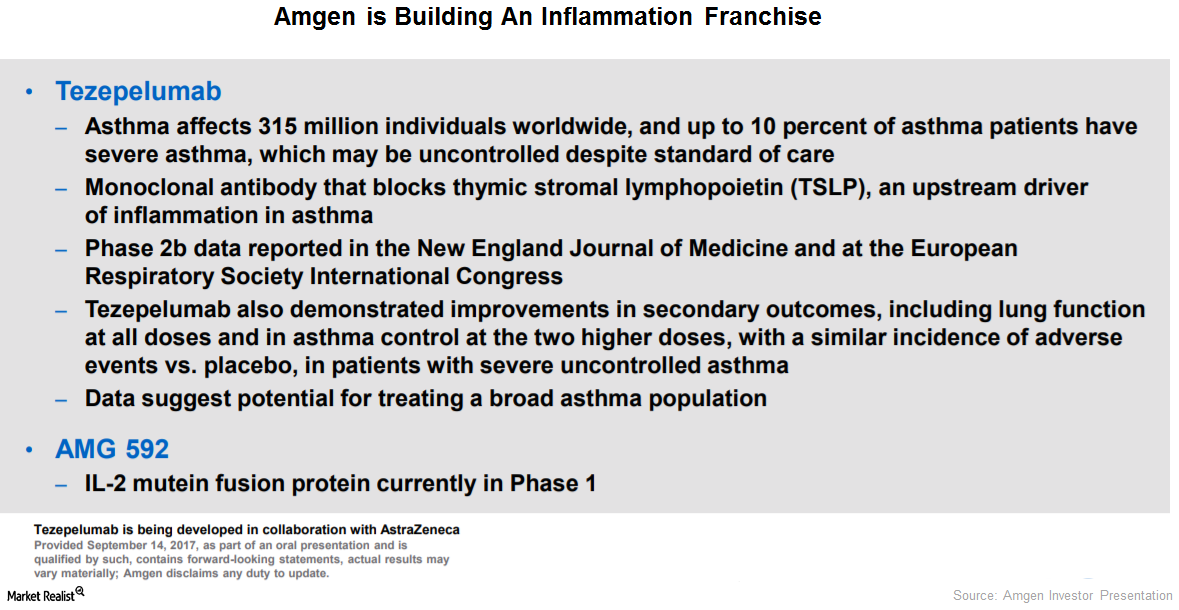

Tezepelumab Could Help Amgen Develop Its Inflammation Franchise

According to World Health Organization (or WHO), around 235 million individuals worldwide have asthma.

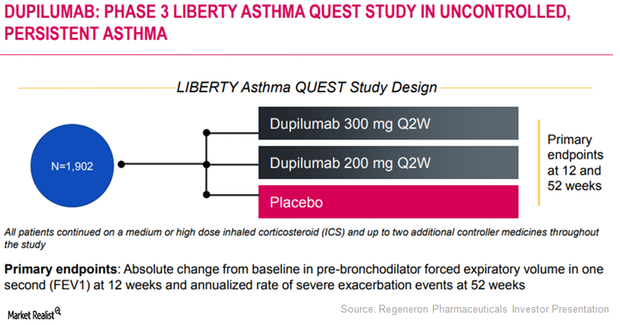

Regulatory Approval in Asthma Indication May Boost Dupixent’s Sales

In June 2017 and July 2017, healthcare providers wrote prescriptions for Regeneron (REGN) and Sanofi’s (SNY) Dupixent for 750 new patients on a weekly basis.

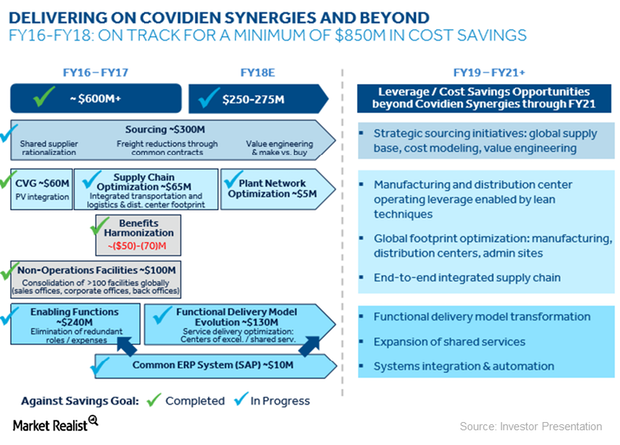

How Medtronic Is Delivering on Its Covidien Synergies

In January 2015, Medtronic (MDT) acquired Covidien for ~$43 billion in cash and MDT stock in a tax inversion deal.

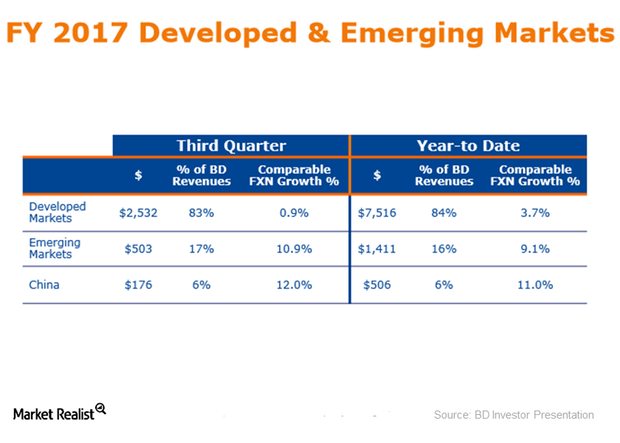

How Is Becton Dickinson Progressing with Emerging Market Growth?

Becton Dickinson’s (BDX) emerging markets registered a strong double-digit growth of 10.9% in 3Q17.

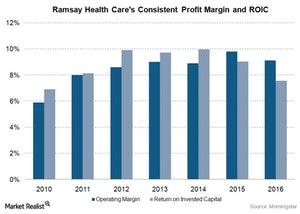

How Ramsay Health Care Became a Cost Leader

Ramsay Health Care is a market leader in private healthcare in Australia, treating almost 3 million patients each year.

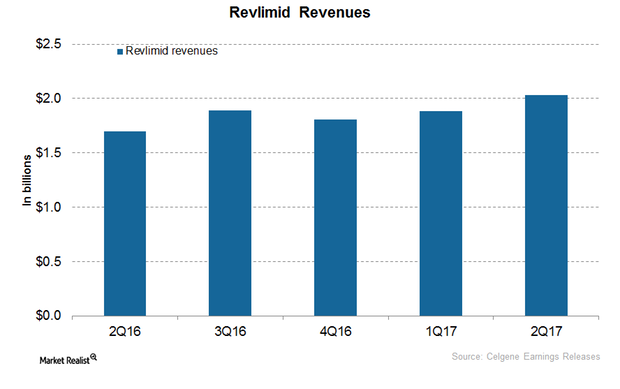

Celgene’s Revlimid Witnessed High Growth in 2Q17

In 2Q17, Celgene’s (CELG) Revlimid generated revenues of ~$2.0 billion, which reflected ~20% growth year-over-year and ~8% growth quarter-over-quarter.

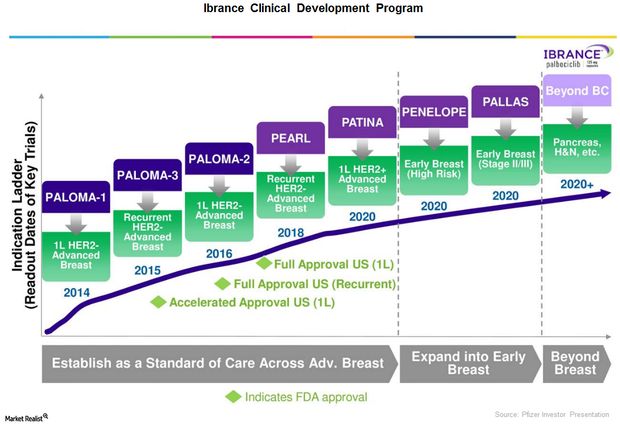

Why Ibrance Could Be Pfizer’s Long-Term Growth Driver

Pfizer (PFE) is extensively conducting clinical trials for the label expansion of Ibrance.

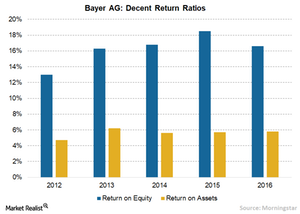

How Bayer Is Creating Value through Innovation

In 2016, Bayer owned ~51,000 valid patent applications and patents relating to ~5,000 protected inventions worldwide.

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

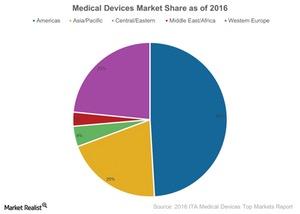

Is Medical Technology Driving the US Healthcare Industry?

The US medical device industry is a global leader. Its market was valued at ~$140 billion for 2016. It represents ~45% of the global market.

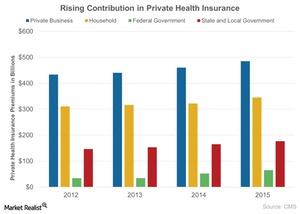

Rising Costs Are a Major Issue in the Healthcare Sector

The US economy is dealing with rising healthcare costs. The national healthcare expenditure grew 5.8% to $3.2 trillion in 2015 or $9,990 per person.

Are Stock Returns during Summer Months That Bad?

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign.

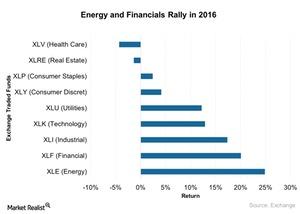

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.