Health Care Select Sector SPDR® ETF

Latest Health Care Select Sector SPDR® ETF News and Updates

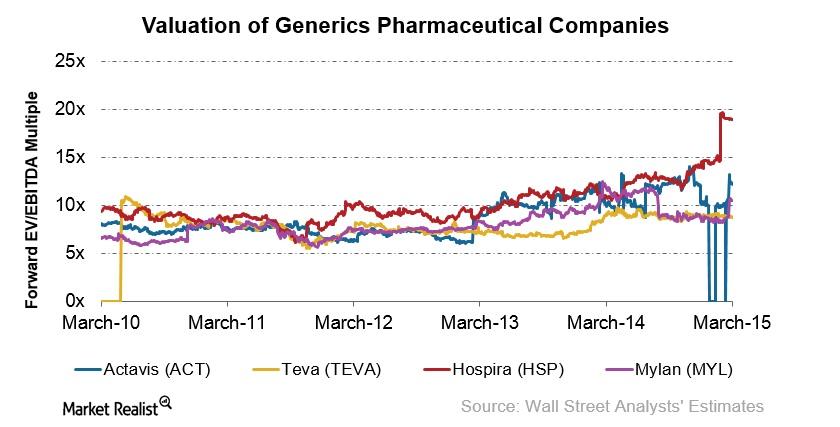

What Drives Generic Pharmaceuticals’ Valuation?

Valuation reflects the market’s perceptions of the industry’s growth prospects. The major value drivers for valuation are ROIC and the growth rate.

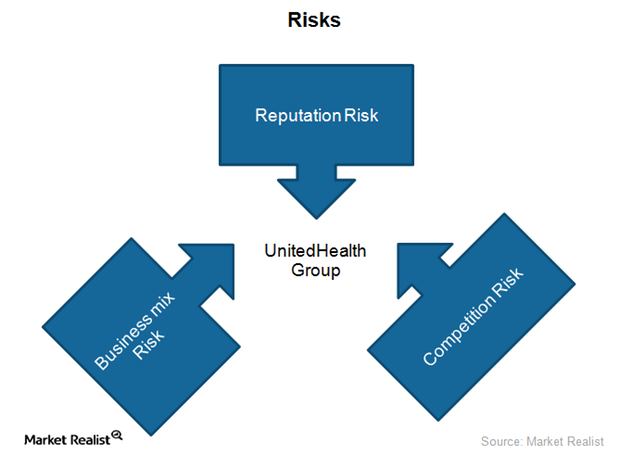

What key risks does UnitedHealth Group face?

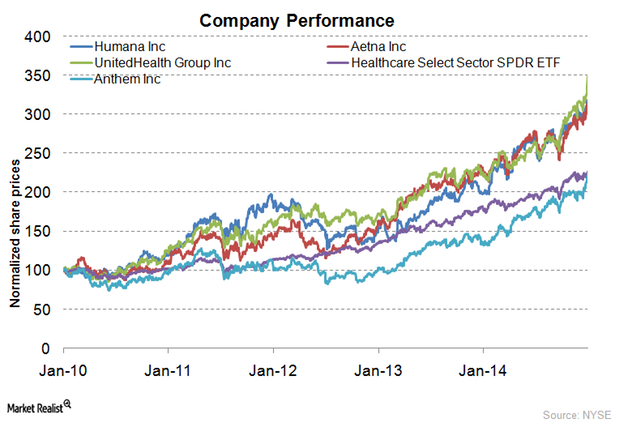

UnitedHealth Group (UNH) is a health insurance provider. It faces a unique combination of business risks, including business mix and competition risks.

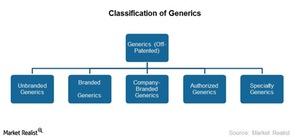

Why the Generic Industry’s Classification Is Still Evolving

The generics industry primarily caters to several large diseases in primary care. Healthcare is organized into three categories—primary, secondary, and tertiary.

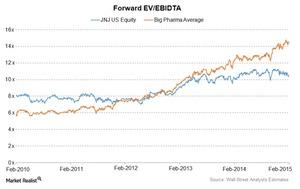

Where Does Johnson & Johnson Stand in the Industry?

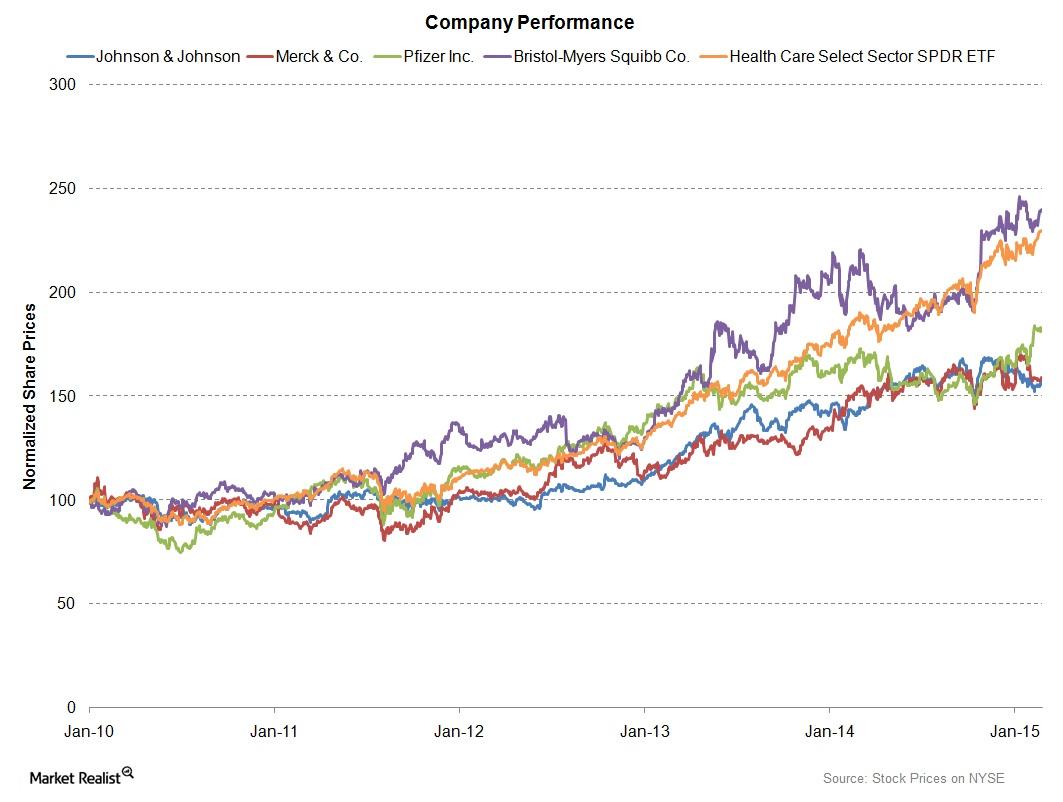

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

What Investors Need to Know about Branded and Generic Drugs

The prescription drug market is divided into two categories—branded or generic drugs. Branded drugs are patented drugs. Generics are off-patented drugs.

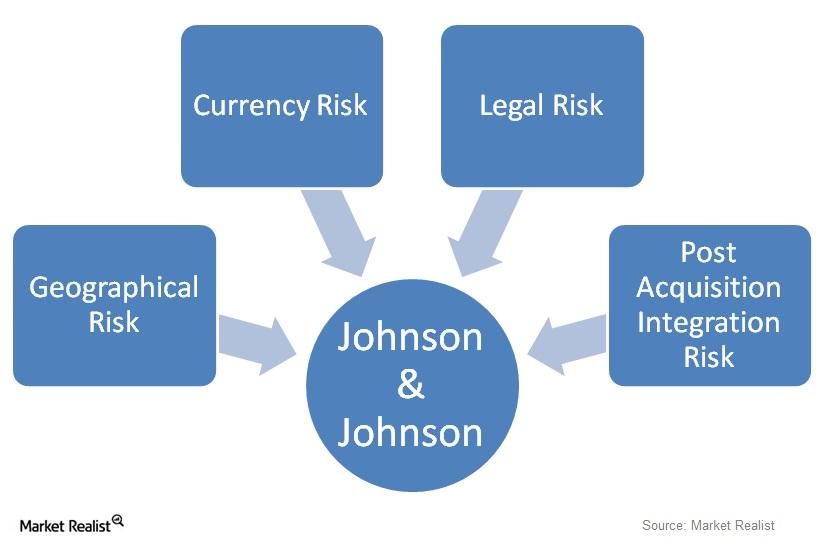

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

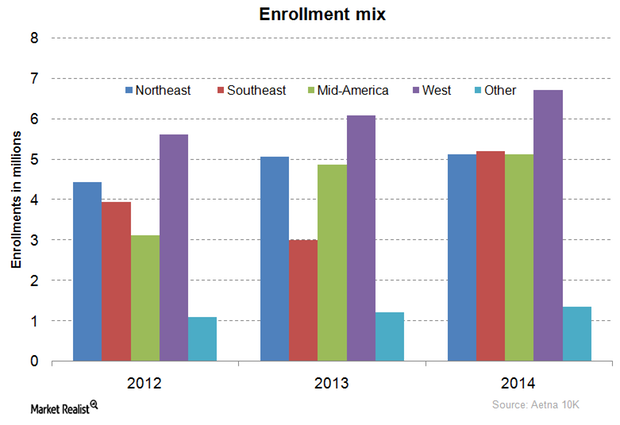

How Is Aetna’s Membership Distributed Across Its Key Markets?

Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the Mid-US, and finally consolidated international enrollments.

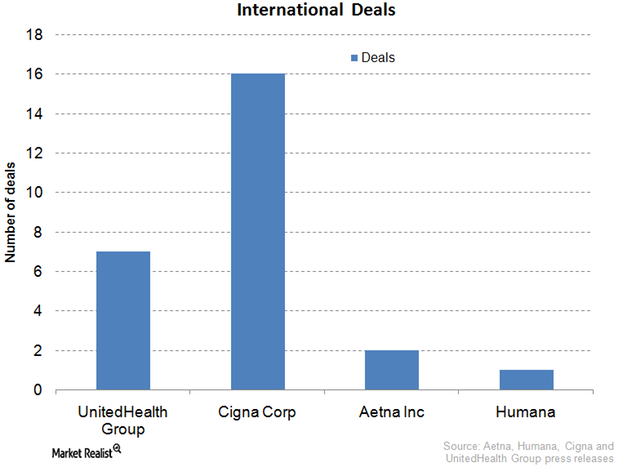

What’s UnitedHealth Group’s strategy for international expansion?

The private health insurance industry in the US has been expanding its footprint in international markets. International markets are less penetrated and competitive.

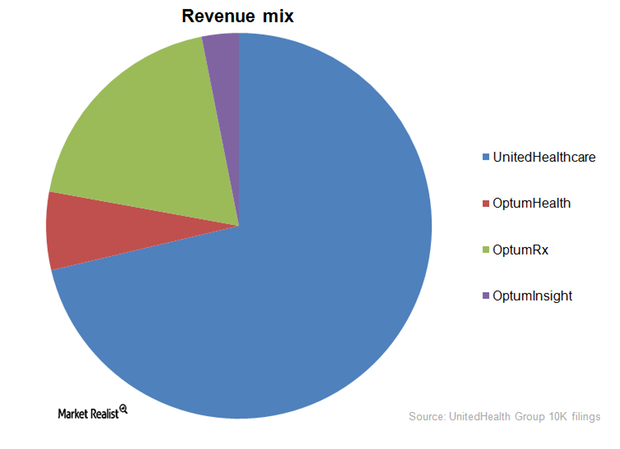

What are UnitedHealth Group’s key business segments?

Out of UnitedHealth Group’s (UNH) four business segments, UnitedHealthcare accounted for 71.3% of the company’s revenue.

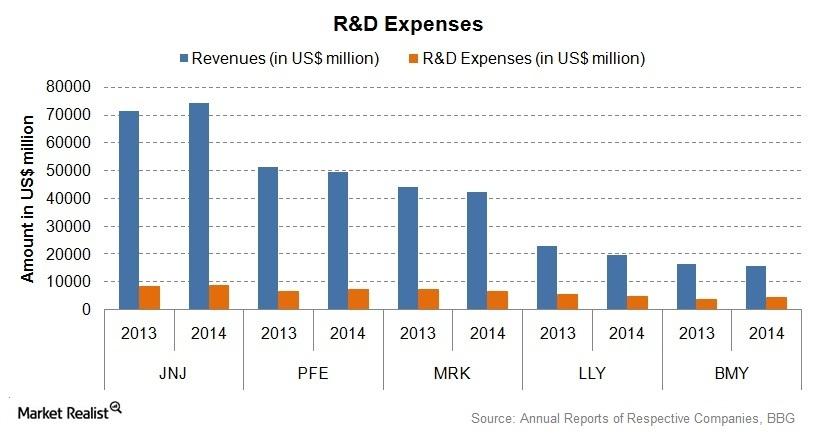

Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.

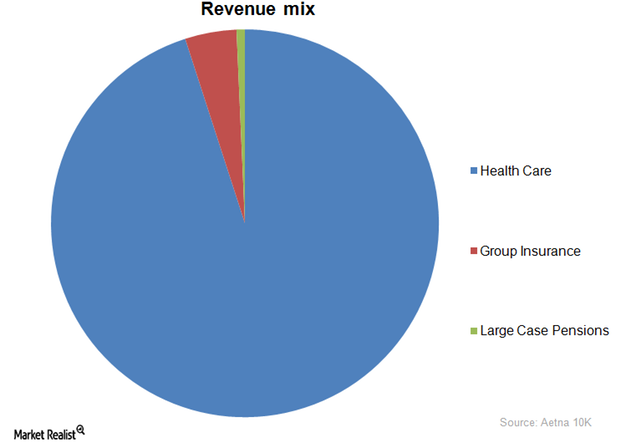

What Are Aetna’s Key Business Segments?

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue.

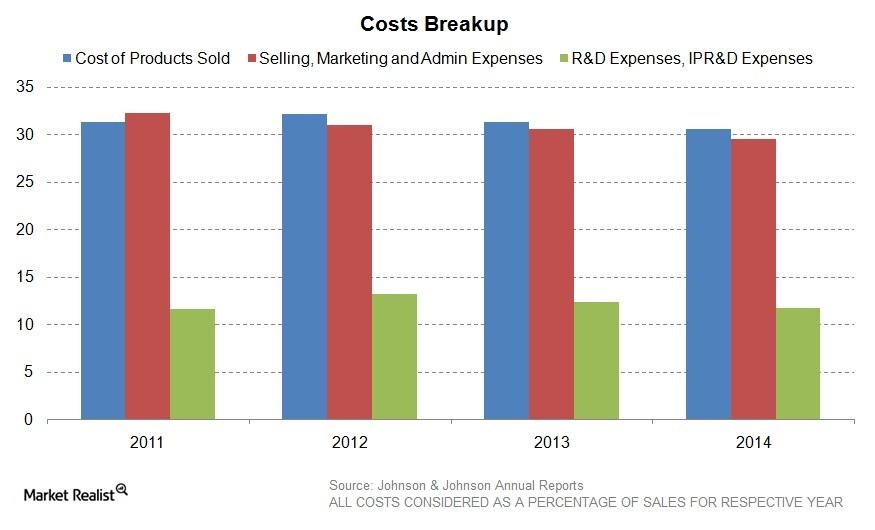

What Were Johnson & Johnson’s Outstanding Expenses?

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

Johnson & Johnson’s Revenue Stream Increased in 2014

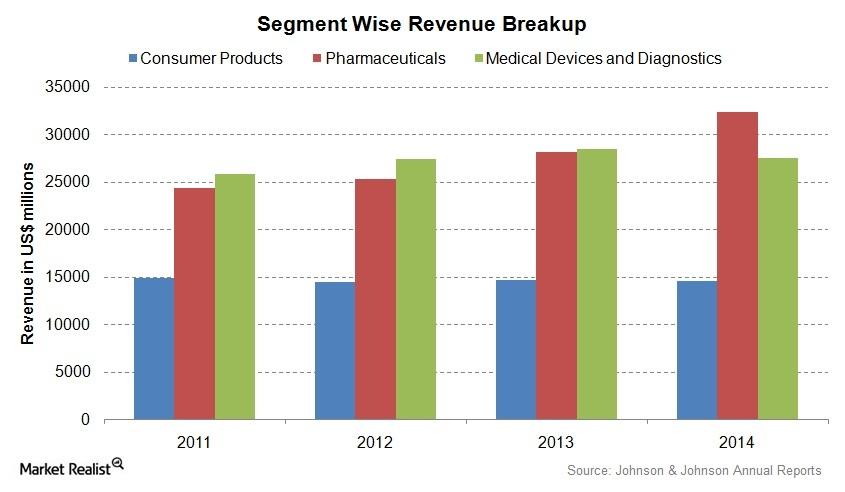

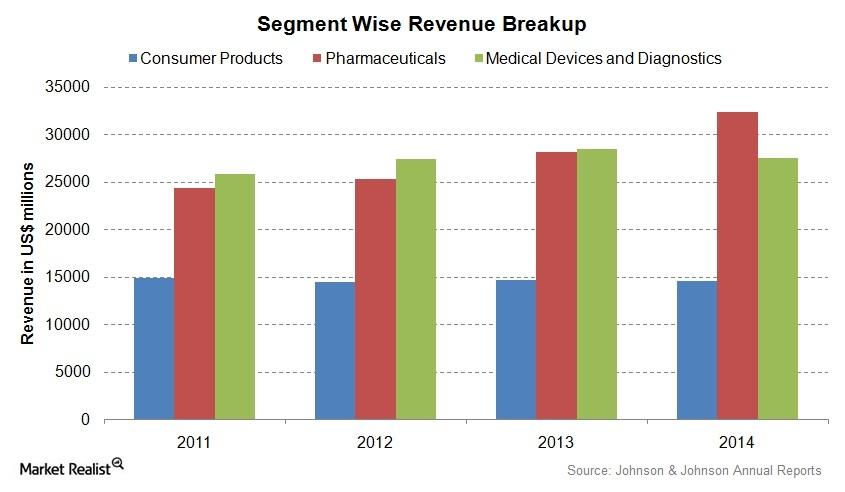

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

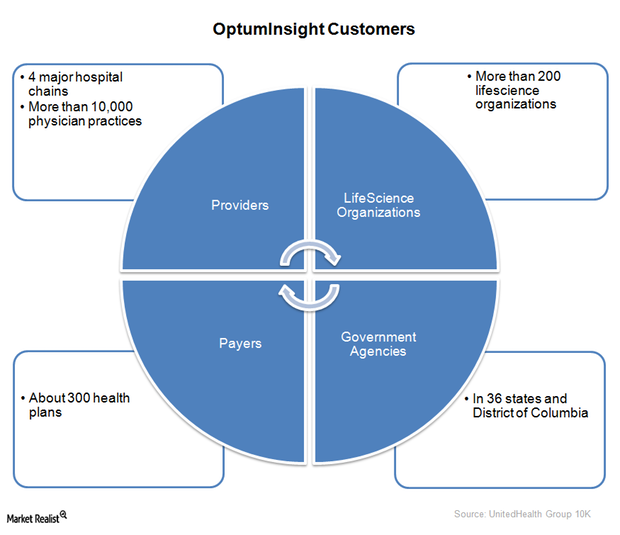

UnitedHealth Group’s OptumInsight – improving medical care

In 2014, OptumInsight released a population health analytics tool—OptumOne. It enables hospitals to improve the quality of care.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

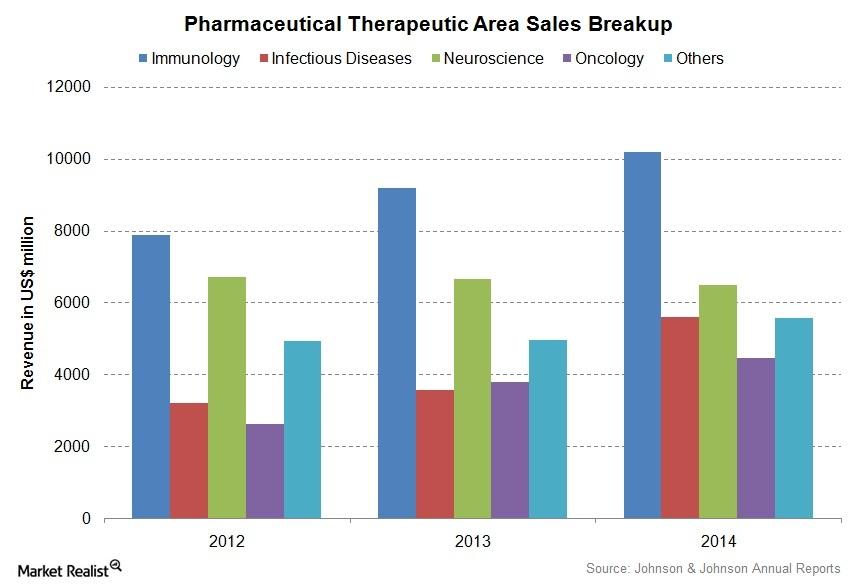

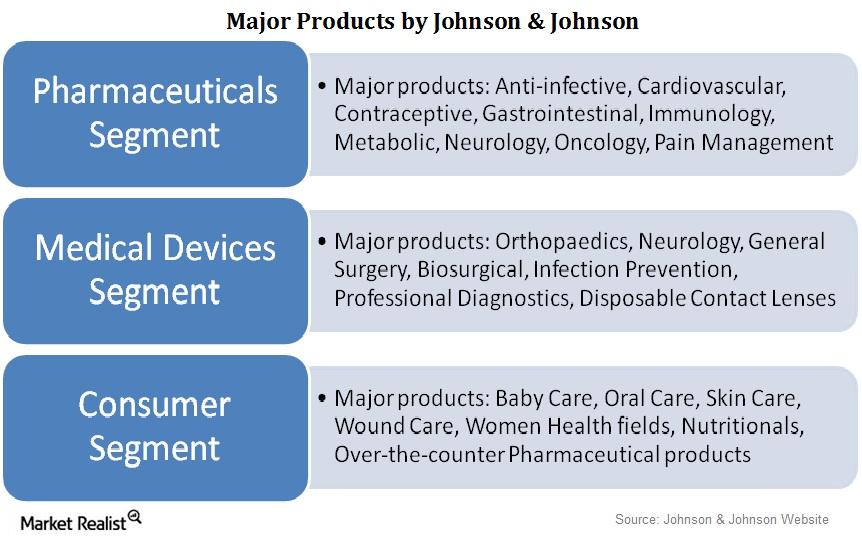

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.

Analyzing Johnson & Johnson’s Three Main Business Segments

Over a period of 128 years, Johnson & Johnson (JNJ) diversified its business into three business segments.

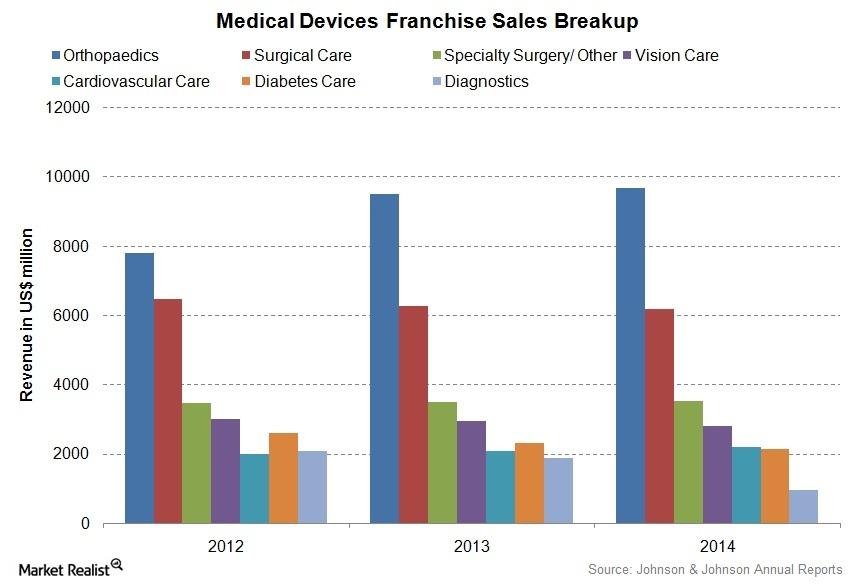

Johnson & Johnson’s Medical Devices and Diagnostics Segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s revenue. In 2014, the segment generated about $27.5 billion in revenue.

Johnson & Johnson: A Leading Pharmaceuticals Company

Johnson & Johnson is a leading pharmaceuticals and healthcare company in the US. It delivered returns of 13.4% from February 2010 to February 2015.

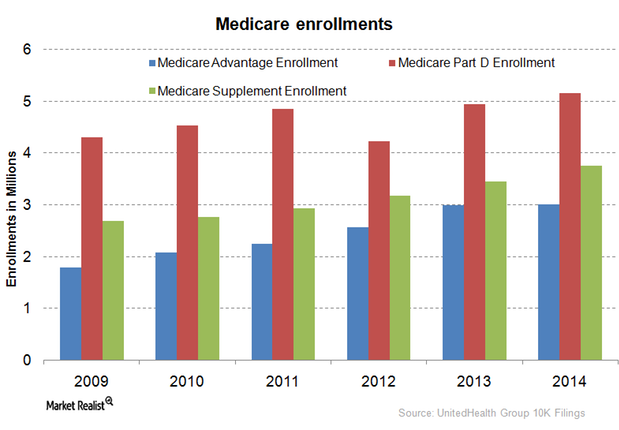

UnitedHealth Group provides services to Medicare beneficiaries

Medicare Part D is a federal government program. It subsidizes prescription drug expenses for Medicare beneficiaries.

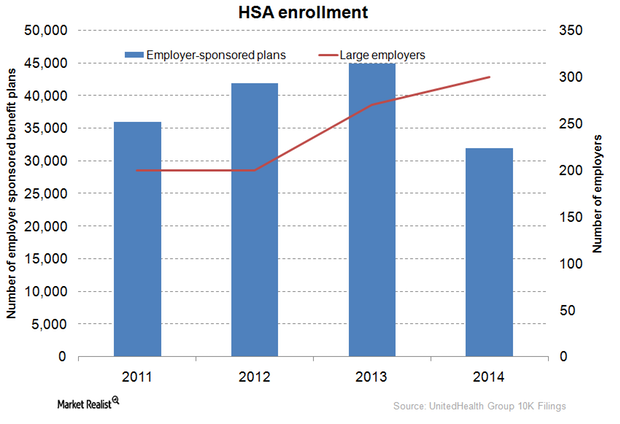

What are UnitedHealth Group’s consumer engagement products?

The private health insurance industry offers a diverse range of products. The products combine health plans with financial accounts to cater to different consumers’ needs.

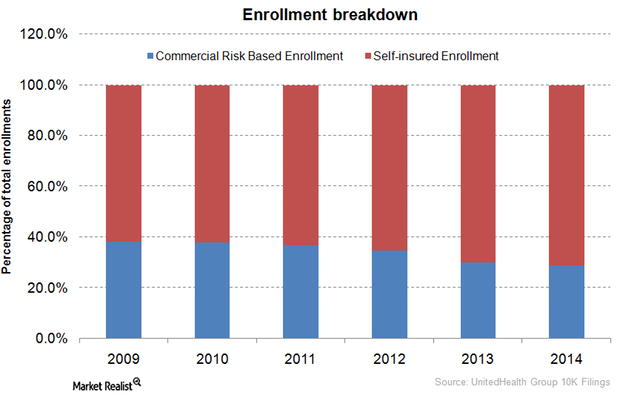

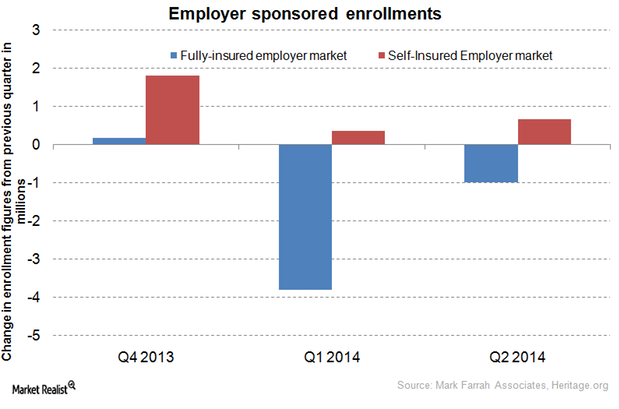

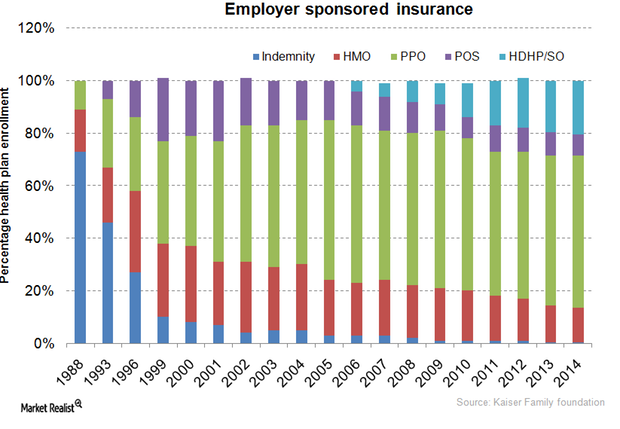

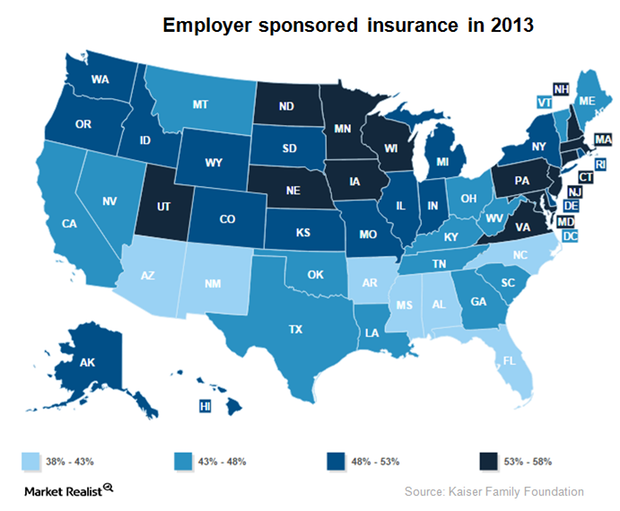

UnitedHealth Group’s employer-sponsored and individual insurance

Employer-sponsored coverage, a major form of insurance, increasingly adopted self-insured plans. They’re more cost-effective and flexible than fully-insured plans.

UnitedHealth Group: The history of a health insurance giant

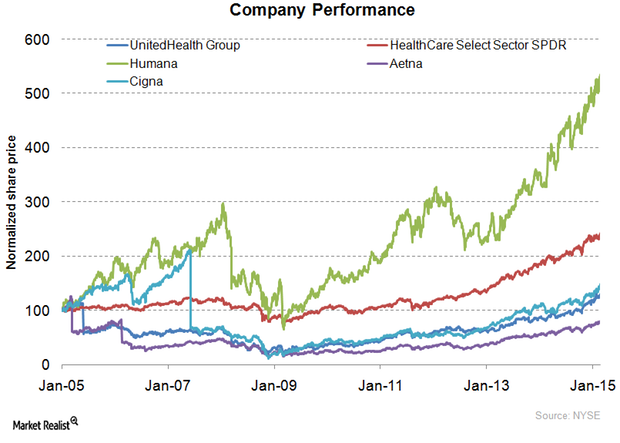

With a market capitalization of $107.1 billion, UnitedHealth Group is the largest insurance provider in the US. It registered revenue worth $130.5 billion in 2014.

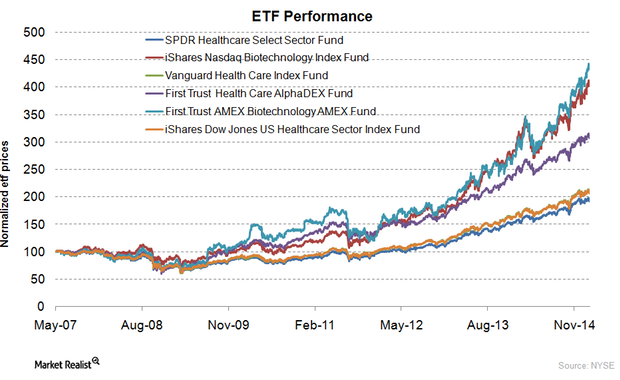

Why should you invest in healthcare ETFs?

Biotechnology funds have performed better than other healthcare ETFs. They invest in companies that use biological processes to produce medical products.

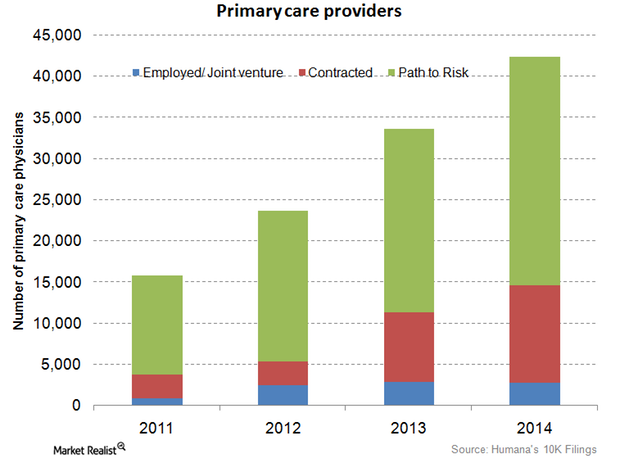

Humana employs and contracts more primary-care physicians in 4Q14

Humana’s employed and contracted primary-care physicians rose by 29.2% from 11,300 in 2013 to 14,600 in 2014.

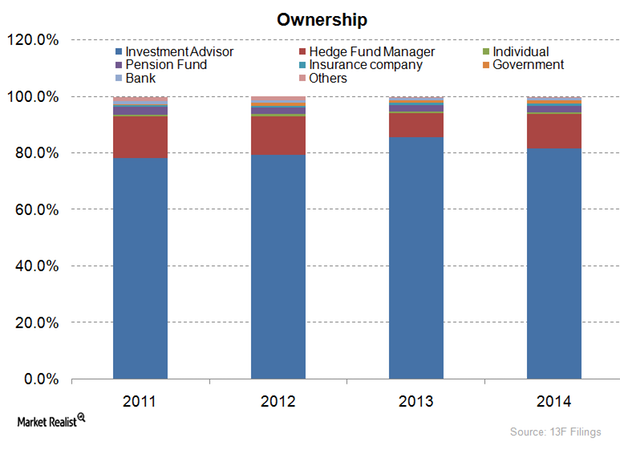

Most Humana stakeholders are mutual funds or advisers

Investment advisers or mutual funds are the main stakeholders in Humana, accounting for about 81.7% of its total ownership picture.

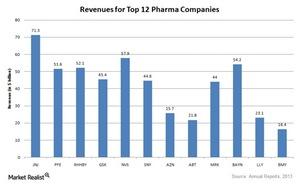

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.

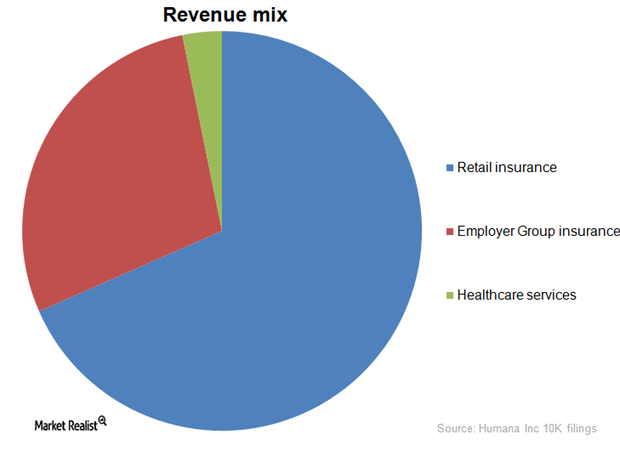

Humana’s Retail Insurance business segment is biggest earner

Humana’s retail insurance business segment contributes 66.5% of overall company revenues. Employer-sponsored programs follow with 27.6%.

Humana: Unraveling the history of a health insurance giant

Humana (HUM) is the third-largest health insurance provider in the US, with over 13 million customers. Humana is also 73rd in Fortune 500 rankings.

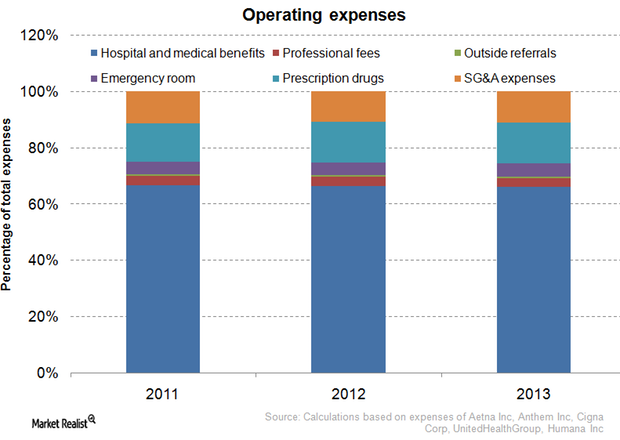

Understanding health insurance companies’ major operating expenses

The operating expenses of the private health insurance industry depend on the design of health plans and on the life history, age, and health of enrollees.

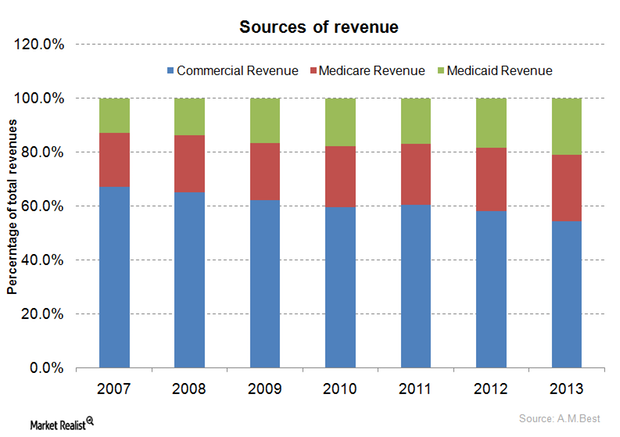

The health insurance industry’s major sources of revenue: A guide

The share of commercial revenues within the private health insurance industry’s total revenues decreased from 67.0% in 2007 to 54.3% in 2013.

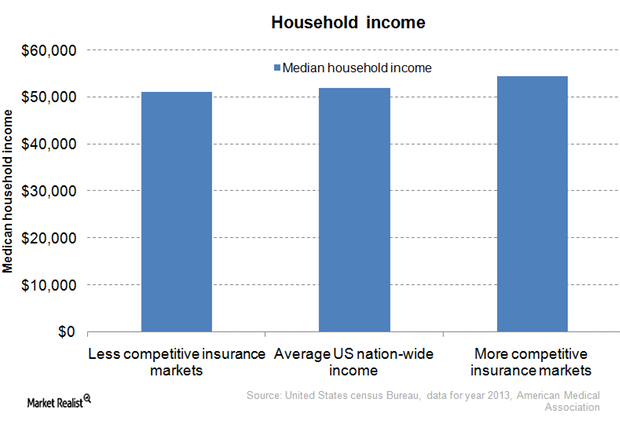

Health insurance monopolies: What you need to know

45 states have only two dominant health insurers accounting for half of the enrollments, giving rise to local market health insurance monopolies.

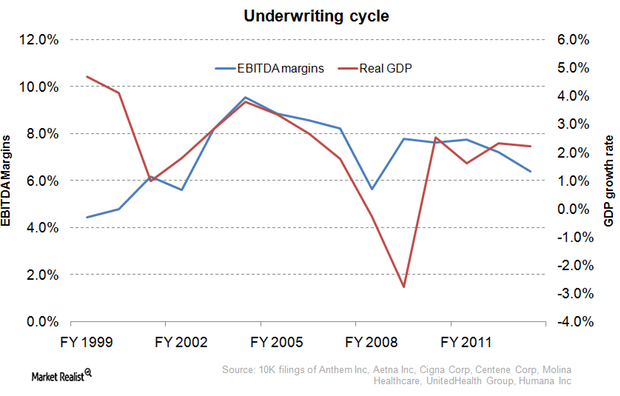

Underwriting cycle: What health insurance investors need to know

The underwriting cycle results from the uncertainty of predicting healthcare expenses and the fluctuating participants in the health insurance industry.

Why the Affordable Care Act hurts the managed care industry

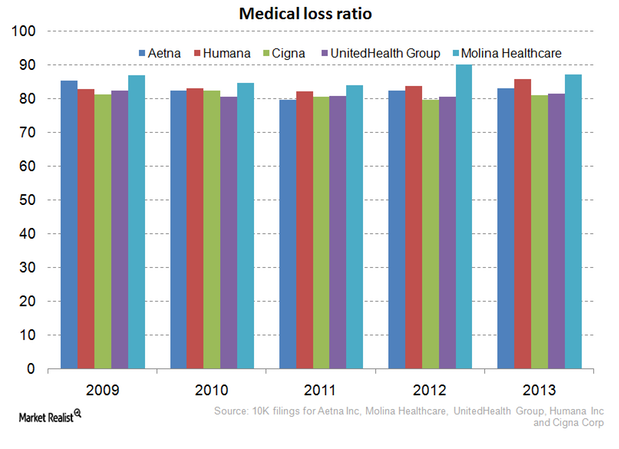

The Affordable Care Act requires health insurers spend at least 80% of premiums on health expenses for small group plans and 85% for large group plans.

Shift to self-insurance plans affects health insurance stocks

As hospital utilization remains low, more employers are exploring the option of self-insurance to reduce their employee benefit costs.

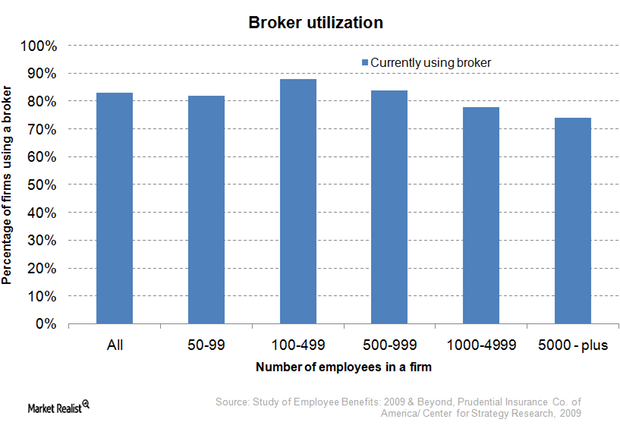

Must-know distribution channels for commercial health plans

The private health insurance industry categorizes commercial health plans as either individual plans, small group plans, or large group plans.

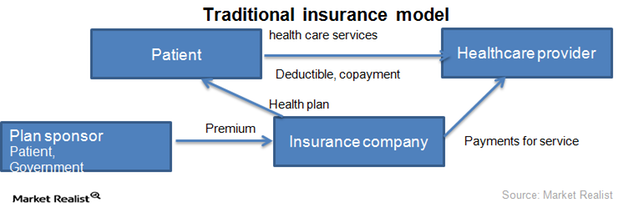

2 key business models of the health insurance industry

The health insurance industry runs on two business models: traditional insurance and managed care organizations.

Your must-read guide to health insurance managed care plans

Employer-sponsored coverage is a key factor for nationwide enrollment trends of managed care plans and independent insurance plans.

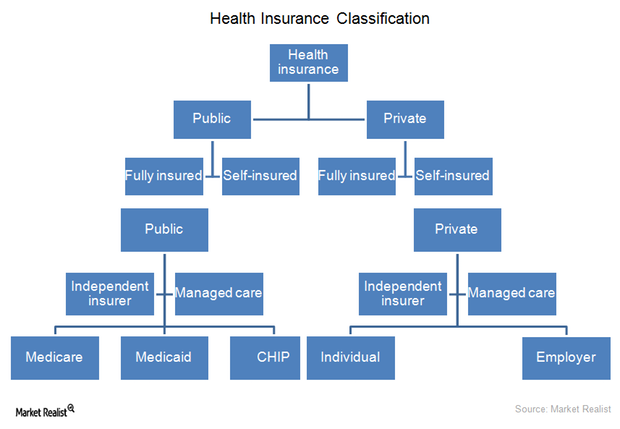

Making sense of health insurance types: An investor’s guide

The health insurance industry operates through two types of organizations: independent insurance companies and managed care organizations.

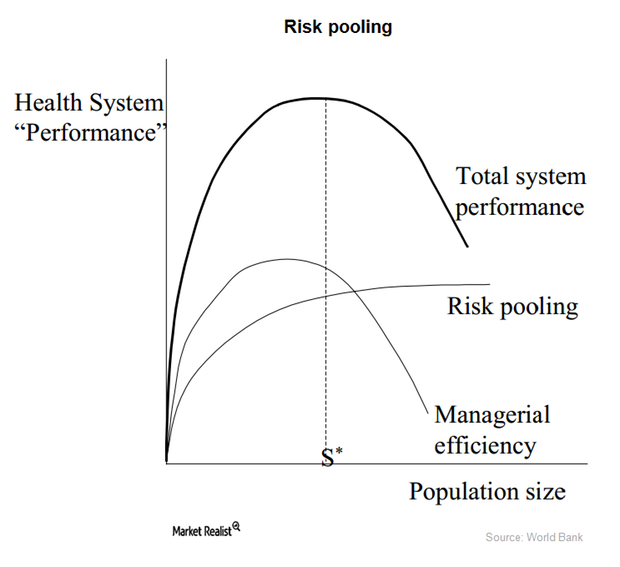

How the health insurance industry manages risks

The health insurance industry mainly gives individuals a risk management tool. People can’t predict the extent or timing of their their healthcare expenses.

An overview of LifePoint Hospitals

With 67 hospitals, acquisitions continue to strengthen its position in rural markets, especially where LifePoint Hospitals is the sole healthcare provider.

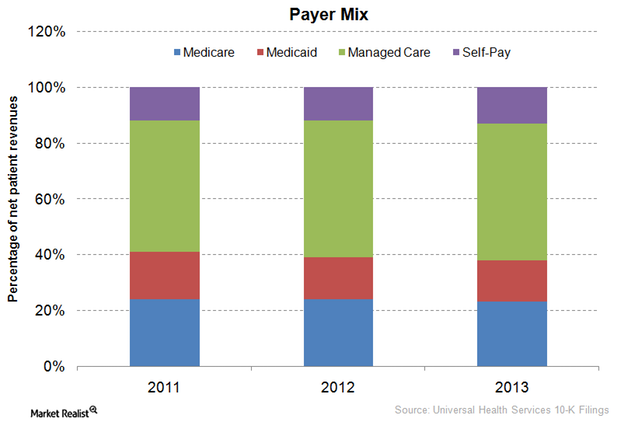

Universal Health Services’ payer mix differs from other companies’

Universal Health Services (UHS) has displayed a trend in payer mix from 2011 to 2013 that differs from other companies in the healthcare industry (XLV).

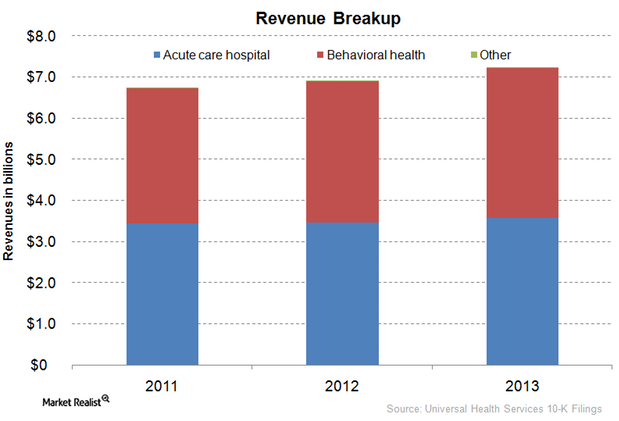

Exploring Universal Health Services’ revenue streams

Universal Health Services’ (UHS) net revenues increased by 4.6% from $6.96 billion in 2012 to $7.28 billion in 2013.

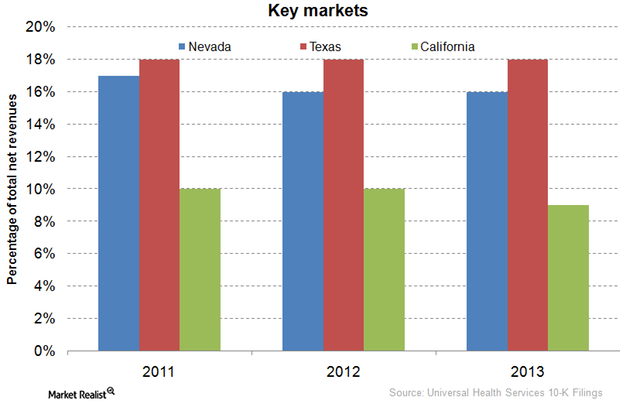

Exploring Universal Health Services’ major markets

Universal Health Services (UHS) earns more than 50% of its total revenues from the Texas, Nevada, Florida, California, and District of Columbia markets.

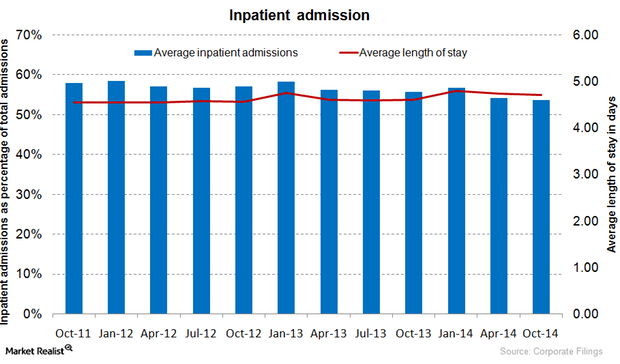

Analyzing the important current trends in hospital admissions

Hospital admissions are classified in two categories, inpatient admissions and outpatient admissions. Patients who are admitted overnight are inpatients.

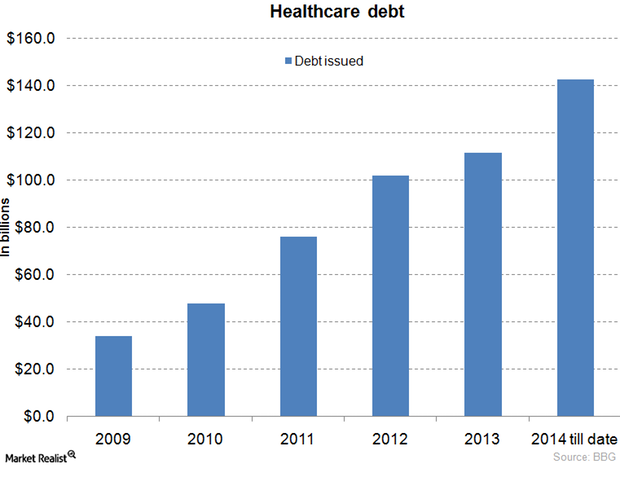

Why changes in interest rates affect the hospital industry

Economic changes in interest rates affect hospital companies, depending on the company’s cost-structure and expansion strategies.

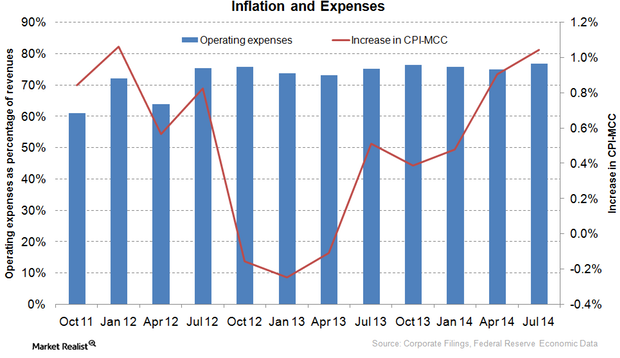

Gauging inflation’s effects on the hospital industry

Inflation closely relates to the performance of the healthcare industry (XLV), as it affects the rates that hospitals charge and the costs of medical care.

Why the unemployment rate affects hospital performance

The healthcare industry, represented by the Healthcare Select Sector SPDR, is affected by the unemployment rate. Income affects people’s health choices.

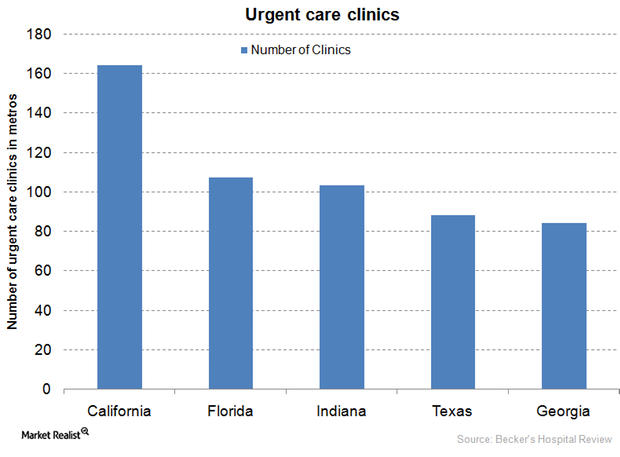

Standalone urgent care strategies

HCA Holdings is capturing market share in the $15 billion urgent care clinic market field by focusing on acquiring or opening standalone urgent care clinics.

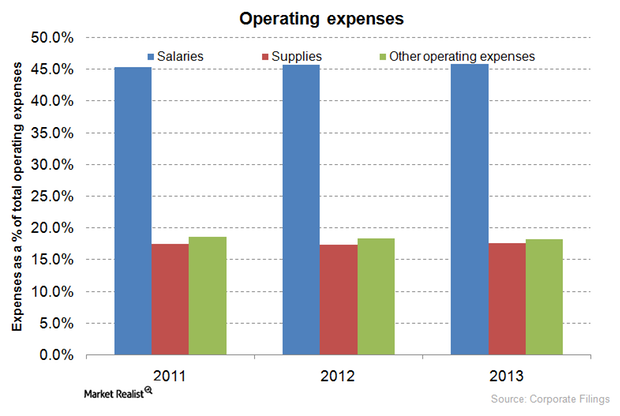

Exploring HCA Holdings’ operating expenses

With solutions such as flexible staffing and optimal group purchasing provided by Parallon, HCA Holdings has better operating margins as compared to its peers.