Health Care Select Sector SPDR® ETF

Latest Health Care Select Sector SPDR® ETF News and Updates

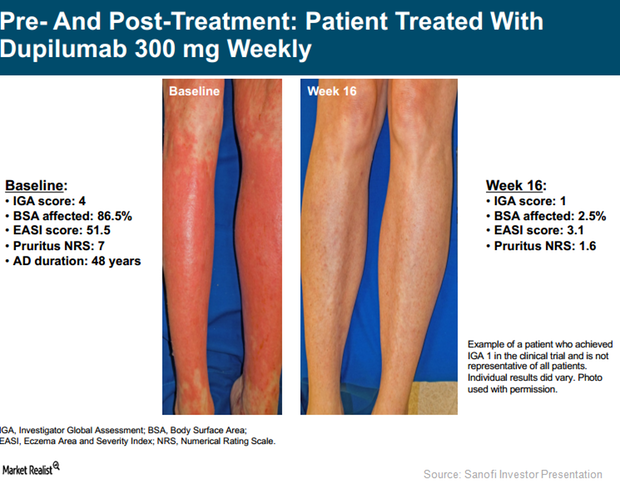

Dupixent: Leading Therapy for Atopic Dermatitis in the Future?

Existing treatment options for AD aren’t tolerated well by the entire patient population. Dupixent might become a preferred regimen in the future.

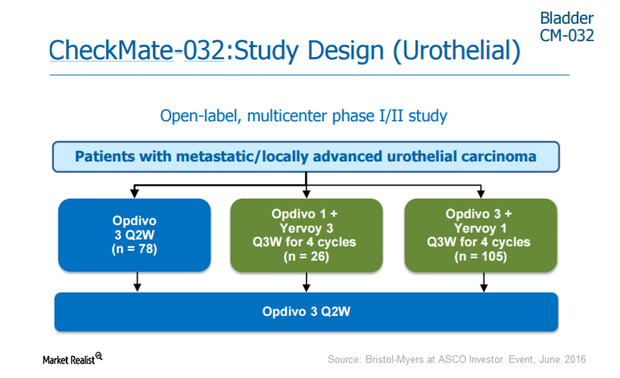

Bristol’s Opdivo Has One Eye on Advanced Bladder Cancer

After its 3Q16 earnings, there were multiple positive triggers for Bristol-Myers Squibb (BMY) stock.

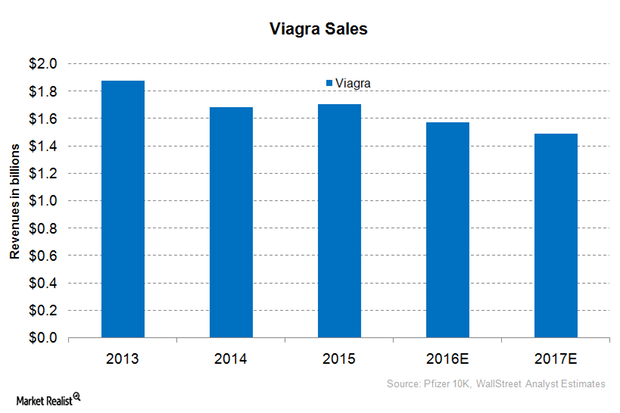

Viagra May Witness a Decline in Revenues in 2016

Wall Street analysts estimate that Viagra’s sales in 2016 will reach approximately $1.6 billion, which would be a year-over-year (or YoY) decline of about 7.7%.

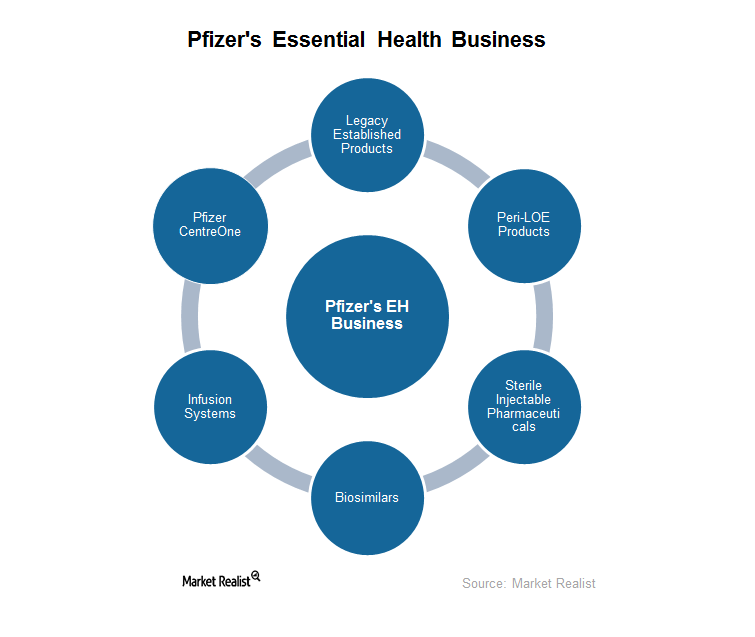

Pfizer’s Essential Health Business: What You Need to Know

In this series, we’ll discuss in detail how Pfizer plans to revive growth for the falling Essential Health business.

What Made Cepheid Attractive to Danaher?

On September 6, 2016, Danaher (DHR) announced that it has entered into a definitive agreement to acquire Cepheid (CPHD) for $4 billion.

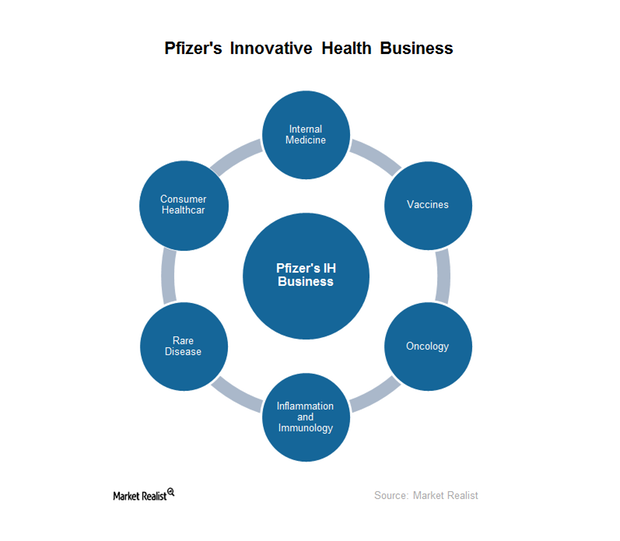

A Look at Pfizer’s Innovative Health Business

In the second quarter of 2016, Pfizer (PFE) reorganized its Innovative Pharmaceutical and Consumer Healthcare operations as the Innovative Health business segment.

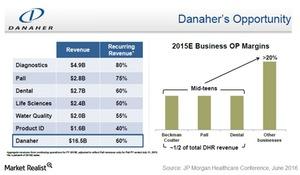

The Key Product Lines That Make Up Danaher’s Diagnostics Business

Danaher’s (DHR) Diagnostics unit, established through the acquisition of Radiometer in 2004, earned $4.9 billion in sales in 2015.

Understanding the Skeleton of Danaher’s Life Sciences Business

Customers in the Danaher life sciences business generally look at how the technology offered by a company can fit into their workflows.

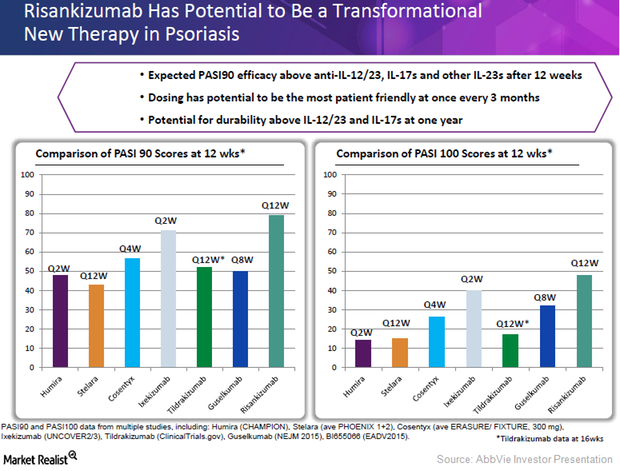

How AbbVie Expects Risankizumab to Be a Transformative Therapy

AbbVie (ABBV) expects its investigational drug Risankizumab to be a transformative therapy for psoriasis.

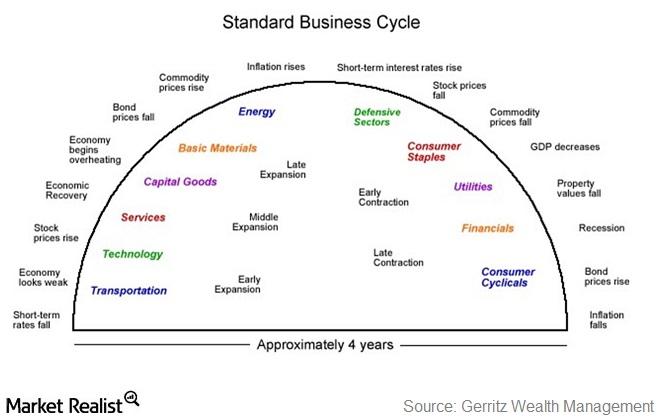

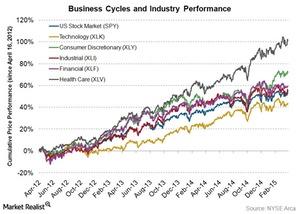

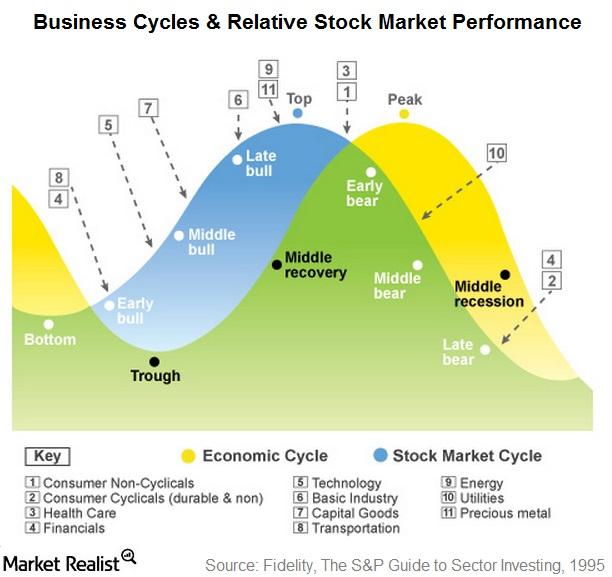

Will the Cyclical Sector Outperform the Defensive Sector?

The cyclical sector has a sizeable correlation with the different phases of the business cycle.

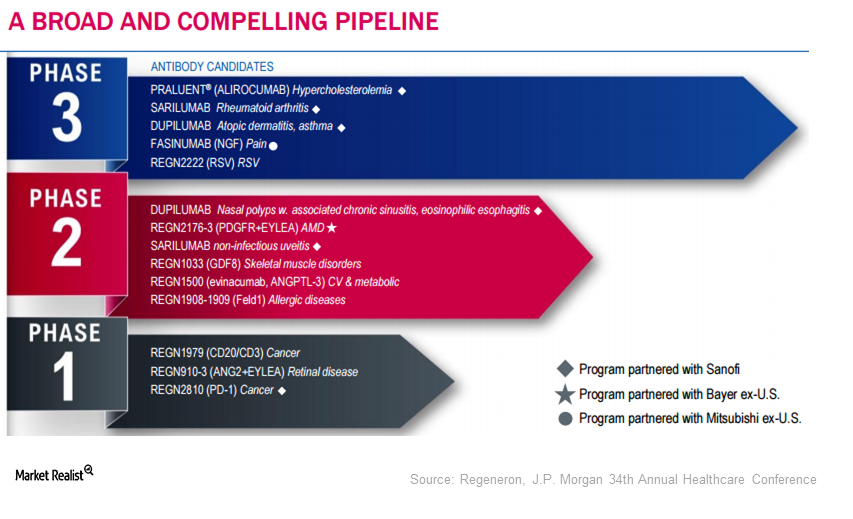

Regeneron’s Robust Pipeline

Regeneron’s (REGN) robust pipeline consists of 13 molecules in various phases of development. Sarilumab is under review with the FDA.

What Is Allergan’s Inorganic Growth Strategy?

Actavis acquired Allergan in March 2015, and the company changed its name from Actavis to Allergan (AGN).

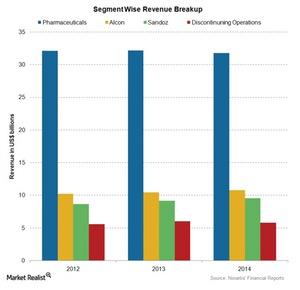

What Are Novartis’s Key Business Segments?

Novartis’s new structure includes only three business segments: pharmaceuticals, Alcon, and Sandoz.

What’s Allergan’s Growth Strategy?

Allergan’s new industry model, “growth pharma,” is based on identifying five characteristics that boost company growth and differentiate it from its peers.

Overview of Boston Scientific, a Leading Medical Device Company

Starting in 2011, Boston Scientific (BSX) has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, BSX started registering positive growth and profitability.

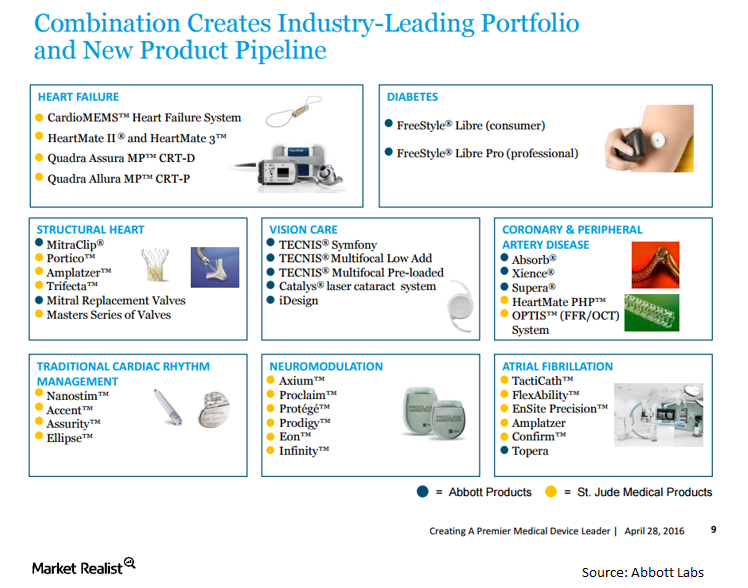

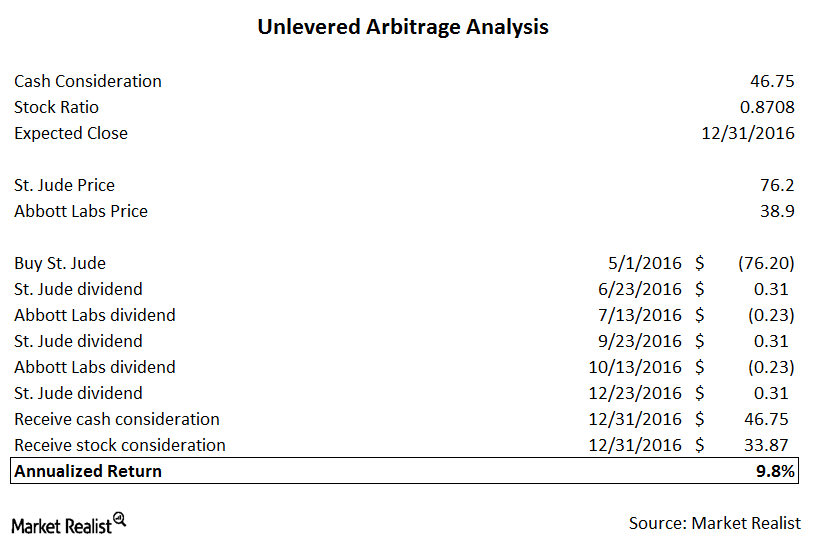

Rationale for the St. Jude Medical-Abbott Merger Transaction

Abbott Labs is buying St. Jude Medical for about $30 billion in cash, stock, and assumed debt to become a dominant player in the cardiovascular health space.

Abbott Buys St. Jude Medical for $85 per Share in Cash and Stock

On April 28, Abbott Labs and St. Jude Medical announced an agreement where Abbott will buy St. Jude for $30 billion in cash, stock, and assumed debt.

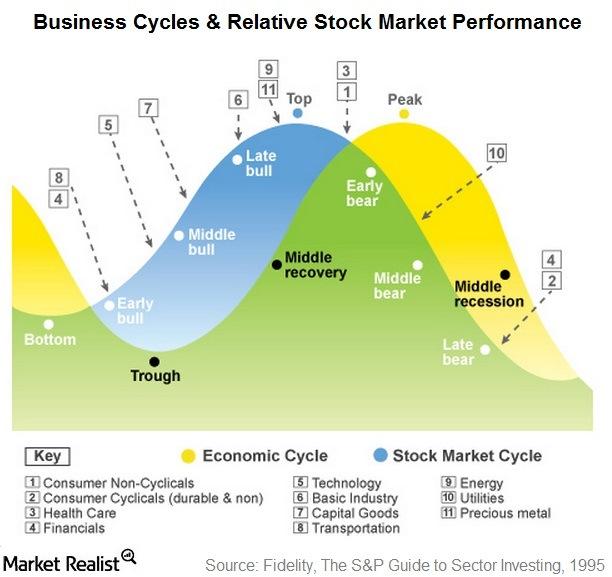

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

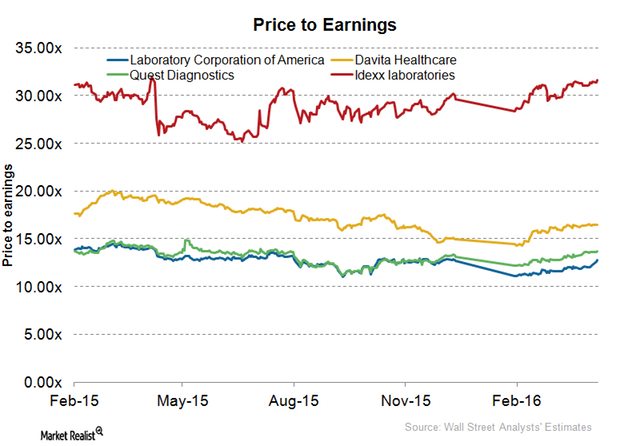

Understanding Quest Diagnostics’ Valuation Multiple Compared to Those of Peers

Quest Diagnostics trades at a premium multiple compared to Lab Corp of America and at a big discount compared to peers Davita Healthcare and IDEXX Labs.

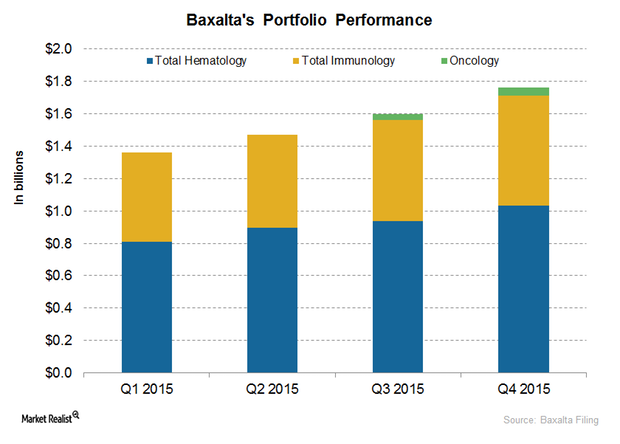

A Look at Baxalta’s Product Segments

Baxalta’s (BXLT) product portfolio can be divided into three parts: hematology, immunology, and oncology.

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

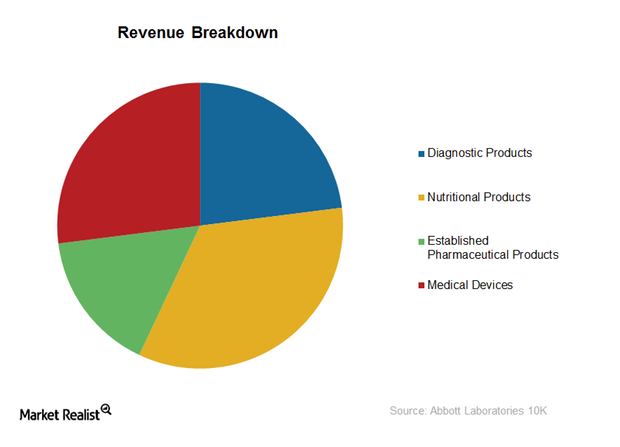

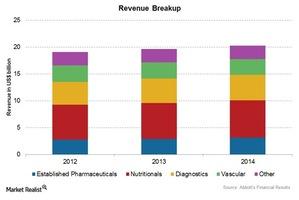

Dissecting Abbott Laboratories: A Key Business Model Analysis

Since 2013, Abbott Laboratories has generated revenues from a diversified healthcare business spanning across geographies and four primary segments.

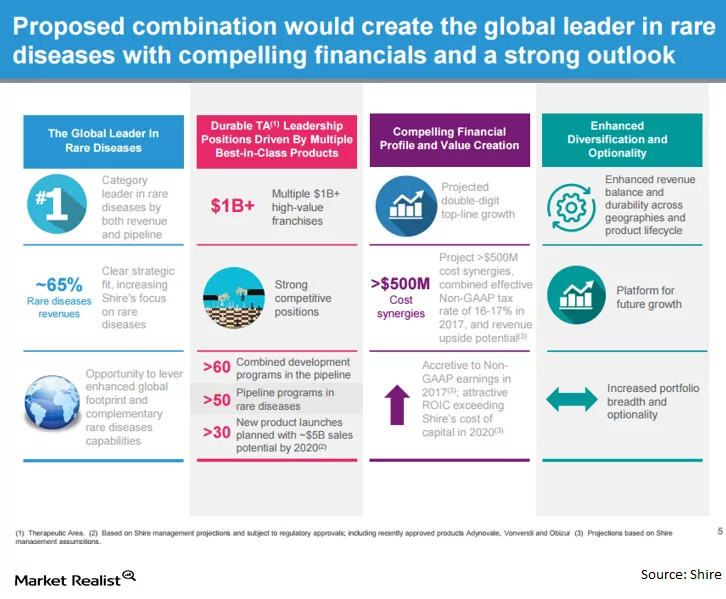

The Baxalta–Shire merger: Basics of Shire Pharmaceuticals

Shire is a biopharmaceutical company that focuses on rare diseases. Shire is best known for its treatments in ADHD, and the market here is quite large.

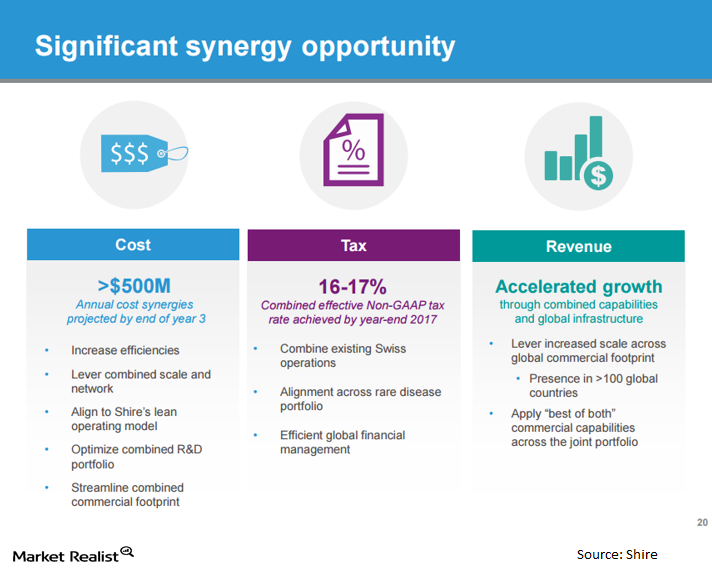

Growth and Synergies Drive the Baxalta–Shire Merger

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta brings Advate, a treatment for hemophilia, a rare blood disease.

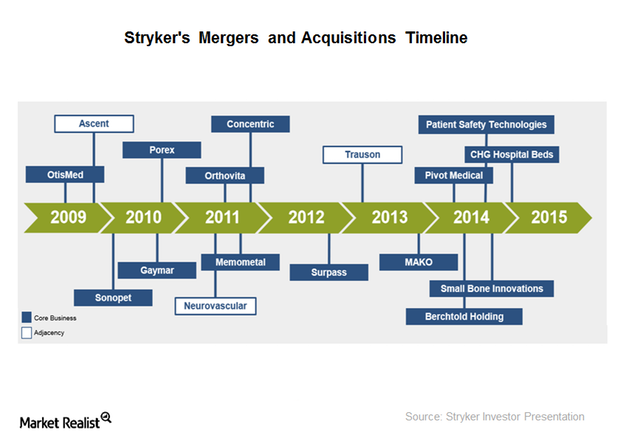

How Inorganic Growth Strategy of Stryker Is Driving Growth

Stryker has expanded its portfolio and geographic reach through mergers and acquisitions and product development. It saw a 7.3% sales growth in 2014.

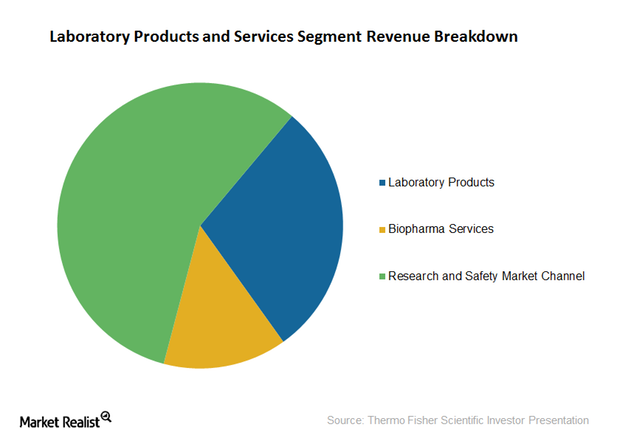

Thermo Fisher Scientific’s Laboratory Products and Services Segment

Thermo Fisher Scientific’s Laboratory Products and Services segment earned revenues of approximately $6.6 billion in 2014, representing organic growth of around 5%.

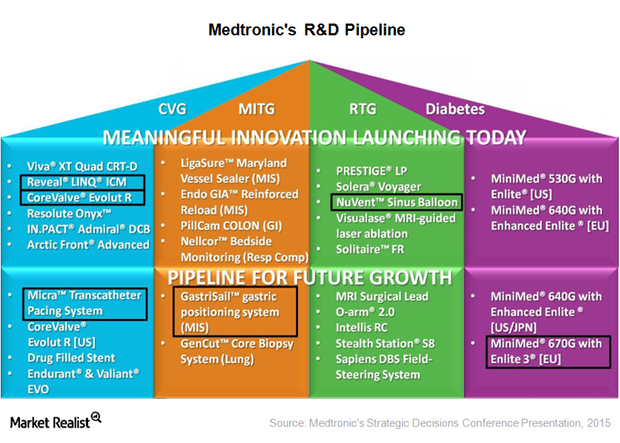

Probing Medtronic’s Research and Development Pipeline

Medtronic spent ~$1.6 billion—approximately 8.1% of its total sales—on research and development programs in fiscal 2015.

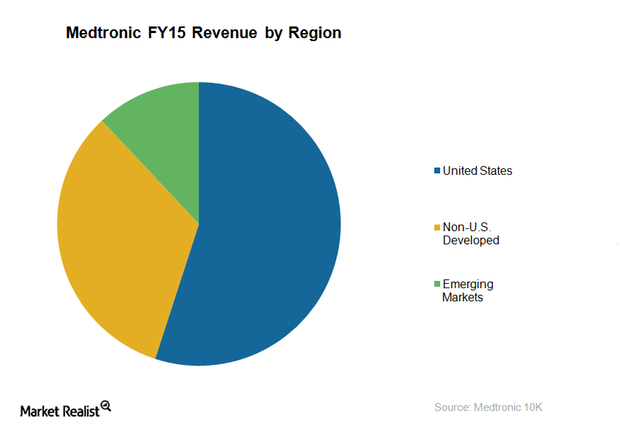

Gauging Medtronic’s Geographic Strategy in 2015

Medtronic’s US market YoY growth rate was 22% in 2015, compared to a 2% growth in 2014, whereas its emerging markets have grown by 23% in 2015.

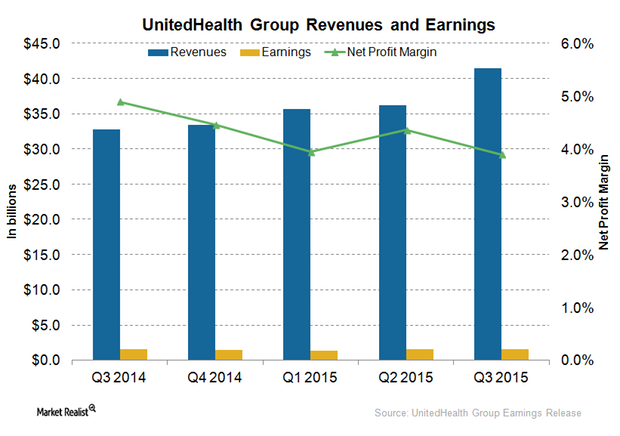

Why UnitedHealth Group’s Net Profit Margins Fell

In 3Q15, despite a rise of total revenues by 27% year-over-year, which includes 10% organic growth, UnitedHealth Group reported a decline of about 1% in net profit margins.

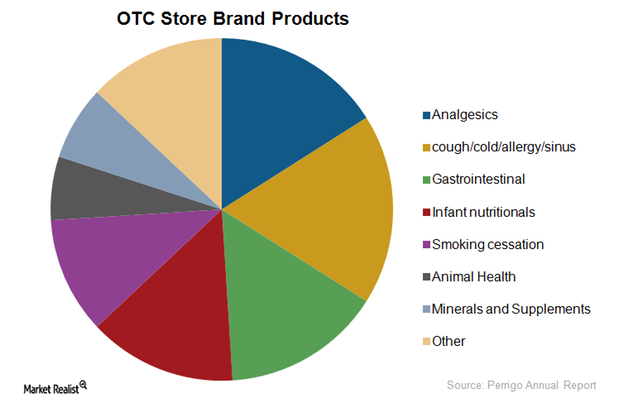

Perrigo Leads the Over-the-Counter Store-Branded Products Market

Perrigo is a market leader in over-the-counter store-branded products. Its leadership position extends to major geographies such as the US, the UK, and Mexico.

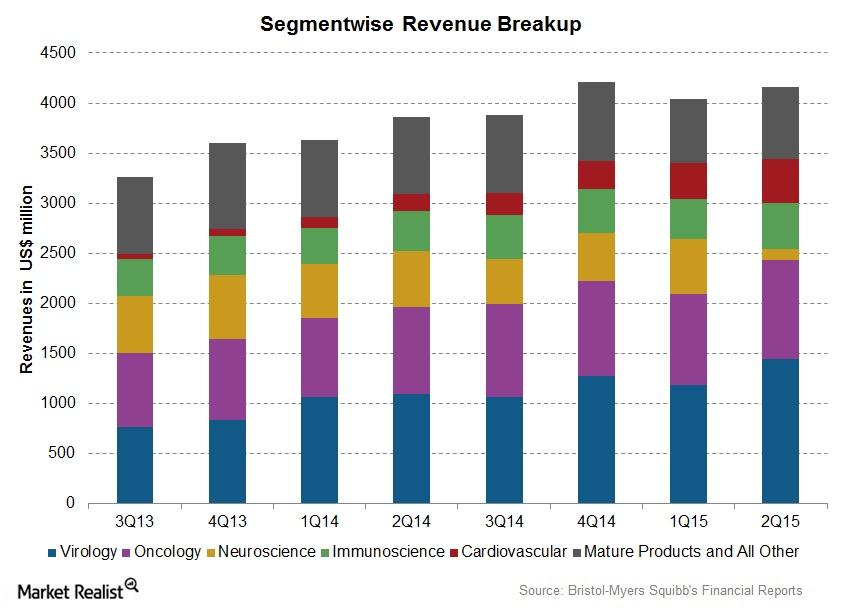

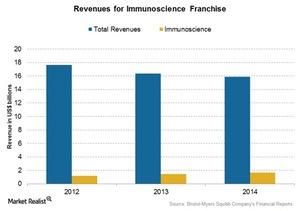

Bristol-Myers Squibb’s Business Segment Performance

Bristol-Myers Squibb (BMY) has classified its business into virology, oncology, immunoscience, cardiovascular, and neuroscience segments.

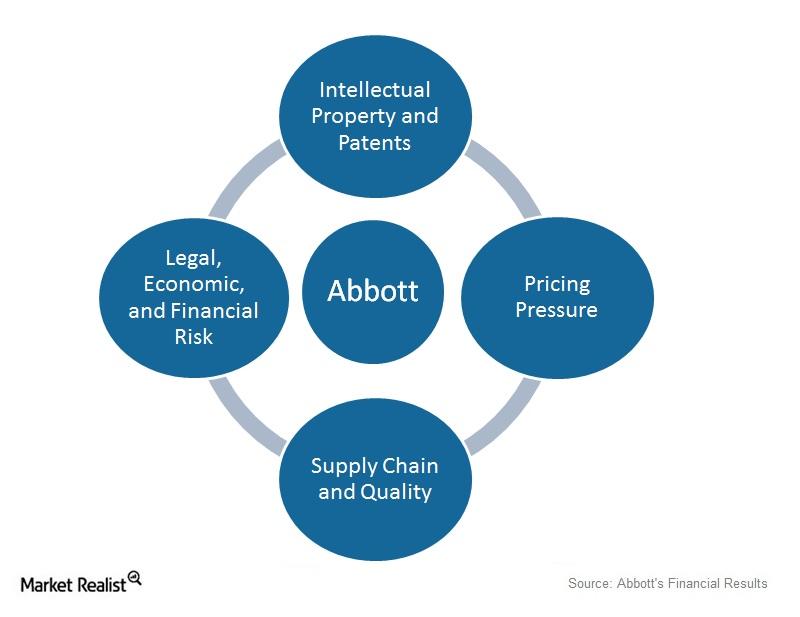

Why Abbott’s Business Is Susceptible to Numerous Risks

Abbott deals with innovative devices and established pharmaceutical products. Any infringement of intellectual property rights may lead to huge losses.

Abbott Laboratories’ Associated Business Segments

Abbott is organized around a broad portfolio—established pharmaceutical products, diagnostic products, nutritional products, and vascular products.

Sanofi’s Position Compared to Its Peers

The forward PE ratio for Sanofi is ~15.1x for 2015, and ~18.1x for the industry.

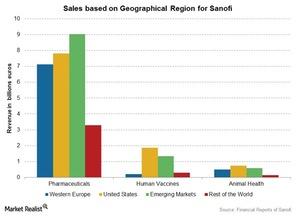

Sanofi’s Segment-Wise Sales by Region

Sanofi (SNY) products are sold in over 120 countries. The company’s markets are classified into four geographical regions for reporting purposes.

Risks for GlaxoSmithKline

GSK operates in over 170 countries and is subject to political, socioeconomic, and financial factors and risks across the globe.

Comparing GlaxoSmithKline with Its Peers

Pharmaceutical companies like GlaxoSmithKline are capital-intensive, with high debt on their balance sheets due to heavy setup costs and huge research and development expenses.

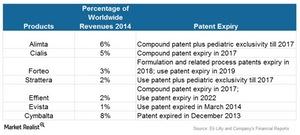

What Risks Does Eli Lilly and Company Face?

The risk of losing market share due to losing patents is the highest risk that Eli Lilly and other pharmaceutical companies face.

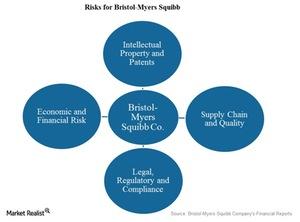

What Are the Risks for Bristol-Myers Squibb?

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights is a huge risk and may lead to huge losses.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.

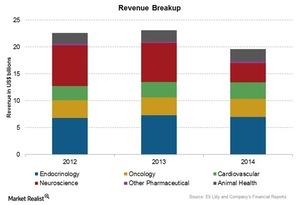

Analyzing Eli Lilly and Company’s Associated Business Segments

The human pharmaceutical segment includes the discovery, development, manufacturing, marketing, and sales of human pharmaceutical products.

Bristol-Myers Squibb’s Immunoscience Franchise

Bristol-Myers Squibb’s (BMY) immunoscience franchise deals with medicines that help defend the body against invading pathogens like bacteria, viruses, and cancer cells.

AstraZeneca’s Position Compared to Its Peers

The forward EV/EBIDTA multiple for AstraZeneca is ~13x, which is slightly lower than the industry average of ~14x.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

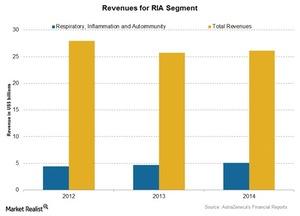

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

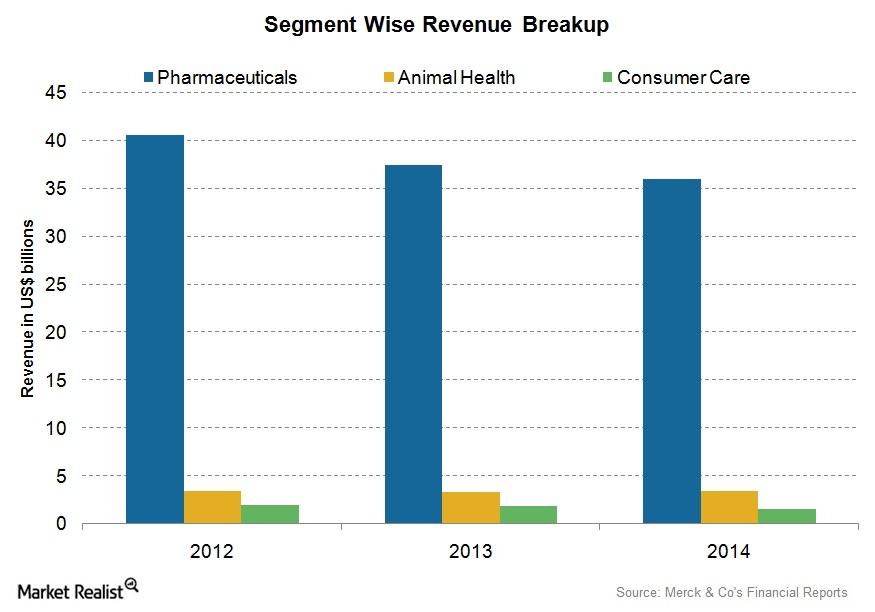

Merck’s Associated Business Segments

Merck’s Pharmaceuticals division accounted for $36.0 billion, or 85%, of group net sales during 2014.

What Stage of the Business Cycle Are We In Now?

Looking at the US economy for the last three years might help us understand which phase of the business cycle the US economy is in right now.

As US Economy Expands, Innovation Is Tide That Lifts All Boats

As the US economy expands, innovation seems to be the tide that is lifting all boats. Innovation is being driven by technology.

ETFs That Outperform in Late Stage, Recession, and Trough

Certain industries typically outperform at various phases of business cycles. This provides important clues to investors and helps them manage their portfolios.

An Investor’s Key Guide to Business Cycle Investing

For those investors who believe that a rising tide lifts all boats, as John F. Kennedy once said, understanding business cycle investing is a must.