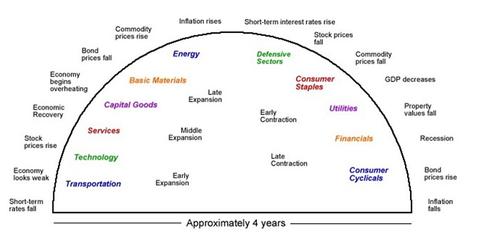

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

April 29 2016, Published 2:11 p.m. ET

Utilities are outperforming, what does this mean?

In the article ETFs That Outperform in Late Stage, Recession, and Trough, we talked about utilities doing well during the middle recessionary phase of the economy, when stock markets are going through a middle bear market.

Currently, we’re seeing utilities outperforming all other sectors of the economy. The Utilities Select Sector SPDR ETF (XLU) and the First Trust Utilities AlphaDEX ETF (FXU) offer equity exposure to the utilities sector.

How are other sectors performing?

Moreover, the healthcare sector (XLV), which does well during the early bear phase of the stock market cycle and the peak of the economic cycle, delivered good returns to its investors in 2014–2015. In 2016 so far, we’ve seen the healthcare sector take a back seat, with consumer staples and utilities coming forward to take its place.

Utility-tracking XLU returned 15.5% year-to-date as of March 31, 2016, compared to the broad market SPDR S&P 500 ETF’s (SPY) 1.3% return. The consumer staples–tracking Consumer Staples Select Sector SPDR ETF (XLP) delivered a 5.6% return.

We’re past the defensive stage

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform. We are clearly in the early contraction, middle bear phase. Utilities and consumer staples are doing well, while the healthcare sector is past its glory.

Accordingly, over the long term, we should see financials and consumer cyclicals doing well from a business cycle investing perspective. However, investors must always take into account the external headwinds that a sector faces before making any long-term bets.

Does our being past the defensive stage mean that we’ve reached the end of the current business cycle? Let’s evaluate.