First Trust Utilities AlphaDEX Fund

Latest First Trust Utilities AlphaDEX Fund News and Updates

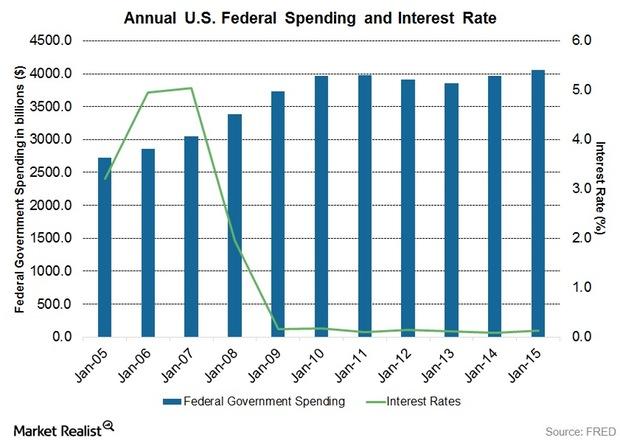

Federal Spending and Interest Rates: Analyzing the Connection

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

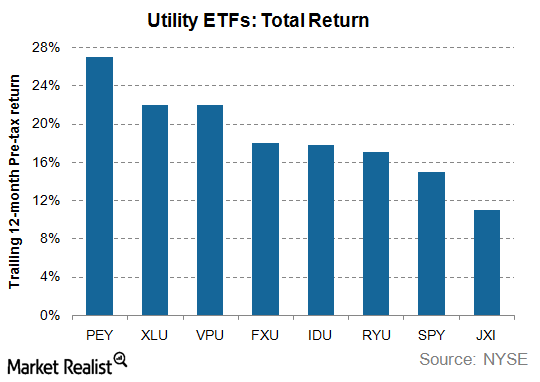

RYU, FXU, and JXI: Will These Utility ETFs Outrun Utility Stocks?

The Guggenheim S&P 500 Equal Weight Utilities ETF (RYU) invests nearly 80% of its portfolio in US utilities and 20% in telecoms.

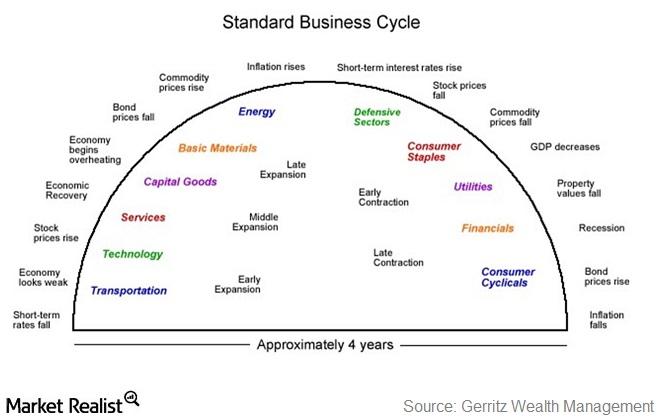

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

Why Is Xcel Energy’s Rising Debt So Concerning?

At the end of the fourth quarter of 2015, Xcel Energy’s total debt stood at $13 billion. Its debt-to-equity ratio was 1.3x, and its debt-to-capitalization ratio was 0.6x.