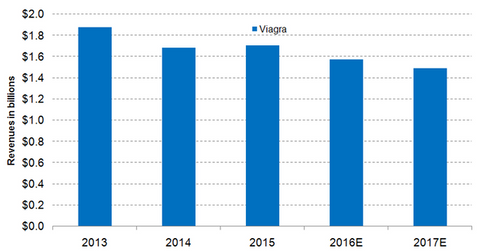

Viagra May Witness a Decline in Revenues in 2016

Wall Street analysts estimate that Viagra’s sales in 2016 will reach approximately $1.6 billion, which would be a year-over-year (or YoY) decline of about 7.7%.

Oct. 25 2016, Updated 11:04 a.m. ET

Viagra’s trends

In the US, Pfizer’s (PFE) Viagra is expected to witness generic competition in late 2017. The drug is indicated for erectile dysfunction.

According to WebMD, “Erectile dysfunction, or ED, is the inability to achieve or sustain an erection suitable for sexual intercourse. Causes include medications, chronic illnesses, poor blood flow to the penis, drinking too much alcohol, or being too tired.”

Similar to Lyrica, Pfizer divides Viagra’s revenues across its two business segments, Pfizer Innovative Health (or IH) and Pfizer Essential Health (or EH). Revenues earned from the US and Canada are reported under the IH segment, while revenues earned from other international markets are presented under the EH segment.

Revenue projections

Wall Street analysts estimate that Viagra’s sales in 2016 will reach approximately $1.6 billion, which would be a year-over-year (or YoY) decline of about 7.7%. This is mainly due to the increasing amount of rebates paid by Pfizer to the pharmacy benefit managers.

Additionally, higher access constraints are also expected to reduce Viagra’s volumes in 2016. These negative prospects are expected to be partially offset by the increasing drug prices and the trend of prescribing a greater number of pills per prescription.

Viagra faces competition from other erectile dysfunction drugs such as Eli Lilly’s (LLY) Cialis, Bayer Healthcare Pharmaceuticals and GlaxoSmithKline’s (GSK) Levitra in the US, and Teva Pharmaceutical’s (TEVA) generic version of the drug in certain European countries.

If Viagra is able to surpass the analysts’ projections in 2016, it may have a positive impact on the share price of Pfizer, as well as that of Health Care Select Sector SPDR ETF (XLV). Pfizer makes up about 7.4% of XLV’s total portfolio holdings.

In the next article, we’ll explore the growth trends of Prevnar, Pfizer’s pneumococcal drug, in 2016.