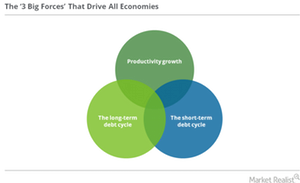

The ‘Three Big Forces’ That Drive All Economies

The “three big forces” Ray Dalio believes that “three big forces” drive all economies. These are: productivity growth the short-term debt cycle the long-term debt cycle An economy has to go through upturns and downturns Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, […]

Nov. 22 2019, Updated 6:24 a.m. ET

The “three big forces”

Ray Dalio believes that “three big forces” drive all economies. These are:

- productivity growth

- the short-term debt cycle

- the long-term debt cycle

An economy has to go through upturns and downturns

Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, the amount of bureaucracy or corruption in the system, health indicators, and people’s attitude towards work.

According to Ray Dalio, an economy has to go through upturns and downturns. These movements form what we call the business cycle, and what Dalio’s template on the economic machine refers to as the “short-term debt cycle.” The cycle usually takes five to ten years.

After a stock market (SDS) (SQQQ) crash, central banks usually lower interest rates in order to generate economic growth. They keep lowering interest rates, leading to short-term debt cycles. Short-term debt cycles add up to a long-term debt cycle, according to Dalio. The long-term debt cycle typically takes up to 75 years, consisting of 50 years of leveraging, followed by two to three years of depression, followed by seven to ten years of reflation.

The Fed needs to study the long-term debt cycle

According to Ray Dalio, the Fed needs to study the long-term debt cycle to understand the huge downside risks that currently face the US economy (SPY) (IWM)(QQQ) in light of the Fed’s difficulty with monetary policy.

For the economy to be in equilibrium, spending must match income. While the short-term debt cycle leads to the creation of deviations between income and spending in the economy, the long-term income is dependent on the economy’s productivity level. Spending converges to re-establish the equilibrium. Dalio also believes that there are three important equilibriums that the economy and the market gravitate towards, which we’ll discuss in the next part.