ProShares UltraShort S&P500

Latest ProShares UltraShort S&P500 News and Updates

We’re in ‘an Environment of Abnormally Slow Growth,’ Says Dalio

This isn’t a normal business cycle Billionaire hedge fund manager Seth Klarman said, “the stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” Ray Dalio believes that this isn’t a normal business cycle. In our April 2015 series Business Cycle Investing: What Should You Look […]

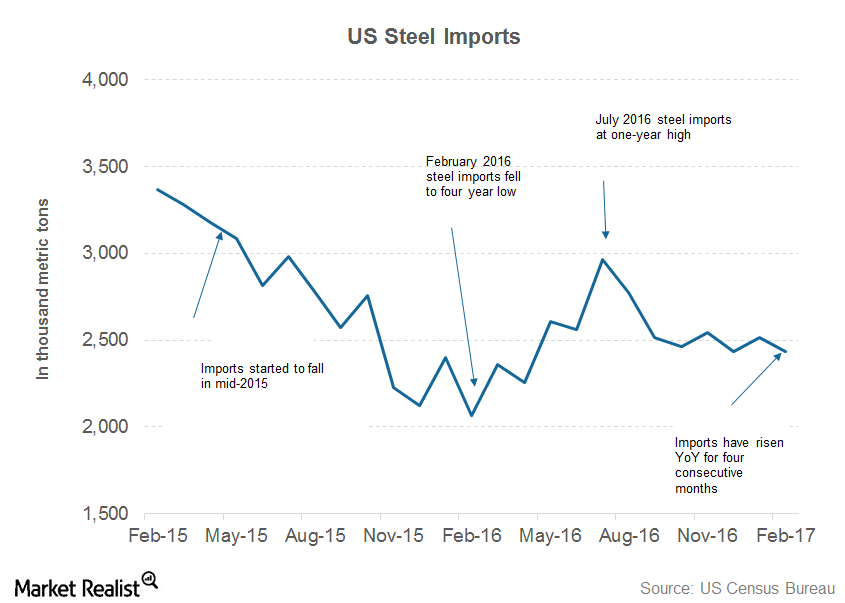

The U.S. Steel Bulls Only Hope?

Analysts’ opinions remain divided over U.S. Steel (X) after its 1Q17 earnings results.

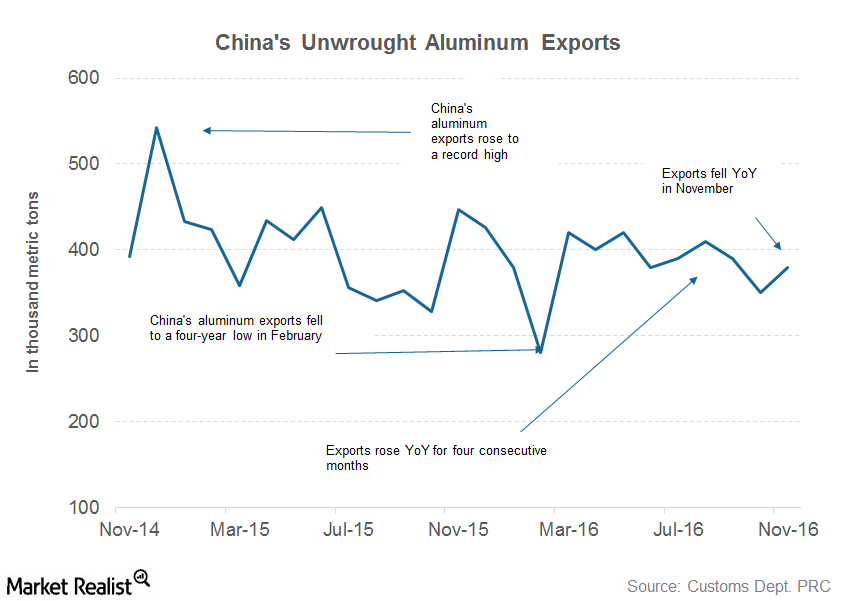

Should Alcoa Bears Like Their Chances in 2017?

Higher Chinese aluminum production could spoil the party that companies such as Alcoa and Century Aluminum (CENX) are currently enjoying.

Ray Dalio: ‘Risks Are Asymmetric on the Downside’

“Risks are asymmetric on the downside” On the economy, Ray Dalio stated that “the risks are asymmetric on the downside, because asset prices are comparatively high at the same time there’s not an ability to ease.” Courtesy of the current global monetary policy’s low interest rates, asset prices are artificially inflated—so much so that they’ve […]

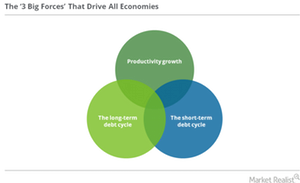

The ‘Three Big Forces’ That Drive All Economies

The “three big forces” Ray Dalio believes that “three big forces” drive all economies. These are: productivity growth the short-term debt cycle the long-term debt cycle An economy has to go through upturns and downturns Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, […]

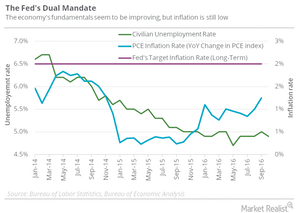

Paul Krugman to the Fed: Don’t Raise Rates

Inflation is moving up towards its target, but it still has a ways to go before it gets there. Paul Krugman believes raising rates could keep inflation from reaching that target.

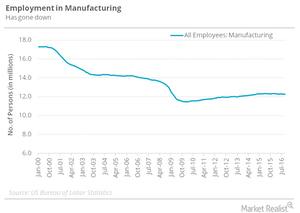

Why Krugman Doesn’t Understand the Focus on Trade All of a Sudden

Trade has been a key focus with respect to the US elections lately.

Why US Steel Bears Could Have a Valid Point

US steel prices have held their ground in 2017 and have built on last year’s gains. However, the bears (SDS) also have some valid points. Let’s discuss them in perspective.

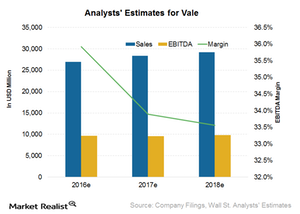

Why Analysts Significantly Raised Vale’s Earnings Estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.