Why Analysts Significantly Raised Vale’s Earnings Estimates

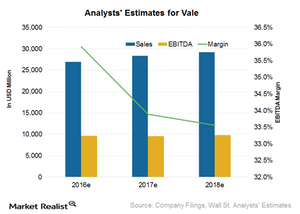

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.

Dec. 1 2016, Updated 10:04 a.m. ET

Factors impacting analyst estimates

There are two major factors driving the estimates for Vale SA (VALE). Going forward, its volumes will get a significant boost from iron ore volumes as its S11D project ramps up. This will also lower its overall iron ore unit costs.

These factors are positive for the company. However, analysts are still worried about the capital needed by the company to finance this project as well as its ability to maintain a strong balance sheet.

It’s worth noting that compared to peers BHP Billiton (BHP), Cliffs Natural Resources (CLF), and Rio Tinto (RIO), Vale SA is in the process of deploying capital for S11D, its expansion project.

At a time when the market’s view on medium-term to long-term iron ore prices is bearish (SDS), analysts are still worried about a high capex (capital expenditure) requirement, especially given Vale’s high financial leverage.

Higher sales estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year. The recent strength in commodity prices has prompted analysts to raise the estimates for miners, including Vale.

Going forward, analysts are projecting higher sales revenue. Consensus estimates are projecting a rise in revenues of 5.2% for 2017 and 3.1% for 2018. Most of this growth is attributable to the startup of S11D, Vale’s expansion project. The project should increase Vale’s iron ore volumes as well as lower the company’s overall costs for producing iron ore.

EBITDA margin estimates

Analysts have significantly raised their EBITDA (earnings before interest, tax, depreciation, and amortization) estimates for Vale for 2016 and 2017. It comes on the back of strength in commodity prices and Vale’s cost-cutting measures. The estimates for 2016 imply a year-over-year change of 37.0%. EBITDA estimates for 2017, on the other hand, imply a change of -1.0%.

Analysts are also projecting higher EBITDA margins of 36.0% for 2016 compared to a margin of 26.0% for 2015. Margins are expected to expand going forward as volumes rise and costs shrink with S11D.