Vale SA

Latest Vale SA News and Updates

Vale’s Favorable Pricing Could Outweigh Its Production Slump

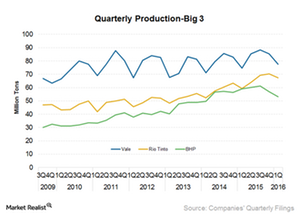

In the mining industry, Vale is struggling with output. However, a favorable pricing forecast could outweigh the slump, and in shareholders’ favor.

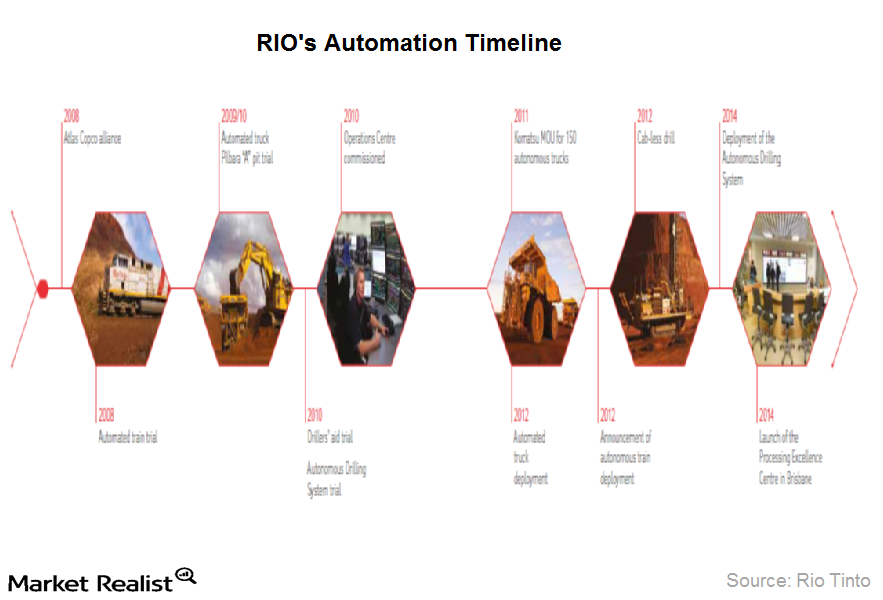

Why Rio Tinto has key advantages over its peers

Rio is the largest owner and operator of autonomous—driverless—trucks in the world. These initiatives are part of Rio’s “Mine of the Future” program.

U.S. Government Invests in Nickel Mining in $25 Million Deal

The U.S. government is investing $25 million dollars in a nickel mining deal that would help lessen its dependence on Chinese mines.Materials Why the demerger of non-core assets makes sense for BHP

BHP had been contemplating whether to sell the non-core assets or go for a demerger. Finally, the company decided in favor of a demerger on August 15. The proposed company will likely have assets in the range of $12–$20 billion.Materials Why did the Cliff’s share price rally?

Iron ore prices are down 19% year-over-year (or YoY) and coal prices are down 30% YoY—volumes were also down YoY, but the stock rallied 7% in a single trading session the next day of the earnings call and up 3% the subsequent trading day.

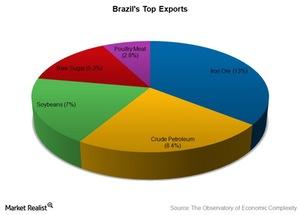

Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

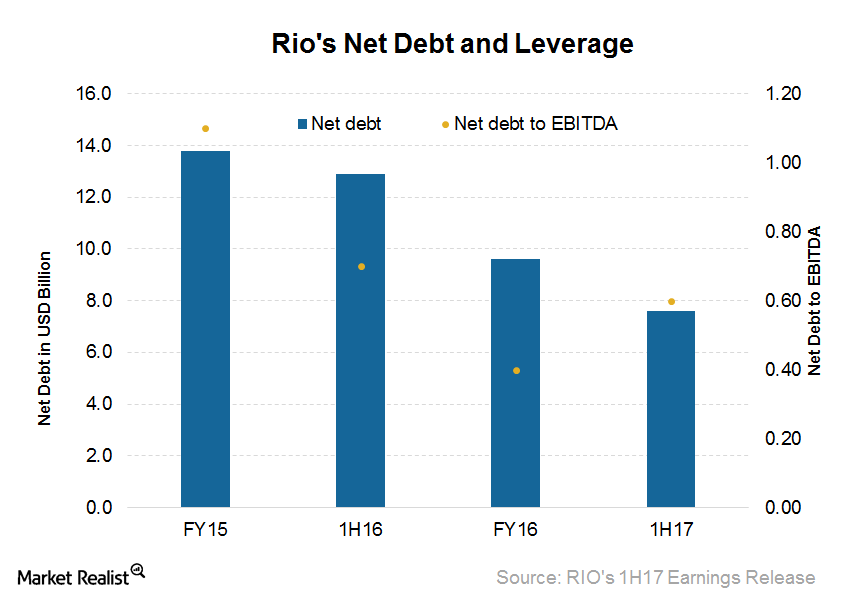

What Rio Tinto’s Balance Sheet Means for Future Growth

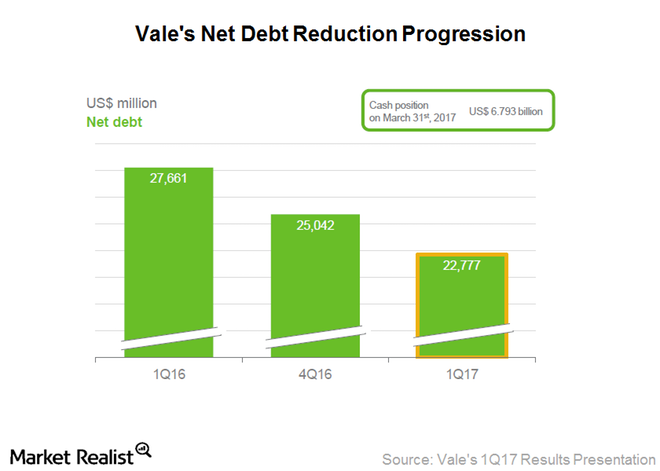

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

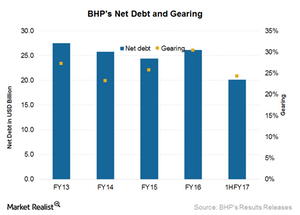

BHP’s Balance Sheet: The 2017 Outlook

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

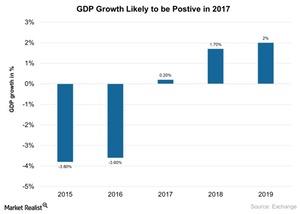

Why IMF Slashed Brazil’s Economic Growth Outlook in 2017

Economic activity in Brazil (EWZ) has been slow as it tries to emerge from its deep recession in 2016. But consumer and business confidence is improving.

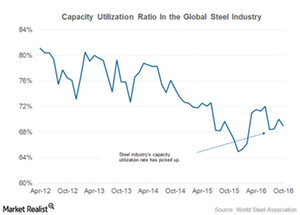

Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

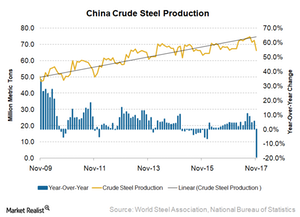

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

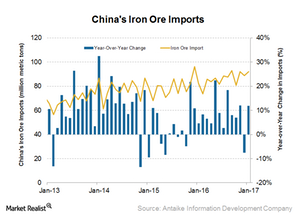

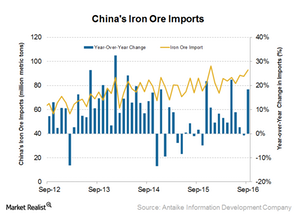

What China’s High Iron Ore Imports Suggest

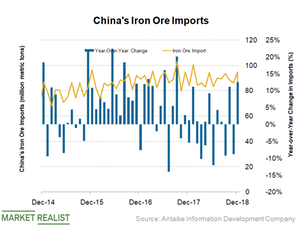

China imported 92 million tons of iron ore in January 2017—a growth of 12.0% YoY and 3.4% month-over-month.

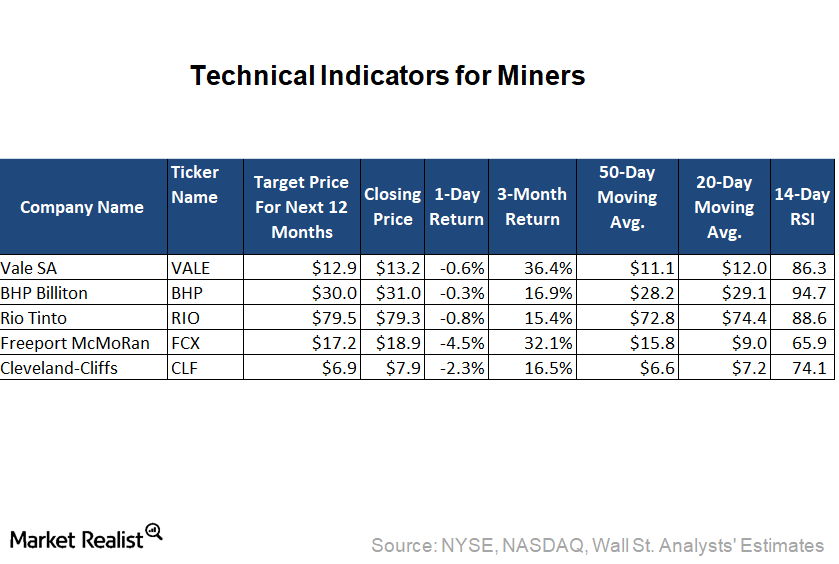

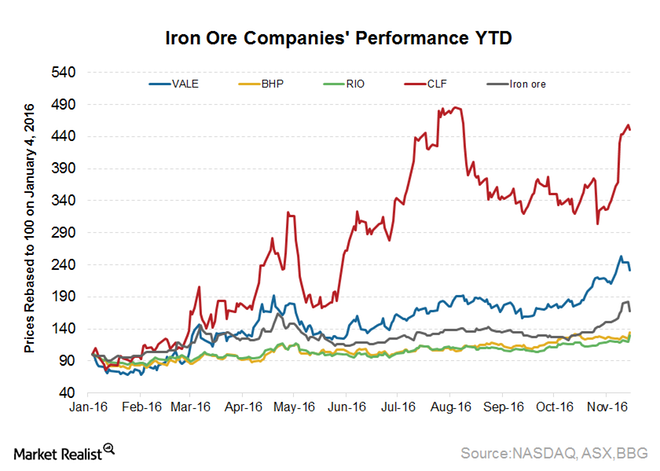

Is the Pullback in Iron Ore Miners Based on Technical Indicators?

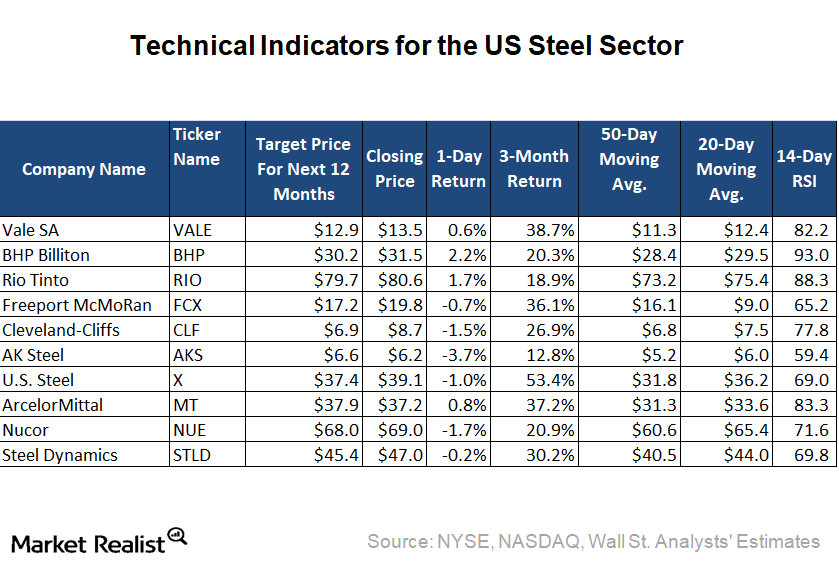

Among the stocks under review in this series, Vale SA (VALE) has given the highest trailing-three-month return of 36.4%, while Rio Tinto (RIO) has generated the lowest return of 15.4%.

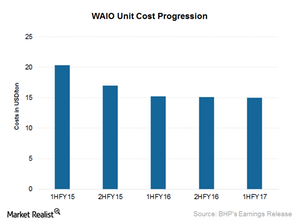

This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

Why Rio Tinto Believes Iron Ore Prices Can Sustain

According to Bloomberg, Rio Tinto CFO Chris Lynch has suggested that iron ore prices will not collapse, as many expect.

Can Vale SA Reverse Its 2Q17 Performance in 2017?

While Vale SA outperformed peers including Rio Tinto (RIO) and BHP Billiton by rising 24.7% in 1Q17, its performance deteriorated significantly in 2Q17.

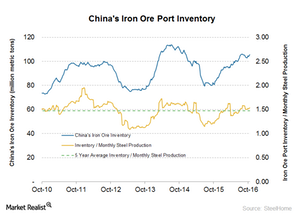

How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

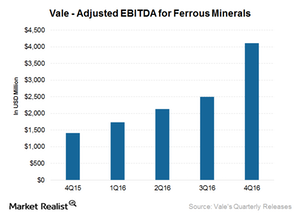

How Vale Reacted to Higher Iron Ore Prices in 4Q16

Iron ore price realization In 4Q16, Vale’s (VALE) ferrous division accounted for ~85.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals came in at $4.1 billion, which was $1.6 billion higher than 3Q16. Higher realized prices and higher sales volumes led to these rises. The CFR […]Materials Why are iron ore futures downward sloping?

“Backwardation” occurs when futures contracts trade below the spot price, and the futures curve begins to downward slope. This means that the market expects further decline in iron ore prices based on current indicators and fundamentals.

Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

What Led Robust Chinese Iron Ore Imports despite Contrary Views

Contrary to what was suggested by many market participants, the iron ore imports by China increased in September 2016 instead of declining.

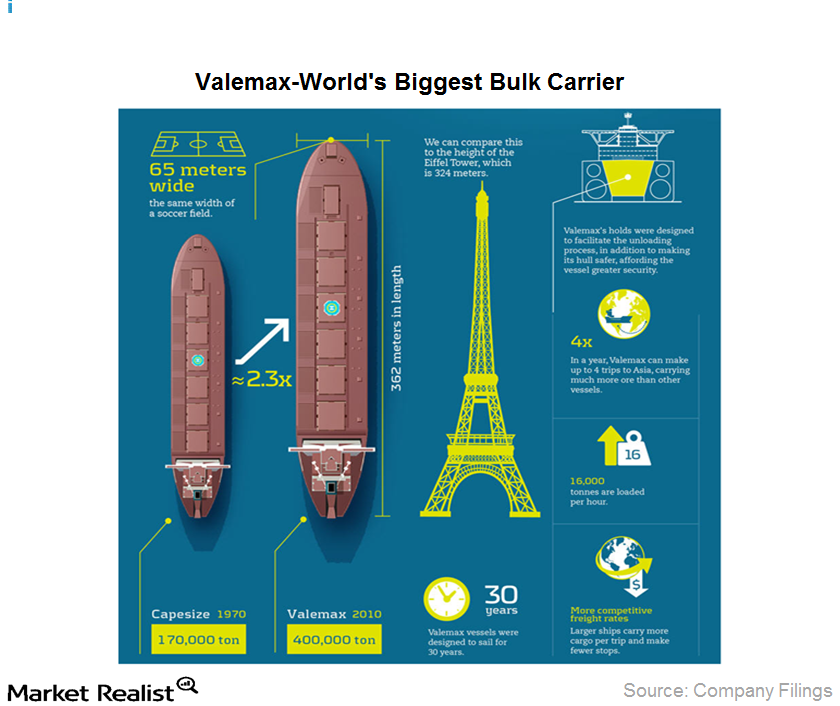

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

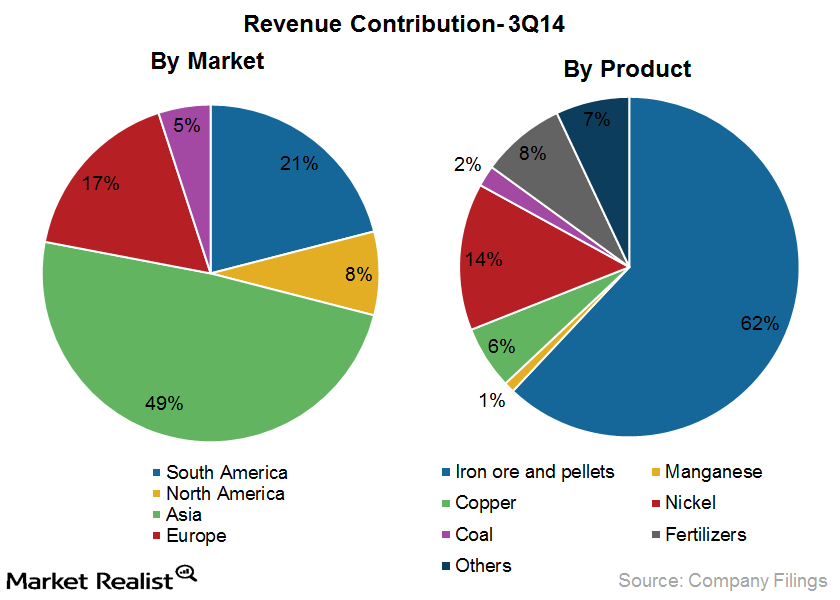

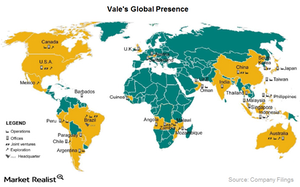

Vale SA: Overview of the world’s largest iron ore company

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

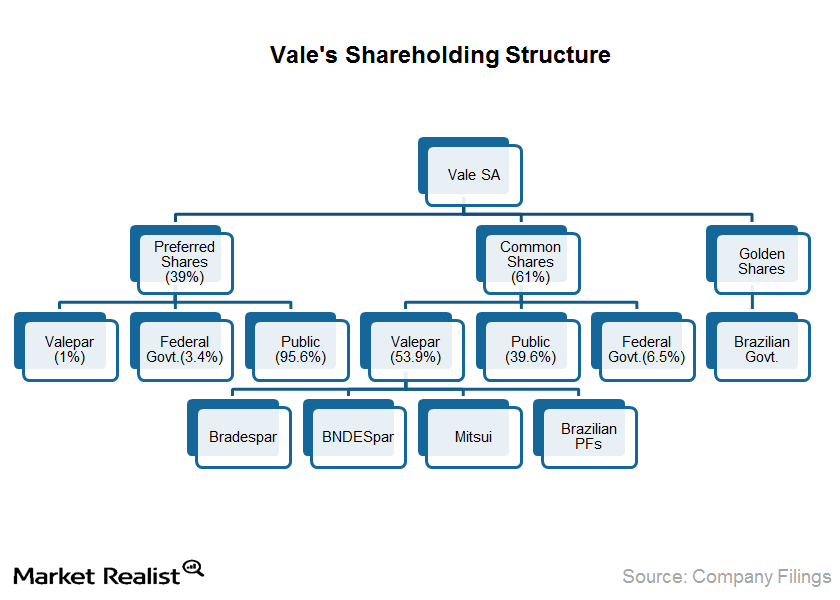

The implications of the Vale SA ownership structure

Although there hasn’t been any recent cause for concern, and the government doesn’t interfere in the day-to-day workings of Vale, there’s always a risk that the company could be pushed into pursuing objectives that aren’t in the best interests of all shareholders.

Vale SA: Top-quality iron ore and pellets

Vale SA (VALE) is the world’s largest producer of iron ore and pellets. Pellets are manufactured by gathering together the powder generated during the ore extraction process.

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

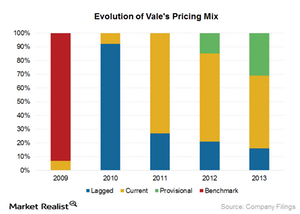

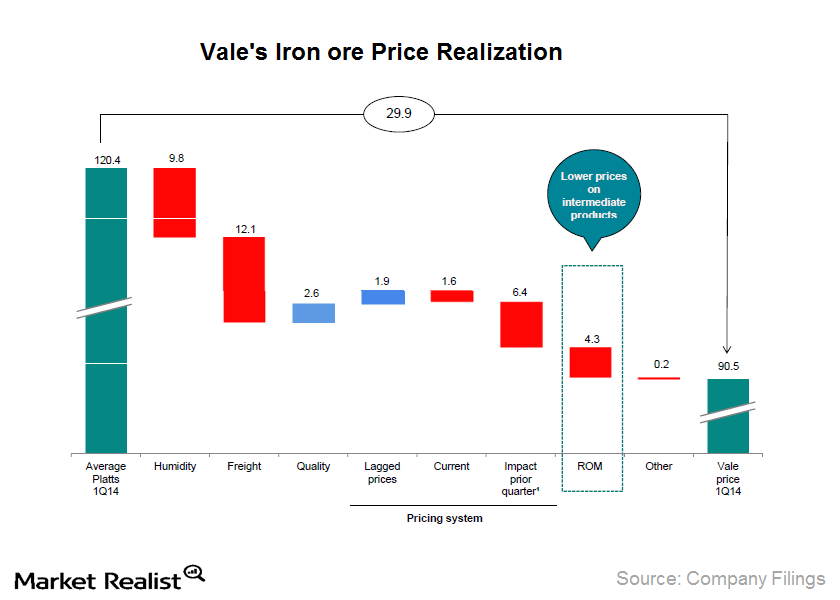

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

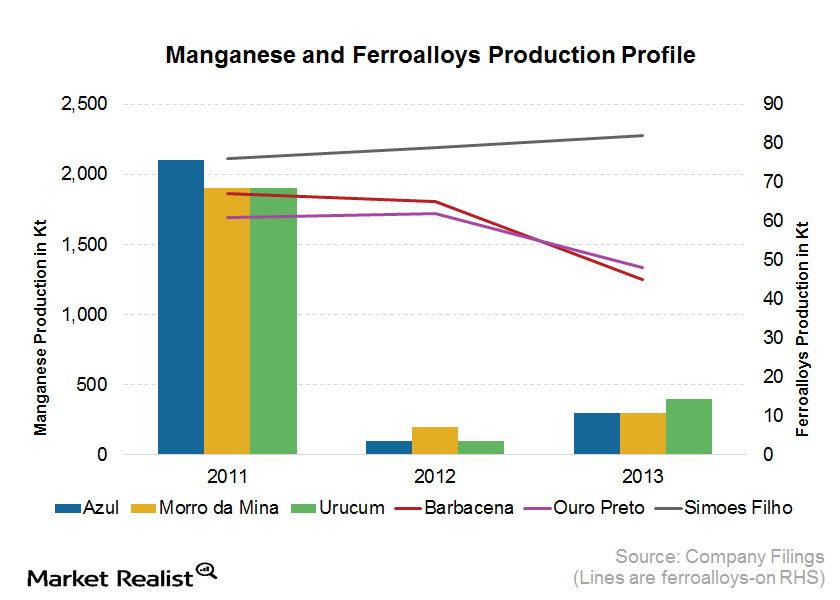

Vale SA in the manganese and ferroalloys business

Vale SA is the largest manganese producer in Brazil, accounting for roughly 70% of the country’s market. The Azul Mine in Para is responsible for 80% of its output.Financials Why Brazil seeks diversification

Given the declining competitiveness of its commodity exports, Brazil’s economy is attempting to diversify away from its economic model.

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.

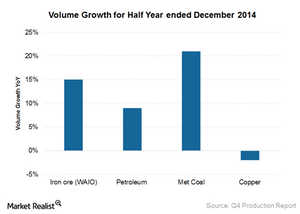

BHP reports mixed production results and maintains its guidance

Overall, BHP reported mixed 2Q15 results. It recorded a 9% production increase during the December 2014 half-year.

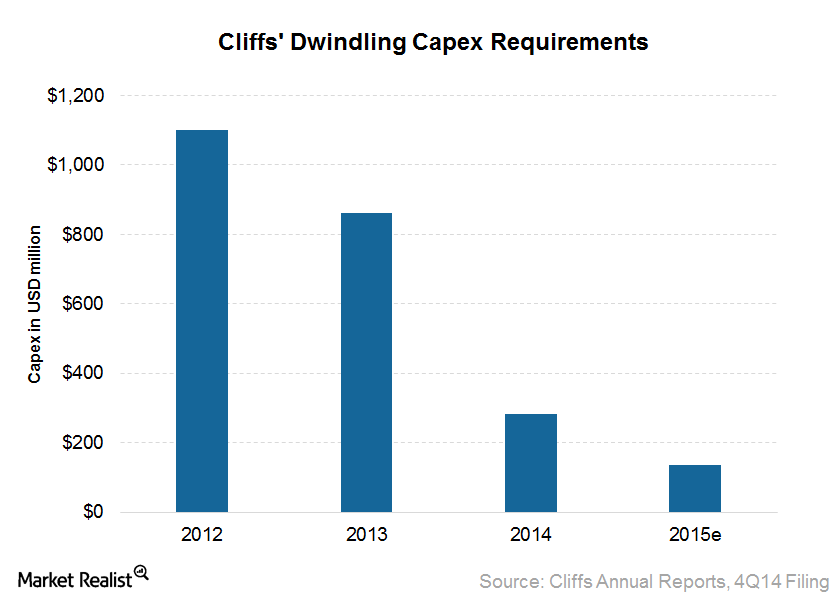

Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.

China’s Iron Ore Imports Drop, Will Prices Stay Elevated?

Falling iron ore imports China consumes more than 70% of seaborne-traded iron ore. As a result, iron ore investors should track China’s demand and outlook. Today, China released its trade data for June. China’s iron ore imports were 75.18 million tons in June—9.7% lower YoY (year-over-year) and 10.2% lower month-over-month. In June, China’s imports fell […]

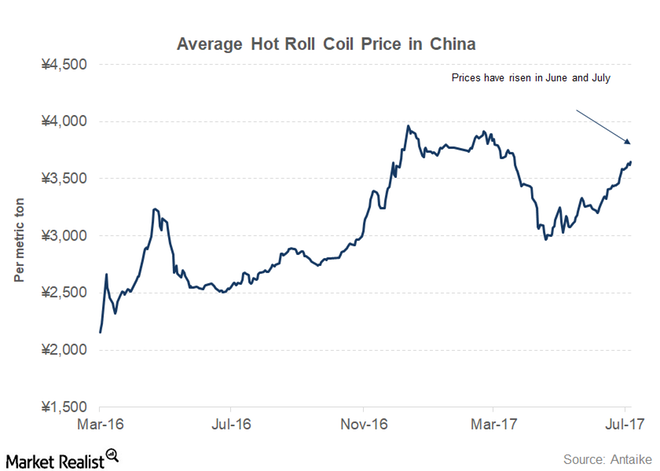

What China’s Steel Price Trends Could Mean for Iron Ore Miners

Bumper margins prompted Chinese steel mills to continue increasing their output.

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

Why Seaborne Iron Ore Prices Might Not Impact Cleveland-Cliffs Much

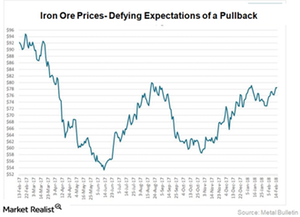

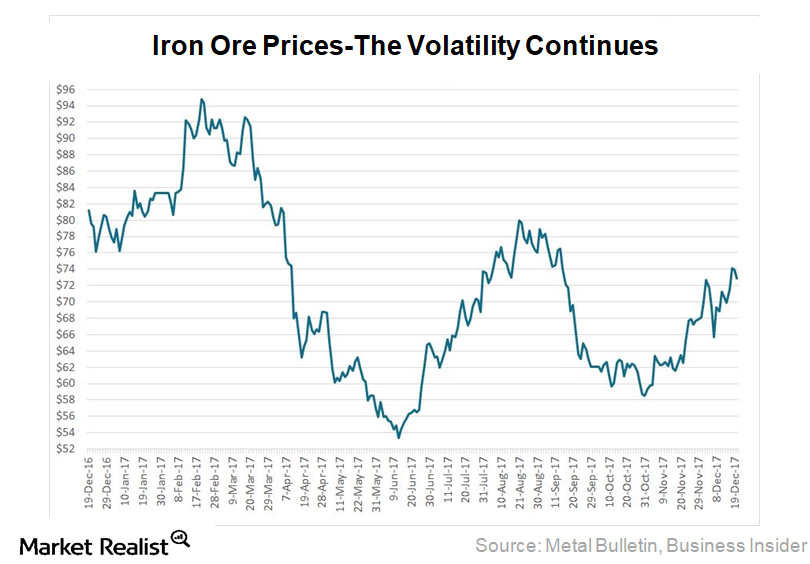

Iron ore prices showed a lot of volatility in 2017, which is continuing well into 2018.

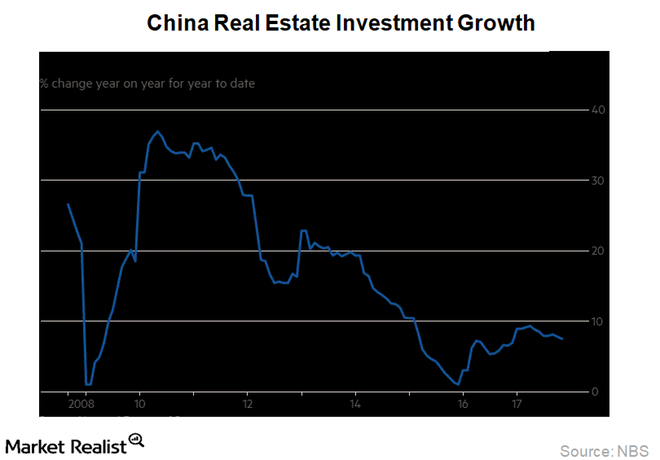

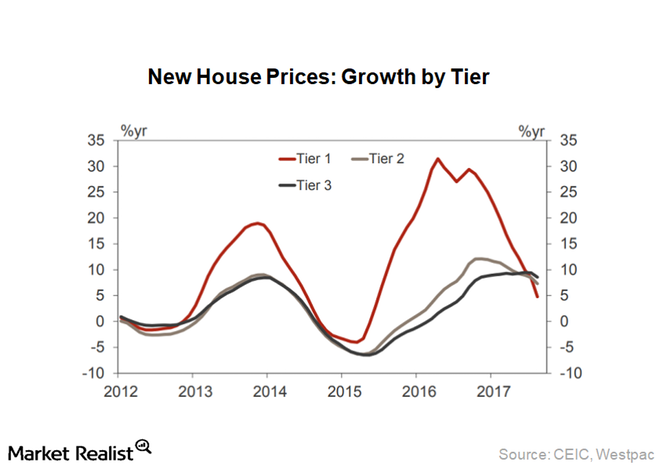

Iron Ore: China’s Property Market Shows Signs of Weakness

It’s vital for iron ore investors to track movements in the Chinese real estate market (TAO). This sector constitutes more than 50% of the total steel consumed in the country.

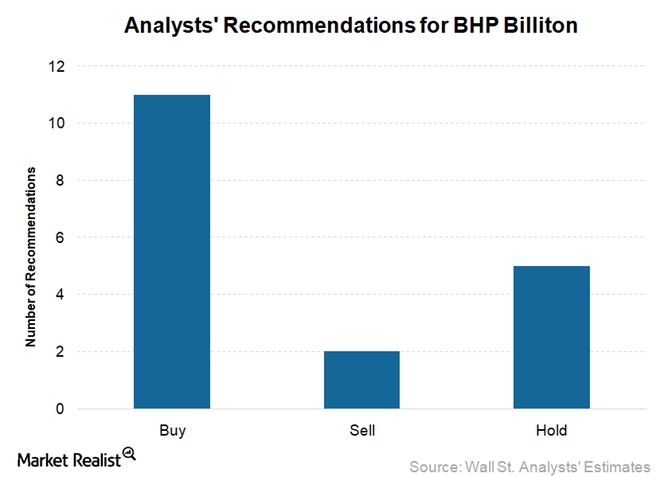

BHP Billiton: Recent Wall Street Upgrades and Downgrades

Of the 18 Wall Street analysts currently covering the BHP Billiton’s (BHP) stock, 61% rate it as a “buy,” 28% recommend a “hold,” and the remaining 11% have a “sell” recommendation on the stock.

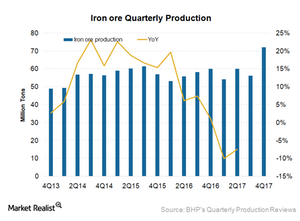

BHP Billiton Outlook: Iron Ore Volumes Flat

Iron ore (PICK) volumes are key to BHP Billiton’s (BHP) revenues and earnings as iron ore is the single largest commodity produced by the company.

What Technical Indicators Say about Cliffs and Peers

Based on its January 12, 2018, closing price, Cleveland-Cliffs is trading ~28% above its 50-day moving average and 15.4% above its 20-day moving average.

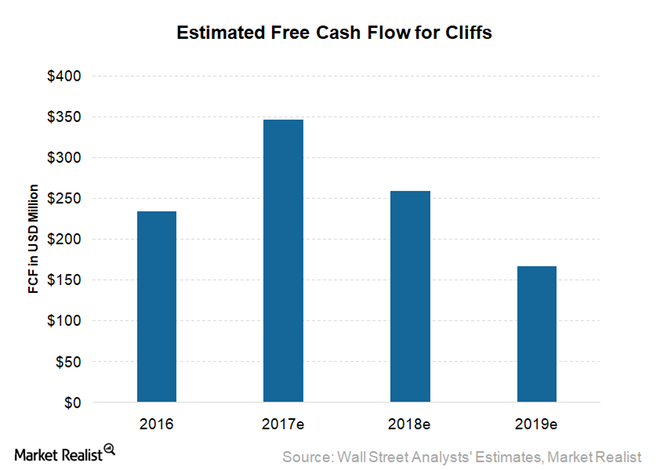

These Factors Could Lead to Upside to CLF’s Free Cash Flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years.

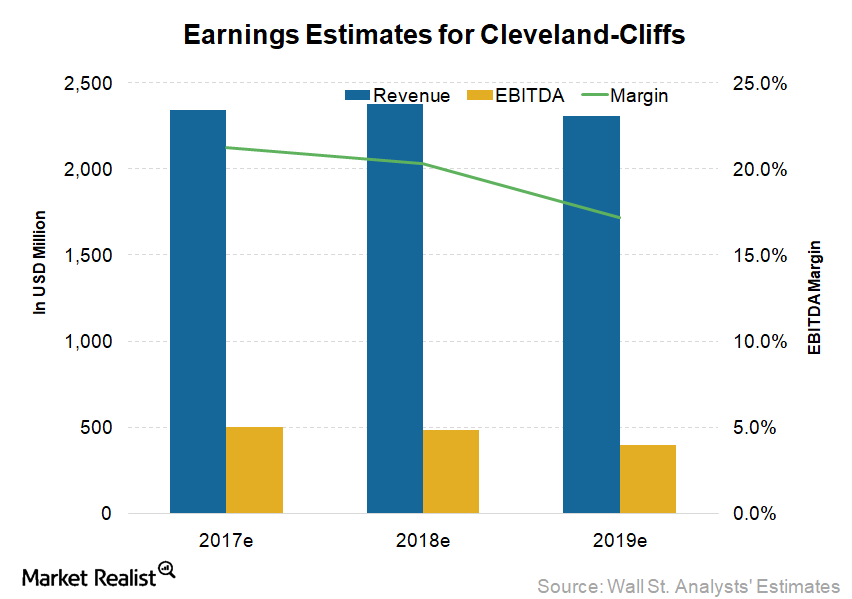

How Analysts View Cleveland-Cliffs’ Earnings for 2017 and Beyond

In this article, we’ll discuss analysts’ projections for Cleveland-Cliffs (CLF). Investors should note that drivers for CLF are quite different from those of its seaborne peers.

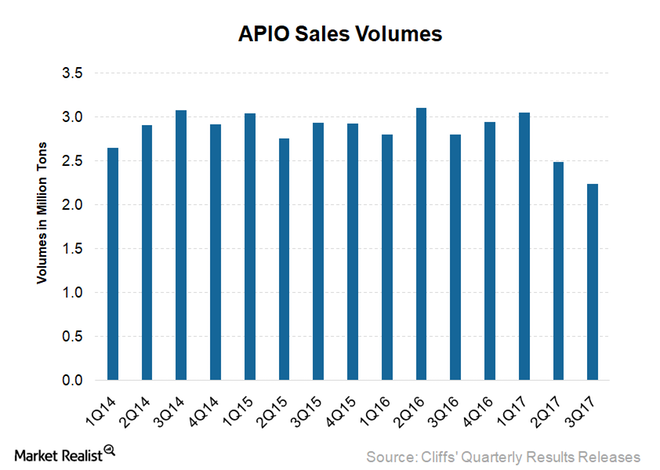

What to Expect from Cleveland-Cliffs’ Asia-Pacific Segment

Iron ore prices have been very volatile lately. While the prices fell substantially in September 2017, they picked up after that.

China’s Steel Demand Indicators: A Slower 2018?

China’s property sector is a steel-intensive market—consuming approximately 50% of overall steel in the country—followed by the automotive industry.

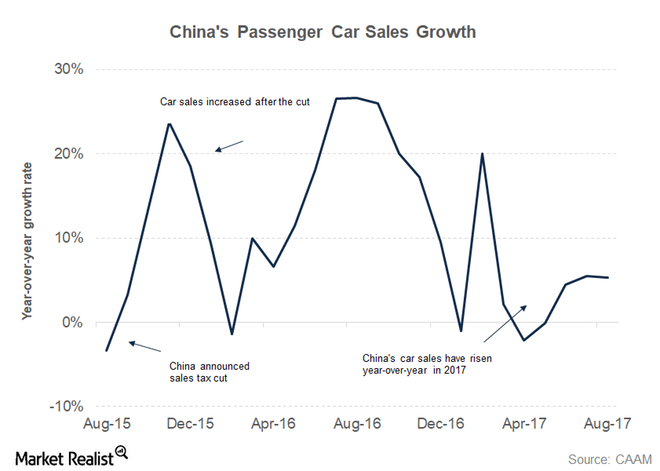

Iron Ore: Could China’s Auto Sales Hit a Rough Patch in 2018?

The China Association of Automobile Manufacturers originally forecast 5.0% growth in total vehicle sales for 2017.

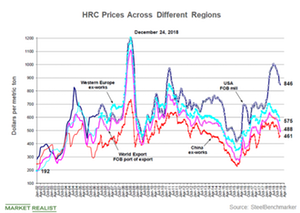

How China’s Steel Prices Can Support Iron Ore in 2018

Due to the government’s efforts to fight pollution in winter months, steel prices in China have hit a nine-year high in the first week of December 2017.

Can China’s Steel Production Pick Up after March 2018 on Pent-Up Demand?

Overall, China’s steel production in 2017 was strong, which was mostly supported by higher steel prices and firm demand.

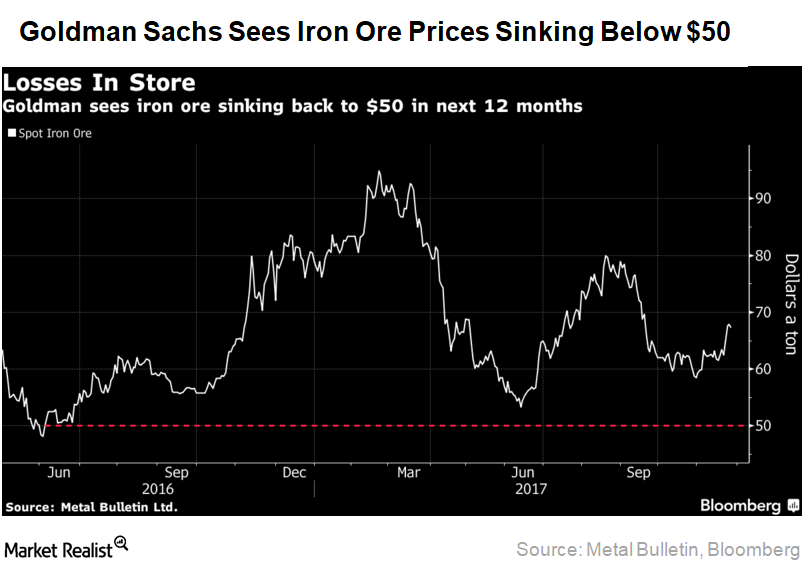

What Are Analysts Predicting for Iron Ore Prices in 2018?

Goldman Sachs (GS) believes that iron ore prices should sink back to $50 per ton in 2018.

Iron Ore Investors Could Anticipate These Factors in 2018

Iron ore prices were tumultuous throughout 2017. There is a 44% difference between the peak of $95 per ton in February and the trough of $53 per ton experienced in July.

China’s Steel Demand Indicator Slowdown—How Will Iron Ore React?

China’s property sector is one of the most steel-intensive sectors, consuming approximately 50% of overall steel in the country.

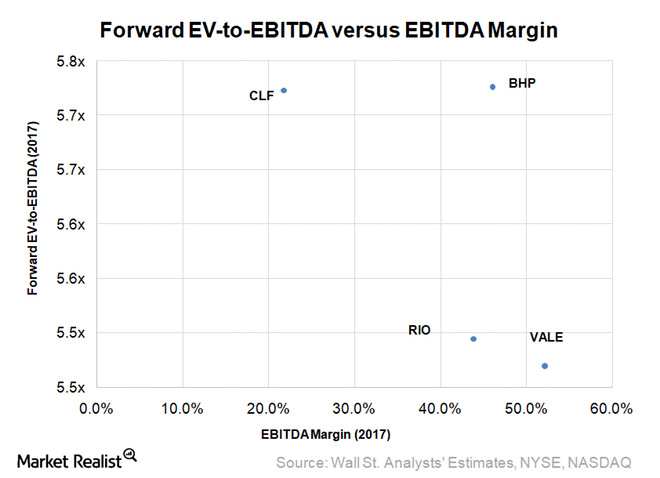

Does Vale Deserve a Rerating of Its Valuation Multiple?

Vale’s CFO (chief financial officer) Luciano Siani Pires said during Vale Day on December 6, 2017, that the company deserves a rerating of its valuation.