Vale SA

Latest Vale SA News and Updates

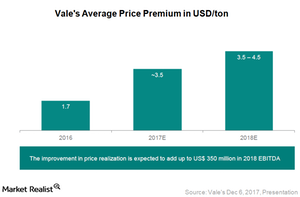

How Vale Could Benefit from a Move to Quality in Iron Ore

Vale has changed its product portfolio and quality in iron ore according to market demand. In 2017, it’s more focused on selling high-quality ore.

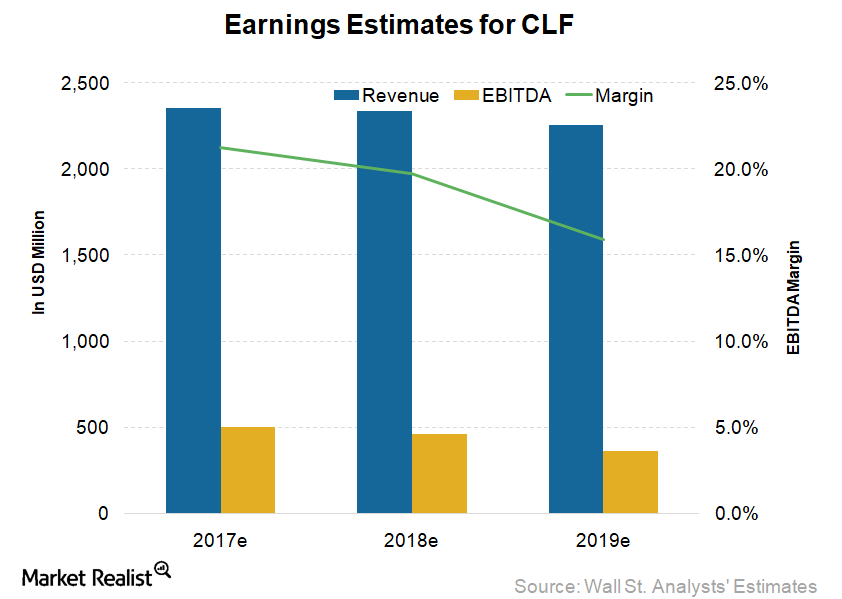

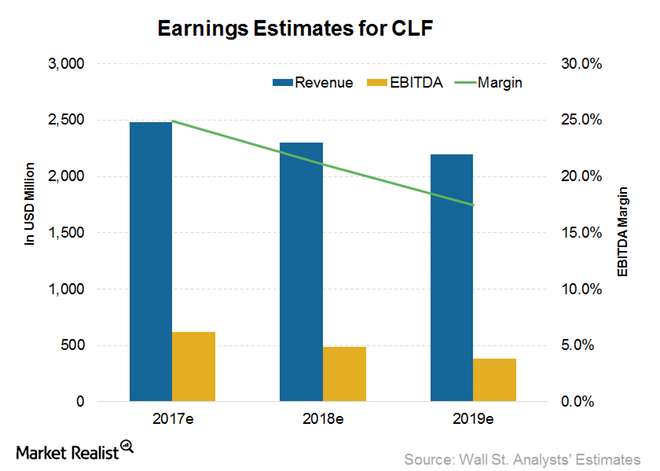

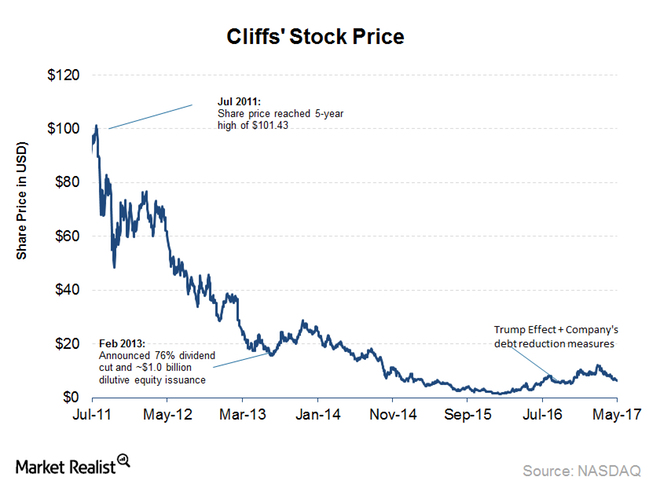

Why Analysts Downgraded Cleveland-Cliffs’s Earnings Estimates

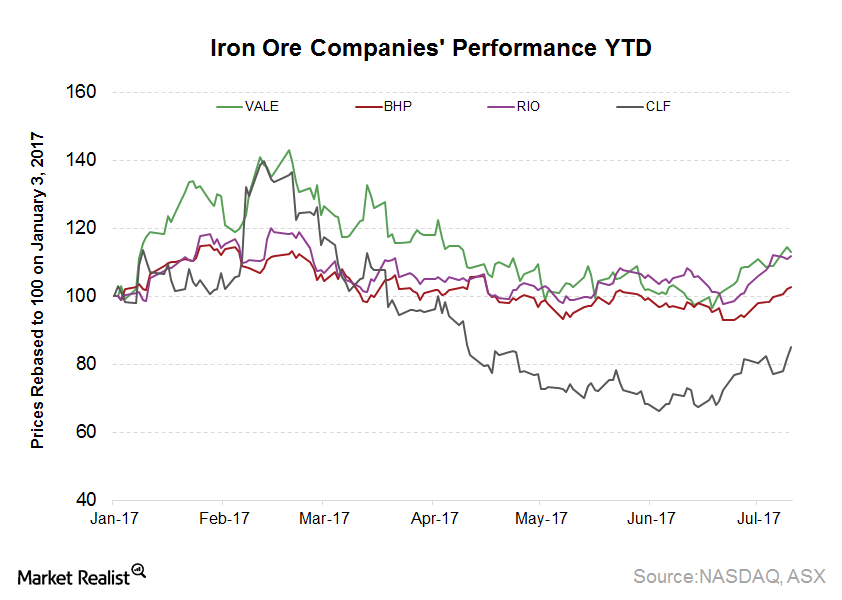

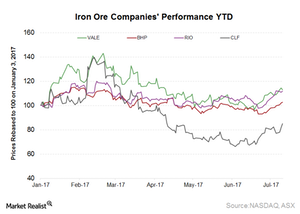

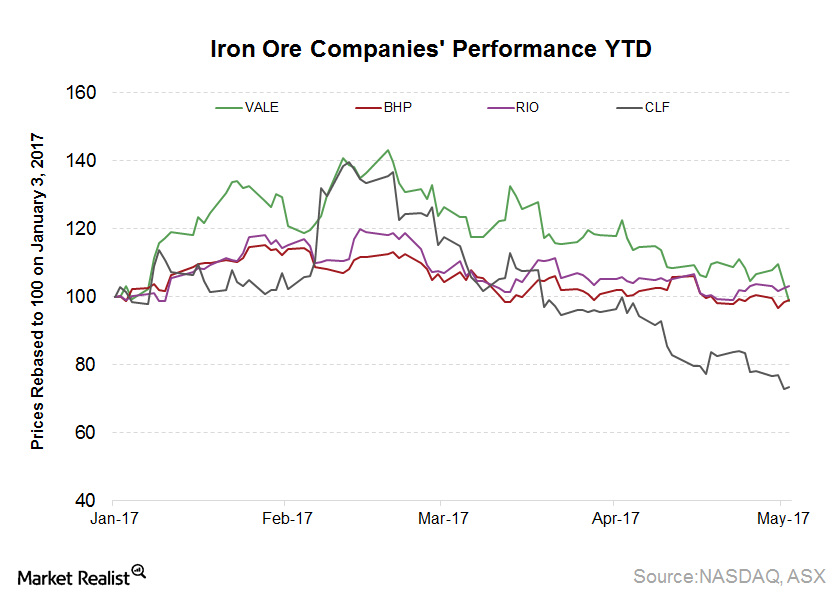

The drivers for Cleveland-Cliffs’ (CLF) top and bottom lines are quite different from the miners we’ve discussed in the previous parts of this series such as Rio Tinto (RIO), BHP (BHP), and Vale (VALE).

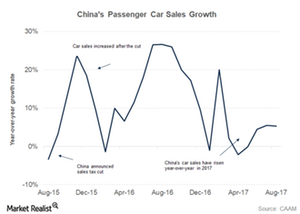

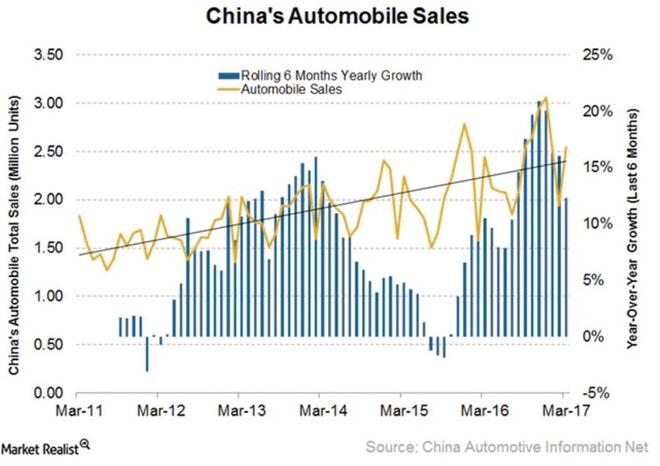

China’s Auto Sales Might Have a Surprise Impact on Iron Ore

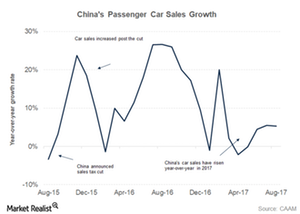

The Chinese automobile industry comes second, after the real estate sector, in consuming the most steel. In this article, we’ll look at the recent developments in this industry to track the associated iron ore demand.

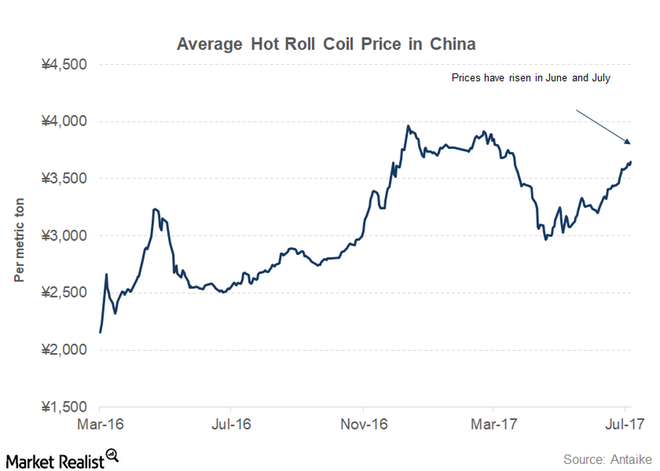

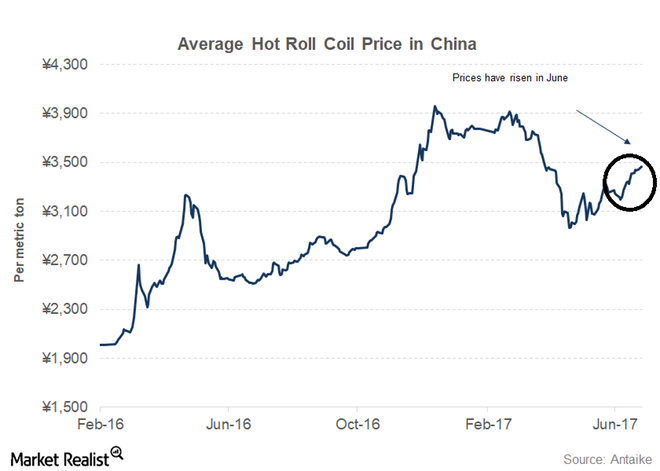

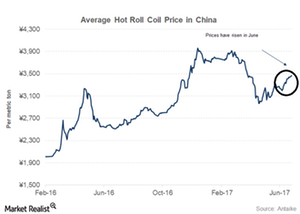

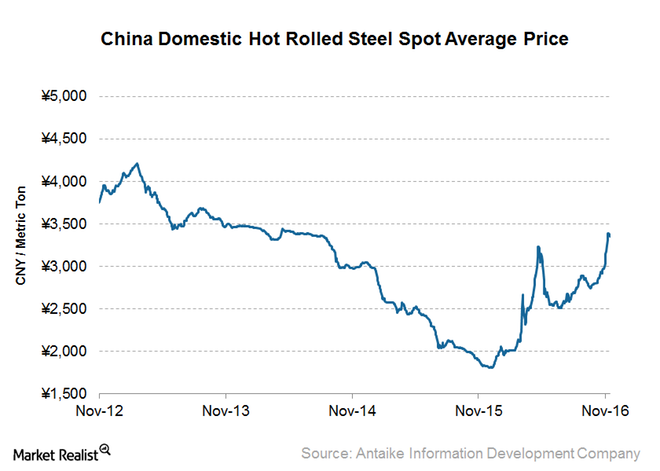

Can China’s Steel Prices Keep Supporting Iron Ore Prices?

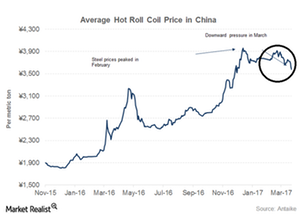

In the previous part of this series, we discussed how the momentum in Chinese steel production in 2017 has come on the back of strong steel prices.

Iron Ore Rebound: How Analyst Ratings for Miners Are Changing

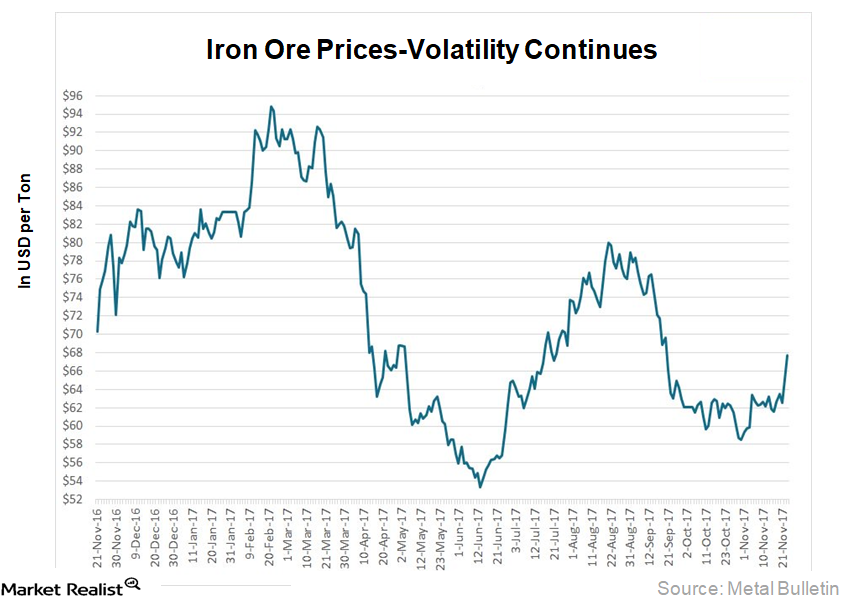

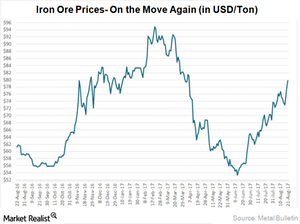

Iron ore prices in 2017 so far have been a roller coaster ride. Prices reached a peak of $95 per ton in February only to slump to a low of $53 per ton in July and take off soon after.

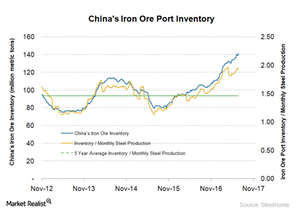

China’s Ever-Rising Iron Ore Port Inventory

It’s important for investors to keep tabs on iron ore port inventories in China. Inventory levels show the balance between demand and supply for iron ore.

Cleveland-Cliffs: Tracking China’s Steel Demand

China’s total vehicle sales rose 2.0% in October 2017 compared to October 2016.

Why Vale Believes the Iron Ore Market Is in Balance

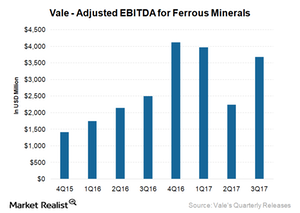

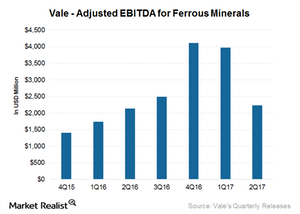

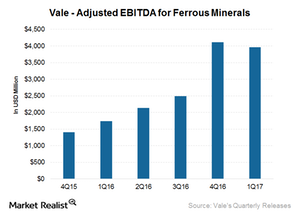

Vale’s (VALE) Ferrous division accounted for ~87.6% of its adjusted EBITDA in 3Q17, compared with ~82.0% in 2Q17.

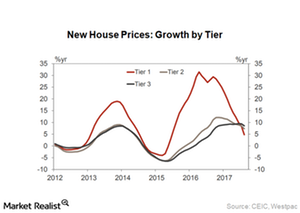

How China’s Steel Demand Could Affect Iron Ore Demand

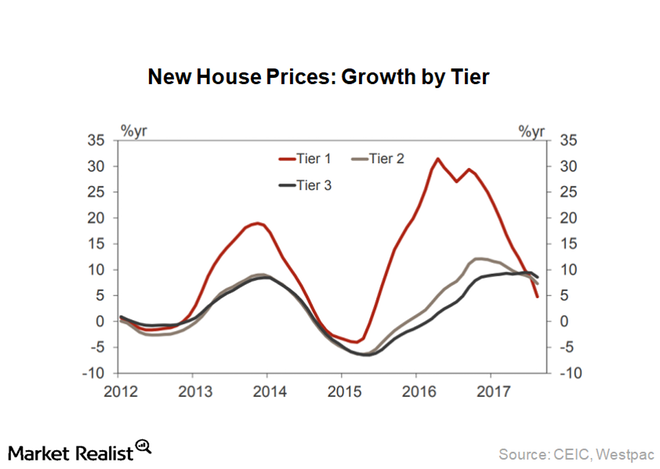

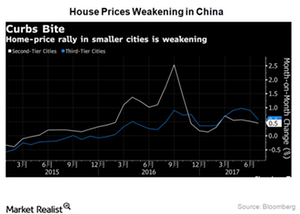

China’s property sector China’s property sector is one of its most steel-hungry sectors, accounting for close to 50% of overall steel demand. Therefore, it is important for steel investors to keep tabs on the sector to gauge the steel demand outlook in China. China’s property sector once again appeared to be under stress in August. […]

How Did China’s Auto Sales Trend in August?

China’s automobile industry is the second-largest steel consumer after the real estate sector.

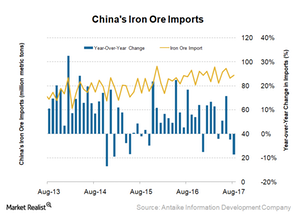

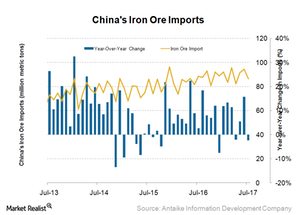

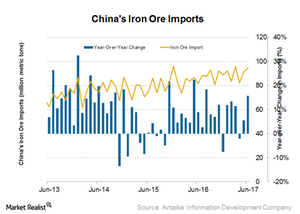

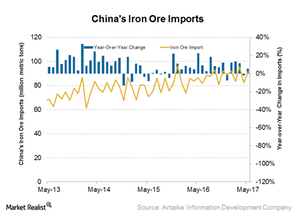

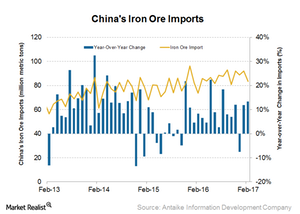

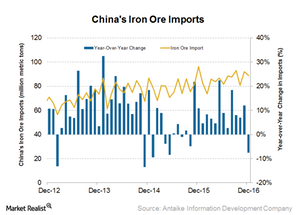

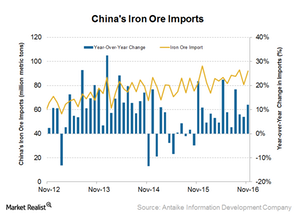

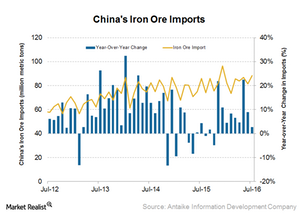

Can China’s Iron Ore Imports Support Prices?

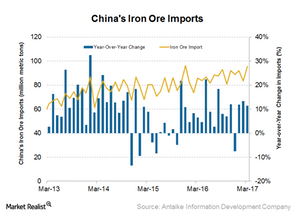

China is the world’s largest consumer of iron ore. Therefore, to gauge the outlook for iron ore demand, it’s important to track China’s iron ore import data.

Understanding Changes in Analyst Estimates for CLF

Wall Street analysts covering Cleveland-Cliffs estimate revenues of ~$2.4 billion in 2017. This implies growth of 14.7% year-over-year.

Inside China’s Steel Demand Indicators and Outlook for Iron Ore

To gauge the steel demand outlook in China, it’s important to keep an eye on the property sector.

China Steel Prices Are Touching Higher Highs: Impact on Iron Ore

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date.

Why China’s Lower Iron Ore Imports in July Could Be a One-Off

China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons.

Does BHP Billiton Expect to Sustain Iron Ore Price Momentum?

BHP Billiton (BHP) attributed the rise in iron ore prices to higher pig iron production in China, the preference for higher grade materials, and improved steel margins.

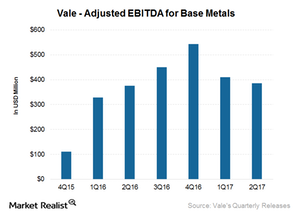

What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

What’s the Outlook for Vale’s Iron Ore Division?

Vale’s (VALE) ferrous division accounted for ~82%.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 2Q17.

These Factors Could Affect Vale Stock in 2H17

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

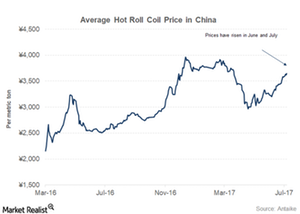

Chinese Steel Prices Are Surging—Can They Keep the Momentum?

Chinese steel production has been hitting one record after another. This renewed vigor in the Chinese steel industry is due to higher steel prices.

China’s Iron Ore Imports Surged in June—Where Will They Go Next?

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

Can Iron Ore Miners’ Supply Discipline Lead to a Price Upside?

Rio Tinto (RIO) released its operational update for 1H17 on July 18, 2017. Rio’s iron ore shipments fell 6% year-over-year (or YoY) to 77.7 million tons in 2Q17.

China’s Auto Sales Rebounded in June: Gauging Iron Ore’s Impact

Since China’s automobile industry is the second-largest consumer of steel after the real estate sector, it’s important to track its developments.

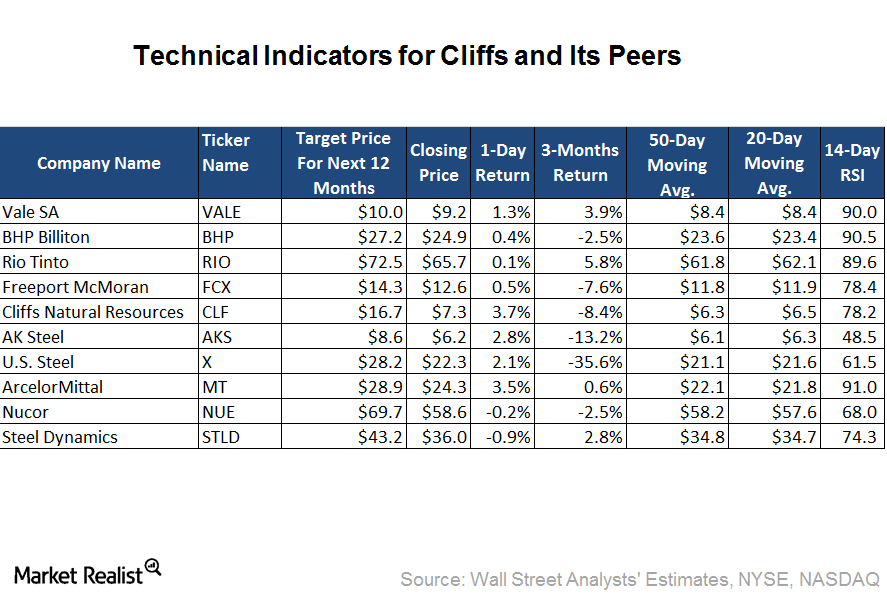

CLF and Peers in Overbought Territory: What Triggered It?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.

Why China’s June Iron Ore Import Outlook Is Strong

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

Cliffs Natural Resources’ First HBI Plant: What You Need to Know

The estimated investment needed for Cliffs Natural Resources’ (CLF) HBI (hot briquetted iron) plant is ~$700 million.

What Will Drive Vale SA’s Iron Ore Division Going Forward?

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

These Factors Led to Weakness in Vale Stock after 1Q17

In 1Q17, Vale (VALE) significantly outperformed its major peers with a rise of ~25%.

China’s Iron Ore Imports Remain Strong: What’s the Outlook?

Strong Chinese iron ore imports China imported 95.6 million tons of iron ore in March, compared with 83.5 million tons in February 2017. This figure implies a strong growth of 11% year-over-year (or YoY). This number is also the second-highest monthly amount on record. China imported 96.3 million tons of iron ore in December 2015. […]

Should Cliffs Worry about Chinese Steel Price Trends?

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

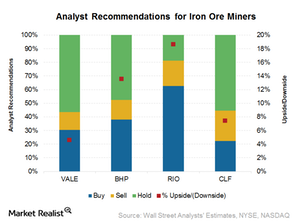

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

What China’s Resilient Iron Ore Imports Mean for Miners

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

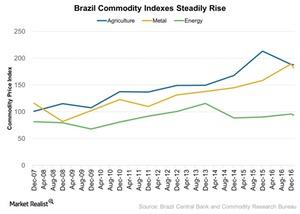

Will Rising Commodity Prices Help Brazil Recover?

Brazil (EWZ) is expected to see a reversal of the downward trend in its economic growth in 2017, mostly with the help of rising commodity prices and improvements in exports.

China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

What Could Impact Chinese Steel Prices in 2017?

Since China is the world’s largest steel producer and exporter, it’s important for investors to keep track of Chinese steel prices.

What’s the Outlook for Chinese Iron Ore Imports?

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

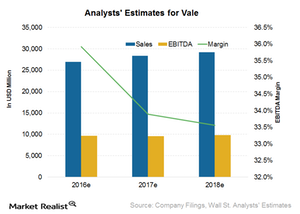

Why Analysts Significantly Raised Vale’s Earnings Estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.

Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

Could China’s Iron Ore Imports Pull Back in the Near Term?

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

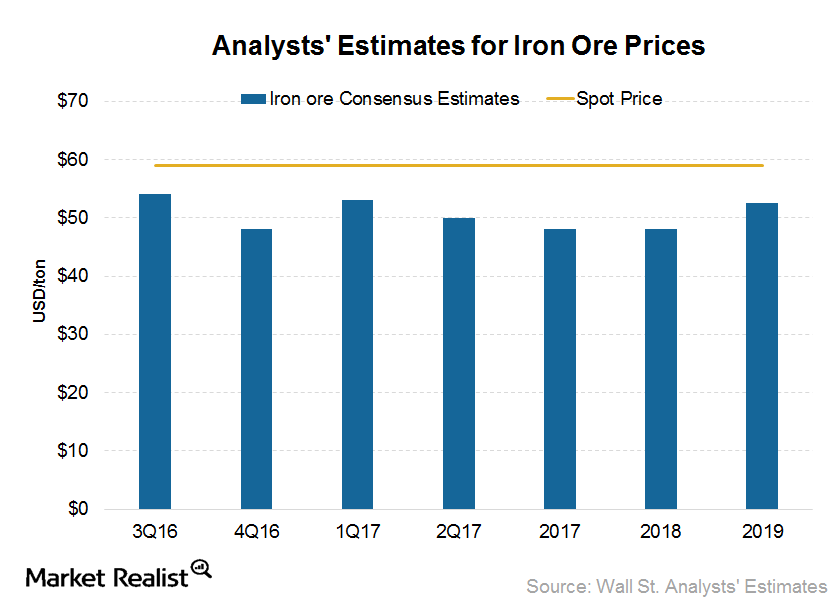

Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

Why China’s Iron Ore Imports May See a Near-Term Pullback

In July 2016, China’s iron ore imports came in at 88.4 million tons. This was a rise of 2.7% compared to 86.1 million tons in July 2015 and 81.6 million tons in June 2016.

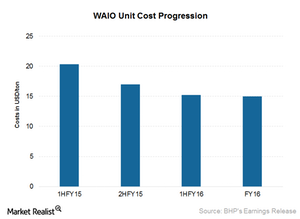

How Much Lower Can BHP Billiton Push Its Costs in Iron Ore?

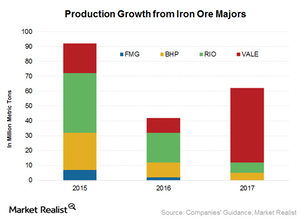

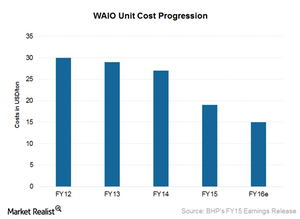

BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

Why Is the Iron Ore Price Rally Losing Steam?

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was a one-off phenomenon or the start of a more sustained uptick in prices.

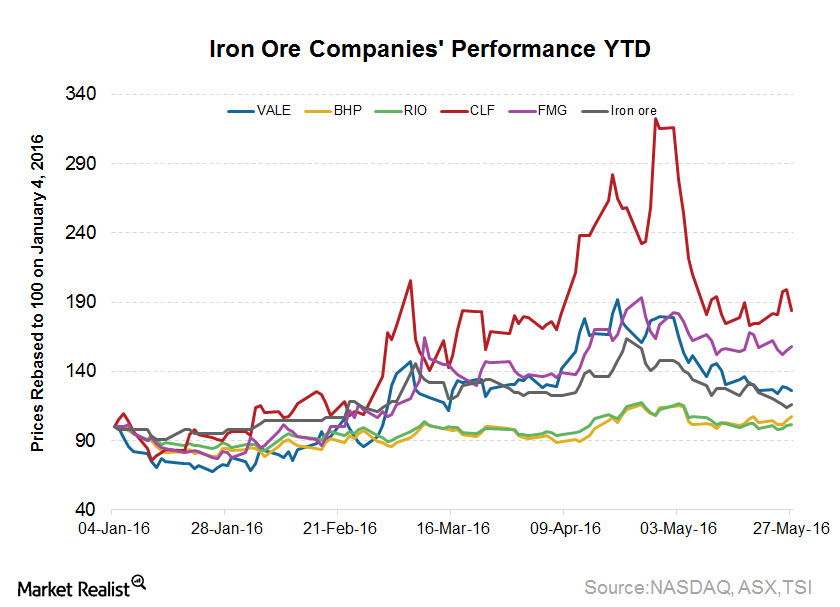

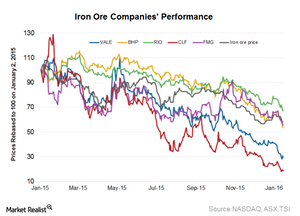

So Far, 2016 Has Been an Unhappy New Year for Iron Ore Stocks

Just a few weeks old, 2016 started where 2015 left off for the iron ore industry. The benchmark seaborne iron ore prices were trading at $40 levels as of January 14, 2016, down 9% for the year.

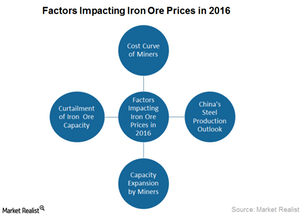

Factors Impacting Iron Ore’s Performance in 2016

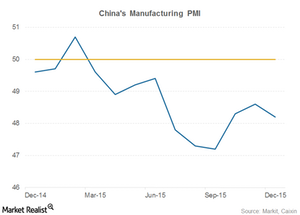

China’s (MCHI) economic slowdown is the biggest challenge for global metal and mining companies, which is why iron ore investors should keep a close eye on the Chinese economy.

Cliffs Natural Resources’ Woes Continued in the Fourth Quarter

In 2015, Fortescue Metals Group (FSUGY) and Cliffs Natural Resources (CLF) fell 35% and 78%, respectively.

Are Curtailments Enough to Offset New Capacity in Iron Ore?

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will cease production in 2016 due to weak iron ore prices.

Depressed Iron Ore Prices Will Strain BHP Billiton’s Cash Flows

Iron ore forms the biggest chunk of BHP Billiton’s revenues and earnings. For its latest quarter, the company delivered 7% year-over-year growth.

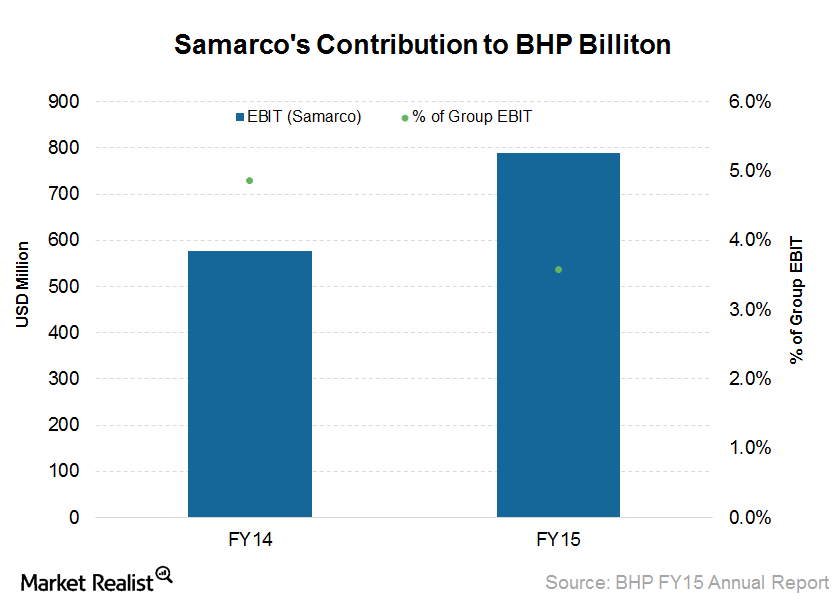

How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.