How China’s Steel Demand Could Affect Iron Ore Demand

China’s property sector China’s property sector is one of its most steel-hungry sectors, accounting for close to 50% of overall steel demand. Therefore, it is important for steel investors to keep tabs on the sector to gauge the steel demand outlook in China. China’s property sector once again appeared to be under stress in August. […]

Oct. 11 2017, Updated 10:37 a.m. ET

China’s property sector

China’s property sector is one of its most steel-hungry sectors, accounting for close to 50% of overall steel demand. Therefore, it is important for steel investors to keep tabs on the sector to gauge the steel demand outlook in China.

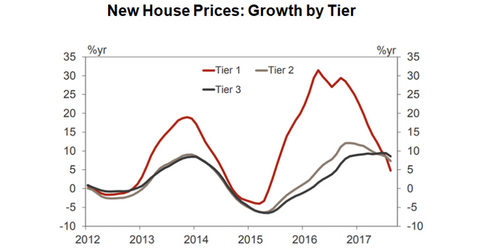

China’s property sector once again appeared to be under stress in August. New house prices grew by an annualized rate of less than 5% in August, which is quite low compared with the 30% growth achieved in 2016. According to Reuters, home price growth was just 8.3% YoY (year-over-year) in August, the slowest growth rate in over a year.

Westpac feels that fixed-asset investments should continue to slow through next year. The company also thinks that China’s residential construction is maturing and future growth could be muted.

China’s auto sales

While China’s latest property sector figures have remained lackluster, its auto sales data did not disappoint in August. Auto sales grew 5.3% YoY, with ~2.2 million units. Data for the last two months has been slightly better and has soothed fears of a slowdown in China’s auto market.

The year-to-date increase is still much lower than last year’s growth, mainly due to the rollback of the Chinese government’s 2016 tax incentive. China Association of Automobile Manufacturers has forecast a 5% growth rate in the auto sector in 2017.

Credit tightening by Chinese authorities could lead to a further slowdown in the property market, and auto sales data doesn’t inspire much confidence. These factors could be negative for global steel (SLX) demand. Lower steel demand is negative for iron ore demand, which impacts seaborne iron ore players such as Rio Tinto (RIO), Vale (VALE), BHP Billiton (BHP), and Cleveland-Cliffs (CLF).