Market Vectors® Steel ETF

Latest Market Vectors® Steel ETF News and Updates

Why the Outlook for US Steel Prices Is Bright beyond 4Q17

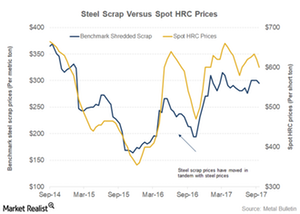

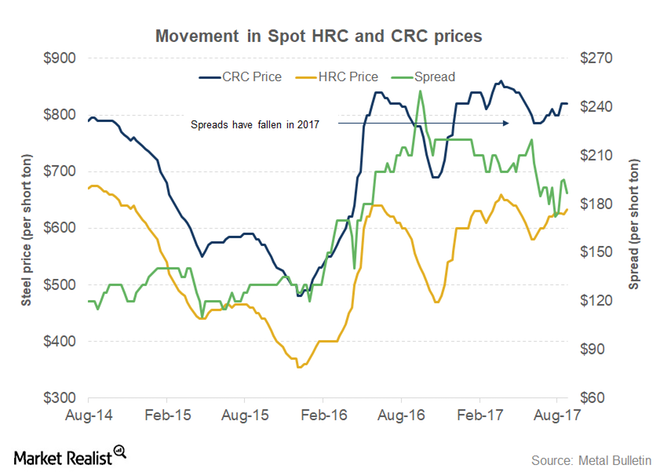

While US steel prices rose to a high of $660 per ton in March 2017, they fell to $580 per ton in June.

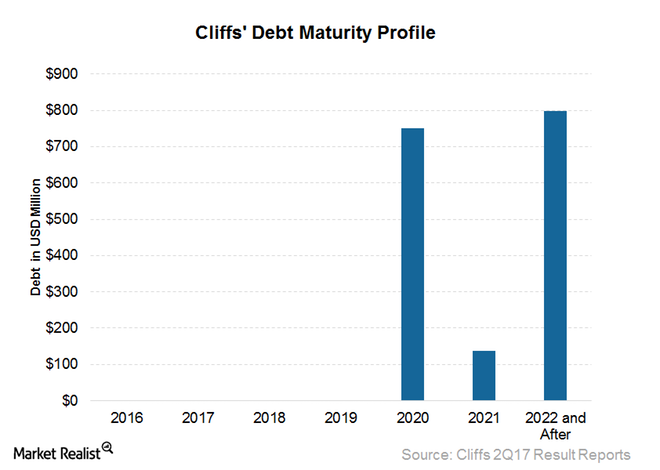

What Cliffs Natural Resources’ Debt Tender Offer Means

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025.

What to Expect from Cliffs Natural Resources’ 2Q17 Earnings

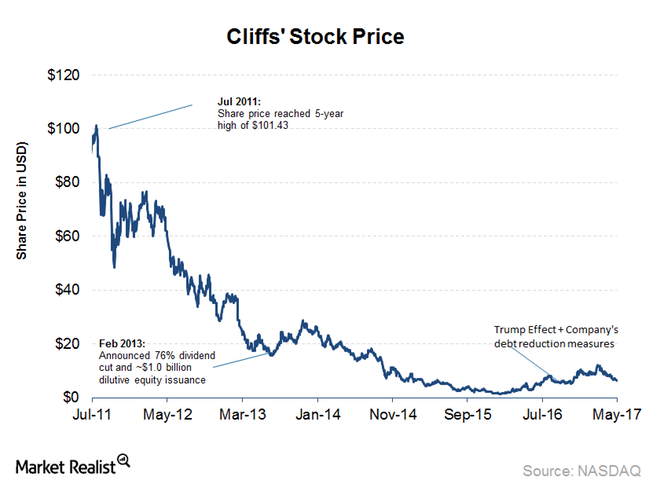

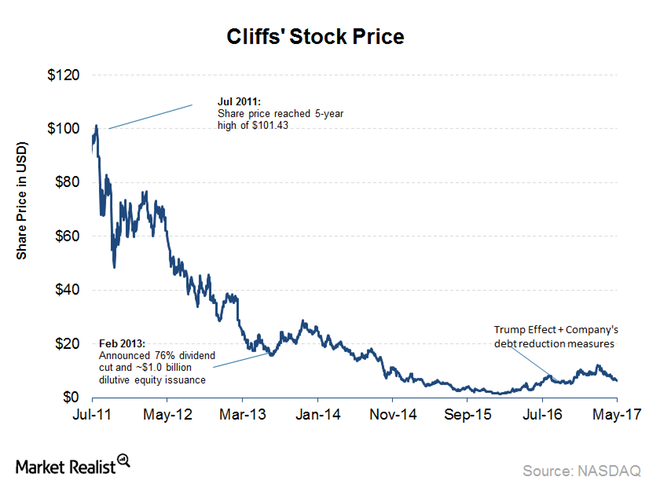

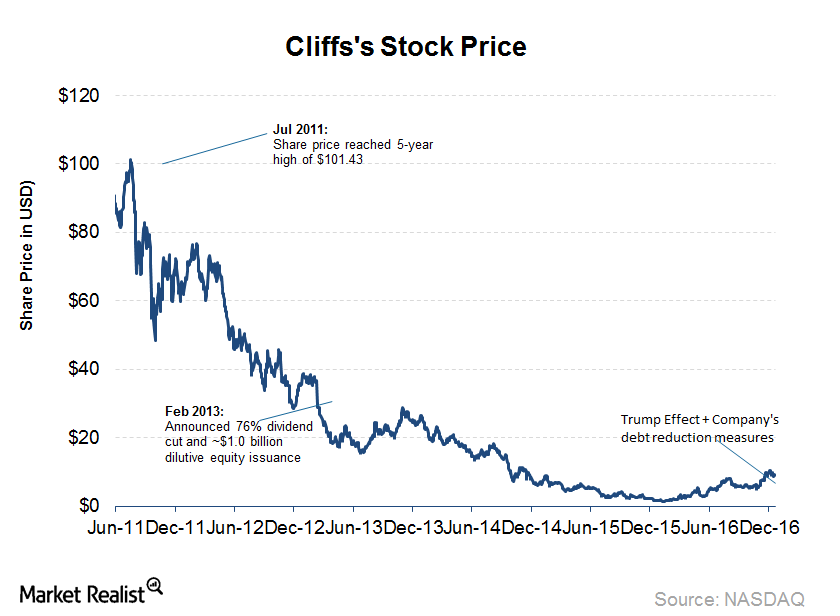

In this series, we’ll see what investors could expect from Cliffs Natural Resources’ (CLF) 2Q17 earnings report. CLF stock has gained 23% in the last 15 trading days.

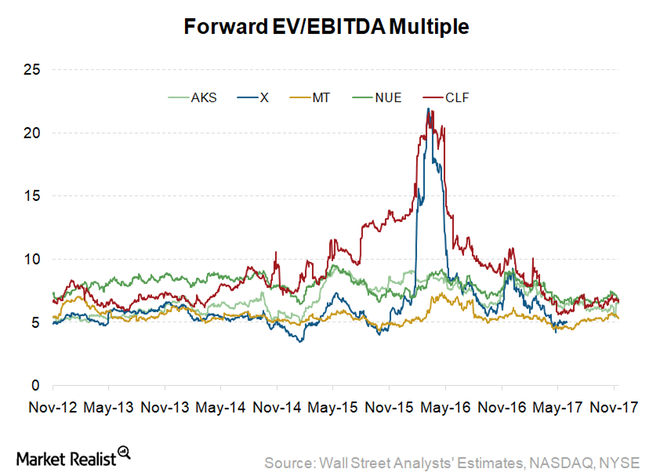

These Factors Could Affect CLF’s Valuation

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last five-year average multiples.

Does 2018 Bode Well for US Steel Prices?

Steel prices are the major driver of steelmakers’ earnings and revenues. So it’s important for steel investors and Cleveland-Cliffs (CLF) investors to track the trend in steel prices.

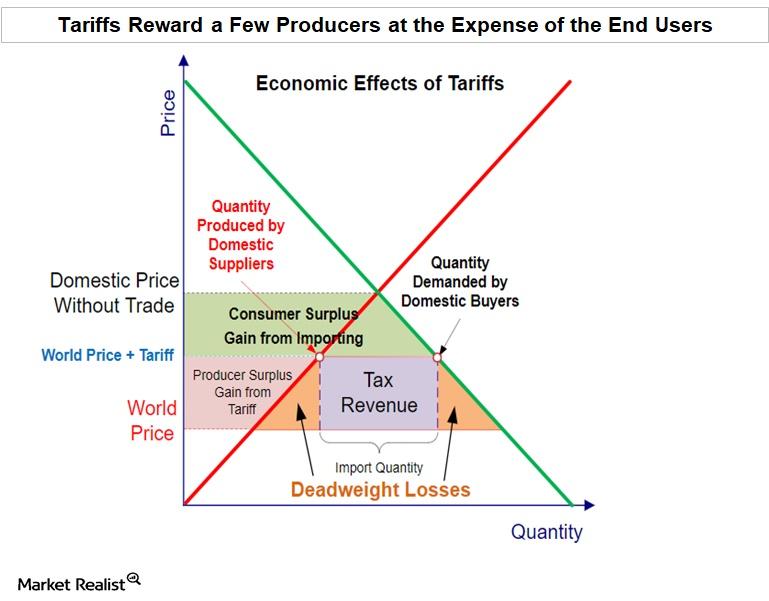

Why Economist Argue That Tariffs Are Bad for the Economy

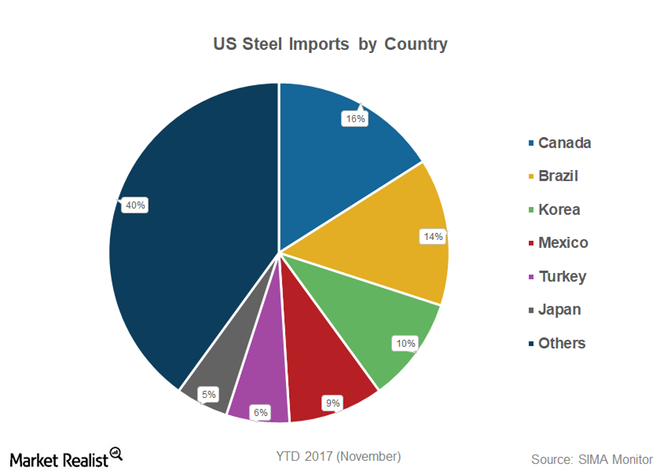

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

How US Steel Import Tariffs Could Affect Cleveland-Cliffs in 2018

US steelmakers (SLX) were facing an onslaught of increasing steel imports into the US, which impacted their capacity utilization and pricing power negatively.

Cleveland-Cliffs Stock Rises on Tariff Recommendations

On February 16, 2018, the US Department of Commerce released its recommendations for the Section 232 probe into steel and aluminum imports.

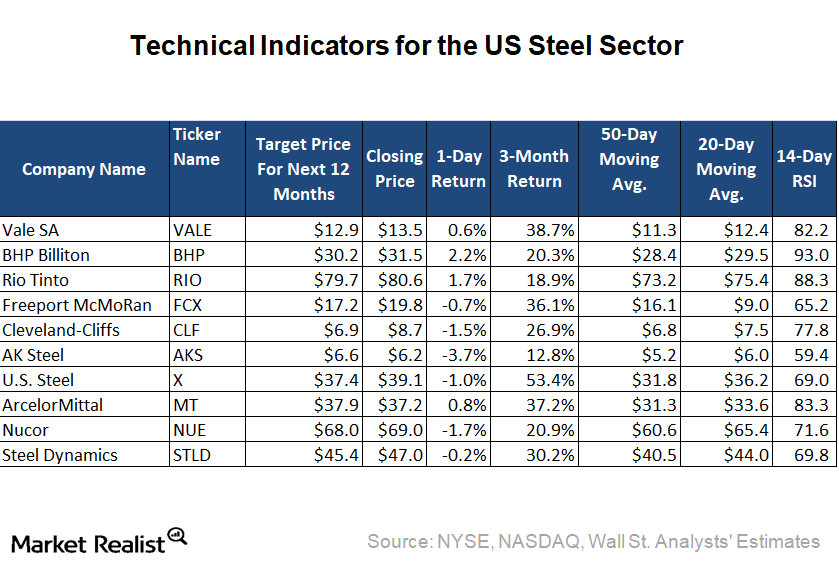

What Technical Indicators Say about Cliffs and Peers

Based on its January 12, 2018, closing price, Cleveland-Cliffs is trading ~28% above its 50-day moving average and 15.4% above its 20-day moving average.

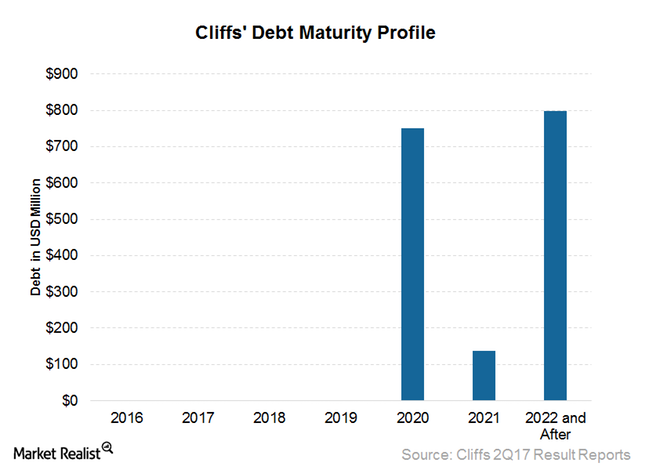

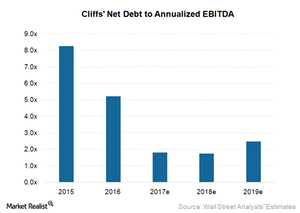

Why Analysts Project Lower Net Debt for Cliffs in 2017

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, it has come a long way with respect to debt levels.

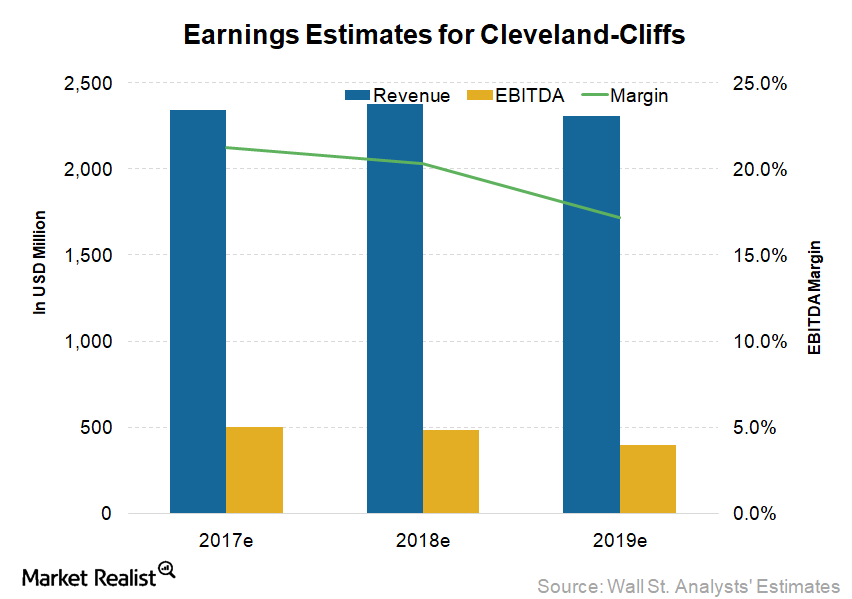

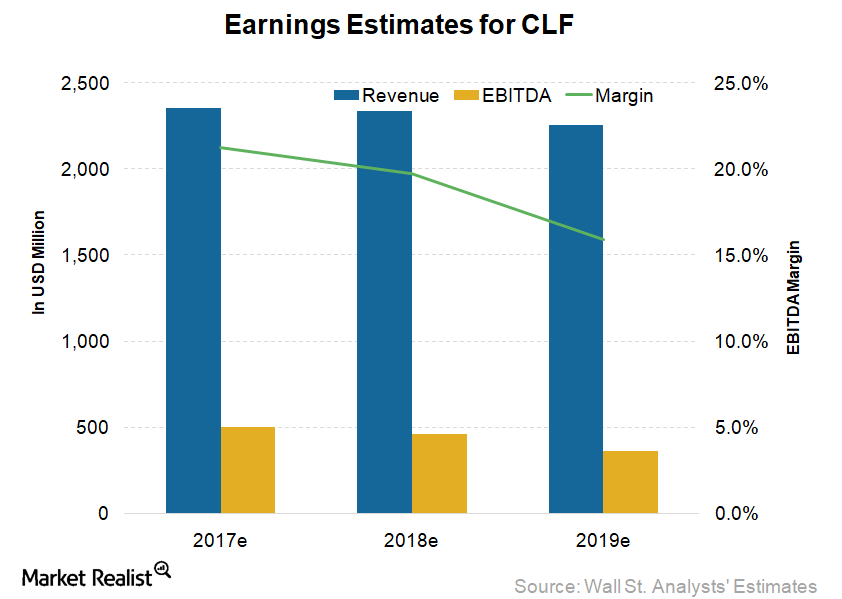

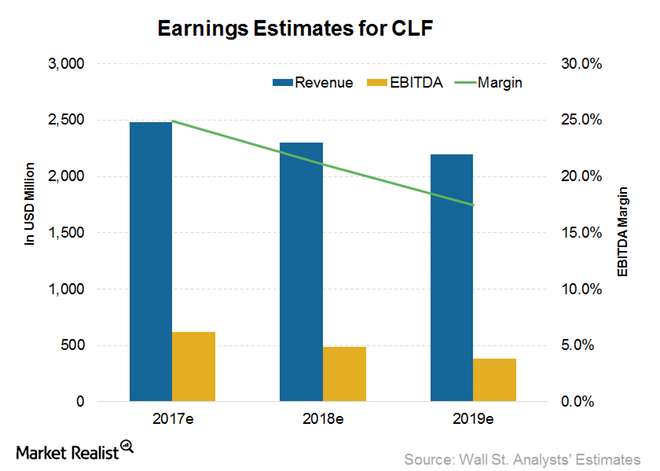

How Analysts View Cleveland-Cliffs’ Earnings for 2017 and Beyond

In this article, we’ll discuss analysts’ projections for Cleveland-Cliffs (CLF). Investors should note that drivers for CLF are quite different from those of its seaborne peers.

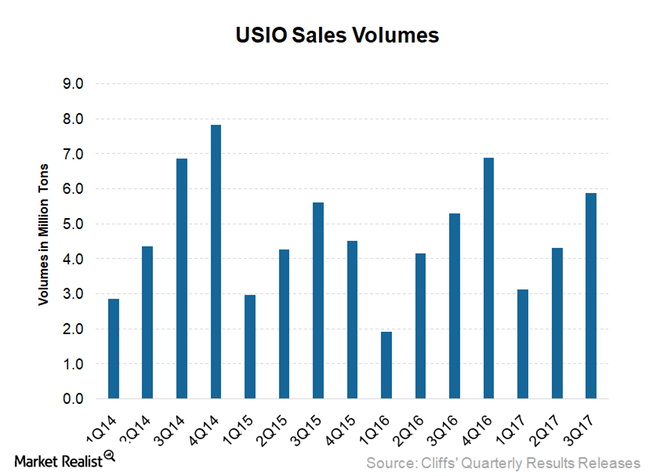

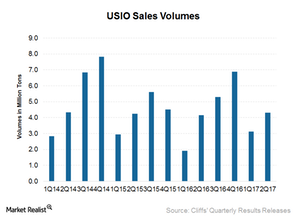

What to Expect from Cleveland-Cliffs’ 4Q17 US Volumes

Cleveland-Cliffs (CLF) achieved US volumes of ~5.9 million tons in 3Q17, an increase of 11% year-over-year (or YoY).

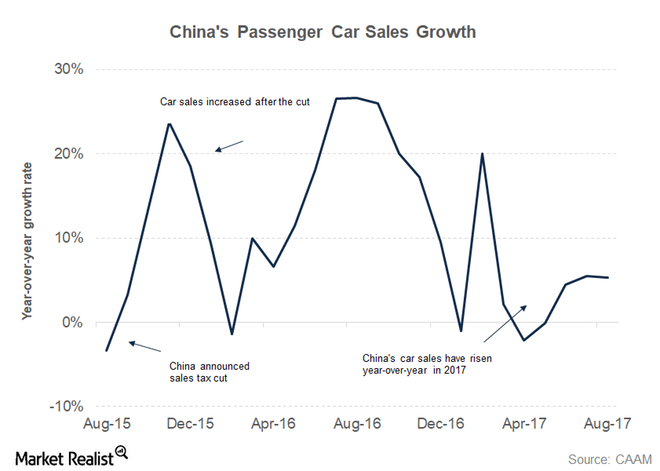

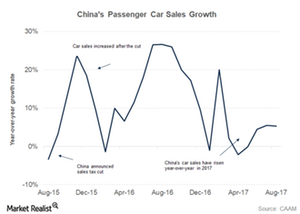

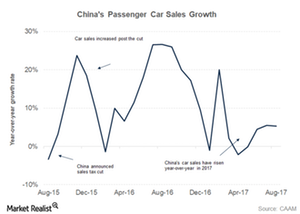

Iron Ore: Could China’s Auto Sales Hit a Rough Patch in 2018?

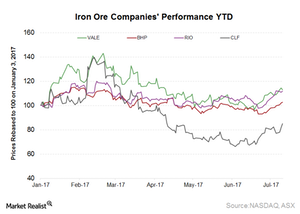

The China Association of Automobile Manufacturers originally forecast 5.0% growth in total vehicle sales for 2017.

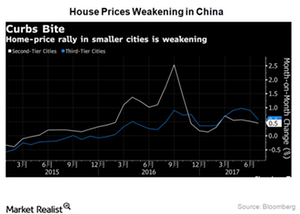

China’s Steel Demand Indicator Slowdown—How Will Iron Ore React?

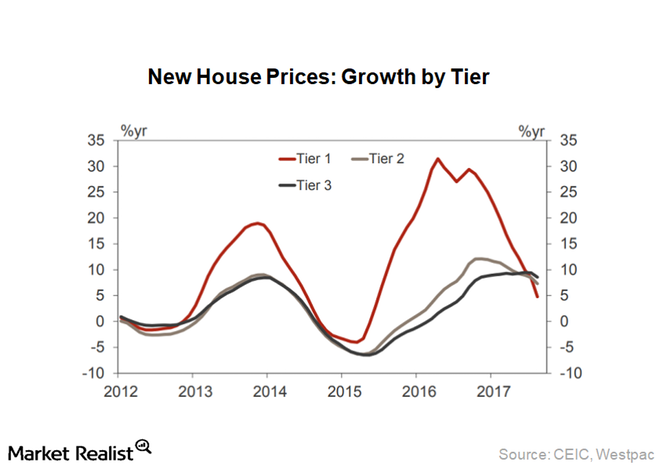

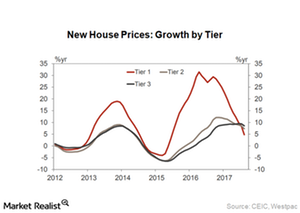

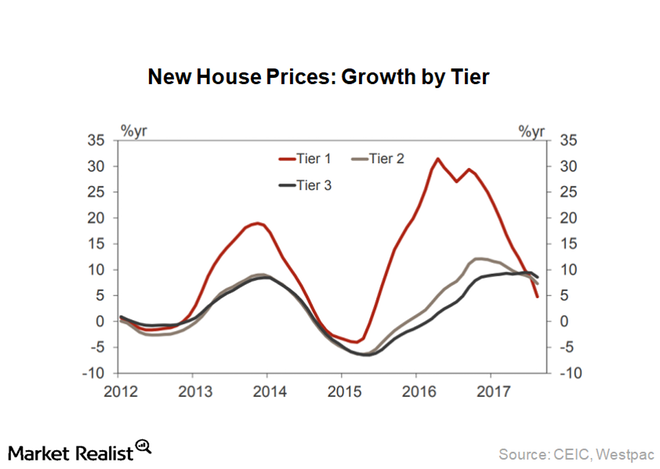

China’s property sector is one of the most steel-intensive sectors, consuming approximately 50% of overall steel in the country.

Why Analysts Downgraded Cleveland-Cliffs’s Earnings Estimates

The drivers for Cleveland-Cliffs’ (CLF) top and bottom lines are quite different from the miners we’ve discussed in the previous parts of this series such as Rio Tinto (RIO), BHP (BHP), and Vale (VALE).

China’s Auto Sales Might Have a Surprise Impact on Iron Ore

The Chinese automobile industry comes second, after the real estate sector, in consuming the most steel. In this article, we’ll look at the recent developments in this industry to track the associated iron ore demand.

Cleveland-Cliffs: Tracking China’s Steel Demand

China’s total vehicle sales rose 2.0% in October 2017 compared to October 2016.

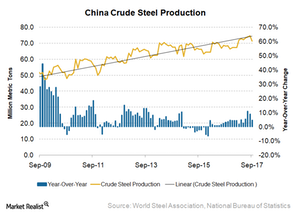

Will China’s Steel Production Take the Sheen Away from Iron Ore Prices?

The most-traded January rebar contract on the Shanghai Futures Exchange climbed 4.3% to 3,776 yuan per ton.

Is Cleveland-Cliffs’ Weak 4Q17 Outlook Temporary?

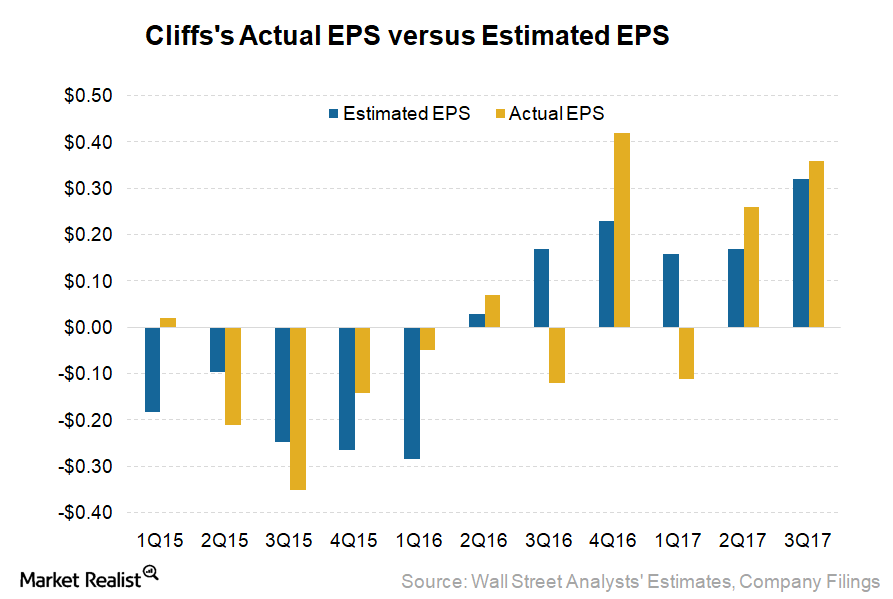

Cleveland-Cliffs (CLF) released its 3Q17 results on October 20. CLF reported earnings per share of $0.36, beating the consensus estimate by $0.04.

Factors Driving Analysts’ Forecast of a Drop in CLF’s Net Debt in 2017

According to consensus estimates, CLF’s net debt should fall 42% by the end of 2017 compared to 2016.

Can Cleveland-Cliffs’ Realized Prices in the US See an Uptick in 3Q17?

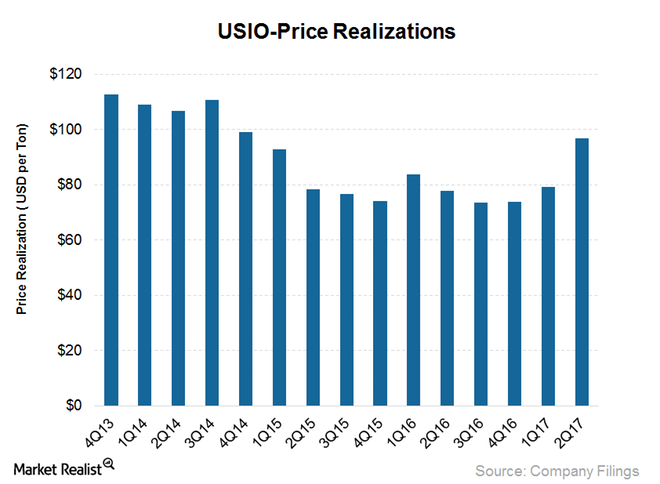

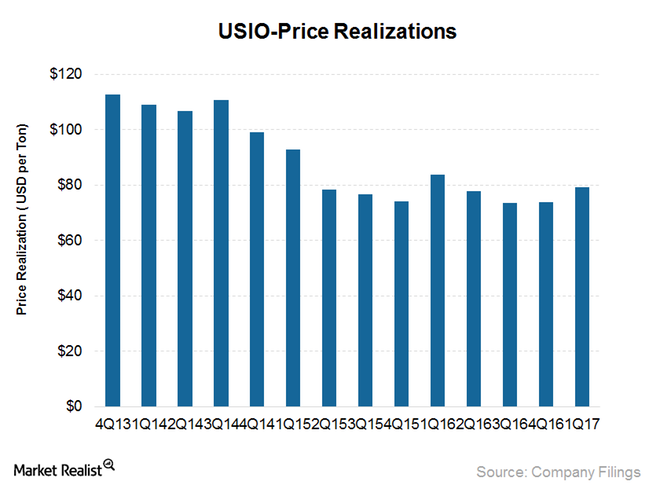

Cleveland-Cliffs’ (CLF) average realized prices increased 24% year-over-year and 22% quarter-over-quarter to $97 per ton in 2Q17.

How China’s Steel Demand Could Affect Iron Ore Demand

China’s property sector China’s property sector is one of its most steel-hungry sectors, accounting for close to 50% of overall steel demand. Therefore, it is important for steel investors to keep tabs on the sector to gauge the steel demand outlook in China. China’s property sector once again appeared to be under stress in August. […]

The Outlook for US Steel Prices in 4Q17

Steel prices Along with steel production, steel prices are among the most important drivers of US steelmakers’ earnings. Therefore, steel and iron ore investors should track US steel prices (SLX). After being depressed for a long period, US steel prices started their upward march in 2016 after high anti-dumping duties were levied on imported steel. Prices also […]

How Owning the Tilden Mine Fits Into Cleveland-Cliffs’s Strategy

Cleveland-Cliffs now fully owns Tilden On October 2, 2017, Cleveland-Cliffs (CLF) announced its acquisition of U.S. Steel Corporation’s (X) 15% equity interest in the Tilden mine for $105 million. Cleveland-Cliffs already owned the other 85% of the joint venture. This transaction will provide 1.2 million tons of annual pellet production capacity to Cleveland-Cliffs, taking its capacity to ~20 million […]

How Did China’s Auto Sales Trend in August?

China’s automobile industry is the second-largest steel consumer after the real estate sector.

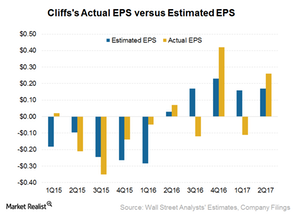

Understanding Changes in Analyst Estimates for CLF

Wall Street analysts covering Cleveland-Cliffs estimate revenues of ~$2.4 billion in 2017. This implies growth of 14.7% year-over-year.

Inside China’s Steel Demand Indicators and Outlook for Iron Ore

To gauge the steel demand outlook in China, it’s important to keep an eye on the property sector.

Impact on CLF: Will the Trump Administration Listen to US Steelmakers?

The American steel industry has written to President Donald Trump requesting that he restrict steel imports immediately.

These Variables Could Drive Cleveland-Cliffs Higher

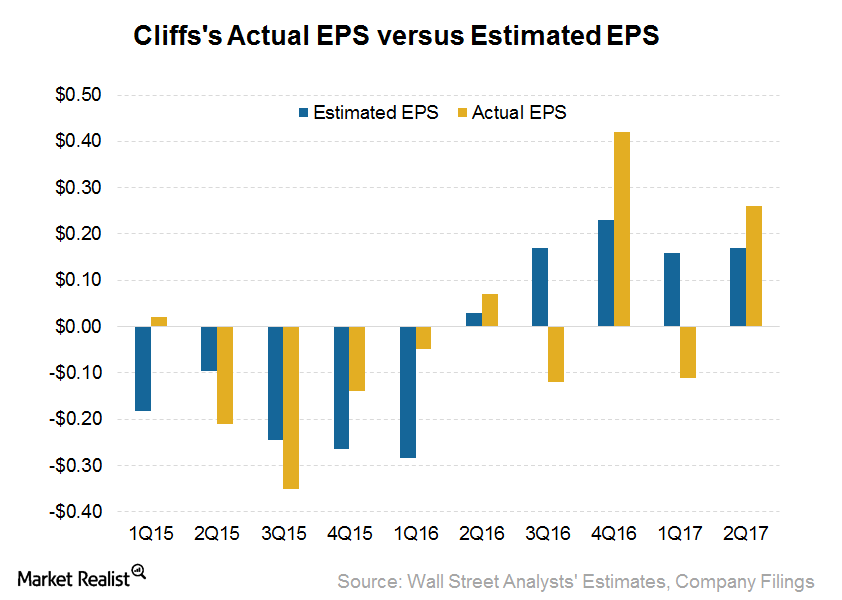

After experiencing a great 2016, US steel stocks are having a tepid 2017.

US Steel Prices: The Outlook for Cliffs Natural Resources

Cliffs Natural Resources (CLF) downgraded its EBITDA and net earnings guidance for 2017 due to weaker-than-expected YTD averages of US HRC and seaborne iron ore prices.

Cliffs Natural Resources: What Will Drive Performance after 2Q17?

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

Key Highlights from Cliffs Natural Resources’ 2Q17 Results

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY).

Why Cliffs Natural Resources’ Stock Fell despite an Earnings Beat

Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened. Here’s what you need to know.

Can Iron Ore Miners’ Supply Discipline Lead to a Price Upside?

Rio Tinto (RIO) released its operational update for 1H17 on July 18, 2017. Rio’s iron ore shipments fell 6% year-over-year (or YoY) to 77.7 million tons in 2Q17.

China’s Auto Sales Rebounded in June: Gauging Iron Ore’s Impact

Since China’s automobile industry is the second-largest consumer of steel after the real estate sector, it’s important to track its developments.

Jefferies Recommends a ‘Buy’ for CLF—What Do Other Analysts Think?

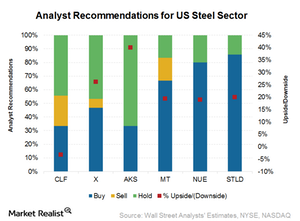

According to the consensus compiled by Thomson Reuters, 22% of the analysts covering Cliffs Natural Resources (CLF) recommended a “sell” for the stock, 33% recommend a “buy,” and 44% recommend a “hold” for the stock.

Can CLF’s Realized Prices See an Uptick in the US Segment?

Compared to 1Q16, Cliffs Natural Resources’ average realized prices fell 5% year-over-year to $79.30 per ton in 1Q17.

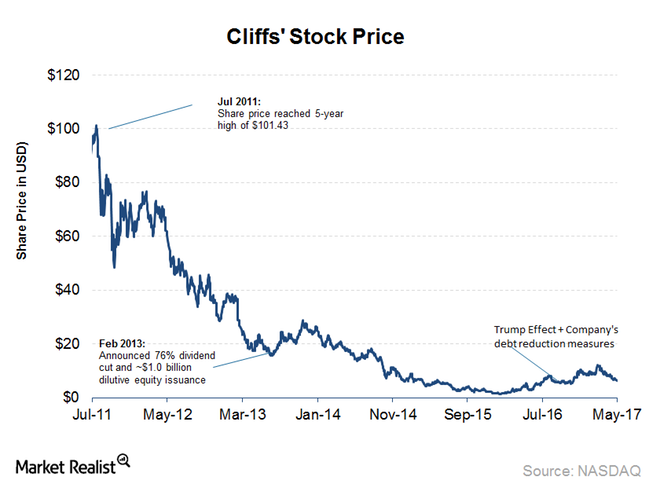

How’s the Industry Outlook for Cliffs for the Rest of 2017?

May 2017 was quite a volatile month for Cliffs Natural Resources (CLF) and its peers. Cliffs fell 12.4% in May alone, bringing its year-to-date losses to 30%.

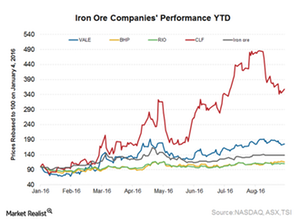

Can Cliffs Natural Resources Scale Greater Heights in 2017?

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the year-to-date rise to a whopping 430.0%.