These Factors Could Affect CLF’s Valuation

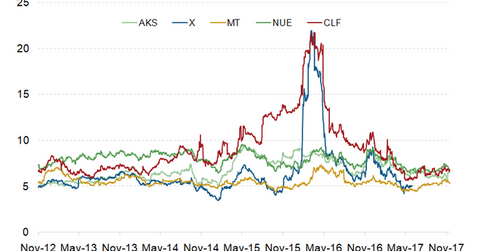

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last five-year average multiples.

Nov. 20 2020, Updated 12:35 p.m. ET

Valuation multiples

We’ll use EV-to-forward-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) to value Cleveland-Cliffs (CLF) in relation to its peers and in relation to its historical multiples. Among US steel peers, U.S. Steel (X) is trading at the lowest forward multiple of 5.9x, while Cliffs and Nucor (NUE) are trading at the highest multiple of 8.1x each.

Discount to long-term multiples

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last-five-year average multiples. AK Steel, Nucor (NUE), and ArcelorMittal (MT) are trading at 0.2%, 2.9%, and 14.5% premiums to their respective trailing five-year average multiples.

Cleveland-Cliffs’ valuation multiple

Cleveland-Cliffs has a current multiple of 8.1x, implying a discount of 10.4% to its historical average multiple but a 19.5% premium to the average multiple of its peers. Its multiple has seen an upward revision of 20% in the last one month alone. Due to firm seaborne iron ore prices, Cliffs’ share price has risen 43% in the same time period.

The pending decision on the Section 232 probe and lower imports into the US could be the next positive catalyst for the stock going forward. These factors could lead to higher earnings estimates from analysts for the stock, leading to re-rating of its multiple.

Keep checking out Market Realist’s Iron Ore page for the latest updates on Cleveland-Cliffs and its seaborne peers.