Does BHP Billiton Expect to Sustain Iron Ore Price Momentum?

BHP Billiton (BHP) attributed the rise in iron ore prices to higher pig iron production in China, the preference for higher grade materials, and improved steel margins.

Aug. 24 2017, Updated 1:36 p.m. ET

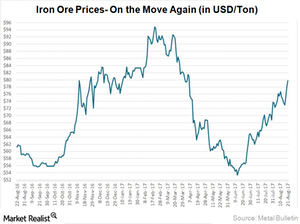

Iron ore prices year-to-date

Iron ore prices have reached nearly $80 per ton recently. After a weaker spell in June and the beginning of July, iron ore prices again defied analysts’ expectations, marching toward the benchmark price of $80 per ton. Most of the recent rise in prices can be attributed to Chinese authorities’ decision to shut down capacity in steel during the winter months to check pollution. This led to bringing forward purchases in anticipation of lower future supply. Analysts are now expecting prices to remain high in 2017, and most of them are expecting to see pressure on prices in 2018 and in the longer term as the fundamentals of oversupply and steady to weaker demand overtake the current enthusiasm.

BHP’s take on iron ore outlook

BHP Billiton (BHP) attributed the year-to-date rise in iron ore prices to higher pig iron production in China (FXI), the preference for higher grade materials, and improved steel margins. It also noted that supplies from Australia, Brazil, and other non-traditional sources remain plentiful. In the medium to long term, it expects the cost curve to flatten further due to the ramp-up of current projects and production increases from de-bottlenecking and productivity.

BHP maintained its views on long-run Chinese steel use. It expects a growth rate of ~1.0% per year, building toward a peak in the mid-2020s. It also expects a recovery in steel production in the rest of the world to continue after a multiyear stagnation. In the long term, it expects incremental demand from India and other emerging markets to support the global steel market.

Other mining peers

Rio Tinto’s (RIO) CEO (chief executive officer) Jean-Sébastien Jacques mentioned during the company’s earnings call for the first half of 2017 that the Chinese economy performed well in 2017. He added that the early signs for 2018 also remain positive. He noted that the order books for the Chinese steel industry remain full, which should be positive for the demand of high-grade iron ore.

Vale’s (VALE) biggest mining project, S11D, has started to ship volumes in 2017. This should boost low-cost supplies, which could put further pressure on prices.

Cliffs Natural Resources (CLF) recorded a huge discount on realized prices compared to the benchmark seaborne iron ore prices (PICK) in 2Q17. That was due to the prevailing discount for below-62.0% material compared to the benchmark.