iShares MSCI Glbl Metals & Mining Prdcrs

Latest iShares MSCI Glbl Metals & Mining Prdcrs News and Updates

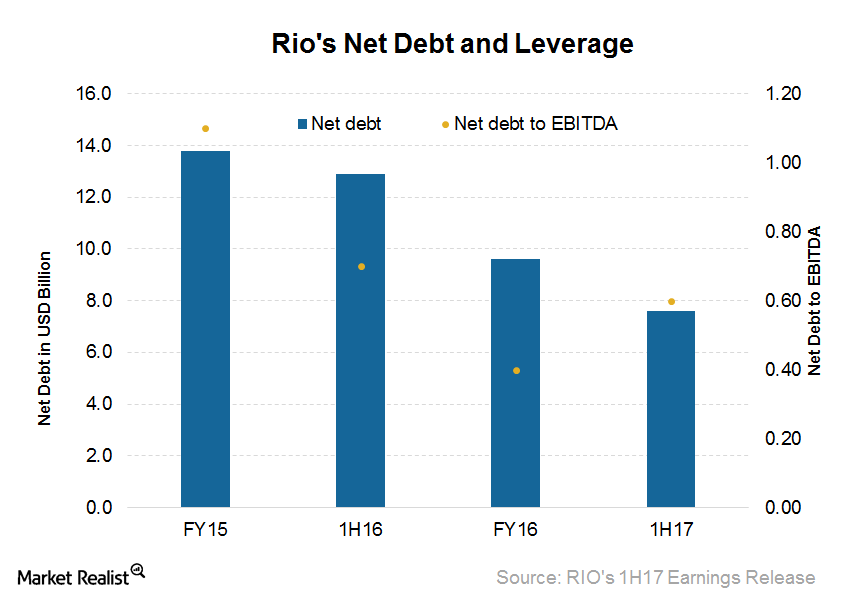

What Rio Tinto’s Balance Sheet Means for Future Growth

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

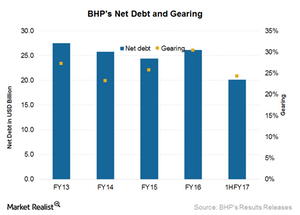

BHP’s Balance Sheet: The 2017 Outlook

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

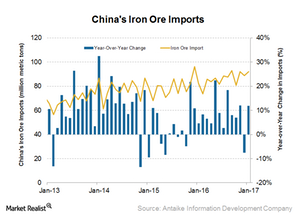

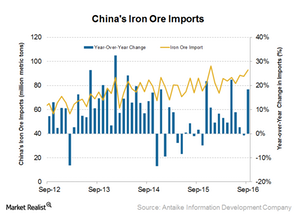

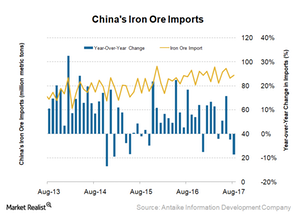

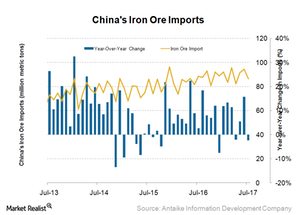

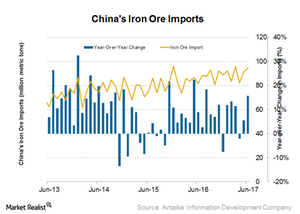

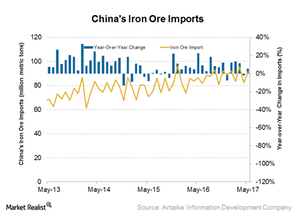

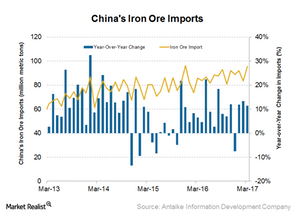

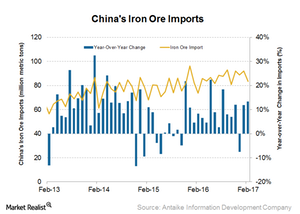

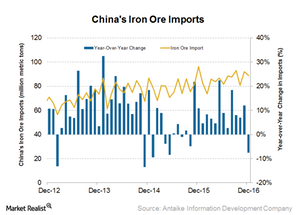

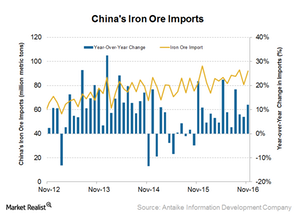

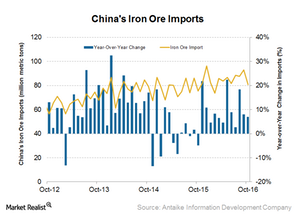

What China’s High Iron Ore Imports Suggest

China imported 92 million tons of iron ore in January 2017—a growth of 12.0% YoY and 3.4% month-over-month.

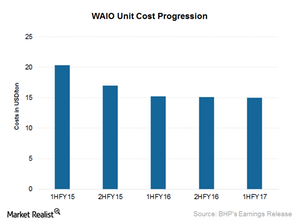

This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

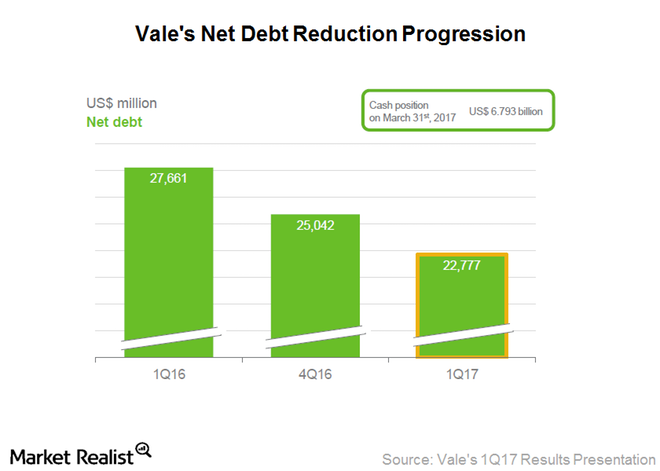

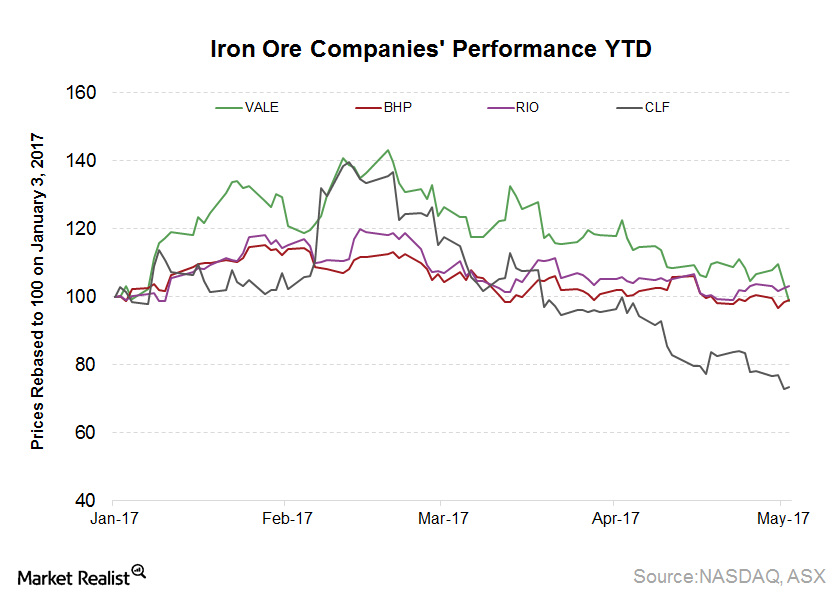

Can Vale SA Reverse Its 2Q17 Performance in 2017?

While Vale SA outperformed peers including Rio Tinto (RIO) and BHP Billiton by rising 24.7% in 1Q17, its performance deteriorated significantly in 2Q17.

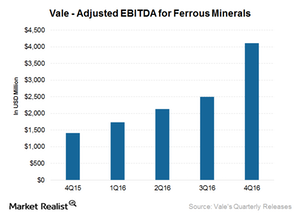

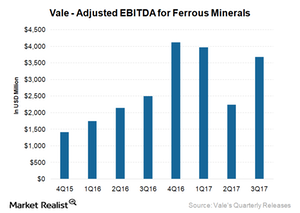

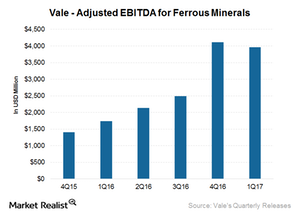

How Vale Reacted to Higher Iron Ore Prices in 4Q16

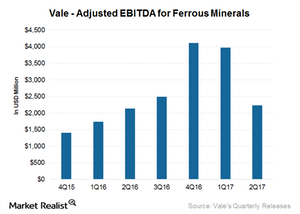

Iron ore price realization In 4Q16, Vale’s (VALE) ferrous division accounted for ~85.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals came in at $4.1 billion, which was $1.6 billion higher than 3Q16. Higher realized prices and higher sales volumes led to these rises. The CFR […]

What Led Robust Chinese Iron Ore Imports despite Contrary Views

Contrary to what was suggested by many market participants, the iron ore imports by China increased in September 2016 instead of declining.

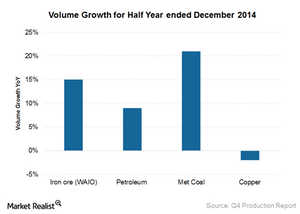

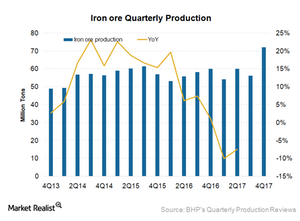

BHP reports mixed production results and maintains its guidance

Overall, BHP reported mixed 2Q15 results. It recorded a 9% production increase during the December 2014 half-year.

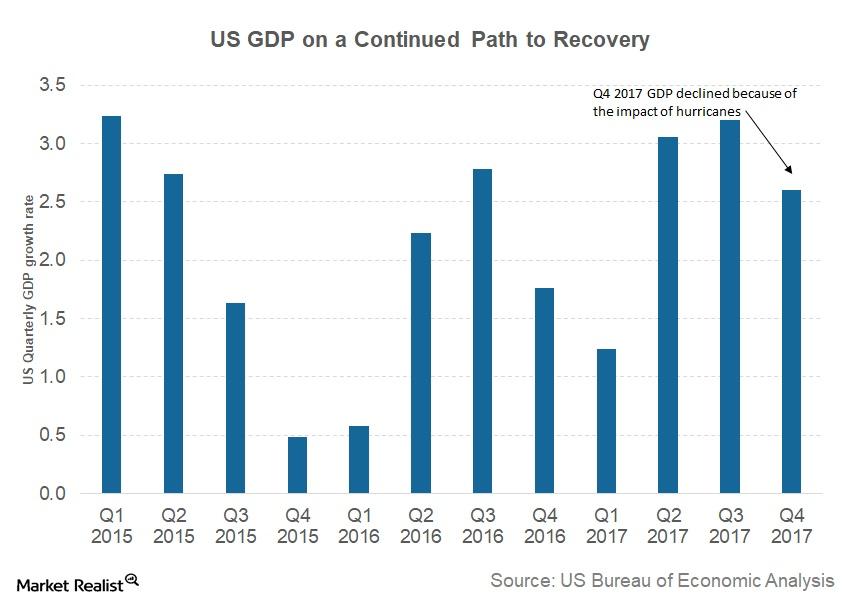

FOMC’s Review of Economic Situation Signals Strong US Economy

As per the FOMC staff report, inflation (TIP) in the US remained below the 2% target.

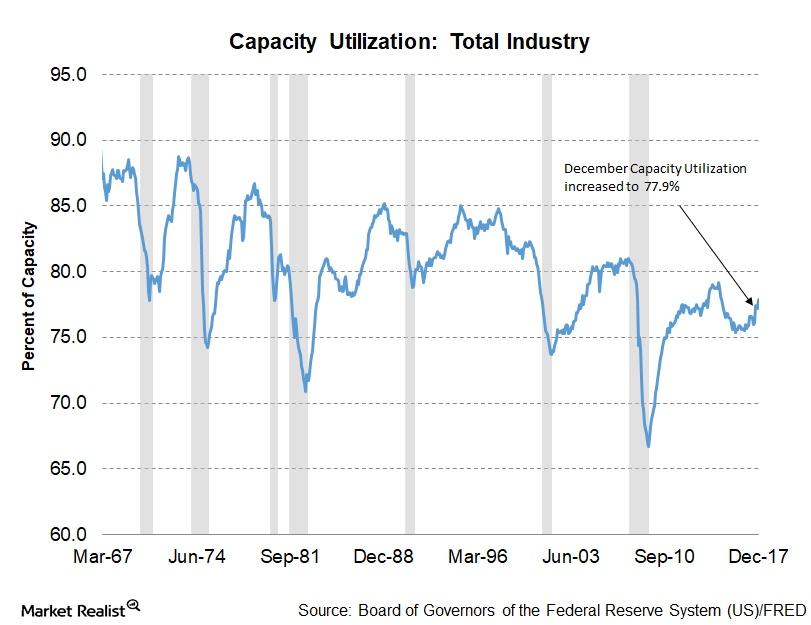

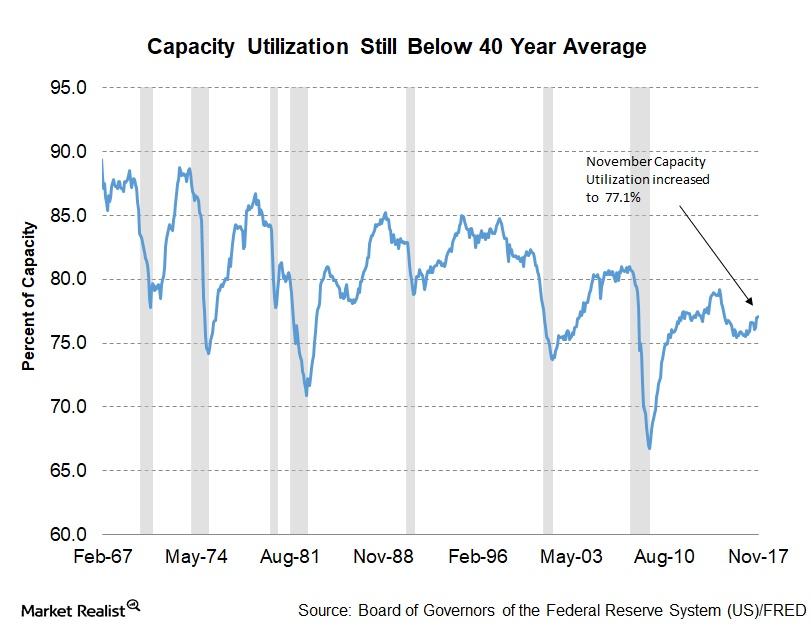

Capacity Utilization Trends across US Industries in December

Capacity utilization and the US economy Among the key macroeconomic indicators published by the Federal Reserve, US industries’ capacity utilization is particularly important for understanding the health of each industry. Changes to this indicator can help forecast any changes to the business cycle, product demand, and workforce demand. Increasing levels of capacity utilization could translate to a higher number […]

BHP Billiton Outlook: Iron Ore Volumes Flat

Iron ore (PICK) volumes are key to BHP Billiton’s (BHP) revenues and earnings as iron ore is the single largest commodity produced by the company.

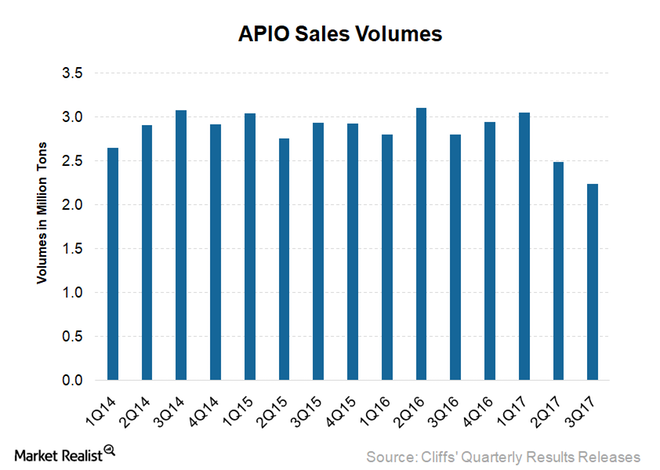

What to Expect from Cleveland-Cliffs’ Asia-Pacific Segment

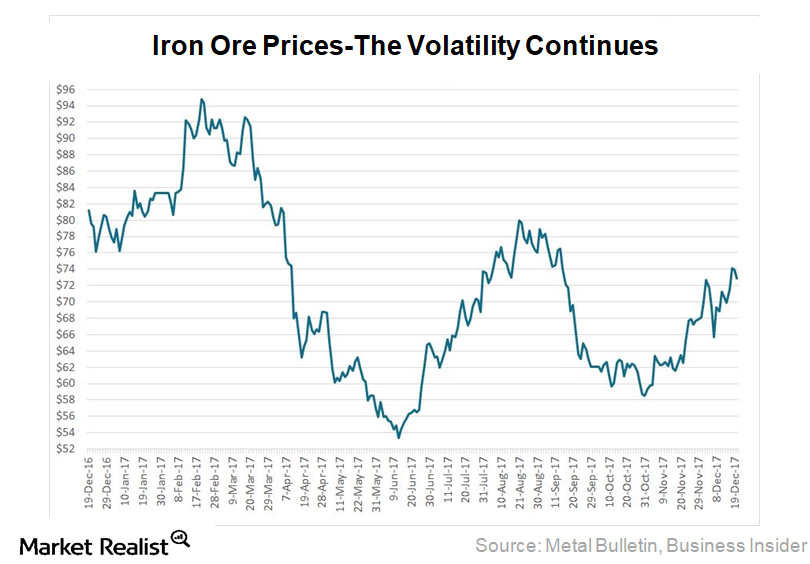

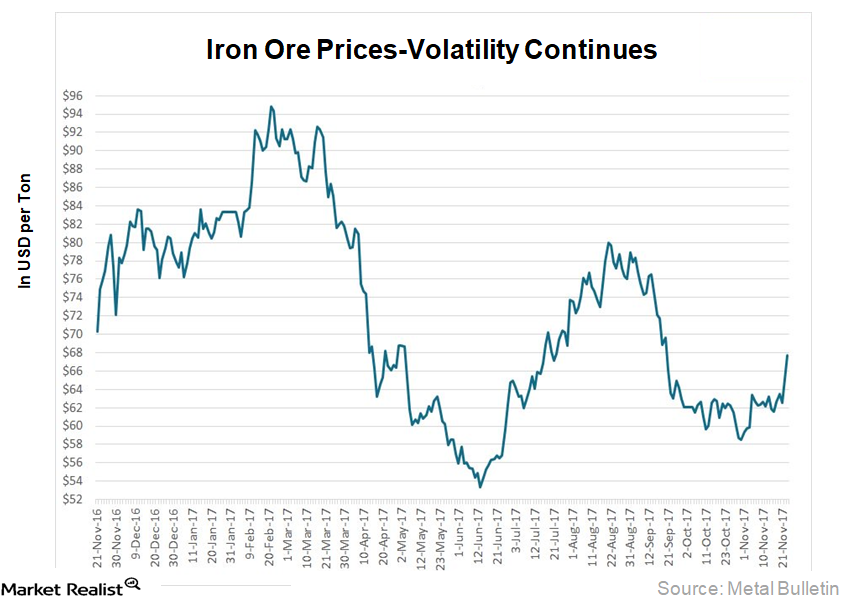

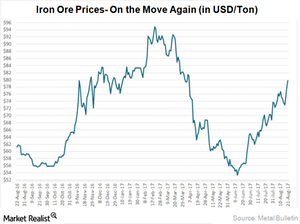

Iron ore prices have been very volatile lately. While the prices fell substantially in September 2017, they picked up after that.

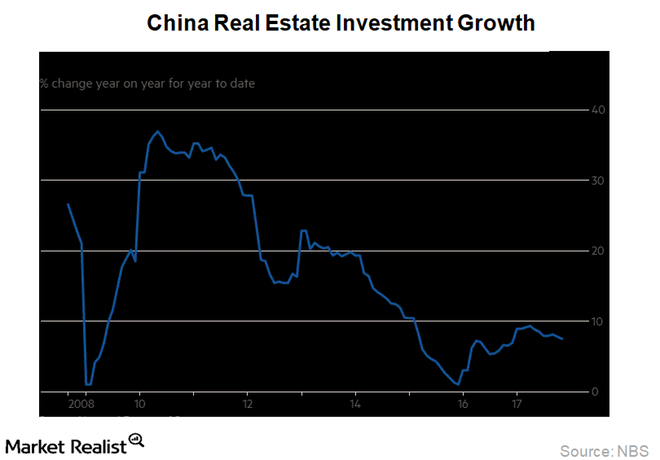

China’s Steel Demand Indicators: A Slower 2018?

China’s property sector is a steel-intensive market—consuming approximately 50% of overall steel in the country—followed by the automotive industry.

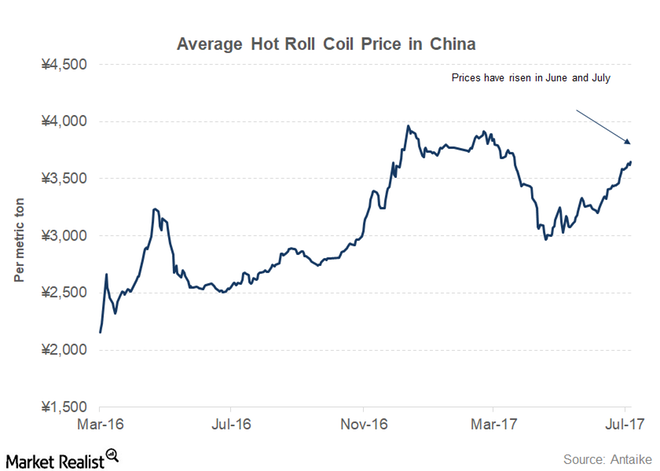

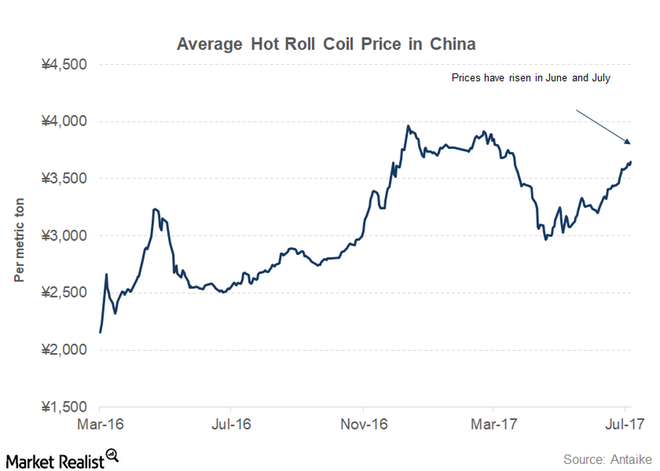

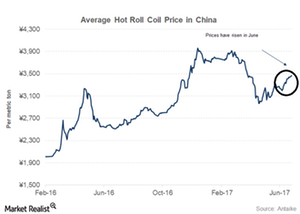

How China’s Steel Prices Can Support Iron Ore in 2018

Due to the government’s efforts to fight pollution in winter months, steel prices in China have hit a nine-year high in the first week of December 2017.

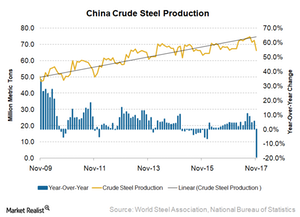

Can China’s Steel Production Pick Up after March 2018 on Pent-Up Demand?

Overall, China’s steel production in 2017 was strong, which was mostly supported by higher steel prices and firm demand.

What Are Analysts Predicting for Iron Ore Prices in 2018?

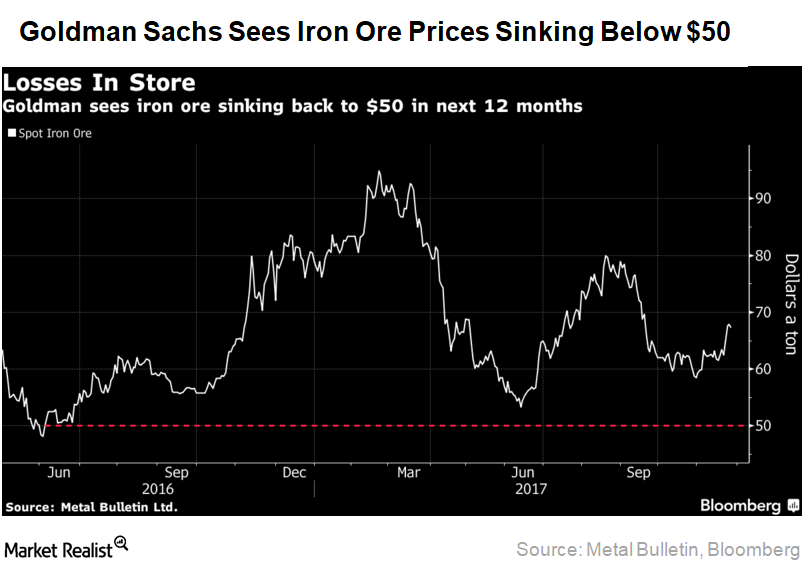

Goldman Sachs (GS) believes that iron ore prices should sink back to $50 per ton in 2018.

Iron Ore Investors Could Anticipate These Factors in 2018

Iron ore prices were tumultuous throughout 2017. There is a 44% difference between the peak of $95 per ton in February and the trough of $53 per ton experienced in July.

A Look at Capacity Utilization across US Industries in November

In the November capacity utilization report, the manufacturing sector remained strong with 76.4% capacity utilization, the highest level since May 2008.

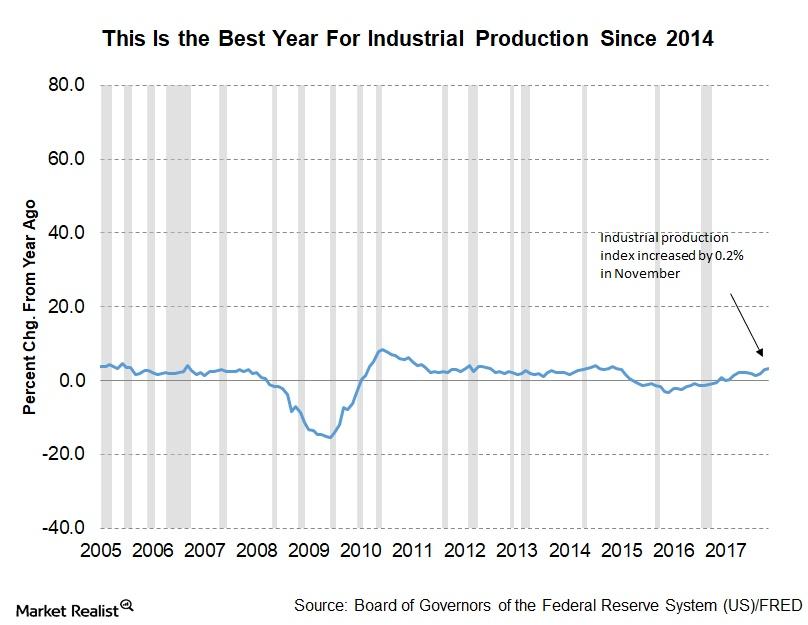

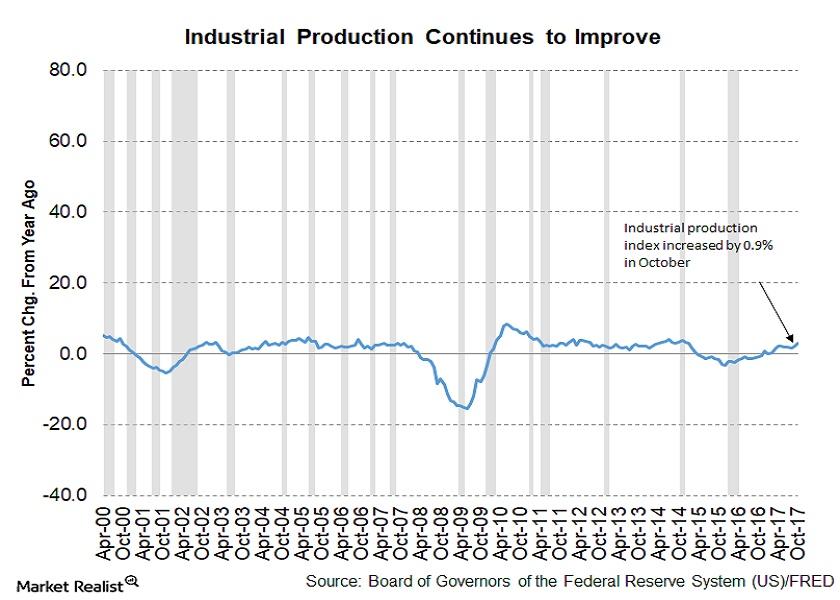

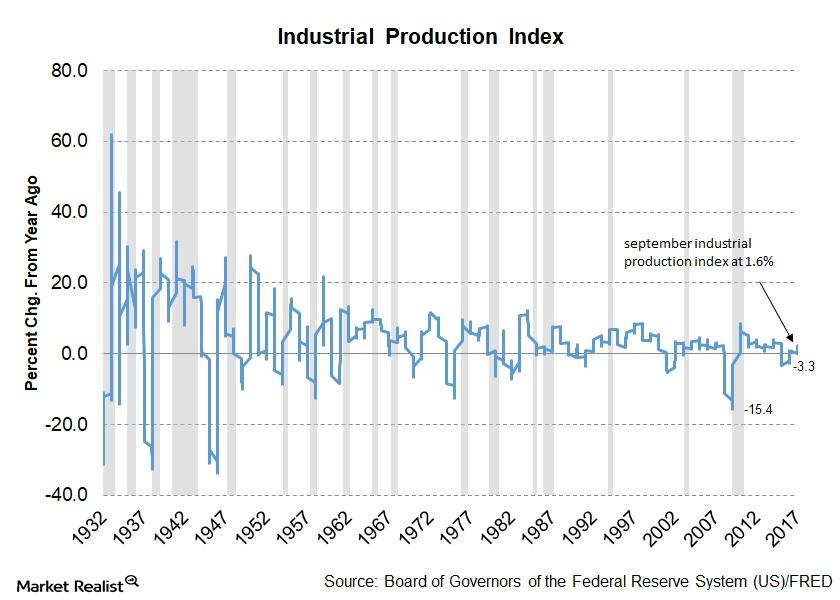

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

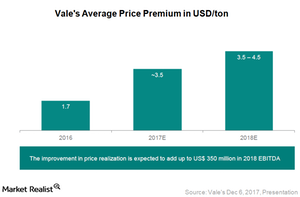

How Vale Could Benefit from a Move to Quality in Iron Ore

Vale has changed its product portfolio and quality in iron ore according to market demand. In 2017, it’s more focused on selling high-quality ore.

Can China’s Steel Prices Keep Supporting Iron Ore Prices?

In the previous part of this series, we discussed how the momentum in Chinese steel production in 2017 has come on the back of strong steel prices.

Iron Ore Rebound: How Analyst Ratings for Miners Are Changing

Iron ore prices in 2017 so far have been a roller coaster ride. Prices reached a peak of $95 per ton in February only to slump to a low of $53 per ton in July and take off soon after.

Which Industries Increased Industrial Production in October?

The October Industrial Production report was released by the Fed on November 16 and showed a continued rebound in key sectors of the US economy.

Why Vale Believes the Iron Ore Market Is in Balance

Vale’s (VALE) Ferrous division accounted for ~87.6% of its adjusted EBITDA in 3Q17, compared with ~82.0% in 2Q17.

Which Industries Increased Production Last Month?

The Federal Reserve released its September industrial production report on October 17. The report indicated that key sectors in the US economy increased production in September.

Can China’s Iron Ore Imports Support Prices?

China is the world’s largest consumer of iron ore. Therefore, to gauge the outlook for iron ore demand, it’s important to track China’s iron ore import data.

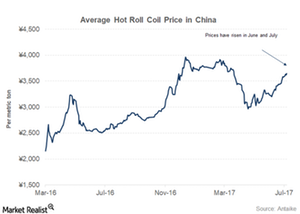

China Steel Prices Are Touching Higher Highs: Impact on Iron Ore

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date.

Why China’s Lower Iron Ore Imports in July Could Be a One-Off

China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons.

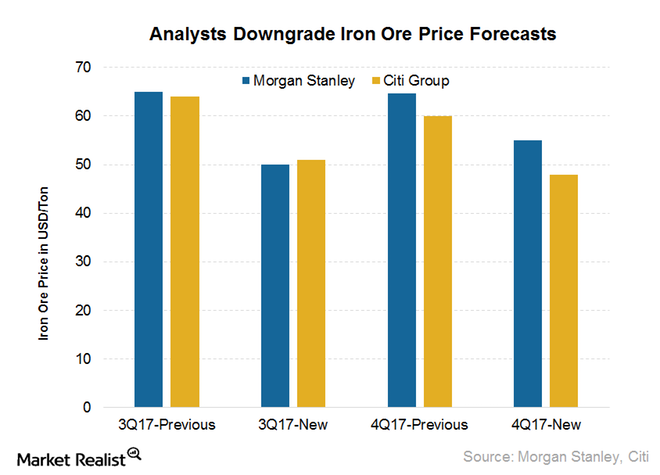

Why Analysts Are Rethinking Their Near-Term Iron Ore Price Forecasts

Goldman Sachs is bullish Although Goldman Sachs (GS) is bullish on the near-term price forecasts for iron ore, it believes that the pressure could return in the long run. In the near term, it believes that prices could be supported by the better-than-expected demand in China. Goldman Sachs believes that the supply pressure could build […]

Does BHP Billiton Expect to Sustain Iron Ore Price Momentum?

BHP Billiton (BHP) attributed the rise in iron ore prices to higher pig iron production in China, the preference for higher grade materials, and improved steel margins.

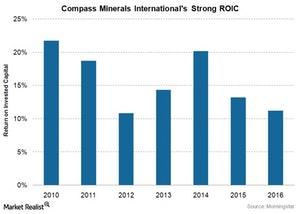

What’s Compass Minerals Doing to Gain a Cost Advantage?

Led by its superior assets, location, and geological advantages, Compass Minerals holds a competitive position with a wide economic moat rating.

What’s the Outlook for Vale’s Iron Ore Division?

Vale’s (VALE) ferrous division accounted for ~82%.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 2Q17.

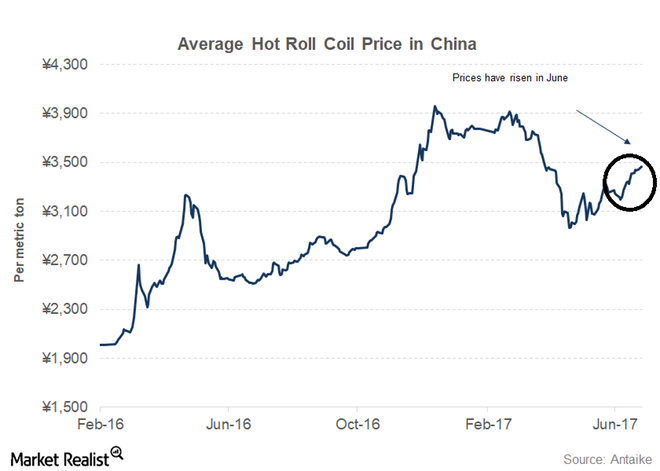

Chinese Steel Prices Are Surging—Can They Keep the Momentum?

Chinese steel production has been hitting one record after another. This renewed vigor in the Chinese steel industry is due to higher steel prices.

China’s Iron Ore Imports Surged in June—Where Will They Go Next?

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

Analysts’ Views: What Iron Ore Price Could Bring Balance?

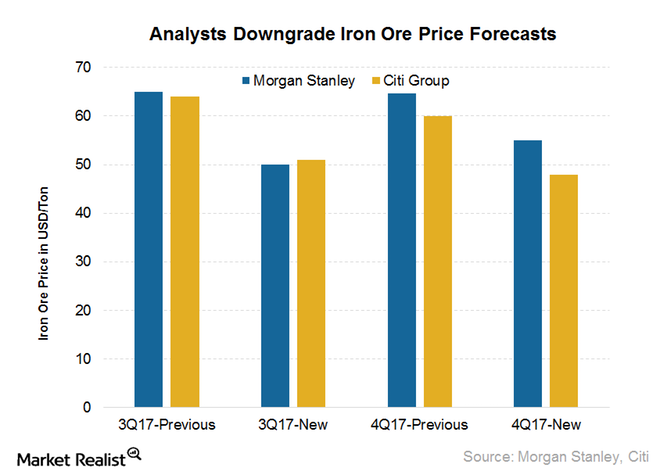

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

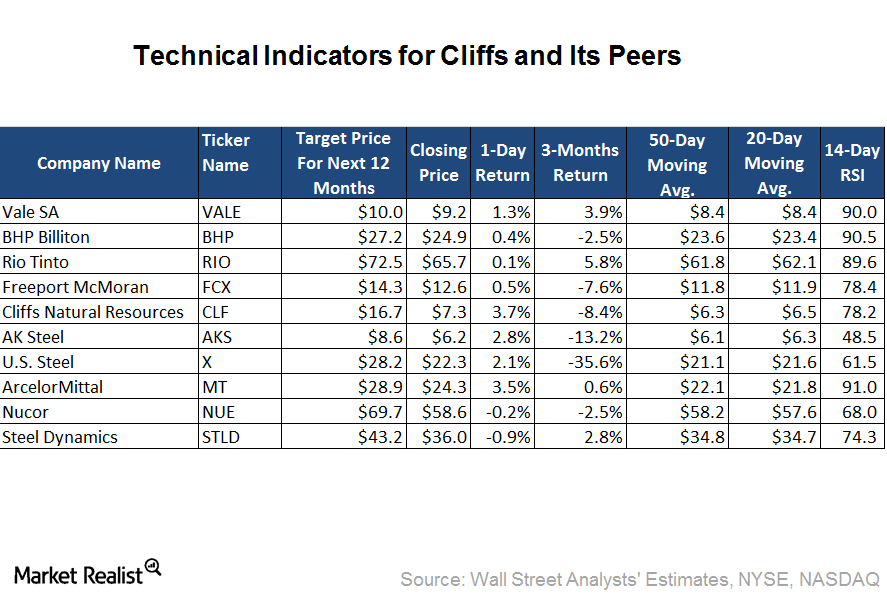

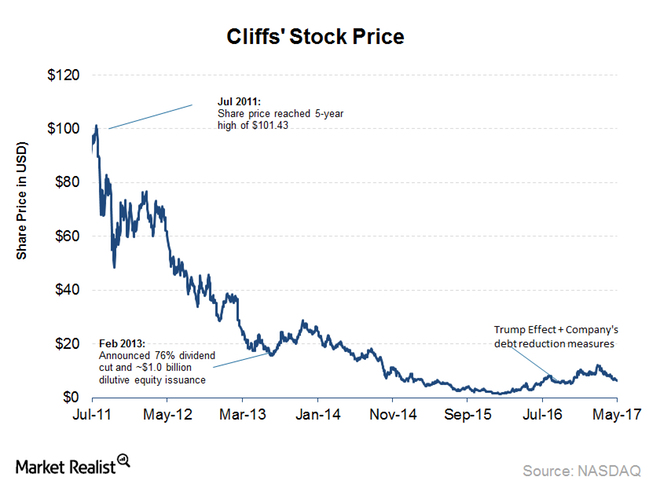

CLF and Peers in Overbought Territory: What Triggered It?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.

Why China’s June Iron Ore Import Outlook Is Strong

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

Cliffs Natural Resources’ First HBI Plant: What You Need to Know

The estimated investment needed for Cliffs Natural Resources’ (CLF) HBI (hot briquetted iron) plant is ~$700 million.

What Will Drive Vale SA’s Iron Ore Division Going Forward?

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

These Factors Led to Weakness in Vale Stock after 1Q17

In 1Q17, Vale (VALE) significantly outperformed its major peers with a rise of ~25%.

China’s Iron Ore Imports Remain Strong: What’s the Outlook?

Strong Chinese iron ore imports China imported 95.6 million tons of iron ore in March, compared with 83.5 million tons in February 2017. This figure implies a strong growth of 11% year-over-year (or YoY). This number is also the second-highest monthly amount on record. China imported 96.3 million tons of iron ore in December 2015. […]

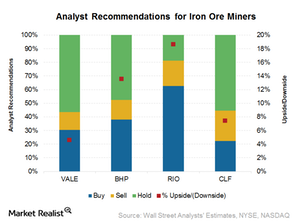

Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

What China’s Resilient Iron Ore Imports Mean for Miners

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

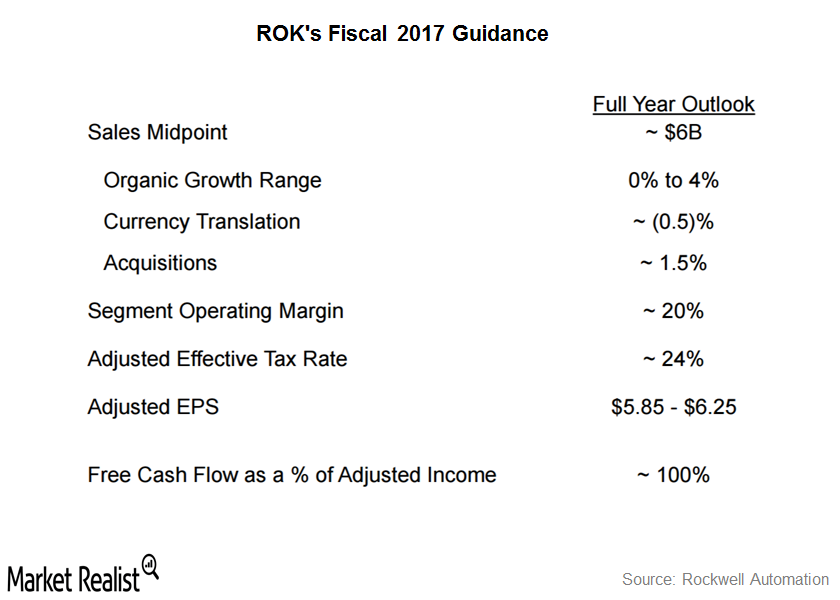

Rockwell Automation’s Fiscal 2017 Guidance: A Closer Look

ROK maintains that oil prices have recovered since early 2016 and that most of its business in the heavy industries end market is expected to stabilize.

What’s the Outlook for Chinese Iron Ore Imports?

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

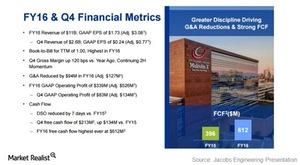

Jacobs Engineering Posts the Highest Annual Free Cash Flows

Jacobs Engineering Group declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77.

After 3 Years, Rockwell Could See Sales Growth in Fiscal 2017

Rockwell Automation maintains that oil prices have recovered since the beginning of 2016, and most of its business in the heavy industries end market is expected to stabilize.