China Steel Prices Are Touching Higher Highs: Impact on Iron Ore

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date.

Aug. 29 2017, Updated 10:37 a.m. ET

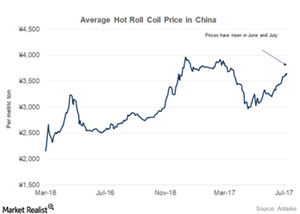

China’s steel prices are surging

Previously in this series, we discussed the new records set by Chinese steel production with each month’s production report. This renewed optimism in production is due to higher Chinese steel prices, which encourage mills to fill the void created by the shutdown of illegal and low-quality steel capacity in the country.

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date. The recent announcements by Chinese authorities regarding shutting down more capacity in the winter months to curb pollution is also working in favor of higher prices.

As customers anticipate lower future supply due to these shutdowns, they’ve brought their purchases forward. This trend has affected prices favorably.

What’s driving prices?

Investors should note that the rally in steel prices is not entirely driven by fundamentals. The China Iron and Steel Industry Association (or CISA) noted in August that the surge in steel futures was driven by speculation over the impact of future capacity cuts.

While some analysts feel that the current steel margins could seem unsustainably high, they could continue for a while due to the mounting supply restrictions.

Impact on mining companies

While high steel prices are supporting steel production and thus iron ore demand, the unsustainable margins could lead to a correction in the coming months. A halt in the steel price rally in China would be negative for seaborne suppliers (PICK) such as Rio Tinto (RIO), BHP Billiton (BHP) (BBL), Vale (VALE), and Cliffs Natural Resources (CLF).