BHP Billiton PLC

Latest BHP Billiton PLC News and Updates

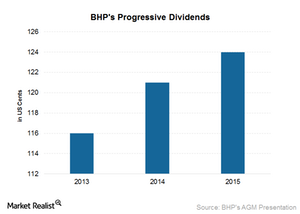

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

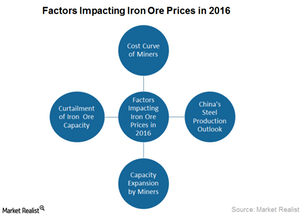

Factors Impacting Iron Ore’s Performance in 2016

China’s (MCHI) economic slowdown is the biggest challenge for global metal and mining companies, which is why iron ore investors should keep a close eye on the Chinese economy.

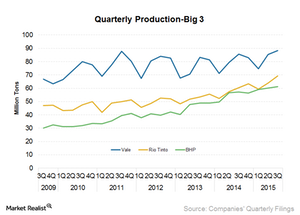

Iron Ore Companies’ Production Continues Unabated Growth

The weak demand from China is hurting iron ore prices. The supply side, on the other hand, remains quite strong.

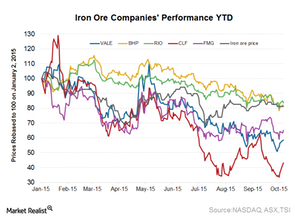

What is Driving the Iron Ore Miners’ Stock Price Performance?

Iron ore prices fell 49% in 2014, which was reflected in the share price performance of major miners. In this series, we’ll discuss the position of various iron ore players on the cost curve relative to iron ore prices.

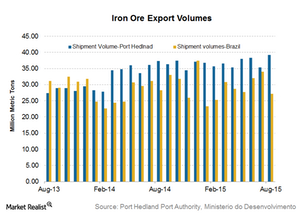

Iron Ore Shipments Remain Strong for August

Iron ore shipments through Port Hedland reached an all-time high of 39.2 million tons in August as compared to 35.3 million tons in July.