Factors Impacting Iron Ore’s Performance in 2016

China’s (MCHI) economic slowdown is the biggest challenge for global metal and mining companies, which is why iron ore investors should keep a close eye on the Chinese economy.

Jan. 27 2016, Updated 8:05 a.m. ET

Price drivers

The price of any commodity, including iron ore, is driven by the supply of and the demand for that commodity. In turn, this impacts the fortunes of iron ore miners such as BHP Billiton (BHP) (BBL), Rio Tinto (RIO), Vale SA (VALE), and Cliffs Natural Resources (CLF).

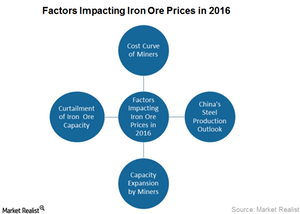

To be specific, there are four key factors that could drive iron ore companies’ performance in 2016:

- China’s steel production outlook

- Capacity expansion plans by majors

- Curtailment in iron ore capacity in China and elsewhere

- Cost curve of miners

Steel demand

In the coming parts of this series, we’ll explore how each of these factors might play out in 2016, which should give us a better understanding of the iron ore industry’s 2016 outlook. We’ll begin by looking at how Chinese steel demand could shape up in 2016.

China’s (MCHI) economic slowdown is the biggest challenge for global metal and mining companies, which is why iron ore investors should keep a close eye on the Chinese economy.

Supply side

While demand is one part of the equation, a buoyant supply side has been another major reason for the current woes of the iron ore miners. The capacity planned at the time of Chinese construction and the infrastructure-led boom has come online when the demand growth from the world’s largest iron ore consumer faltered. So, it is important to look at the miners’ expansion plans going forward in 2016.

Capacity curtailment in the iron ore sector is one of the factors that can limit the downside to the iron ore prices. This would occur by correcting the supply-demand imbalance to an extent, so investors should also keep an eye on this.

Investors who want broad-based exposure to this industry can consider the SPDR S&P Metals and Mining ETF (XME). Currently, XME has almost half of its holdings invested in US-based steel companies.