iShares MSCI Glbl Metals & Mining Prdcrs

Latest iShares MSCI Glbl Metals & Mining Prdcrs News and Updates

Caterpillar’s 3Q16 Earnings Bring ‘Inflection’ Back into Focus

Caterpillar, the world’s largest manufacturer of construction and mining equipment, will declare its 3Q16 earnings before the market opens on October 25.

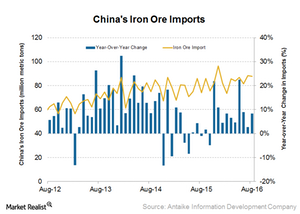

Could China’s Iron Ore Imports Pull Back in the Near Term?

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

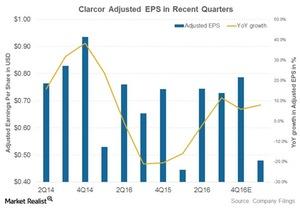

Higher Productivity and Lower Sales Highlight Clarcor’s 3Q Results

Clarcor beat Wall Street estimates by four cents with 3Q16 adjusted earnings per share (or EPS) of $0.73.

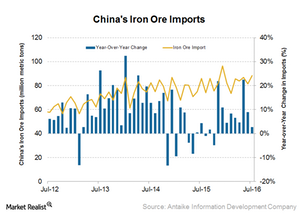

Why China’s Iron Ore Imports May See a Near-Term Pullback

In July 2016, China’s iron ore imports came in at 88.4 million tons. This was a rise of 2.7% compared to 86.1 million tons in July 2015 and 81.6 million tons in June 2016.

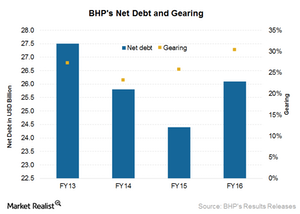

A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

More Losses? Caterpillar Puts Part of Its Mining Business on Sale

Caterpillar logged four consecutive quarters of operating losses in the Resource Industries segment—it houses the mining equipment business.

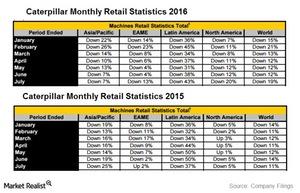

Investors Shouldn’t Expect Near-Term Optimism from Caterpillar

Caterpillar (CAT) released its retail statistics for July on a three-month rolling basis on August 18. However, Caterpillar’s retail sales fell in July.

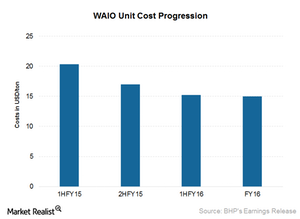

How Much Lower Can BHP Billiton Push Its Costs in Iron Ore?

BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

Parker-Hannifin’s 2017 Guidance Suggests Slowdown in Industrials

Parker-Hannifin has guided its fiscal 2017 adjusted EPS at $6.40–$7.10. The midpoint of this range is roughly 4.5% higher than $6.46 in fiscal 2016.

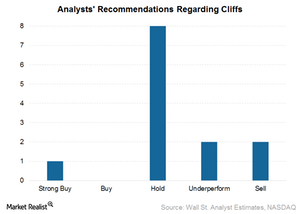

What’s the Current Market Sentiment for Cliffs Natural Resources?

As for market sentiment, Cliffs (CLF) seems to be on the receiving end. Most of it is due to the worsening current and future outlook for iron ore prices.

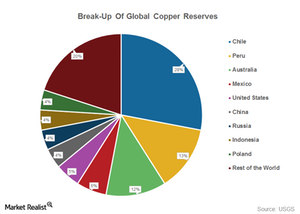

An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.