How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.

Dec. 16 2015, Published 7:31 p.m. ET

What happened at Samarco?

Tailings are residues from the crushing process of iron ore. They are made up of sand and iron ore. They are usually mixed with water and stored in large dams. At Samarco, Brazil, the tailings were stored in a series of three-tiered dams. On November 5, 2015, the middle dam failed and caused the dam below it to overflow.

These tailings flooded the surrounding villages, which caused at least 13 people to be killed. At least six others remain missing.

Legal proceedings

The Brazilian federal government and some state governments have announced that they intend to start legal proceedings against Samarco, Vale (VALE), and BHP Billiton (BHP) (BBL) for the tailings dam failure. The suit will be for approximately 20 billion Brazilian real ($5.2 billion).

The lawsuit relates to environmental and community damages. This in on top of the ~$260 million that Samarco has already agreed to contribute in an emergency fund and the $65 million that it will pay in fines to Brazil’s environmental authorities.

Samarco’s future

Given such punitive fines, Samarco’s future could come into question as all its equity value erodes.

Samarco’s cash position is $700 million. It has also agreed to deposit $260 million into an emergency fund. Its debt service is $200 million per year. Though Samarco is a separate entity and a 50-50 joint venture between Vale and BHP, Brazil’s attorney general has mentioned that controlling shareholders have direct responsibility, and it will treat the three entities as one for legal purposes.

The operations at Samarco continue to remain suspended and could remain so for 12 months to two years, according to different estimates.

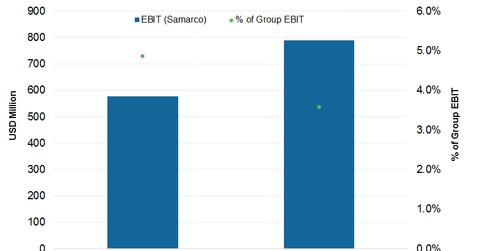

Samarco contributed 4.9% to BHP’s EBIT (earnings before interest and tax) in fiscal 2014 and 3.6% in fiscal 2015. In addition, BHP’s share of Samarco’s production was 14.5 million tons in fiscal 2015, or 6.2% of BHP’s overall iron ore production.

BHP may also have to pay its share (50% of $5.2 billion) of legal liabilities arising out of Samarco. In addition to the financial impact, the event will likely have a long-lasting impact on BHP’s reputation.

While Samarco will have a one-off impact on BHP and Vale, commodity prices (XME) in general are taking their toll on mining companies such as Rio Tinto (RIO), Glencore (GLNCY), and Freeport-McMoran (FCX).

In the next part of this series, we’ll see how BHP might perform in the current depressed iron ore environment.