Freeport-McMoRan Inc

Latest Freeport-McMoRan Inc News and Updates

FCX Stock Is a Good Buy for Investors as Copper Prices Top $10,000

Copper prices have hit the $10,000 per metric ton level. Here's why Freeport-McMoRan (FCX) looks like a good stock to buy now.

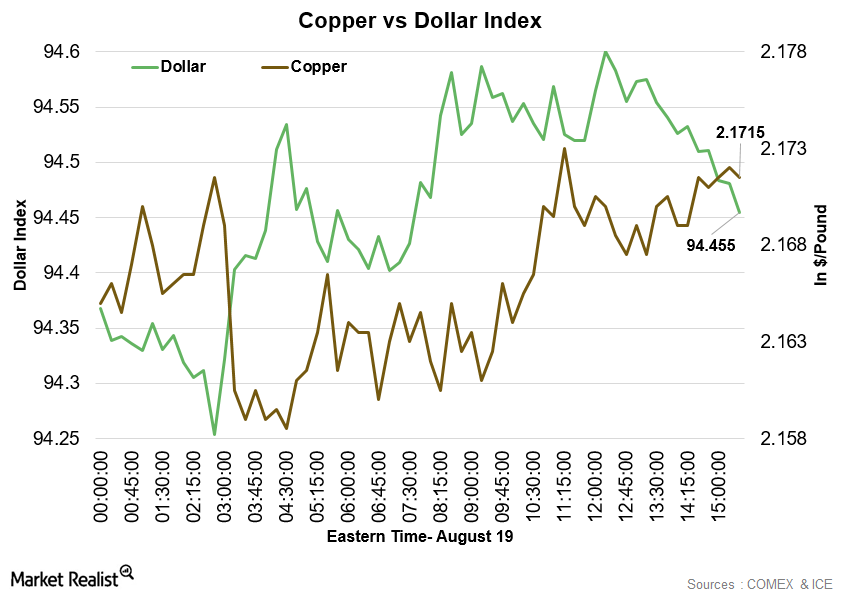

Copper Weaker on August 19 Due to Weaker Demand Signs

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

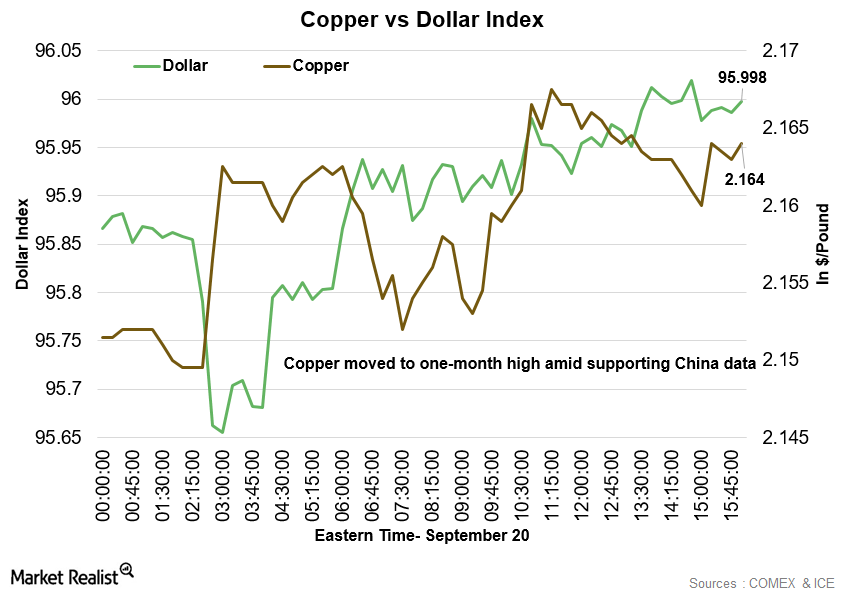

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

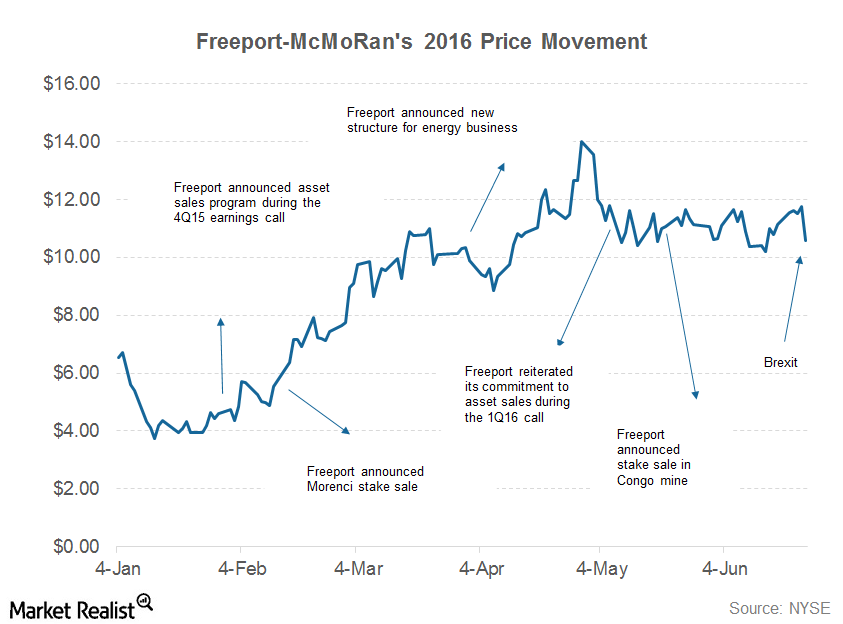

Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

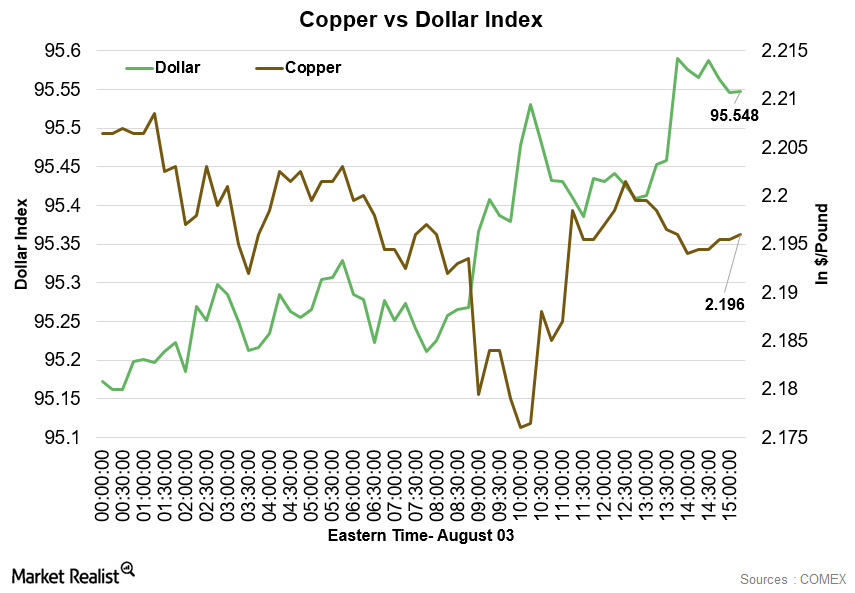

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.

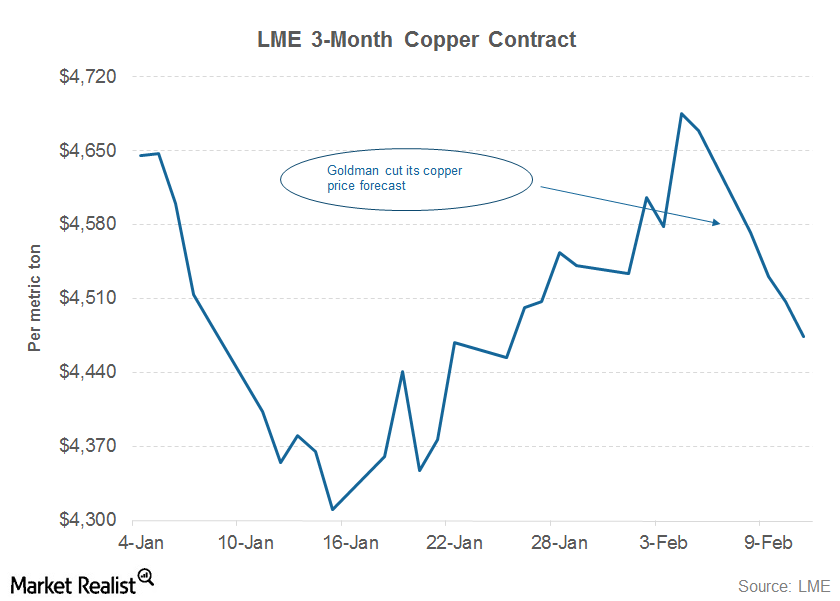

Must Know: Goldman Provided Fodder to Copper Bears

Goldman Sachs (GS) now expects copper prices to fall to $4,000 per metric ton this year. In its previous guidance, Goldman had expected copper to fall to $4,500 per metric ton in 2016.

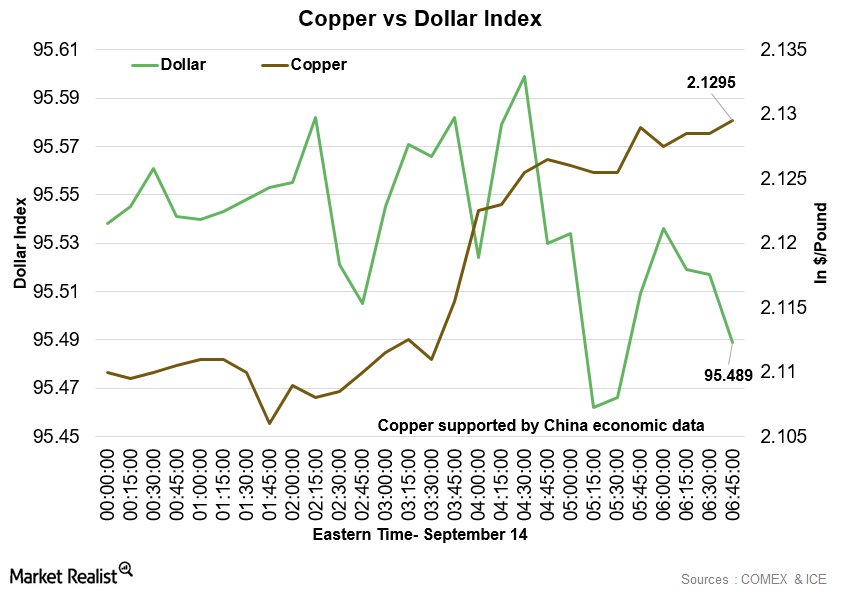

Why Is Copper Trading High in the Early Hours on September 14?

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

Is Freeport-McMoRan, FCX, Stock a Buy or Sell?

Copper demand will likely rise in the next decade. Should you buy or sell Freeport-McMoRan (FCX) stock after the rally this year?

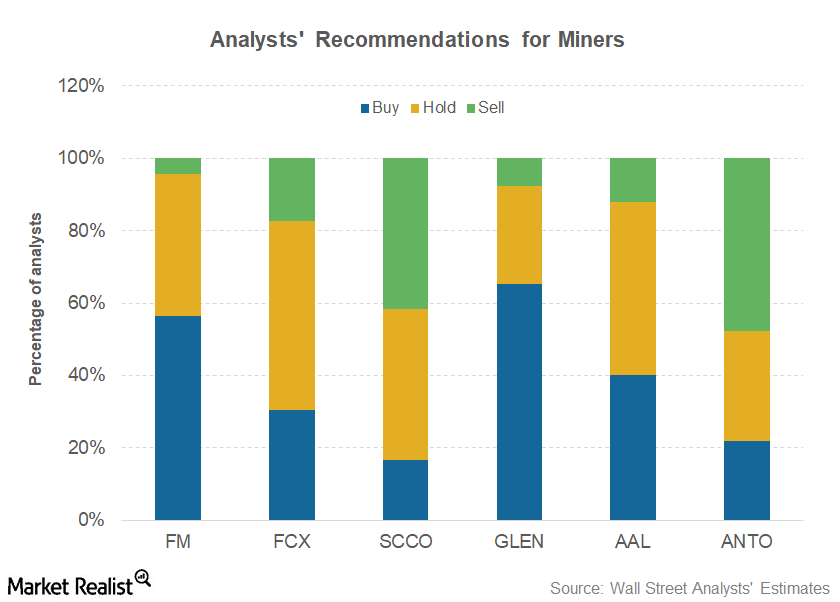

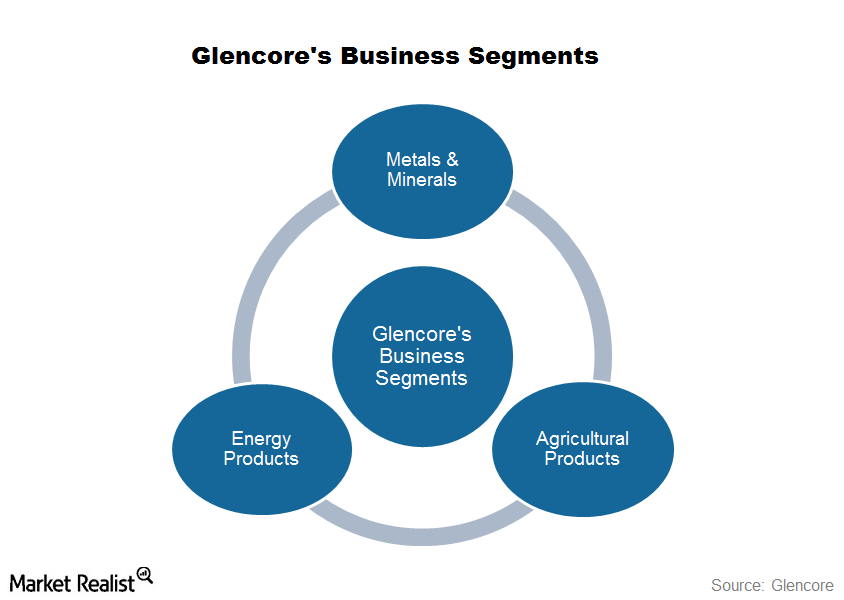

Glencore or Freeport: Which Has More Upside Potential?

Glencore (GLEN-L) has the highest percentage of “buy” or higher recommendations in our select group of mining stocks.

Understanding Glencore’s Metals and Mining Business

Glencore’s metals and mining segment was the second-biggest contributor to its 1H15 revenues.

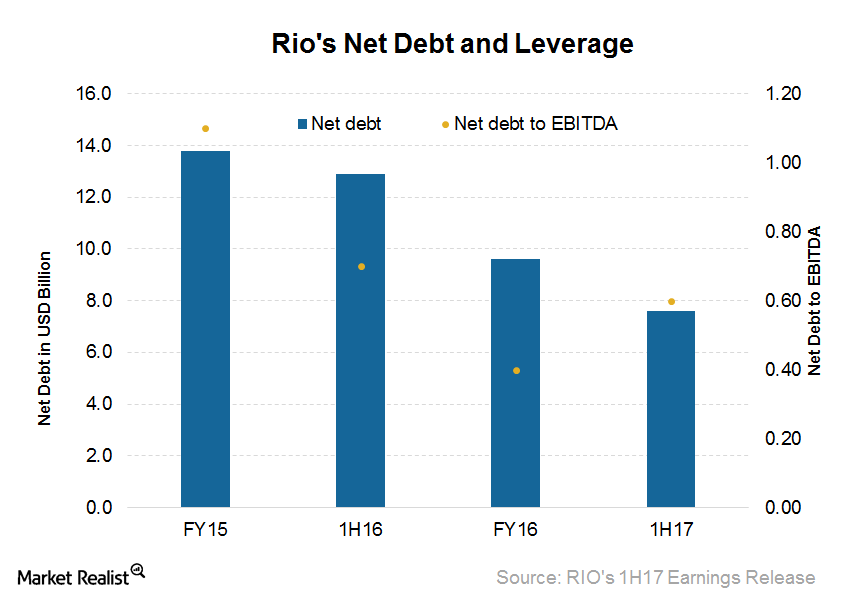

What Rio Tinto’s Balance Sheet Means for Future Growth

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

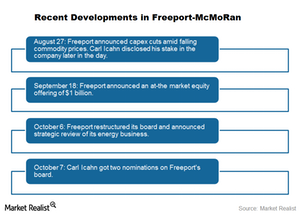

Icahn Lift or Commodity Drag: What Could Drive Freeport-McMoRan?

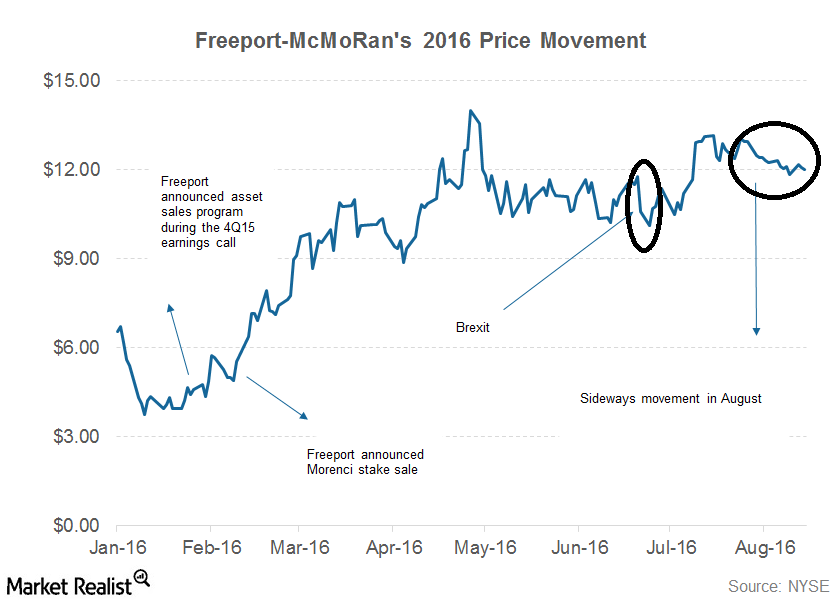

Freeport-McMoRan (FCX) jumped smartly in August after activist investor Carl Icahn disclosed his 8.5% stake in the company, known as the “Icahn lift.”

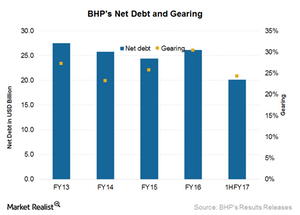

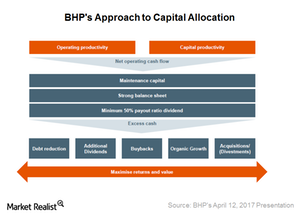

BHP’s Balance Sheet: The 2017 Outlook

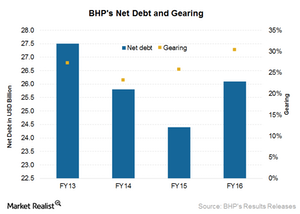

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

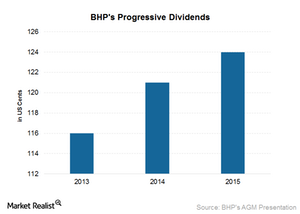

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

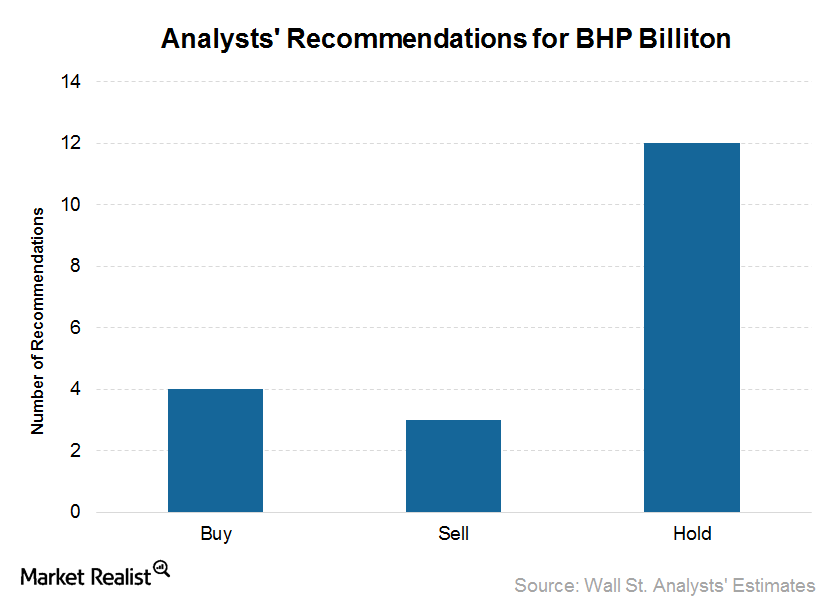

Inside BHP Billiton’s Recent Upgrades and Downgrades

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

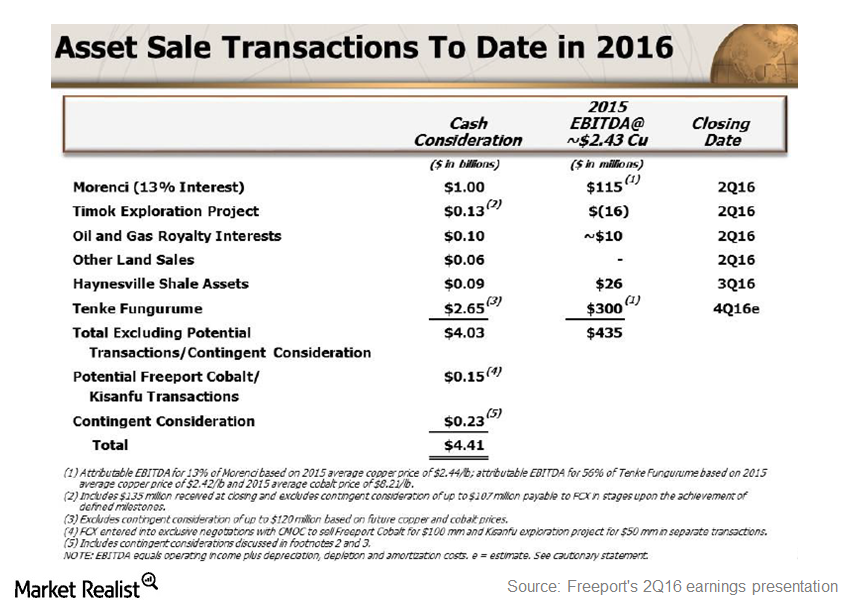

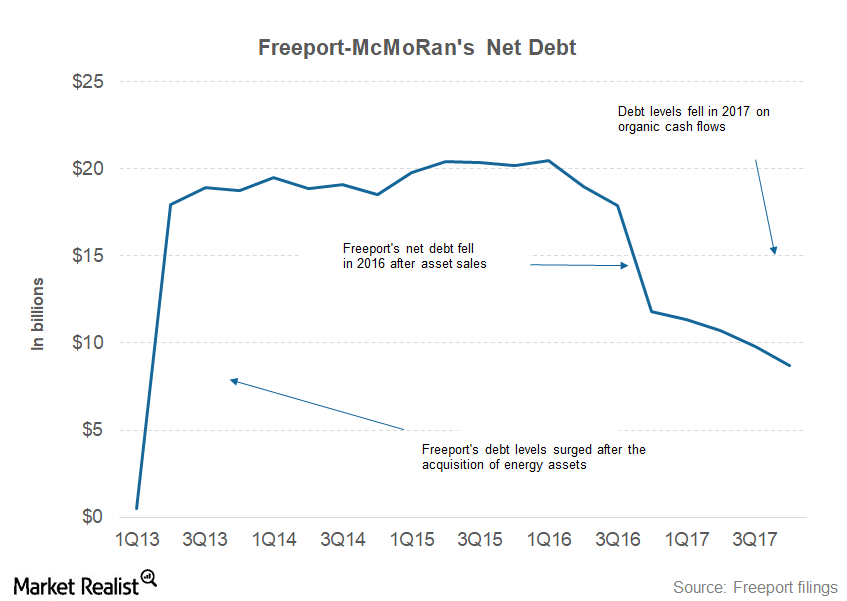

Freeport-McMoRan’s Debt Reduction Plan: Key Takeaways

During its 4Q15 earnings conference call, Freeport-McMoRan (FCX) mentioned a debt reduction program to raise $5 billion–$10 billion to shore up its balance sheet.

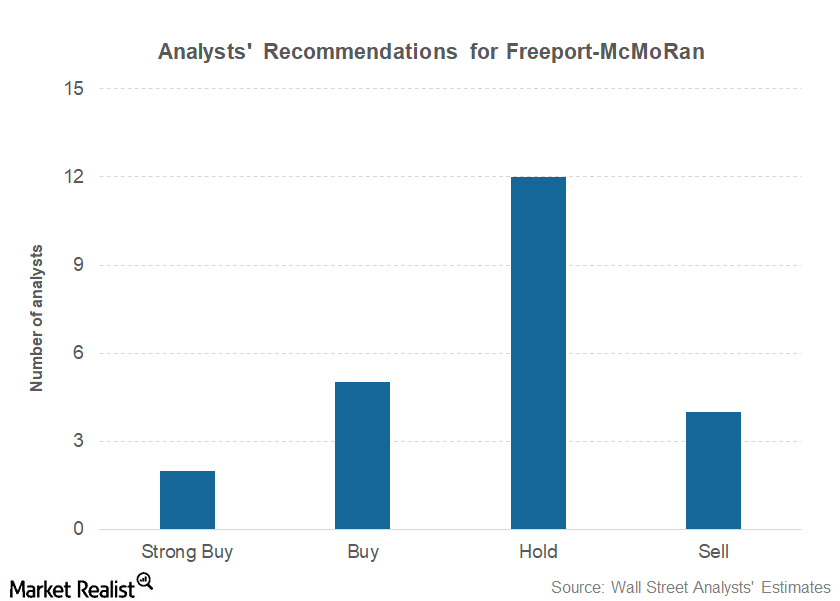

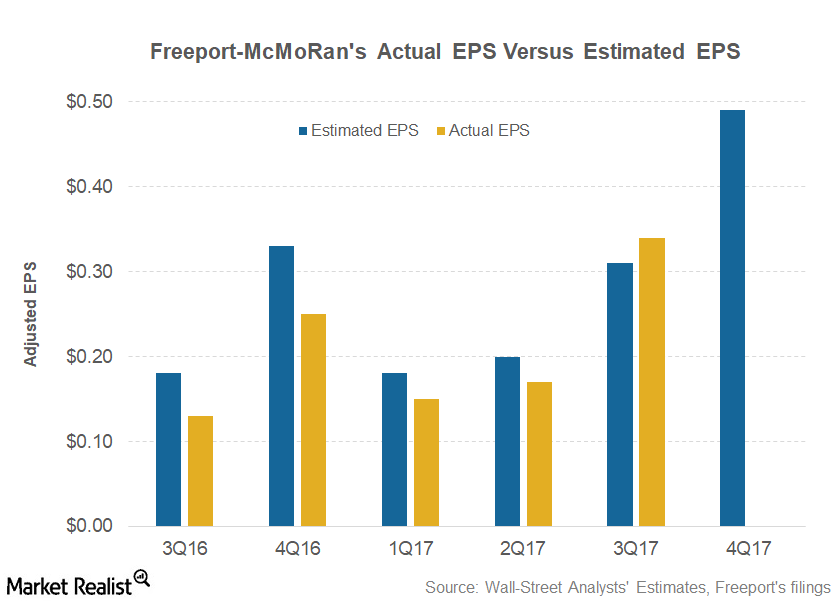

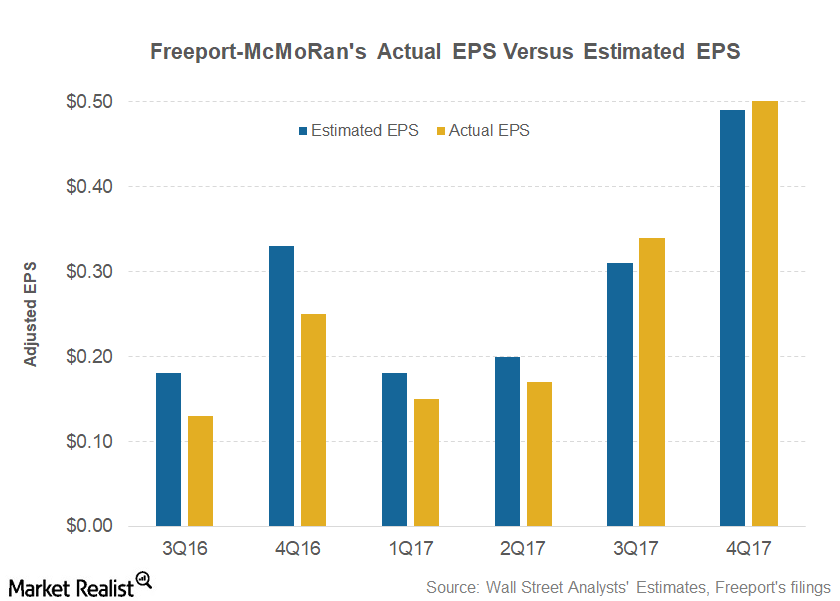

How Analysts View Freeport after Its 3Q17 Earnings Beat

Freeport-McMoRan released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17.

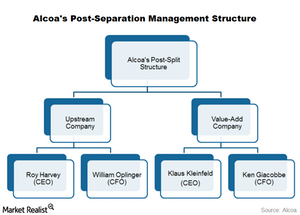

Will Elliott Management Start Taking an Active Interest in Alcoa?

Elliott Management plans to engage in a “constructive dialogue” with Alcoa’s board about Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

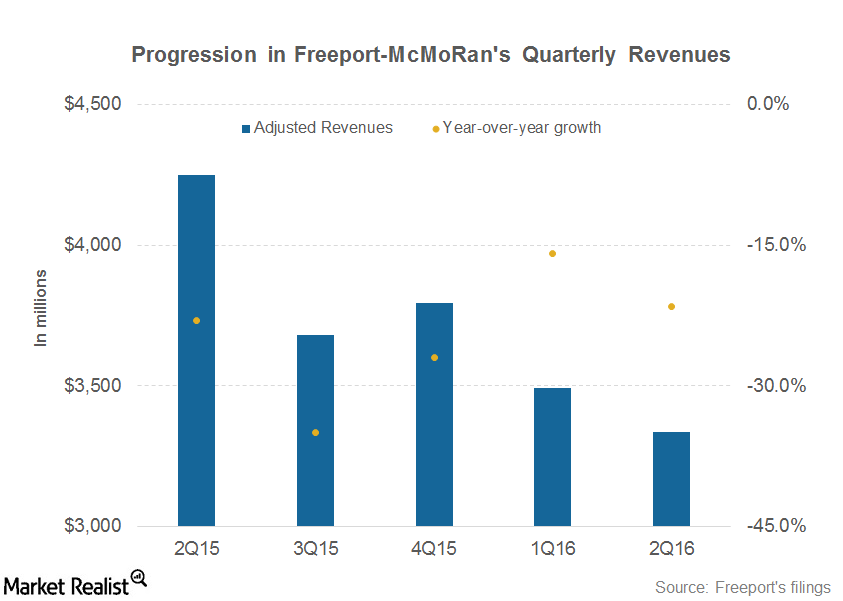

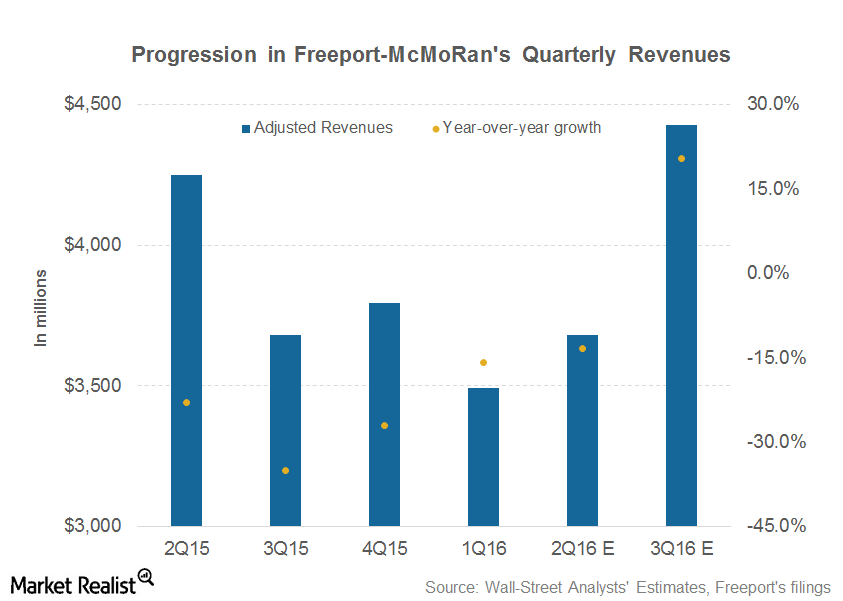

Why Freeport-McMoRan Missed Q2 Revenue Estimates

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15.

Can Freeport’s 4Q17 Earnings Keep Investor Optimism Alive?

Freeport-McMoRan (FCX), the leading US-based copper miner (XME), is scheduled to release its 4Q17 earnings on January 25.

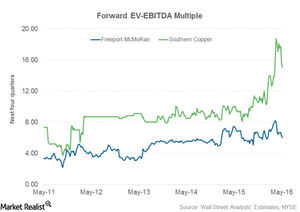

Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

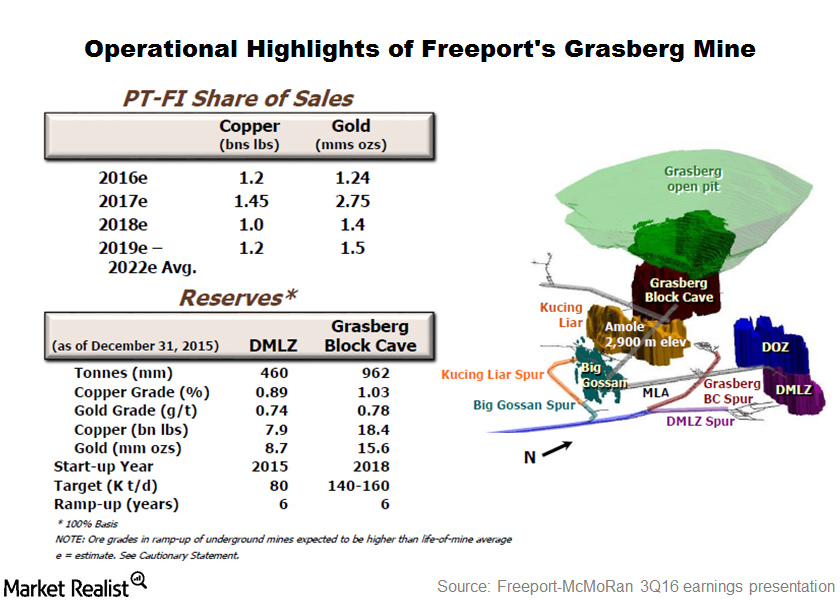

The Love-Hate Relationship between Freeport and Indonesia

According to Freeport-McMoRan’s agreement with Indonesia’s government, it must divest an additional 20.6% stake in its Indonesian operations to the government or its citizens.

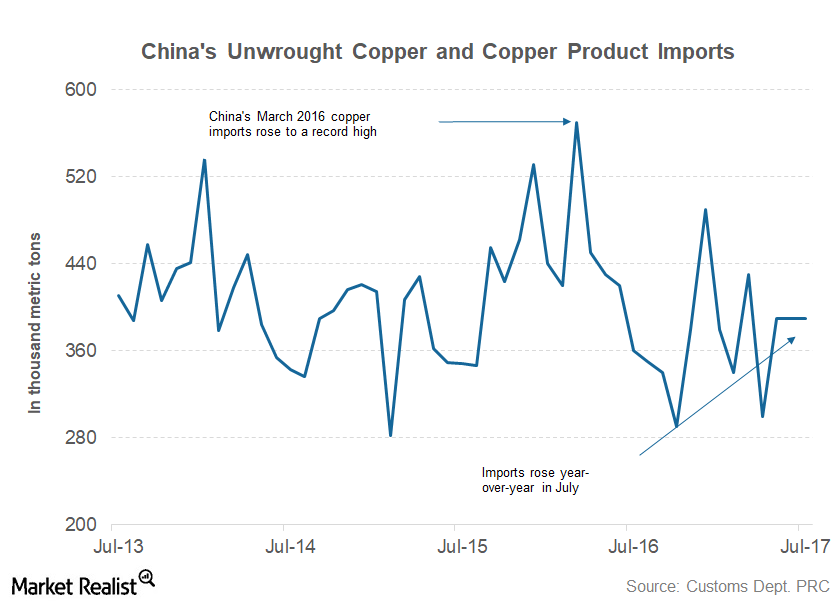

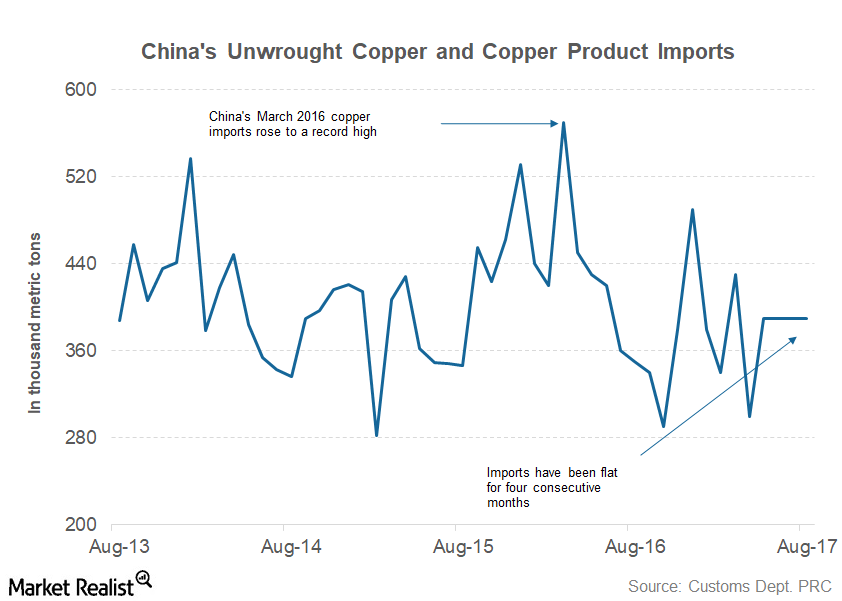

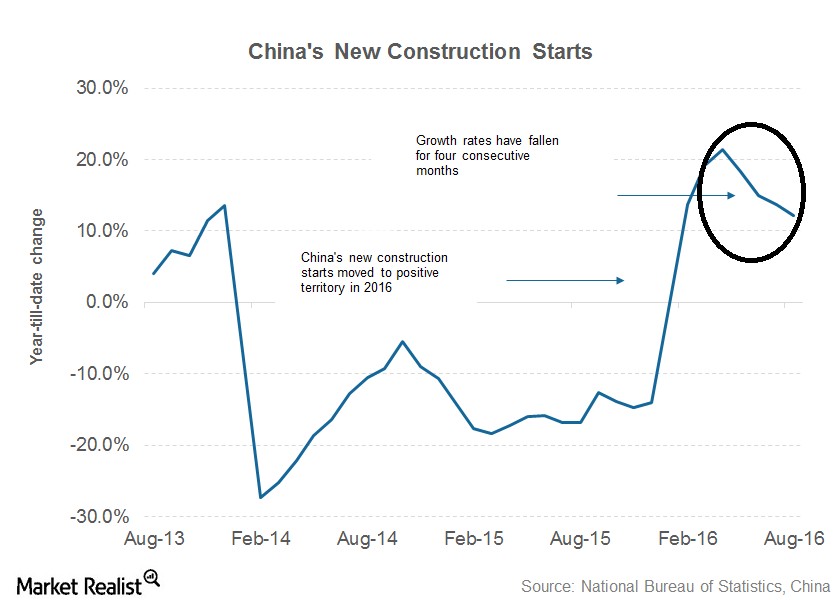

Chinese Copper Imports: Can Freeport’s Good Run Continue?

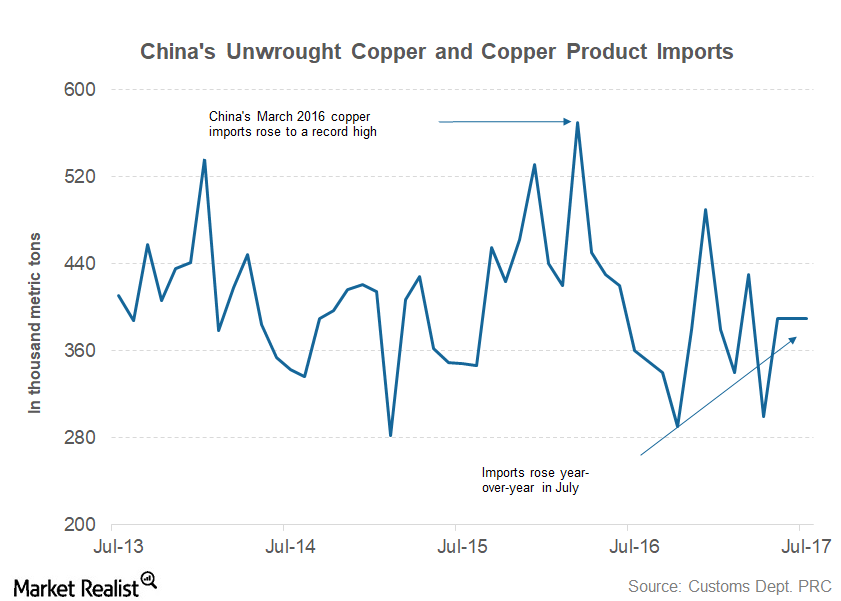

Previously in this series, we’ve looked at China’s July steel and aluminum exports. In this final part of the series, we’ll look at Chinese copper imports.

Advanced Valuation Concepts: The Art of Valuing Stocks

Stock valuation is both an art and a science. We’ll look at some advanced valuation concepts, drilling down into the “art” part of valuing stocks.

Stock Valuation: Using Fundamental Analysis in Equities

When it comes to equity investments, stock valuation is a crucial part of the process. Let’s look at valuation techniques using fundamental analysis.

Get Real: Why Is the Market Restless?

In today’s Get Real, we saw Tesla’s plans for China, AMD’s expectations for 2020, the state of crude oil prices, and more.

Understanding Freeport’s Capital Allocation Strategy

As copper market conditions have improved, companies have also taken another look at their capital allocation strategies.

How Analysts View Copper Miners amid the Market Carnage

The repercussions of the equity market carnage are evident in commodity markets. Copper, which some analysts see as an indicator of the global economy’s health, has come off its 2018 highs.

Freeport-McMoRan’s 4Q17 Earnings: What You Need to Know

Freeport-McMoRan (FCX) reported its 4Q17 earnings on January 25, 2018. The company reported an adjusted net income of $750 million.

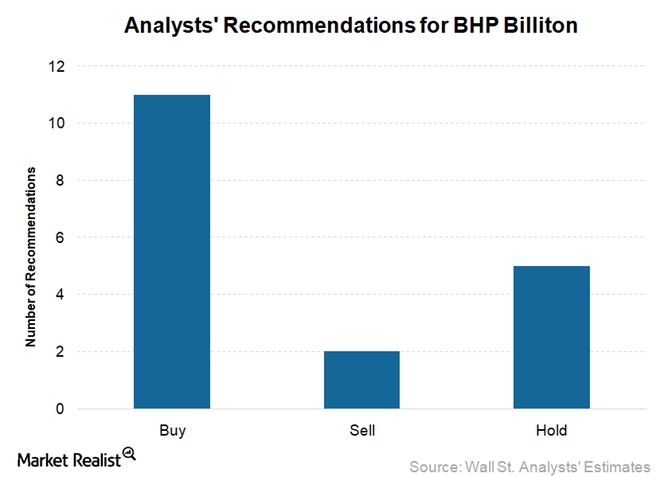

BHP Billiton: Recent Wall Street Upgrades and Downgrades

Of the 18 Wall Street analysts currently covering the BHP Billiton’s (BHP) stock, 61% rate it as a “buy,” 28% recommend a “hold,” and the remaining 11% have a “sell” recommendation on the stock.

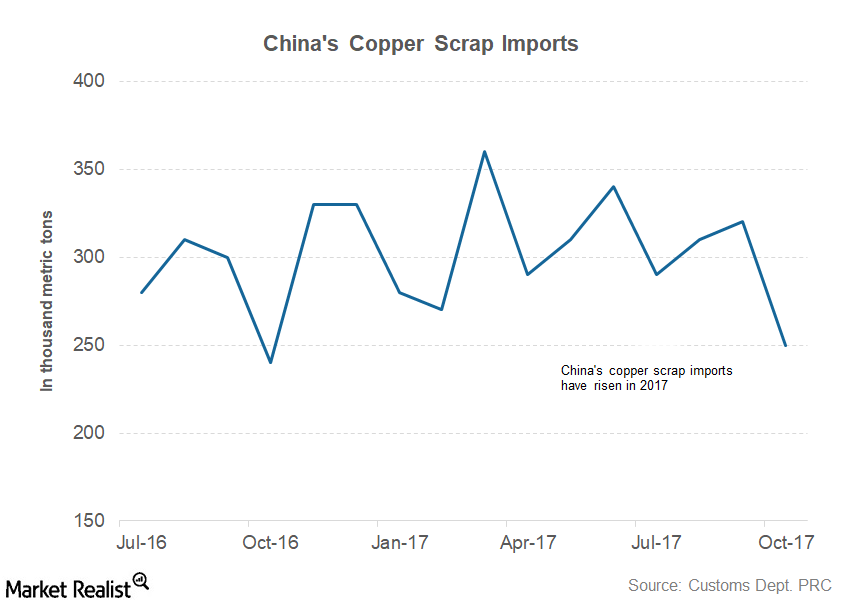

How the Secondary Market Could Impact Copper Prices in 2018

Copper, like other metals, is widely recycled. Last year, we saw improved scrap flows as copper prices moved to higher price levels.

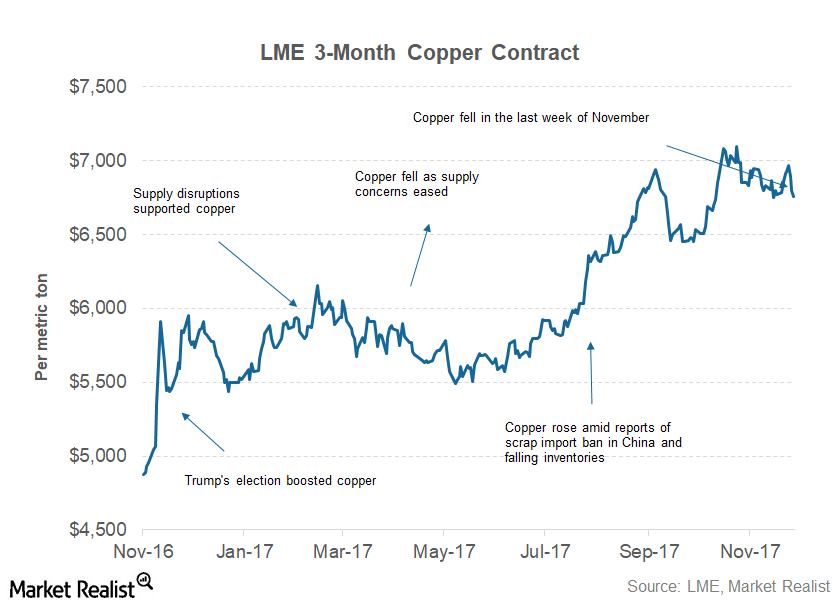

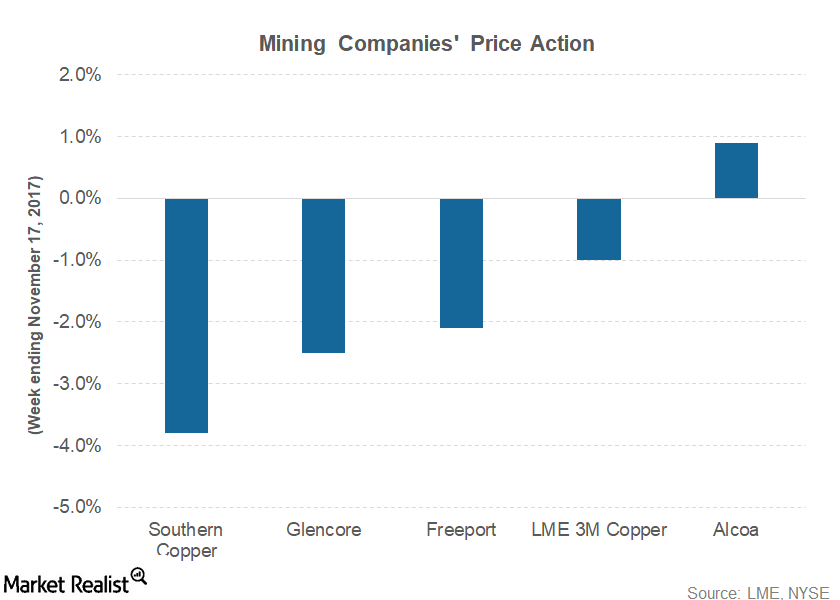

Copper Bulls Took a Back Seat in November

Copper bulls had a nice run since July. Copper underperformed several industrial metals in 1H17. However, copper has been on an uptrend in 2H17.

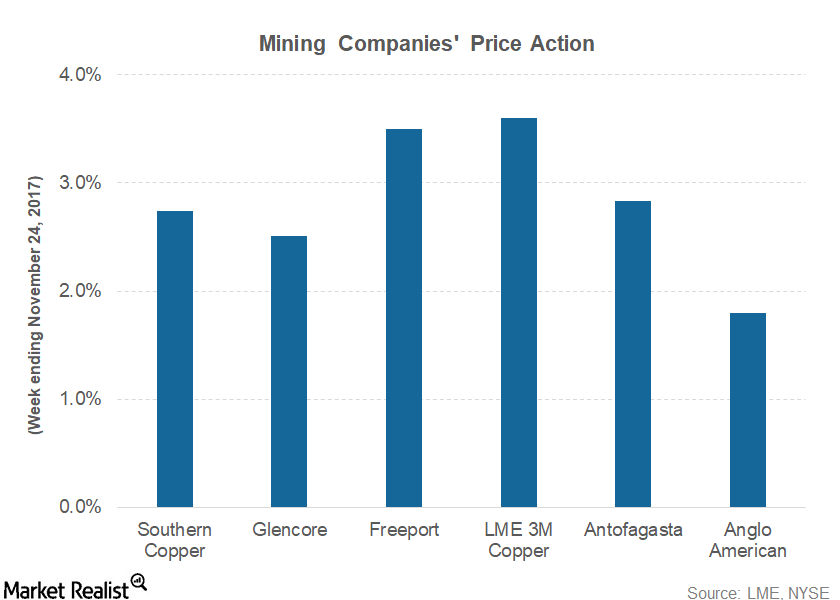

Copper Tests $7,000 as Industrial Metals Rebound

Last week was broadly positive for industrial metals (DBC). Copper rose 3.6%, while aluminum prices rose 1.3% in the week ending November 24.

Metal Prices Fell on Demand Concerns Last Week

In this series, we’ll look at the key developments that impacted mining companies last week. We’ll also look at some of the company-specific developments that impacted mining stocks.

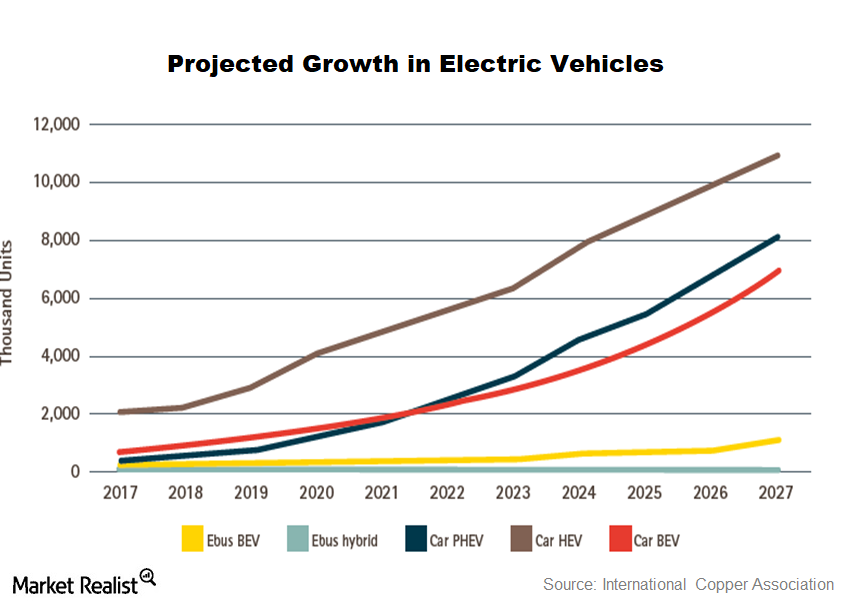

How Freeport-McMoRan Benefits from Electric and Hybrid Vehicles

Investments in renewable energy bode well for global copper demand, as the copper intensity in renewable energy is higher than in non-renewable energy.

China’s Copper Imports: Did Data Spoil Freeport’s Party?

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in August 2016.

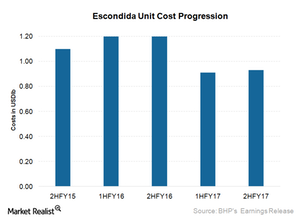

What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

Freeport and Copper: Is a Correction in the Cards?

Copper prices have shown strength over the last few trading sessions, which has helped the upwards price action of miners including Freeport-McMoRan (FCX), Glencore (GLNCY), and Southern Copper (SCCO).

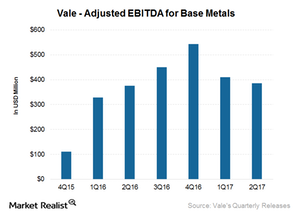

What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

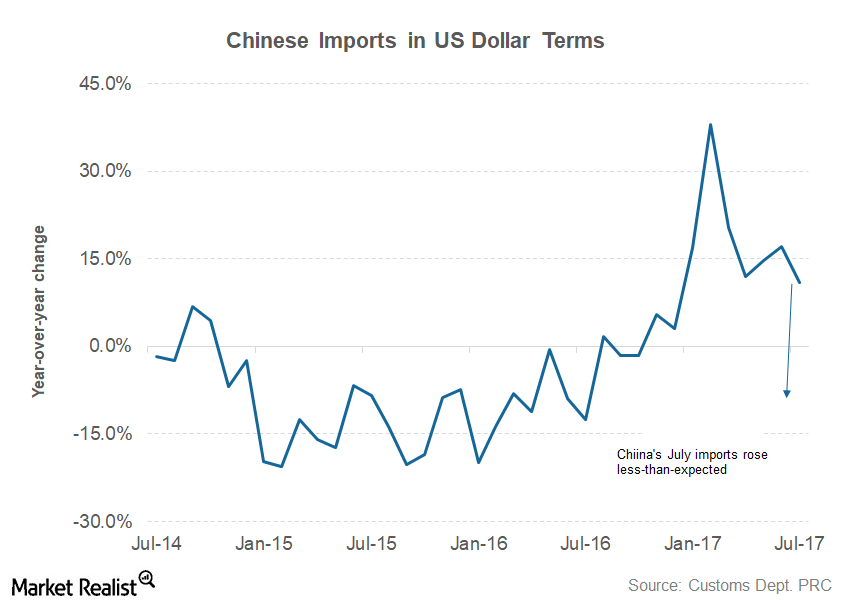

Will China’s Disappointing July Trade Deflate Metal Bulls?

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%.

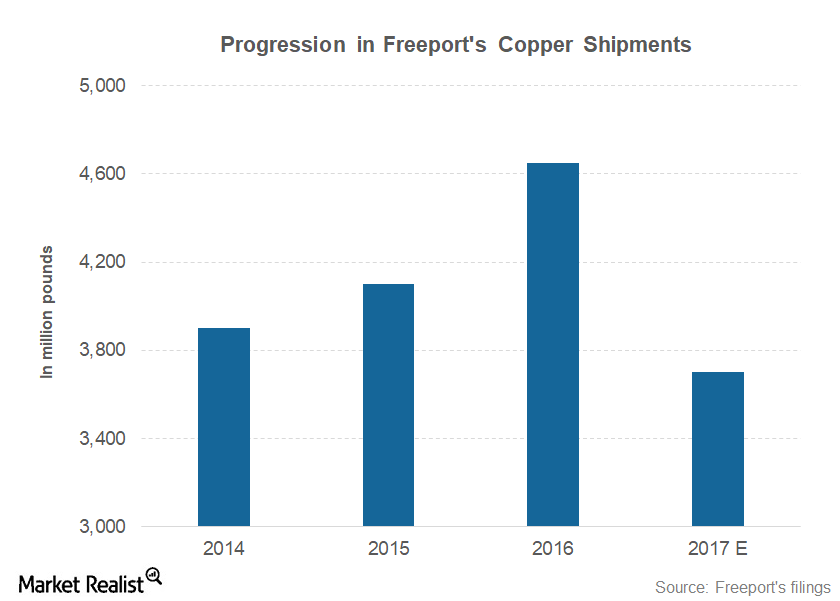

Analyzing Copper Miners’ 2017 Production Plans

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds.

Cyclical Nature of BHP’s Business and Mechanistic Share Buybacks

The third element of Elliott Funds’ “value unlock” plan for BHP Billiton (BHP) (BBL) is the adoption of a policy of consistent and optimized capital returns to shareholders.

Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

What Are Freeport’s Near-Term Growth Drivers?

Freeport expects its copper shipments to fall next year due to asset sales. The falling trend in its copper shipments could continue beyond 2017.

How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

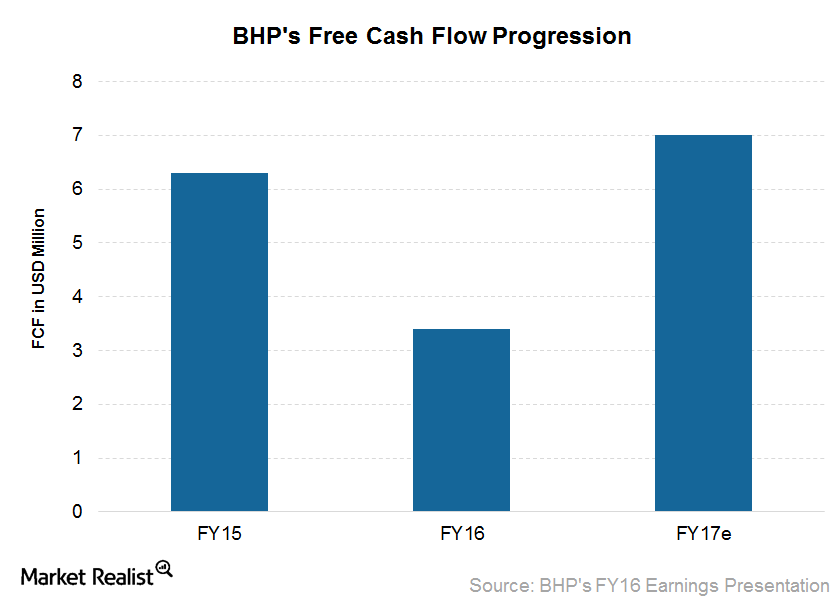

What Could Drive BHP Billiton’s Free Cash Flows for Fiscal 2017?

BHP Billiton’s (BHP) (BBL) unit costs declined by 16% in fiscal 2016, supported by increased capital efficiency. This helped BHP generate strong free cash flow.

How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.