Copper Weaker on August 19 Due to Weaker Demand Signs

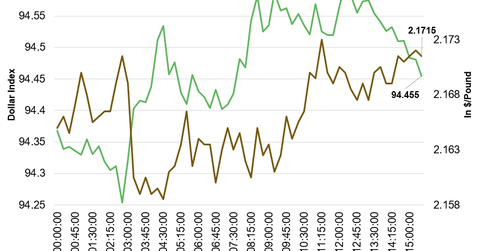

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

Dec. 4 2020, Updated 10:53 a.m. ET

Copper closes the week with profits

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

The recovery of the dollar on August 19 weighed on copper prices. Please read Why Are Copper, Gold, and Silver Weaker Early on August 19? to learn how copper traded in the early hours on Friday.

Weak demand signals from China

After starting this week on a positive note and gaining for three out of the first four trading days of the week, copper lost momentum on Friday, August 19, due to the dollar’s recovery. The firm dollar weighs on dollar-denominated commodities like copper, gold, and silver. In addition to the recovery in the dollar, the oversupply situation and weak demand signals from China are weighing on the copper market.

According to data released by the National Bureau of Statistics (or NBS), the number of cities in China that reported a decline in home prices increased for the fourth consecutive month. In July, 16 out of 70 cities reported a decline in prices, raising concerns about the slowdown in China’s property market.

Considering the fact that China is the world’s largest copper consumer, the data regarding Chinese economy, construction activity, and industrial production has an influence on copper’s demand and price trends.

At 1:55 PM EDT on Friday, August 19, major copper producers Freeport-McMoRan (FCX), Glencore (GLNCY), BHP Billiton (BHP), and Rio Tinto (RIO) fell by ~2.5%, ~4.8%, ~2%, and ~2.2%, respectively. The SPDR S&P Metals & Mining ETF (XME) and the PowerShares DB Base Metals ETF (DBB) fell by 3.2% and ~0.44%, respectively.