Invesco DB Base Metals Fund

Latest Invesco DB Base Metals Fund News and Updates

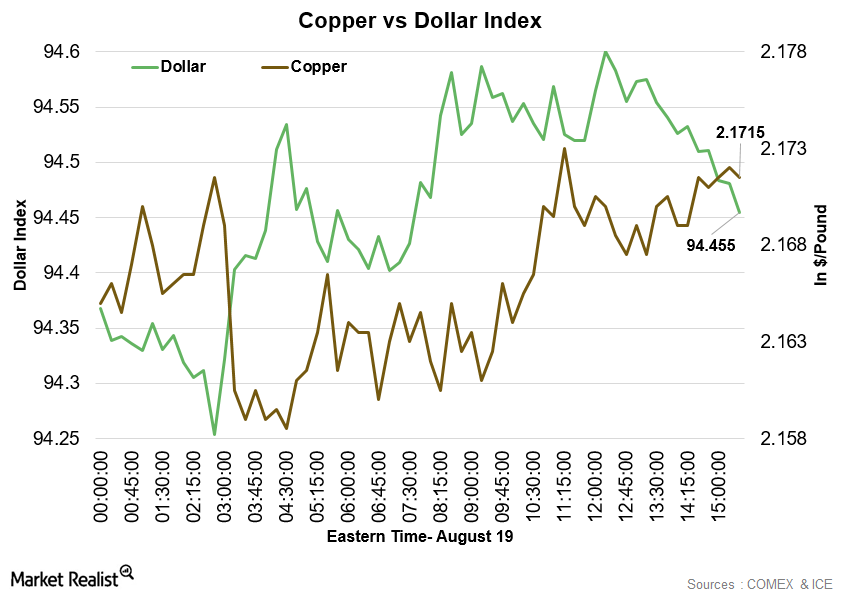

Copper Weaker on August 19 Due to Weaker Demand Signs

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

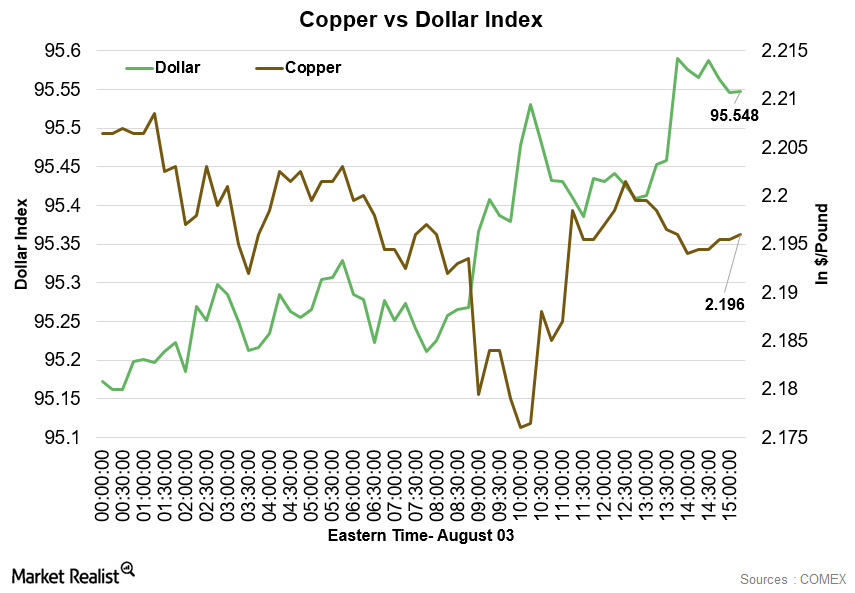

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.

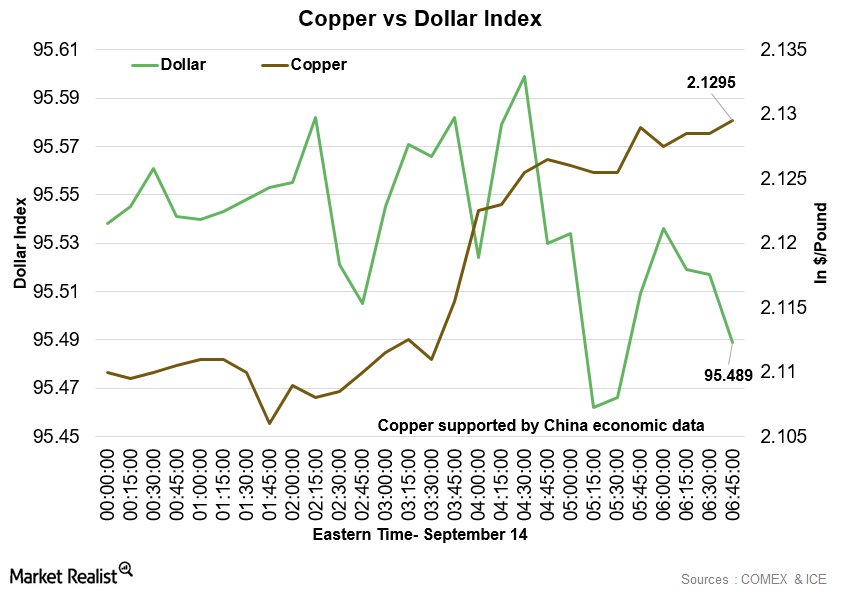

Why Is Copper Trading High in the Early Hours on September 14?

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

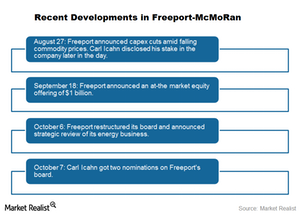

Icahn Lift or Commodity Drag: What Could Drive Freeport-McMoRan?

Freeport-McMoRan (FCX) jumped smartly in August after activist investor Carl Icahn disclosed his 8.5% stake in the company, known as the “Icahn lift.”

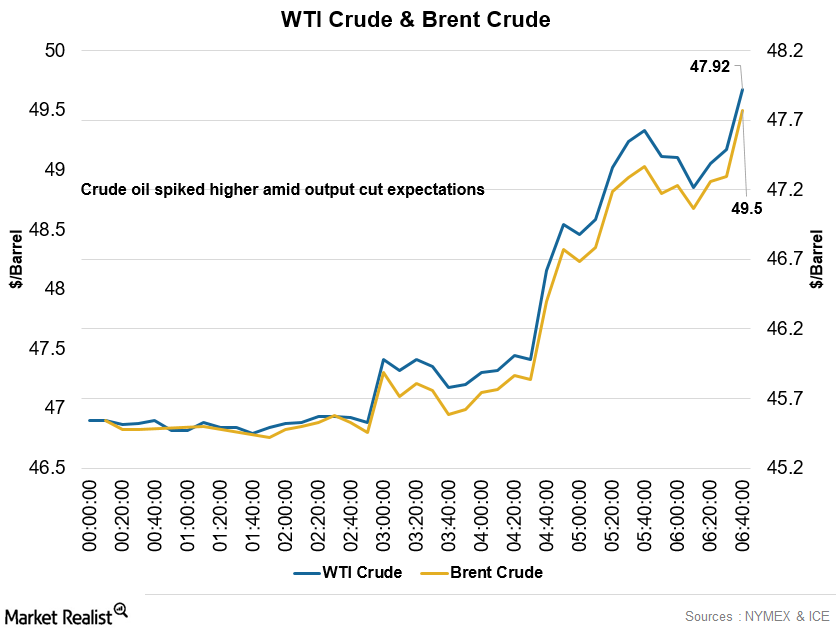

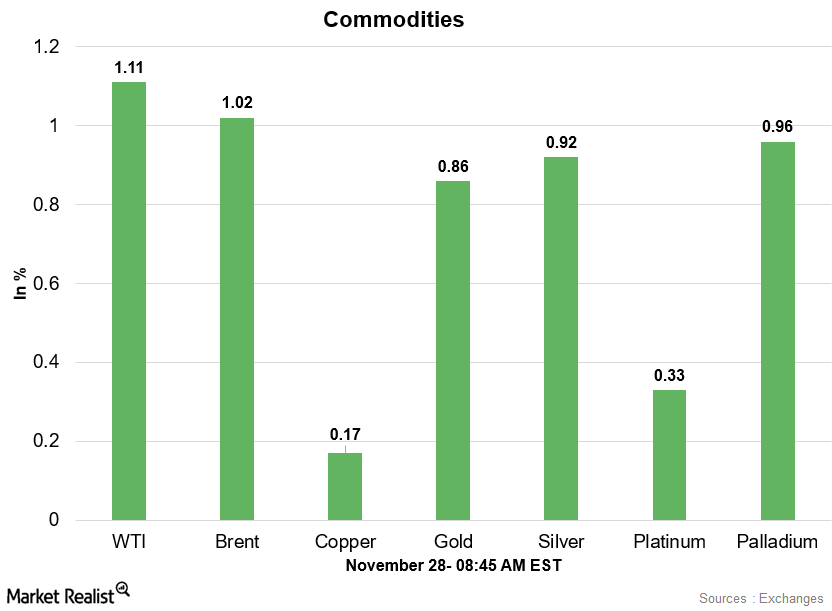

Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

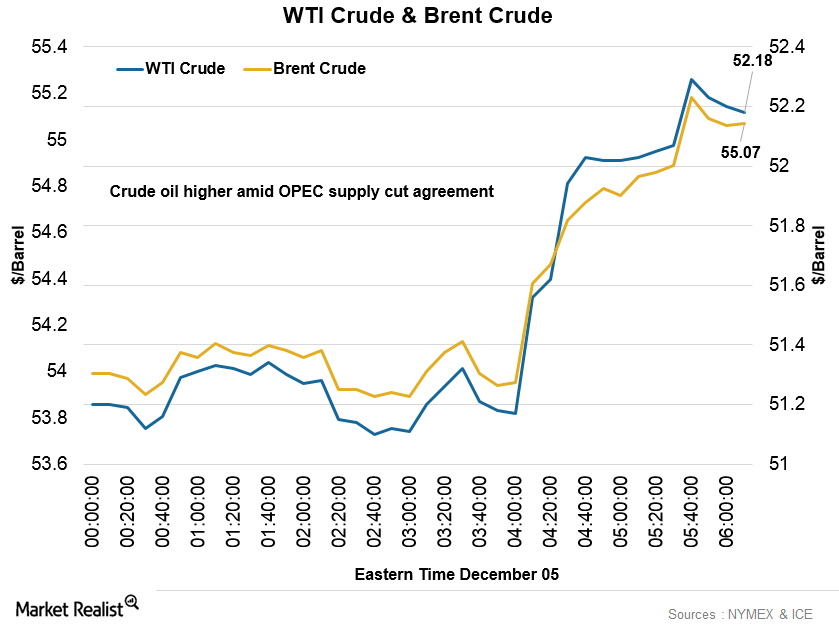

Why Did Crude Oil Prices Hit a 16-Month High?

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

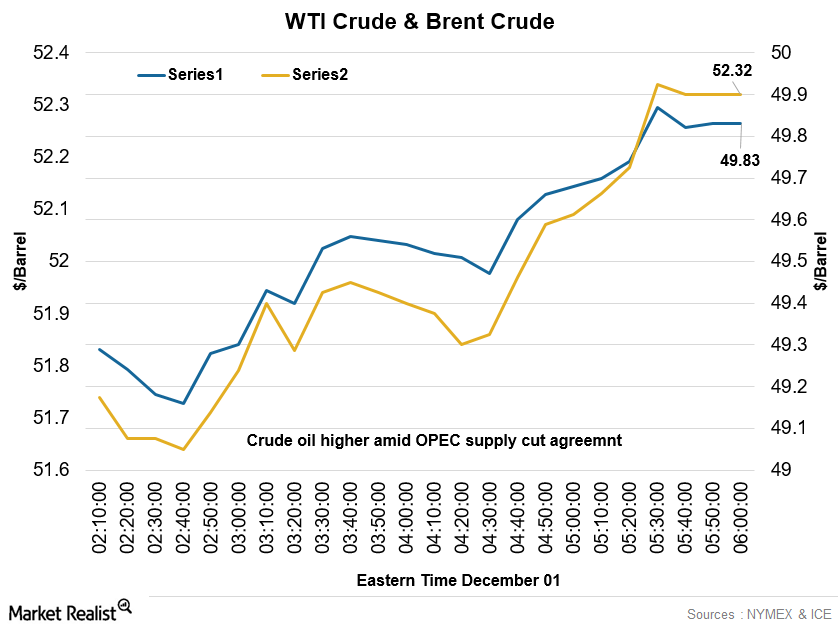

Crude Oil Continued to Rise, OPEC Agreed to the Supply Cut

At 5:45 AM EST, the WTI crude oil futures contract for January 2017 delivery was trading at $49.88 per barrel—a rise of ~0.89%.

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

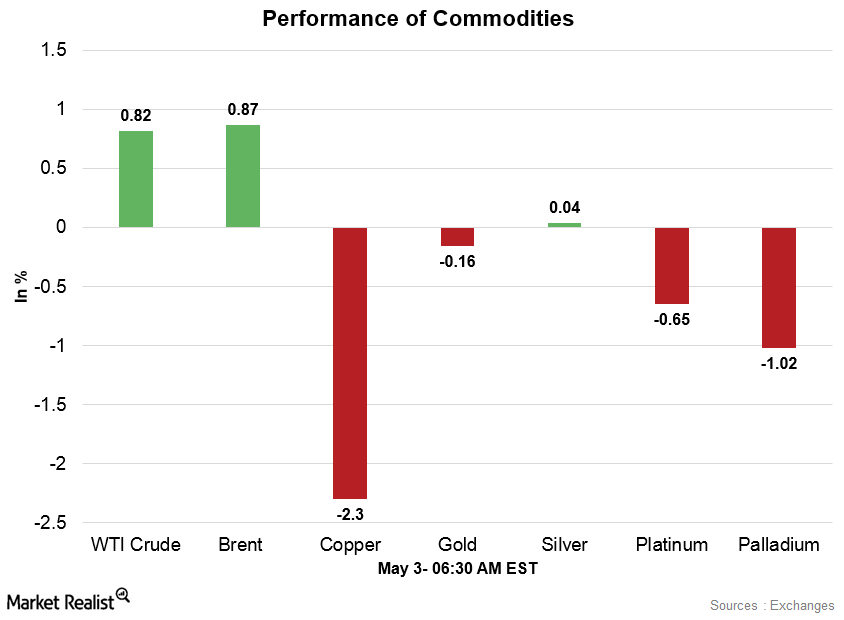

Crude Oil Is Stable amid Lower Inventory Levels

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday.

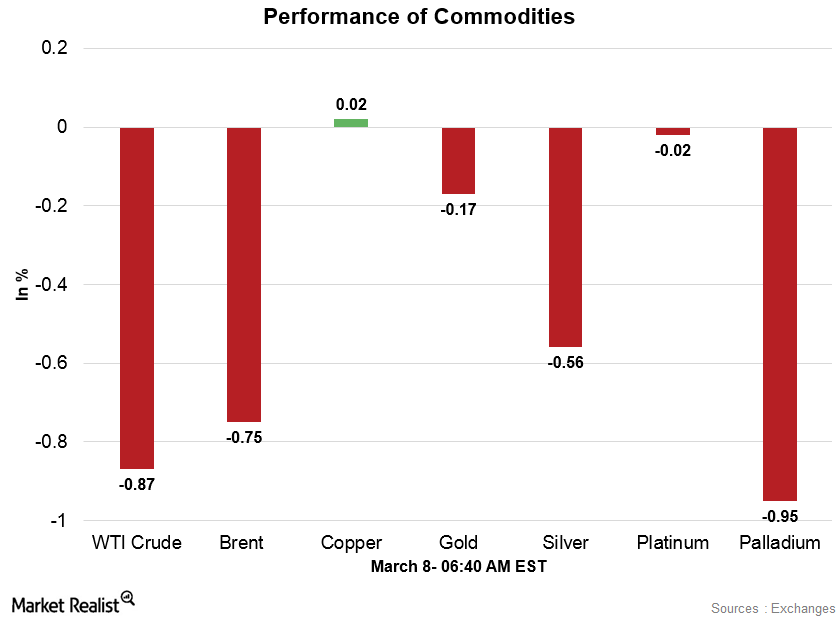

Commodities Are Weaker amid the Firmer Dollar

Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting.

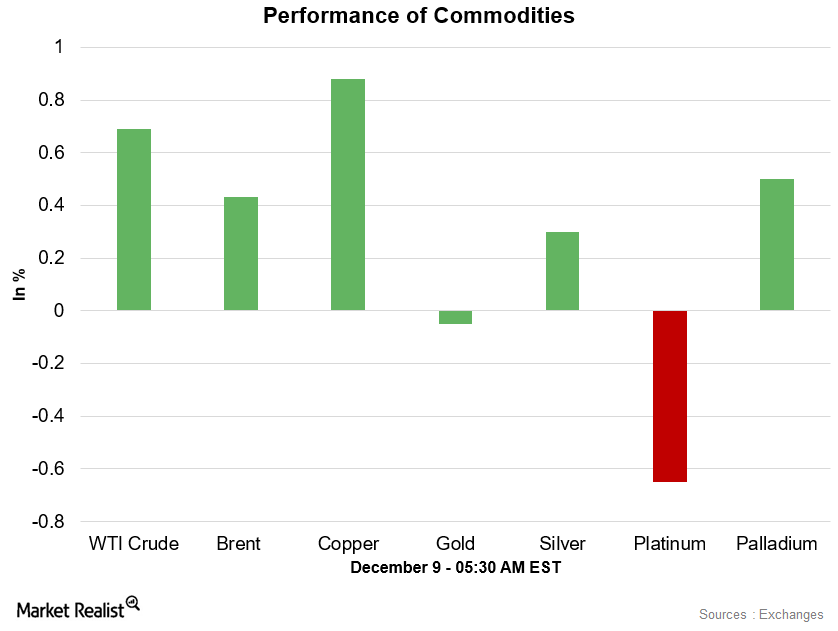

Crude Oil and Copper Are Stable, Gold Is Weaker on December 9

At 5:00 AM EST on December 9, the WTI crude oil futures contract for January 2017 delivery was trading at $51.21 per barrel—a rise of ~0.71%.

China’s Trade Data and the Weaker Dollar Support Commodities

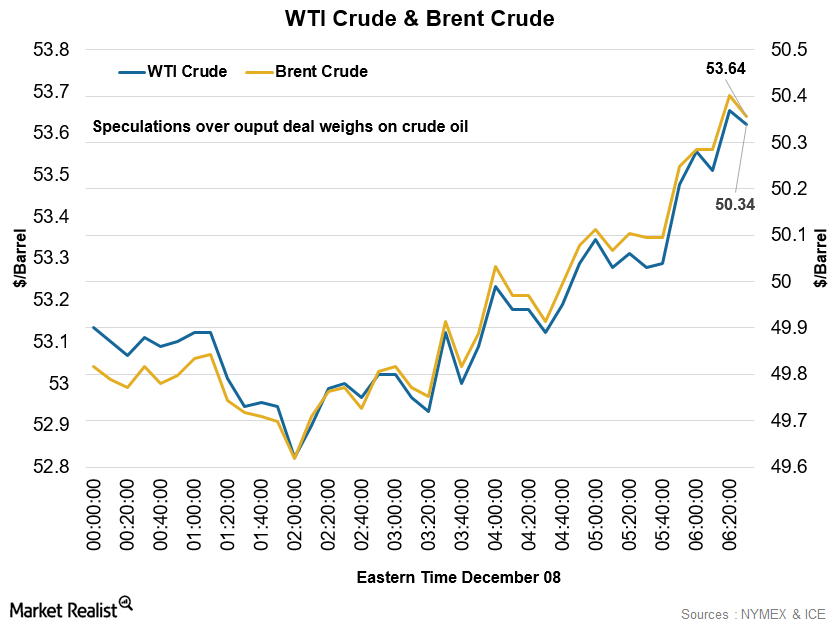

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

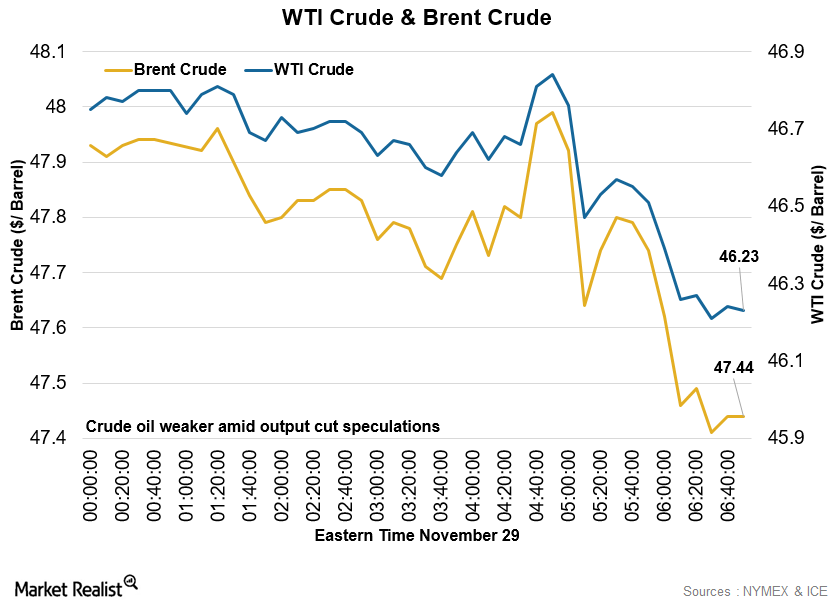

Early Morning Update: Crude Oil Fell, Metals Were Mixed

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

Early Morning Update: Energy, Metals, and Mining Sector

The market is also waiting for the weekly crude oil inventory reports from the U.S. Energy Information Administration and the American Petroleum Institute.

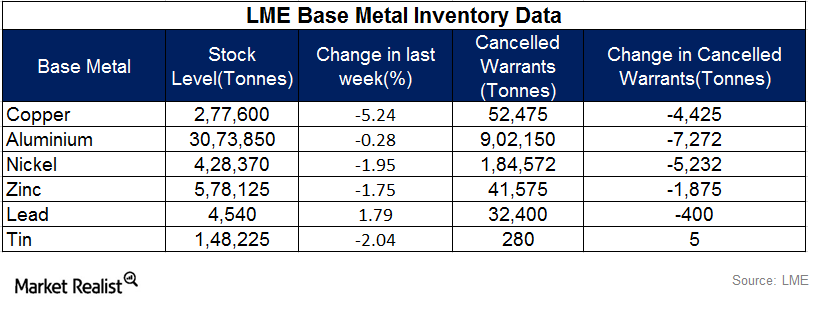

LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

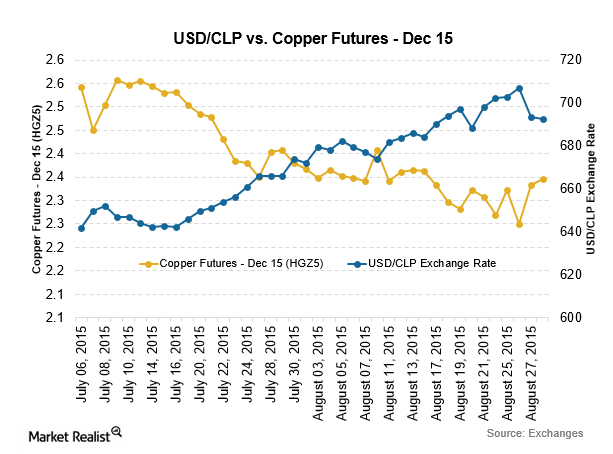

The High Correlation between the Chilean Peso and Copper Prices

Any variation in copper demand or supply directly affects the value of the Chilean peso against the US dollar.