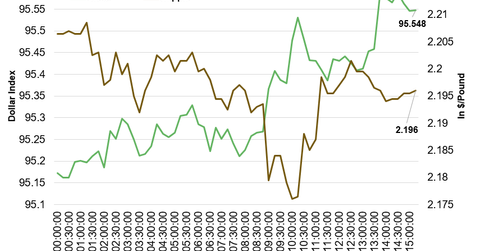

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.

Dec. 4 2020, Updated 10:53 a.m. ET

Copper declined on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and fell lower. At 2:00 PM EDT on Wednesday, August 3, the COMEX copper futures contract for September delivery was trading at ~$2.20 per pound, a drop of ~0.54%.

Please read Copper, Gold, and Silver Are Weaker Early on August 3 to learn how copper performed in the early morning hours on August 3. The recovery in the US dollar weighed on copper prices on August 3.

Market awaits stimulus from China

Amid weak signals of demand from China, the Market is looking forward to the monetary stimulus from the country’s central bank. The Market participants are expecting a monetary stimulus from the Central Bank of China in the near term.

Even though Chinese state planners are calling for a stimulus, lack of information on the timing of a stimulus is weighing on prices and pushed prices to two-week low levels on August 3.

Considering the fact that China is the largest consumer of copper, accounting for 45% of global consumption, the economic situation in China has an impact on the copper price and demand trends.

Chilean miners reduce cost of production

The lower prices of copper has led to a decreased cost of production. Chile is one of the major copper producers and accounts for more than 30% of global copper production. The Chile Copper Commission reported that the cost of production in major Chilean mines declined by 13% in 1Q16 when compared to 1Q15.

At 2:15 PM EDT on August 3, major copper producers Freeport-McMoRan (FCX), BHP Billiton (BHP), and Rio Tinto (RIO) gained ~1.2%, ~1.7%, and ~0.27%, respectively. Glencore (GLNCY) declined by ~0.61%.

The SPDR S&P Metals & Mining ETF (XME) and the PowerShares DB Base Metals ETF (DBB) gained ~0.56% and ~0.51%, respectively.

The following article explains the performance of gold on Wednesday, August 3.