Val Kensington

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Val Kensington

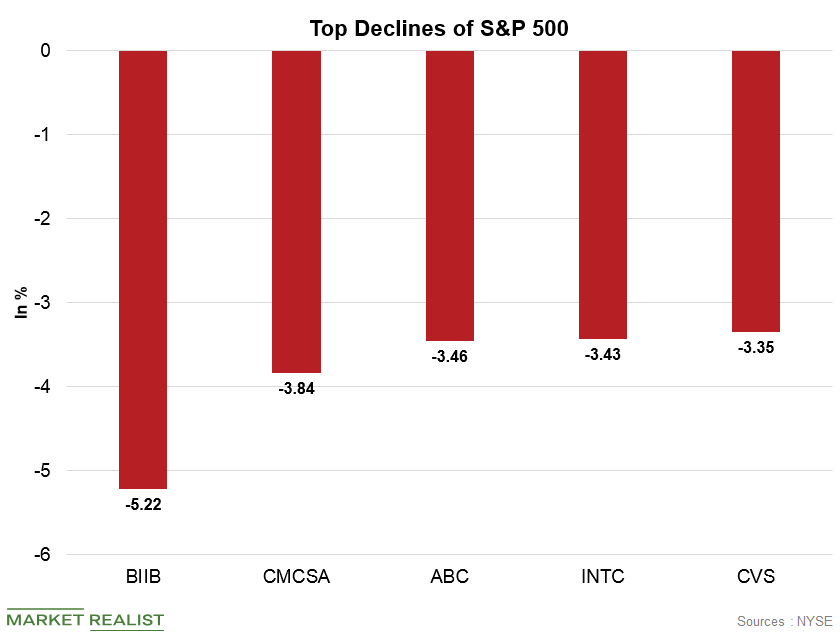

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

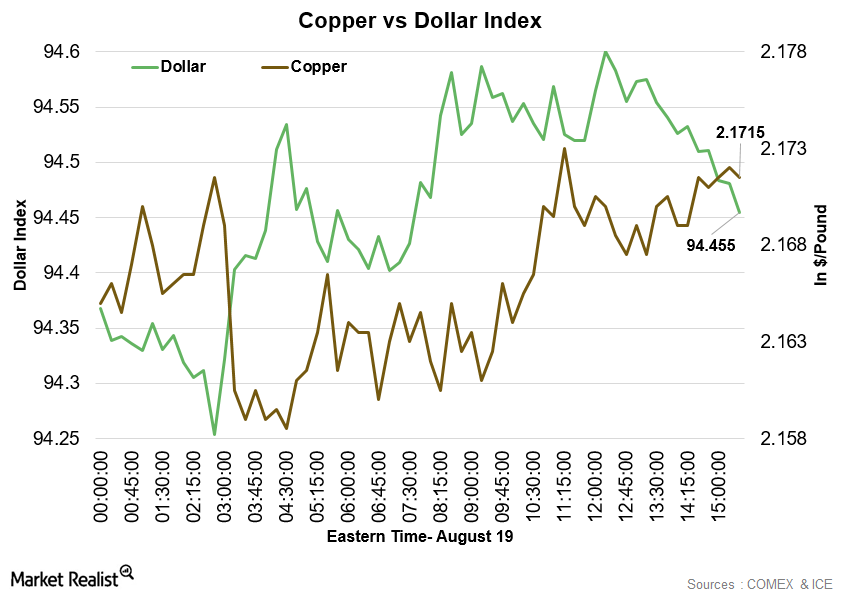

Copper Weaker on August 19 Due to Weaker Demand Signs

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

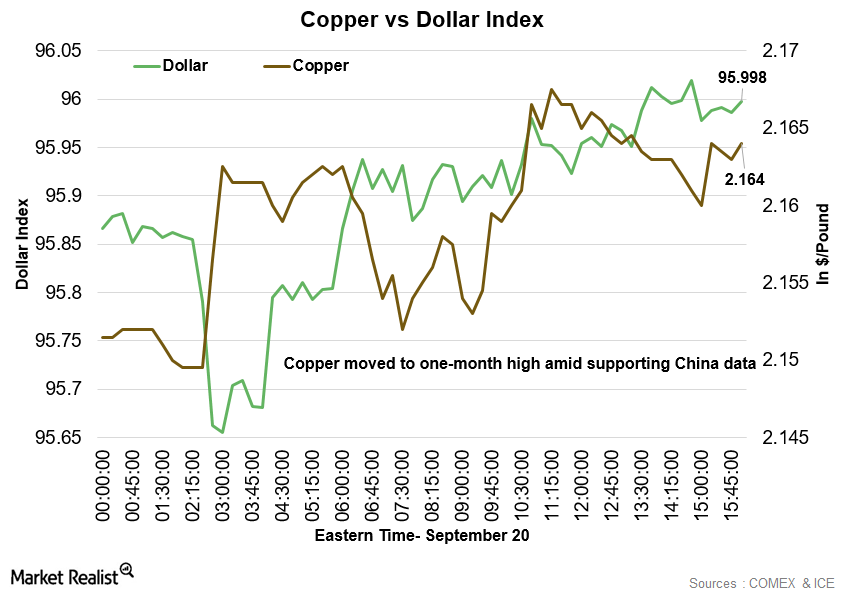

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

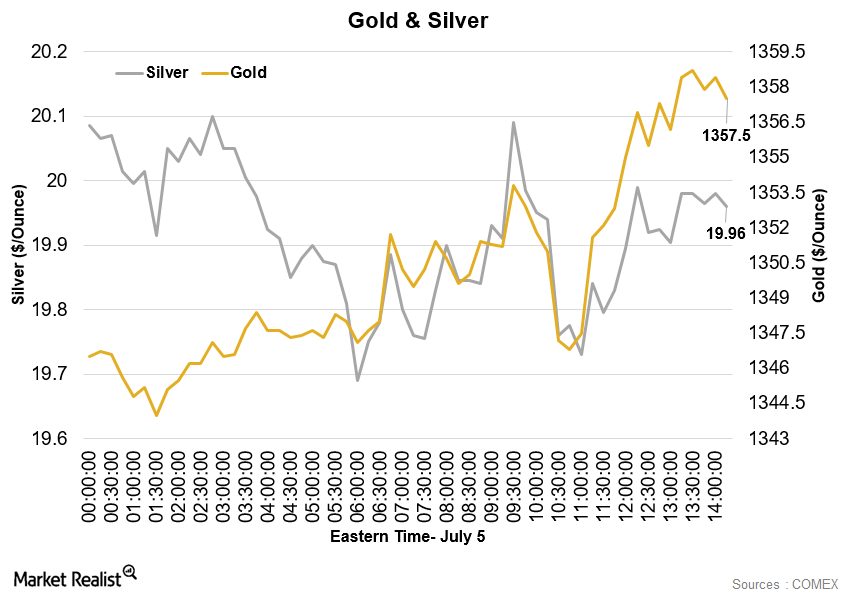

Gold Rose amid Increased Demand for Safe-Haven Assets

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

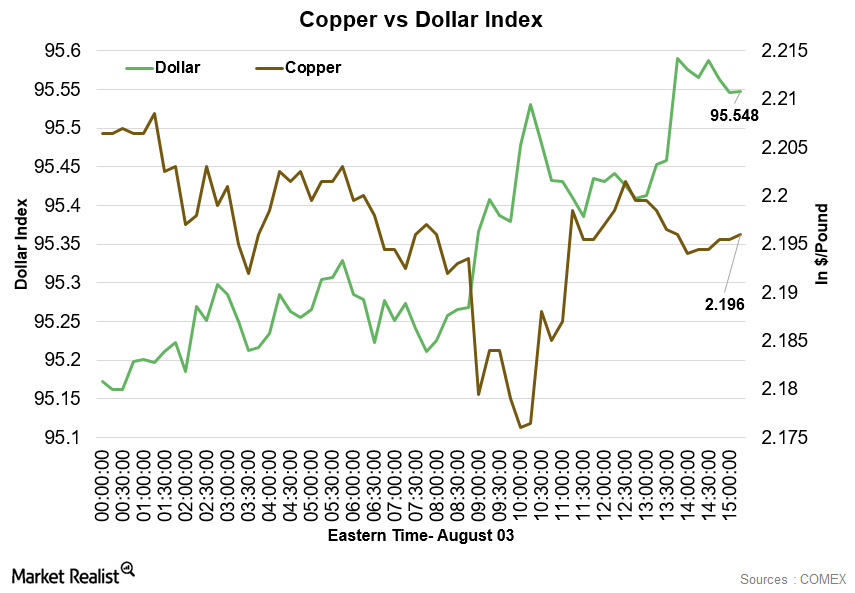

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.

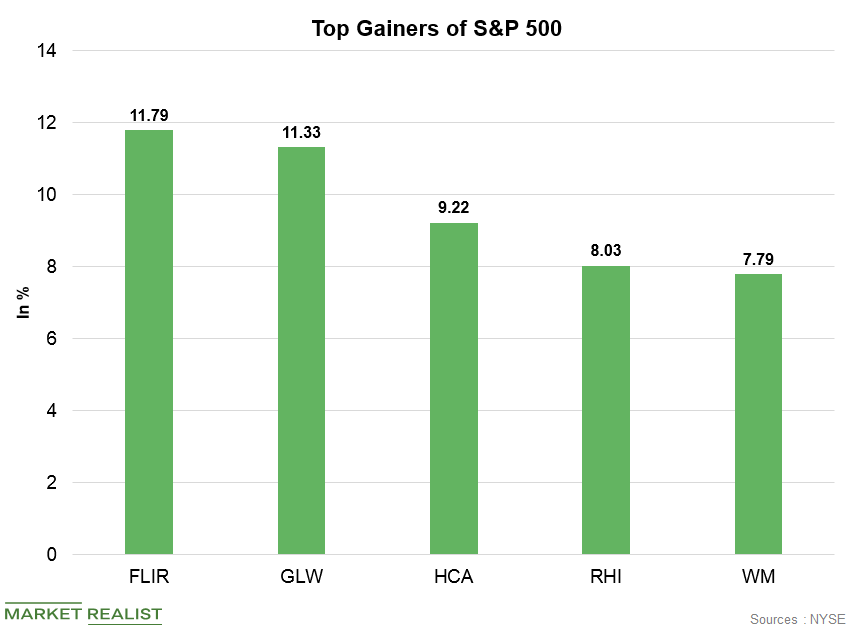

S&P 500’s Top Gainers: FLIR Systems Rose to Record Highs

FLIR Systems was the S&P 500’s top gainer on July 25. FLIR Systems opened higher on July 25 and rose to record high price levels.

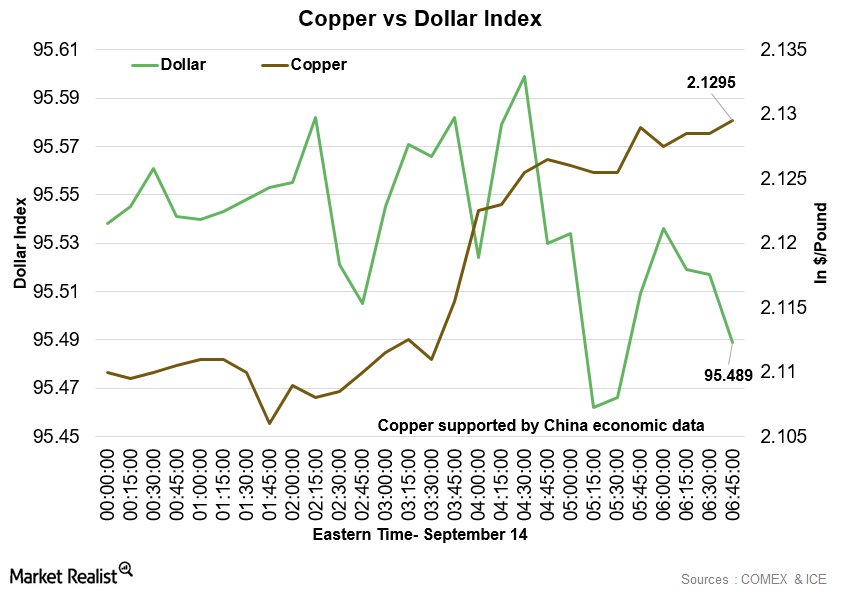

Why Is Copper Trading High in the Early Hours on September 14?

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

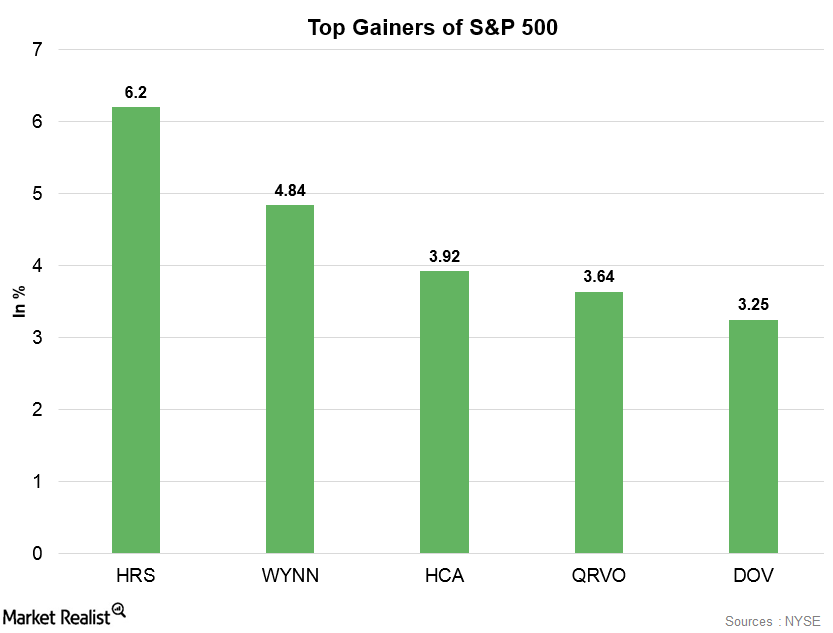

Harris Corporation: S&P 500’s Top Gainer on January 30

Harris Corporation was the S&P 500’s top gainer on January 30. On January 30, Harris Corporation gained 6.2% and closed the day at $156.31.

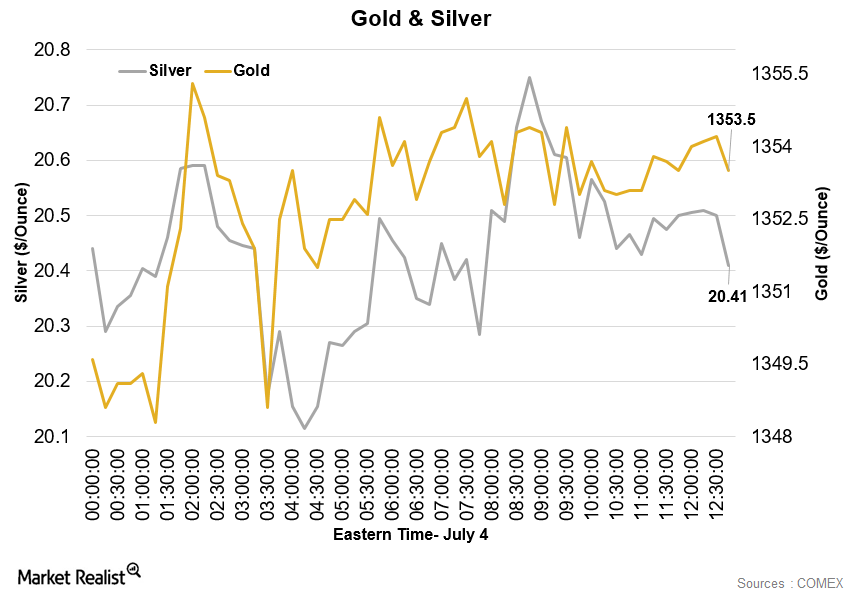

Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

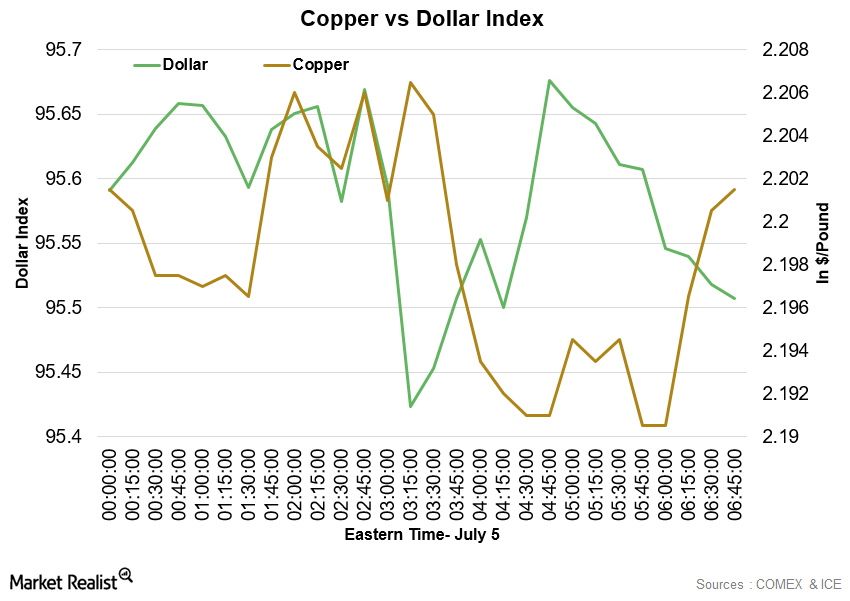

Copper Fell and Gold Stabilized on July 5

At 6:40 AM EST on July 5, the COMEX Copper futures contract for September delivery was trading at $2.2 per pound—a drop of 0.81%.

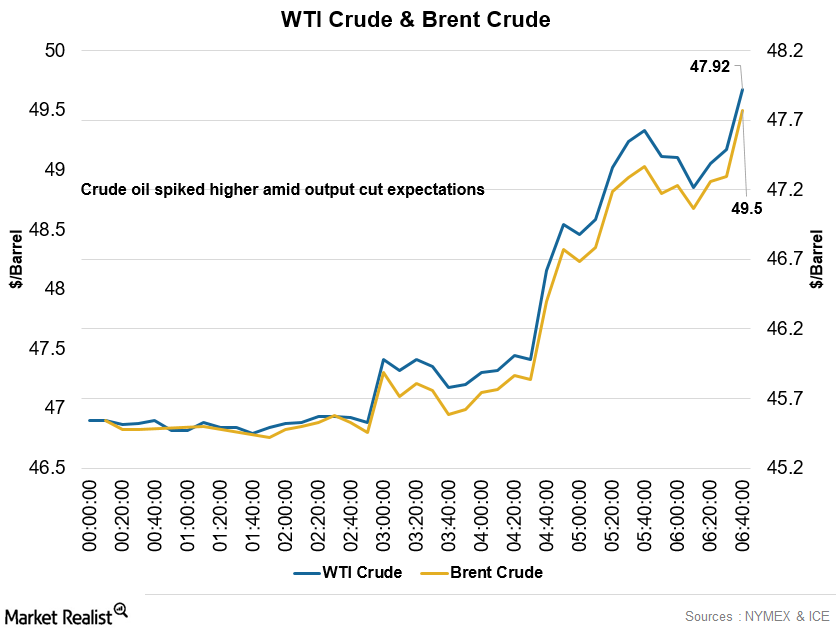

Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

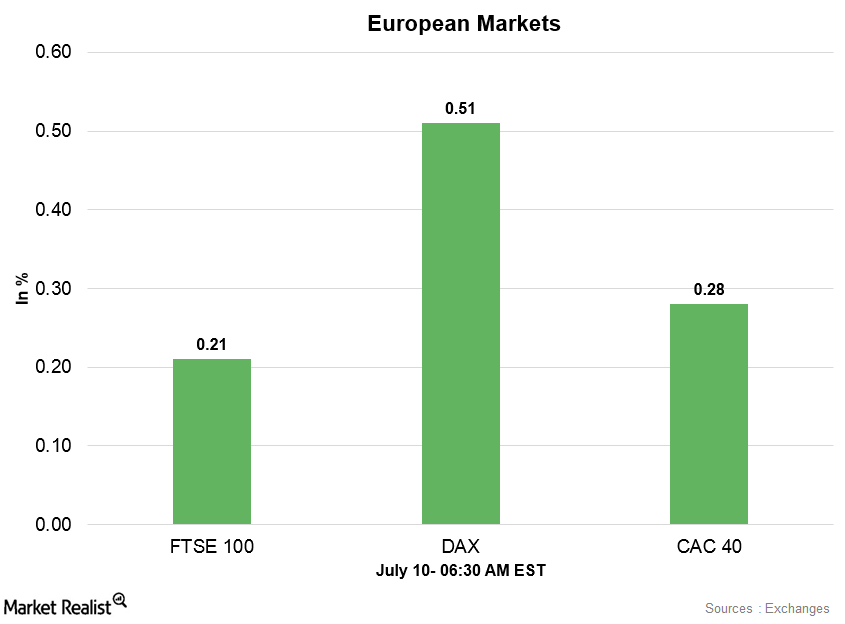

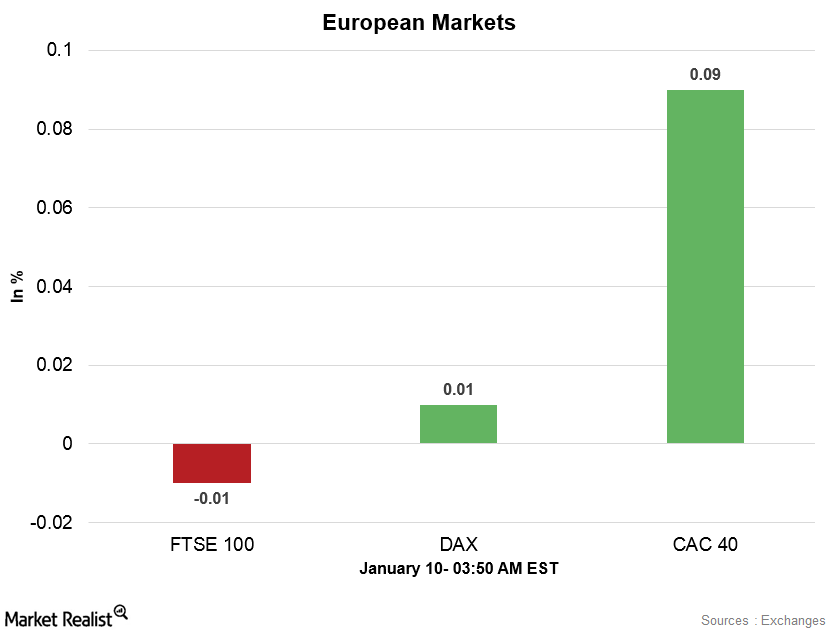

European Markets Opened Higher amid Improved Global Sentiment

France’s CAC 40 Index quit falling last week and traded in a range of 5,200–5,100. This week, it opened higher amid improved global sentiment.

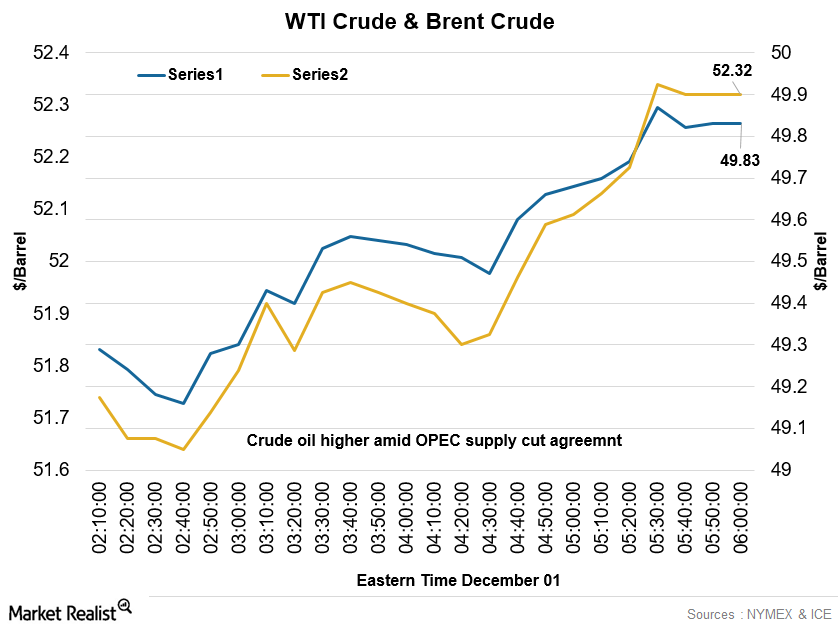

Why Did Crude Oil Prices Hit a 16-Month High?

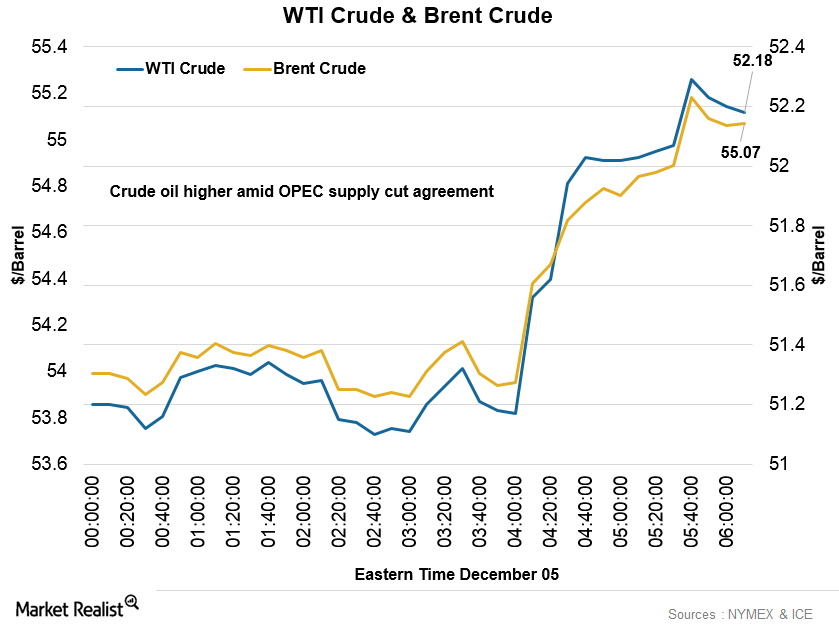

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

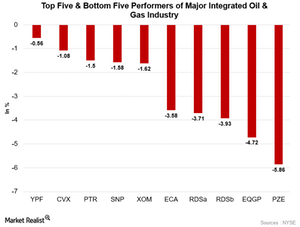

Energy and Base Metal Sectors Fell on November 11

The companies in the energy sector were weaker on November 11. The major ETFs related to the energy sector such as USO and DBO fell 2.6% and 2.7%.

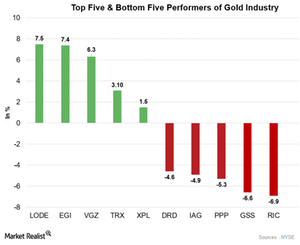

Metal and Mining Sector Companies Fell on November 2

On November 2, the stocks related to base metals and precious metal miners moved lower. DBB and XME fell 1.3% and 2%, while GLD rose 0.73%.

European Markets Are Mixed Early on January 11

At 3:45 AM EST on January 11, the DAX Index was trading at 13,275.50—a fall of 0.04%. The iShares MSCI Germany (EWG) fell 0.88% on January 10.

Crude Oil Continued to Rise, OPEC Agreed to the Supply Cut

At 5:45 AM EST, the WTI crude oil futures contract for January 2017 delivery was trading at $49.88 per barrel—a rise of ~0.89%.

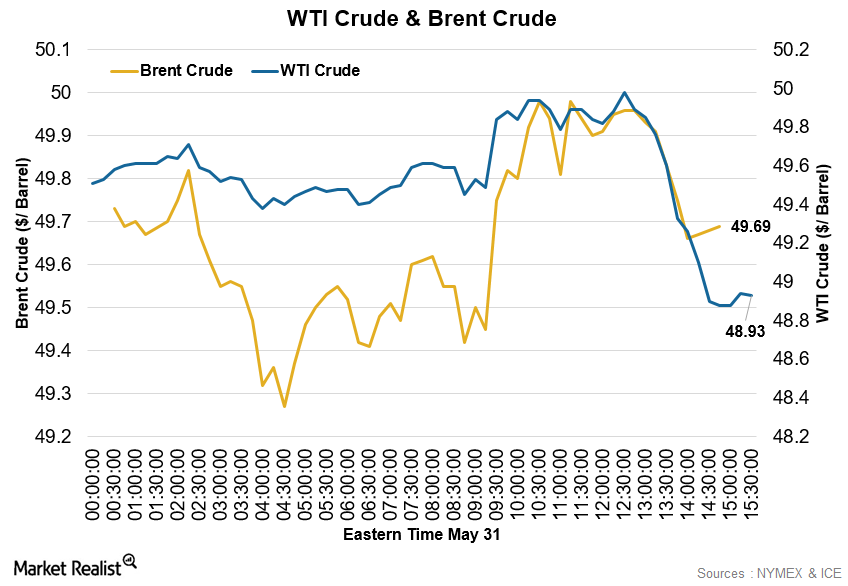

How Did Crude Oil Perform on Tuesday, May 31?

Crude oil had a volatile trading day on Tuesday, May 31, 2016. At 1:40 PM EDT, WTI crude for July delivery traded at $49.67 per barrel, a gain of 0.67%.

Asian Markets Are Weak amid Trade War Concerns

The Shanghai Composite Index declined 0.84% and closed the day at 3,136.63 on April 3. The SPDR S&P China (GXC) declined 2.4% on April 2.

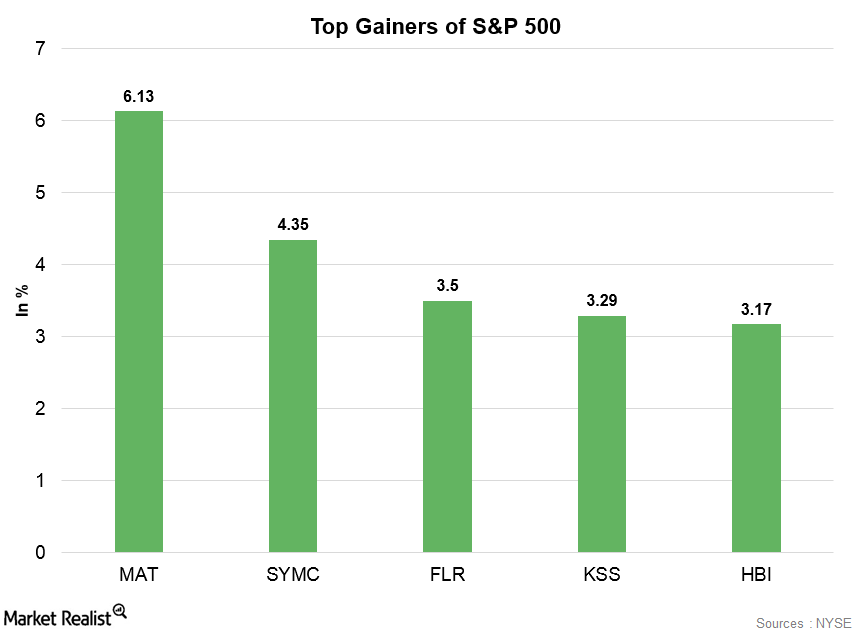

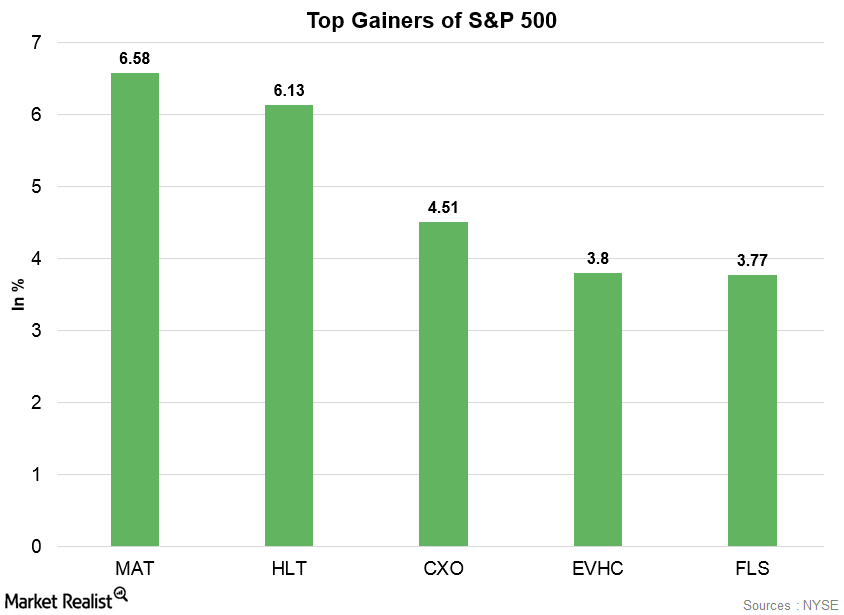

Mattel: S&P 500’s Top Gainer on May 15

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on May 15.

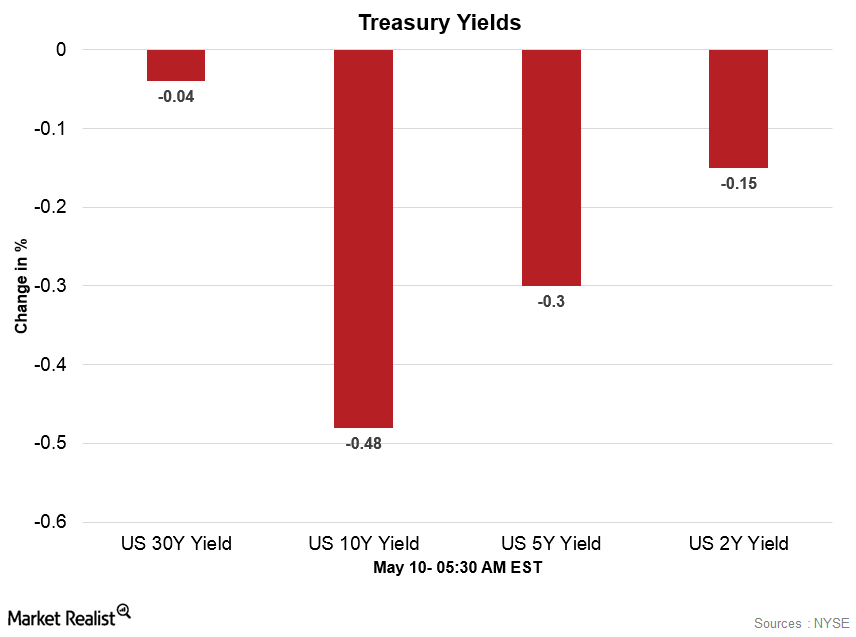

US Dollar Index and Treasury Yields in the Early Hours

The US Dollar Index started Thursday on a mixed note and traded with weakness in the early hours.

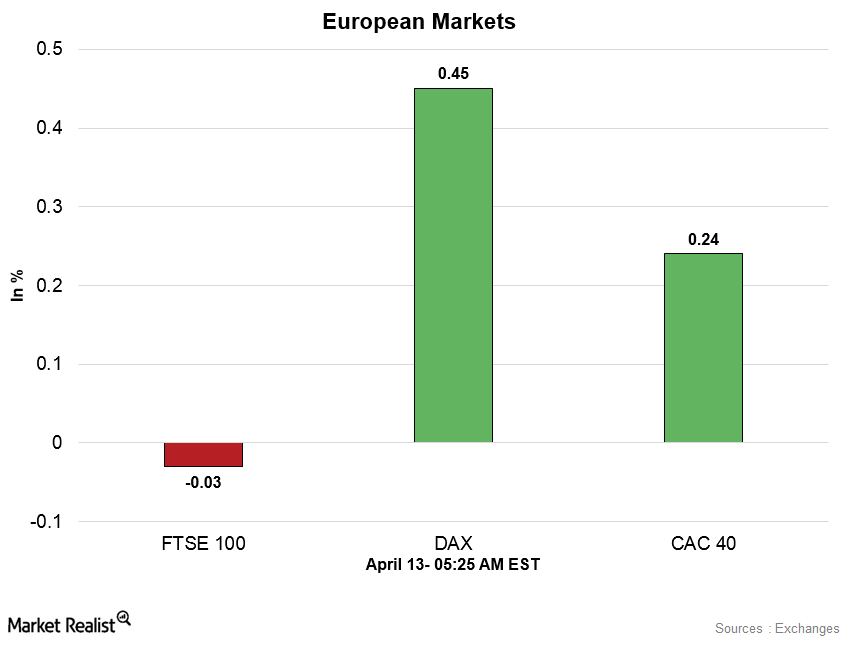

European Markets Are Stable Early on April 13

At 5:25 AM EST on Friday, the CAC 40 Index was trading at 5,322.22—a gain of 0.24%. The iShares MSCI France (EWQ) gained 0.47% on April 12.

Mattel: S&P 500’s Top Gainer on April 11

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on Wednesday.

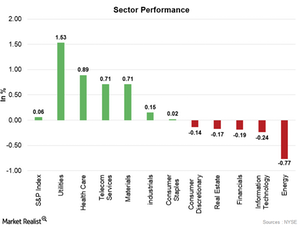

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

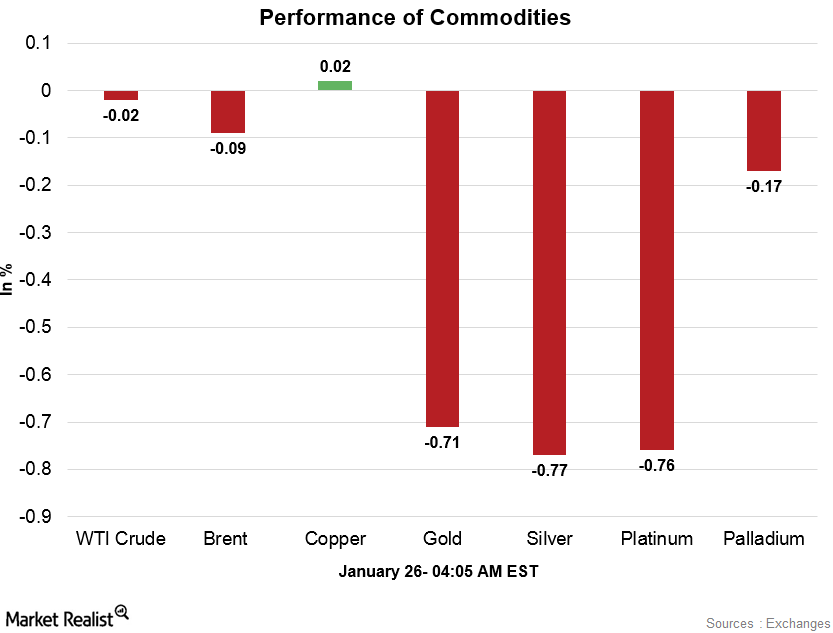

Commodities Are Strong in the Early Hours on January 26

At 4:00 AM EST on January 26, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $65.44 per barrel—a drop of 0.11%.

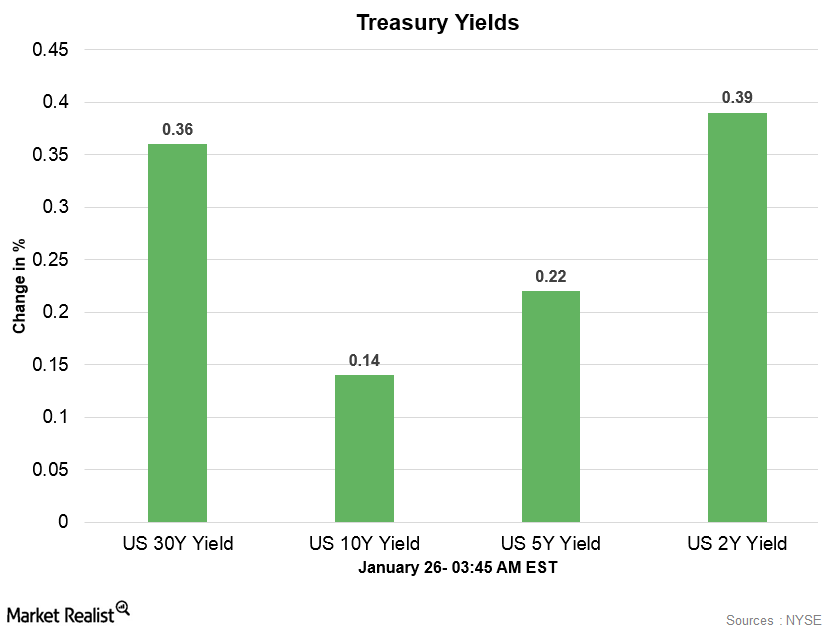

US Dollar Index and Treasury Yields Early on January 26

The US Dollar Index started this week on a weaker note. At 3:35 AM EST on January 26, the US Dollar Index was trading at 88.83—a drop of 0.62%.

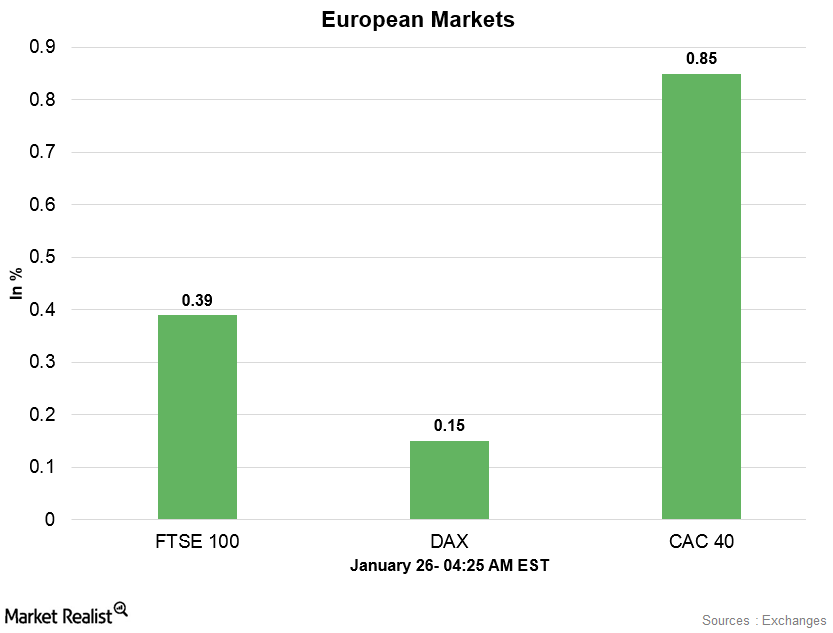

European Markets Are Mixed in the Morning Session on January 26

At 4:25 AM EST on January 26, the DAX Index was trading at 13,306.50—a gain of 0.06%. The iShares MSCI Germany (EWG) fell 0.7% on January 25.

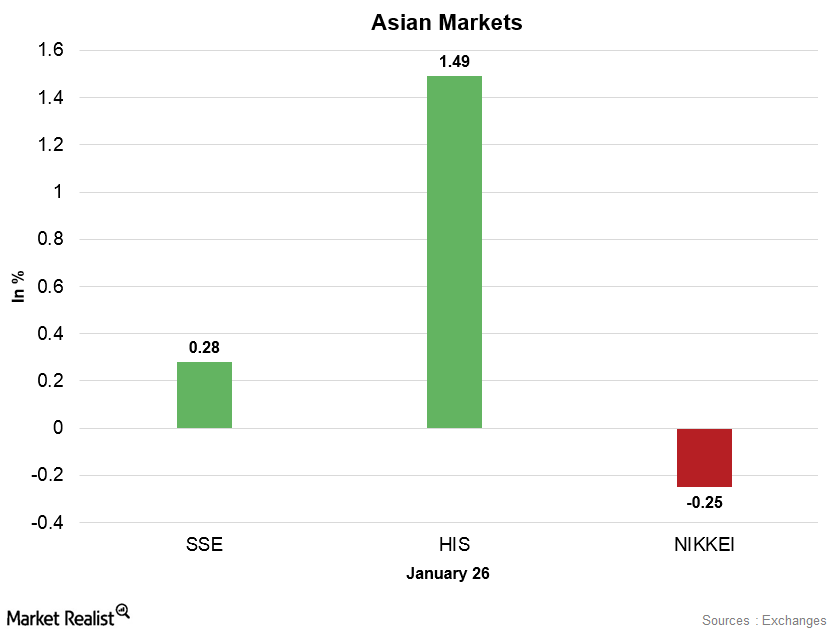

How Did Asian Markets Perform on January 26?

The Shanghai Composite Index rose 0.28% and closed the day at 3,558.13 on January 26. The SPDR S&P China (GXC) fell 0.42% on January 25.

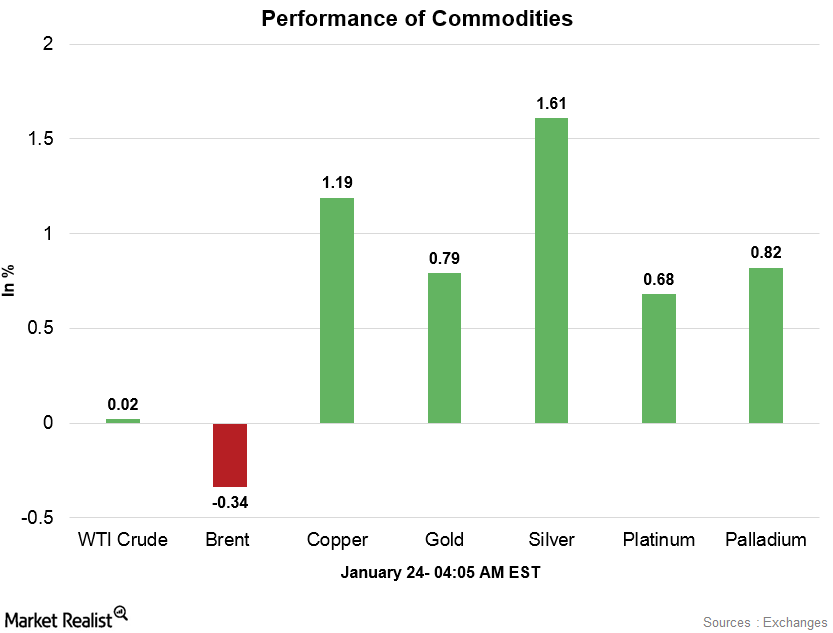

Commodities Are Strong Early on January 24

At 4:00 AM EST on January 24, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $64.50 per barrel—a gain of 0.05%.

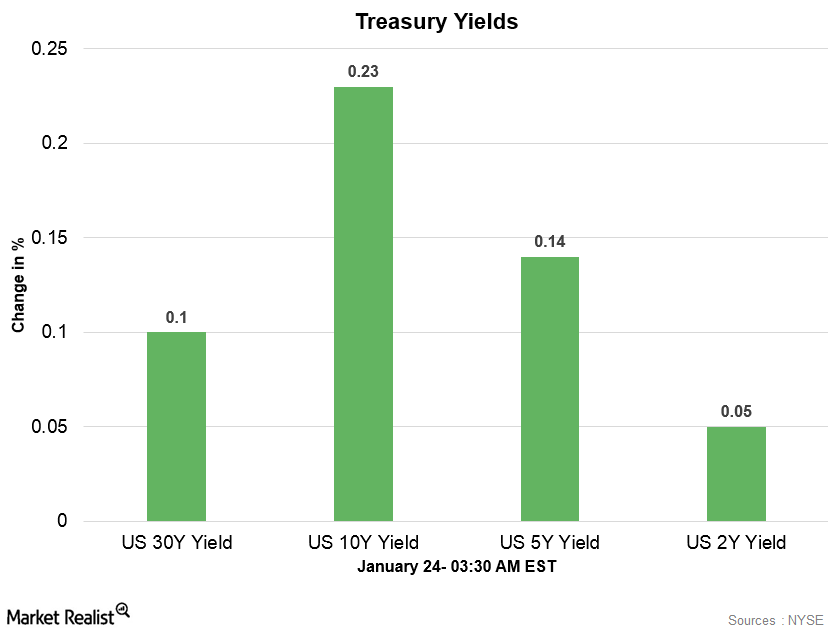

US Dollar Index and Treasury Yields Are Mixed in the Early Hours

On January 24, 2018, the US Dollar Index opened the day lower and traded at fresh three-year low price levels in the early hours.

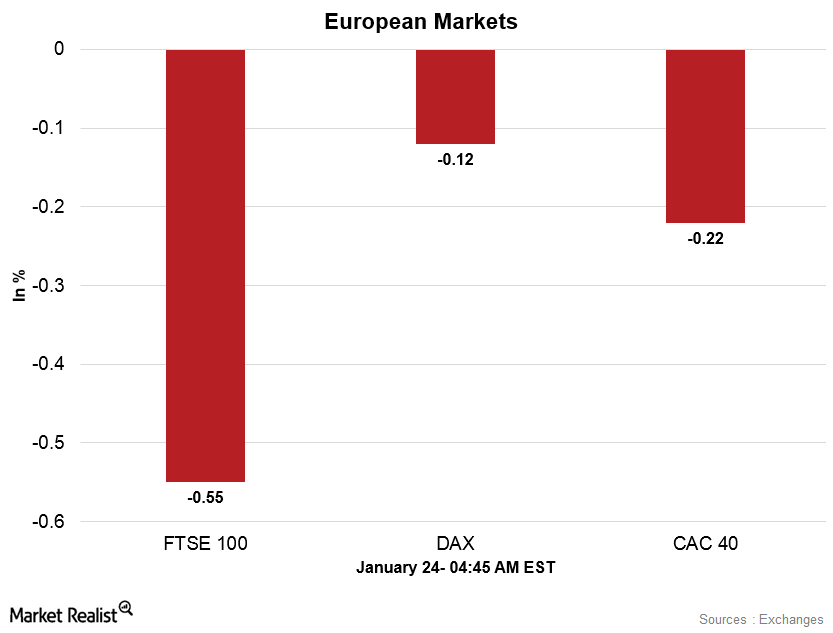

Analyzing European Markets Early on January 24

At 4:40 AM EST on January 24, the DAX Index was trading at 13,536.50—a fall of 0.17%. The iShares MSCI Germany (EWG) rose 0.54% on January 23.

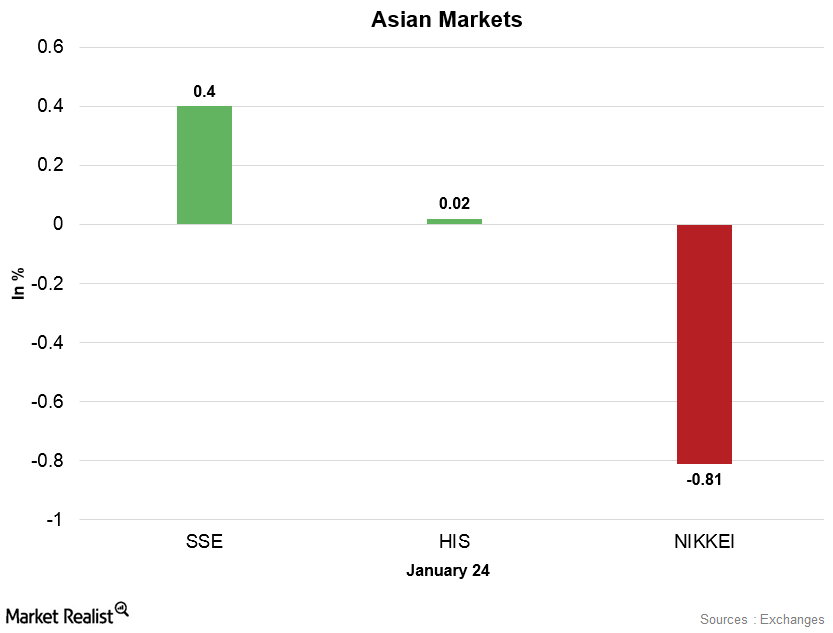

Why Are Asian Markets Mixed on January 24?

The Shanghai Composite Index rose 0.4% and closed the day at 3,560.73 on January 24. The SPDR S&P China (GXC) rose 1.3% on January 23.

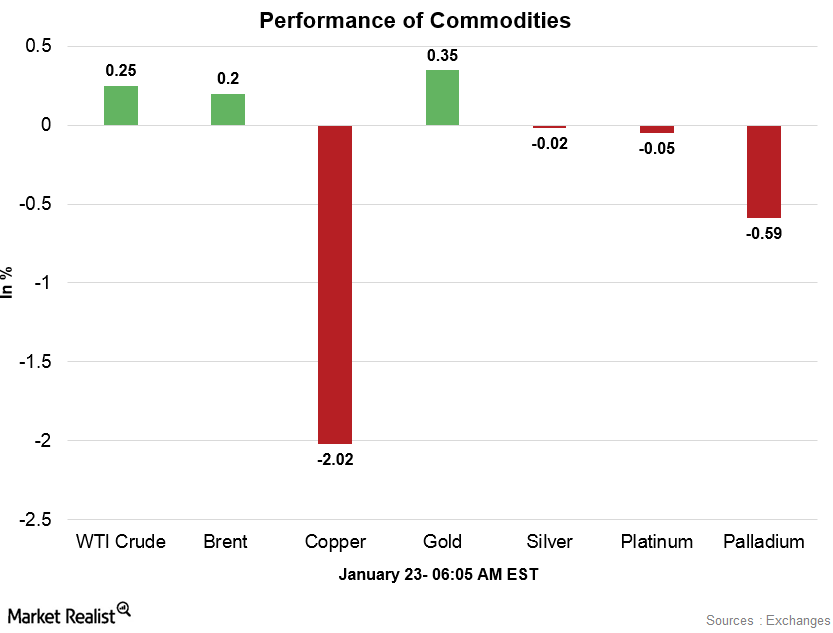

Analyzing Commodities in the Early Hours on January 23

At 5:55 AM EST on January 23, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $63.88 per barrel—a gain of 0.49%.

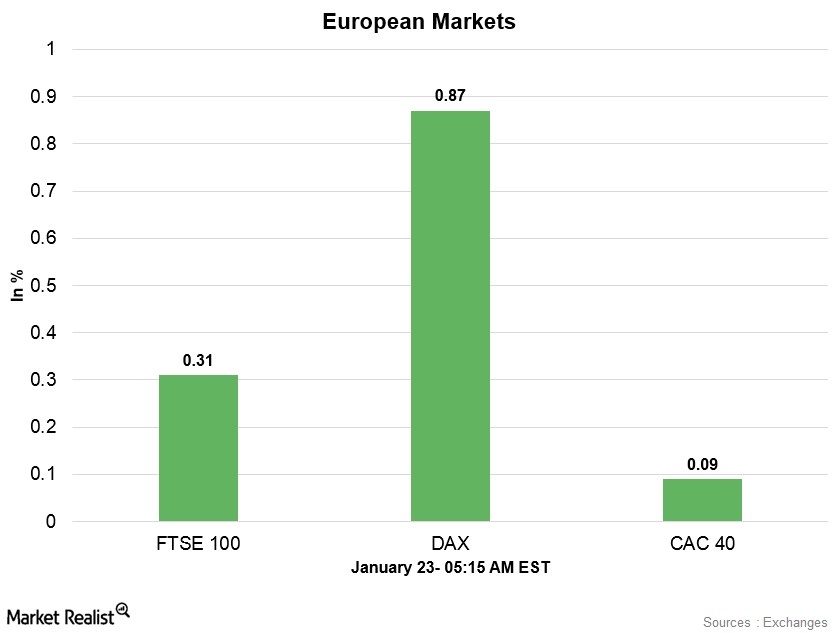

European Markets Were Stronger Early on January 23

At 5:05 AM EST on January 23, the DAX Index was trading at 13,574.50—a rise of 0.82%. The iShares MSCI Germany (EWG) rose 0.62% on January 22.

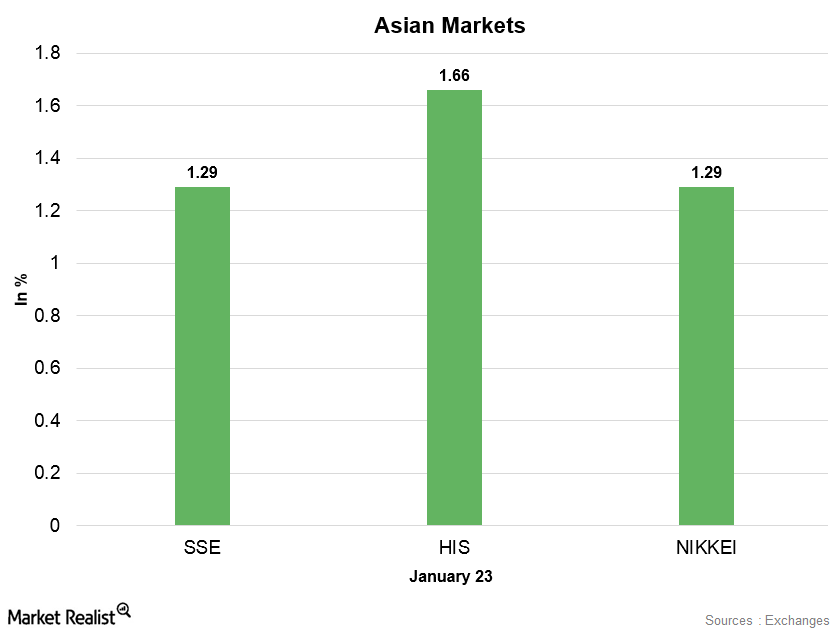

Why Did Asian Markets Increase on January 23?

On January 23, the Hang Seng Index rose 1.7% and closed the day at 32,930.70. The iShares MSCI Hong Kong (EWH) rose 0.87% on January 22.

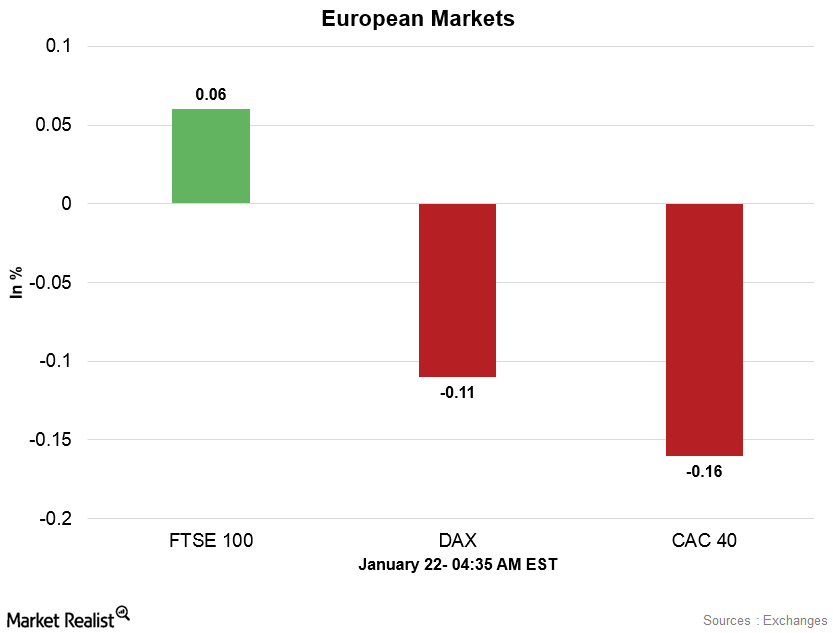

European Markets in the Morning Session on January 22

At 4:30 AM EST on January 22, the DAX Index was trading at 13,419.50—a fall of 0.1%. The iShares MSCI Germany (EWG) rose 1.1% on January 19.

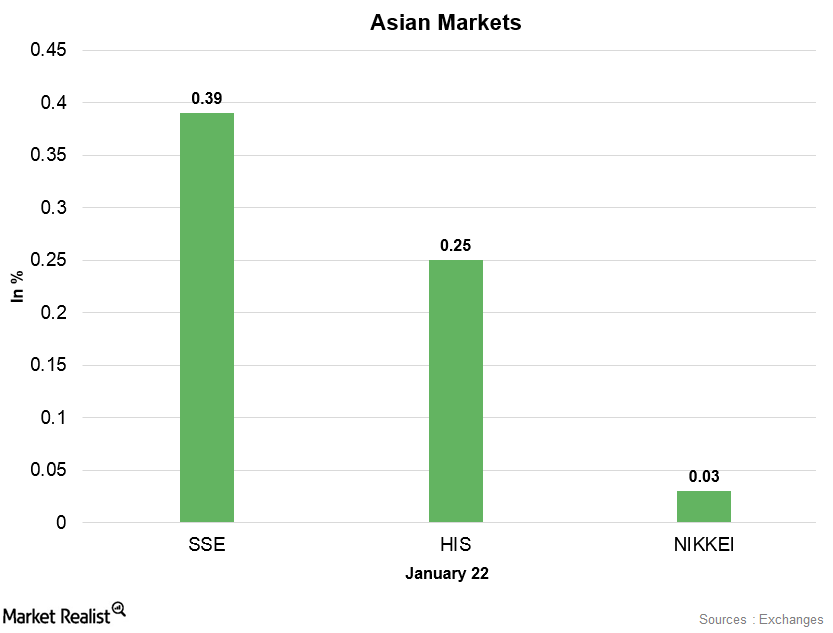

How Did Asian Markets Perform on January 22?

On January 22, the Hang Seng Index rose 0.25% and closed the day at 32,334.50. The iShares MSCI Hong Kong (EWH) rose 0.45% on January 19.

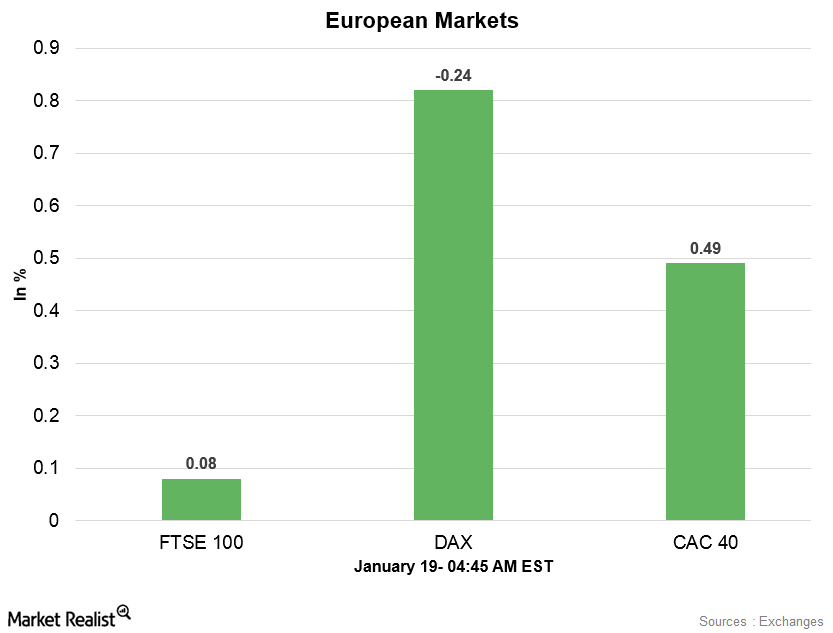

European Markets Are Strong Early on January 19

At 4:45 AM EST on January 19, the DAX Index was trading at 13,387.50—a gain of 0.8%. The iShares MSCI Germany (EWG) rose 0.58% on January 18.

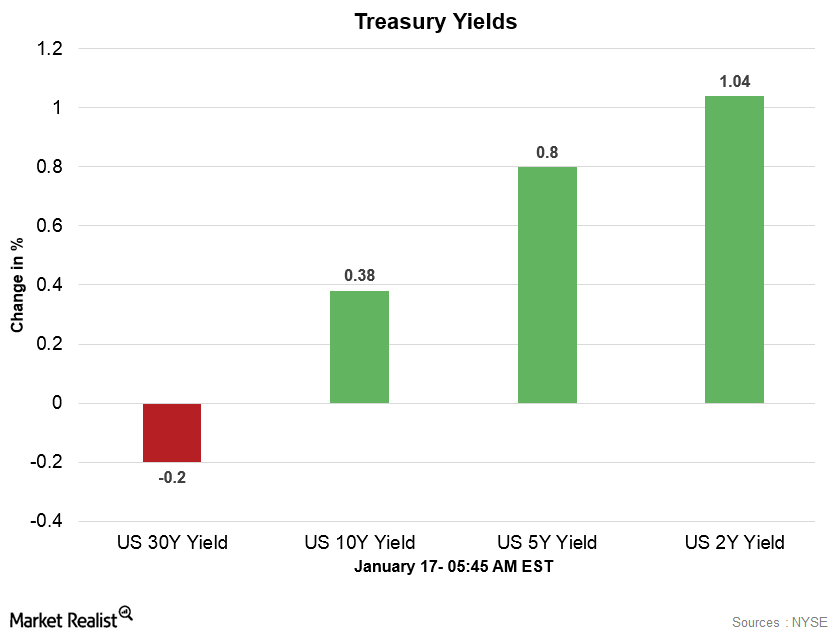

US Dollar Index and Treasury Yields on January 17

The US Dollar Index is trading above opening prices with stability. At 5:30 AM EST on January 17, the US Dollar Index was trading at 90.6.

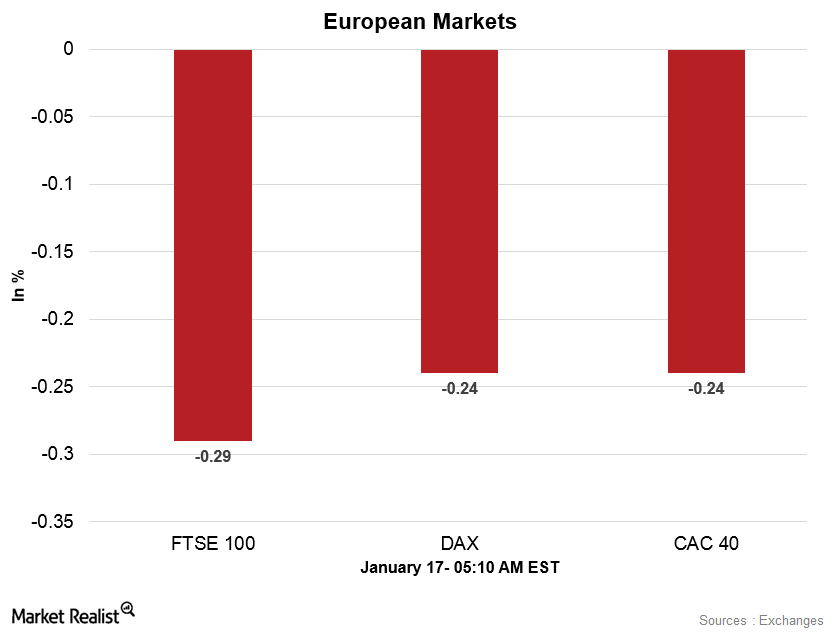

Analyzing European Markets in the Morning Session on January 17

At 4:55 AM EST on January 17, the DAX Index was trading at 13,224.50—a drop of 0.16%. The iShares MSCI Germany (EWG) rose 0.14% on January 16.

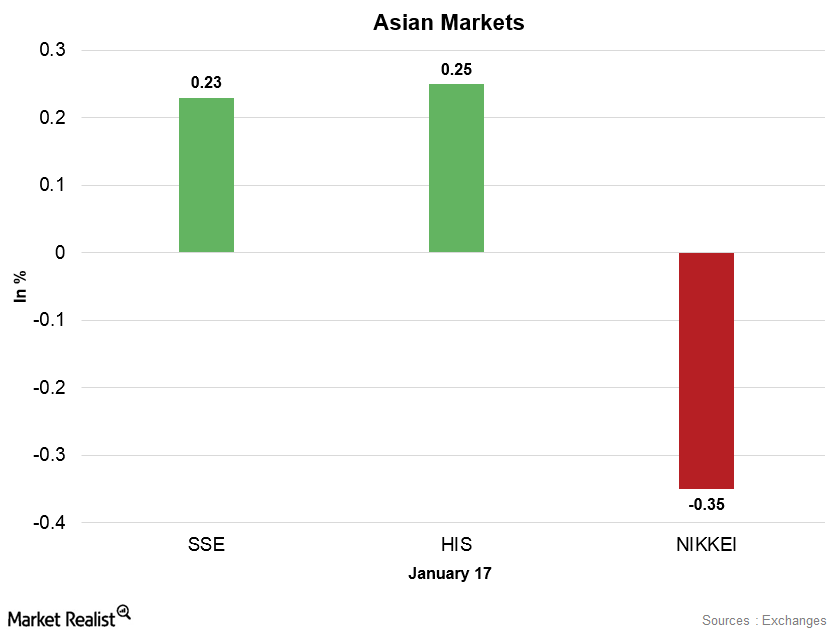

How Did Asian Markets Perform on January 17?

On January 17, the Hang Seng Index rose 0.25% and closed the day at 31,983.41. The iShares MSCI Hong Kong (EWH) rose 0.08% on January 16.

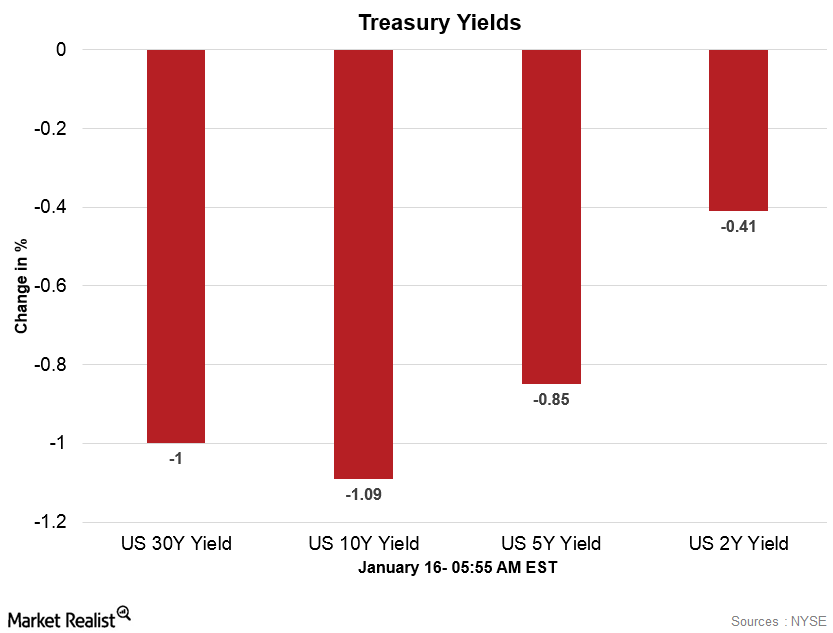

US Dollar Index Regained Strength Early on January 16

After falling for four consecutive trading weeks, the US Dollar Index started this week on a weaker note by falling to three-year low price levels.

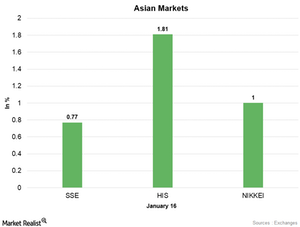

Why Did Asian Markets Rise on January 16?

On January 16, the Hang Seng Index rose 1.8% and closed the day at 31,904.75. The iShares MSCI Hong Kong (EWH) rose 0.65% on January 12.

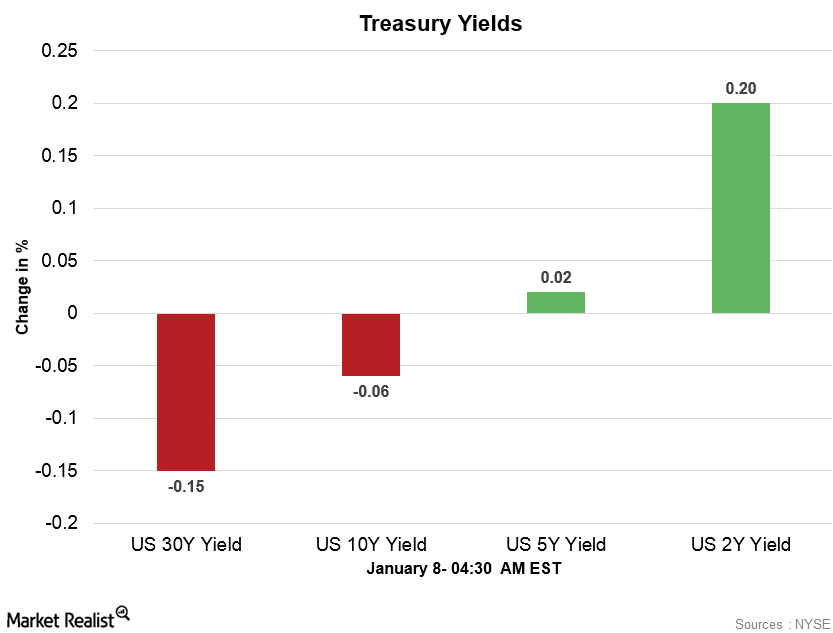

US Dollar Index and Treasury Yields Early on January 8

The US Dollar Index opened January 8 on a stronger note and traded at one-week high price levels in the early hours.

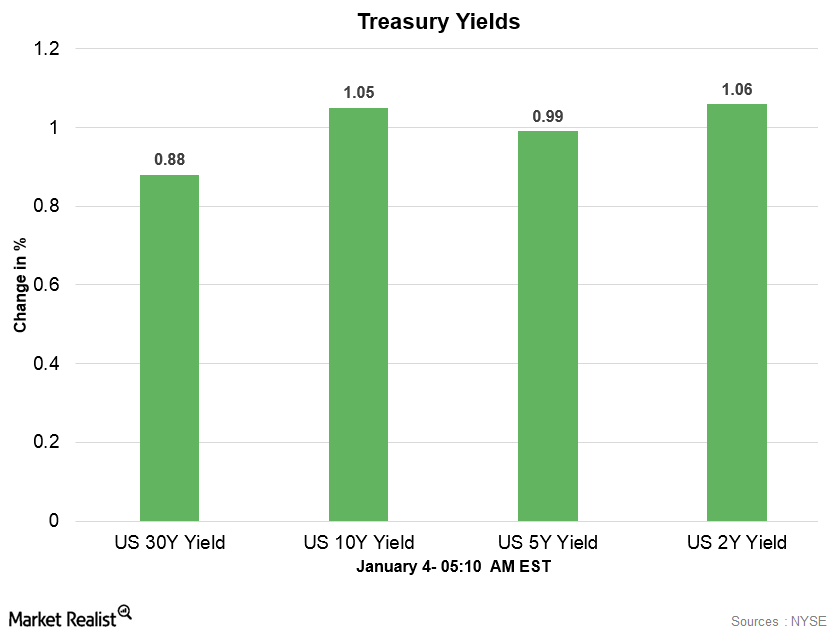

US Dollar Index and Treasury Yields Early on January 4

After falling for two consecutive trading weeks, the US Dollar Index started this week on a weaker note and traded with mixed sentiment.

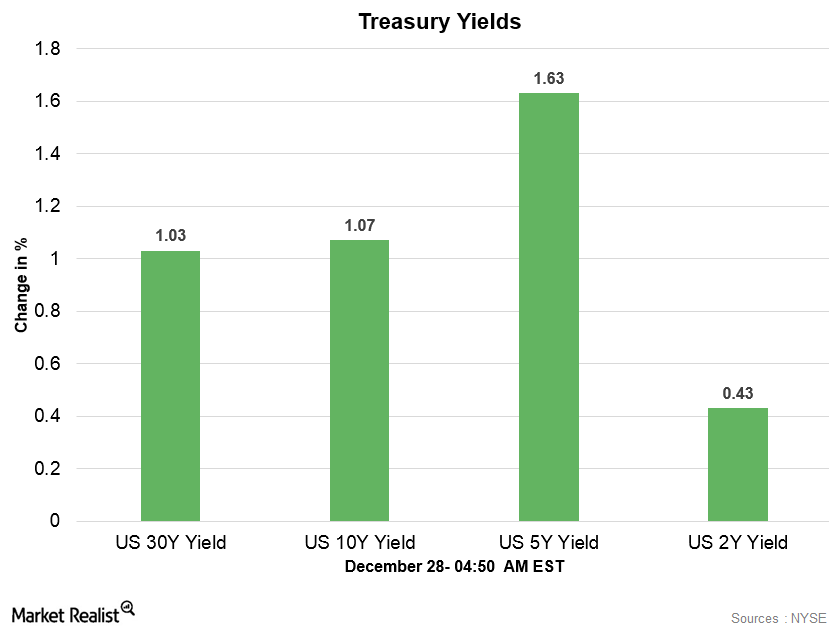

How the US Dollar Index and Treasury Yields Performed on December 28

The US Dollar Index broke its three-week-long gaining steak this week and fell to three-week low price levels on Wednesday.

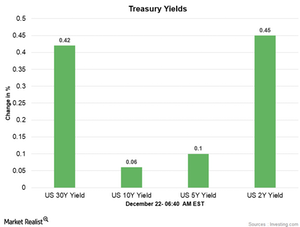

US Dollar Index and Treasury Yields Are Stable in the Early Hours

After gaining for three trading weeks, the US Dollar Index started this week on a weaker note and fell in the first four trading days of the week.

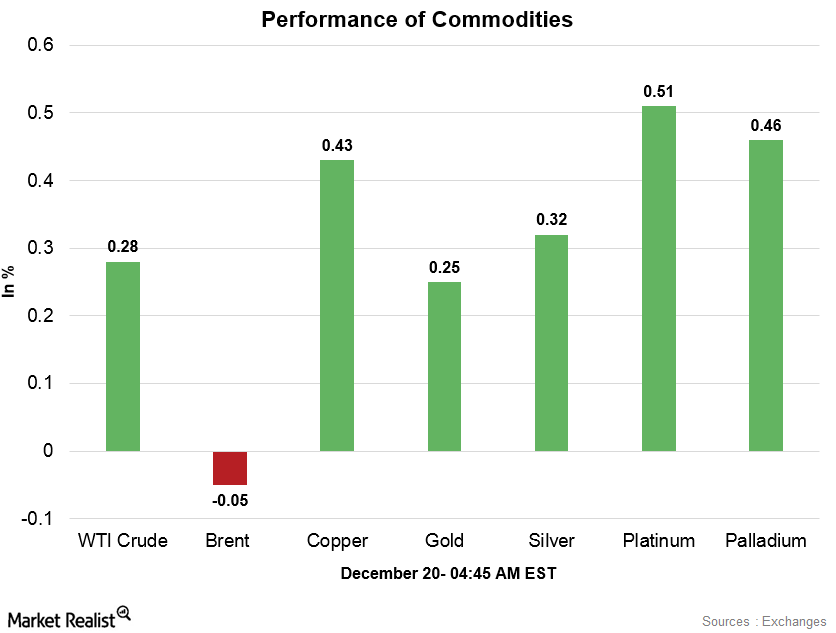

Commodities Are Strong in the Early Hours on December 20

Gold and silver are strong early on December 20. The lower global risk appetite and weak US dollar are supporting gold prices in the early hours.

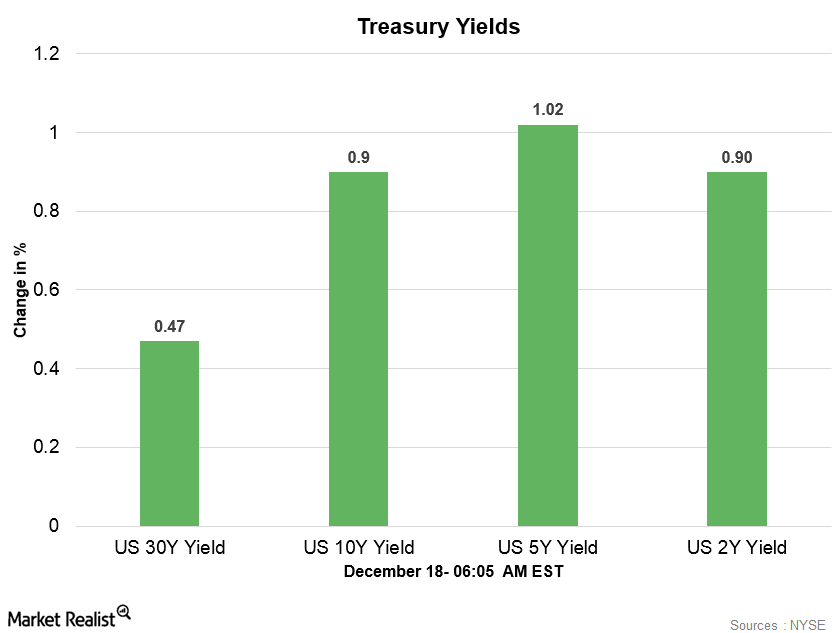

US Dollar Index and Treasury Yields Rose in the Early Hours

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a mixed note.

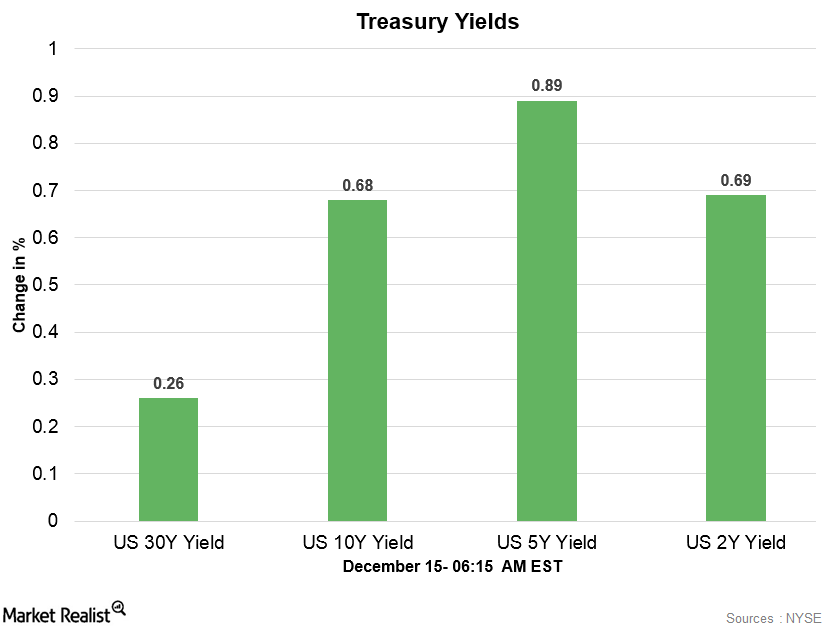

US Dollar Index is Weak in the Early Hours on December 15

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment.