Val Kensington

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Val Kensington

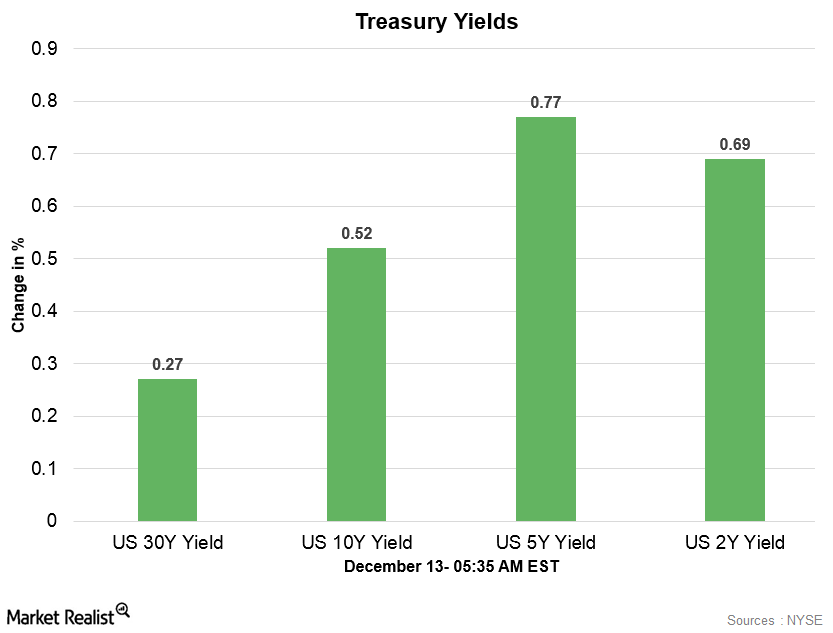

US Dollar Index Is Weak Early on December 13

In the early hours on Wednesday, the US Dollar Index is weak and trading below the opening prices. At 3:50 AM EST, it was trading at 94—a fall of 0.11%.

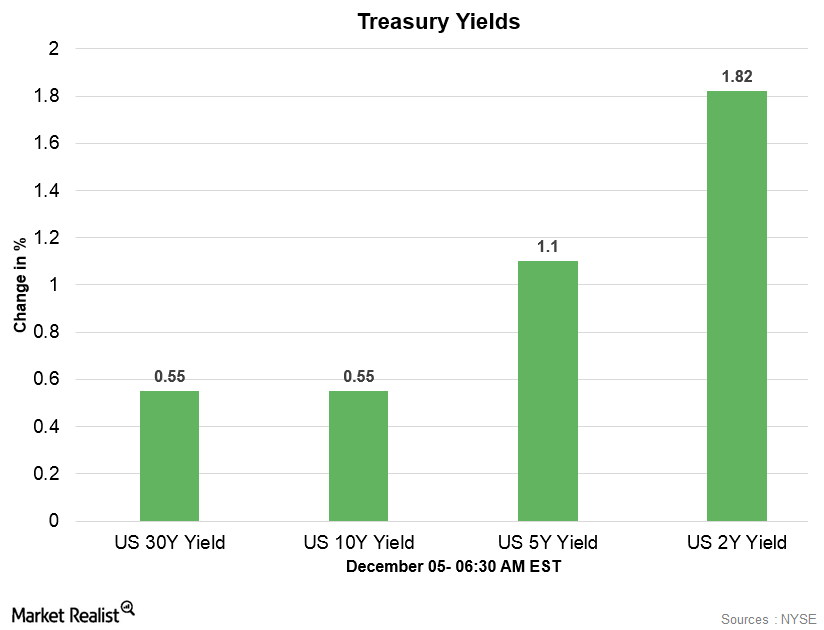

US Dollar Index and Treasury Yields Are Stable

The US Dollar Index started this week on a stronger note by rebounding on Monday. The US Dollar Index opened Tuesday on a stable note.

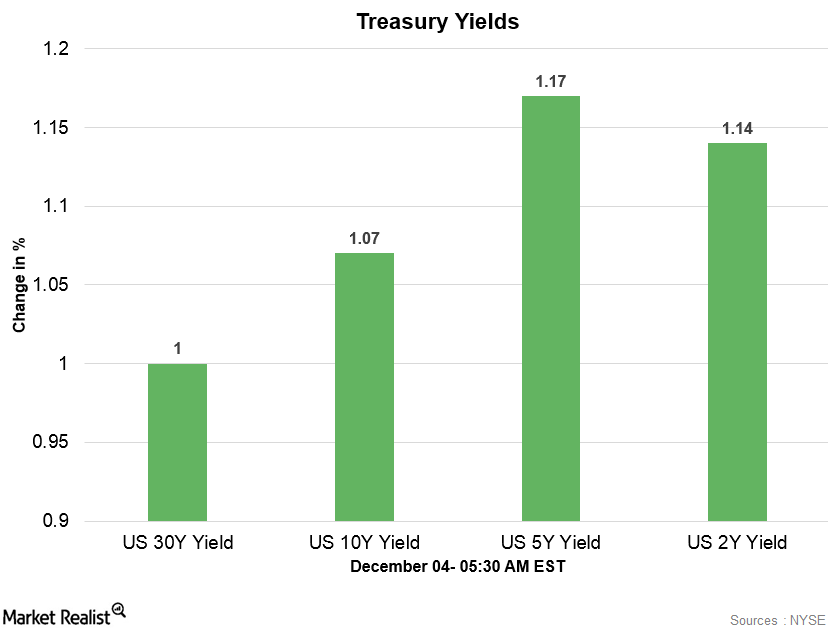

US Dollar Index and Treasury Yields Are Strong

The US Dollar Index broke its three-week losing streak last week and regained stability. The US Dollar Index opened higher on Monday.

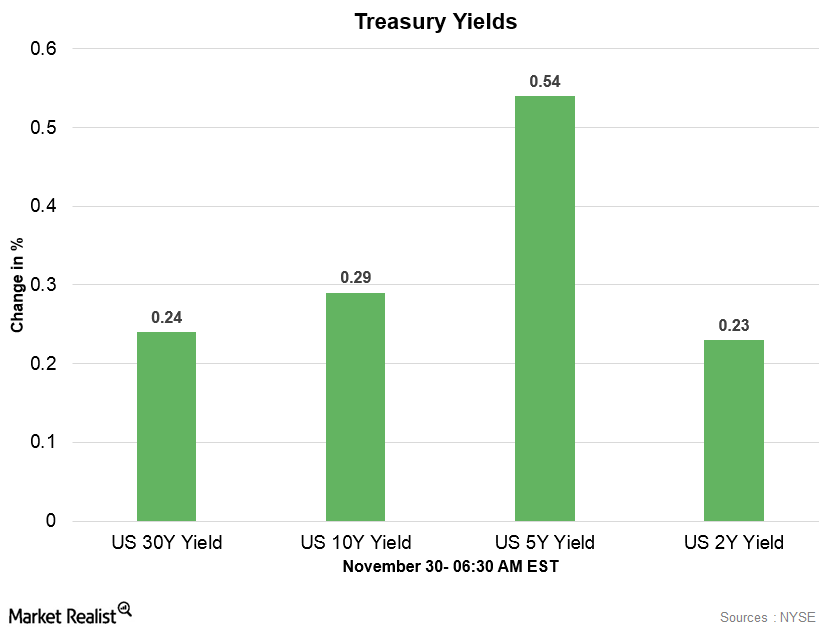

US Dollar Index and Treasury Yields Are Strong on November 30

In the early hours on November 30, the US Dollar Index is trading with strength above opening prices.

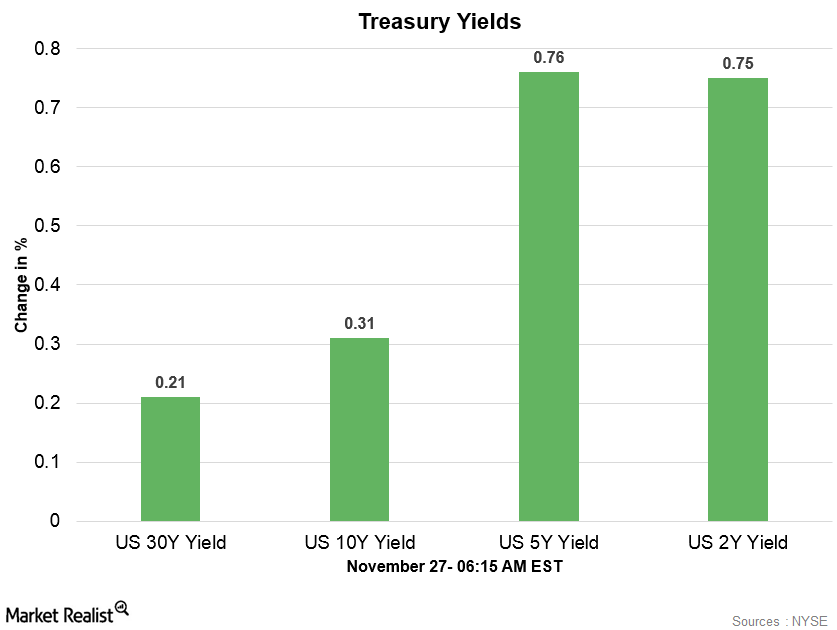

US Dollar Index Is Weak in the Early Hours on November 27

The US Dollar Index started this week on a weaker note and traded below the opening prices in the early hours on Monday.

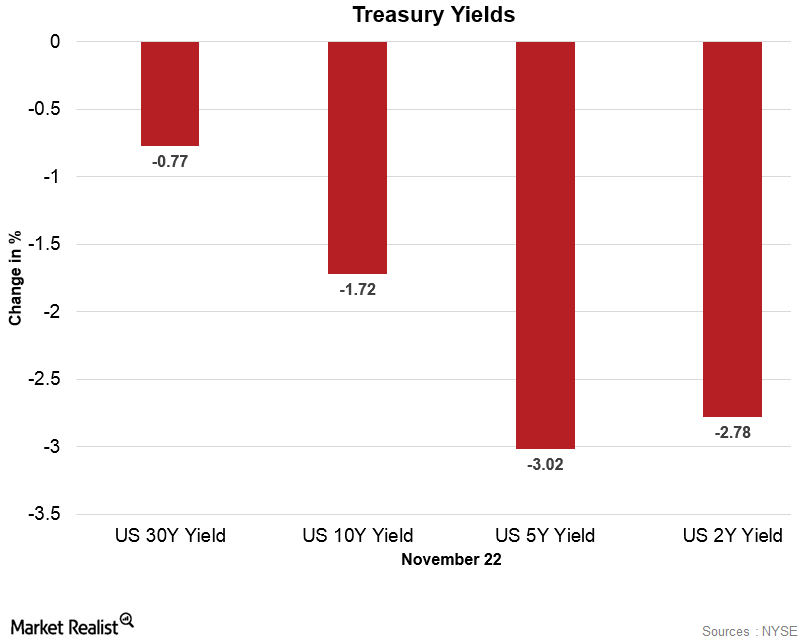

US Dollar Index Weak in The Early Hours of November 23

US Dollar Index The US Dollar Index has been weak for two consecutive trading weeks, and started this week on a mixed note. The index lost strength as the week progressed and fell to four-week lows on Wednesday. The US Dollar Index opened the day with weakness on Thursday. Market sentiment Market sentiment towards the US Dollar Index was […]

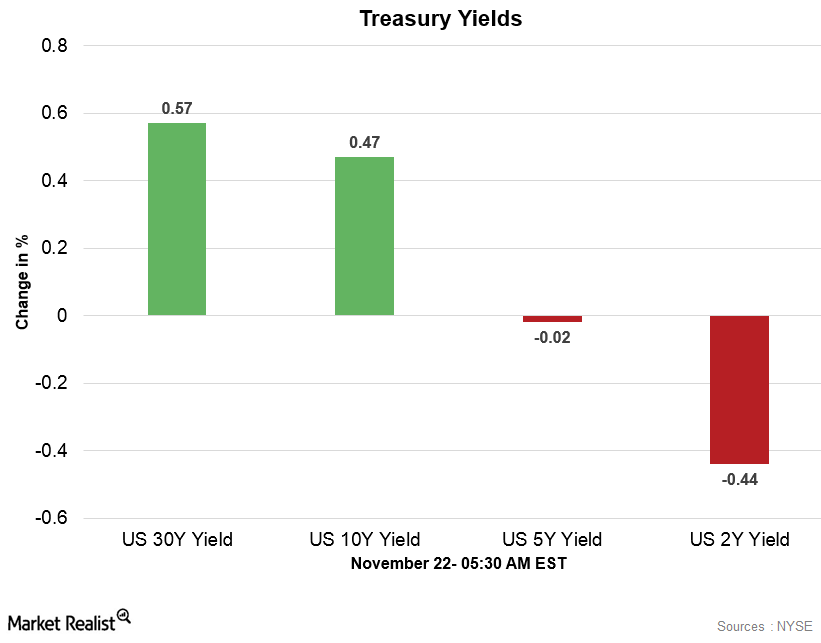

US Dollar Index Consolidates in the Early Hours

In the early hours on November 22, the US Dollar Index is trading with weakness below the opening prices.

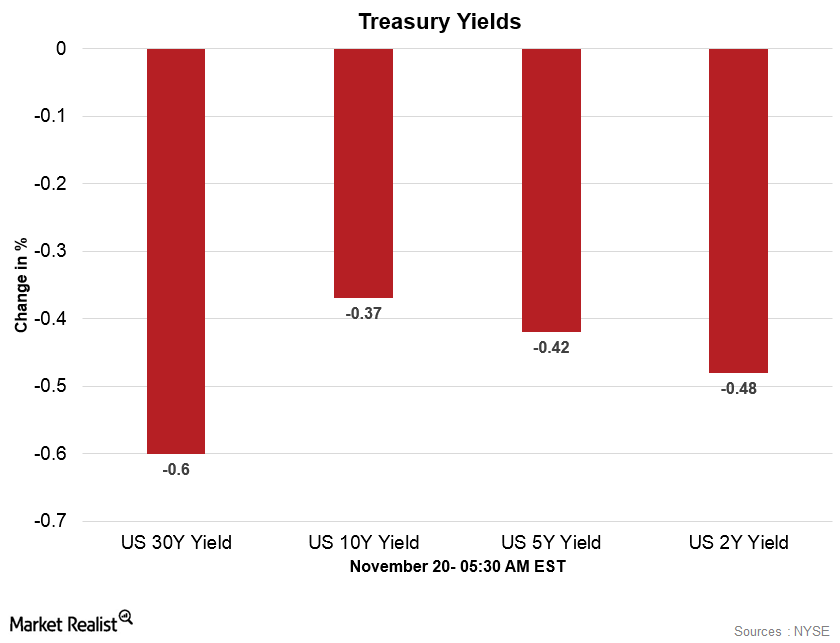

US Dollar Index is Stable in the Early Hours on November 20

The US Dollar Index opened on a stronger note on November 20. However, the dollar lost strength as the day progressed.

US Dollar Index Is Weak in the Early Hours on November 17

The US Dollar Index started Friday on a weaker note and traded below the opening prices with weakness in the morning session.

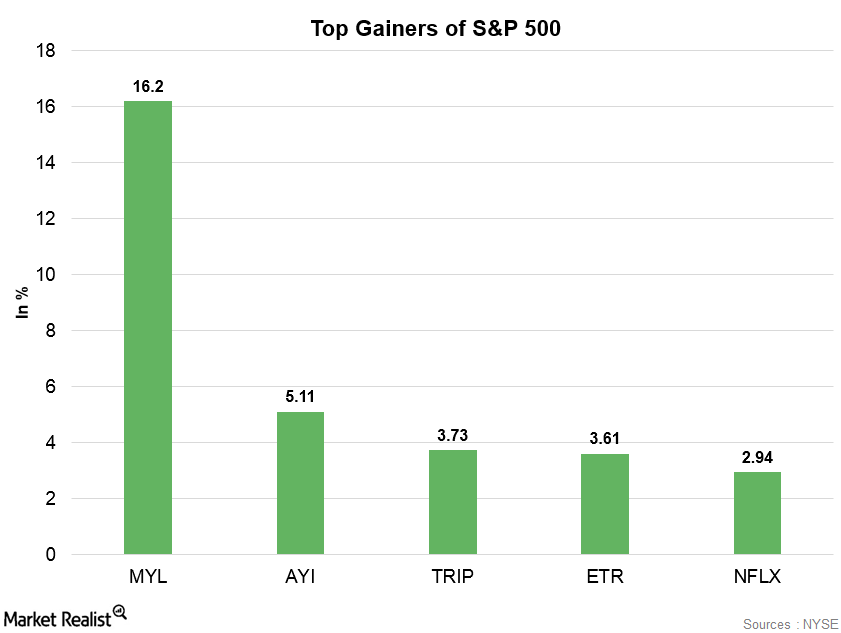

Mylan: S&P 500’s Top Gainer on October 4

Mylan, which is one of the leading global pharmaceutical companies in the world, was the S&P 500’s top gainer on October 4.

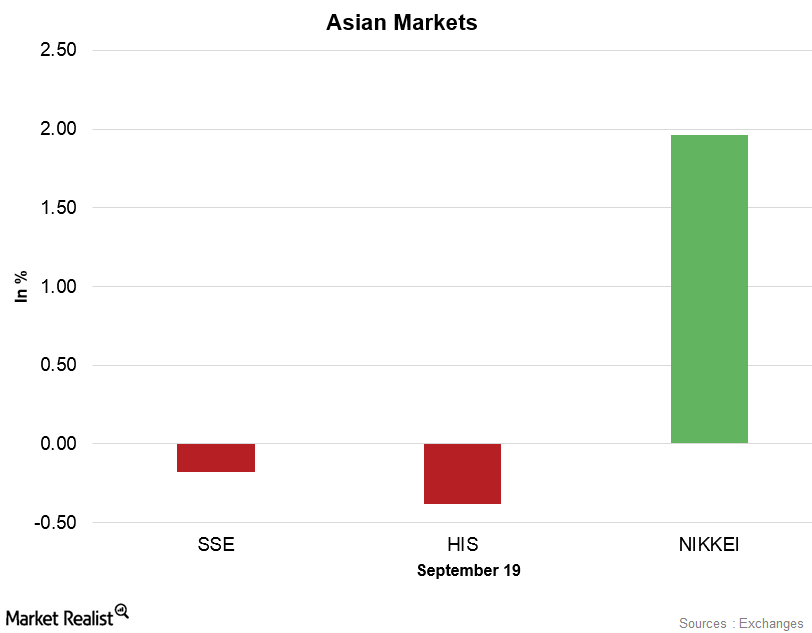

Asian Markets Are Mixed on September 19, Decreased Risk Appetite

On September 19, 2017, the Shanghai Composite Index fell 0.18% and ended at 3,356.84. The SPDR S&P China ETF (GXC) rose 1.1% and closed at 104.38.

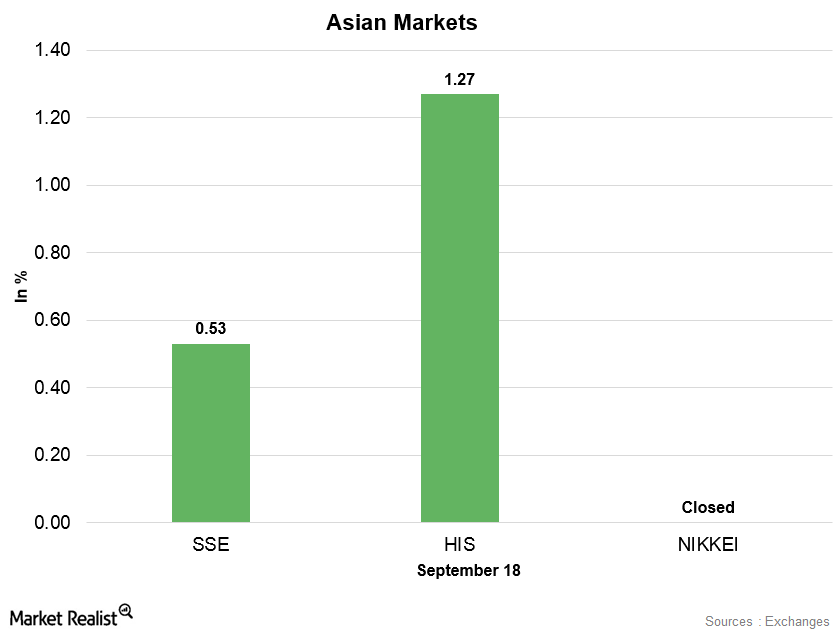

Asian Markets Rose amid China’s Strong New Loans Data

On September 18, 2017, the Shanghai Composite Index rose 0.53% and ended at 3,362.86. The SPDR S&P China ETF (GXC) rose 0.54% and closed at 103.20.

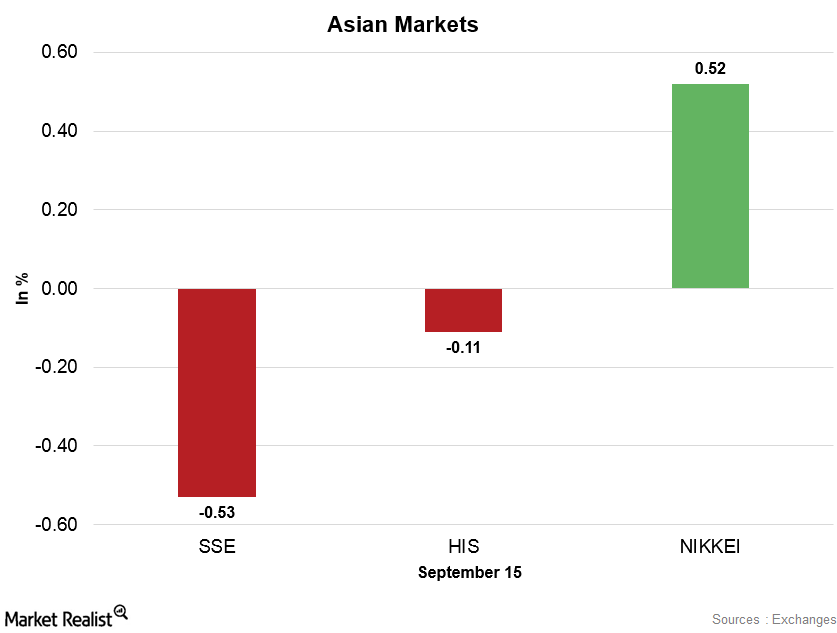

Asian Markets Are Mixed amid North Korea Tensions

On September 15, 2017, the Shanghai Composite Index fell 0.53% and ended at 3,353.62. The SPDR S&P China ETF (GXC) fell 0.1% and closed at 102.65.

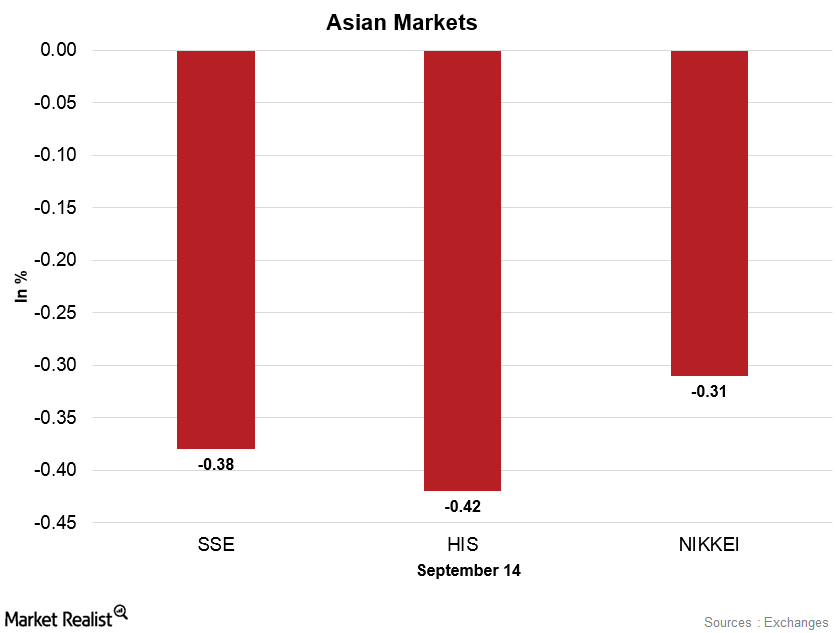

Asian Markets Pulled Back amid China’s Weak Economic Data

On September 14, 2017, the Shanghai Composite Index fell 0.38% and ended at 3,371.43. The SPDR S&P China ETF (GXC) rose 0.33% and closed at 102.75.

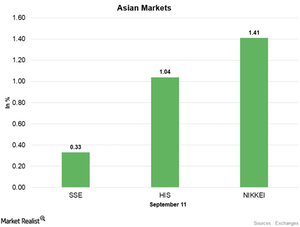

Asian Markets Started the Week on a Stable Note

On September 11, 2017, the Shanghai Composite Index rose 0.33% and ended at 3,376.42. The SPDR S&P China ETF (GXC) fell 0.53% and closed at 100.30.

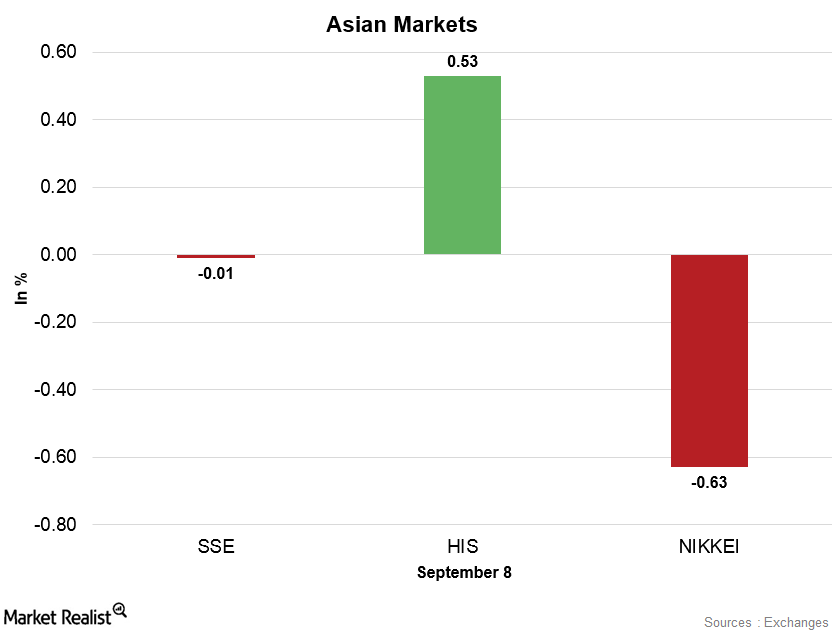

Asian Markets Were Mixed on September 8

On September 8, 2017, the Shanghai Composite Index fell 0.01% and ended at 3,365.24. The SPDR S&P China ETF (GXC) rose 0.78% and closed at 100.83.

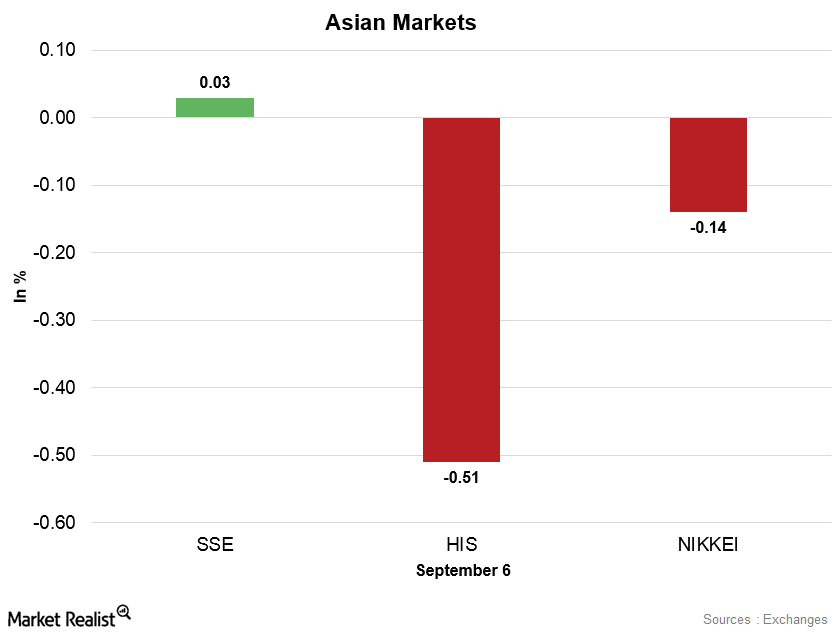

Asian Markets Lost Strength amid North Korea Tensions

On Tuesday, the Shanghai Composite started the day on a weaker note by opening lower. However, the market gained strength as the day progressed.

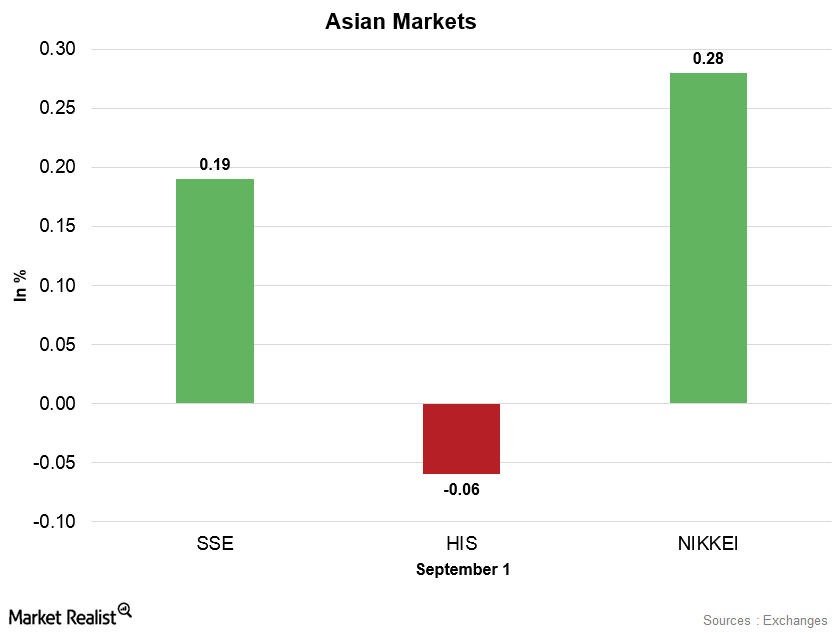

Asian Markets Are Stable on September 1

On September 1, 2017, the Shanghai Composite Index rose 0.19% and ended at 3,367.12. The SPDR S&P China ETF (GXC) rose 0.32% and closed at 100.65.

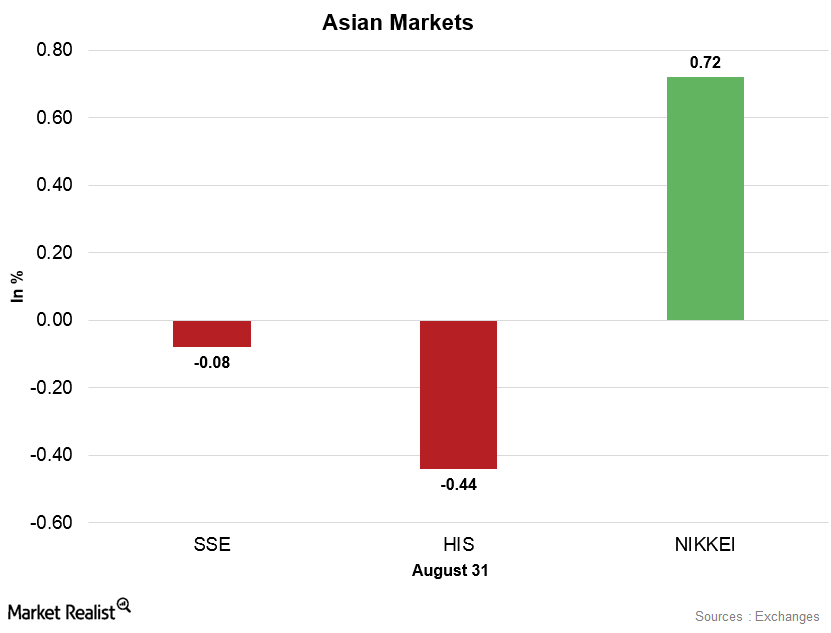

Asian Markets Are Mixed on August 31

On August 31, 2017, the Shanghai Composite Index fell 0.08% and ended at 3,360.81. The SPDR S&P China ETF (GXC) rose 0.83% and closed at 100.33.

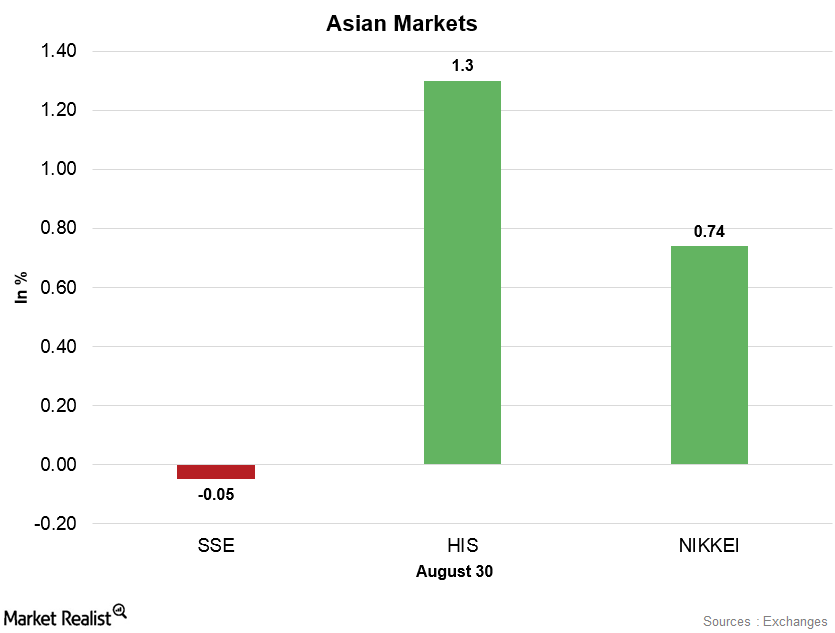

Asian Markets Are Mixed amid Improved Market Sentiment

On August 30, 2017, the Shanghai Composite Index fell 0.05% and ended at 3,363.63. The SPDR S&P China ETF (GXC) rose 0.02% and closed at 99.50.

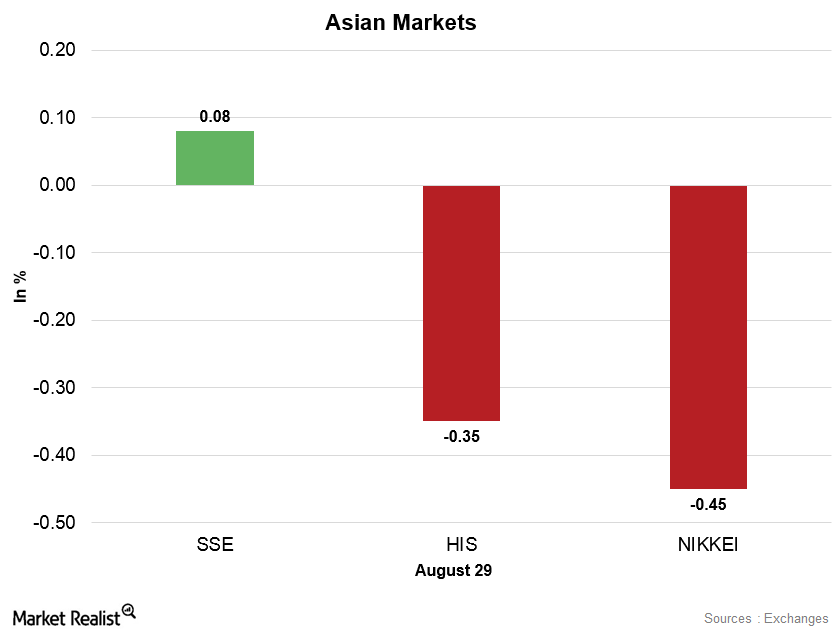

Asian Markets Are Weak on August 29 amid Geopolitical Tension

On August 29, 2017, the Shanghai Composite Index rose 0.08% and ended at 3,365.23. The SPDR S&P China ETF (GXC) fell 0.71% and closed at 99.48.

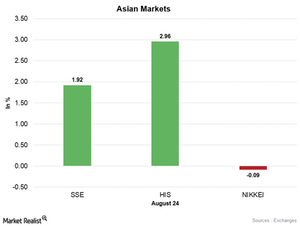

Why Were Asian Markets Mixed on August 28?

On August 28, the Shanghai Composite opened the day above the important resistance of 3,300 and rose to fresh 20-month high price levels.

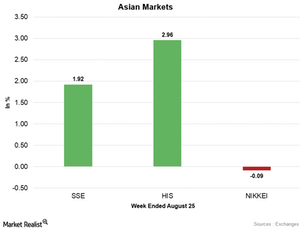

Asian Markets Rose in the Week Ending on August 25

After regaining strength last week, China’s Shanghai Composite Index continued to gain in the week ending on August 25.

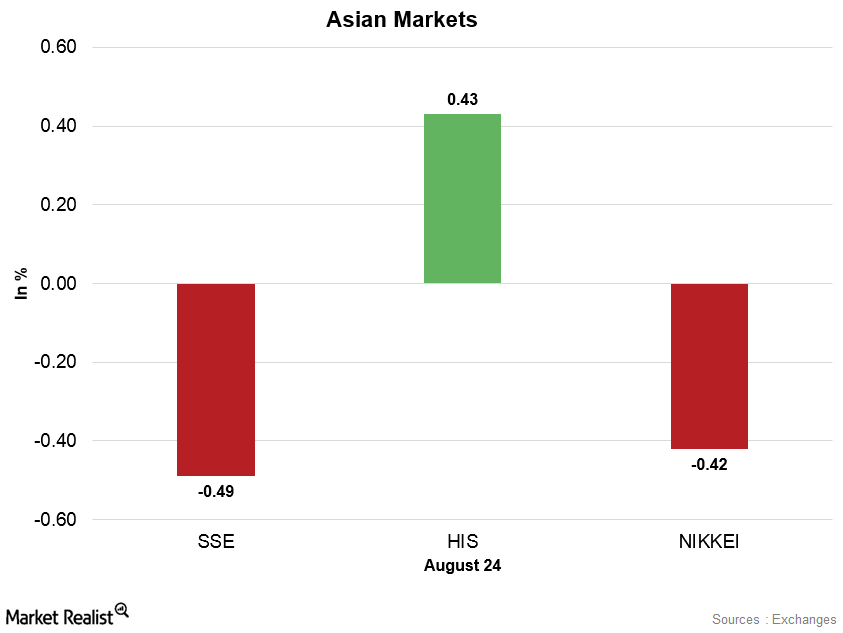

Mixed Asian Markets, Shanghai Composite Fell the Most in 2 Weeks

China’s Shanghai Composite Index started this week on a stronger note after regaining strength last week. However, it consolidated on August 22–23.

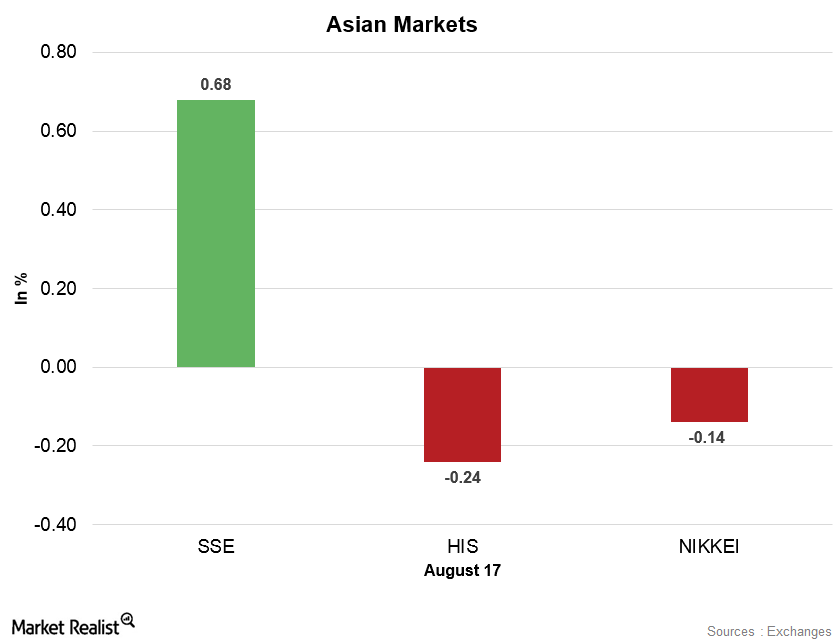

Asian Markets Are Mixed on August 17, China Regains Strength

China’s Shanghai Composite Index fell last week. On August 17, 2017, the Shanghai Composite Index rose 0.68% and ended at 3,268.43.

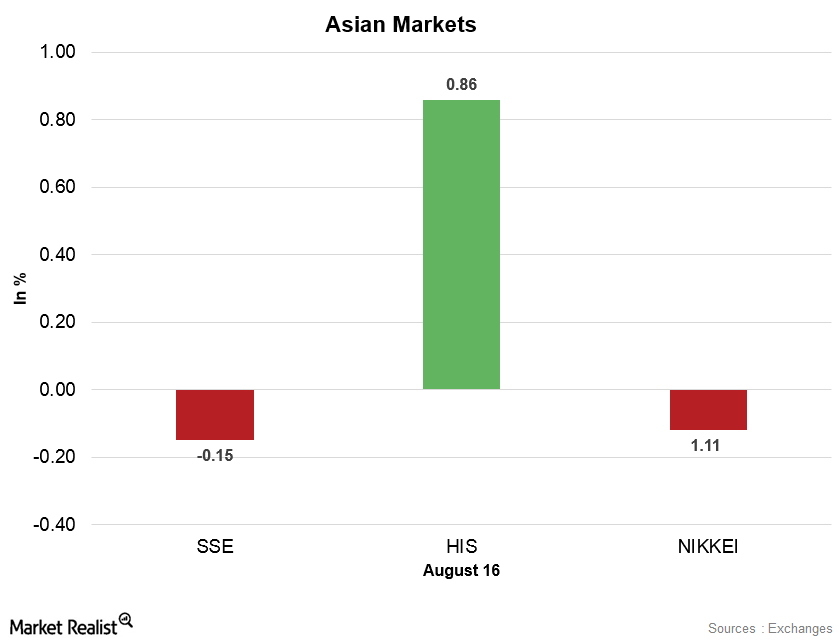

Asian Markets Were Mixed on August 16, China Pulled Back

After gaining for seven consecutive trading weeks, China’s Shanghai Composite Index fell last week. The index started this week on a stronger note.

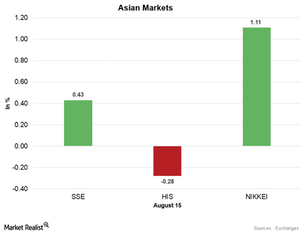

Asian Markets Buoyed by Increased Risk Appetite

After gaining for seven consecutive trading weeks, China’s Shanghai Composite Index fell last week. But despite weak economic data, the index rebounded on Monday.

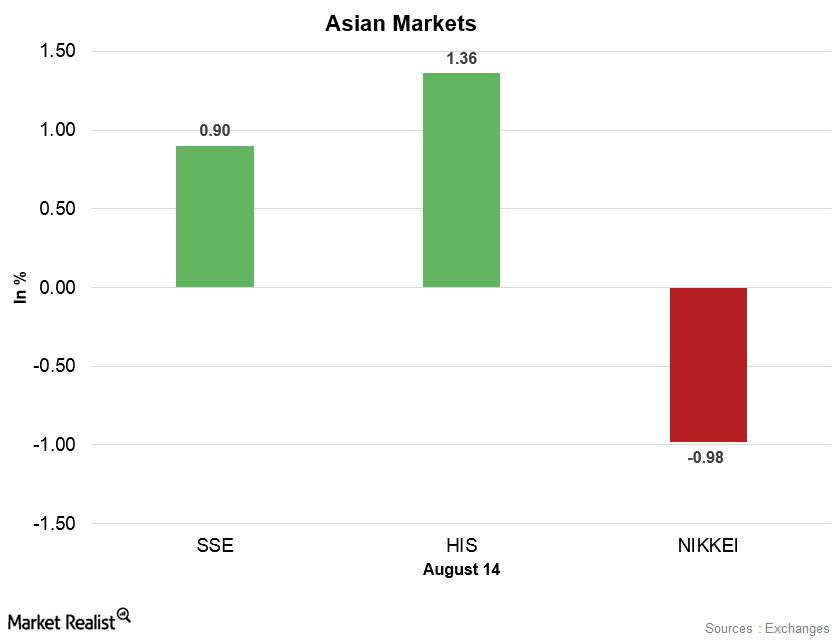

Why Asian Markets Rebounded on August 14

Asian markets rebounded on Monday as concerns about the geopolitical tensions between North Korea and the United States abated.

Asian Markets Continue to Weaken amid North Korean Strife

With an additional weakness in the markets due to tensions in North Korea, Japan’s Nikkei Index fell on Thursday to the lowest level in more than two months.

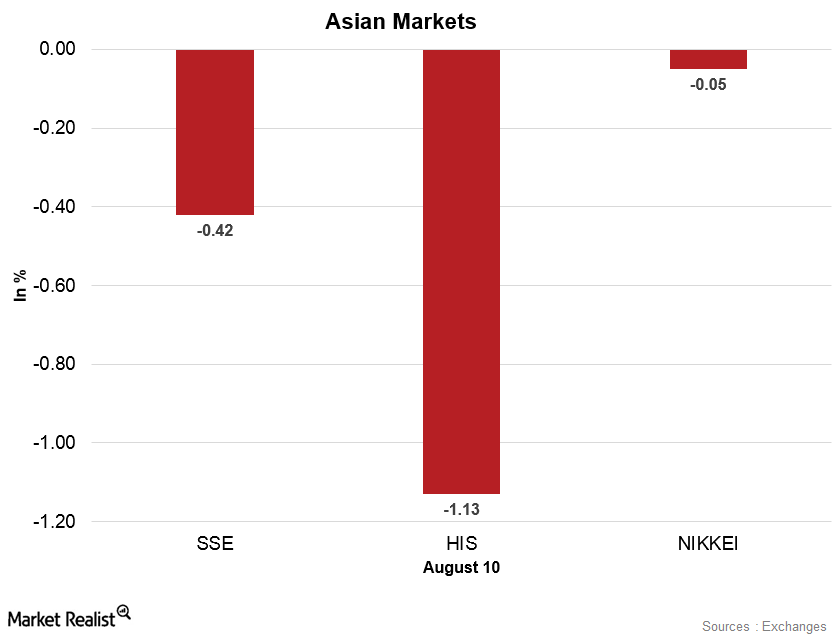

Asian Markets Are Weaker amid North Korea Tensions

On August 10, the Shanghai Composite Index fell 0.42% and ended at 3,261.75. The market is looking forward to the release of China’s new loans data.

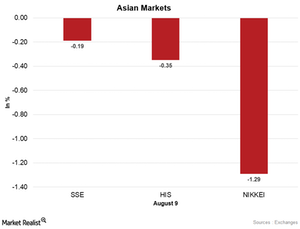

Asian Markets Pulled Back amid North Korea Tensions

On Wednesday, the Nikkei opened the day lower and closed at more than two-month lows. Increased tensions with North Korea weighed on the Nikkei Index.

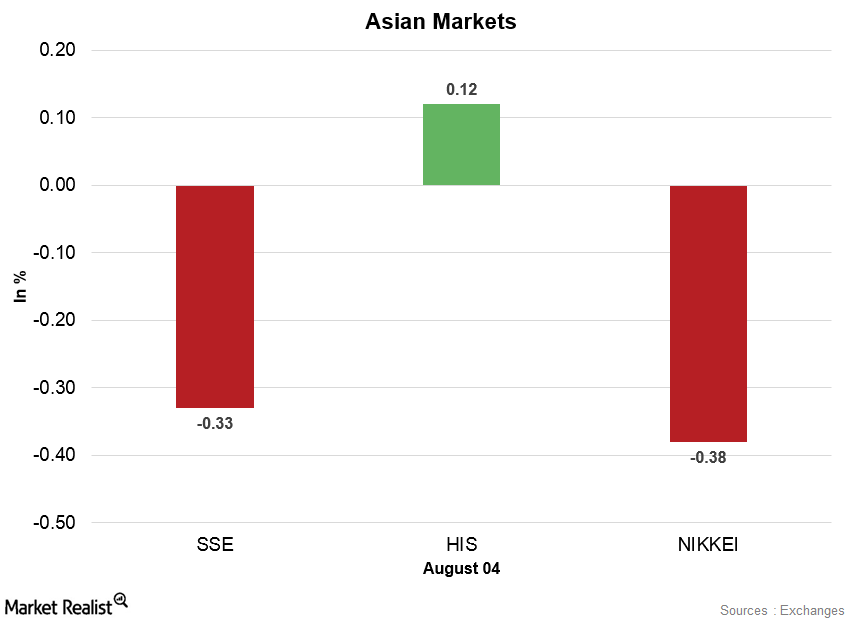

Asian Markets Were Weak on August 4, Decreased Risk Appetite

On August 4, the Shanghai Composite Index fell 0.33% and ended the day at 3,262.08. The SPDR S&P China ETF (GXC) fell 0.05% to $96.77 on August 3.

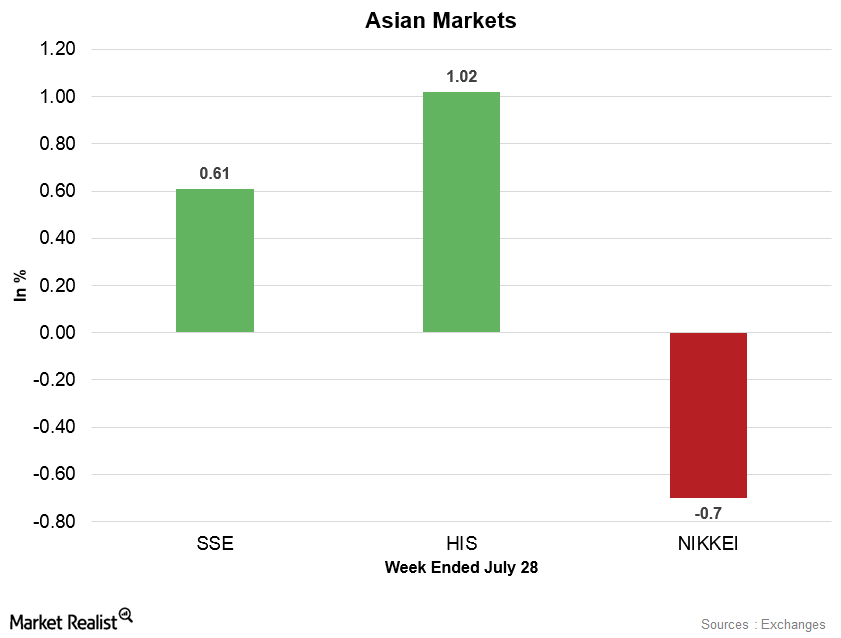

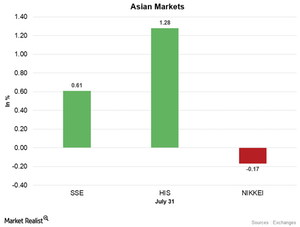

Asian Markets Were Mixed in the Week Ending July 28

After gaining for five consecutive trading weeks, China’s Shanghai Composite Index started the week ending July 28 on a stronger note.

Asian Markets Started This Week on a Positive Note

After gaining for six consecutive trading weeks, China’s Shanghai Composite Index started this week on a stronger note.

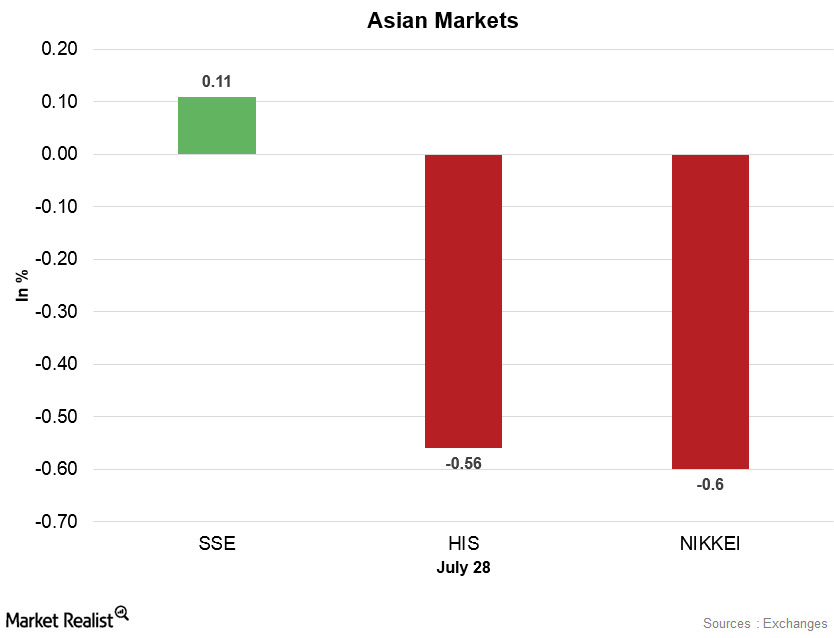

Asian Markets Pulled Back on July 28

On July 28, the Shanghai Composite Index rose 0.11% and ended the day at 3,253.24. The SPDR S&P China ETF (GXC) fell 0.48% to $95.76 on July 27.

Asian Markets Maintained Strength on July 27

On July 27, the Shanghai Composite Index rose 0.06% and ended the day at 3,249.78. The SPDR S&P China ETF (GXC) rose 0.91% to $96.22 on July 26.

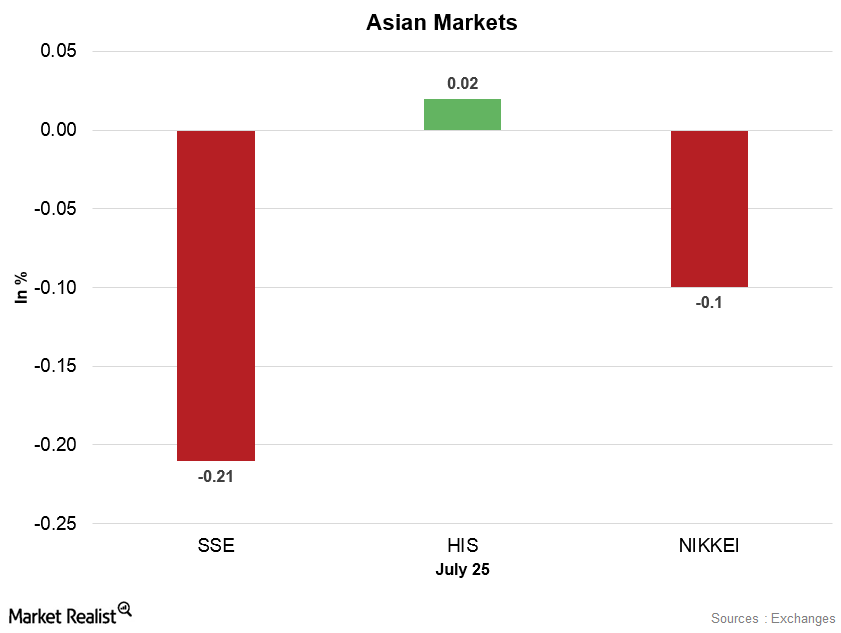

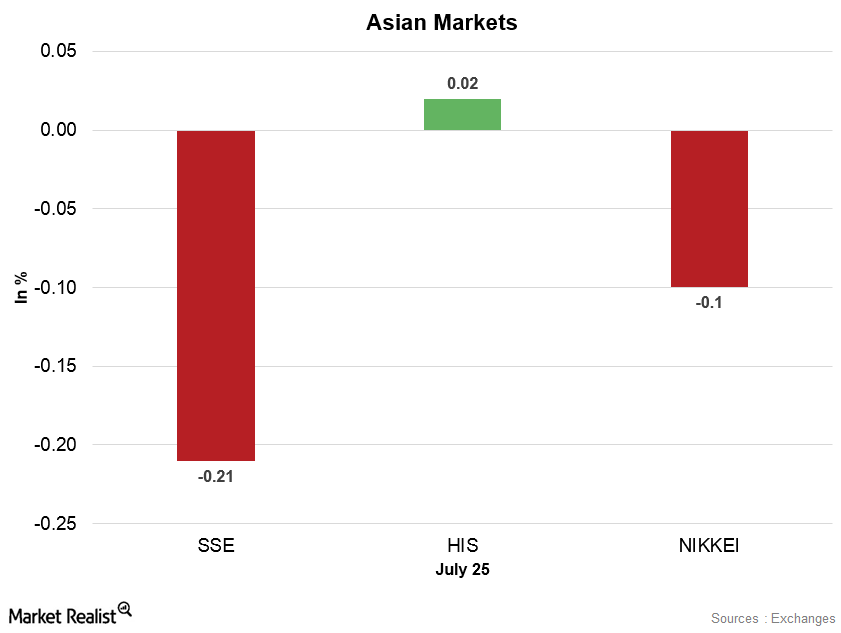

Asian Markets Lost Momentum on July 25

On July 25, the Shanghai Composite Index started the day on a stable note but ended the day with losses amid profit-booking.

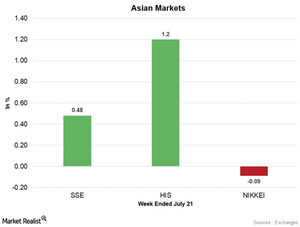

Asian Markets Were Stronger in the Week Ending July 21

China’s Shanghai Composite Index started the week ending July 21 weaker by falling to almost three-week low price levels on the first day of trading.

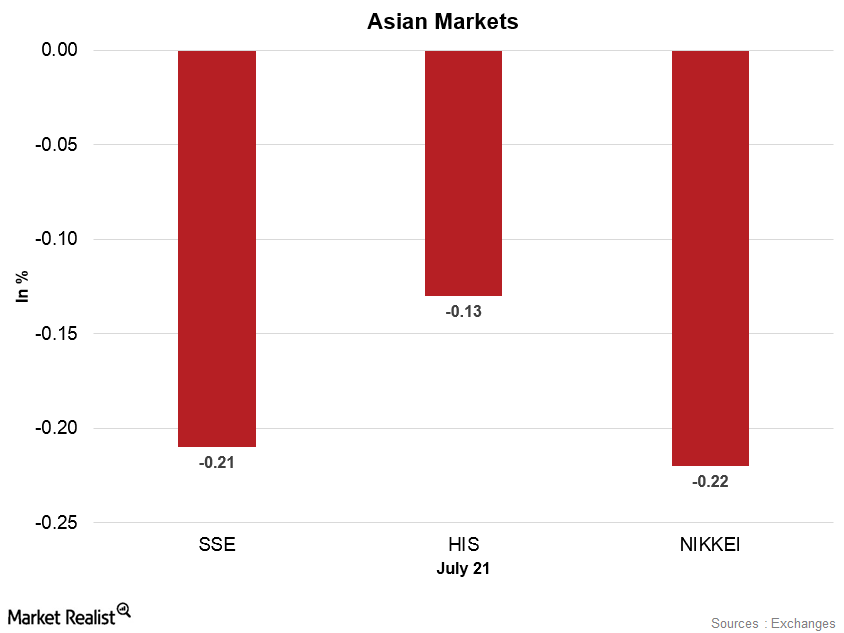

Asian Markets Pulled Back amid Dented Market Sentiment

China’s market regained strength this week amid improved market sentiment. It gained for three consecutive trading days until Thursday.

Asian Markets Rose Early on July 20

On July 20, the Shanghai Composite Index rose 0.43% and ended the day at 3,244.86. The SPDR S&P China ETF (GXC) rose 1.4% to $95.44 on July 19.

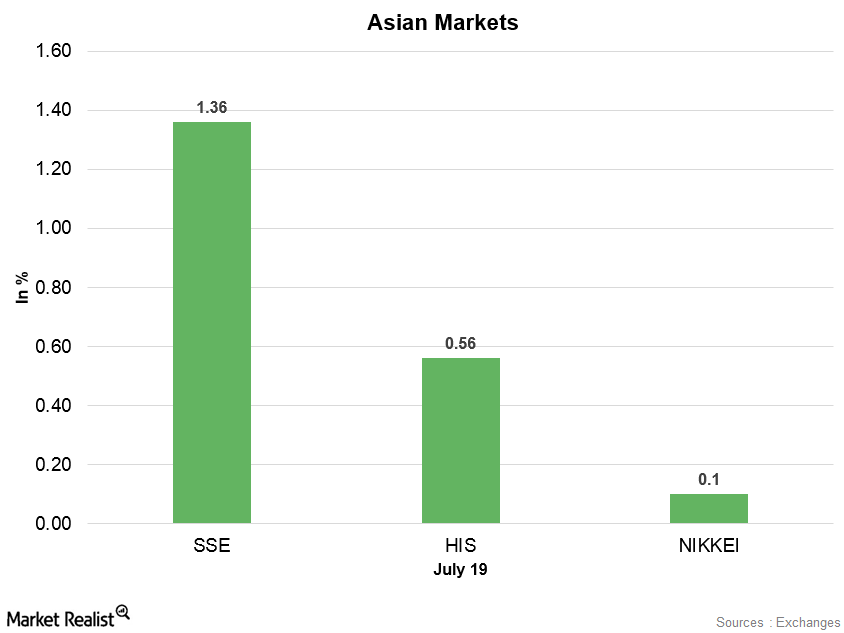

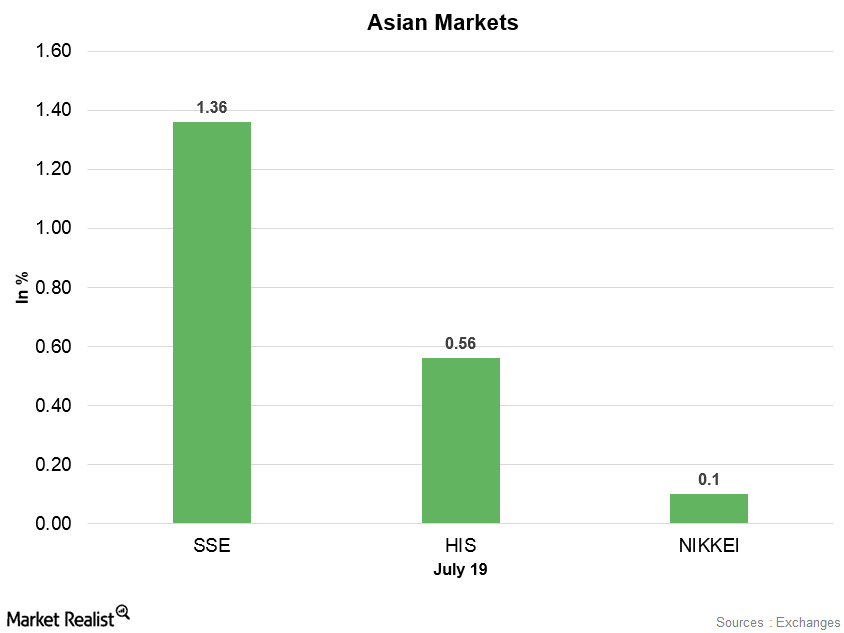

Asian Markets Are Strong, Japan Awaits Monetary Policy Statement

Japan’s Nikkei Index started this week on a weaker note by falling below 20,000 on Tuesday. On July 19, Nikkei opened the day lower but regained strength.

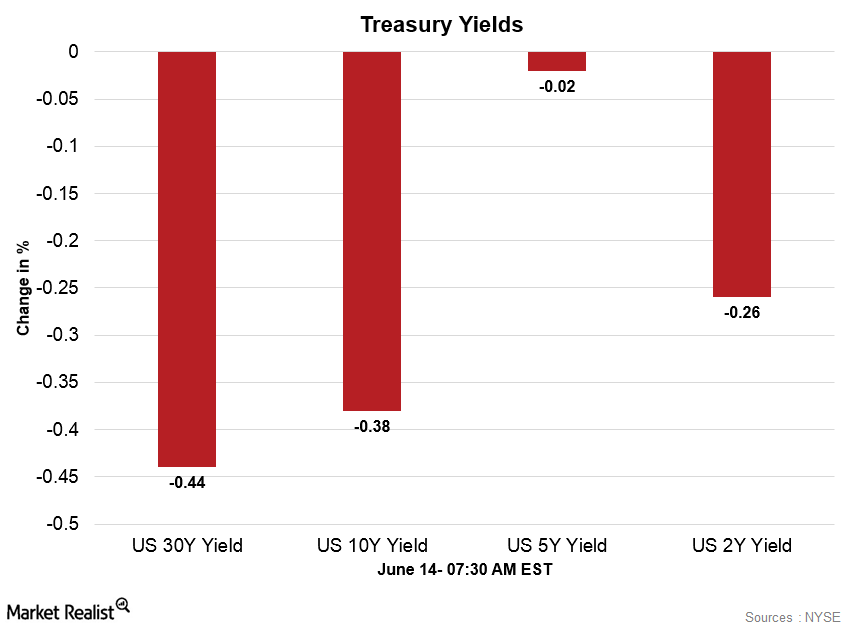

US Dollar and US Treasuries Are Slightly Weaker

In the early hours on Wednesday, the US Dollar Index is slightly weaker. At 5:45 AM EST on June 14, the US Dollar Index was trading at 96.99—0.01% higher.

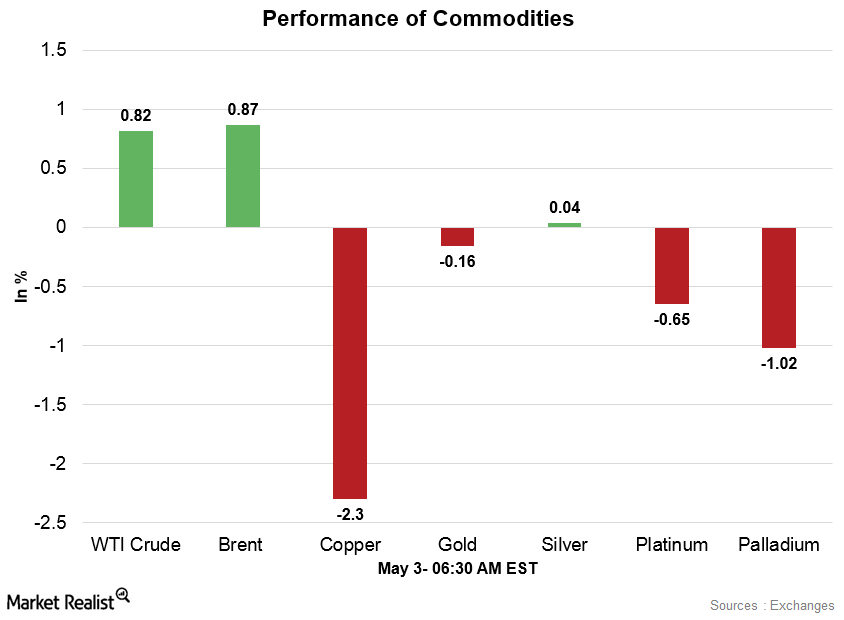

Crude Oil Is Stable amid Lower Inventory Levels

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday.

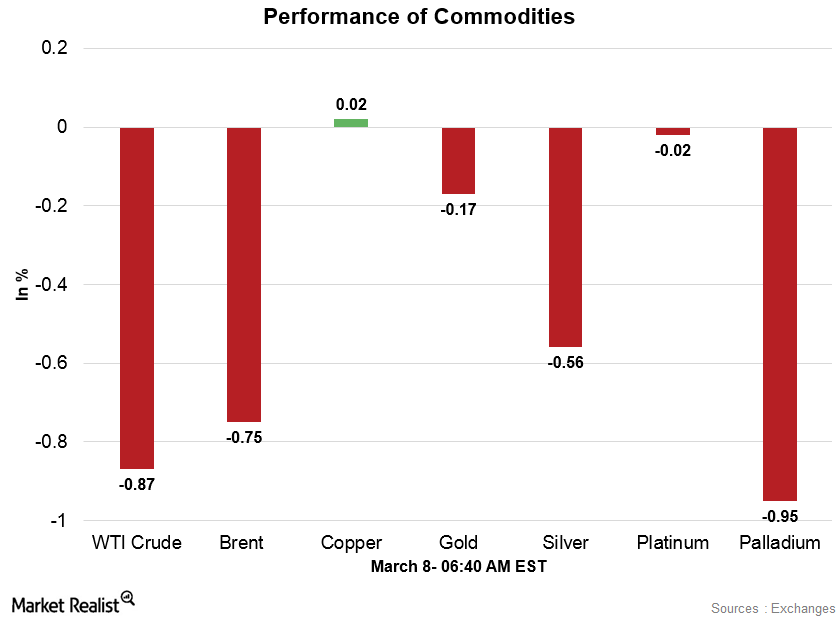

Commodities Are Weaker amid the Firmer Dollar

Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting.

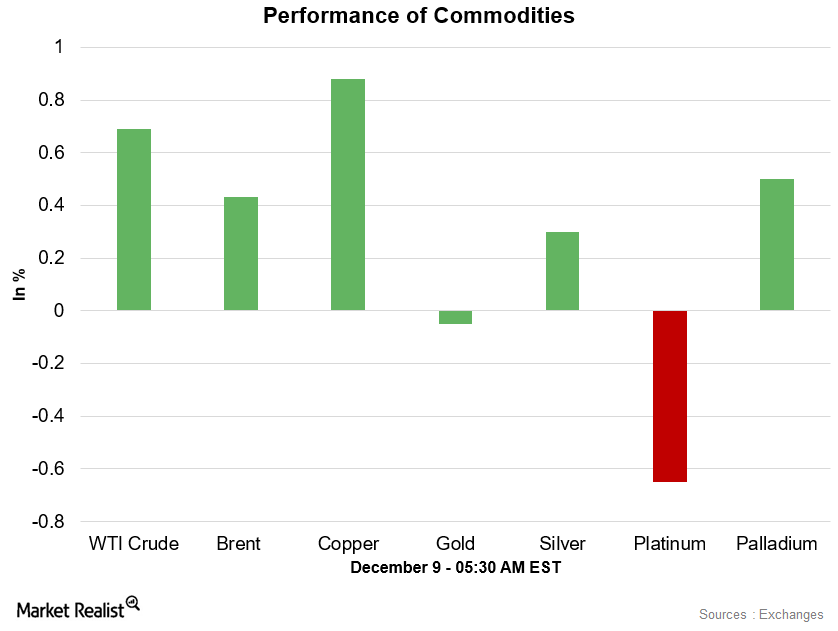

Crude Oil and Copper Are Stable, Gold Is Weaker on December 9

At 5:00 AM EST on December 9, the WTI crude oil futures contract for January 2017 delivery was trading at $51.21 per barrel—a rise of ~0.71%.

China’s Trade Data and the Weaker Dollar Support Commodities

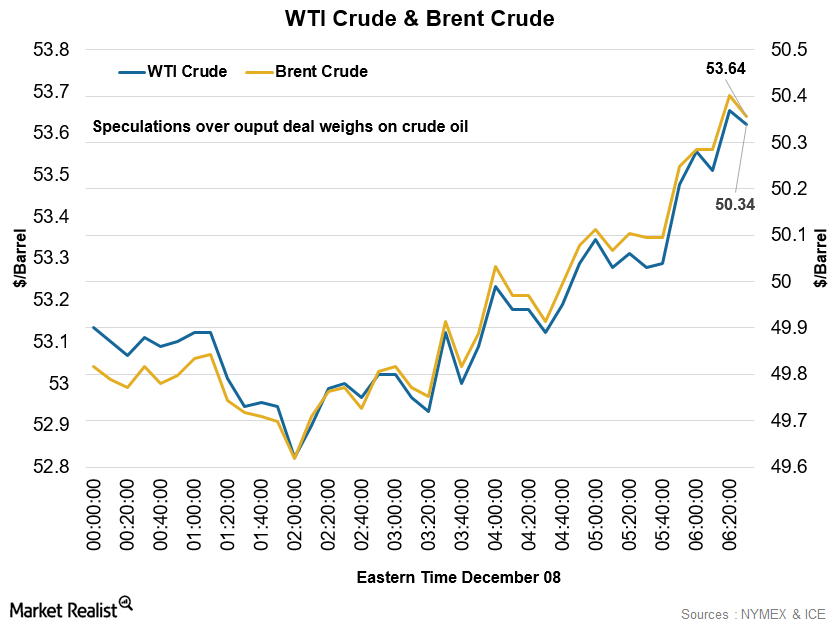

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

Early Morning Update: Crude Oil Fell, Metals Were Mixed

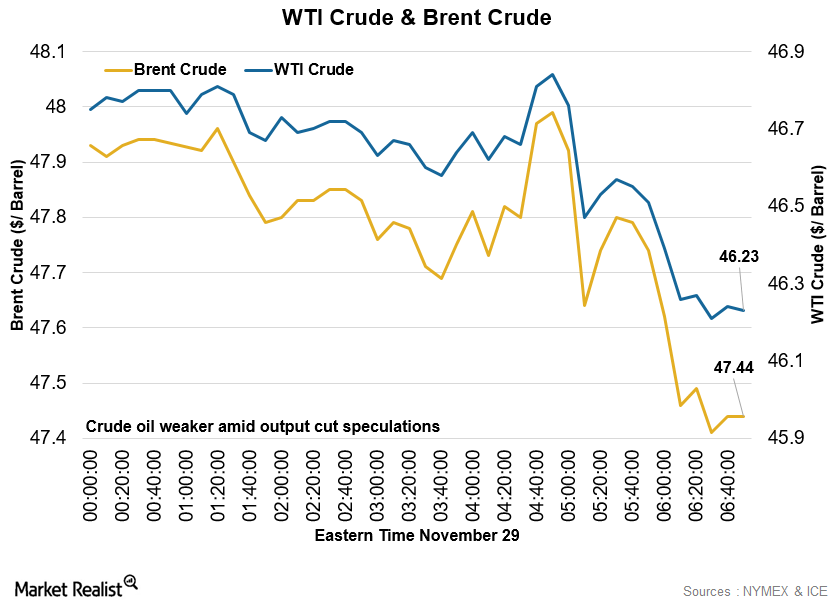

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

Early Morning Update: Energy, Metals, and Mining Sector

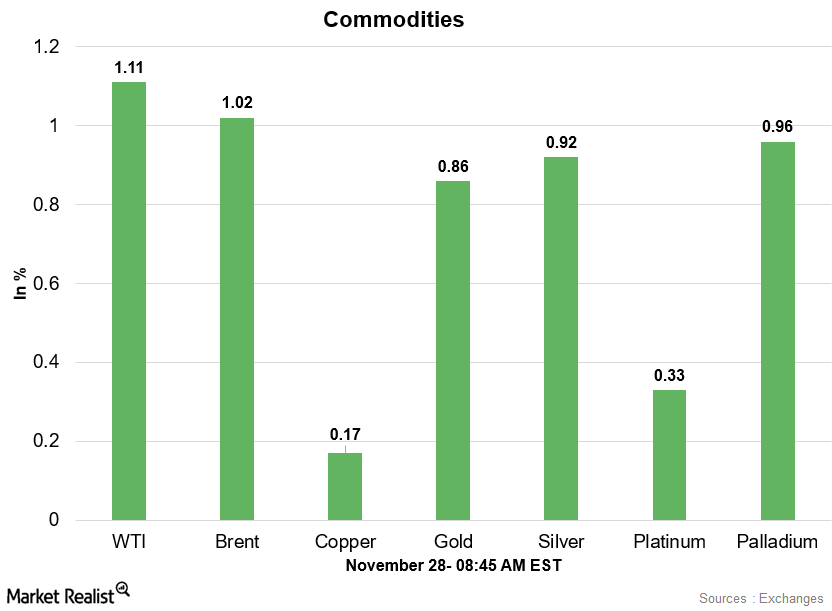

The market is also waiting for the weekly crude oil inventory reports from the U.S. Energy Information Administration and the American Petroleum Institute.

Companies in the Metals and Mining Sector Were Mixed

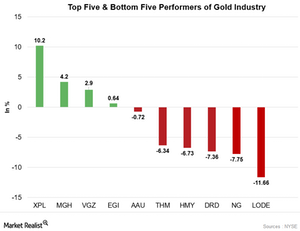

On November 7, the stocks related to base metals rose and precious metal miners weakened. DBB and XME rose 1.3% and 1.8%. GLD fell ~1.8%.

Performance of Companies in Energy and Mining Sectors on September 1

The companies in the energy sector fell on Thursday, September 1, due to falling oil prices. At 3:05 PM EDT, the United States Oil ETF (USO) fell by ~3.4%.