Early Morning Update: Crude Oil Fell, Metals Were Mixed

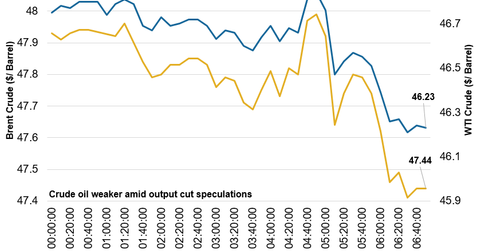

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

By Val Kensington

Nov. 29 2016, Updated 11:05 a.m. ET

Crude oil

- Crude oil prices are weaker early on November 29 amid speculations about the successful execution of supply cuts.

- Russia, which is a non-OPEC producer, confirmed on November 29 that it wouldn’t attend OPEC’s meeting. It also added that a meeting with OPEC and non-OPEC producers is possible at a later stage.

- Increased volatility is expected in the crude oil market this week.

- According to Goldman Sachs, the successful supply cut would push prices to $50 per barrel.

- At 5:00 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $46.43 per barrel—a fall of ~1.4%. The Brent crude futures contract for January 2017 delivery fell ~1.3% to $48.56 per barrel.

- In its previous meeting in Algeria, OPEC announced a supply cut for its members to 32.5 MMbpd–33 MMbpd (million barrels per day). The market is looking forward to producers’ meeting on November 30 in Vienna. Individual supply quotas will be declared.

- The PowerShares Dynamic Energy Exploration & Production Portfolio (PXE) and the SPDR S&P Oil & Gas Exploration & Production (XOP) fell 0.78% and 3.4% on November 28.

Article continues below advertisement

Copper

- After posting moderate losses on November 28, copper prices pulled back in the early hours of November 29.

- At 5:10 AM EST on November 29, the COMEX copper futures contract for March 2017 delivery fell 1.7% to $2.62 per pound.

- Even though copper pulled back from high levels, it’s on its way to close the month with the biggest monthly gain in a decade.

- Last week, the improved domestic demand for copper in China along with expectations about the increase in US infrastructural spending under Donald Trump pushed the prices higher.

- The PowerShares DB Base Metals (DBB) and the SPDR S&P Metals & Mining (XME) fell 1.6% and 0.81% on November 28.

Precious metals

- Gold rebounded from multimonth lows in the early hours on November 28 amid a pull back in the dollar. On the other hand, gold is feeling the pressure from an increase in US interest rate hike expectations.

- At 7:15 AM EST, the gold futures contract for December delivery was trading at $1,189 per ounce—a gain of ~0.9%. The SPDR Gold Trust ETF (GLD) rose 1.0% on November 28.

- The platinum futures contract for January 2017 delivery was trading at $916.85 per ounce—a gain of ~0.94%.

- The silver futures contract for December delivery was trading at $16.58 per ounce—a fall of ~0.56%.

- After rising to 17-month high price levels last week, palladium is holding its ground at fresh 2016 highs. At 7:15 AM EST, the palladium futures contract for March 2017 delivery was trading at $750.03 per ounce—a gain of ~0.96%.