PowerShares Dynamic Engy Explr&Prdtn ETF

Latest PowerShares Dynamic Engy Explr&Prdtn ETF News and Updates

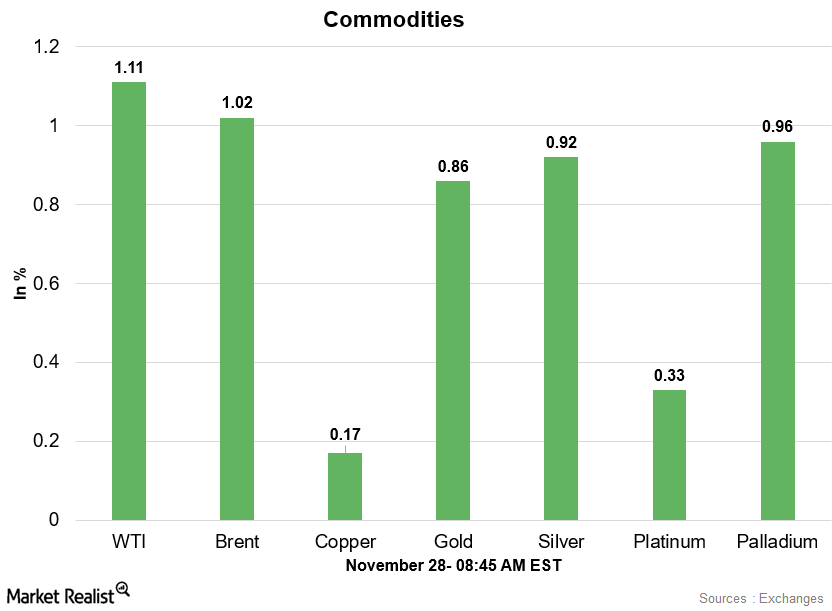

Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

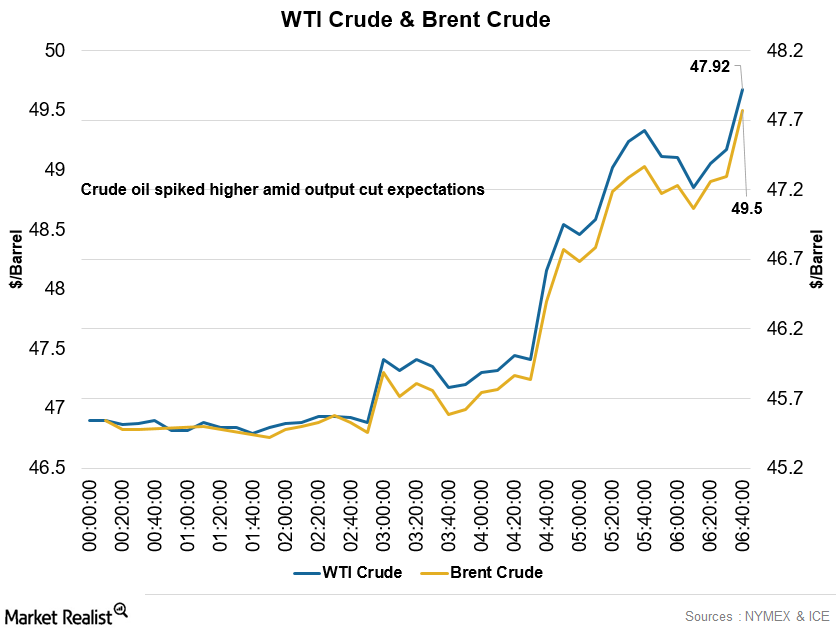

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

Why Did Crude Oil Prices Hit a 16-Month High?

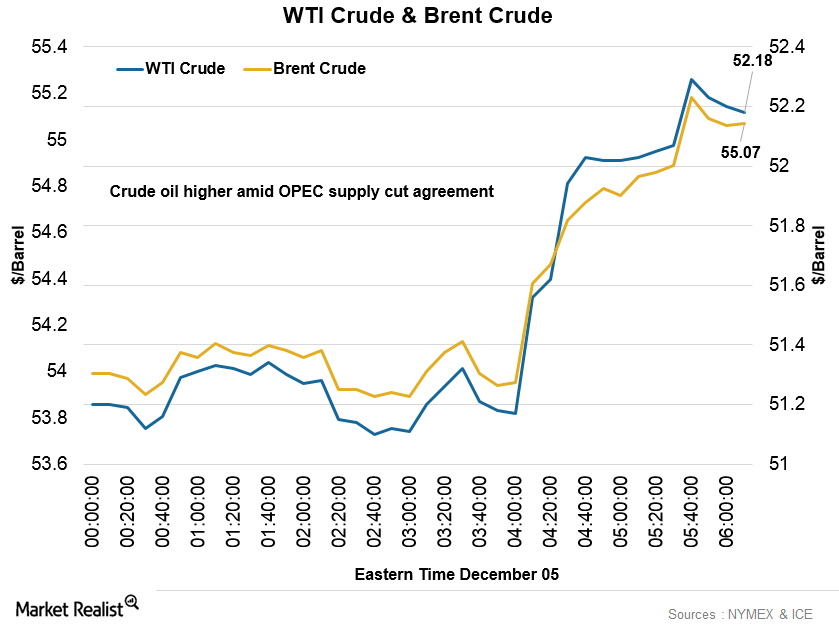

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

Crude Oil Continued to Rise, OPEC Agreed to the Supply Cut

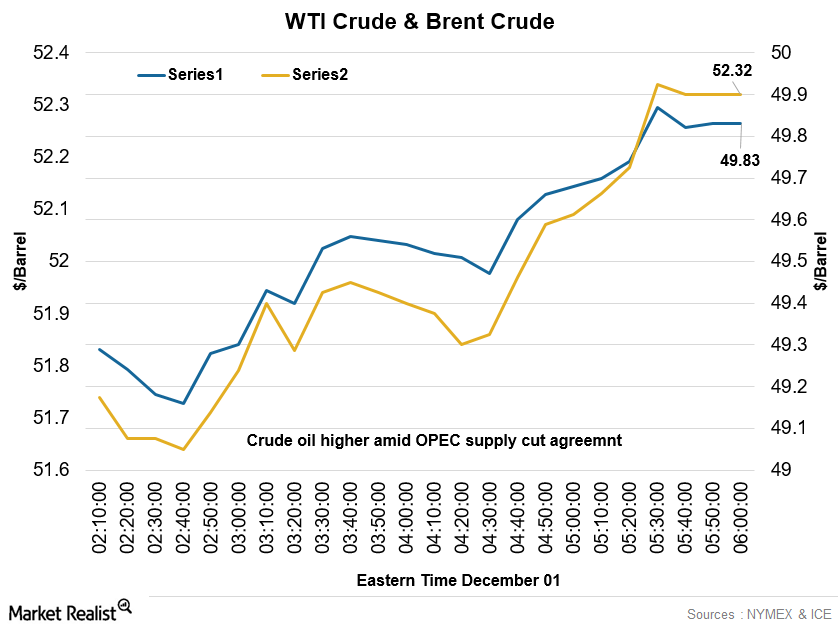

At 5:45 AM EST, the WTI crude oil futures contract for January 2017 delivery was trading at $49.88 per barrel—a rise of ~0.89%.

Crude Oil and Copper Are Stable, Gold Is Weaker on December 9

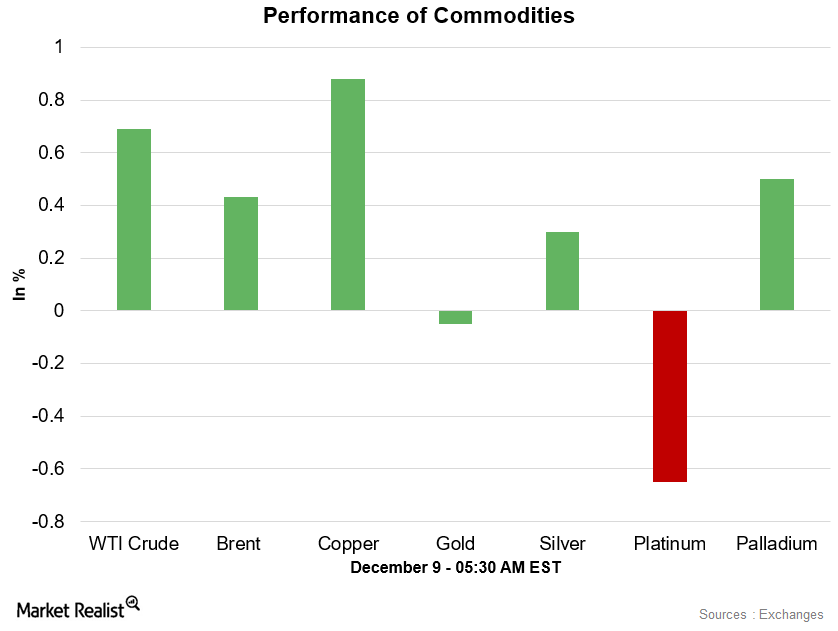

At 5:00 AM EST on December 9, the WTI crude oil futures contract for January 2017 delivery was trading at $51.21 per barrel—a rise of ~0.71%.

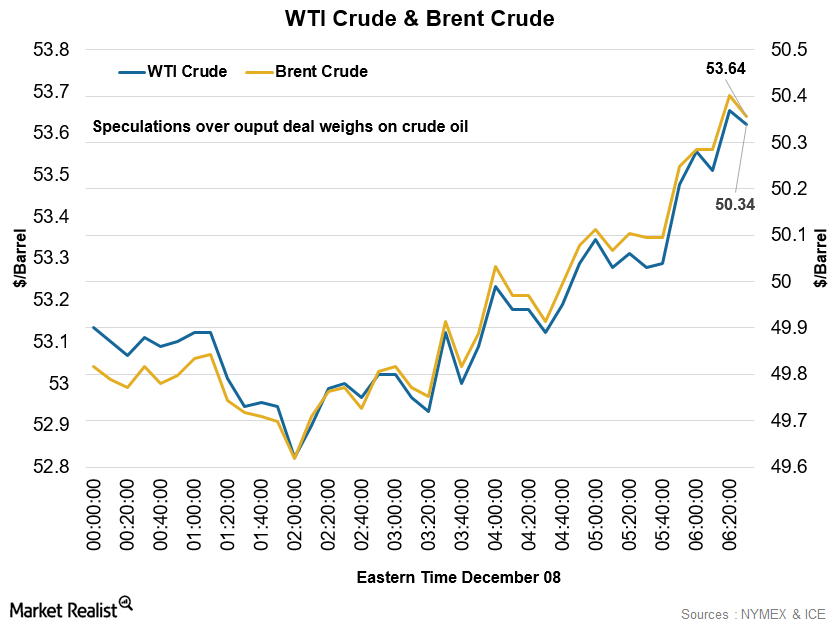

China’s Trade Data and the Weaker Dollar Support Commodities

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

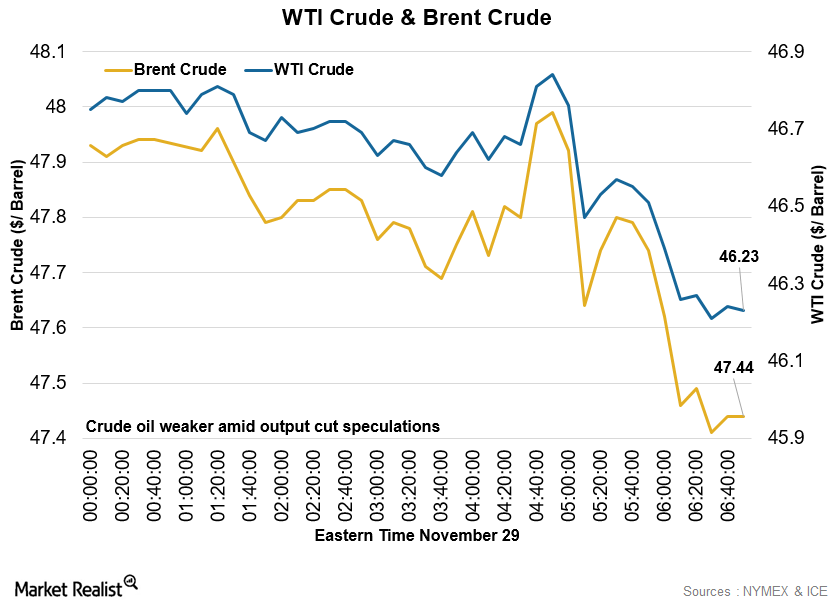

Early Morning Update: Crude Oil Fell, Metals Were Mixed

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

Early Morning Update: Energy, Metals, and Mining Sector

The market is also waiting for the weekly crude oil inventory reports from the U.S. Energy Information Administration and the American Petroleum Institute.