US Dollar Index and Treasury Yields on January 17

The US Dollar Index is trading above opening prices with stability. At 5:30 AM EST on January 17, the US Dollar Index was trading at 90.6.

Jan. 18 2018, Updated 7:32 a.m. ET

US Dollar Index

Following a weak performance for four weeks, the US Dollar Index carried the weakness to this week and declined to three-year low price levels on Monday. However, the US Dollar Index regained stability as the week progressed. On Wednesday, the US Dollar Index is trading above opening prices with stability in the early hours.

Despite the release of strong economic data, the upbeat economic outlook, and high expectations of an interest rate hike in March, the US Dollar Index is trading with weakness. The strength in the euro was part of the reason behind the US dollar’s weakness. With selling taking a break this week, investors are waiting for the release of US economic data, which could impact the US Dollar Index. On Wednesday, the market is looking forward to the release of January’s manufacturing and industrial production data at 9:15 AM EST.

At 5:30 AM EST on January 17, the US Dollar Index was trading at 90.6—a gain of 0.22%.

US Treasury yields

US Treasury yields started this week on a mixed note but regained strength as the week progressed. Increased optimism about the economic growth outlook along with higher expectations for earnings season weighed on bonds and supported Treasury yields. The yields move opposite to the movements in bond prices.

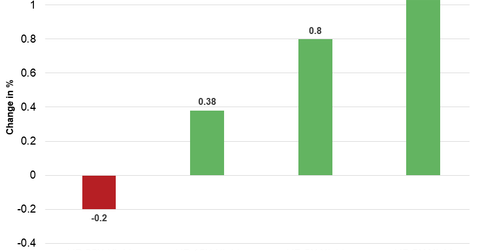

Below are the movements in Treasury yields as of 5:30 AM EST on January 17:

- The ten-year Treasury yield was trading at 2.554—a rise of ~0.38%.

- The 30-year Treasury yield was trading at 2.830—a fall of ~0.17%.

- The five-year Treasury yield was trading at 2.372—a rise of ~0.73%.

- The two-year Treasury yield was trading at 2.039—a rise of ~1.0%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.42%. The ProShares UltraPro Short 20+ Year Treasury (TTT) and the ProShares UltraShort 20+ Year Treasury (TBT) fell 1.2% and 0.91%, respectively, on January 16.

Bitcoin

After starting this week on a weaker note, Bitcoin continued to decline amid the dented market sentiment. Increased instability in the market amid regulatory concerns in Asia triggered a sell-off across all of the major cryptocurrencies this week. At 5:40 AM EST, the Bitcoin-US Dollar contract was trading at $10,090.0—a drop of 14.4%.

Next, we’ll discuss how commodities performed in the early hours on January 17.