How Did Asian Markets Perform on January 26?

The Shanghai Composite Index rose 0.28% and closed the day at 3,558.13 on January 26. The SPDR S&P China (GXC) fell 0.42% on January 25.

Jan. 26 2018, Published 9:36 a.m. ET

Economic calendar

8:30 EST – FOMC member Bullard speaks

8:30 EST – US core durable goods orders (December)

8:30 EST – US GDP (Q4)

8:30 EST – US GDP Price Index (Q4)

9:00 EST – Bank of England Governor Carney speaks

China

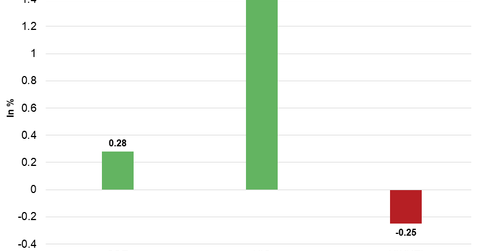

China’s Shanghai Composite Index surged to two-year high price levels last week and recorded the fifth consecutive weekly gain. Carrying forward the strength, the Shanghai Composite Index started this week on a stronger note and reached fresh two-year high levels.

After a brief pullback on January 25, the Shanghai Composite Index opened Friday lower but regained strength and rebounded as the day progressed. The end of the US government shutdown and release of China’s upbeat GDP data added strength to the market. On Friday, strength in the real estate and transport sectors pushed the market higher. The market is looking forward to the release of China’s manufacturing and non-manufacturing purchasing managers index data next week.

The Shanghai Composite Index rose 0.28% and closed the day at 3,558.13 on January 26. The SPDR S&P China (GXC) fell 0.42% on January 25.

Hong Kong

Hong Kong’s Hang Seng Index surged to record high price levels last week and clocked the sixth consecutive gaining week. With improved sentiment, the Hang Seng Index started this week on a stronger note and rallied higher as the week progressed. On Friday, the Hang Seng Index opened the day higher and surged to a fresh record high price levels. The improved Asian market sentiment along with strength in IT and property developer stocks pushed the Hang Seng Index higher.

On January 26, the Hang Seng Index rose 1.5% and closed the day at 33,141.50. The iShares MSCI Hong Kong (EWH) remained unchanged on January 25.

Japan

Following consolidation for two weeks, Japan’s Nikkei Index started this week on a stable note but lost upward momentum as the week progressed. Following a pullback on Thursday, the Nikkei Index opened Friday higher but lost strength and closed the day at three-week low price levels. Strength in the yen along and weakness in the steel and automobile and parts sectors pushed the market lower.

On January 26, the Nikkei Index fell 0.25% and closed the day at 23,610.00. The iShares MSCI Japan (EWJ) fell 0.48% on January 25.

Next, we’ll discuss how European markets performed in the early hours on January 26.