European Markets Are Mixed Early on January 11

At 3:45 AM EST on January 11, the DAX Index was trading at 13,275.50—a fall of 0.04%. The iShares MSCI Germany (EWG) fell 0.88% on January 10.

Nov. 20 2020, Updated 12:00 p.m. ET

United Kingdom

After gaining for five consecutive trading weeks, the United Kingdom’s FTSE 100 Index started this week on a weaker note. However, it regained strength as the week progressed. After closing at fresh record high price levels on Wednesday, the FTSE 100 Index opened higher on Thursday and traded at all-time high price levels in the morning session.

Market sentiment

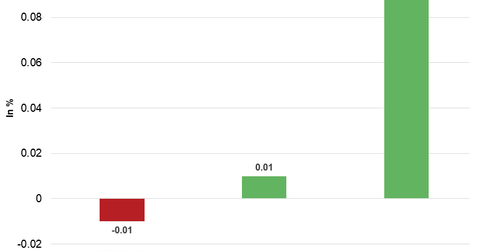

The market sentiment on the FTSE 100 Index is strong this week amid the improved global sentiment. On Wednesday, bond yields’ strength supported the financial sector in European markets and major indices. Upbeat economic data and oil stocks’ rally also added strength to the FTSE 100 Index. According to the Office for National Statistics, the United Kingdom’s manufacturing production and industrial production rose 0.4% in November. The market was expecting 0.3% and 0.4% growth, respectively.

On Thursday, the market is looking forward to the meeting minutes from the ECB’s (European Central Bank) policy meeting. The minutes are scheduled to release at 7:30 AM EST today. At 3:40 AM EST today, the FTSE 100 Index was trading at 7,755.25—a gain of 0.09%. The iShares MSCI United Kingdom (EWU) fell 0.11% on January 10.

Germany

Following the strong rally last week, Germany’s DAX Index started this week on a positive note and rose in the first two trading days. However, the market lost strength on Wednesday. Profit-booking at elevated levels ahead of the ECB’s meeting minutes weighed on the DAX Index. On Thursday, the DAX Index opened higher and traded with mixed sentiment in the morning session.

At 3:45 AM EST on January 11, the DAX Index was trading at 13,275.50—a fall of 0.04%. The iShares MSCI Germany (EWG) fell 0.88% on January 10.

France

France’s CAC 40 Index started this week on a positive note and rose to ten-year high price levels on Tuesday. Weaker-than-expected industrial production data and profit-booking weighed on the CAC 40 Index on Wednesday. According to the National Institute of Statistics and Economic Studies (INSEE), France’s industrial production fell 0.5% in November.

At 3:50 AM EST today, the CAC 40 Index was trading at 5,510.00—a rise of 0.10%. The iShares MSCI France (EWQ) fell 0.56% on January 10.

In the next part, we’ll discuss how US Treasury yields and the US dollar performed in the early hours on Thursday.