Glencore Unsp ADR

Latest Glencore Unsp ADR News and Updates

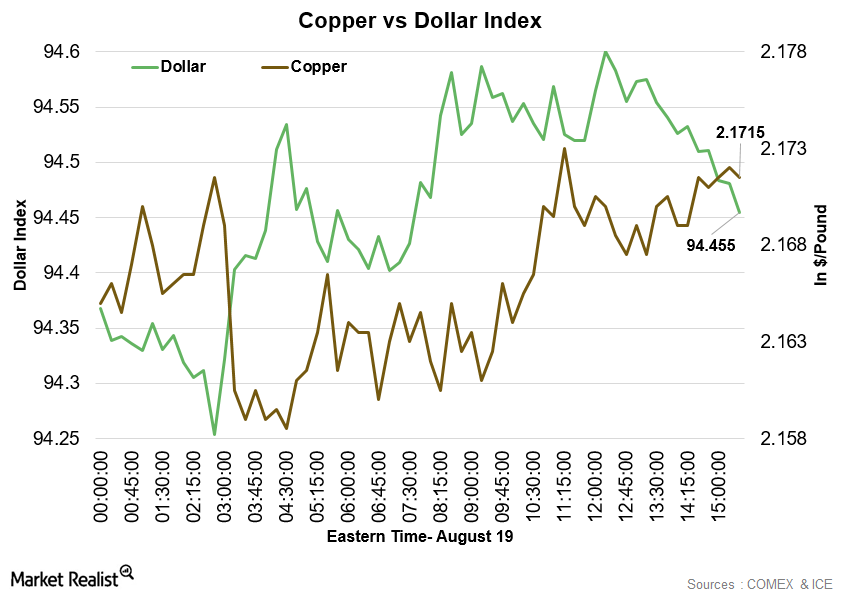

Copper Weaker on August 19 Due to Weaker Demand Signs

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

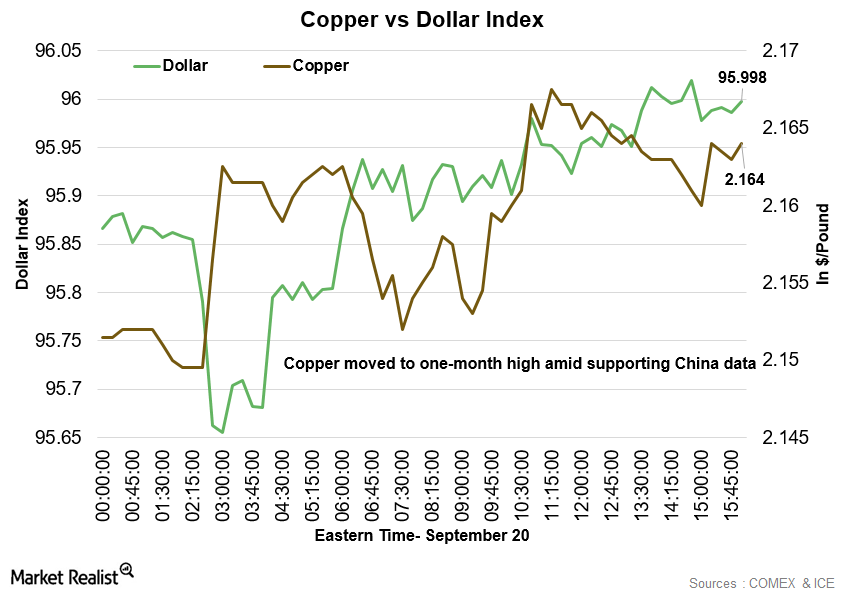

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

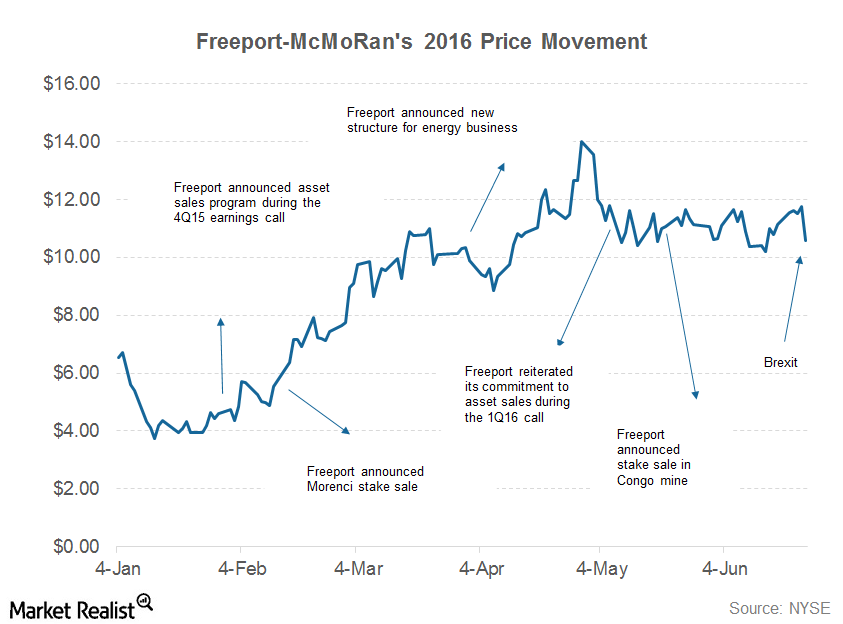

Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

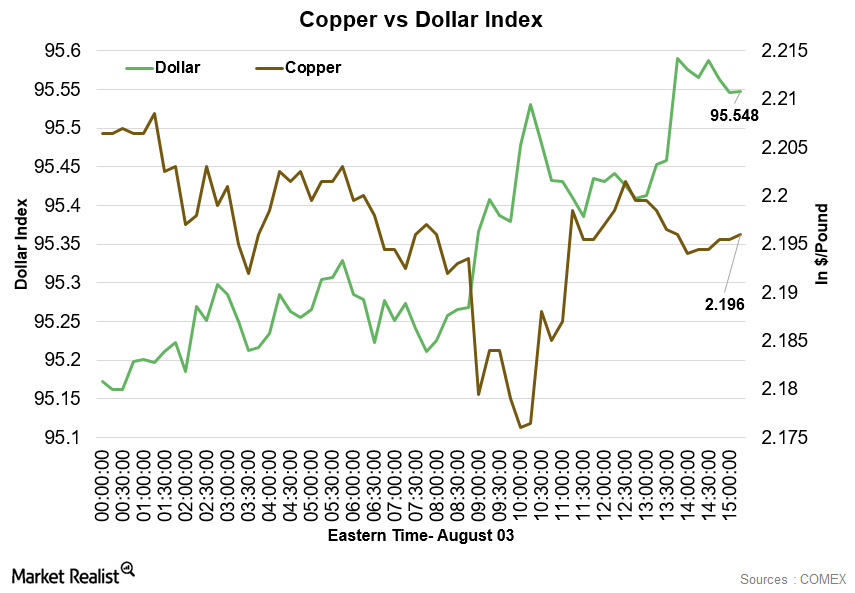

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.

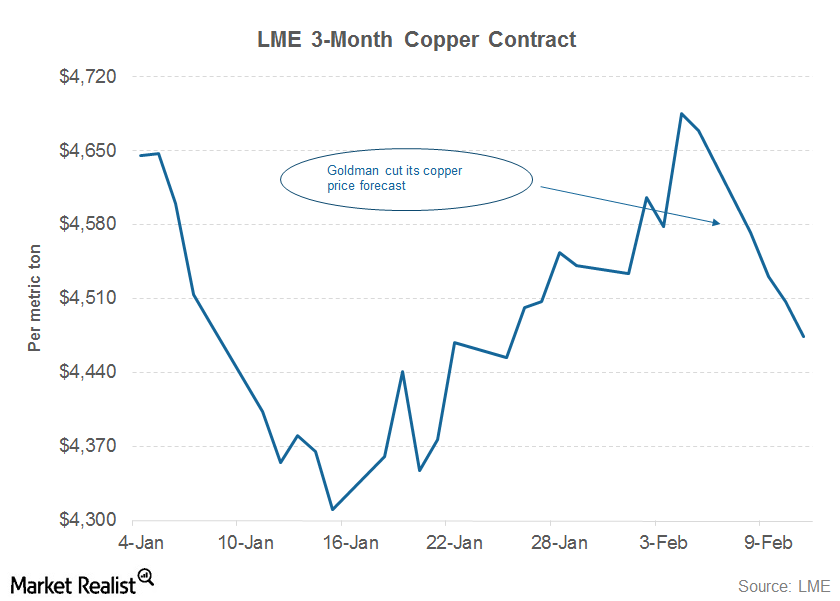

Must Know: Goldman Provided Fodder to Copper Bears

Goldman Sachs (GS) now expects copper prices to fall to $4,000 per metric ton this year. In its previous guidance, Goldman had expected copper to fall to $4,500 per metric ton in 2016.

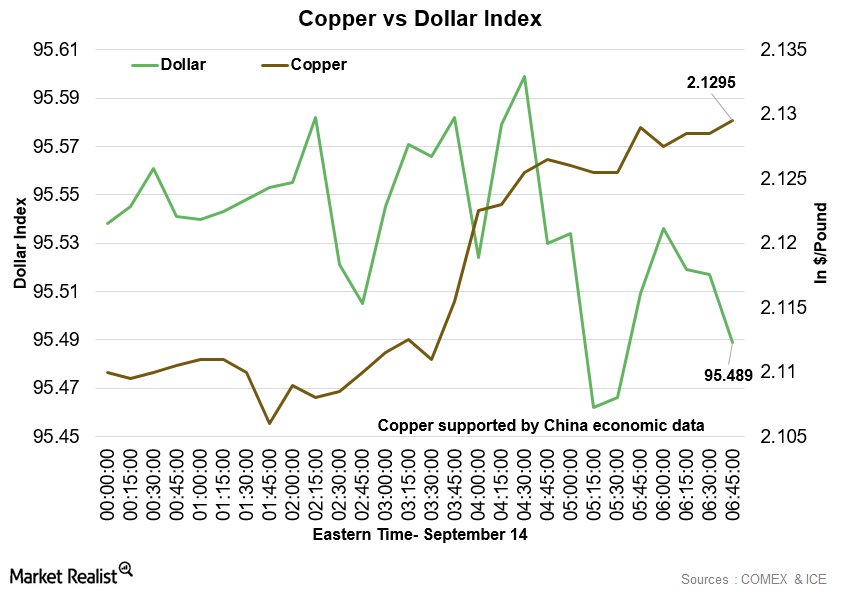

Why Is Copper Trading High in the Early Hours on September 14?

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

Understanding Glencore’s Metals and Mining Business

Glencore’s metals and mining segment was the second-biggest contributor to its 1H15 revenues.

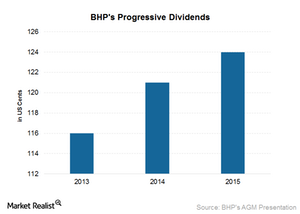

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

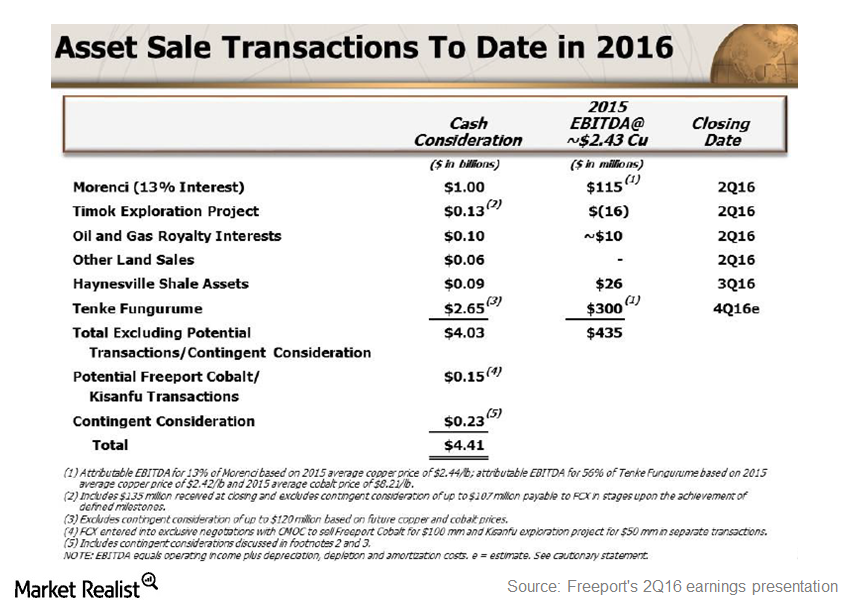

Freeport-McMoRan’s Debt Reduction Plan: Key Takeaways

During its 4Q15 earnings conference call, Freeport-McMoRan (FCX) mentioned a debt reduction program to raise $5 billion–$10 billion to shore up its balance sheet.

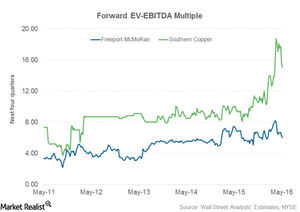

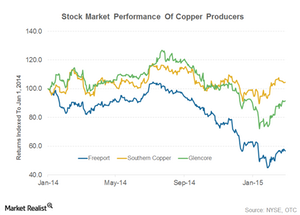

Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

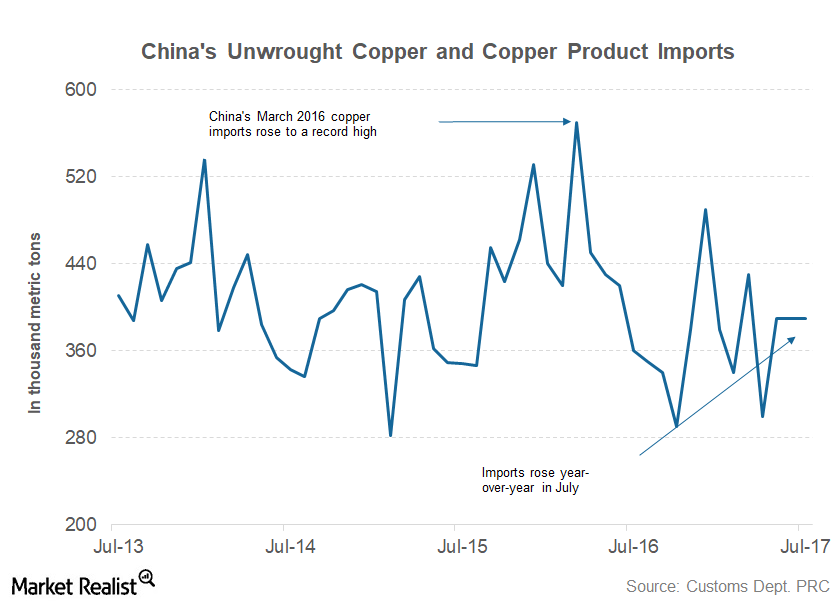

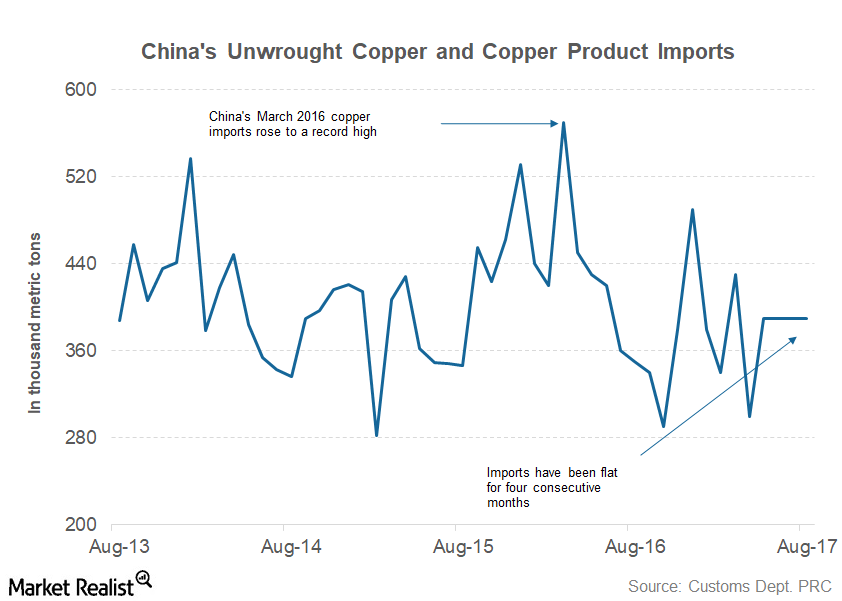

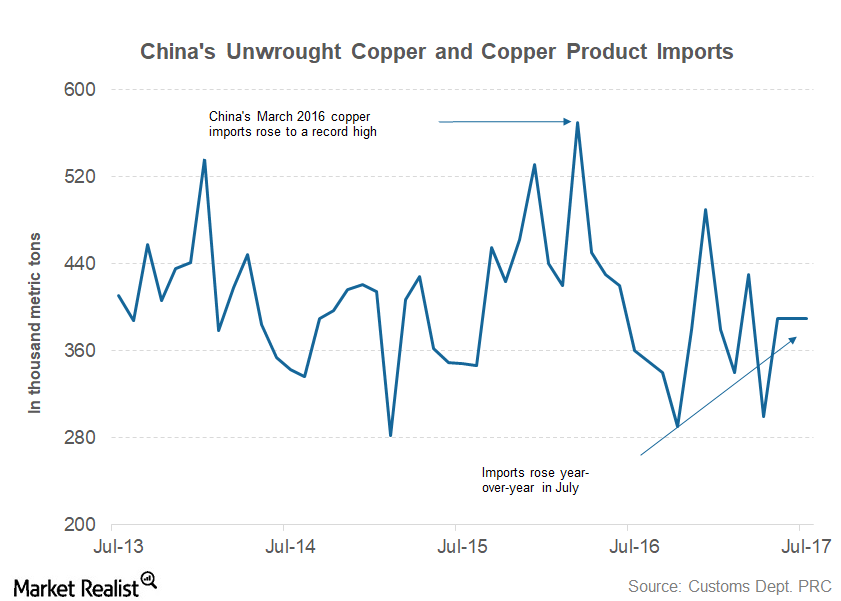

Chinese Copper Imports: Can Freeport’s Good Run Continue?

Previously in this series, we’ve looked at China’s July steel and aluminum exports. In this final part of the series, we’ll look at Chinese copper imports.

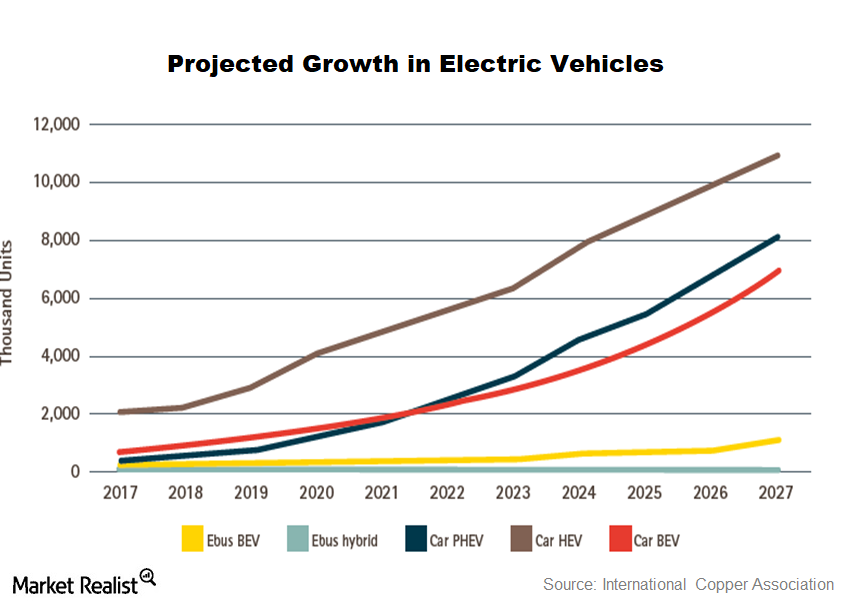

How Freeport-McMoRan Benefits from Electric and Hybrid Vehicles

Investments in renewable energy bode well for global copper demand, as the copper intensity in renewable energy is higher than in non-renewable energy.

China’s Copper Imports: Did Data Spoil Freeport’s Party?

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in August 2016.

Freeport and Copper: Is a Correction in the Cards?

Copper prices have shown strength over the last few trading sessions, which has helped the upwards price action of miners including Freeport-McMoRan (FCX), Glencore (GLNCY), and Southern Copper (SCCO).

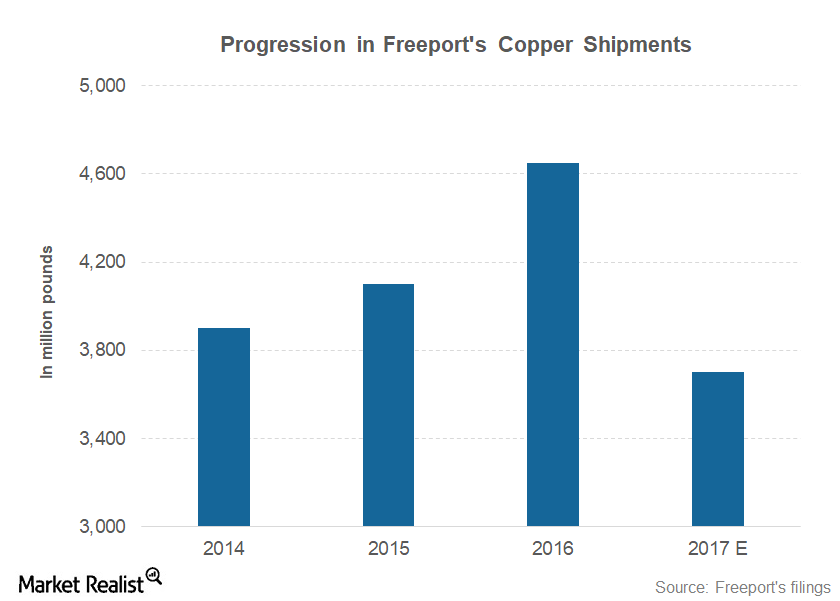

Analyzing Copper Miners’ 2017 Production Plans

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds.

Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

What Could Drive BHP Billiton’s Free Cash Flows for Fiscal 2017?

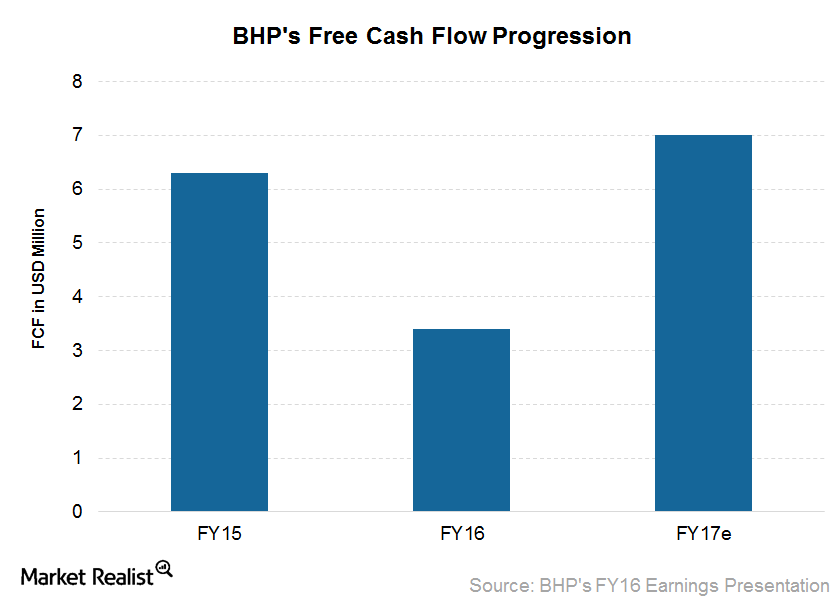

BHP Billiton’s (BHP) (BBL) unit costs declined by 16% in fiscal 2016, supported by increased capital efficiency. This helped BHP generate strong free cash flow.

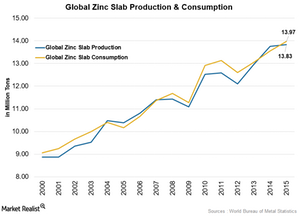

Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

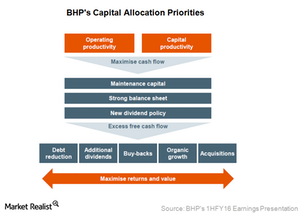

A Look at BHP Billiton’s Capital Allocation Priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.Company & Industry Overviews The Energy and Materials Sectors Pulled VEURX into the Red in 2015

The Vanguard European Stock Index Fund was the worst performer for 2015 among the ten funds in this review.

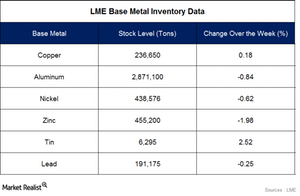

Base Metal Inventories Fell Last Week: How Much?

In the week ended January 9, copper and tin inventories increased. Levels for other base metals fell.

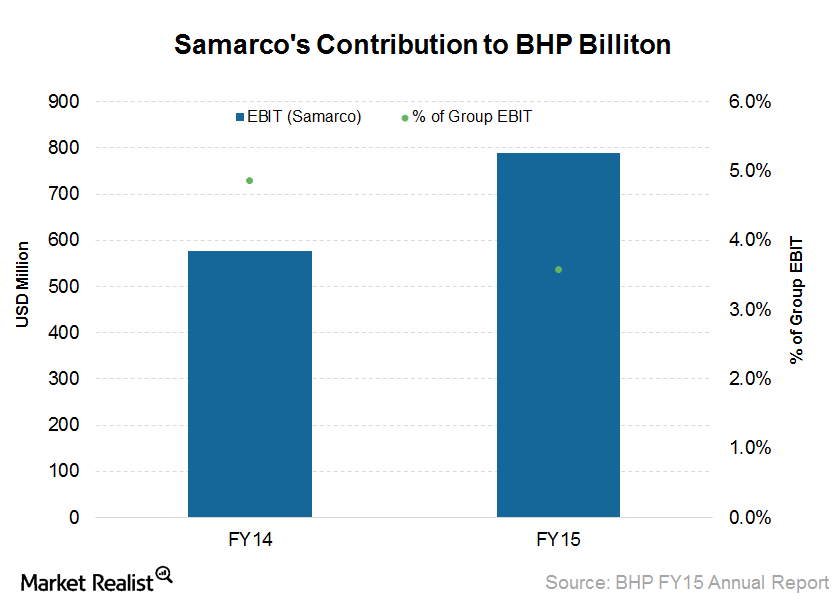

How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.

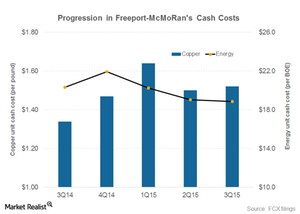

Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

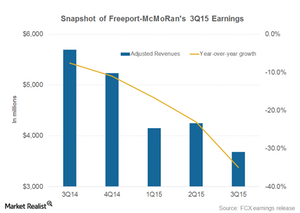

Why Freeport-McMoRan’s 3Q15 Revenues Fell Off a Cliff

In this part of the series, we’ll explore the trend in Freeport-McMoRan’s (FCX) revenues.

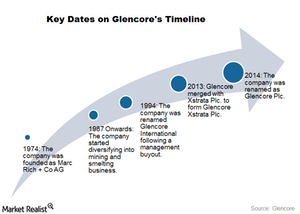

Must Know: How Did Glencore Take Shape?

Glencore (GLNCY) is a relatively new entrant in the metals and mining industry. The company was founded in 1974.

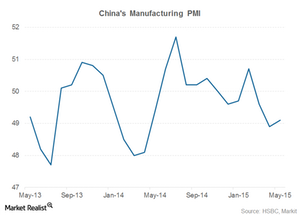

Which Way Is the Chinese Copper Industry Headed This Year?

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like copper, iron ore, and aluminum.

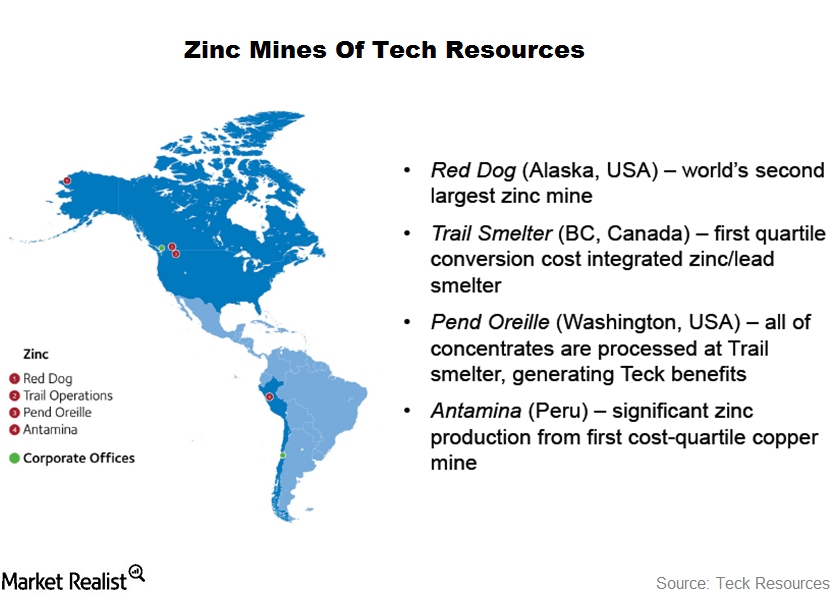

Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

Copper Prices Hold Steady Amid Commodity Carnage

The trend in copper prices has been clearly uneven this year. Higher copper prices benefit copper producers like Freeport-McMoRan.

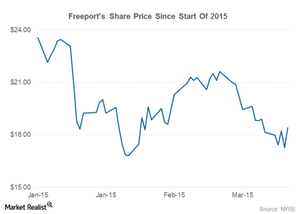

Key Indicators Freeport Investors Should Track

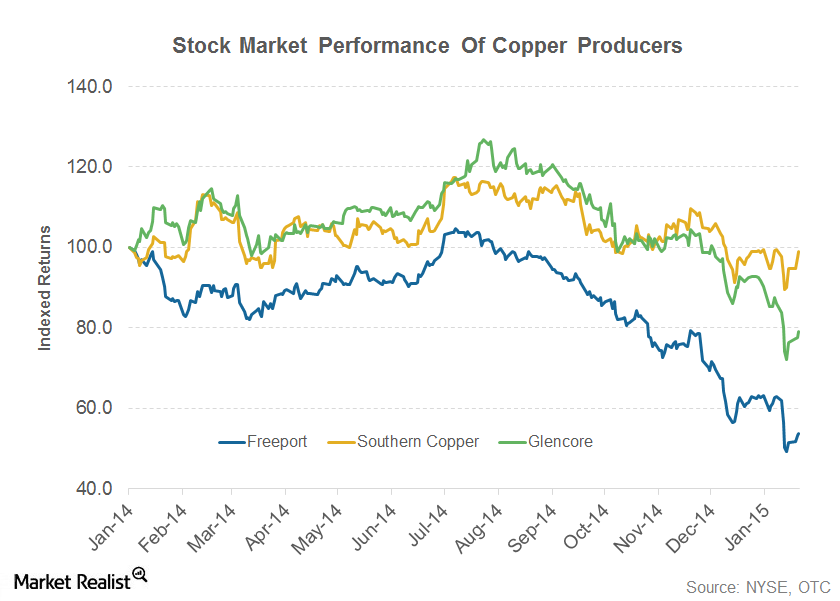

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.

An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.