Which Way Is the Chinese Copper Industry Headed This Year?

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like copper, iron ore, and aluminum.

June 3 2015, Updated 11:06 a.m. ET

The Chinese copper industry

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like iron ore, aluminum, and copper. Expectations of higher Chinese demand fueled expansion projects of mining giants such as Glencore (GLNCY) and Rio Tinto (RIO). However, Chinese demand has not exactly shaped up the way these companies expected.

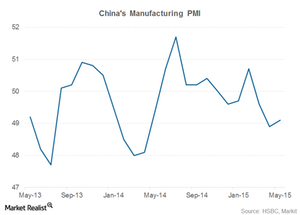

PMI data

The economic data emerging from China doesn’t really paint a rosy picture for the Chinese economy. Analysts and investor fraternities are closely watching China’s manufacturing purchasing managers’ index (or PMI) figures.

PMI figures provide crucial insights into economic activity. HSBC Markit releases the index on a monthly basis. The index is based on the diffusion indices of the following five components:

- new orders – 30%

- inventory levels – 10%

- output – 25%

- supplier delivery times – 15%

- employment environment – 20%

PMI can provide crucial insights into future GDP (gross domestic product) levels. Readings above 50 generally indicate economic expansion, while a reading below 50 indicates contraction.

China’s PMI is below 50 for three months

The above chart shows China’s manufacturing PMI figures released by HSBC Markit. In the final May reading, manufacturing PMI stood at 49.2. The figure came in higher than the April reading of 48.9. China’s PMI has now been below 50 for three consecutive months.

However, official PMI figures released by the National Bureau of Statistics of China edged up to 50.2 in May.

The PMI has been below 50 for four out of five months in the current year. PMI figures below 50 are associated with a contraction in manufacturing activity. Copper producers like Southern Copper (SCCO) and Turquoise Hill Resources (TRQ) are negatively impacted by the slowdown in the Chinese industrial sector.

In the next part of this series, we’ll analyze a few more data points from China.