Turquoise Hill Resources Ltd

Latest Turquoise Hill Resources Ltd News and Updates

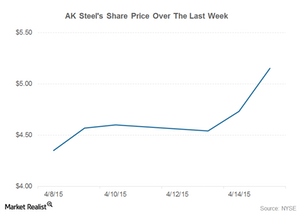

Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

The Love-Hate Relationship between Freeport and Indonesia

According to Freeport-McMoRan’s agreement with Indonesia’s government, it must divest an additional 20.6% stake in its Indonesian operations to the government or its citizens.

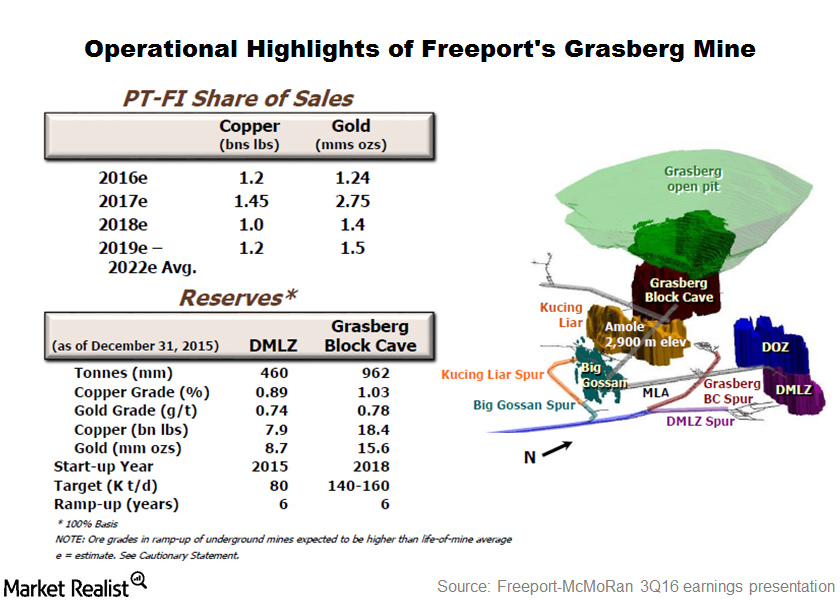

What Are Freeport’s Near-Term Growth Drivers?

Freeport expects its copper shipments to fall next year due to asset sales. The falling trend in its copper shipments could continue beyond 2017.

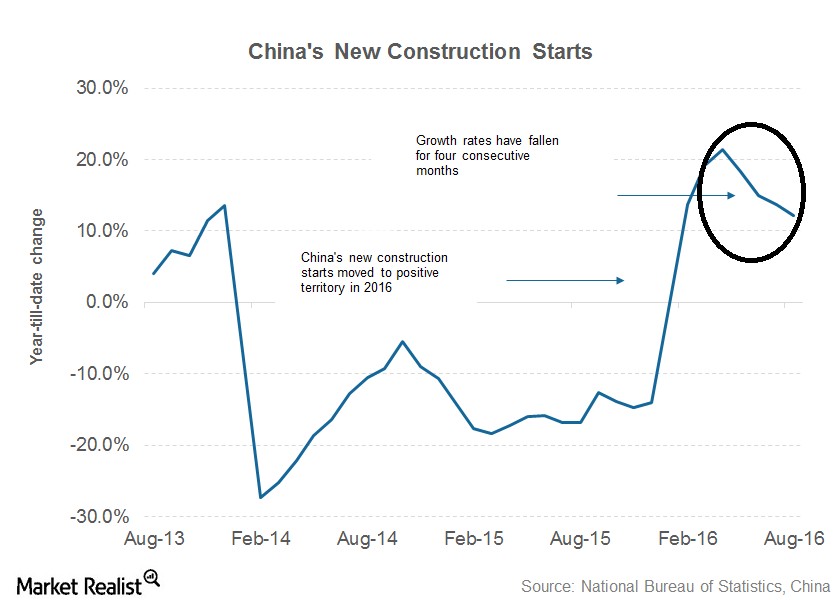

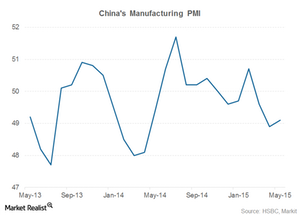

How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

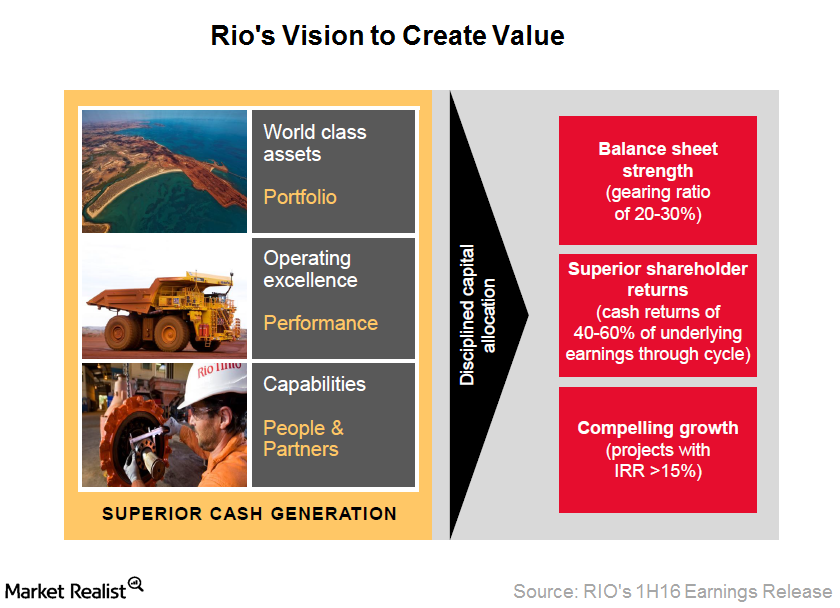

Rio Tinto’s Earnings during 1H16 Were Driven by This

Rio Tinto reported its 1H16 results on August 3, 2016. Its underlying earnings came in at $1.6 billion, 7% ahead of consensus expectations of $1.5 billion.

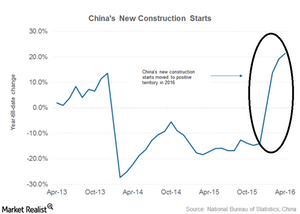

Chinese Copper Demand Indicators: Not That Worrisome So Far

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.

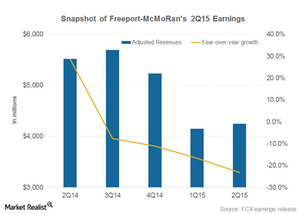

Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

Which Way Is the Chinese Copper Industry Headed This Year?

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like copper, iron ore, and aluminum.

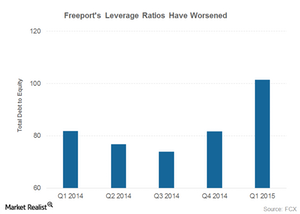

Cash-Starved Freeport Looks at IPO of Energy Business

On April 23, Freeport said it might look at selling a minority stake in its energy business and come out with an IPO of its oil and gas subsidiary later in the year.

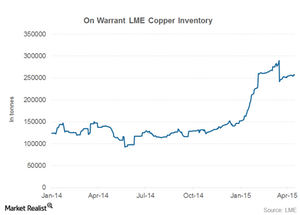

London Metal Exchange Copper Inventory Sees On-Warrant Stock Dip

A declining on-warrant copper inventory means that more metal is being booked for delivery. This is generally associated with stronger demand.