Southern Copper Corp

Latest Southern Copper Corp News and Updates

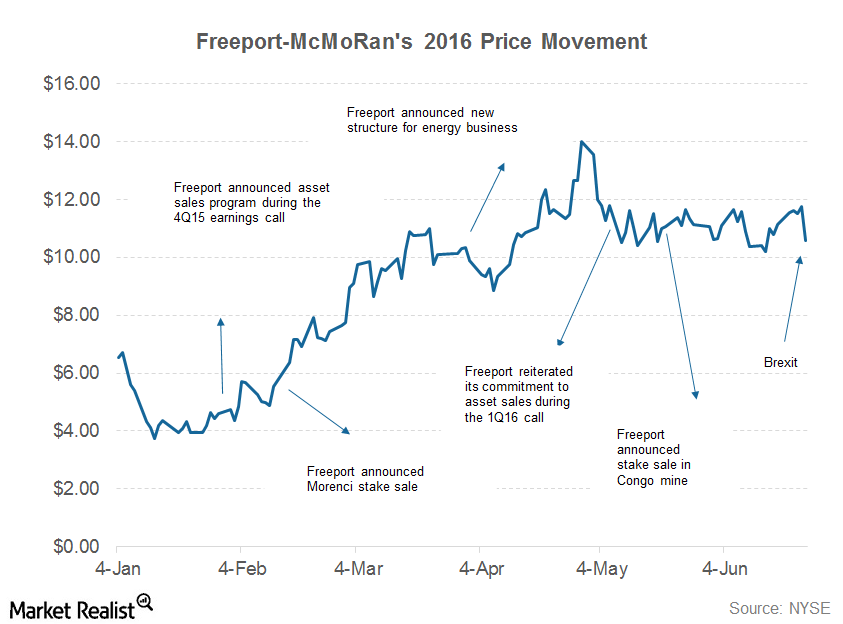

Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

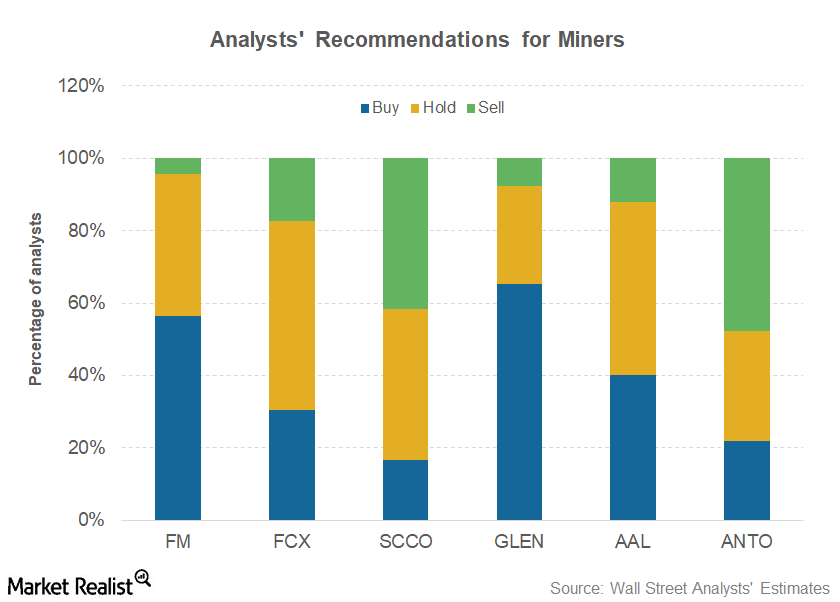

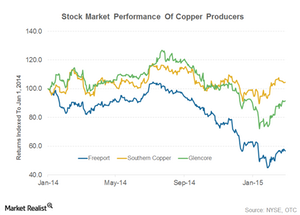

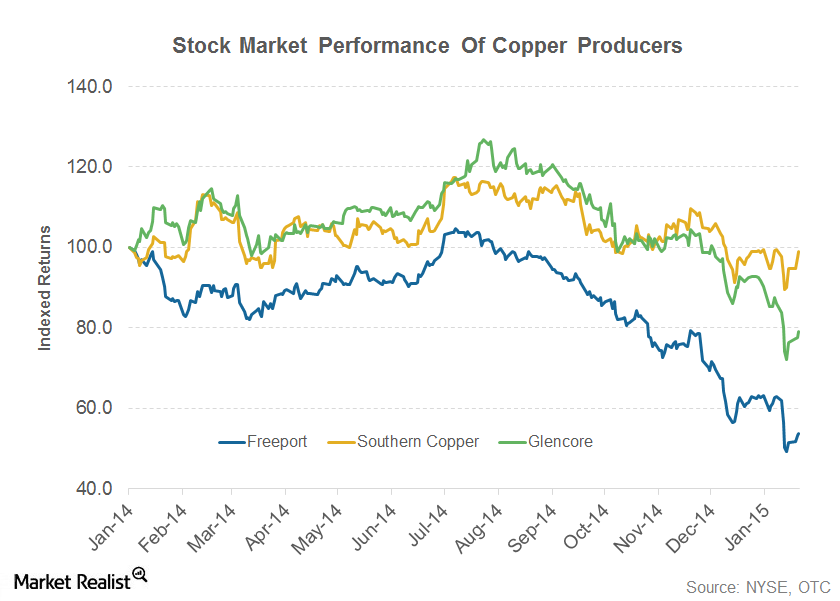

Glencore or Freeport: Which Has More Upside Potential?

Glencore (GLEN-L) has the highest percentage of “buy” or higher recommendations in our select group of mining stocks.

Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

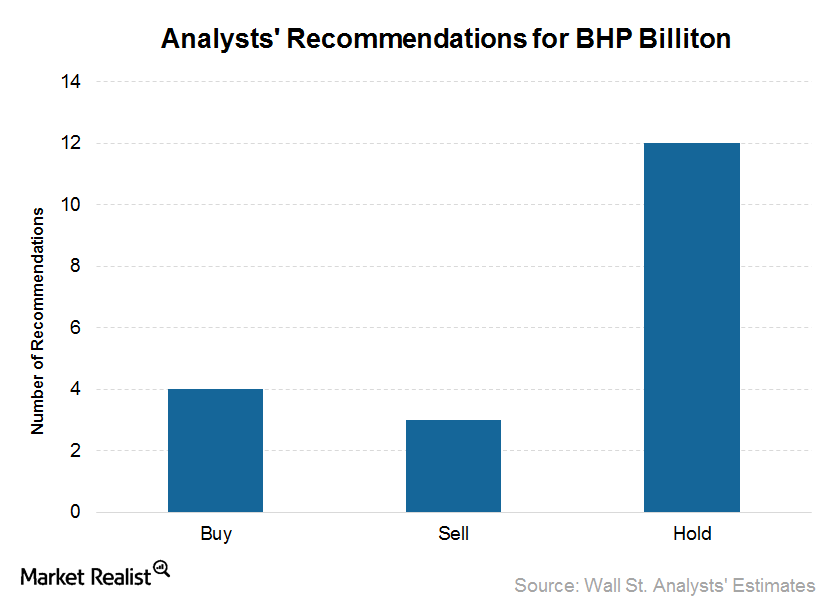

Inside BHP Billiton’s Recent Upgrades and Downgrades

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

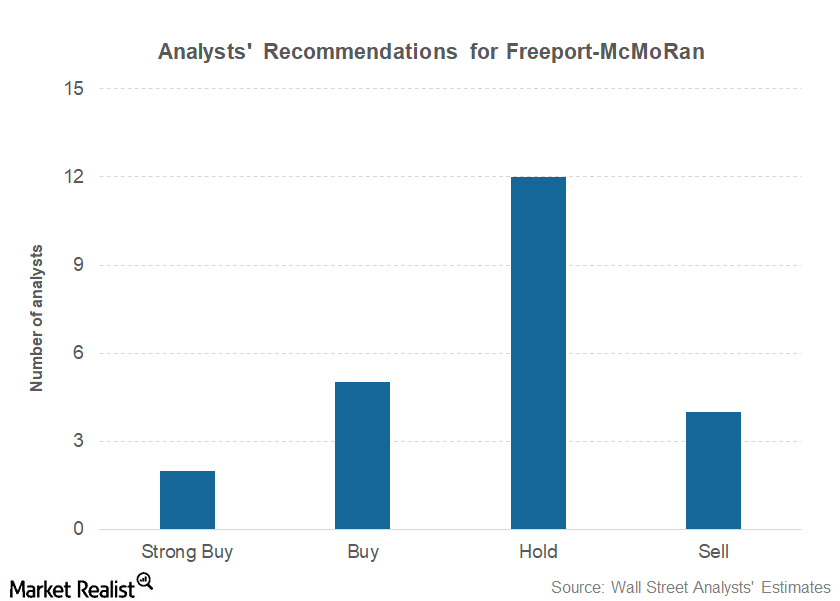

How Analysts View Freeport after Its 3Q17 Earnings Beat

Freeport-McMoRan released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17.

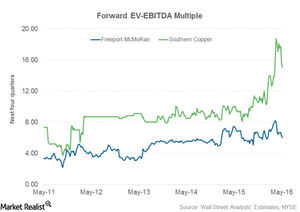

Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

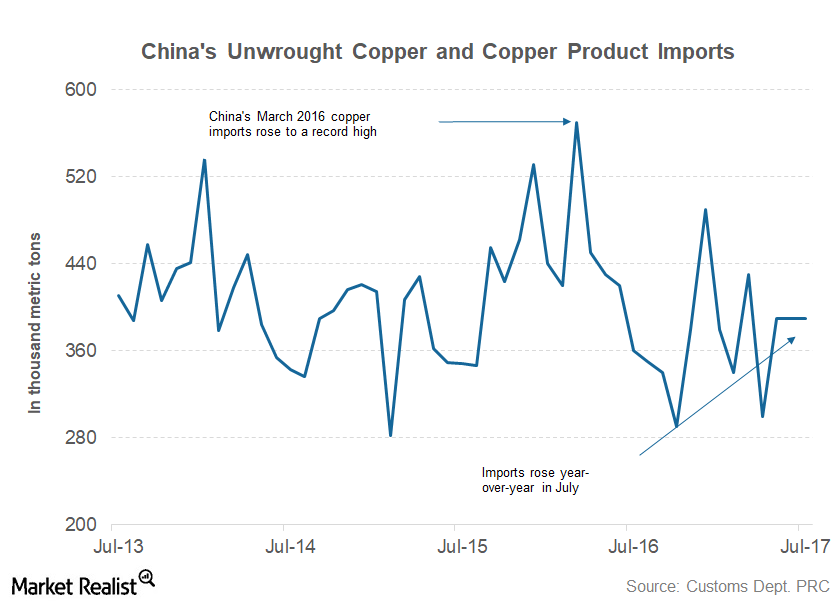

Chinese Copper Imports: Can Freeport’s Good Run Continue?

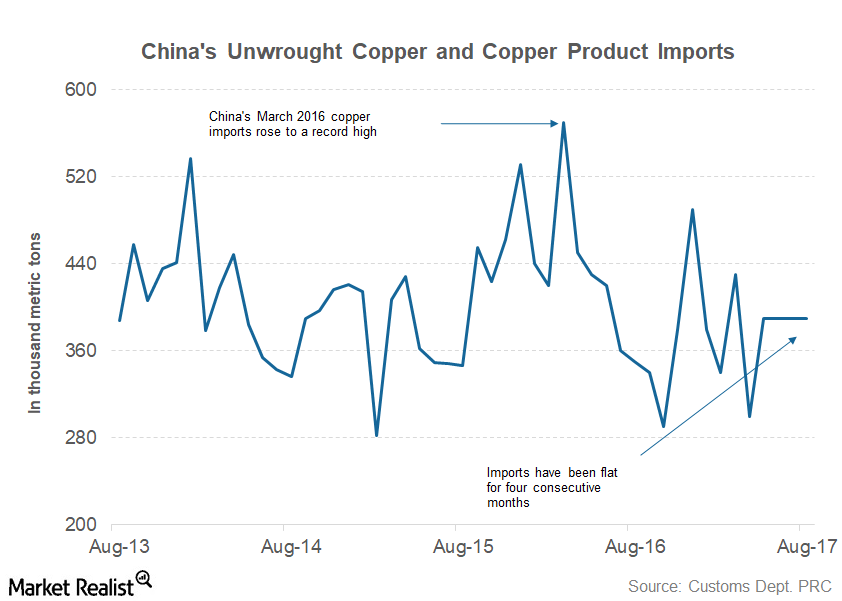

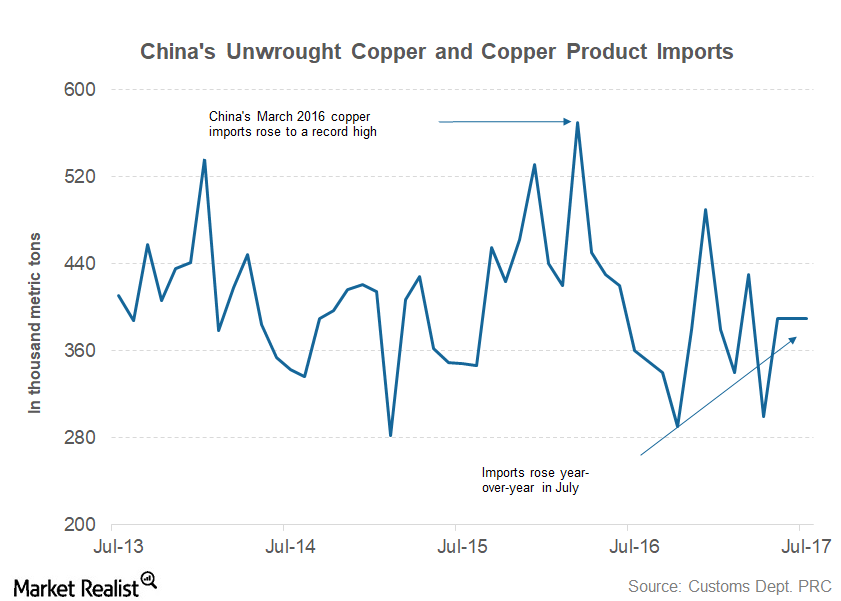

Previously in this series, we’ve looked at China’s July steel and aluminum exports. In this final part of the series, we’ll look at Chinese copper imports.

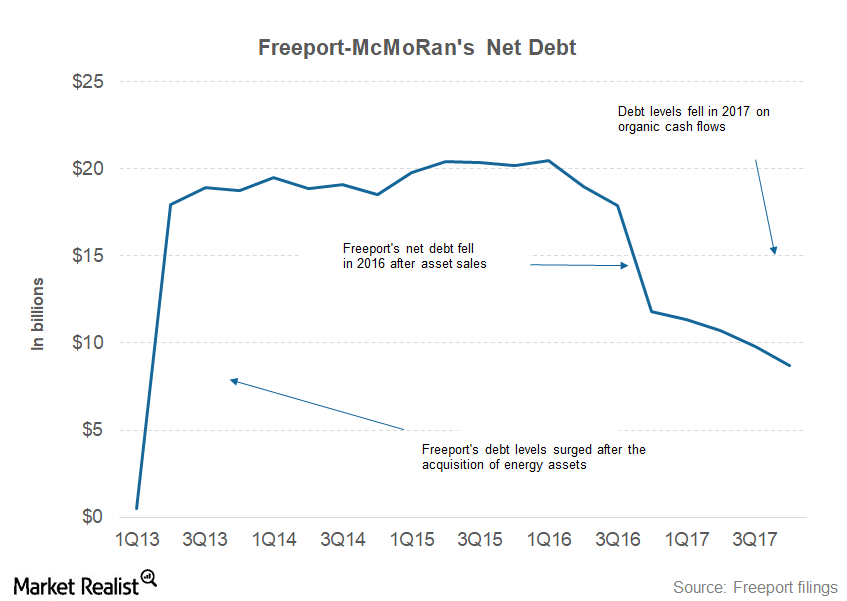

Understanding Freeport’s Capital Allocation Strategy

As copper market conditions have improved, companies have also taken another look at their capital allocation strategies.

How Analysts View Copper Miners amid the Market Carnage

The repercussions of the equity market carnage are evident in commodity markets. Copper, which some analysts see as an indicator of the global economy’s health, has come off its 2018 highs.

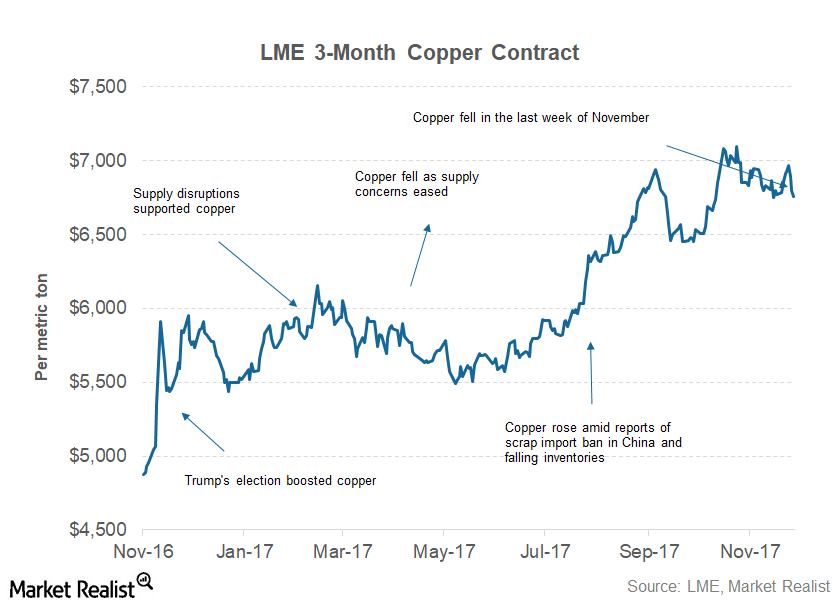

Copper Bulls Took a Back Seat in November

Copper bulls had a nice run since July. Copper underperformed several industrial metals in 1H17. However, copper has been on an uptrend in 2H17.

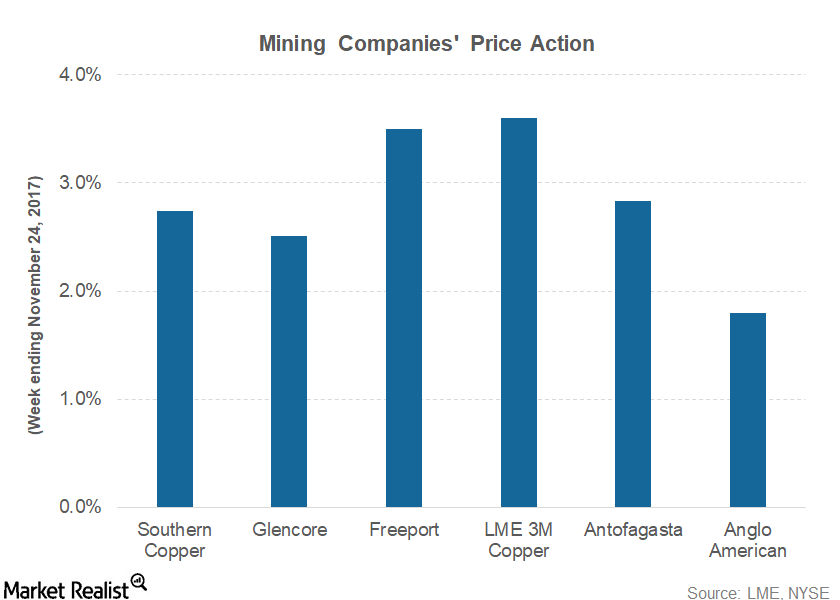

Copper Tests $7,000 as Industrial Metals Rebound

Last week was broadly positive for industrial metals (DBC). Copper rose 3.6%, while aluminum prices rose 1.3% in the week ending November 24.

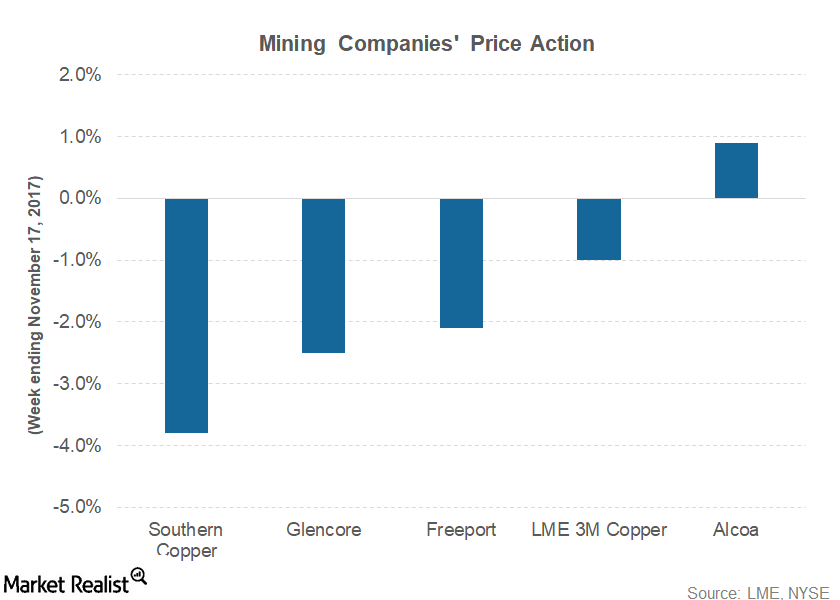

Metal Prices Fell on Demand Concerns Last Week

In this series, we’ll look at the key developments that impacted mining companies last week. We’ll also look at some of the company-specific developments that impacted mining stocks.

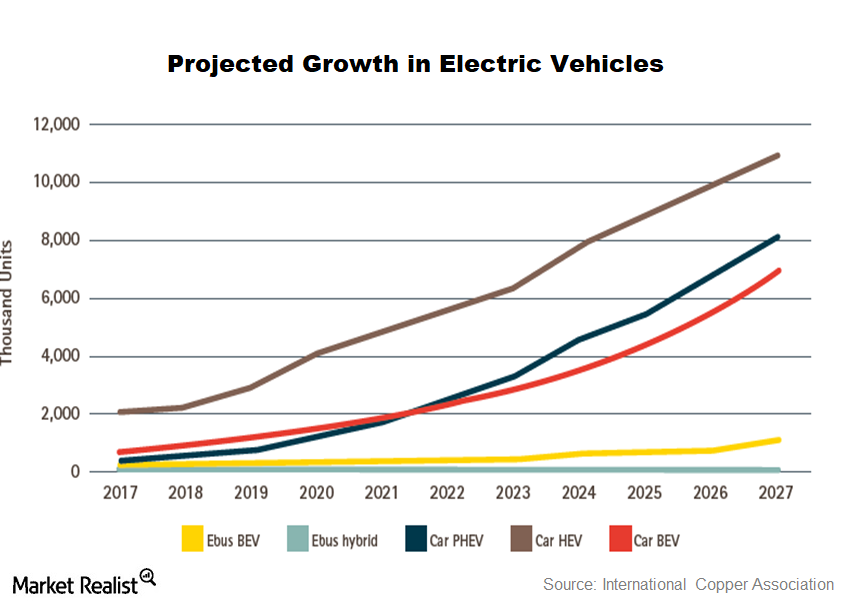

How Freeport-McMoRan Benefits from Electric and Hybrid Vehicles

Investments in renewable energy bode well for global copper demand, as the copper intensity in renewable energy is higher than in non-renewable energy.

China’s Copper Imports: Did Data Spoil Freeport’s Party?

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in August 2016.

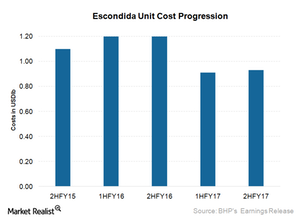

What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

Freeport and Copper: Is a Correction in the Cards?

Copper prices have shown strength over the last few trading sessions, which has helped the upwards price action of miners including Freeport-McMoRan (FCX), Glencore (GLNCY), and Southern Copper (SCCO).

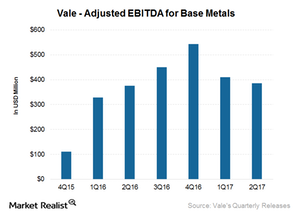

What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

Analyzing Copper Miners’ 2017 Production Plans

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds.

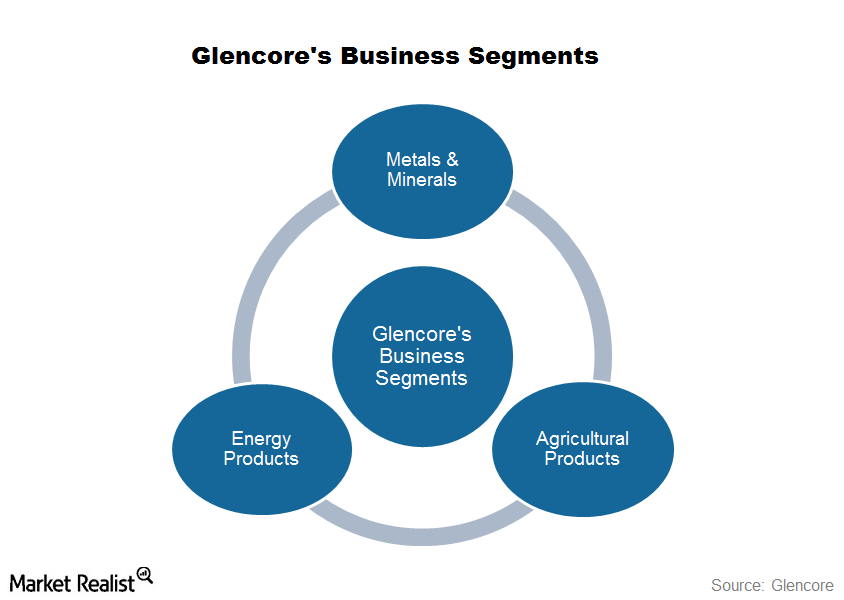

Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

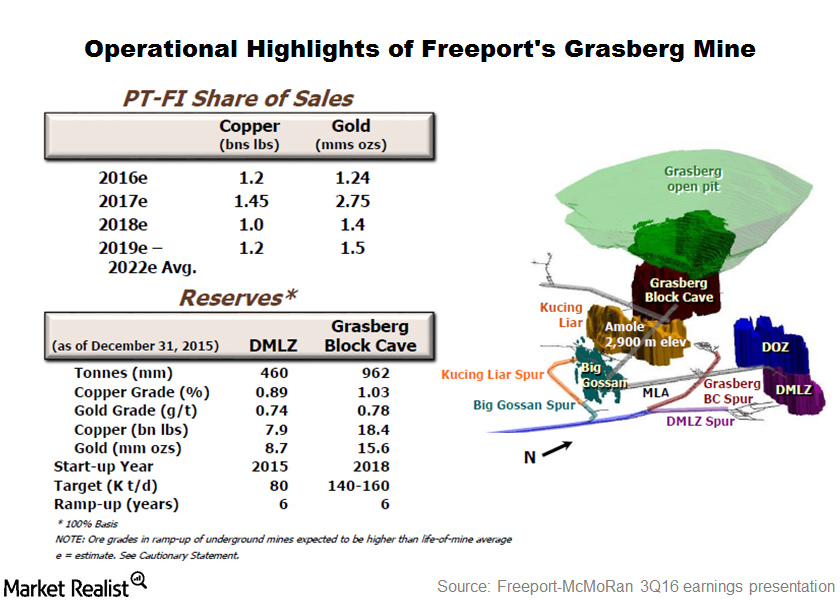

What Are Freeport’s Near-Term Growth Drivers?

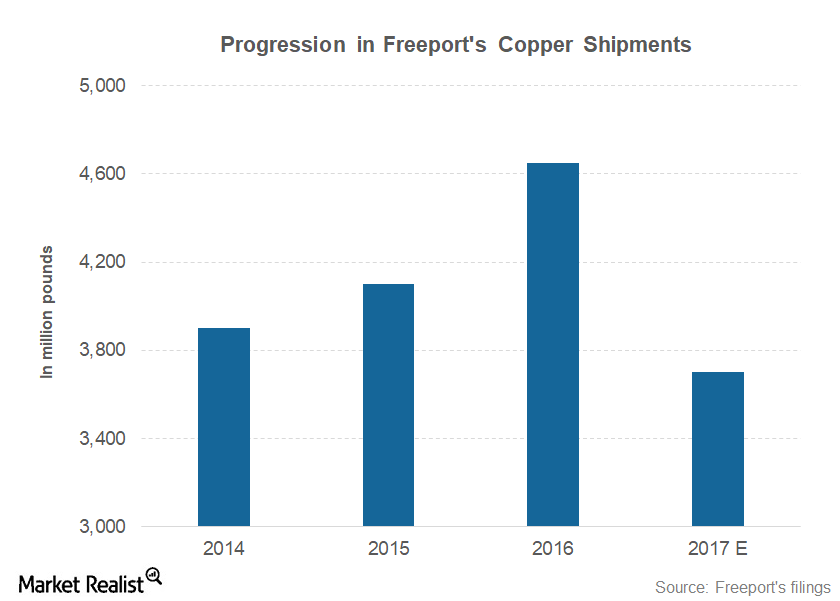

Freeport expects its copper shipments to fall next year due to asset sales. The falling trend in its copper shipments could continue beyond 2017.

How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

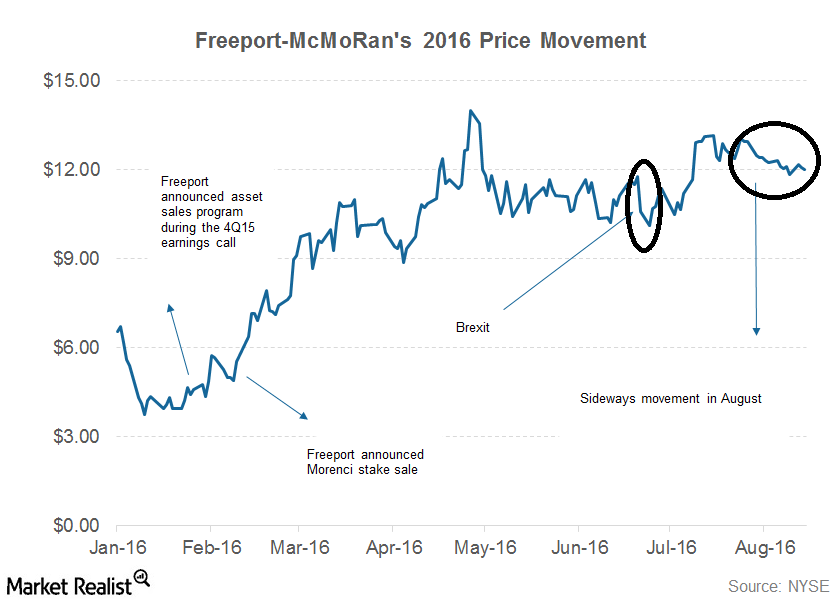

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

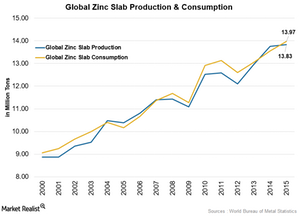

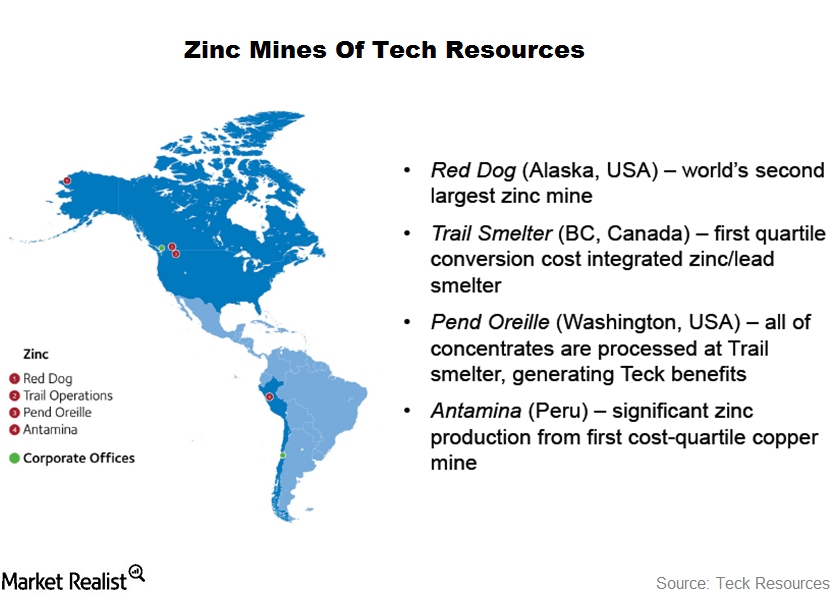

Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

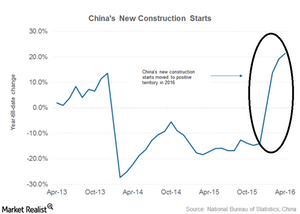

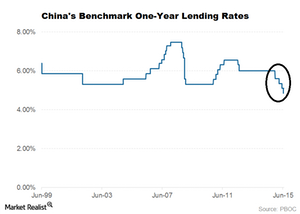

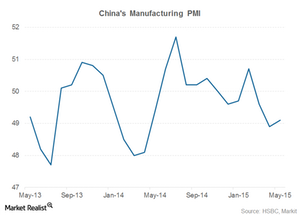

Chinese Copper Demand Indicators: Not That Worrisome So Far

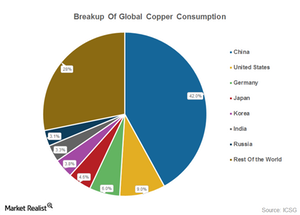

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.

Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

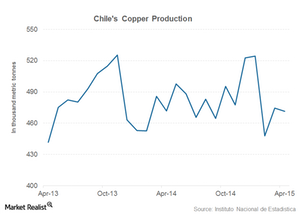

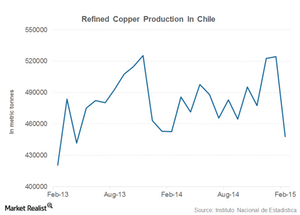

Copper Production in Peru, Chile Falls in First 3 Months of 2015

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year.

Which Way Is the Chinese Copper Industry Headed This Year?

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like copper, iron ore, and aluminum.

Chilean Refined Copper Production Falls to 2-Year Low

On a year-over-year basis, Chilean refined copper production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.

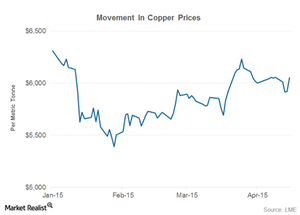

Supply Disruptions in 2015 Support Copper Prices

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

Copper Prices Hold Steady Amid Commodity Carnage

The trend in copper prices has been clearly uneven this year. Higher copper prices benefit copper producers like Freeport-McMoRan.

An Investor’s Guide to the Copper Supply Chain

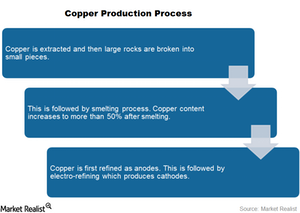

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

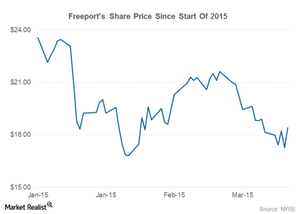

Key Indicators Freeport Investors Should Track

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

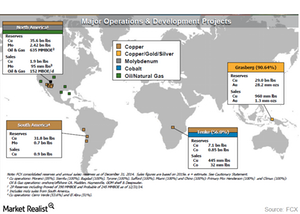

Freeport-McMoRan’s global mining portfolio

Freeport’s global mining portfolio shows that Freeport has major operations in North America, South America, Africa, and Indonesia.

An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.

An Investor’s Guide To The Chinese Copper Industry

China overtook the US and Japan as the premier manufacturing location. China doesn’t have sufficient copper reserves, leading to the global copper trade.

Key Facts About The Copper Value Chain

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into shapes based on end usage, such as cakes, ingots, rods, and billets.

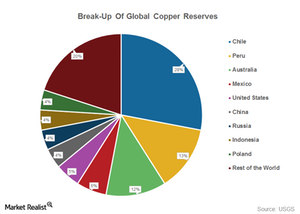

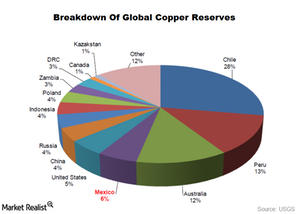

Why It’s Important To Understand Global Copper Reserves

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia.

An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.