Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

Dec. 2 2016, Updated 11:05 a.m. ET

Glencore’s business operations

Glencore (GLNCY) is among some of the most diversified natural resources companies (BHP). Its operations span the world. In this part of the series, we’ll look at Glencore’s key operations.

Key business segments

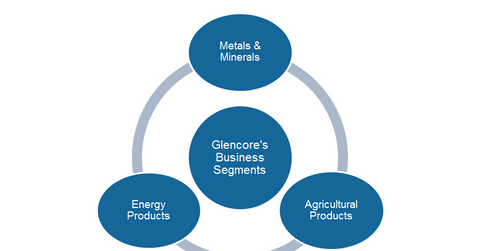

Glencore has three business segments:

- Metals and Minerals

- Energy Products

- Agricultural Products

Along with production activities, Glencore is also involved in the physical trading of various commodities. In 1H16, such marketing activities accounted for ~32% of its consolidated adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

Marketing activities

Notably, while trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business. In 1H16, coal, copper, and zinc accounted for more than 65% of Glencore’s consolidated adjusted EBITDA. Copper is the biggest contributor to Glencore’s earnings. It accounted for more than one-third of its 1H16 adjusted EBITDA.

We should remember that while zinc has been strong for most of 2016, copper only started to gain traction this month. Copper producers including Freeport-McMoRan (FCX), Southern Copper (SCCO), and Teck Resources (TCK) followed copper to higher price levels.

Several fundamental and sentiment factors are impacting copper this month. Read Freeport Investors: Is a Bubble Building in Copper Prices? to learn more about the recent movement in copper prices.

In its Energy segment, Glencore derives most of its revenues and earnings from thermal coal sales. We should remember that thermal coal is used in energy generation. Coal prices have been strong this year. China’s clampdown on coal mining combined with supply-side issues in Australia supported coal prices this year.

In the next part, we’ll explore what life looks like for Glencore under the current pricing environment.