Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

June 3 2016, Updated 3:04 a.m. ET

Zinc outperformed other base metals

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category. The sharp inventory declines and signs of increased demand from China have been some of the primary drivers of zinc prices in 2016.

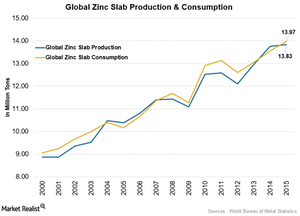

Zinc market to be in a deficit in 2016

According to the latest report released by the International Lead and Zinc Study Group (or ILZSG), the demand-supply balance forecast for 2016 is expected to support higher prices. According to ILZSG, demand for refined zinc in 2016 is forecasted to grow by 3.5% from 2015 to reach 14.3 million tons. The growth of China’s infrastructure sector is expected to drive the demand for zinc upwards in 2016. The production of refined zinc is forecasted to reach 14.0 million tonnes in 2016, which could lead to a deficit of 0.35 million tons in 2016.

Demand from China’s infrastructure sector

Given that China’s infrastructure sector accounts for almost 25% of global zinc consumption and China is the world’s largest zinc consumer, the surge in infrastructure spending of China is raising hopes of increased demand. According to the National Bureau of Statistics, China’s infrastructure spending rose 19% at the beginning of 2016. According to the recent data, China’s real estate investments grew by 9.7% in April with a 61.4% YoY surge in home sales in the first four months of 2016. Better infrastructure figures from China are raising hopes of improved demand. According to ILZSG, zinc demand from China’s infrastructure sector is expected to surge 4.5% in 2016.

In addition, mine closures along with the production cuts and a decline in inventory levels are supporting zinc prices. To know more about the production cuts from zinc producers and China’s top smelters, please read Market Realist’s article, China’s Top Smelters Declare Zinc Production Cuts.

Major zinc producers Glencore (GLNCY), BHP Billiton (BHP), Southern Copper (SCCO), and Tech Resources (TCK) rose 39.6%, 4.2%, 2.2%, and 156.0%, respectively. The PowerShares DB Base Metals Fund (DBB) and the SPDR S&P Metals & Mining ETF (XME) rose 3.9% and 39%, respectively.