An Investor’s Guide To The Chinese Copper Industry

China overtook the US and Japan as the premier manufacturing location. China doesn’t have sufficient copper reserves, leading to the global copper trade.

Feb. 12 2015, Updated 12:05 p.m. ET

Chinese copper industry

In the previous article, we learned about copper’s production process. Here, we will learn more about the Chinese copper industry, which represents the world’s largest consumer of copper. Let’s begin by looking at major consumers of copper. Because copper is a global commodity, understanding the global dynamics of the copper industry is important for investors.

Freeport-McMoRan (FCX), Southern Copper (SCCO), Barrick Gold (ABX), and Rio Tinto (RIO) have copper mining operations. FCX forms 4.22% of the Materials Select Sector SPDR ETF (XLB).

Major copper consumers

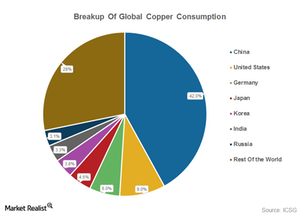

The above chart shows the major consumers of copper. As the world’s largest consumer, China accounts for 42% of global copper consumption. United States has the second biggest slice with 28% of the world’s consumption, followed by Germany’s 6%.

In 1990, the US was the biggest consumer of copper, accounting for 20% of global copper consumption. On the other hand, China accounted for only 5% of global copper consumption that year. Japan was the second largest copper consumer in 1990 and is the fourth largest consumer now.

Changing world dynamics

The changing trends in copper consumption reflect the new world dynamics. As the global manufacturing hub, China has overtaken the US and Japan as the premier manufacturing location.

However, China does not have sufficient copper reserves, which gives rise to the global copper trade. Chinese copper demand is a key driver of global trade in copper, and the boom in the Chinese economy led to the commodity super cycle. With the Chinese economy now growing at a slower pace, commodity prices have also crashed. We will explore this in detail later in this series. First, let’s learn more about the Chinese copper industry.