Key Facts About The Copper Value Chain

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into shapes based on end usage, such as cakes, ingots, rods, and billets.

Feb. 12 2015, Updated 11:05 a.m. ET

Copper value chain

In the previous article, we learned how copper mines are geographically concentrated in Latin America. Mining is the first step in the copper value chain. Open-pit and underground mining are two prominent methods of copper ore extraction. Let’s see what happens to this extracted copper ore.

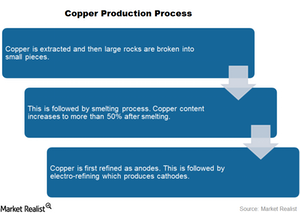

Copper production process

The extracted copper has very low copper content and must be further treated to make it usable. The first step after copper extraction is called beneficiation. Copper is extracted as rocks and is converted into more usable shapes under this step. The above chart shows the major steps in copper’s production process. Freeport-McMoRan (FCX), Southern Copper (SCCO), Barrick Gold (ABX), and Rio Tinto (RIO) have copper mining operations. FCX forms 3.63% of the SPDR S&P Metals and Mining ETF (XME).

Smelting is the next major step in copper’s production process. After the smelting process, the copper content increases beyond 50%. After this, copper is melted and cast as anodes, which are then electrorefined to produce high-purity cathodes. Cathodes contain more than 99.99% copper content.

First users of copper

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into different shapes based on end usage, such as cakes, ingots, rods, and billets. This step is performed by copper semis (or semi-finished) fabricators, which are also known as the first users of refined copper. Brass mills and wire rod plants are among the first users of copper.

Most of the semis fabricators are concentrated in China, which we’ll explore in the next article.