Freeport-McMoRan Inc

Latest Freeport-McMoRan Inc News and Updates

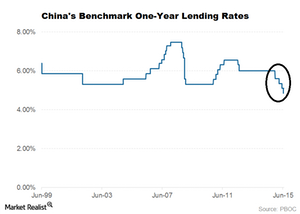

Chinese Copper Demand Indicators: Not That Worrisome So Far

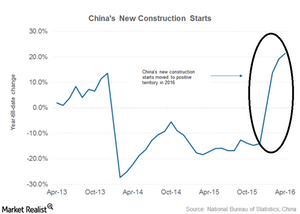

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.

Rio Tinto Surprised the Markets with Dividend Policy Change

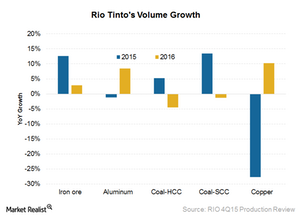

Rio Tinto’s 2015 results were mostly in line with market expectations. Underlying EBITDA and underlying profits were $12.6 billion and $4.5 billion, respectively.

Rio Tinto Reported Overall Strong Production Results for 4Q15

Rio Tinto’s copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

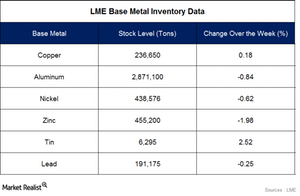

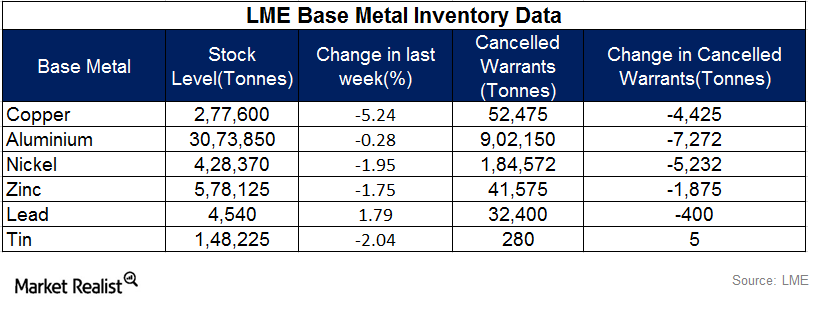

Base Metal Inventories Fell Last Week: How Much?

In the week ended January 9, copper and tin inventories increased. Levels for other base metals fell.

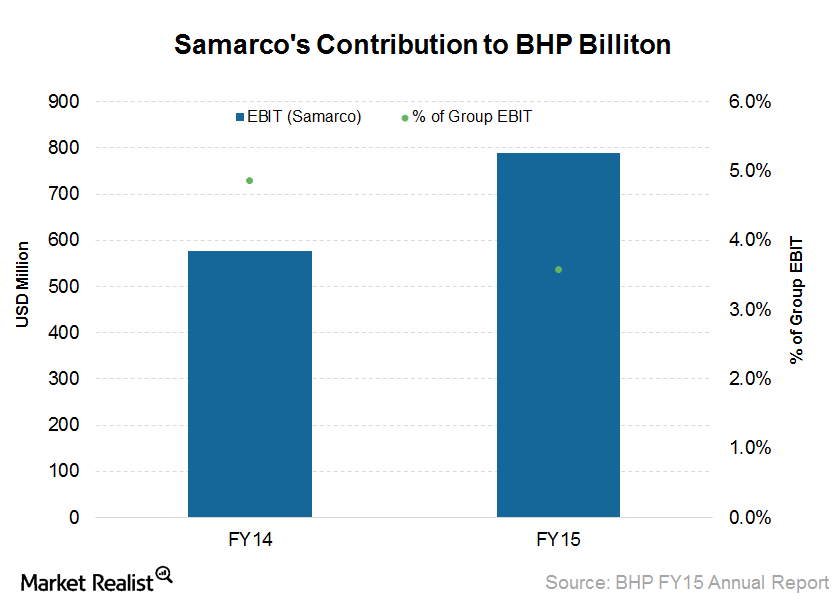

How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.

LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

Why Aren’t BHP and RIO Cutting Copper Production?

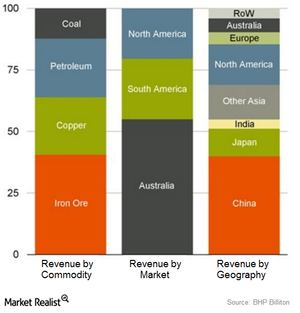

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.

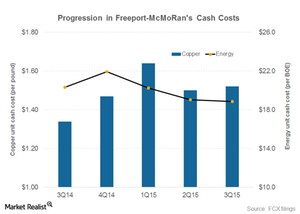

Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

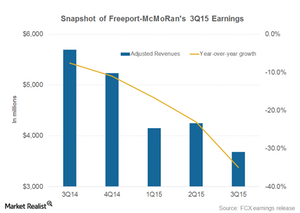

Why Freeport-McMoRan’s 3Q15 Revenues Fell Off a Cliff

In this part of the series, we’ll explore the trend in Freeport-McMoRan’s (FCX) revenues.

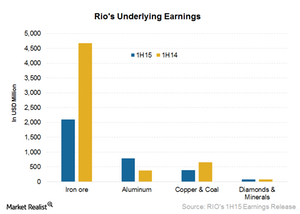

Will the Slide in Rio Tinto’s Underlying Earnings Continue?

Rio Tinto’s (RIO) underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) was $7.3 billion for 1H15.

Is Freeport-McMoRan Worth a Look for Investors?

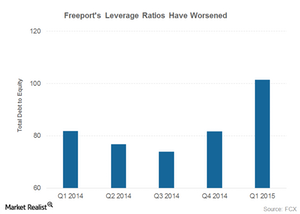

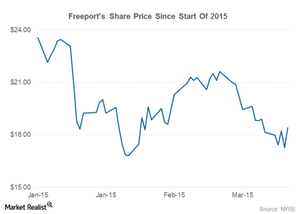

With the recent news of activist investor Carl Icahn taking an 8.5% stake in the company coupled with Freeport’s lower capital expenditure guidance, the stock has seen a smart up move.

Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

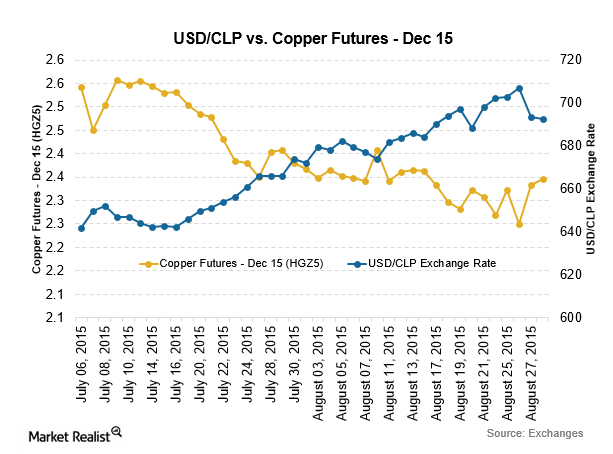

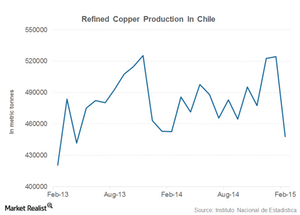

The High Correlation between the Chilean Peso and Copper Prices

Any variation in copper demand or supply directly affects the value of the Chilean peso against the US dollar.

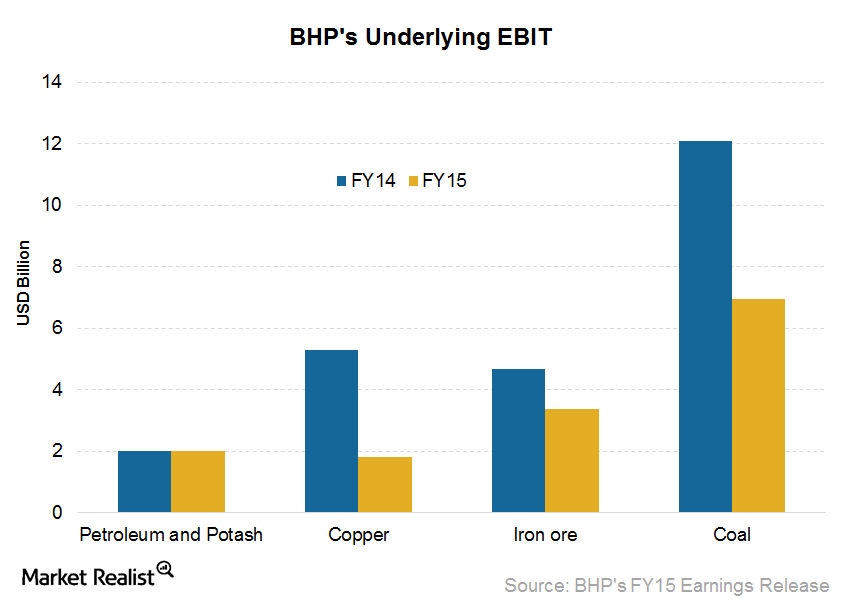

Why BHP’s Operating Income Fell in Fiscal 2015

BHP Billiton’s (BHP) (BBL) underlying EBITDA was $21.9 billion for fiscal 2015. This is a fall of 28% year-over-year (or YOY). Operating income also fell 46% YoY in fiscal 2015.

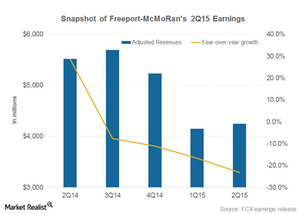

Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

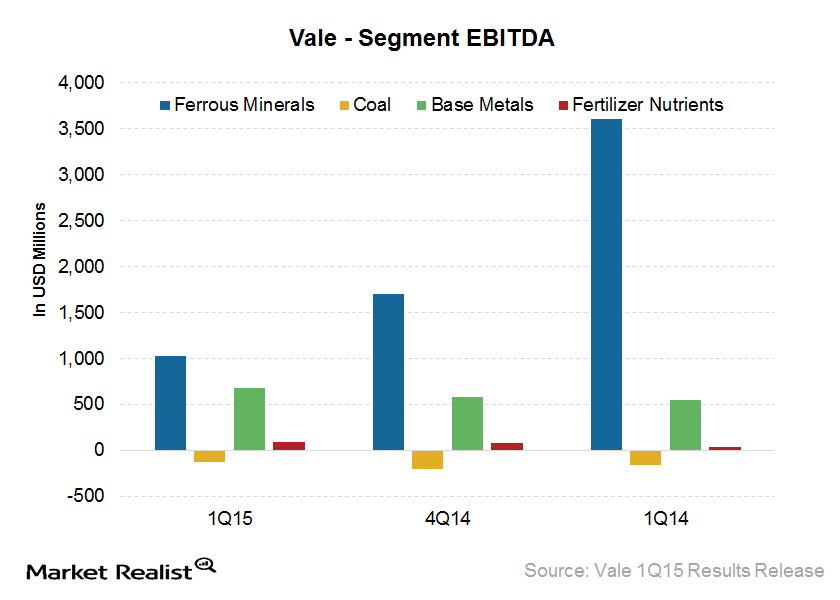

Vale’s 1Q15 Earnings Take a Hit

Vale S.A. (VALE) reported revenues of $6.4 billion in 1Q15, a decline of $2.9 billion compared to 4Q14. Most of the decline is due to seasonally lower sales volumes and lower commodity prices.

Cash-Starved Freeport Looks at IPO of Energy Business

On April 23, Freeport said it might look at selling a minority stake in its energy business and come out with an IPO of its oil and gas subsidiary later in the year.

Chilean Refined Copper Production Falls to 2-Year Low

On a year-over-year basis, Chilean refined copper production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.

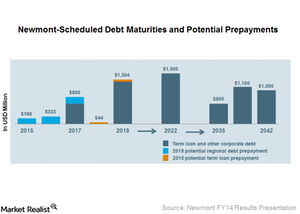

Key Updates Investors Should Look for in Newmont’s 1Q15 Results

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

Supply Disruptions in 2015 Support Copper Prices

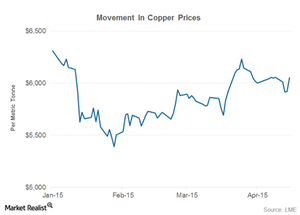

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

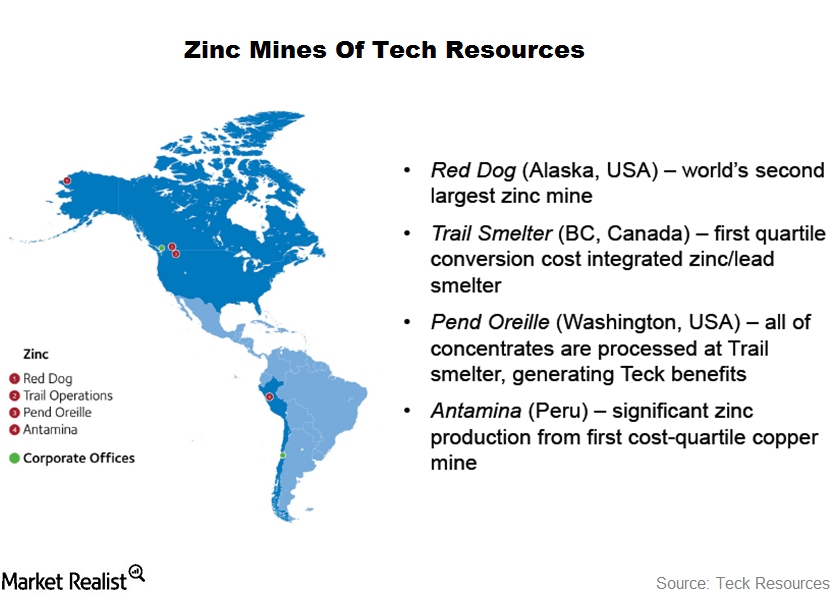

Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

Why Freeport Investors Should Track China’s Automobile Industry

China is the world’s biggest automotive market, where close to 22 million vehicles are sold each year. A mid-sized vehicle has ~50 pounds of copper content.

Copper Prices Hold Steady Amid Commodity Carnage

The trend in copper prices has been clearly uneven this year. Higher copper prices benefit copper producers like Freeport-McMoRan.

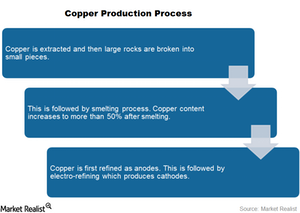

An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

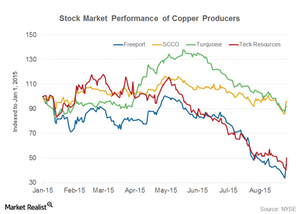

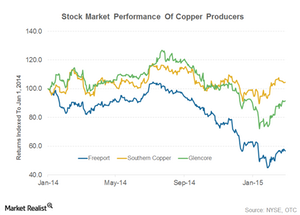

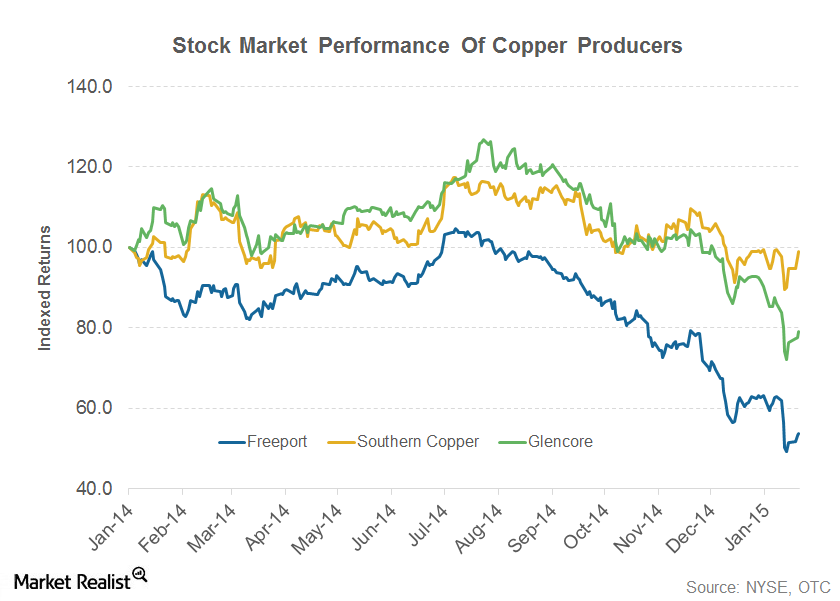

Key Indicators Freeport Investors Should Track

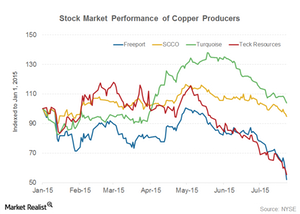

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

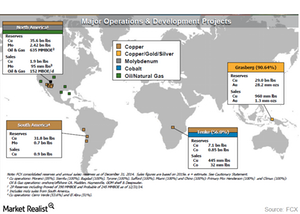

Freeport-McMoRan’s global mining portfolio

Freeport’s global mining portfolio shows that Freeport has major operations in North America, South America, Africa, and Indonesia.

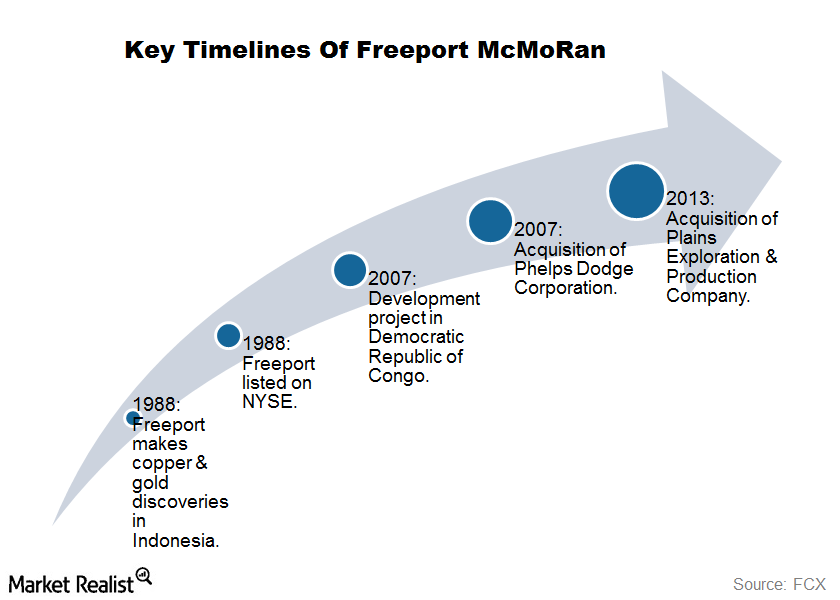

Why is Freeport’s key historical timeline important?

Freeport’s key historical timeline starts more than a century ago when Freeport Sulphur established the city of Freeport, Texas, near its sulphur mine.

An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.

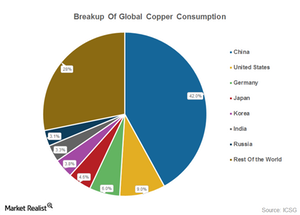

An Investor’s Guide To The Chinese Copper Industry

China overtook the US and Japan as the premier manufacturing location. China doesn’t have sufficient copper reserves, leading to the global copper trade.

Key Facts About The Copper Value Chain

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into shapes based on end usage, such as cakes, ingots, rods, and billets.

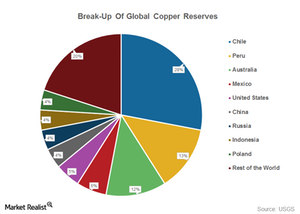

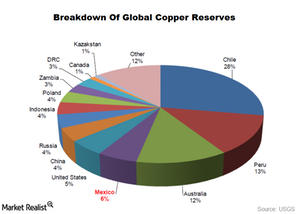

Why It’s Important To Understand Global Copper Reserves

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia.

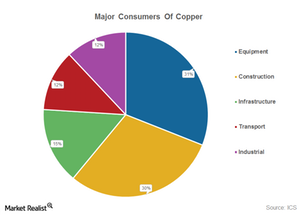

Must Know: Major Consumers Of Copper

Because of its excellent heat transfer capabilities, copper is also widely used in producing heat exchange equipment and other uses in extreme environments.

An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.