Why BHP’s Operating Income Fell in Fiscal 2015

BHP Billiton’s (BHP) (BBL) underlying EBITDA was $21.9 billion for fiscal 2015. This is a fall of 28% year-over-year (or YOY). Operating income also fell 46% YoY in fiscal 2015.

Sept. 8 2015, Published 12:31 p.m. ET

Operating income

BHP Billiton’s (BHP) (BBL) underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) was $21.9 billion for fiscal 2015. This is a fall of 28% year-over-year (or YOY). Operating income also fell 46% YoY in fiscal 2015. In this article, we’ll see the reasons for the declining EBITDA and operating income.

BHP’s fall in operating income

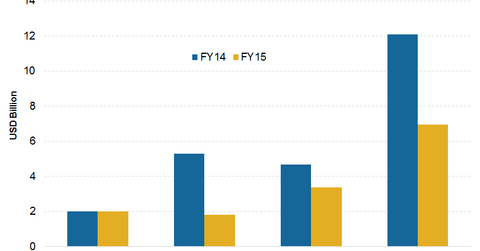

- Lower realized prices were the main culprit behind BHP’s fall in operating income. Lower prices reduced earnings by $16.4 billion. They also offset the impact of productivity gains BHP achieved during the year.

- A bulk of the drop in operating income, or EBIT (earning before interest and taxes) was due to the fall in the average realized iron ore prices. They fell 41% YoY in fiscal 2015. Of a total fall of $16.4 billion, $9.5 billion, or 58%, was due to lower iron ore prices.

- Weaker realized prices for petroleum, copper, and coal dropped EBIT by $4.2 billion, $1.6 billion, and $1.1 billion, respectively.

Volume and productivity led gain

- On the other hand, volume growth delivered through productivity enhancements and ramp-ups led to an increase in EBIT by $3 billion. Western Australia iron ore (or WAIO) was the major driver behind improved volume performance.

- Doubling of liquids production from Black Hawk and Permian was the other significant driver behind volume-related increase in EBIT.

- Reduction in labor, contractor, and maintenance costs also led to an increase in EBIT by $1.5 billion during fiscal 2015.

The fall in operating income is not limited to just BHP. Other miners, including Vale SA (VALE), Rio Tinto (RIO), Cliffs Natural Resources (CLF), and Freeport-McMoRan (FCX) also reported a fall in their respective incomes for 2Q15. Iron ore, petroleum, coal, and copper prices are going through a rough phase, impacted by oversupply amid slowing growth concerns in China and elsewhere. The SPDR S&P Metals and Mining ETF (XME) invests in diversified metals and mining space. FCX forms 3% of XME’s holdings.

In the next article, we’ll look at the volumes for iron ore. Iron ore contributes to the majority of BHP’s earnings. It contributed 40% to BHP’s fiscal 2015 EBITDA.