Rio Tinto Surprised the Markets with Dividend Policy Change

Rio Tinto’s 2015 results were mostly in line with market expectations. Underlying EBITDA and underlying profits were $12.6 billion and $4.5 billion, respectively.

Feb. 17 2016, Updated 11:31 a.m. ET

Results met expectations

Rio Tinto (RIO) reported its 2015 results on February 11, 2016. The company held its conference call the same day. The results were mostly in line with market expectations. Underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) and underlying profits were $12.6 billion and $4.5 billion, respectively.

A few surprises

While RIO’s operating results were mostly in-line with market expectations, there were a number of surprises in the earnings release. The change in dividend policy from progressive to one based on payout on earnings, a larger-than-expected decline in net debt, and a capital expenditure guidance cut were some of the changes the market didn’t fully expect.

A dividend policy based on earnings is more appropriate for a cyclical industry. Thus, a revised dividend policy is prudent in many ways. However, RIO might see reduced interest from income-seeking investors as a result of its policy change. This is likely the reason that RIO’s stock price fell by 2.5% within two days of declaring the results.

Miners’ stock performances

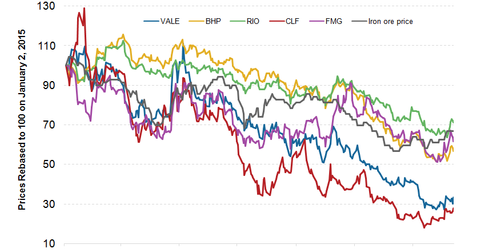

In 2015, iron ore prices declined by 39%, which led to a steep decline in prices of iron ore players as well. Of the big miners, RIO has been the outperformer with its stock price falling by 23% compared to a fall of 34% for its nearest peer, BHP Billiton (BHP) (BBL). Vale (VALE) has seen a correction of 59% while Cliffs Natural Resources (CLF) has had the worst fall of all with a return of -78% in the same time period.

Other miners such as Freeport-McMoRan (FCX), Alcoa (AA), and Glencore (GLNCY) have also fallen considerably in 2015. It has prompted them to take drastic measures in terms of capital allocation and portfolio restructuring.

In this series, we’ll analyze RIO’s 2015 earnings. We’ll also discuss the management team’s outlook on the business and see how it’s trying to position the company in this falling commodity price (COMT) environment.

To read about RIO’s production results for 2015 and guidance for 2016, please visit, Rio Tinto’s 4Q15 Production Numbers are Strong: What about 2016?